Key Insights

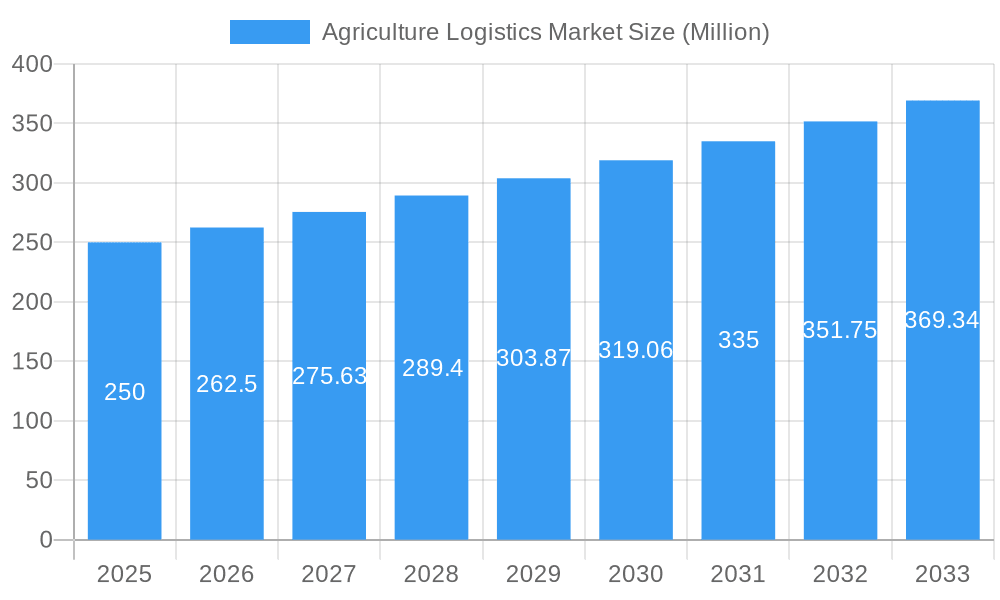

The global agriculture logistics market is poised for substantial expansion, driven by escalating global food demand, the burgeoning e-commerce sector for agricultural produce, and the increasing integration of advanced technologies such as blockchain for enhanced supply chain transparency. With a projected Compound Annual Growth Rate (CAGR) of 9.6%, the market is set for significant growth. Key growth drivers include transportation and warehousing services, serving both small and large enterprises. Value-added services, particularly cold chain logistics and specialized handling of perishable goods, are emerging as high-potential niches, responding to consumer demand for premium, fresh produce. Despite regional infrastructure challenges and volatile fuel prices, the market outlook is overwhelmingly positive. The growing emphasis on sustainability and food waste reduction presents opportunities for innovative, eco-friendly logistics solutions. Major logistics providers and specialized agricultural logistics firms are strategically positioning themselves to capitalize on this expanding market. Geographic expansion into developing economies, especially within the Asia-Pacific and LAMEA regions, offers considerable growth prospects.

Agriculture Logistics Market Market Size (In Billion)

The competitive landscape features established global logistics providers alongside specialized regional players. Strategic alliances and mergers and acquisitions are anticipated to continue shaping market dynamics. Ongoing technological advancements, including AI and IoT for route optimization, inventory management, and predictive analytics, will further enhance the efficiency and resilience of the agricultural logistics sector. While regulatory compliance and food safety remain paramount, the long-term prospects are exceptionally strong, underpinned by evolving global food consumption patterns and the imperative for efficient agricultural supply chains. The market size was estimated at $414.57 billion in the base year 2025.

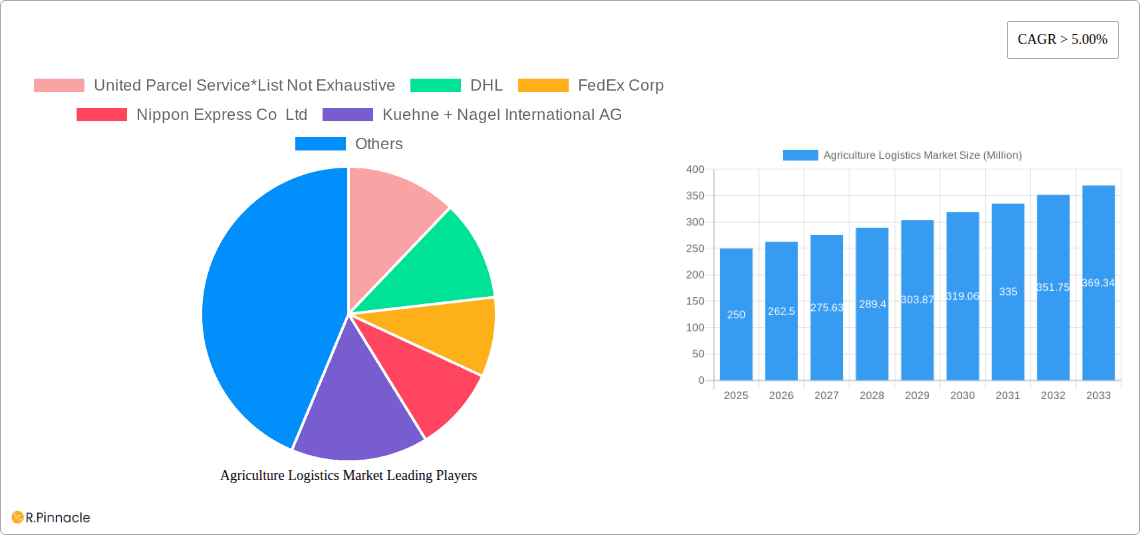

Agriculture Logistics Market Company Market Share

Agriculture Logistics Market Analysis: Size, Share, Trends & Forecast (2025-2033)

This comprehensive report delivers critical market insights for industry stakeholders and investors. Covering the forecast period from 2025 to 2033, it provides an in-depth analysis of market dynamics, identifies key players, and forecasts future growth opportunities.

Agriculture Logistics Market Structure & Innovation Trends

This section analyzes the competitive landscape of the agriculture logistics market, exploring market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller specialized firms. Market share is currently dominated by a few key players, with the top 5 holding approximately xx% of the market share. Innovation is driven by advancements in technology, particularly in areas such as automation, data analytics, and cold chain logistics. Regulatory frameworks vary by region, impacting operational costs and efficiency. The presence of substitute transportation modes, such as rail and waterways, exerts competitive pressure. The end-user demographic is largely composed of large agricultural enterprises, SMEs and individual farmers. M&A activity has been significant, with deals valued at approximately USD xx Million in the last 5 years, reflecting a trend toward consolidation within the sector.

- Market Concentration: High, with a few dominant players.

- Innovation Drivers: Technology advancements (automation, data analytics, cold chain).

- Regulatory Frameworks: Vary by region, influencing operational costs.

- Product Substitutes: Rail, waterways, and alternative transportation methods.

- End-User Demographics: Large enterprises, SMEs, and individual farmers.

- M&A Activity: Significant, with deals totaling USD xx Million in recent years.

Agriculture Logistics Market Dynamics & Trends

The agriculture logistics market exhibits robust growth, driven by factors like increasing global food demand, the growth of e-commerce in agricultural products, and rising consumer preference for fresh and high-quality produce. Technological disruptions, such as the adoption of IoT and AI in supply chain management, are transforming operational efficiency. Competitive dynamics are intense, with companies focusing on service differentiation, cost optimization, and geographic expansion. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various regions. Challenges such as fluctuating fuel prices, geopolitical instability, and regulatory compliance add complexity.

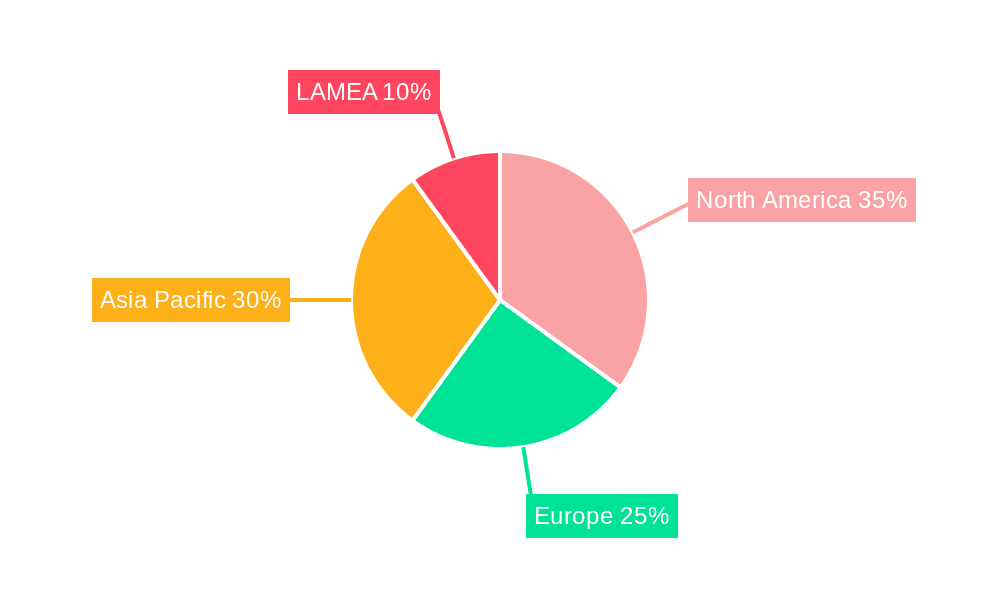

Dominant Regions & Segments in Agriculture Logistics Market

The report identifies key regional and segmental dominance within the agriculture logistics market. North America and Europe currently hold significant market share, driven by advanced infrastructure, strong regulatory frameworks, and high agricultural output. However, Asia-Pacific is emerging as a rapidly growing region due to its expanding agricultural sector and rising consumer incomes.

By Service:

- Transportation: Dominated by road transport, with significant growth in specialized refrigerated transport.

- Warehousing: Cold storage facilities are crucial for perishable goods, driving significant growth.

- Value-added Services: Growing demand for services like packaging, labeling, and quality control.

By End-User:

- Large Enterprises: Contribute a larger share due to higher volume shipments.

- Small and Medium Enterprises (SMEs): Represent a significant and growing segment.

Key Drivers for Dominant Regions:

- North America/Europe: Developed infrastructure, strong regulatory frameworks, high agricultural output.

- Asia-Pacific: Expanding agricultural sector, rising consumer incomes.

Agriculture Logistics Market Product Innovations

Recent innovations center around enhancing efficiency and traceability throughout the supply chain. This includes technologies such as blockchain for tracking produce, AI-powered route optimization, and automated warehousing systems. These innovations are enhancing product quality, reducing waste, and improving transparency, which resonates strongly with consumer preferences.

Report Scope & Segmentation Analysis

This report segments the Agriculture Logistics Market by Service (Transportation, Warehousing, Value-added Services) and by End-User (SMEs, Large Enterprises). Each segment presents unique growth trajectories and competitive landscapes. For example, the warehousing segment is experiencing significant growth driven by demand for cold storage facilities, while the value-added services segment is expanding as customers seek more sophisticated handling and processing of agricultural products. Growth projections for each segment vary, reflecting the specific dynamics of the market.

Key Drivers of Agriculture Logistics Market Growth

Several factors contribute to market growth, including: rising global food demand driven by population growth and changing dietary habits; increasing adoption of technology (e.g., IoT, AI, and blockchain) for improved efficiency and traceability; and government initiatives promoting agricultural modernization and sustainable practices. These factors collectively create significant opportunities for expansion.

Challenges in the Agriculture Logistics Market Sector

The agriculture logistics sector faces challenges such as fluctuating fuel prices, increasing labor costs, and stringent regulatory compliance requirements. Supply chain disruptions due to unforeseen events like natural disasters or geopolitical instability can significantly impact logistics operations. The highly fragmented nature of the market creates competitive pressure amongst stakeholders.

Emerging Opportunities in Agriculture Logistics Market

Emerging opportunities exist in areas like sustainable logistics, the adoption of advanced technologies such as drones for delivery in remote areas, and the growth of e-commerce platforms specialized in agricultural products. These trends offer growth potential for businesses that can adapt and innovate.

Leading Players in the Agriculture Logistics Market Market

- United Parcel Service

- DHL

- FedEx Corp

- Nippon Express Co Ltd

- Kuehne + Nagel International AG

- CEVA Logistics

- The Maersk Group

- C H Robinson

- Bollore Logistics

- Blue Yonder

Key Developments in Agriculture Logistics Market Industry

- June 2022: CEVA Logistics opened a new 14,000-square-meter facility in the Philippines, enhancing its Southeast Asian capabilities.

- January 2023: Deutsche Post DHL Group announced a USD 137 Million investment in the U.S. e-commerce market, targeting the growing B2C cross-border segment. (Note: The report incorrectly states a growth from USD 400 billion in 2022 to USD 1 trillion in 2020. This is likely a typo and should be reviewed).

Future Outlook for Agriculture Logistics Market Market

The Agriculture Logistics Market is poised for continued expansion, driven by technological advancements, rising global food demand, and a growing focus on sustainable practices. Strategic opportunities exist for companies that can leverage technological innovations to enhance efficiency, traceability, and sustainability within the agricultural supply chain. This will likely involve strategic partnerships and investments in innovative technologies.

Agriculture Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing

- 1.3. Value-added Services

-

2. End-User

- 2.1. Small and Medium Enterprises (SMEs)

- 2.2. Large Enterprises

Agriculture Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. SouthKorea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. LAMEA

- 4.1. Brazil

- 4.2. South Africa

- 4.3. GCC

- 4.4. Rest of LAMEA

Agriculture Logistics Market Regional Market Share

Geographic Coverage of Agriculture Logistics Market

Agriculture Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Increasing Importance of Logistics Management in the U.S.’s Largest Crop Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Small and Medium Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. LAMEA

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing

- 6.1.3. Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Small and Medium Enterprises (SMEs)

- 6.2.2. Large Enterprises

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing

- 7.1.3. Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Small and Medium Enterprises (SMEs)

- 7.2.2. Large Enterprises

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing

- 8.1.3. Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Small and Medium Enterprises (SMEs)

- 8.2.2. Large Enterprises

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. LAMEA Agriculture Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing

- 9.1.3. Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Small and Medium Enterprises (SMEs)

- 9.2.2. Large Enterprises

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 United Parcel Service*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DHL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FedEx Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nippon Express Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kuehne + Nagel International AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CEVA Logistics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The Maersk Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 C H Robinson

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bollore Logistics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Blue Yonder

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 United Parcel Service*List Not Exhaustive

List of Figures

- Figure 1: Global Agriculture Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 9: Europe Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 15: Asia Pacific Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 17: Asia Pacific Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: LAMEA Agriculture Logistics Market Revenue (billion), by Service 2025 & 2033

- Figure 21: LAMEA Agriculture Logistics Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: LAMEA Agriculture Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: LAMEA Agriculture Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: LAMEA Agriculture Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: LAMEA Agriculture Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Agriculture Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: SouthKorea Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Agriculture Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Global Agriculture Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 27: Global Agriculture Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Brazil Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: South Africa Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: GCC Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of LAMEA Agriculture Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agriculture Logistics Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Agriculture Logistics Market?

Key companies in the market include United Parcel Service*List Not Exhaustive, DHL, FedEx Corp, Nippon Express Co Ltd, Kuehne + Nagel International AG, CEVA Logistics, The Maersk Group, C H Robinson, Bollore Logistics, Blue Yonder.

3. What are the main segments of the Agriculture Logistics Market?

The market segments include Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 414.57 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Increasing Importance of Logistics Management in the U.S.’s Largest Crop Production.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

January 2023: Deutsche Post DHL Group announced a USD 137 million investment plan for the U.S. domestic and cross-border e-commerce market. The Group's objective is to exploit the global B2C e-commerce market for shipments crossing borders which is expected to grow from USD 400 billion in 2022 to a total global volume of USD 1 trillion in 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agriculture Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agriculture Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agriculture Logistics Market?

To stay informed about further developments, trends, and reports in the Agriculture Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence