Key Insights

The Adhesion Promoters Market is poised for significant expansion, projecting a substantial market size and a healthy Compound Annual Growth Rate (CAGR) throughout the study period of 2019-2033. Driven by the increasing demand for enhanced material performance across diverse industries such as automotive, aerospace, electronics, and construction, adhesion promoters are becoming indispensable in ensuring durable and reliable bonds. The automotive sector, in particular, is a key driver, with manufacturers increasingly relying on these additives to improve the structural integrity and longevity of composite materials and bonded assemblies, crucial for lightweighting initiatives and electric vehicle battery integration. Similarly, the electronics industry's drive towards miniaturization and more sophisticated device construction necessitates superior adhesion for components, further fueling market growth. The construction industry also plays a vital role, with a growing emphasis on advanced coatings, sealants, and adhesives for infrastructure projects demanding long-term durability and resistance to environmental factors.

Adhesion Promoters Market Market Size (In Billion)

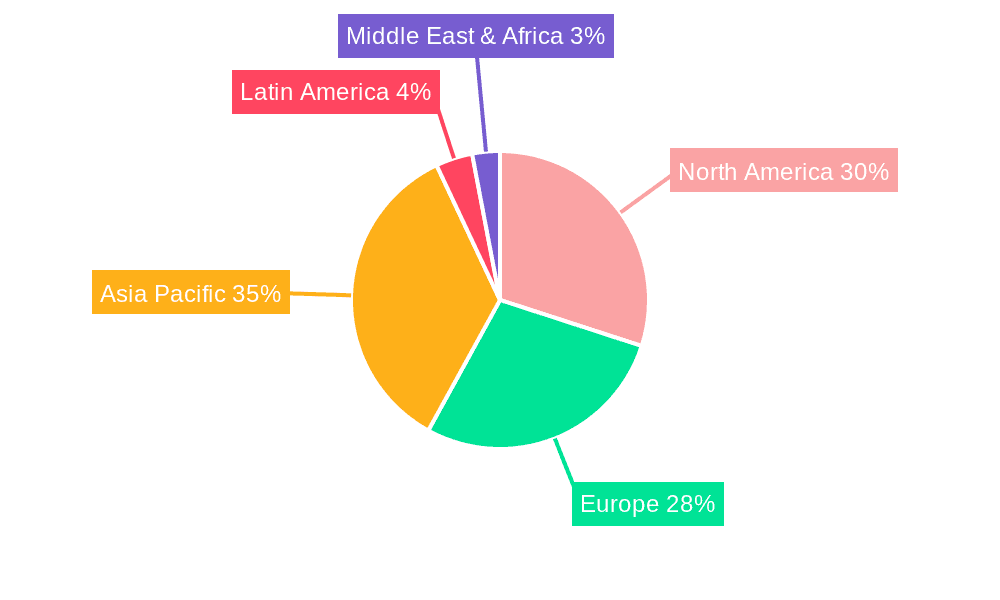

Looking ahead, the market's trajectory indicates sustained growth, with the forecast period of 2025-2033 anticipating a robust CAGR. This growth is underpinned by ongoing research and development leading to the innovation of novel adhesion promoter chemistries offering superior performance, broader application ranges, and improved environmental profiles. The increasing regulatory focus on sustainability is also indirectly benefiting the market, as efficient bonding solutions can contribute to product longevity and reduced waste. Geographically, regions with strong industrial bases, such as North America and Europe, are expected to maintain a significant market share due to established manufacturing hubs and a high adoption rate of advanced materials. However, the rapidly industrializing economies in Asia Pacific are anticipated to exhibit the highest growth rates, driven by substantial investments in manufacturing infrastructure and a burgeoning consumer market demanding higher quality and more durable products. The market's expansion is also linked to the increasing use of advanced composites, plastics, and dissimilar material bonding, where the role of adhesion promoters is critical.

Adhesion Promoters Market Company Market Share

This comprehensive report delves into the Adhesion Promoters Market, a critical sector enabling superior material bonding across a multitude of applications. With the study period spanning from 2019 to 2033, and a base year of 2025, this analysis provides deep insights into market dynamics, key players, and future trajectories. The market is projected to witness substantial growth, driven by increasing demand for high-performance materials in industries such as automotive, construction, and electronics.

Adhesion Promoters Market Market Structure & Innovation Trends

The Adhesion Promoters Market exhibits a moderately consolidated structure, with a blend of large multinational corporations and specialized niche players. Key innovators are focusing on developing eco-friendly and high-efficacy adhesion promoters that offer enhanced durability and faster curing times. Regulatory frameworks, particularly concerning environmental impact and material safety, are increasingly shaping product development and market entry strategies. Substitutes for conventional adhesion promoters are emerging, but often come with performance trade-offs. End-user demographics are diverse, with a growing emphasis on sustainability and advanced material properties. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market share, acquiring new technologies, and expanding geographical reach. For instance, recent M&A deals within the specialty chemicals sector have seen values ranging from XX Million to XX Million. Innovation drivers include the need for robust bonding in demanding environments, lightweighting initiatives in automotive, and miniaturization trends in electronics.

Adhesion Promoters Market Market Dynamics & Trends

The global Adhesion Promoters Market is experiencing robust growth, propelled by a confluence of technological advancements and expanding application frontiers. A significant growth driver is the escalating demand for high-performance adhesives and coatings that require superior substrate adhesion, particularly in sectors like automotive and aerospace where material integrity and safety are paramount. The automotive industry's push towards lightweighting through the extensive use of composites and advanced plastics necessitates effective bonding solutions, directly benefiting the adhesion promoters market. Similarly, the burgeoning electrical and electronics sector, with its ever-increasing complexity and miniaturization of devices, relies heavily on adhesion promoters to ensure the reliability and longevity of components.

Technological disruptions are manifesting in the form of novel adhesion promoter chemistries offering improved compatibility with a wider range of substrates, including challenging polymers and composites. The development of water-borne and low-VOC (Volatile Organic Compound) adhesion promoters is a direct response to stringent environmental regulations and growing consumer preference for sustainable products. These innovations are not only addressing regulatory compliance but also opening up new market segments.

Consumer preferences are increasingly shifting towards products that are durable, long-lasting, and environmentally responsible. This sentiment is translating into a demand for advanced materials and the bonding solutions that enable them. Manufacturers are responding by investing in research and development to create adhesion promoters that meet these evolving expectations, offering improved performance characteristics such as enhanced chemical resistance, thermal stability, and weatherability.

Competitive dynamics within the market are characterized by intense R&D efforts, strategic partnerships, and a focus on customer-centric solutions. Companies are differentiating themselves by offering tailored adhesion promoter formulations for specific applications and substrates, backed by strong technical support. The market penetration of advanced adhesion promoters is steadily increasing as industries recognize the long-term cost benefits and performance advantages they offer, despite potentially higher initial costs. The projected CAGR for the Adhesion Promoters Market stands at an impressive XX% over the forecast period, reflecting its dynamic growth trajectory and the critical role it plays in modern manufacturing.

Dominant Regions & Segments in Adhesion Promoters Market

The Asia Pacific region stands out as the dominant force in the Adhesion Promoters Market, driven by its rapidly expanding industrial base and significant investments in manufacturing across key end-user industries. Countries like China, Japan, and South Korea are at the forefront, fueled by their strong presence in automotive production, burgeoning electronics manufacturing, and substantial construction activities. The economic policies supporting industrial growth, coupled with massive infrastructure development projects, create a continuous demand for materials that require robust adhesion, thereby propelling the consumption of adhesion promoters.

Within the Type segmentation, Silane adhesion promoters are consistently leading the market. Their versatility, excellent adhesion to a wide array of inorganic and organic substrates, and their ability to improve the mechanical properties of composites make them indispensable. The growing use of fiber-reinforced polymers in automotive and wind energy applications, alongside advancements in semiconductor manufacturing, significantly contributes to the dominance of silanes. Maleic Anhydride-based promoters also hold a substantial share, particularly in plastics and composites, owing to their effectiveness in coupling dissimilar materials.

In terms of Application, Plastics & Composites represent the largest and fastest-growing segment. The lightweighting trend in automotive and aerospace, the demand for durable and high-performance materials in construction, and the increasing adoption of advanced composites in renewable energy (wind turbines) are primary accelerators. The ability of adhesion promoters to enhance the bonding between polymer matrices and reinforcing fibers is critical for achieving desired structural integrity and performance.

The Automotive and Transportation end-user industry is the most significant consumer of adhesion promoters. The relentless pursuit of fuel efficiency through vehicle lightweighting, the integration of advanced safety features requiring sophisticated bonding, and the increasing use of composite materials in vehicle bodies and components drive substantial demand. Electric vehicles (EVs), with their complex battery systems and lightweight structures, further amplify this demand. The Electrical & Electronics sector also exhibits strong growth, driven by the miniaturization of devices, the need for reliable bonding of intricate components, and the adoption of advanced packaging technologies.

Adhesion Promoters Market Product Innovations

Product innovations in the Adhesion Promoters Market are centered on enhancing performance, sustainability, and application versatility. Companies are developing novel silane-based coupling agents that offer superior adhesion to a broader range of substrates, including difficult-to-bond plastics and advanced composites. There's a significant push towards water-borne and low-VOC adhesion promoter formulations to meet stringent environmental regulations and consumer demand for greener products. Innovations also focus on creating promoters with faster curing times and improved thermal and chemical resistance, catering to demanding applications in automotive, aerospace, and electronics. These advancements provide manufacturers with competitive advantages by enabling the use of lighter, stronger, and more durable materials.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Adhesion Promoters Market, segmented by Type, Application, and End-User Industry. The Type segmentation includes Silane, Maleic Anhydride, Titanate and Zirconate, Chlorinated Polyolefins, Non-chlorinated Polyolefins, and Others. Silane promoters are projected to maintain their leading position due to their broad applicability and performance. Application segments are Plastics & Composites, Paints & Coatings, Rubber, Adhesive, Metal Substrate, and Others. The Plastics & Composites segment is expected to exhibit the highest growth rate, driven by lightweighting trends. The End-User Industry segmentation comprises Automotive and Transportation, Electrical & Electronics, Packaging, Consumer Goods, Construction & Others. The Automotive and Transportation sector is the largest segment, with significant growth anticipated from the increasing adoption of electric vehicles and advanced materials. The Electrical & Electronics sector also presents robust growth opportunities.

Key Drivers of Adhesion Promoters Market Growth

The Adhesion Promoters Market growth is significantly driven by the escalating demand for lightweight and high-strength materials across various industries, particularly automotive and aerospace, to improve fuel efficiency and performance. Technological advancements in material science are leading to the development of new composite materials and advanced polymers that require sophisticated bonding solutions. Stringent environmental regulations are pushing the development and adoption of eco-friendly, low-VOC adhesion promoters, creating new market opportunities. Furthermore, the expanding applications in the electrical and electronics sector, driven by miniaturization and the need for reliable component bonding, contribute substantially to market expansion.

Challenges in the Adhesion Promoters Market Sector

Despite robust growth, the Adhesion Promoters Market faces several challenges. The increasing complexity of new material formulations can sometimes lead to compatibility issues, requiring extensive testing and R&D. Fluctuations in raw material prices, particularly for key chemical precursors, can impact manufacturing costs and profit margins. Stringent regulatory requirements concerning environmental impact and health safety necessitate continuous investment in compliance and product reformulation. Moreover, the availability of effective substitutes in certain niche applications, albeit with performance limitations, poses a competitive threat. Supply chain disruptions, as witnessed in recent global events, can also affect the availability and cost of essential components, posing a significant challenge for manufacturers.

Emerging Opportunities in Adhesion Promoters Market

Emerging opportunities in the Adhesion Promoters Market lie in the growing adoption of advanced composites in renewable energy sectors, such as wind turbine blades and solar panel manufacturing, requiring specialized bonding solutions. The continuous evolution of electric vehicle technology, with its unique material bonding requirements for batteries and lightweight chassis, presents a significant growth avenue. The increasing demand for sustainable and bio-based adhesion promoters, driven by consumer preferences and environmental consciousness, offers a substantial opportunity for innovation and market penetration. Furthermore, the expansion of smart manufacturing and IoT devices, which rely on intricate and durable electronic component bonding, opens up new application frontiers for high-performance adhesion promoters.

Leading Players in the Adhesion Promoters Market Market

- Shin Etsu Chemical Co Ltd

- MHM Holding GmbH

- DIC Corporation

- Nouryon

- Altana AG

- Evonik Industries AG

- 3M

- Kemipex

- Momentive

- BASF SE

- Arkema Group

- Dow

- Eastman Chemical Company

- Borica Co Ltd

- Nippon Paper Industries Co Ltd

- EMS-CHEMIE HOLDING AG

- Nagase & Co Ltd

- Toyobo Co Ltd

Key Developments in Adhesion Promoters Market Industry

- 2023: Launch of new high-performance silane adhesion promoters for advanced composite materials in the automotive sector.

- 2022: Acquisition of a specialty chemical company by a major player to expand its portfolio of sustainable adhesion promoter solutions.

- 2021: Introduction of a novel water-borne adhesion promoter catering to the paints and coatings industry, significantly reducing VOC emissions.

- 2020: Development of advanced adhesion promoters for bonding dissimilar materials in the aerospace industry, enhancing structural integrity and weight reduction.

- 2019: Strategic partnership formed to accelerate the research and development of bio-based adhesion promoters for consumer goods applications.

Future Outlook for Adhesion Promoters Market Market

The future outlook for the Adhesion Promoters Market is highly promising, fueled by sustained innovation and expanding application horizons. The ongoing global drive towards lightweighting in transportation, coupled with the rapid growth of the electric vehicle market, will continue to be a primary growth accelerator. Advancements in material science will necessitate more sophisticated bonding solutions, creating opportunities for high-performance adhesion promoters. The increasing focus on sustainability and circular economy principles will drive demand for eco-friendly and recyclable adhesion promoter formulations. Strategic collaborations, technological advancements, and the exploration of new market segments, such as advanced medical devices and smart textiles, are poised to further propel market growth and unlock significant strategic opportunities in the coming years.

Adhesion Promoters Market Segmentation

-

1. Type

- 1.1. Silane

- 1.2. Maleic Anhydride

- 1.3. Titanate and Zirconate

- 1.4. Chlorinated Polyolefins

- 1.5. Non-chlorinated Polyolefins

- 1.6. Others

-

2. Application

- 2.1. Plastics & Composites

- 2.2. Paints & Coatings

- 2.3. Rubber

- 2.4. Adhesive

- 2.5. Metal Substrate

- 2.6. Others

-

3. End-User Industry

- 3.1. Automotive and Transportation

- 3.2. Electrical & Electronics

- 3.3. Packaging

- 3.4. Consumer Goods

- 3.5. Construction & Others

Adhesion Promoters Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. Iran

- 6.2. United Arab Emirates

- 6.3. South Africa

- 6.4. Rest of Middle East

Adhesion Promoters Market Regional Market Share

Geographic Coverage of Adhesion Promoters Market

Adhesion Promoters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Usage in the Packaging Sector; Increasing Applications in the Electrical and Electronics Industry

- 3.3. Market Restrains

- 3.3.1. ; Negative Environmental Effect

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Paints & Coatings Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Silane

- 5.1.2. Maleic Anhydride

- 5.1.3. Titanate and Zirconate

- 5.1.4. Chlorinated Polyolefins

- 5.1.5. Non-chlorinated Polyolefins

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Plastics & Composites

- 5.2.2. Paints & Coatings

- 5.2.3. Rubber

- 5.2.4. Adhesive

- 5.2.5. Metal Substrate

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive and Transportation

- 5.3.2. Electrical & Electronics

- 5.3.3. Packaging

- 5.3.4. Consumer Goods

- 5.3.5. Construction & Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Silane

- 6.1.2. Maleic Anhydride

- 6.1.3. Titanate and Zirconate

- 6.1.4. Chlorinated Polyolefins

- 6.1.5. Non-chlorinated Polyolefins

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Plastics & Composites

- 6.2.2. Paints & Coatings

- 6.2.3. Rubber

- 6.2.4. Adhesive

- 6.2.5. Metal Substrate

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Automotive and Transportation

- 6.3.2. Electrical & Electronics

- 6.3.3. Packaging

- 6.3.4. Consumer Goods

- 6.3.5. Construction & Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Silane

- 7.1.2. Maleic Anhydride

- 7.1.3. Titanate and Zirconate

- 7.1.4. Chlorinated Polyolefins

- 7.1.5. Non-chlorinated Polyolefins

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Plastics & Composites

- 7.2.2. Paints & Coatings

- 7.2.3. Rubber

- 7.2.4. Adhesive

- 7.2.5. Metal Substrate

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Automotive and Transportation

- 7.3.2. Electrical & Electronics

- 7.3.3. Packaging

- 7.3.4. Consumer Goods

- 7.3.5. Construction & Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Silane

- 8.1.2. Maleic Anhydride

- 8.1.3. Titanate and Zirconate

- 8.1.4. Chlorinated Polyolefins

- 8.1.5. Non-chlorinated Polyolefins

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Plastics & Composites

- 8.2.2. Paints & Coatings

- 8.2.3. Rubber

- 8.2.4. Adhesive

- 8.2.5. Metal Substrate

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Automotive and Transportation

- 8.3.2. Electrical & Electronics

- 8.3.3. Packaging

- 8.3.4. Consumer Goods

- 8.3.5. Construction & Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Silane

- 9.1.2. Maleic Anhydride

- 9.1.3. Titanate and Zirconate

- 9.1.4. Chlorinated Polyolefins

- 9.1.5. Non-chlorinated Polyolefins

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Plastics & Composites

- 9.2.2. Paints & Coatings

- 9.2.3. Rubber

- 9.2.4. Adhesive

- 9.2.5. Metal Substrate

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Automotive and Transportation

- 9.3.2. Electrical & Electronics

- 9.3.3. Packaging

- 9.3.4. Consumer Goods

- 9.3.5. Construction & Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Silane

- 10.1.2. Maleic Anhydride

- 10.1.3. Titanate and Zirconate

- 10.1.4. Chlorinated Polyolefins

- 10.1.5. Non-chlorinated Polyolefins

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Plastics & Composites

- 10.2.2. Paints & Coatings

- 10.2.3. Rubber

- 10.2.4. Adhesive

- 10.2.5. Metal Substrate

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Automotive and Transportation

- 10.3.2. Electrical & Electronics

- 10.3.3. Packaging

- 10.3.4. Consumer Goods

- 10.3.5. Construction & Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Adhesion Promoters Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Silane

- 11.1.2. Maleic Anhydride

- 11.1.3. Titanate and Zirconate

- 11.1.4. Chlorinated Polyolefins

- 11.1.5. Non-chlorinated Polyolefins

- 11.1.6. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Plastics & Composites

- 11.2.2. Paints & Coatings

- 11.2.3. Rubber

- 11.2.4. Adhesive

- 11.2.5. Metal Substrate

- 11.2.6. Others

- 11.3. Market Analysis, Insights and Forecast - by End-User Industry

- 11.3.1. Automotive and Transportation

- 11.3.2. Electrical & Electronics

- 11.3.3. Packaging

- 11.3.4. Consumer Goods

- 11.3.5. Construction & Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shin Etsu Chemical Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MHM Holding GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 DIC Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nouryon

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Altana AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Evonik Industries AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 3M

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kemipex

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Momentive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BASF SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Arkema Group

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Dow

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Eastman Chemical Company

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Borica Co Ltd

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Nippon Paper Industries Co Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 EMS-CHEMIE HOLDING AG

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Nagase & Co Ltd

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Toyobo Co Ltd*List Not Exhaustive

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.1 Shin Etsu Chemical Co Ltd

List of Figures

- Figure 1: Global Adhesion Promoters Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: Asia Pacific Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: Asia Pacific Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: North America Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: North America Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Europe Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: South America Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: South America Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Adhesion Promoters Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Saudi Arabia Adhesion Promoters Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Saudi Arabia Adhesion Promoters Market Revenue (Million), by Application 2025 & 2033

- Figure 45: Saudi Arabia Adhesion Promoters Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Saudi Arabia Adhesion Promoters Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 47: Saudi Arabia Adhesion Promoters Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 48: Saudi Arabia Adhesion Promoters Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Saudi Arabia Adhesion Promoters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Adhesion Promoters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Canada Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 25: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Germany Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 41: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Adhesion Promoters Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Adhesion Promoters Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Adhesion Promoters Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 45: Global Adhesion Promoters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Iran Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: United Arab Emirates Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: South Africa Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Adhesion Promoters Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Adhesion Promoters Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Adhesion Promoters Market?

Key companies in the market include Shin Etsu Chemical Co Ltd, MHM Holding GmbH, DIC Corporation, Nouryon, Altana AG, Evonik Industries AG, 3M, Kemipex, Momentive, BASF SE, Arkema Group, Dow, Eastman Chemical Company, Borica Co Ltd, Nippon Paper Industries Co Ltd, EMS-CHEMIE HOLDING AG, Nagase & Co Ltd, Toyobo Co Ltd*List Not Exhaustive.

3. What are the main segments of the Adhesion Promoters Market?

The market segments include Type, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Usage in the Packaging Sector; Increasing Applications in the Electrical and Electronics Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Paints & Coatings Industry.

7. Are there any restraints impacting market growth?

; Negative Environmental Effect.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Adhesion Promoters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Adhesion Promoters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Adhesion Promoters Market?

To stay informed about further developments, trends, and reports in the Adhesion Promoters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence