Key Insights

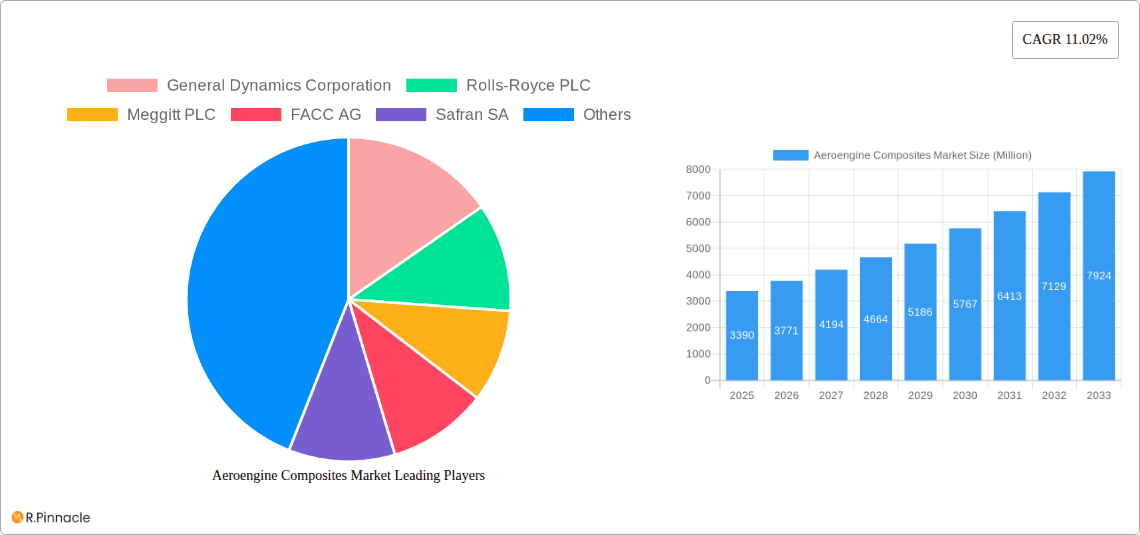

The global Aeroengine Composites Market is poised for significant expansion, projected to reach $3.39 Billion by 2025. This robust growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.02% during the forecast period of 2025-2033. A primary driver for this surge is the increasing demand for lighter, more fuel-efficient, and durable aircraft components, which composite materials are uniquely suited to provide. The aviation industry's ongoing commitment to reducing operational costs and environmental impact directly translates into a higher adoption rate for advanced composite solutions in aeroengine manufacturing. Furthermore, the continuous innovation in composite material technology, leading to enhanced performance characteristics such as superior strength-to-weight ratios and improved thermal resistance, further propels market growth.

Aeroengine Composites Market Market Size (In Billion)

The market's expansion is further bolstered by diverse applications across commercial, military, and general aviation aircraft. Key components like fan blades, fan cases, guide vanes, and shrouds are increasingly being manufactured using composite materials, displacing traditional metallic parts. Emerging trends such as the development of next-generation engines designed for increased thrust and reduced emissions, alongside the growing emphasis on sustainable aviation practices, are expected to create new avenues for growth. While the market is characterized by strong drivers, potential restraints such as the high initial investment for manufacturing infrastructure and the need for specialized skill sets for composite component production, along with fluctuating raw material prices, warrant careful consideration by market participants. Nevertheless, the overarching demand for enhanced performance and efficiency in aerospace applications positions the Aeroengine Composites Market for substantial and sustained growth.

Aeroengine Composites Market Company Market Share

Aeroengine Composites Market: Comprehensive Market Analysis and Future Projections (2019-2033)

This in-depth report provides a comprehensive analysis of the global Aeroengine Composites Market, offering critical insights into market dynamics, innovation trends, competitive landscapes, and future growth trajectories. Leveraging high-ranking keywords and detailed segmentation, this report is essential for industry professionals seeking to understand and capitalize on the evolving aeroengine composites sector. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report equips stakeholders with data-driven intelligence for strategic decision-making.

Aeroengine Composites Market Market Structure & Innovation Trends

The Aeroengine Composites Market exhibits a moderate to high concentration, driven by the significant capital investment required for research, development, and manufacturing of advanced composite materials for aerospace applications. Key innovation drivers include the relentless pursuit of weight reduction, enhanced fuel efficiency, improved engine performance, and increased durability. Regulatory frameworks, particularly those set by aviation authorities like the FAA and EASA, play a crucial role in dictating material certifications, safety standards, and manufacturing processes. Product substitutes, primarily advanced metallic alloys, are continuously being challenged by the superior strength-to-weight ratio and thermal resistance of composites. End-user demographics are primarily dominated by major aircraft manufacturers and Tier 1 aerospace suppliers. Mergers and acquisitions (M&A) activities, such as the strategic partnership extensions and new facility investments, are shaping the market landscape, fostering consolidation and specialized expertise. For instance, the extended partnership between Safran Aircraft Engines and Albany International Corp. underscores a strategic focus on advanced composite technologies. While specific M&A deal values are proprietary, significant investments are observed in R&D centers and manufacturing capabilities dedicated to next-generation composite materials.

Aeroengine Composites Market Market Dynamics & Trends

The Aeroengine Composites Market is experiencing robust growth, fueled by the increasing demand for lighter, more fuel-efficient, and higher-performance aircraft. The primary growth driver is the continuous innovation in composite material science, leading to the development of advanced materials like ceramic matrix composites (CMCs) and carbon fiber reinforced polymers (CFRPs) that offer superior thermal and mechanical properties. These materials enable engine manufacturers to achieve higher operating temperatures, leading to improved thrust-to-weight ratios and reduced fuel consumption, a critical factor in meeting stringent environmental regulations and operational cost targets for airlines. Technological disruptions are a constant feature, with ongoing research into novel manufacturing techniques such as additive manufacturing for composite components and advanced resin systems promising further advancements in design freedom and cost-effectiveness. Consumer preferences, largely dictated by airlines and military operators, are heavily skewed towards enhanced performance, reduced environmental impact, and extended component lifespan. The competitive dynamics within the market are characterized by intense R&D efforts, strategic alliances, and a focus on securing long-term supply contracts with major engine Original Equipment Manufacturers (OEMs). The increasing complexity of aeroengine designs necessitates specialized expertise in composite design, manufacturing, and testing, leading to a market that rewards innovation and technical prowess. The CAGR for the aeroengine composites market is projected to be in the range of 6-8% over the forecast period. Market penetration of advanced composites in critical engine components continues to rise as their benefits become more evident and manufacturing processes mature, moving beyond experimental applications into mainstream production.

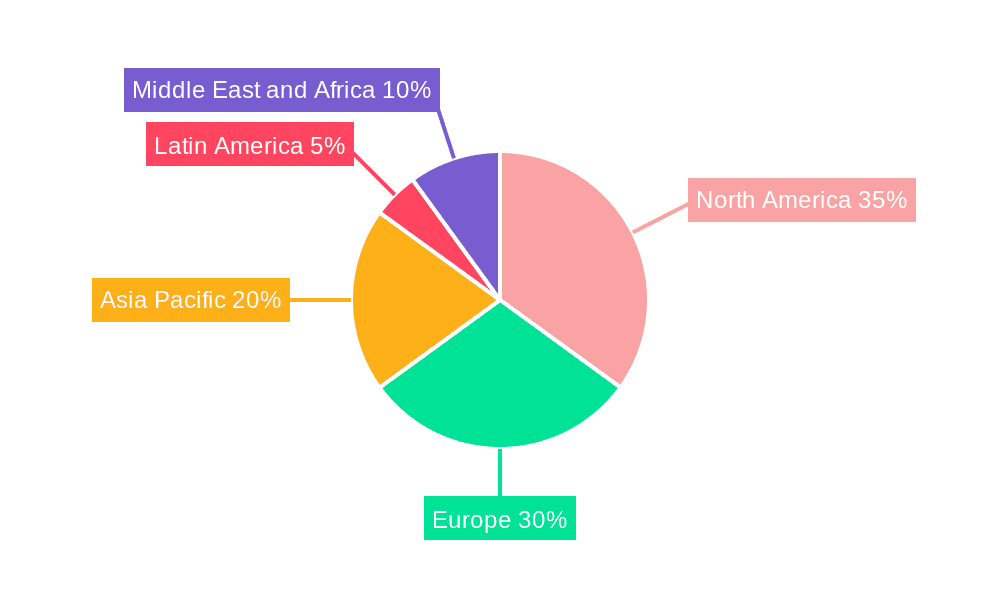

Dominant Regions & Segments in Aeroengine Composites Market

The Aeroengine Composites Market is significantly influenced by the presence of major aerospace manufacturing hubs and the demand from diverse aircraft applications.

Dominant Region: North America currently holds a dominant position in the aeroengine composites market, largely due to the presence of leading aerospace companies such as GE Aviation and Pratt & Whitney, significant military aircraft development programs, and a strong focus on technological innovation. The region benefits from established research institutions and a skilled workforce.

- Key Drivers:

- High concentration of major aeroengine manufacturers.

- Robust government funding for aerospace R&D and defense programs.

- Early adoption of advanced composite technologies.

- Stringent fuel efficiency and emission regulations driving innovation.

Dominant Segment - Application: Commercial Aircraft represent the largest and fastest-growing application segment within the aeroengine composites market. The increasing global air travel demand and the need for fuel-efficient fleets are paramount drivers.

- Key Drivers:

- Surging passenger traffic worldwide.

- Fleet modernization initiatives by airlines.

- Demand for lighter and more fuel-efficient aircraft to reduce operating costs.

- Development of new-generation, fuel-efficient aircraft models.

Dominant Segment - Component: Fan Blades currently represent a significant segment, owing to their critical role in engine performance and the widespread adoption of composite materials for their construction. The drive for lighter, more aerodynamically efficient fan blades directly contributes to improved fuel efficiency and reduced noise levels.

- Key Drivers:

- Need for lightweight and high-strength components.

- Improved aerodynamic efficiency and performance.

- Reduced vibration and noise levels.

- Enhanced resistance to foreign object damage (FOD).

The market also witnesses substantial growth in other components like fan cases, shrouds, and guide vanes as manufacturers increasingly integrate composites to leverage their unique properties across various engine sections. The military aircraft segment, while smaller in volume, represents a crucial segment driven by defense modernization programs and the demand for high-performance, lightweight engines for advanced combat and transport aircraft. General Aviation Aircraft, though the smallest segment, is also seeing increased adoption of composites for their efficiency and performance benefits, particularly in newer aircraft designs.

Aeroengine Composites Market Product Innovations

Product innovations in the Aeroengine Composites Market are primarily focused on developing materials with enhanced thermal stability, superior mechanical strength, and improved damage tolerance. Advancements in Ceramic Matrix Composites (CMCs) are enabling higher operating temperatures in turbine sections, leading to significant efficiency gains. Furthermore, innovations in resin systems and fiber architectures, such as 3D woven composites, are enhancing the structural integrity and manufacturing capabilities of components like fan blades and fan cases. These innovations provide a competitive advantage by allowing for lighter engine designs, reducing fuel burn, and extending component lifespan, thereby meeting the stringent performance and environmental demands of the aerospace industry.

Report Scope & Segmentation Analysis

This report comprehensively covers the Aeroengine Composites Market, segmented by Application and Component.

Application Segments:

- Commercial Aircraft: This segment is projected to witness the highest growth, driven by increasing global air travel and the need for fuel-efficient fleets. Market sizes are expected to reach xx Million by 2033, with a CAGR of approximately 7%.

- Military Aircraft: This segment, driven by defense modernization and the demand for high-performance engines, is expected to grow steadily, with market sizes reaching xx Million by 2033 and a CAGR of around 5%.

- General Aviation Aircraft: This segment, while smaller, shows promising growth as manufacturers incorporate advanced composites for efficiency and performance in new aircraft designs, with market sizes anticipated to reach xx Million by 2033 and a CAGR of 6%.

Component Segments:

- Fan Blades: This segment is a leading contributor, driven by the demand for lightweight and high-strength blades. Projected market sizes are xx Million by 2033 with a CAGR of 7.5%.

- Fan Case: This segment is experiencing significant growth due to the advantages composites offer in terms of weight reduction and structural integrity, with projected market sizes of xx Million by 2033 and a CAGR of 7%.

- Guide Vanes: Expected to grow steadily as composites replace traditional materials for improved performance, with market sizes reaching xx Million by 2033 and a CAGR of 6.5%.

- Shrouds: Driven by the need for high-temperature resistance and lightweight solutions, this segment is forecast to grow to xx Million by 2033 with a CAGR of 7%.

- Other Components: This encompasses various other engine parts where composites are increasingly utilized, contributing to overall market growth with projected sizes of xx Million by 2033 and a CAGR of 6%.

Key Drivers of Aeroengine Composites Market Growth

The Aeroengine Composites Market is propelled by several key factors. Foremost is the relentless pursuit of enhanced fuel efficiency and reduced emissions by aircraft manufacturers and airlines, driven by both economic pressures and stringent environmental regulations. Advanced composite materials offer a superior strength-to-weight ratio compared to traditional metallic alloys, enabling lighter engine designs and consequently, lower fuel consumption. Technological advancements in material science, including the development of high-performance resins, fibers, and manufacturing processes like Resin Transfer Molding (RTM) and 3D weaving, are continuously expanding the applicability and performance envelope of composites in aeroengines. Furthermore, the increasing demand for next-generation aircraft with improved performance characteristics, such as higher thrust and longer service life, further fuels the adoption of composites. Strategic collaborations and investments by key players in research and development are also instrumental in driving innovation and market expansion.

Challenges in the Aeroengine Composites Market Sector

Despite its promising growth, the Aeroengine Composites Market faces several challenges. The high cost of raw materials, such as carbon fibers and advanced resins, significantly impacts the overall manufacturing cost of composite components, making them more expensive than traditional metallic alternatives. The complex and specialized manufacturing processes require substantial capital investment and highly skilled labor, posing a barrier to entry for new players. Stringent and evolving regulatory requirements for aerospace materials necessitate extensive testing and certification processes, which can be time-consuming and costly. Furthermore, the risk of delamination and susceptibility to foreign object damage (FOD) in certain composite structures require careful design considerations and robust in-service inspection methodologies, adding to operational complexities. Supply chain disruptions and the availability of specialized raw materials can also pose challenges to consistent production.

Emerging Opportunities in Aeroengine Composites Market

The Aeroengine Composites Market is ripe with emerging opportunities driven by evolving technological landscapes and market demands. The increasing focus on sustainable aviation fuels and electric/hybrid-electric propulsion systems opens avenues for the development of novel composite materials tailored for these advanced powertrains, potentially offering enhanced thermal management and lightweighting solutions. The expansion of commercial aviation into developing economies presents significant growth potential for new aircraft orders, consequently driving the demand for composite components. Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are creating opportunities for predictive maintenance and optimized design of composite structures, improving lifecycle management and reducing operational costs. Furthermore, the development of more cost-effective manufacturing techniques and the exploration of recyclable composite materials are poised to broaden market access and address environmental concerns.

Leading Players in the Aeroengine Composites Market Market

- General Dynamics Corporation

- Rolls-Royce PLC

- Meggitt PLC

- FACC AG

- Safran SA

- Solvay SA

- Hexcel Corporation

- GE Aviation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Albany Engineered Composites Inc

- GKN Aerospace

Key Developments in Aeroengine Composites Market Industry

- November 2021: Safran Aircraft Engines and Albany International Corp. announced an agreement extending their partnership to 2046, reinforcing their commitment to developing advanced composite parts using 3D woven and Resin Transfer Molded (RTM) technologies for aircraft engines, landing gears, and nacelles. This strategic move highlights the long-term focus on collaborative innovation and secured supply chains for critical composite components.

- July 2021: Pratt & Whitney opened a new ceramic matrix composites (CMCs) engineering and development 'Center of Excellence' in Carlsbad, California. This facility is dedicated to the engineering, development, and low-rate production of CMCs for aerospace applications, signifying a significant investment in next-generation materials that offer superior high-temperature performance and weight savings for advanced aeroengines.

Future Outlook for Aeroengine Composites Market Market

The future outlook for the Aeroengine Composites Market is exceptionally positive, characterized by sustained growth and technological evolution. The increasing global demand for air travel, coupled with stringent environmental regulations, will continue to drive the adoption of lightweight and fuel-efficient composite materials in aeroengines. Innovations in material science, such as the development of advanced CMCs and novel resin systems, will enable engines to operate at higher temperatures and pressures, leading to significant performance enhancements. The trend towards digital manufacturing, including additive manufacturing for composite parts and the use of AI in design and quality control, will further optimize production processes and reduce costs. Strategic partnerships and expansions by key players will ensure a robust supply chain and continued investment in R&D. The market is poised to witness the integration of composites in an even wider array of engine components, contributing to the development of more sustainable and high-performance aircraft for decades to come.

Aeroengine Composites Market Segmentation

-

1. Application

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation Aircraft

-

2. Component

- 2.1. Fan Blades

- 2.2. Fan Case

- 2.3. Guide Vanes

- 2.4. Shrouds

- 2.5. Other Components

Aeroengine Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

-

2. Application

- 2.1. Canada

- 3. Application

-

4. Europe

- 4.1. United Kingdom

-

5. Application

- 5.1. France

-

6. Application

- 6.1. Germany

-

7. Application

- 7.1. Rest of Europe

- 8. Application

-

9. Asia Pacific

- 9.1. China

-

10. Application

- 10.1. India

-

11. Application

- 11.1. Japan

-

12. Application

- 12.1. Rest of Asia Pacific

- 13. Application

-

14. Latin America

- 14.1. Brazil

-

15. Application

- 15.1. Rest of Latin America

- 16. Application

-

17. Middle East and Africa

- 17.1. Saudi Arabia

-

18. Application

- 18.1. United Arab Emirates

-

19. Application

- 19.1. Egypt

-

20. Application

- 20.1. Rest of Middle East and Africa

- 21. Application

Aeroengine Composites Market Regional Market Share

Geographic Coverage of Aeroengine Composites Market

Aeroengine Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment Held the Highest Market Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Fan Blades

- 5.2.2. Fan Case

- 5.2.3. Guide Vanes

- 5.2.4. Shrouds

- 5.2.5. Other Components

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Application

- 5.3.3. Application

- 5.3.4. Europe

- 5.3.5. Application

- 5.3.6. Application

- 5.3.7. Application

- 5.3.8. Application

- 5.3.9. Asia Pacific

- 5.3.10. Application

- 5.3.11. Application

- 5.3.12. Application

- 5.3.13. Application

- 5.3.14. Latin America

- 5.3.15. Application

- 5.3.16. Application

- 5.3.17. Middle East and Africa

- 5.3.18. Application

- 5.3.19. Application

- 5.3.20. Application

- 5.3.21. Application

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Fan Blades

- 6.2.2. Fan Case

- 6.2.3. Guide Vanes

- 6.2.4. Shrouds

- 6.2.5. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Fan Blades

- 7.2.2. Fan Case

- 7.2.3. Guide Vanes

- 7.2.4. Shrouds

- 7.2.5. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Aircraft

- 8.1.2. Military Aircraft

- 8.1.3. General Aviation Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Fan Blades

- 8.2.2. Fan Case

- 8.2.3. Guide Vanes

- 8.2.4. Shrouds

- 8.2.5. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Europe Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Aircraft

- 9.1.2. Military Aircraft

- 9.1.3. General Aviation Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Fan Blades

- 9.2.2. Fan Case

- 9.2.3. Guide Vanes

- 9.2.4. Shrouds

- 9.2.5. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Aircraft

- 10.1.2. Military Aircraft

- 10.1.3. General Aviation Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Fan Blades

- 10.2.2. Fan Case

- 10.2.3. Guide Vanes

- 10.2.4. Shrouds

- 10.2.5. Other Components

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Commercial Aircraft

- 11.1.2. Military Aircraft

- 11.1.3. General Aviation Aircraft

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Fan Blades

- 11.2.2. Fan Case

- 11.2.3. Guide Vanes

- 11.2.4. Shrouds

- 11.2.5. Other Components

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Commercial Aircraft

- 12.1.2. Military Aircraft

- 12.1.3. General Aviation Aircraft

- 12.2. Market Analysis, Insights and Forecast - by Component

- 12.2.1. Fan Blades

- 12.2.2. Fan Case

- 12.2.3. Guide Vanes

- 12.2.4. Shrouds

- 12.2.5. Other Components

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Commercial Aircraft

- 13.1.2. Military Aircraft

- 13.1.3. General Aviation Aircraft

- 13.2. Market Analysis, Insights and Forecast - by Component

- 13.2.1. Fan Blades

- 13.2.2. Fan Case

- 13.2.3. Guide Vanes

- 13.2.4. Shrouds

- 13.2.5. Other Components

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Asia Pacific Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Application

- 14.1.1. Commercial Aircraft

- 14.1.2. Military Aircraft

- 14.1.3. General Aviation Aircraft

- 14.2. Market Analysis, Insights and Forecast - by Component

- 14.2.1. Fan Blades

- 14.2.2. Fan Case

- 14.2.3. Guide Vanes

- 14.2.4. Shrouds

- 14.2.5. Other Components

- 14.1. Market Analysis, Insights and Forecast - by Application

- 15. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Application

- 15.1.1. Commercial Aircraft

- 15.1.2. Military Aircraft

- 15.1.3. General Aviation Aircraft

- 15.2. Market Analysis, Insights and Forecast - by Component

- 15.2.1. Fan Blades

- 15.2.2. Fan Case

- 15.2.3. Guide Vanes

- 15.2.4. Shrouds

- 15.2.5. Other Components

- 15.1. Market Analysis, Insights and Forecast - by Application

- 16. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Application

- 16.1.1. Commercial Aircraft

- 16.1.2. Military Aircraft

- 16.1.3. General Aviation Aircraft

- 16.2. Market Analysis, Insights and Forecast - by Component

- 16.2.1. Fan Blades

- 16.2.2. Fan Case

- 16.2.3. Guide Vanes

- 16.2.4. Shrouds

- 16.2.5. Other Components

- 16.1. Market Analysis, Insights and Forecast - by Application

- 17. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - by Application

- 17.1.1. Commercial Aircraft

- 17.1.2. Military Aircraft

- 17.1.3. General Aviation Aircraft

- 17.2. Market Analysis, Insights and Forecast - by Component

- 17.2.1. Fan Blades

- 17.2.2. Fan Case

- 17.2.3. Guide Vanes

- 17.2.4. Shrouds

- 17.2.5. Other Components

- 17.1. Market Analysis, Insights and Forecast - by Application

- 18. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 18.1. Market Analysis, Insights and Forecast - by Application

- 18.1.1. Commercial Aircraft

- 18.1.2. Military Aircraft

- 18.1.3. General Aviation Aircraft

- 18.2. Market Analysis, Insights and Forecast - by Component

- 18.2.1. Fan Blades

- 18.2.2. Fan Case

- 18.2.3. Guide Vanes

- 18.2.4. Shrouds

- 18.2.5. Other Components

- 18.1. Market Analysis, Insights and Forecast - by Application

- 19. Latin America Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 19.1. Market Analysis, Insights and Forecast - by Application

- 19.1.1. Commercial Aircraft

- 19.1.2. Military Aircraft

- 19.1.3. General Aviation Aircraft

- 19.2. Market Analysis, Insights and Forecast - by Component

- 19.2.1. Fan Blades

- 19.2.2. Fan Case

- 19.2.3. Guide Vanes

- 19.2.4. Shrouds

- 19.2.5. Other Components

- 19.1. Market Analysis, Insights and Forecast - by Application

- 20. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 20.1. Market Analysis, Insights and Forecast - by Application

- 20.1.1. Commercial Aircraft

- 20.1.2. Military Aircraft

- 20.1.3. General Aviation Aircraft

- 20.2. Market Analysis, Insights and Forecast - by Component

- 20.2.1. Fan Blades

- 20.2.2. Fan Case

- 20.2.3. Guide Vanes

- 20.2.4. Shrouds

- 20.2.5. Other Components

- 20.1. Market Analysis, Insights and Forecast - by Application

- 21. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 21.1. Market Analysis, Insights and Forecast - by Application

- 21.1.1. Commercial Aircraft

- 21.1.2. Military Aircraft

- 21.1.3. General Aviation Aircraft

- 21.2. Market Analysis, Insights and Forecast - by Component

- 21.2.1. Fan Blades

- 21.2.2. Fan Case

- 21.2.3. Guide Vanes

- 21.2.4. Shrouds

- 21.2.5. Other Components

- 21.1. Market Analysis, Insights and Forecast - by Application

- 22. Middle East and Africa Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 22.1. Market Analysis, Insights and Forecast - by Application

- 22.1.1. Commercial Aircraft

- 22.1.2. Military Aircraft

- 22.1.3. General Aviation Aircraft

- 22.2. Market Analysis, Insights and Forecast - by Component

- 22.2.1. Fan Blades

- 22.2.2. Fan Case

- 22.2.3. Guide Vanes

- 22.2.4. Shrouds

- 22.2.5. Other Components

- 22.1. Market Analysis, Insights and Forecast - by Application

- 23. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 23.1. Market Analysis, Insights and Forecast - by Application

- 23.1.1. Commercial Aircraft

- 23.1.2. Military Aircraft

- 23.1.3. General Aviation Aircraft

- 23.2. Market Analysis, Insights and Forecast - by Component

- 23.2.1. Fan Blades

- 23.2.2. Fan Case

- 23.2.3. Guide Vanes

- 23.2.4. Shrouds

- 23.2.5. Other Components

- 23.1. Market Analysis, Insights and Forecast - by Application

- 24. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 24.1. Market Analysis, Insights and Forecast - by Application

- 24.1.1. Commercial Aircraft

- 24.1.2. Military Aircraft

- 24.1.3. General Aviation Aircraft

- 24.2. Market Analysis, Insights and Forecast - by Component

- 24.2.1. Fan Blades

- 24.2.2. Fan Case

- 24.2.3. Guide Vanes

- 24.2.4. Shrouds

- 24.2.5. Other Components

- 24.1. Market Analysis, Insights and Forecast - by Application

- 25. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 25.1. Market Analysis, Insights and Forecast - by Application

- 25.1.1. Commercial Aircraft

- 25.1.2. Military Aircraft

- 25.1.3. General Aviation Aircraft

- 25.2. Market Analysis, Insights and Forecast - by Component

- 25.2.1. Fan Blades

- 25.2.2. Fan Case

- 25.2.3. Guide Vanes

- 25.2.4. Shrouds

- 25.2.5. Other Components

- 25.1. Market Analysis, Insights and Forecast - by Application

- 26. Application Aeroengine Composites Market Analysis, Insights and Forecast, 2020-2032

- 26.1. Market Analysis, Insights and Forecast - by Application

- 26.1.1. Commercial Aircraft

- 26.1.2. Military Aircraft

- 26.1.3. General Aviation Aircraft

- 26.2. Market Analysis, Insights and Forecast - by Component

- 26.2.1. Fan Blades

- 26.2.2. Fan Case

- 26.2.3. Guide Vanes

- 26.2.4. Shrouds

- 26.2.5. Other Components

- 26.1. Market Analysis, Insights and Forecast - by Application

- 27. Competitive Analysis

- 27.1. Global Market Share Analysis 2025

- 27.2. Company Profiles

- 27.2.1 General Dynamics Corporation

- 27.2.1.1. Overview

- 27.2.1.2. Products

- 27.2.1.3. SWOT Analysis

- 27.2.1.4. Recent Developments

- 27.2.1.5. Financials (Based on Availability)

- 27.2.2 Rolls-Royce PLC

- 27.2.2.1. Overview

- 27.2.2.2. Products

- 27.2.2.3. SWOT Analysis

- 27.2.2.4. Recent Developments

- 27.2.2.5. Financials (Based on Availability)

- 27.2.3 Meggitt PLC

- 27.2.3.1. Overview

- 27.2.3.2. Products

- 27.2.3.3. SWOT Analysis

- 27.2.3.4. Recent Developments

- 27.2.3.5. Financials (Based on Availability)

- 27.2.4 FACC AG

- 27.2.4.1. Overview

- 27.2.4.2. Products

- 27.2.4.3. SWOT Analysis

- 27.2.4.4. Recent Developments

- 27.2.4.5. Financials (Based on Availability)

- 27.2.5 Safran SA

- 27.2.5.1. Overview

- 27.2.5.2. Products

- 27.2.5.3. SWOT Analysis

- 27.2.5.4. Recent Developments

- 27.2.5.5. Financials (Based on Availability)

- 27.2.6 Solvay SA

- 27.2.6.1. Overview

- 27.2.6.2. Products

- 27.2.6.3. SWOT Analysis

- 27.2.6.4. Recent Developments

- 27.2.6.5. Financials (Based on Availability)

- 27.2.7 Hexcel Corporation

- 27.2.7.1. Overview

- 27.2.7.2. Products

- 27.2.7.3. SWOT Analysis

- 27.2.7.4. Recent Developments

- 27.2.7.5. Financials (Based on Availability)

- 27.2.8 GE Aviation

- 27.2.8.1. Overview

- 27.2.8.2. Products

- 27.2.8.3. SWOT Analysis

- 27.2.8.4. Recent Developments

- 27.2.8.5. Financials (Based on Availability)

- 27.2.9 Pratt & Whitney (Raytheon Technologies Corporation

- 27.2.9.1. Overview

- 27.2.9.2. Products

- 27.2.9.3. SWOT Analysis

- 27.2.9.4. Recent Developments

- 27.2.9.5. Financials (Based on Availability)

- 27.2.10 Albany Engineered Composites Inc

- 27.2.10.1. Overview

- 27.2.10.2. Products

- 27.2.10.3. SWOT Analysis

- 27.2.10.4. Recent Developments

- 27.2.10.5. Financials (Based on Availability)

- 27.2.11 GKN Aerospace

- 27.2.11.1. Overview

- 27.2.11.2. Products

- 27.2.11.3. SWOT Analysis

- 27.2.11.4. Recent Developments

- 27.2.11.5. Financials (Based on Availability)

- 27.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Aeroengine Composites Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 5: North America Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 11: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 12: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 17: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Europe Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Europe Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 29: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 33: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 35: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 36: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 41: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 42: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 45: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 47: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 48: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 51: Asia Pacific Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 52: Asia Pacific Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 53: Asia Pacific Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Asia Pacific Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 55: Asia Pacific Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 56: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 57: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 59: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 60: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 63: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 64: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 65: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 66: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 67: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 68: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 69: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 71: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 72: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 73: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 75: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 76: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 77: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 78: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 79: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 80: Latin America Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 81: Latin America Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 82: Latin America Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 83: Latin America Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 84: Latin America Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 85: Latin America Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 87: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 88: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 89: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 90: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 91: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 92: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 93: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 94: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 95: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 96: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 97: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 99: Middle East and Africa Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 100: Middle East and Africa Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 101: Middle East and Africa Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 102: Middle East and Africa Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 103: Middle East and Africa Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 104: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 105: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 106: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 107: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 108: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 109: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 110: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 111: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 112: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 113: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 114: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 115: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 116: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 117: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 118: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 119: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 120: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 121: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 122: Application Aeroengine Composites Market Revenue (Million), by Application 2025 & 2033

- Figure 123: Application Aeroengine Composites Market Revenue Share (%), by Application 2025 & 2033

- Figure 124: Application Aeroengine Composites Market Revenue (Million), by Component 2025 & 2033

- Figure 125: Application Aeroengine Composites Market Revenue Share (%), by Component 2025 & 2033

- Figure 126: Application Aeroengine Composites Market Revenue (Million), by Country 2025 & 2033

- Figure 127: Application Aeroengine Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Aeroengine Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Canada Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 21: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: France Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Germany Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 29: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Rest of Europe Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 33: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 36: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: China Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 40: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: India Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 44: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 45: Japan Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 47: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 48: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 49: Rest of Asia Pacific Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 51: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 52: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 53: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 55: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Brazil Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 59: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Rest of Latin America Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 62: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 63: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 65: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 66: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 67: Saudi Arabia Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 69: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 70: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 71: United Arab Emirates Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 73: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 74: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 75: Egypt Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 77: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 78: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

- Table 79: Rest of Middle East and Africa Aeroengine Composites Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Global Aeroengine Composites Market Revenue Million Forecast, by Application 2020 & 2033

- Table 81: Global Aeroengine Composites Market Revenue Million Forecast, by Component 2020 & 2033

- Table 82: Global Aeroengine Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aeroengine Composites Market?

The projected CAGR is approximately 11.02%.

2. Which companies are prominent players in the Aeroengine Composites Market?

Key companies in the market include General Dynamics Corporation, Rolls-Royce PLC, Meggitt PLC, FACC AG, Safran SA, Solvay SA, Hexcel Corporation, GE Aviation, Pratt & Whitney (Raytheon Technologies Corporation, Albany Engineered Composites Inc, GKN Aerospace.

3. What are the main segments of the Aeroengine Composites Market?

The market segments include Application, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment Held the Highest Market Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Safran Aircraft Engines and Albany International Corp. announced an agreement extending their partnership to 2046. Albany International and Safran signed the original framework agreement in 2006, resulting in the creation of their joint venture for the development of high technology composite parts (3D woven and Resin Transfer Molded technologies) designed for aircraft engines, landing gears, and nacelles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aeroengine Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aeroengine Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aeroengine Composites Market?

To stay informed about further developments, trends, and reports in the Aeroengine Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence