Key Insights

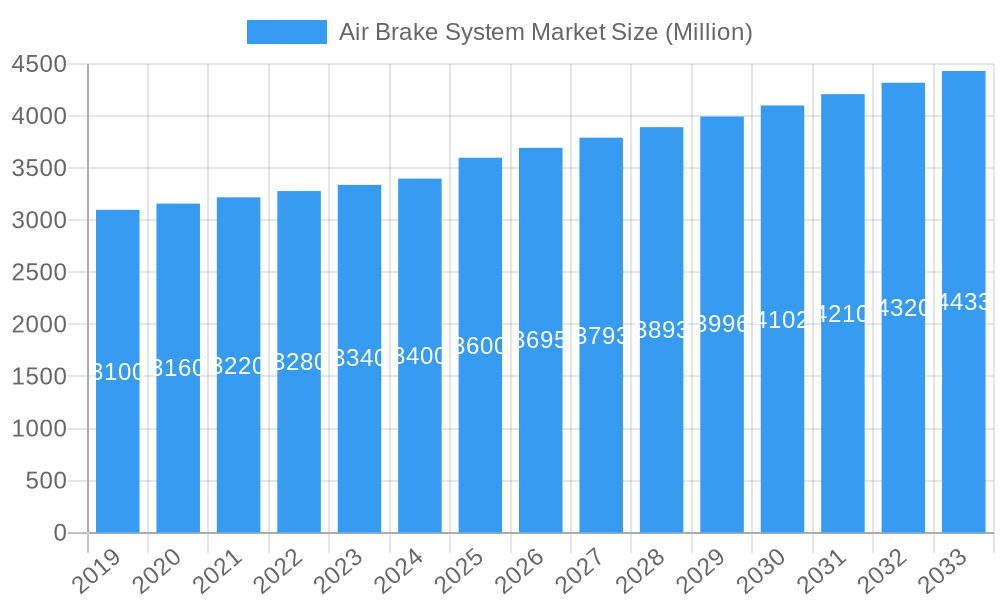

The global Air Brake System Market is poised for steady expansion, projected to reach approximately $3.60 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 2.80% anticipated from 2019 to 2033. This growth is primarily fueled by the increasing production of commercial vehicles, including rigid body trucks, heavy-duty trucks, and semi-trailer tractors, across both developed and emerging economies. The continuous emphasis on road safety regulations and the need for reliable braking solutions in large-tonnage vehicles are significant drivers. Furthermore, advancements in air brake technology, focusing on improved efficiency, reduced wear, and enhanced braking performance, are contributing to market expansion. The integration of smart features and electronic control systems within air brake assemblies is also gaining traction, catering to the evolving demands of the automotive industry for more sophisticated and safer vehicles.

Air Brake System Market Market Size (In Billion)

The market landscape is characterized by a diverse range of components, with compressors, governors, and storage tanks forming the core of air brake systems. Drum air brakes and disc air brakes represent the two prominent brake types, each with its specific applications and advantages. While disc air brakes are increasingly favored in newer, high-performance vehicles due to their superior stopping power and heat dissipation, drum air brakes continue to hold a significant share, particularly in certain heavy-duty applications and cost-sensitive markets. Geographically, North America and Europe are established markets with stringent safety standards, driving demand for premium air brake solutions. The Asia Pacific region, however, presents the most substantial growth potential, driven by rapid industrialization, burgeoning logistics sectors, and a growing fleet of commercial vehicles. Restraints may include the higher initial cost of advanced air brake systems and the availability of alternative braking technologies in some vehicle segments, alongside potential supply chain disruptions that could impact production volumes.

Air Brake System Market Company Market Share

This comprehensive Air Brake System Market report offers an in-depth analysis of the global market for essential braking solutions. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides critical insights for industry professionals, manufacturers, and stakeholders. Leveraging high-ranking keywords such as "air brake system," "truck brakes," "heavy-duty vehicle braking," and "commercial vehicle safety," this report ensures maximum search visibility and reader engagement. Dive into market structure, dynamics, regional dominance, product innovations, growth drivers, challenges, emerging opportunities, and the competitive landscape.

Air Brake System Market Market Structure & Innovation Trends

The Air Brake System Market exhibits a moderately concentrated structure, with key players like Knorr-Bremse AG, Meritor Inc., and Wabtec Corporation holding significant market share. Innovation is primarily driven by the increasing demand for enhanced safety features, fuel efficiency, and the integration of advanced technologies like Electronic Braking Systems (EBS). Regulatory frameworks, particularly those focused on vehicle safety and emissions, play a crucial role in shaping product development and market entry. While product substitutes exist, particularly in lighter vehicle segments, the inherent reliability and power of air brake systems for heavy-duty applications ensure their continued dominance. End-user demographics are shifting towards fleet operators prioritizing lifecycle costs, safety compliance, and driver comfort. Merger and acquisition (M&A) activities, with estimated deal values ranging from tens to hundreds of millions of USD, continue to consolidate the market and drive synergistic growth. Key M&A trends focus on expanding technological capabilities in areas like braking control systems and automation.

- Market Concentration: Moderately concentrated, dominated by a few large global players.

- Innovation Drivers: Safety enhancements, fuel efficiency, integration of smart technologies, electrification.

- Regulatory Frameworks: Strict safety standards (e.g., UNECE R13), emissions regulations influencing component design.

- Product Substitutes: Limited for heavy-duty applications; more prevalent in smaller vehicle segments.

- End-User Demographics: Fleet operators, logistics companies, public transportation authorities.

- M&A Activities: Focus on technology acquisition, market expansion, and product portfolio diversification.

Air Brake System Market Market Dynamics & Trends

The Air Brake System Market is experiencing robust growth, propelled by escalating global demand for commercial vehicles, particularly heavy-duty trucks, semi-trailer tractors, and buses. The increasing stringency of safety regulations worldwide mandates the adoption of advanced braking systems, significantly boosting market penetration for sophisticated air brake solutions. Technological advancements are revolutionizing the sector; the integration of Electronic Braking Systems (EBS) with features like Anti-lock Braking Systems (ABS) and Electronic Stability Control (ESC) is becoming standard, enhancing vehicle safety and driver responsiveness. The burgeoning e-commerce sector and globalized supply chains necessitate more efficient and reliable transportation, thereby driving the demand for trucks equipped with high-performance air brakes. Furthermore, the growing trend towards vehicle electrification, while posing a long-term shift, also presents an opportunity for air brake manufacturers to develop integrated solutions that work in tandem with regenerative braking systems, as exemplified by the collaboration between Tevva and ZF Friedrichshafen AG. The market is also witnessing a growing preference for disc air brakes due to their superior performance in terms of stopping power and heat dissipation compared to traditional drum air brakes. The average Compound Annual Growth Rate (CAGR) for the air brake system market is projected to be around 6.5% during the forecast period. Key market penetration is already high in developed regions but is expected to see significant growth in emerging economies as their transportation infrastructure expands. The focus on reducing fleet operational costs through durable and low-maintenance braking systems is another critical consumer preference driving market trends. The competitive landscape is characterized by continuous product development, strategic partnerships, and a focus on meeting diverse vehicle type requirements across rigid body trucks, heavy-duty trucks, and semi-trailer tractors.

Dominant Regions & Segments in Air Brake System Market

The Air Brake System Market is predominantly driven by North America and Europe, owing to their well-established commercial vehicle industries, stringent safety regulations, and high adoption rates of advanced braking technologies. Asia-Pacific is emerging as a rapidly growing region, fueled by expanding infrastructure, increasing vehicle production, and a growing logistics sector.

- Leading Region: North America, followed closely by Europe.

- Emerging Region: Asia-Pacific, with significant growth potential in China, India, and Southeast Asia.

Dominant Segments:

Vehicle Type:

- Heavy-Duty Trucks: This segment holds the largest market share due to the extensive use of air brakes for their immense braking power requirements, essential for transporting heavy payloads over long distances. The increasing global trade and e-commerce logistics fuel the demand for these vehicles and, consequently, their air brake systems.

- Semi-Trailer Tractors: Crucial for freight transportation, semi-trailer tractors rely heavily on robust air brake systems for safe operation, especially when carrying heavy loads. The growth in global supply chains directly translates to increased demand in this segment.

- Buses: Public transportation and coach services necessitate reliable and safe braking systems. Air brakes provide the necessary stopping power and durability for frequent stopping and starting in urban and intercity environments.

- Rigid Body Trucks: While also utilizing air brakes, their demand is relatively lower compared to articulated vehicles due to typically smaller payload capacities and operational uses.

- Other Vehicle Types: Includes specialized vehicles and off-highway equipment that may employ air braking systems.

Component:

- Compressor: As the heart of the air brake system, the compressor's demand is directly tied to the overall market growth and the number of vehicles equipped with air brakes. Its reliability and efficiency are critical for maintaining air pressure.

- Slack Adjuster: Essential for maintaining proper brake shoe clearance, the slack adjuster is a vital component in ensuring optimal braking performance and wear management. Demand is steady with vehicle production.

- Storage Tank: Crucial for storing compressed air, the storage tank's importance remains constant with the number of vehicles equipped.

- Governor: Regulates compressor operation and air pressure, ensuring system efficiency and safety.

Brake Type:

- Drum Air Brake: Historically dominant, drum brakes are still widely used in various commercial vehicles due to their cost-effectiveness and robustness.

- Disc Air Brake: Gaining significant traction due to superior braking performance, better heat dissipation, and reduced fade compared to drum brakes, especially in demanding applications. Their adoption is increasing as safety standards tighten.

Key drivers for regional and segment dominance include economic policies supporting infrastructure development, growth in the logistics and transportation sectors, stringent vehicle safety mandates, and technological advancements enabling more efficient and safer braking solutions.

Air Brake System Market Product Innovations

Product innovations in the Air Brake System Market are focused on enhancing safety, reliability, and efficiency. Manufacturers are developing lighter-weight components, advanced friction materials for improved stopping power and reduced wear, and integrated systems that combine air brakes with electronic controls for enhanced performance. The rise of electric and hybrid vehicles is also driving the development of air brake systems that can seamlessly integrate with regenerative braking technology, optimizing energy recovery and braking feel. Competitive advantages are being gained through modular designs, predictive maintenance capabilities, and extended product lifecycles.

Report Scope & Segmentation Analysis

The Air Brake System Market report provides a detailed segmentation across key categories including Brake Type (Drum Air Brake, Disc Air Brake), Vehicle Type (Rigid Body Trucks, Heavy-Duty Trucks, Semi-Trailer Tractors, Buses, Other Vehicle Types), and Component (Compressor, Governor, Storage Tank, Slack Adjuster, Other Components). The market is meticulously analyzed for each segment, providing insights into their respective growth projections, current market sizes, and prevailing competitive dynamics. The Disc Air Brake segment is experiencing higher growth rates due to increasing demand for superior braking performance and safety. Heavy-Duty Trucks and Semi-Trailer Tractors are the largest vehicle type segments, driven by global freight transportation needs. Within components, the Compressor segment mirrors the overall market growth, being fundamental to the air brake system's operation.

Key Drivers of Air Brake System Market Growth

The Air Brake System Market is propelled by several key growth drivers. Stringent government regulations mandating enhanced vehicle safety, particularly for commercial fleets, are a primary catalyst. The burgeoning global logistics and e-commerce industries necessitate a larger fleet of heavy-duty trucks and semi-trailer tractors, directly increasing the demand for reliable air brake systems. Technological advancements, such as the integration of Electronic Braking Systems (EBS), Anti-lock Braking Systems (ABS), and Electronic Stability Control (ESC), are crucial for improving vehicle safety and driver control, driving adoption of these advanced systems. Furthermore, the ongoing electrification of commercial vehicles is spurring innovation in integrated braking solutions that combine air brakes with regenerative braking for optimal efficiency and performance.

Challenges in the Air Brake System Market Sector

Despite robust growth, the Air Brake System Market faces several challenges. The increasing cost of advanced materials and manufacturing processes can impact affordability, especially for smaller manufacturers and in price-sensitive markets. Stringent and evolving regulatory landscapes require continuous product adaptation and investment in R&D, which can be a barrier. Supply chain disruptions, as witnessed in recent global events, can affect component availability and lead times, impacting production schedules. Moreover, the emergence of alternative braking technologies in specific niche applications, while not yet a widespread threat, represents a potential competitive pressure. The high initial investment for advanced air brake systems can also be a deterrent for some fleet operators in developing economies.

Emerging Opportunities in Air Brake System Market

Emerging opportunities within the Air Brake System Market are significantly tied to technological innovation and market expansion. The increasing global adoption of electric and hybrid commercial vehicles presents a substantial opportunity for manufacturers to develop integrated braking systems that optimize energy regeneration and braking performance. The growing demand for autonomous driving features will necessitate highly sophisticated and responsive braking systems, creating a market for advanced electronic control units and sensor integration. Furthermore, the expanding transportation infrastructure in emerging economies, particularly in Asia-Pacific and Africa, offers significant untapped market potential. There is also an increasing demand for intelligent braking systems with predictive maintenance capabilities, allowing for proactive servicing and reducing downtime, which presents a strong value proposition for fleet operators.

Leading Players in the Air Brake System Market Market

- TSE Brakes Inc

- Meritor Inc

- Nabtesco Corporation

- Continental AG

- Haldex Group

- Federal-Mogul Holding Corporation

- Knorr-Bremse AG

- Brakes India Limited

- SORL Auto Parts Inc

- Wabtec Corporation

- ZF Friedrichshafen AG

Key Developments in Air Brake System Market Industry

- January 2024: Wabtec Corporation secured a massive order worth USD 157 million to supply high-quality brake systems to Siemens India. The order is specifically intended for use in the manufacturing of powerful 9000 horsepower (hp) locomotives that will be utilized by the Indian Railways.

- December 2023: Tevva, one of the leading electric vehicle manufacturers in the United Kingdom, collaborated with ZF Friedrichshafen AG. Through this partnership, the truck uses an electronic brake system (EBS) that blends regenerative and compressed-air brakes for improved safety and driver responsiveness.

Future Outlook for Air Brake System Market Market

The future outlook for the Air Brake System Market is exceptionally positive, characterized by sustained growth driven by ongoing advancements in vehicle technology and increasing global demand for safe and efficient transportation. The market is poised to witness accelerated adoption of disc air brakes due to their superior performance and the growing emphasis on vehicle safety. The integration of electronic braking systems and smart technologies will continue to be a defining trend, enhancing responsiveness, control, and diagnostic capabilities. As the commercial vehicle industry embraces electrification, air brake manufacturers will play a crucial role in developing synergistic braking solutions that optimize performance and energy efficiency. Strategic collaborations and technological innovation will be paramount for companies to maintain a competitive edge and capitalize on the evolving needs of the global transport sector.

Air Brake System Market Segmentation

-

1. Brake Type

- 1.1. Drum Air Brake

- 1.2. Disc Air Brake

-

2. Vehicle Type

- 2.1. Rigid Body Trucks

- 2.2. Heavy-Duty Trucks

- 2.3. Semi-Trailer Tractors

- 2.4. Buses

- 2.5. Other Vehicle Types

-

3. Component

- 3.1. Compressor

- 3.2. Governor

- 3.3. Storage Tank

- 3.4. Slack Adjuster

- 3.5. Other Components

Air Brake System Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Air Brake System Market Regional Market Share

Geographic Coverage of Air Brake System Market

Air Brake System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Sale of Commercial Vehicles

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost

- 3.4. Market Trends

- 3.4.1. Buses Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Brake System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Brake Type

- 5.1.1. Drum Air Brake

- 5.1.2. Disc Air Brake

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Rigid Body Trucks

- 5.2.2. Heavy-Duty Trucks

- 5.2.3. Semi-Trailer Tractors

- 5.2.4. Buses

- 5.2.5. Other Vehicle Types

- 5.3. Market Analysis, Insights and Forecast - by Component

- 5.3.1. Compressor

- 5.3.2. Governor

- 5.3.3. Storage Tank

- 5.3.4. Slack Adjuster

- 5.3.5. Other Components

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Brake Type

- 6. North America Air Brake System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Brake Type

- 6.1.1. Drum Air Brake

- 6.1.2. Disc Air Brake

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Rigid Body Trucks

- 6.2.2. Heavy-Duty Trucks

- 6.2.3. Semi-Trailer Tractors

- 6.2.4. Buses

- 6.2.5. Other Vehicle Types

- 6.3. Market Analysis, Insights and Forecast - by Component

- 6.3.1. Compressor

- 6.3.2. Governor

- 6.3.3. Storage Tank

- 6.3.4. Slack Adjuster

- 6.3.5. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Brake Type

- 7. Europe Air Brake System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Brake Type

- 7.1.1. Drum Air Brake

- 7.1.2. Disc Air Brake

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Rigid Body Trucks

- 7.2.2. Heavy-Duty Trucks

- 7.2.3. Semi-Trailer Tractors

- 7.2.4. Buses

- 7.2.5. Other Vehicle Types

- 7.3. Market Analysis, Insights and Forecast - by Component

- 7.3.1. Compressor

- 7.3.2. Governor

- 7.3.3. Storage Tank

- 7.3.4. Slack Adjuster

- 7.3.5. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Brake Type

- 8. Asia Pacific Air Brake System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Brake Type

- 8.1.1. Drum Air Brake

- 8.1.2. Disc Air Brake

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Rigid Body Trucks

- 8.2.2. Heavy-Duty Trucks

- 8.2.3. Semi-Trailer Tractors

- 8.2.4. Buses

- 8.2.5. Other Vehicle Types

- 8.3. Market Analysis, Insights and Forecast - by Component

- 8.3.1. Compressor

- 8.3.2. Governor

- 8.3.3. Storage Tank

- 8.3.4. Slack Adjuster

- 8.3.5. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Brake Type

- 9. Rest of the World Air Brake System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Brake Type

- 9.1.1. Drum Air Brake

- 9.1.2. Disc Air Brake

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Rigid Body Trucks

- 9.2.2. Heavy-Duty Trucks

- 9.2.3. Semi-Trailer Tractors

- 9.2.4. Buses

- 9.2.5. Other Vehicle Types

- 9.3. Market Analysis, Insights and Forecast - by Component

- 9.3.1. Compressor

- 9.3.2. Governor

- 9.3.3. Storage Tank

- 9.3.4. Slack Adjuster

- 9.3.5. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Brake Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TSE Brakes Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Meritor Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nabtesco Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Continenal A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Haldex Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fedral-Mogul Holding Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Knorr-Bremse AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Brakes India Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SORL Auto Parts Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wabtec Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 TSE Brakes Inc

List of Figures

- Figure 1: Global Air Brake System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Brake System Market Revenue (Million), by Brake Type 2025 & 2033

- Figure 3: North America Air Brake System Market Revenue Share (%), by Brake Type 2025 & 2033

- Figure 4: North America Air Brake System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Air Brake System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Air Brake System Market Revenue (Million), by Component 2025 & 2033

- Figure 7: North America Air Brake System Market Revenue Share (%), by Component 2025 & 2033

- Figure 8: North America Air Brake System Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Air Brake System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Air Brake System Market Revenue (Million), by Brake Type 2025 & 2033

- Figure 11: Europe Air Brake System Market Revenue Share (%), by Brake Type 2025 & 2033

- Figure 12: Europe Air Brake System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Air Brake System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Air Brake System Market Revenue (Million), by Component 2025 & 2033

- Figure 15: Europe Air Brake System Market Revenue Share (%), by Component 2025 & 2033

- Figure 16: Europe Air Brake System Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Air Brake System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Air Brake System Market Revenue (Million), by Brake Type 2025 & 2033

- Figure 19: Asia Pacific Air Brake System Market Revenue Share (%), by Brake Type 2025 & 2033

- Figure 20: Asia Pacific Air Brake System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Air Brake System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Air Brake System Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Pacific Air Brake System Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Pacific Air Brake System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Air Brake System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Air Brake System Market Revenue (Million), by Brake Type 2025 & 2033

- Figure 27: Rest of the World Air Brake System Market Revenue Share (%), by Brake Type 2025 & 2033

- Figure 28: Rest of the World Air Brake System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Air Brake System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Air Brake System Market Revenue (Million), by Component 2025 & 2033

- Figure 31: Rest of the World Air Brake System Market Revenue Share (%), by Component 2025 & 2033

- Figure 32: Rest of the World Air Brake System Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Air Brake System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Brake System Market Revenue Million Forecast, by Brake Type 2020 & 2033

- Table 2: Global Air Brake System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Air Brake System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global Air Brake System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Air Brake System Market Revenue Million Forecast, by Brake Type 2020 & 2033

- Table 6: Global Air Brake System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Air Brake System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Air Brake System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Air Brake System Market Revenue Million Forecast, by Brake Type 2020 & 2033

- Table 10: Global Air Brake System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Air Brake System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Air Brake System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Air Brake System Market Revenue Million Forecast, by Brake Type 2020 & 2033

- Table 14: Global Air Brake System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Air Brake System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Global Air Brake System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Air Brake System Market Revenue Million Forecast, by Brake Type 2020 & 2033

- Table 18: Global Air Brake System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Air Brake System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 20: Global Air Brake System Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Brake System Market?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Air Brake System Market?

Key companies in the market include TSE Brakes Inc, Meritor Inc, Nabtesco Corporation, Continenal A, Haldex Group, Fedral-Mogul Holding Corporation, Knorr-Bremse AG, Brakes India Limited, SORL Auto Parts Inc, Wabtec Corporation, ZF Friedrichshafen AG.

3. What are the main segments of the Air Brake System Market?

The market segments include Brake Type, Vehicle Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Sale of Commercial Vehicles.

6. What are the notable trends driving market growth?

Buses Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Maintenance Cost.

8. Can you provide examples of recent developments in the market?

January 2024: Wabtec Corporation secured a massive order worth USD 157 million to supply high-quality brake systems to Siemens India. The order is specifically intended for use in the manufacturing of powerful 9000 horsepower (hp) locomotives that will be utilized by the Indian Railways.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Brake System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Brake System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Brake System Market?

To stay informed about further developments, trends, and reports in the Air Brake System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence