Key Insights

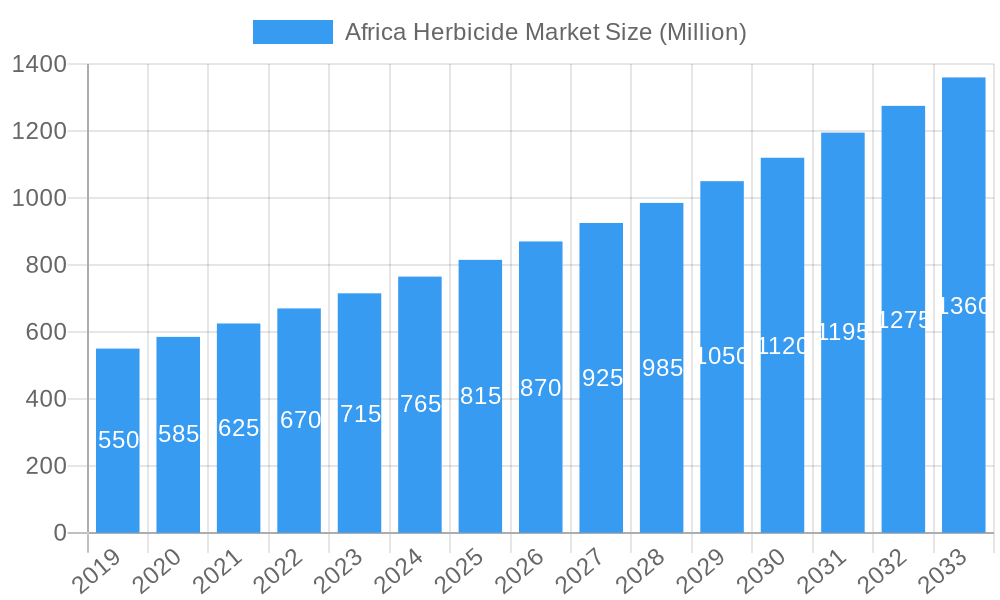

The African herbicide market is projected to achieve significant growth, reaching an estimated 1.23 billion by 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 3.88% through 2033. This expansion is driven by the increasing adoption of advanced agricultural practices across the continent, spurred by the imperative for food security and enhanced crop yields to support a growing population. Key growth catalysts include government initiatives promoting modern agriculture, increased investment in agricultural research and development, and the rising adoption of precision agriculture for optimized herbicide application. The burgeoning commercial farming sector, particularly for grains, cereals, fruits, and vegetables, is a major contributor, as farmers recognize the economic advantages of effective weed management for boosting productivity and profitability. Furthermore, a growing middle class and rising disposable incomes indirectly fuel demand for a diverse range of agricultural produce.

Africa Herbicide Market Market Size (In Billion)

Market segmentation highlights a diverse array of applications and crop types benefiting from herbicide solutions. Chemigation and soil treatment are emerging as efficient and targeted application methods. Commercial crops, fruits & vegetables, and grains & cereals are anticipated to command the largest market share, reflecting their agricultural and global food supply chain significance. While strong demand and favorable trends propel market growth, certain restraints may influence its trajectory. These include fluctuating raw material prices for herbicide production, stringent regional regulatory frameworks, and environmental concerns linked to the overuse of specific chemicals. However, continuous innovation in sustainable herbicide formulations and increased farmer awareness of integrated pest management are expected to counterbalance these challenges, fostering a dynamic and expanding African herbicide market.

Africa Herbicide Market Company Market Share

Gain unparalleled insights into the dynamic Africa Herbicide Market with this comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delivers critical data for strategic decision-making. Explore market size, CAGR, competitive landscapes, and future trends essential for stakeholders in African agriculture. The report meticulously details market segmentation by application modes and crop types, underscoring the influence of industry leaders and groundbreaking developments.

Africa Herbicide Market Market Structure & Innovation Trends

The Africa Herbicide Market is characterized by a moderate to high level of concentration, with leading multinational corporations holding significant market share. Innovation is primarily driven by the relentless pursuit of more effective, selective, and environmentally benign herbicide formulations. Key drivers include the increasing demand for higher crop yields to feed a growing population, the need to combat herbicide-resistant weeds, and the development of precision agriculture technologies. Regulatory frameworks are evolving, with a growing emphasis on product registration, safety standards, and the promotion of integrated pest management (IPM) practices. Product substitutes, such as mechanical weeding and biological control agents, are gaining traction, albeit with limitations in scalability and cost-effectiveness for large-scale commercial farming. End-user demographics are diverse, ranging from smallholder farmers to large commercial agricultural enterprises, each with unique needs and adoption capacities. Mergers and acquisitions (M&A) are strategic tools employed by major players to expand their product portfolios, geographic reach, and technological capabilities. For instance, recent M&A activities are projected to consolidate market share among top players, potentially leading to further innovation investment.

- Market Concentration: Dominated by key global players with established distribution networks.

- Innovation Drivers: Yield enhancement, weed resistance management, sustainable agriculture.

- Regulatory Frameworks: Increasing stringency on product approval and environmental impact.

- Product Substitutes: Mechanical weeding, biological control methods.

- End-User Demographics: Smallholders to large commercial farms.

- M&A Activities: Strategic consolidations to enhance market position and technological access.

Africa Herbicide Market Market Dynamics & Trends

The Africa Herbicide Market is poised for significant growth, driven by a confluence of factors that underscore the increasing importance of agricultural productivity across the continent. The burgeoning population, projected to reach over 2 billion by 2050, necessitates a substantial increase in food production, making effective weed management a critical component of agricultural strategy. This demand directly fuels the market for herbicides, which are indispensable tools for optimizing crop yields and minimizing harvest losses. Technological disruptions are playing a pivotal role in reshaping the market. The advent of precision agriculture, coupled with advanced application technologies like drones and GPS-guided sprayers, allows for more targeted and efficient herbicide application, reducing waste and environmental impact. This, in turn, appeals to a growing segment of environmentally conscious farmers. Consumer preferences are also evolving; there is a discernible shift towards sustainably produced food, prompting herbicide manufacturers to invest in the development of bio-based and lower-toxicity products. This trend is further amplified by increasing consumer awareness regarding food safety and residue levels. Competitive dynamics within the Africa Herbicide Market are intensifying. Established multinational corporations are vying for market share alongside emerging regional players who possess a deep understanding of local agricultural practices and challenges. The competitive landscape is shaped by product innovation, pricing strategies, distribution channel efficiency, and robust research and development capabilities. The market penetration of advanced herbicide solutions is steadily increasing, particularly in regions with developing agricultural infrastructure and a strong focus on export-oriented crops. The projected Compound Annual Growth Rate (CAGR) for the Africa Herbicide Market is estimated to be around 6.5% for the forecast period, reflecting strong underlying growth potential. This growth is underpinned by government initiatives aimed at boosting agricultural output, increasing investment in agricultural R&D, and a growing adoption of modern farming techniques across various African nations. The continuous need to address evolving weed resistance patterns and enhance crop protection strategies will further propel market expansion.

Dominant Regions & Segments in Africa Herbicide Market

The Africa Herbicide Market is experiencing significant expansion, with certain regions and crop segments emerging as dominant forces. North Africa, particularly countries like Egypt, Morocco, and Algeria, demonstrates a strong demand for herbicides driven by established commercial agriculture, extensive irrigation systems, and a focus on cash crops. The economic policies in these nations often prioritize agricultural exports, necessitating high-yield farming practices that rely heavily on effective weed control. Furthermore, the presence of well-developed agricultural infrastructure, including advanced irrigation networks and established distribution channels for agrochemicals, facilitates higher market penetration for herbicides.

Application Mode Dominance:

- Soil Treatment: This segment holds a significant share due to its effectiveness in controlling a broad spectrum of weeds before planting, ensuring a clean seedbed for optimal crop establishment. Its widespread adoption is linked to its cost-effectiveness and ability to provide extended weed control.

- Foliar Application: This mode of application is crucial for post-emergence weed control and is widely utilized across various crops. The ease of application and targeted delivery contribute to its sustained demand.

Crop Type Dominance:

- Grains & Cereals: This segment represents a cornerstone of African agriculture, with crops like maize, wheat, and rice being staple foods and significant export commodities. The vast acreage dedicated to these crops naturally translates into substantial herbicide consumption for effective weed management, directly impacting yield and food security.

- Commercial Crops: This broad category, encompassing crops such as cotton, sugarcane, and coffee, also exhibits high herbicide usage. These crops are often grown on large commercial farms where maximizing yield and minimizing losses due to weed competition are paramount economic considerations.

The competitive landscape within these dominant segments is characterized by a mix of global players and local formulators. Factors such as the availability of effective generic herbicides, the adoption of integrated weed management practices, and governmental support for agricultural inputs contribute to the growth trajectory of these segments. The demand for specialized herbicides tailored to specific weed challenges and crop types is also on the rise, driving innovation and market diversification. Emerging markets within Sub-Saharan Africa are also showing increasing potential, driven by investments in agricultural development and a growing awareness of the benefits of modern weed control technologies.

Africa Herbicide Market Product Innovations

Product innovation in the Africa Herbicide Market is increasingly focused on developing solutions that are both highly effective against resistant weeds and environmentally sustainable. This includes the creation of selective herbicides that target specific weed species while sparing crops, thereby minimizing damage and improving crop quality. Furthermore, there is a growing emphasis on the development of herbicides with reduced environmental persistence and lower toxicity profiles, aligning with global trends towards safer agricultural practices. Companies are also leveraging advancements in formulation technology to improve herbicide efficacy, such as enhanced droplet adhesion and rainfastness, ensuring better performance even under challenging climatic conditions prevalent in Africa. The integration of herbicides with digital farming tools and precision application technologies allows for more targeted and efficient use, leading to cost savings and reduced environmental impact.

Report Scope & Segmentation Analysis

This comprehensive report offers a granular analysis of the Africa Herbicide Market, segmented by key application modes and crop types. The Application Mode segmentation includes Chemigation, Foliar, Fumigation, and Soil Treatment, providing insights into the dominant methods of herbicide application and their respective market shares. Foliar application is expected to witness robust growth due to its versatility and post-emergence efficacy. The Crop Type segmentation covers Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, and Turf & Ornamental. The Grains & Cereals segment, being fundamental to food security, is projected to maintain its leading position. Commercial Crops also present significant growth opportunities due to large-scale farming operations. Each segment's growth projections, market sizes, and competitive dynamics are meticulously detailed.

Key Drivers of Africa Herbicide Market Growth

Several pivotal factors are propelling the growth of the Africa Herbicide Market. Firstly, the imperative to enhance food security for a rapidly expanding population necessitates increased agricultural productivity, making efficient weed management a critical component. Secondly, the rising prevalence of herbicide-resistant weeds due to the overuse of certain chemicals compels farmers to adopt more advanced and diversified herbicide solutions. Thirdly, government initiatives across various African nations are focused on modernizing agriculture, providing subsidies, and encouraging the adoption of advanced farming techniques, including the use of agrochemicals. Technological advancements in herbicide formulation and application, such as precision agriculture, are also significant drivers, offering more efficient and targeted weed control.

Challenges in the Africa Herbicide Market Sector

Despite the promising growth trajectory, the Africa Herbicide Market faces several significant challenges. Regulatory hurdles, including lengthy and complex product registration processes in some countries, can impede market entry for new products and manufacturers. Supply chain disruptions, exacerbated by logistical complexities and infrastructure deficits in certain regions, can impact the availability and affordability of herbicides. The prevalence of counterfeit agrochemicals poses a serious threat to both market integrity and farmer livelihoods, leading to reduced efficacy and potential environmental damage. Furthermore, the high cost of certain advanced herbicide formulations can be a barrier to adoption for smallholder farmers, who constitute a substantial portion of the agricultural community.

Emerging Opportunities in Africa Herbicide Market

The Africa Herbicide Market presents a wealth of emerging opportunities. The increasing adoption of integrated pest management (IPM) strategies creates a demand for herbicides that are compatible with biological control agents and other sustainable practices. The growing awareness of environmental sustainability is fostering a market for bio-based and lower-toxicity herbicides, offering a distinct competitive advantage. Expansion into underdeveloped agricultural regions with significant untapped potential represents another key opportunity. Furthermore, the development of customized herbicide solutions tailored to specific local weed challenges and crop varieties can unlock significant market share. The digital revolution in agriculture also opens avenues for herbicide providers to offer data-driven weed management solutions.

Leading Players in the Africa Herbicide Market Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group

- Syngenta Group

- UPL Limited

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Developments in Africa Herbicide Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

- October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

Future Outlook for Africa Herbicide Market Market

The future outlook for the Africa Herbicide Market is exceptionally robust, driven by an accelerating demand for agricultural intensification and food security. Continued investments in research and development by leading players will yield more sophisticated and sustainable herbicide solutions. The expanding middle class across Africa will further fuel demand for higher quality and more diverse food products, indirectly boosting the need for efficient crop protection. Government policies aimed at revitalizing agricultural sectors and promoting modern farming practices will continue to be a significant growth accelerator. The increasing adoption of digital agriculture technologies will enable more precise and efficient herbicide application, minimizing environmental impact and maximizing economic returns for farmers. Strategic partnerships and collaborations are expected to further consolidate market strengths and drive innovation.

Africa Herbicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Africa Herbicide Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Herbicide Market Regional Market Share

Geographic Coverage of Africa Herbicide Market

Africa Herbicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. The risk associated with the traditional weeding methods is increasing the need for herbicides in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Herbicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wynca Group (Wynca Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nufarm Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Africa Herbicide Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Herbicide Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Herbicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 2: Africa Herbicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 3: Africa Herbicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 4: Africa Herbicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 5: Africa Herbicide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Africa Herbicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 7: Africa Herbicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 8: Africa Herbicide Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 9: Africa Herbicide Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 10: Africa Herbicide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Nigeria Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Egypt Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Kenya Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Ethiopia Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Morocco Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Ghana Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Algeria Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Tanzania Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Ivory Coast Africa Herbicide Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Herbicide Market?

The projected CAGR is approximately 3.88%.

2. Which companies are prominent players in the Africa Herbicide Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Africa Herbicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

The risk associated with the traditional weeding methods is increasing the need for herbicides in the region.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Herbicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Herbicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Herbicide Market?

To stay informed about further developments, trends, and reports in the Africa Herbicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence