Key Insights

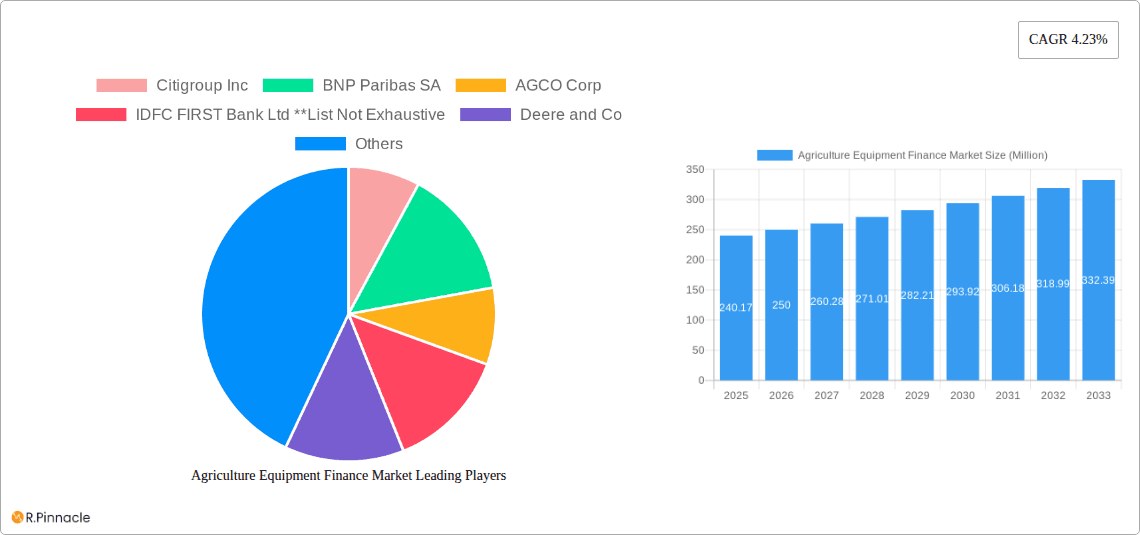

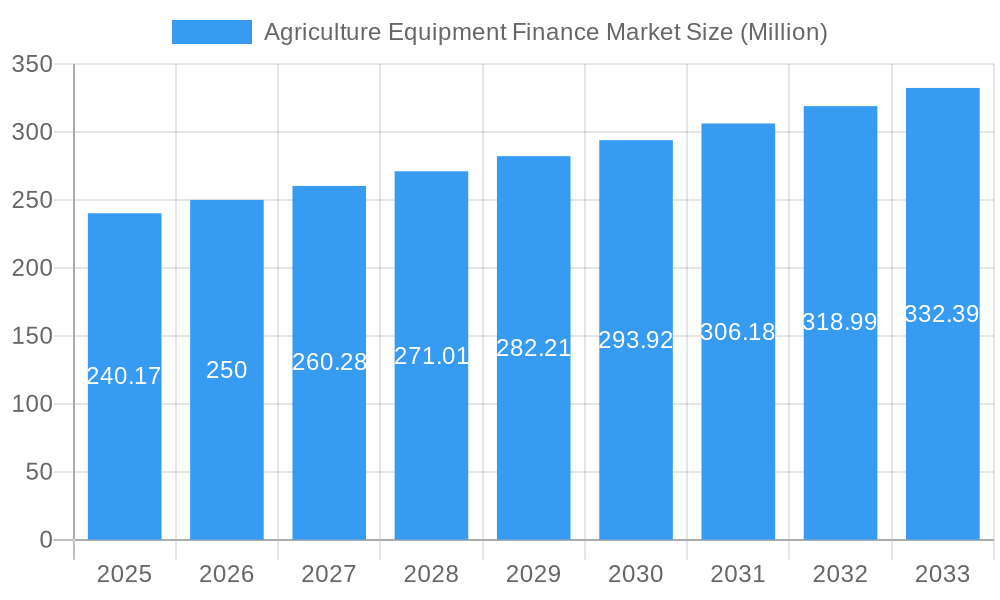

The global Agriculture Equipment Finance Market is projected to reach \$240.17 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.23% from 2025 to 2033. This growth is driven by several factors. Increasing demand for technologically advanced agricultural equipment, coupled with farmers' need for efficient financing options to acquire these assets, fuels market expansion. Government initiatives promoting agricultural modernization and mechanization in various regions further stimulate demand for financing solutions. The market is segmented by equipment type (tractors, harvesters, haying equipment, and others) and financing type (lease, loan, and line of credit), offering diverse options to farmers based on their specific needs and financial capabilities. The preference for leasing, owing to its flexibility and lower upfront costs, is contributing significantly to market growth. Furthermore, the increasing adoption of precision farming techniques necessitates investments in advanced equipment, bolstering the demand for financing. Key players like Citigroup Inc., BNP Paribas SA, AGCO Corp., and Deere & Co. are actively shaping the market landscape through their financial products and services tailored to the agricultural sector.

Agriculture Equipment Finance Market Market Size (In Million)

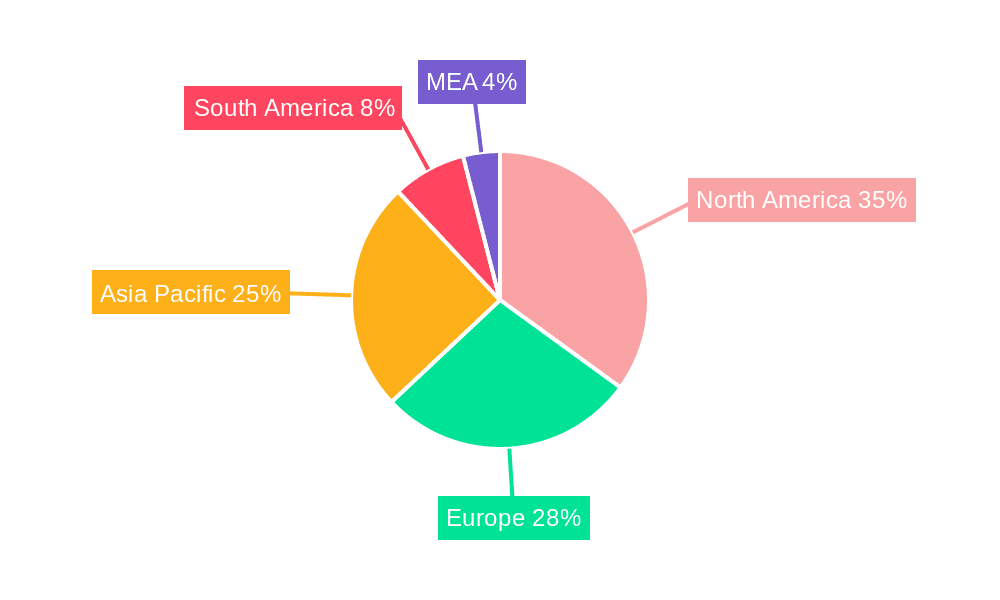

Competition among financial institutions and equipment manufacturers is expected to intensify, leading to innovative financing solutions and potentially more competitive pricing. While the market is experiencing substantial growth, challenges such as fluctuating commodity prices, varying creditworthiness across farmer demographics, and the risk associated with agricultural lending remain. However, the long-term outlook for the Agriculture Equipment Finance Market remains positive, driven by the consistent need for modernizing agricultural practices and the growing global population requiring reliable food production. The regional distribution of the market is likely to see significant contributions from North America, Europe, and Asia-Pacific, reflecting the concentration of agricultural activity and access to financial resources in these areas. Growth in emerging economies, particularly in Asia and South America, presents further opportunities.

Agriculture Equipment Finance Market Company Market Share

Agriculture Equipment Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Agriculture Equipment Finance Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. We analyze market trends, competitive landscapes, and future growth potential, covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The report is meticulously researched and presents actionable data to help navigate this dynamic sector. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033, demonstrating a significant CAGR.

Agriculture Equipment Finance Market Structure & Innovation Trends

The Agriculture Equipment Finance Market exhibits a moderately concentrated structure, with key players like Citigroup Inc, BNP Paribas SA, AGCO Corp, and Deere & Co holding significant market share. However, the presence of numerous regional and specialized lenders fosters competition. Innovation is driven by the increasing adoption of precision agriculture technologies, necessitating sophisticated financing solutions. Regulatory frameworks vary across geographies, impacting lending practices and interest rates. Product substitutes, such as leasing arrangements or equipment sharing platforms, are emerging, influencing market dynamics. End-user demographics are shifting towards larger, more technologically advanced farms, demanding customized financing options.

- Market Concentration: Moderate, with top players holding approximately xx% combined market share in 2025.

- M&A Activity: Significant activity observed in the historical period (2019-2024), with deal values exceeding xx Million. The recent AGCO Corp and Trimble joint venture exemplifies this trend.

- Innovation Drivers: Precision agriculture, automation, data analytics, and sustainable farming practices.

- Regulatory Impact: Varies across regions, influencing lending regulations and compliance costs.

Agriculture Equipment Finance Market Dynamics & Trends

The Agriculture Equipment Finance Market is characterized by robust growth, propelled by factors such as increasing agricultural output, rising demand for modern equipment, and favorable government policies promoting agricultural modernization. Technological advancements, particularly in precision farming, are transforming operational efficiencies, driving demand for financing to adopt these new technologies. Consumer preferences are shifting towards leasing and other flexible finance options, reflecting a preference for managing capital expenditures effectively. Competitive dynamics are intense, with existing players vying for market share and new entrants seeking opportunities. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with significant market penetration anticipated in developing economies. The market penetration rate was estimated at xx% in 2025.

Dominant Regions & Segments in Agriculture Equipment Finance Market

The North American region currently holds a dominant position in the Agriculture Equipment Finance Market, driven by strong agricultural output, high equipment adoption rates, and robust financial markets. Within the product segment, tractors represent the largest share, followed by harvesters and haying equipment. Lease financing is the most prevalent type of finance, favored for its flexibility.

Key Drivers in North America: Developed agricultural infrastructure, high farmer income levels, government support for agriculture.

Tractor Segment Dominance: Driven by high demand for efficient and technologically advanced tractors.

Lease Financing Prevalence: Preferred for its lower upfront capital requirement and flexibility.

Key Drivers in Europe: Government subsidies for modernizing agricultural practices.

Harvester Segment Growth: Driven by increased acreage under cultivation.

Loan Financing Significance: Preferred by larger farms due to greater access to capital.

Key Drivers in Asia-Pacific: Rising agricultural production, government initiatives to support agricultural modernization.

Haying Equipment Segment Growth: Driven by increased livestock farming activities.

Line of Credit Significance: Used by farmers for flexible access to capital to manage operational costs.

Agriculture Equipment Finance Market Product Innovations

Recent product innovations are focused on providing tailored financing solutions for specific agricultural equipment, including bundled financing packages combining equipment purchase with insurance and maintenance contracts. Technological trends like AI-powered credit scoring and blockchain-based transaction systems are streamlining the lending process and improving transparency. These developments are improving market fit by addressing the unique financial needs of various farm sizes and crop types.

Report Scope & Segmentation Analysis

This report segments the Agriculture Equipment Finance Market based on product type (Tractors, Harvesters, Haying Equipment, Others) and type of finance (Lease, Loan, Line of Credit). Each segment's growth projection, market size, and competitive dynamics are analyzed. The Tractors segment, due to its high demand, is projected to show significant growth, while leasing is expected to maintain its dominant position among financing options due to its flexibility.

Key Drivers of Agriculture Equipment Finance Market Growth

Technological advancements in agricultural equipment and precision farming techniques are key drivers, increasing efficiency and productivity. Favorable government policies and subsidies are encouraging adoption of modern technologies. Rising global food demand is driving the need for increased agricultural output, boosting investment in modern equipment. The increasing availability of financing options tailored to the specific needs of farmers further fuels market growth.

Challenges in the Agriculture Equipment Finance Market Sector

Volatility in agricultural commodity prices poses a risk, impacting farmers' ability to repay loans. Supply chain disruptions and geopolitical uncertainties can impact equipment availability and financing costs. Competition among lenders intensifies pricing pressures. Stringent regulatory requirements and compliance costs can hinder the growth of smaller financing institutions. The impact of climate change on crop yields presents a significant concern, potentially influencing credit risk assessments.

Emerging Opportunities in Agriculture Equipment Finance Market

The growing adoption of sustainable agriculture practices presents a lucrative opportunity for lenders offering specialized financing solutions for green technologies. Expansion into emerging markets with high agricultural potential but limited access to finance presents significant growth possibilities. The development of innovative financing models like crowdfunding or peer-to-peer lending platforms could expand access to credit for smallholder farmers. Investment in fintech solutions for improving credit scoring and risk assessment can further unlock market potential.

Leading Players in the Agriculture Equipment Finance Market Market

- Citigroup Inc

- BNP Paribas SA

- AGCO Corp

- IDFC FIRST Bank Ltd

- Deere & Co

- Adani Group

- Barclays PLC

- BlackRock Inc

- Agricultural Bank Ltd of China

- Argo Tractors SpA

- ICICI Bank Ltd

Key Developments in Agriculture Equipment Finance Market Industry

- September 2023: AGCO Corporation's USD 2 Billion acquisition of an 85% share in Trimble's agricultural assets and technologies signifies a major shift towards precision agriculture and strengthens AGCO's position in the market. This will likely increase demand for financing solutions related to these technologies.

- May 2023: AGCO Corporation's capital improvement project to expand production capacity will likely lead to increased demand for financing to support this expansion. This signifies confidence in the sector's future growth.

Future Outlook for Agriculture Equipment Finance Market Market

The Agriculture Equipment Finance Market is poised for sustained growth, driven by technological advancements, rising food demand, and supportive government policies. Strategic opportunities lie in providing innovative financing solutions tailored to the needs of sustainable agriculture, precision farming, and emerging markets. The increasing penetration of digital technologies and data analytics will further enhance efficiency and transparency within the market. The market’s future looks promising with continued expansion and adoption of advanced technologies.

Agriculture Equipment Finance Market Segmentation

-

1. Type of Finance

- 1.1. Lease

- 1.2. Loan

- 1.3. Line of Credit

-

2. Product

- 2.1. Tractors

- 2.2. Harvesters

- 2.3. Haying Equipment

- 2.4. Others

Agriculture Equipment Finance Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. South America

- 5. Middle East

Agriculture Equipment Finance Market Regional Market Share

Geographic Coverage of Agriculture Equipment Finance Market

Agriculture Equipment Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate

- 3.3. Market Restrains

- 3.3.1. Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 3.4. Market Trends

- 3.4.1. Rising Demand For Tractors In Agriculture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Finance

- 5.1.1. Lease

- 5.1.2. Loan

- 5.1.3. Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Tractors

- 5.2.2. Harvesters

- 5.2.3. Haying Equipment

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Finance

- 6. Asia Pacific Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Finance

- 6.1.1. Lease

- 6.1.2. Loan

- 6.1.3. Line of Credit

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Tractors

- 6.2.2. Harvesters

- 6.2.3. Haying Equipment

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type of Finance

- 7. North America Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Finance

- 7.1.1. Lease

- 7.1.2. Loan

- 7.1.3. Line of Credit

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Tractors

- 7.2.2. Harvesters

- 7.2.3. Haying Equipment

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type of Finance

- 8. Europe Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Finance

- 8.1.1. Lease

- 8.1.2. Loan

- 8.1.3. Line of Credit

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Tractors

- 8.2.2. Harvesters

- 8.2.3. Haying Equipment

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type of Finance

- 9. South America Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Finance

- 9.1.1. Lease

- 9.1.2. Loan

- 9.1.3. Line of Credit

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Tractors

- 9.2.2. Harvesters

- 9.2.3. Haying Equipment

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type of Finance

- 10. Middle East Agriculture Equipment Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Finance

- 10.1.1. Lease

- 10.1.2. Loan

- 10.1.3. Line of Credit

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Tractors

- 10.2.2. Harvesters

- 10.2.3. Haying Equipment

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type of Finance

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Citigroup Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BNP Paribas SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AGCO Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IDFC FIRST Bank Ltd **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deere and Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adani Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barclays PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BlackRock Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agricultural Bank Ltd of China

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Argo Tractors SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ICICI Bank Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Citigroup Inc

List of Figures

- Figure 1: Global Agriculture Equipment Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 3: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 4: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 5: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: Asia Pacific Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 9: North America Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 10: North America Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 11: North America Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: North America Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 15: Europe Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 16: Europe Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 17: Europe Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 21: South America Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 22: South America Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 23: South America Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: South America Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Agriculture Equipment Finance Market Revenue (Million), by Type of Finance 2025 & 2033

- Figure 27: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Type of Finance 2025 & 2033

- Figure 28: Middle East Agriculture Equipment Finance Market Revenue (Million), by Product 2025 & 2033

- Figure 29: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East Agriculture Equipment Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Agriculture Equipment Finance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 2: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 5: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 8: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 9: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 11: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 14: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Type of Finance 2020 & 2033

- Table 17: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global Agriculture Equipment Finance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Equipment Finance Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Agriculture Equipment Finance Market?

Key companies in the market include Citigroup Inc, BNP Paribas SA, AGCO Corp, IDFC FIRST Bank Ltd **List Not Exhaustive, Deere and Co, Adani Group, Barclays PLC, BlackRock Inc, Agricultural Bank Ltd of China, Argo Tractors SpA, ICICI Bank Ltd.

3. What are the main segments of the Agriculture Equipment Finance Market?

The market segments include Type of Finance, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 240.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Financing to support women in the agricultural sector is the primary trend shaping the growth of the market; Government initiatives to provide loans at a lower interest rate.

6. What are the notable trends driving market growth?

Rising Demand For Tractors In Agriculture Industry.

7. Are there any restraints impacting market growth?

Costlier bank lending rates are a challenge that affects the growth of the market.; One of the biggest obstacles to market growth is the ever-evolving emission standards..

8. Can you provide examples of recent developments in the market?

September 2023: AGCO Corporation, a global manufacturer and distributor of precision agriculture equipment and technology, entered a joint venture with Trimble in which AGCO will purchase an 85% share of Trimble's portfolio of agricultural assets and technologies for a cash consideration of USD 2 billion, subject to the participation of JCA Technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Equipment Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Equipment Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Equipment Finance Market?

To stay informed about further developments, trends, and reports in the Agriculture Equipment Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence