Key Insights

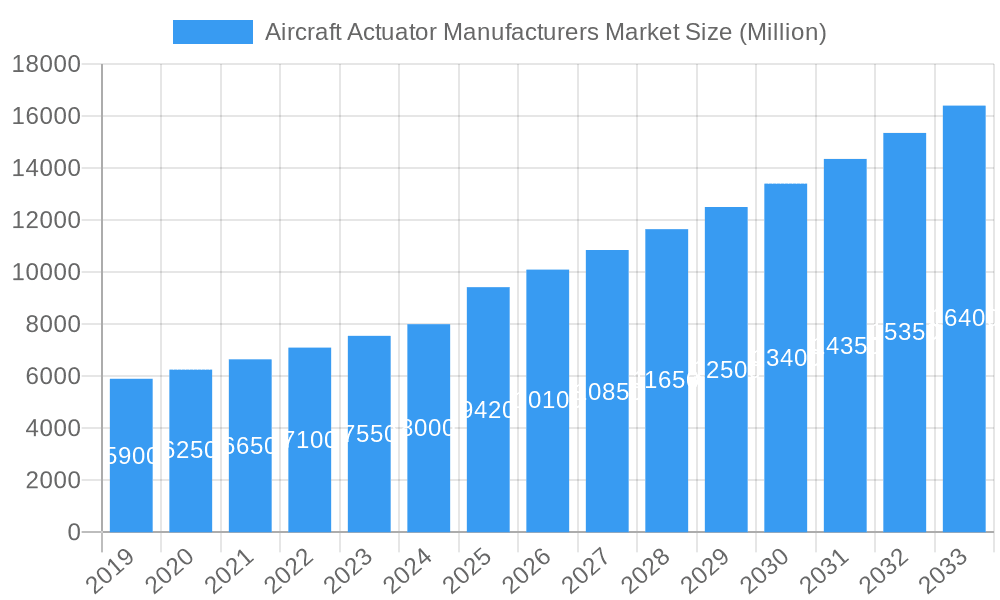

The global Aircraft Actuator Manufacturers Market is poised for robust expansion, projected to reach an estimated USD 9420 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.44% expected throughout the forecast period of 2025-2033. This significant growth is propelled by several key drivers, including the escalating demand for new commercial aircraft driven by increasing global air travel and the expansion of airline fleets. Furthermore, the continuous advancements in aerospace technology, leading to the development of more efficient, lighter, and reliable actuator systems, play a crucial role. The increasing integration of fly-by-wire and advanced flight control systems, which heavily rely on sophisticated actuators, also fuels market expansion. The military aviation sector also presents substantial opportunities, with governments investing in modernizing their air forces and acquiring advanced combat and transport aircraft, all requiring sophisticated actuation systems.

Aircraft Actuator Manufacturers Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. In terms of type, both linear and rotary actuators are critical, serving distinct functions in flight control surfaces, landing gear, and other aircraft systems. The system segment showcases a diverse range of technologies, with hydraulic actuators historically dominating due to their power density and reliability, while electrical actuators are gaining traction owing to their efficiency, reduced weight, and lower maintenance requirements. Pneumatic and mechanical actuators also hold their ground for specific applications. The end-user segment is primarily driven by commercial aircraft, followed by military aircraft, and then general aviation. Geographically, North America, led by the United States, is expected to maintain a significant market share due to its well-established aerospace industry and substantial defense spending. Europe, with its strong manufacturing base and key players like Airbus, is another vital region. Asia Pacific, particularly China and India, presents the fastest-growing market, driven by burgeoning aviation sectors and increasing domestic aircraft production. Key players such as Honeywell International Inc., Raytheon Technologies Corporation, Eaton Corporation plc, and Safran SA are actively shaping this market through innovation and strategic collaborations.

Aircraft Actuator Manufacturers Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Aircraft Actuator Manufacturers Market, offering critical insights into market dynamics, trends, regional dominance, product innovations, and future outlook. Covering the historical period of 2019–2024 and a robust forecast period of 2025–2033, with 2025 serving as the base and estimated year, this study is an indispensable resource for industry stakeholders seeking to understand the competitive landscape and capitalize on emerging opportunities. With a projected market size of $XX Billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of XX%, this report delves into the intricacies of actuator technologies, including Linear and Rotary types, and system classifications such as Hydraulic Actuators, Electrical Actuators, Pneumatic Actuators, and Mechanical Actuators. The end-user segments of Commercial Aircraft, Military Aircraft, and General Aviation Aircraft are meticulously examined to provide a holistic market view.

Aircraft Actuator Manufacturers Market Market Structure & Innovation Trends

The Aircraft Actuator Manufacturers Market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Innovation is a primary driver, fueled by the increasing demand for lightweight, energy-efficient, and technologically advanced actuators. Regulatory frameworks, such as those established by the FAA and EASA, play a crucial role in ensuring safety and performance standards, influencing product development and adoption. Product substitutes, while present in lower-end applications, are generally less prevalent in the demanding aerospace sector where reliability and precision are paramount. End-user demographics are shifting towards a greater demand for sophisticated systems in commercial aviation, driven by fleet modernization and the growth of electric and hybrid-electric aircraft concepts. Mergers and acquisitions (M&A) activities are strategically employed by leading companies to expand product portfolios, gain technological expertise, and enhance market reach. For instance, recent M&A deals have focused on consolidating expertise in electromechanical actuation and advanced control systems. The market share distribution among top manufacturers is constantly evolving, with key players like Parker Hannifin Corporation and Honeywell International Inc. vying for leadership. M&A deal values have ranged from tens of millions to several hundred million dollars, reflecting the strategic importance of acquiring innovative technologies and established customer bases.

Aircraft Actuator Manufacturers Market Market Dynamics & Trends

The Aircraft Actuator Manufacturers Market is experiencing robust growth, propelled by several key drivers. The continuous expansion of the global aviation industry, marked by an increasing number of aircraft orders for both commercial and military applications, directly translates to a higher demand for actuators. The ongoing fleet modernization programs undertaken by airlines worldwide are a significant growth catalyst, as older aircraft are retired and replaced with newer, more technologically advanced models that incorporate state-of-the-art actuator systems. Furthermore, the burgeoning development of electric vertical take-off and landing (eVTOL) aircraft and other new aviation technologies is creating substantial new market opportunities for specialized actuators. These innovative aircraft often require lighter, more power-efficient, and precisely controlled actuators, driving demand for advanced electromechanical and hydraulic solutions. Technological disruptions are also shaping the market landscape. The shift towards more electric aircraft (MEA) and the increasing integration of digital technologies, such as AI and IoT, in aircraft systems are leading to the development of smarter, more autonomous actuators with enhanced diagnostic and predictive maintenance capabilities. Consumer preferences, particularly from aircraft manufacturers, are gravitating towards actuators that offer improved fuel efficiency, reduced weight, and lower maintenance costs, thereby contributing to a competitive edge. The competitive dynamics within the market are intense, with established players investing heavily in research and development to maintain their technological leadership and capture a larger market share. New entrants, often specializing in niche technologies like advanced electromechanical actuators for eVTOLs, are also emerging, adding further complexity to the competitive environment. Market penetration for advanced actuator technologies is steadily increasing, driven by their proven benefits in terms of performance, reliability, and operational efficiency. The CAGR for the overall Aircraft Actuator Manufacturers Market is projected to be a healthy XX%, indicating sustained growth over the forecast period. This growth is underpinned by the indispensable role actuators play in the safe and efficient operation of all aircraft.

Dominant Regions & Segments in Aircraft Actuator Manufacturers Market

North America currently stands as the dominant region in the Aircraft Actuator Manufacturers Market. This leadership is primarily attributed to the presence of major aircraft manufacturers like Boeing, the robust defense industry, and a well-established MRO (Maintenance, Repair, and Overhaul) infrastructure. Stringent regulatory standards and a high rate of technological adoption further solidify North America's leading position. The United States, in particular, accounts for a substantial share of the global market, driven by its extensive aerospace manufacturing capabilities and significant investment in defense and commercial aviation research and development.

- Key Drivers of Dominance in North America:

- Strong Aerospace Manufacturing Base: Presence of leading aircraft OEMs and a well-developed supply chain.

- High Military Spending: Significant demand from the defense sector for advanced actuator systems.

- Technological Advancements: Early adoption and development of cutting-edge actuator technologies.

- Supportive Government Policies: Favorable regulations and R&D funding for the aerospace sector.

The Commercial Aircraft segment is the largest contributor to the overall market revenue. This is driven by the sheer volume of commercial aircraft produced and operated globally, coupled with continuous fleet expansion and modernization initiatives. The increasing demand for fuel-efficient and reliable aircraft to meet growing air travel needs directly fuels the demand for sophisticated actuators.

Among the System types, Hydraulic Actuators have historically dominated due to their proven reliability, high power density, and robustness, making them suitable for heavy-duty applications in large commercial and military aircraft. However, Electrical Actuators are witnessing rapid growth. This surge is propelled by the trend towards more electric aircraft (MEA), the development of eVTOLs, and the need for lighter, more energy-efficient, and digitally controllable actuation systems. Their ability to be precisely controlled and integrated with advanced avionics makes them increasingly attractive for newer aircraft designs.

In terms of Type, Linear Actuators are widely used across various aircraft systems, including flight controls, landing gear, and door mechanisms, contributing significantly to market demand. Rotary Actuators are crucial for applications such as thrust reversers and control surface actuation.

Aircraft Actuator Manufacturers Market Product Innovations

Product innovations in the Aircraft Actuator Manufacturers Market are focused on enhancing efficiency, reducing weight, and improving performance. The development of advanced electromechanical actuators (EMAs) that offer higher power density and reduced maintenance is a key trend. Innovations also include the integration of smart sensors for real-time diagnostics and predictive maintenance, as well as the development of actuators for novel applications like eVTOL aircraft and advanced flight control systems. These advancements provide competitive advantages by enabling lighter aircraft, reducing fuel consumption, and improving overall operational reliability.

Report Scope & Segmentation Analysis

This report segments the Aircraft Actuator Manufacturers Market by Type into Linear and Rotary actuators. Linear actuators are essential for applications requiring straight-line motion, such as landing gear deployment and flight control surfaces, with projected market growth driven by new aircraft designs. Rotary actuators, used for applications like thrust reversers and flap actuation, are also experiencing steady demand.

By System, the market is divided into Hydraulic, Electrical, Pneumatic, and Mechanical actuators. Hydraulic actuators, known for their power, continue to hold a significant share, especially in legacy aircraft. Electrical actuators are projected to see the fastest growth due to their efficiency and integration capabilities with advanced avionics, particularly in emerging eVTOL markets. Pneumatic actuators are employed in specific applications where air pressure is readily available, while Mechanical actuators cater to simpler actuation needs.

The End User segments include Commercial Aircraft, Military Aircraft, and General Aviation Aircraft. Commercial Aircraft represent the largest segment due to the substantial global fleet and ongoing fleet renewal programs. Military Aircraft demand is driven by defense modernization and the development of new combat and transport platforms. General Aviation Aircraft, while smaller in individual unit volume, represent a stable and growing segment.

Key Drivers of Aircraft Actuator Manufacturers Market Growth

The growth of the Aircraft Actuator Manufacturers Market is propelled by several critical factors. The relentless expansion of the global aviation industry, evidenced by increasing air passenger traffic and cargo demand, directly fuels the need for new aircraft and, consequently, their components. Fleet modernization programs, driven by airlines seeking to enhance fuel efficiency and passenger experience, necessitate the integration of advanced actuator systems. The rapid development and anticipated commercialization of electric and hybrid-electric aircraft, including eVTOLs, are creating a substantial new demand for lightweight and highly efficient electromechanical actuators. Furthermore, the sustained investment in defense spending by governments worldwide drives the demand for robust and sophisticated actuators for military aircraft and defense systems.

Challenges in the Aircraft Actuator Manufacturers Market Sector

The Aircraft Actuator Manufacturers Market faces several challenges that can impede its growth trajectory. Stringent regulatory compliance, including rigorous testing and certification processes mandated by aviation authorities, can lead to extended development cycles and increased costs. Supply chain disruptions, exacerbated by global events, can impact the availability of raw materials and critical components, leading to production delays and price volatility. Intense competition among established players and the emergence of new market entrants can put pressure on profit margins. The high initial investment required for research, development, and manufacturing of aerospace-grade actuators also presents a barrier to entry for smaller companies. Furthermore, the economic sensitivity of the aviation industry, susceptible to global economic downturns and geopolitical instability, can lead to fluctuations in demand.

Emerging Opportunities in Aircraft Actuator Manufacturers Market

Emerging opportunities within the Aircraft Actuator Manufacturers Market are abundant, particularly driven by technological advancements and evolving aviation trends. The burgeoning eVTOL market presents a significant opportunity for manufacturers specializing in lightweight, energy-efficient, and precisely controlled electromechanical actuators. The increasing adoption of sustainable aviation fuels (SAFs) and the drive towards zero-emission flight are creating a demand for actuators compatible with next-generation propulsion systems. The integration of artificial intelligence (AI) and machine learning (ML) in aircraft systems opens avenues for developing smart actuators capable of predictive maintenance and enhanced autonomy. The growing demand for connected aircraft and the associated in-flight entertainment and connectivity systems will also require specialized actuator solutions. Furthermore, opportunities exist in the aftermarket for actuator upgrades and retrofits, aiming to improve the performance and lifespan of existing aircraft fleets.

Leading Players in the Aircraft Actuator Manufacturers Market Market

- Arkwin Industries Inc

- Honeywell International Inc

- Raytheon Technologies Corporation

- Eaton Corporation plc

- Liebherr-International Deutschland GmbH

- Nook Industries Inc

- Woodward Inc

- Safran SA

- Electromech Technologies (TransDigm Group)

- Moog Inc

- Beaver Aerospace & Defense Inc

- Triumph Group

- Parker Hannifin Corporation

Key Developments in Aircraft Actuator Manufacturers Market Industry

- July 2022: Hanwha Aerospace Co. Ltd., a South Korea-based aerospace industrial company, established a joint development program with Vertical Aerospace, a United Kingdom-based electric vertical take-off and landing aircraft manufacturer, to design, test, manufacture, and supply electromechanical actuators for Vertical's VX4 electric aircraft. This program aims to support the development of zero-emission, electrically powered aircraft technology.

- January 2022: Moog provided electromechanical actuators for launch motion control in the DARPA Gremlins unmanned aircraft. The Gremlins demonstration system successfully flew three Gremlins, conducting four individual flight sorties for a combined 6.7 hours of flight, including the 1.4-hour airborne recovery mission. Moog's contribution to this program highlights the company's expertise in developing and delivering high-performance electromechanical systems for the aerospace industry.

Future Outlook for Aircraft Actuator Manufacturers Market Market

The future outlook for the Aircraft Actuator Manufacturers Market is exceptionally positive, driven by the sustained growth of the global aviation sector and transformative technological advancements. The projected increase in commercial aircraft production, coupled with the ongoing need for military aircraft modernization, will continue to provide a strong foundation for market expansion. The rapid development and anticipated widespread adoption of eVTOL aircraft and other advanced air mobility solutions represent a significant growth accelerator, creating substantial demand for specialized electromechanical actuators. Investments in sustainable aviation technologies, including electric and hybrid-electric propulsion systems, will further propel the demand for innovative and efficient actuator solutions. Strategic partnerships and collaborations between actuator manufacturers and aircraft OEMs will be crucial for co-developing next-generation actuation systems that meet the evolving performance, efficiency, and safety requirements of future aircraft. The market is poised for continued innovation, with a focus on digitalization, automation, and enhanced product lifecycles, ensuring sustained growth and profitability for leading players.

Aircraft Actuator Manufacturers Market Segmentation

-

1. Type

- 1.1. Linear

- 1.2. Rotary

-

2. System

- 2.1. Hydraulic Actuators

- 2.2. Electrical Actuators

- 2.3. Pneumatic Actuators

- 2.4. Mechanical Actuators

-

3. End User

- 3.1. Commercial Aircraft

- 3.2. Military Aircraft

- 3.3. General Aviation Aircraft

Aircraft Actuator Manufacturers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Aircraft Actuator Manufacturers Market Regional Market Share

Geographic Coverage of Aircraft Actuator Manufacturers Market

Aircraft Actuator Manufacturers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Linear Actuators Segment is Anticipated to Show the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Linear

- 5.1.2. Rotary

- 5.2. Market Analysis, Insights and Forecast - by System

- 5.2.1. Hydraulic Actuators

- 5.2.2. Electrical Actuators

- 5.2.3. Pneumatic Actuators

- 5.2.4. Mechanical Actuators

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial Aircraft

- 5.3.2. Military Aircraft

- 5.3.3. General Aviation Aircraft

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Linear

- 6.1.2. Rotary

- 6.2. Market Analysis, Insights and Forecast - by System

- 6.2.1. Hydraulic Actuators

- 6.2.2. Electrical Actuators

- 6.2.3. Pneumatic Actuators

- 6.2.4. Mechanical Actuators

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial Aircraft

- 6.3.2. Military Aircraft

- 6.3.3. General Aviation Aircraft

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Linear

- 7.1.2. Rotary

- 7.2. Market Analysis, Insights and Forecast - by System

- 7.2.1. Hydraulic Actuators

- 7.2.2. Electrical Actuators

- 7.2.3. Pneumatic Actuators

- 7.2.4. Mechanical Actuators

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial Aircraft

- 7.3.2. Military Aircraft

- 7.3.3. General Aviation Aircraft

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Linear

- 8.1.2. Rotary

- 8.2. Market Analysis, Insights and Forecast - by System

- 8.2.1. Hydraulic Actuators

- 8.2.2. Electrical Actuators

- 8.2.3. Pneumatic Actuators

- 8.2.4. Mechanical Actuators

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial Aircraft

- 8.3.2. Military Aircraft

- 8.3.3. General Aviation Aircraft

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Linear

- 9.1.2. Rotary

- 9.2. Market Analysis, Insights and Forecast - by System

- 9.2.1. Hydraulic Actuators

- 9.2.2. Electrical Actuators

- 9.2.3. Pneumatic Actuators

- 9.2.4. Mechanical Actuators

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial Aircraft

- 9.3.2. Military Aircraft

- 9.3.3. General Aviation Aircraft

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Aircraft Actuator Manufacturers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Linear

- 10.1.2. Rotary

- 10.2. Market Analysis, Insights and Forecast - by System

- 10.2.1. Hydraulic Actuators

- 10.2.2. Electrical Actuators

- 10.2.3. Pneumatic Actuators

- 10.2.4. Mechanical Actuators

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial Aircraft

- 10.3.2. Military Aircraft

- 10.3.3. General Aviation Aircraft

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arkwin Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raytheon Technologies Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liebherr-International Deutschland GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nook Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Woodward Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Safran SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Electromech Technologies (TransDigm Group)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Moog Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beaver Aerospace & Defense Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Triumph Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Parker Hannifin Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Arkwin Industries Inc

List of Figures

- Figure 1: Global Aircraft Actuator Manufacturers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Actuator Manufacturers Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Aircraft Actuator Manufacturers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aircraft Actuator Manufacturers Market Revenue (Million), by System 2025 & 2033

- Figure 5: North America Aircraft Actuator Manufacturers Market Revenue Share (%), by System 2025 & 2033

- Figure 6: North America Aircraft Actuator Manufacturers Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Aircraft Actuator Manufacturers Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Aircraft Actuator Manufacturers Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Aircraft Actuator Manufacturers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Actuator Manufacturers Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Aircraft Actuator Manufacturers Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aircraft Actuator Manufacturers Market Revenue (Million), by System 2025 & 2033

- Figure 13: Europe Aircraft Actuator Manufacturers Market Revenue Share (%), by System 2025 & 2033

- Figure 14: Europe Aircraft Actuator Manufacturers Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Aircraft Actuator Manufacturers Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Aircraft Actuator Manufacturers Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Aircraft Actuator Manufacturers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aircraft Actuator Manufacturers Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Aircraft Actuator Manufacturers Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Aircraft Actuator Manufacturers Market Revenue (Million), by System 2025 & 2033

- Figure 21: Asia Pacific Aircraft Actuator Manufacturers Market Revenue Share (%), by System 2025 & 2033

- Figure 22: Asia Pacific Aircraft Actuator Manufacturers Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Aircraft Actuator Manufacturers Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Aircraft Actuator Manufacturers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Aircraft Actuator Manufacturers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aircraft Actuator Manufacturers Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Aircraft Actuator Manufacturers Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Aircraft Actuator Manufacturers Market Revenue (Million), by System 2025 & 2033

- Figure 29: Latin America Aircraft Actuator Manufacturers Market Revenue Share (%), by System 2025 & 2033

- Figure 30: Latin America Aircraft Actuator Manufacturers Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Aircraft Actuator Manufacturers Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Aircraft Actuator Manufacturers Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Aircraft Actuator Manufacturers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue (Million), by System 2025 & 2033

- Figure 37: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue Share (%), by System 2025 & 2033

- Figure 38: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Aircraft Actuator Manufacturers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 3: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 7: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 13: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 22: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 31: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by System 2020 & 2033

- Table 37: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global Aircraft Actuator Manufacturers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Egypt Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Aircraft Actuator Manufacturers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Actuator Manufacturers Market?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Aircraft Actuator Manufacturers Market?

Key companies in the market include Arkwin Industries Inc, Honeywell International Inc, Raytheon Technologies Corporation, Eaton Corporation plc, Liebherr-International Deutschland GmbH, Nook Industries Inc, Woodward Inc, Safran SA, Electromech Technologies (TransDigm Group), Moog Inc, Beaver Aerospace & Defense Inc, Triumph Group, Parker Hannifin Corporation.

3. What are the main segments of the Aircraft Actuator Manufacturers Market?

The market segments include Type, System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.42 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Linear Actuators Segment is Anticipated to Show the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Hanwha Aerospace Co. Ltd., a South Korea-based aerospace industrial company, established a joint development program with Vertical Aerospace, a United Kingdom-based electric vertical take-off and landing aircraft manufacturer, to design, test, manufacture, and supply electromechanical actuators for Vertical's VX4 electric aircraft. This program aims to support the development of zero-emission, electrically powered aircraft technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Actuator Manufacturers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Actuator Manufacturers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Actuator Manufacturers Market?

To stay informed about further developments, trends, and reports in the Aircraft Actuator Manufacturers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence