Key Insights

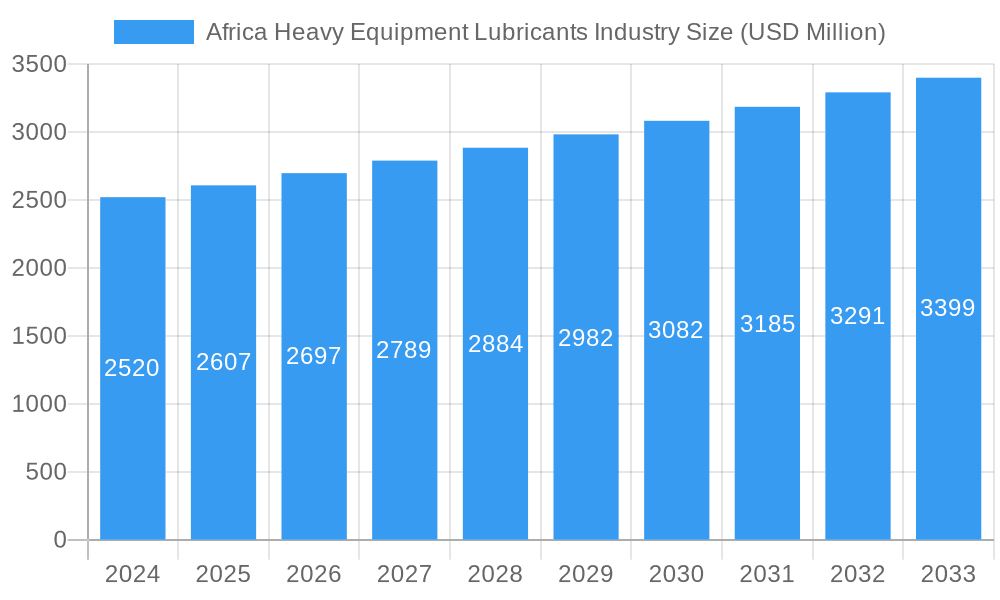

The Africa Heavy Equipment Lubricants Market is poised for significant expansion, projected to reach USD 2.52 billion in 2024. This robust growth is underpinned by a CAGR of 3.43%, indicating a healthy and sustained increase in demand throughout the forecast period (2025-2033). The market's expansion is primarily driven by the escalating investments in infrastructure development across the continent, particularly in burgeoning sectors like construction and mining. These industries rely heavily on heavy-duty machinery, which necessitates high-performance lubricants for optimal operation and longevity. Furthermore, the burgeoning oil and gas sector, coupled with a resurgent agricultural industry, contributes significantly to the demand for specialized lubricants like engine oils, transmission fluids, and hydraulic oils. The ongoing mechanization in agriculture and the exploration and production activities in the oil and gas domain are creating consistent opportunities for lubricant manufacturers.

Africa Heavy Equipment Lubricants Industry Market Size (In Billion)

Despite the promising outlook, certain factors could influence the market's trajectory. Fluctuations in crude oil prices, a key raw material for lubricant production, can impact manufacturing costs and, consequently, market pricing. Geopolitical instability in some regions and the increasing adoption of electric heavy equipment, which requires different lubrication solutions or none at all, present potential restraints. However, the widespread presence of existing internal combustion engine fleets and the long lifecycle of heavy equipment in many African nations suggest that conventional lubricants will continue to dominate the market for the foreseeable future. Key growth opportunities lie in the development of advanced, eco-friendly lubricant formulations that cater to evolving regulatory standards and industry demands for sustainability, particularly in countries like South Africa and Nigeria, which represent substantial market segments.

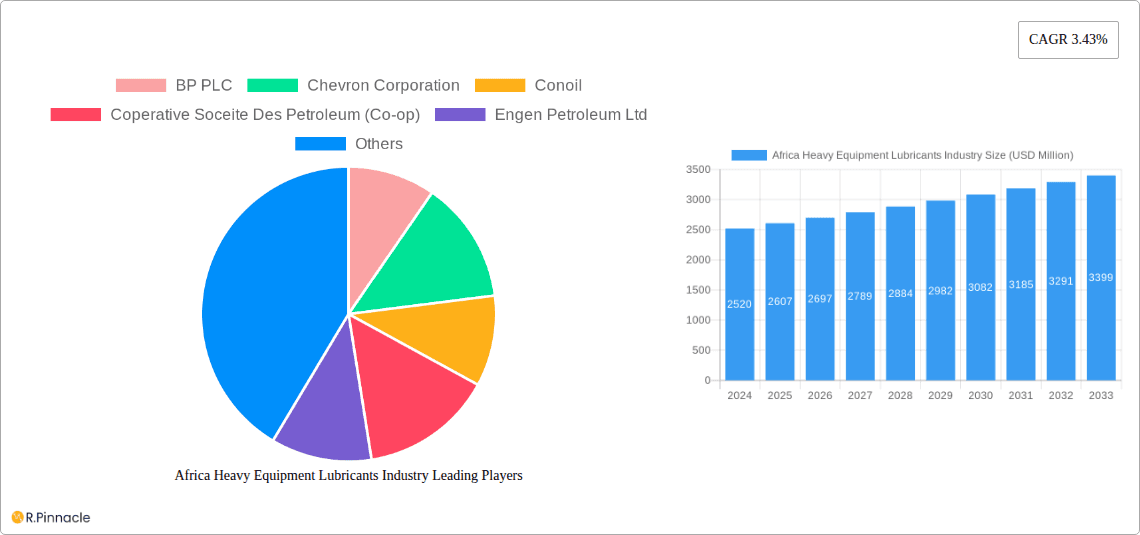

Africa Heavy Equipment Lubricants Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Africa Heavy Equipment Lubricants Industry, offering critical insights into market structure, dynamics, regional dominance, product innovations, and future outlook. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on this burgeoning market. Leveraging high-ranking keywords, this report aims to boost search visibility and engage industry professionals.

Africa Heavy Equipment Lubricants Industry Market Structure & Innovation Trends

The Africa Heavy Equipment Lubricants Industry exhibits a moderately consolidated market structure, with a few key players holding significant market share, estimated to be over 50% for the top 5 companies. Innovation is driven by the increasing demand for high-performance, environmentally friendly lubricants and advanced additive technologies. Regulatory frameworks, while evolving, present a complex landscape across different African nations, influencing product formulations and market entry strategies. Product substitutes, such as synthetic greases and bio-lubricants, are gaining traction but currently represent a smaller market share compared to conventional mineral-based lubricants. End-user demographics are dominated by large-scale industrial operations in construction, mining, and oil and gas sectors, requiring specialized and durable lubricant solutions. Mergers and acquisitions (M&A) activity is expected to increase, with estimated deal values in the hundreds of billions of dollars as companies seek to expand their geographical reach and product portfolios. Key M&A drivers include the pursuit of market share, technological advancements, and the consolidation of supply chains.

- Market Concentration: Moderately consolidated with significant share held by top players.

- Innovation Drivers: Demand for high-performance, eco-friendly lubricants, advanced additive technologies.

- Regulatory Frameworks: Evolving and complex across different nations.

- Product Substitutes: Growing adoption of synthetic greases and bio-lubricants.

- End-user Demographics: Dominated by construction, mining, and oil & gas sectors.

- M&A Activities: Expected to increase with substantial deal values in the billions.

Africa Heavy Equipment Lubricants Industry Market Dynamics & Trends

The Africa Heavy Equipment Lubricants Industry is poised for robust growth, driven by several key factors. A projected Compound Annual Growth Rate (CAGR) of approximately 7.5% indicates a dynamic market expansion. The escalating investment in infrastructure development across the continent, including roads, bridges, and urban expansion projects, directly fuels the demand for heavy equipment and, consequently, high-quality lubricants. The burgeoning mining sector, particularly in regions rich in mineral resources, also represents a significant growth catalyst, requiring specialized lubricants to withstand extreme operating conditions. Furthermore, the expansion of the oil and gas industry, involving exploration and production activities, necessitates a consistent supply of advanced lubricants for drilling rigs, pipelines, and processing machinery. Consumer preferences are gradually shifting towards lubricants that offer extended drain intervals, improved fuel efficiency, and enhanced protection against wear and tear, aligning with the industry's focus on sustainability and operational cost reduction. Technological disruptions, such as the introduction of intelligent lubricants with embedded sensors for real-time monitoring and predictive maintenance, are beginning to penetrate the market, offering significant competitive advantages. The competitive landscape is characterized by both global giants and strong regional players, vying for market share through product innovation, strategic partnerships, and aggressive distribution networks. Market penetration is expected to deepen, especially in previously underserved regions as economic development continues.

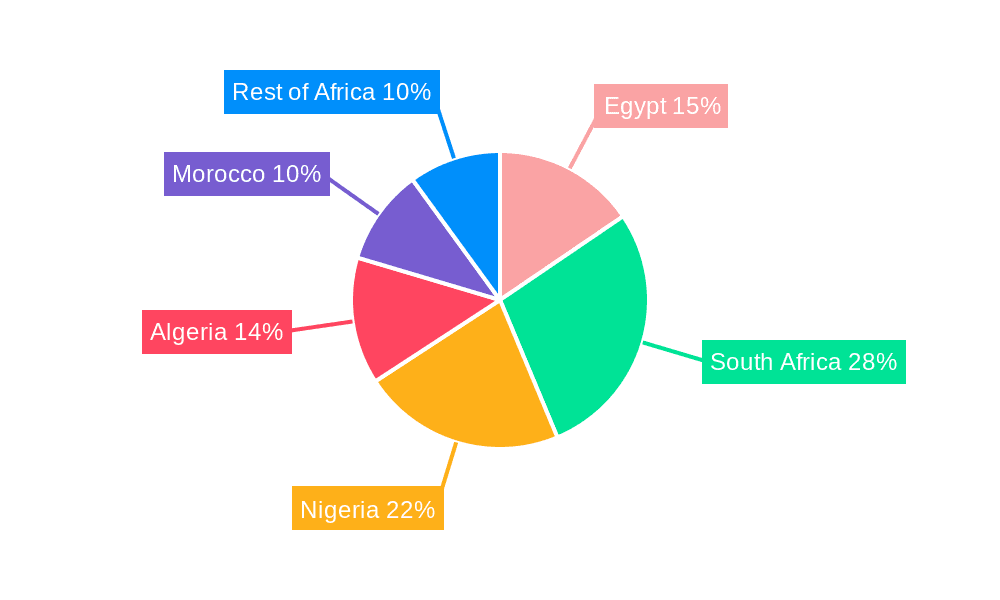

Dominant Regions & Segments in Africa Heavy Equipment Lubricants Industry

South Africa emerges as the dominant region in the Africa Heavy Equipment Lubricants Industry, driven by its well-established industrial base in mining, construction, and manufacturing. Nigeria and Egypt also represent significant markets, fueled by extensive oil and gas activities and ongoing infrastructure projects respectively. Within the Product Type segmentation, Engine Oil commands the largest market share, estimated at over 35% of the total market value, due to its universal application in virtually all heavy equipment. Transmission and Hydraulic Fluid follows closely, essential for the operational efficiency of complex machinery in demanding environments. The End-user Industry segmentation clearly points to the Construction sector as the leading consumer, accounting for an estimated 40% of the market, followed by Mining, which accounts for approximately 30%. The Geography segmentation sees South Africa leading, followed by Nigeria and Egypt.

- Dominant Region: South Africa, driven by robust industrial sectors.

- Leading Product Type: Engine Oil, essential for a wide array of heavy machinery.

- Key End-user Industry: Construction, with significant demand from ongoing infrastructure projects.

- Secondary End-user Industry: Mining, a vital sector demanding specialized lubricants.

- Emerging Geographic Markets: Nigeria and Egypt, propelled by oil & gas and infrastructure growth.

- Key Drivers for Regional Dominance:

- South Africa: Mature mining and construction sectors, advanced industrialization.

- Nigeria: Extensive oil and gas exploration and production activities.

- Egypt: Large-scale infrastructure development and a growing manufacturing base.

- Market Share Projections (Product Type):

- Engine Oil: 35% - 40%

- Transmission and Hydraulic Fluid: 25% - 30%

- General Industrial Oil: 10% - 15%

- Gear Oil: 8% - 12%

- Grease: 5% - 8%

- Process Oil: 2% - 5%

- Other Product Types: <2%

Africa Heavy Equipment Lubricants Industry Product Innovations

Product innovations in the Africa Heavy Equipment Lubricants Industry are primarily focused on developing high-performance, long-lasting lubricants that offer superior protection under extreme conditions. Key developments include advanced synthetic formulations engineered for enhanced thermal stability and oxidation resistance, significantly extending drain intervals and reducing maintenance costs. The introduction of bio-based and biodegradable lubricants is gaining momentum, driven by increasing environmental regulations and a growing demand for sustainable solutions. Nanotechnology is being integrated into lubricants to improve wear protection and friction reduction, leading to greater equipment efficiency and lifespan. These innovations provide manufacturers with a competitive edge by addressing the specific operational challenges faced by heavy equipment in diverse African environments.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the Africa Heavy Equipment Lubricants Industry, segmenting the market comprehensively across Product Type, End-user Industry, and Geography. The Product Type segmentation includes Engine Oil, Transmission and Hydraulic Fluid, General Industrial Oil, Gear Oil, Grease, Process Oil, and Other Product Types. Each segment's growth projections and market sizes are meticulously detailed. The End-user Industry segmentation covers Construction, Mining, Agriculture, and Oil and Gas, providing insights into the specific demands and growth trajectories of each sector. The Geography segmentation analyzes the market landscape across Egypt, South Africa, Nigeria, Algeria, Morocco, and the Rest of Africa, offering a nuanced understanding of regional dynamics and competitive landscapes.

Key Drivers of Africa Heavy Equipment Lubricants Industry Growth

The growth of the Africa Heavy Equipment Lubricants Industry is propelled by several significant drivers. Increased government spending on infrastructure development, including transportation networks and public works, directly boosts the demand for heavy machinery and related lubricants. The expansion of mining operations, driven by global demand for commodities, necessitates robust lubrication solutions for extraction and processing equipment. Advancements in lubricant technology, leading to higher performance, extended drain intervals, and improved fuel efficiency, are key economic drivers for adoption. Furthermore, the growing emphasis on equipment longevity and reduced downtime encourages investment in premium lubrication products.

Challenges in the Africa Heavy Equipment Lubricants Industry Sector

The Africa Heavy Equipment Lubricants Industry faces several challenges that can impede its growth trajectory. Inconsistent regulatory enforcement and varying standards across different African countries create a complex compliance landscape. Supply chain disruptions, stemming from logistical complexities and underdeveloped infrastructure in some regions, can lead to stockouts and increased costs. The prevalence of counterfeit and low-quality lubricants poses a significant threat to market integrity and equipment reliability. Intense price competition among market players, particularly for standard lubricant grades, can pressure profit margins for manufacturers and distributors.

Emerging Opportunities in Africa Heavy Equipment Lubricants Industry

The Africa Heavy Equipment Lubricants Industry presents numerous emerging opportunities. The rapid urbanization and expanding middle class across the continent are driving demand for infrastructure development, creating sustained demand for construction equipment lubricants. The untapped potential in the agricultural sector, with increased mechanization and a focus on improving crop yields, offers a significant growth avenue for specialized lubricants. The growing adoption of stricter environmental standards across African nations is creating a market for bio-based and eco-friendly lubricants. Furthermore, the increasing focus on predictive maintenance and the integration of IoT in heavy equipment present opportunities for advanced, intelligent lubricant solutions.

Leading Players in the Africa Heavy Equipment Lubricants Industry Market

- BP PLC

- Chevron Corporation

- Conoil

- Coperative Soceite Des Petroleum (Co-op)

- Engen Petroleum Ltd

- Exxon Mobil Corporation

- FUCHS

- Hasspetroleum

- Kenolkobil Limited

- Puma Energy

- Royal Dutch Shell PLC

- Sasol

- Total

Key Developments in Africa Heavy Equipment Lubricants Industry Industry

- 2023: Launch of new synthetic engine oils by Exxon Mobil Corporation, offering enhanced performance and fuel efficiency for heavy-duty vehicles in the African market.

- 2023: Engen Petroleum Ltd expands its distribution network in East Africa, aiming to increase market penetration for its range of industrial lubricants.

- 2024: Chevron Corporation invests in R&D for bio-lubricants to cater to the growing demand for sustainable solutions in South Africa's mining sector.

- 2024: Total introduces a new line of hydraulic fluids designed for extreme temperature applications in the Algerian oil and gas industry.

- 2024: FUCHS partners with a major construction equipment manufacturer to develop customized lubricant solutions for large-scale infrastructure projects in Nigeria.

Future Outlook for Africa Heavy Equipment Lubricants Industry Market

The future outlook for the Africa Heavy Equipment Lubricants Industry is exceptionally positive, driven by sustained economic growth, ongoing infrastructure development, and the increasing mechanization of key sectors like mining and agriculture. The demand for high-performance, environmentally conscious lubricants will continue to rise, creating opportunities for innovation and market differentiation. Strategic investments in R&D, expanding distribution networks, and forging strong partnerships will be crucial for companies looking to capitalize on the vast potential of this dynamic market. The industry is expected to witness further consolidation and a growing emphasis on value-added services, including technical support and maintenance solutions.

Africa Heavy Equipment Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oil

- 1.5. Grease

- 1.6. Process Oil

- 1.7. Other Product Types

-

2. End-user Industry

- 2.1. Construction

- 2.2. Mining

- 2.3. Agriculture

- 2.4. Oil and Gas

-

3. Geography

- 3.1. Egypt

- 3.2. South Africa

- 3.3. Nigeria

- 3.4. Algeria

- 3.5. Morocco

- 3.6. Rest of Africa

Africa Heavy Equipment Lubricants Industry Segmentation By Geography

- 1. Egypt

- 2. South Africa

- 3. Nigeria

- 4. Algeria

- 5. Morocco

- 6. Rest of Africa

Africa Heavy Equipment Lubricants Industry Regional Market Share

Geographic Coverage of Africa Heavy Equipment Lubricants Industry

Africa Heavy Equipment Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from the End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand from the End-user Industries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Mining Industry to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oil

- 5.1.5. Grease

- 5.1.6. Process Oil

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Mining

- 5.2.3. Agriculture

- 5.2.4. Oil and Gas

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Egypt

- 5.3.2. South Africa

- 5.3.3. Nigeria

- 5.3.4. Algeria

- 5.3.5. Morocco

- 5.3.6. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.4.2. South Africa

- 5.4.3. Nigeria

- 5.4.4. Algeria

- 5.4.5. Morocco

- 5.4.6. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Egypt Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Engine Oil

- 6.1.2. Transmission and Hydraulic Fluid

- 6.1.3. General Industrial Oil

- 6.1.4. Gear Oil

- 6.1.5. Grease

- 6.1.6. Process Oil

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Mining

- 6.2.3. Agriculture

- 6.2.4. Oil and Gas

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Egypt

- 6.3.2. South Africa

- 6.3.3. Nigeria

- 6.3.4. Algeria

- 6.3.5. Morocco

- 6.3.6. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Engine Oil

- 7.1.2. Transmission and Hydraulic Fluid

- 7.1.3. General Industrial Oil

- 7.1.4. Gear Oil

- 7.1.5. Grease

- 7.1.6. Process Oil

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Mining

- 7.2.3. Agriculture

- 7.2.4. Oil and Gas

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Egypt

- 7.3.2. South Africa

- 7.3.3. Nigeria

- 7.3.4. Algeria

- 7.3.5. Morocco

- 7.3.6. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Nigeria Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Engine Oil

- 8.1.2. Transmission and Hydraulic Fluid

- 8.1.3. General Industrial Oil

- 8.1.4. Gear Oil

- 8.1.5. Grease

- 8.1.6. Process Oil

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Mining

- 8.2.3. Agriculture

- 8.2.4. Oil and Gas

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Egypt

- 8.3.2. South Africa

- 8.3.3. Nigeria

- 8.3.4. Algeria

- 8.3.5. Morocco

- 8.3.6. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Algeria Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Engine Oil

- 9.1.2. Transmission and Hydraulic Fluid

- 9.1.3. General Industrial Oil

- 9.1.4. Gear Oil

- 9.1.5. Grease

- 9.1.6. Process Oil

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Mining

- 9.2.3. Agriculture

- 9.2.4. Oil and Gas

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Egypt

- 9.3.2. South Africa

- 9.3.3. Nigeria

- 9.3.4. Algeria

- 9.3.5. Morocco

- 9.3.6. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Morocco Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Engine Oil

- 10.1.2. Transmission and Hydraulic Fluid

- 10.1.3. General Industrial Oil

- 10.1.4. Gear Oil

- 10.1.5. Grease

- 10.1.6. Process Oil

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Mining

- 10.2.3. Agriculture

- 10.2.4. Oil and Gas

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Egypt

- 10.3.2. South Africa

- 10.3.3. Nigeria

- 10.3.4. Algeria

- 10.3.5. Morocco

- 10.3.6. Rest of Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Africa Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Engine Oil

- 11.1.2. Transmission and Hydraulic Fluid

- 11.1.3. General Industrial Oil

- 11.1.4. Gear Oil

- 11.1.5. Grease

- 11.1.6. Process Oil

- 11.1.7. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Construction

- 11.2.2. Mining

- 11.2.3. Agriculture

- 11.2.4. Oil and Gas

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Egypt

- 11.3.2. South Africa

- 11.3.3. Nigeria

- 11.3.4. Algeria

- 11.3.5. Morocco

- 11.3.6. Rest of Africa

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chevron Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Conoil

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Coperative Soceite Des Petroleum (Co-op)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Engen Petroleum Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Exxon Mobil Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 FUCHS

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hasspetroleum

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kenolkobil Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Puma Energy

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Royal Dutch Shell PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Sasol

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Total*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 BP PLC

List of Figures

- Figure 1: Global Africa Heavy Equipment Lubricants Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 15: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 35: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Heavy Equipment Lubricants Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Africa Heavy Equipment Lubricants Industry?

Key companies in the market include BP PLC, Chevron Corporation, Conoil, Coperative Soceite Des Petroleum (Co-op), Engen Petroleum Ltd, Exxon Mobil Corporation, FUCHS, Hasspetroleum, Kenolkobil Limited, Puma Energy, Royal Dutch Shell PLC, Sasol, Total*List Not Exhaustive.

3. What are the main segments of the Africa Heavy Equipment Lubricants Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from the End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

Mining Industry to Dominate the market.

7. Are there any restraints impacting market growth?

; Growing Demand from the End-user Industries; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Heavy Equipment Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Heavy Equipment Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Heavy Equipment Lubricants Industry?

To stay informed about further developments, trends, and reports in the Africa Heavy Equipment Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence