Key Insights

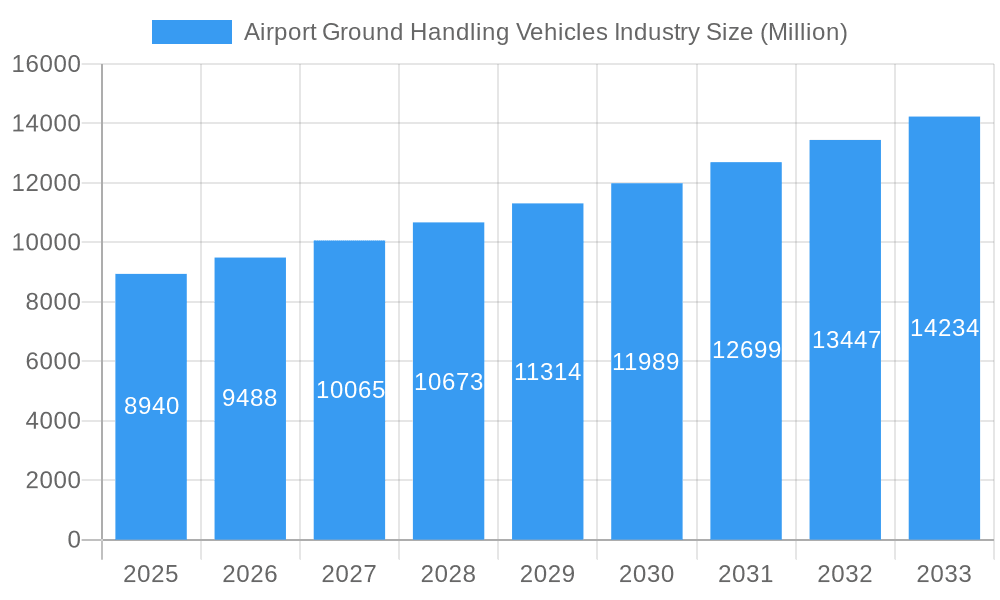

The Airport Ground Handling Vehicles (AGHV) market, valued at $8.94 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic globally and a corresponding need for efficient ground support operations. A Compound Annual Growth Rate (CAGR) of 5.99% from 2025 to 2033 indicates a significant expansion of this market, reaching an estimated value exceeding $15 billion by 2033. Key drivers include the rising adoption of electric and hybrid vehicles to reduce carbon emissions and noise pollution at airports, coupled with technological advancements leading to improved safety, efficiency, and automation in ground handling processes. The market is segmented by vehicle type (refuelers, tugs and tractors, passenger buses, de-icing vehicles, ground power units, and others) and power source (electric, non-electric, hybrid). The electric segment is expected to witness the most rapid growth, fueled by environmental regulations and sustainability initiatives within the aviation industry. Regional growth will be driven by expansion in Asia-Pacific and North America, mirroring the growth of major airport hubs and increasing air travel demand in these regions. However, the market faces restraints such as high initial investment costs for advanced vehicles and the need for robust infrastructure to support electric fleets. Nevertheless, the long-term outlook for the AGHV market remains positive, propelled by the industry's continuous push toward enhanced operational efficiency and environmental responsibility.

Airport Ground Handling Vehicles Industry Market Size (In Billion)

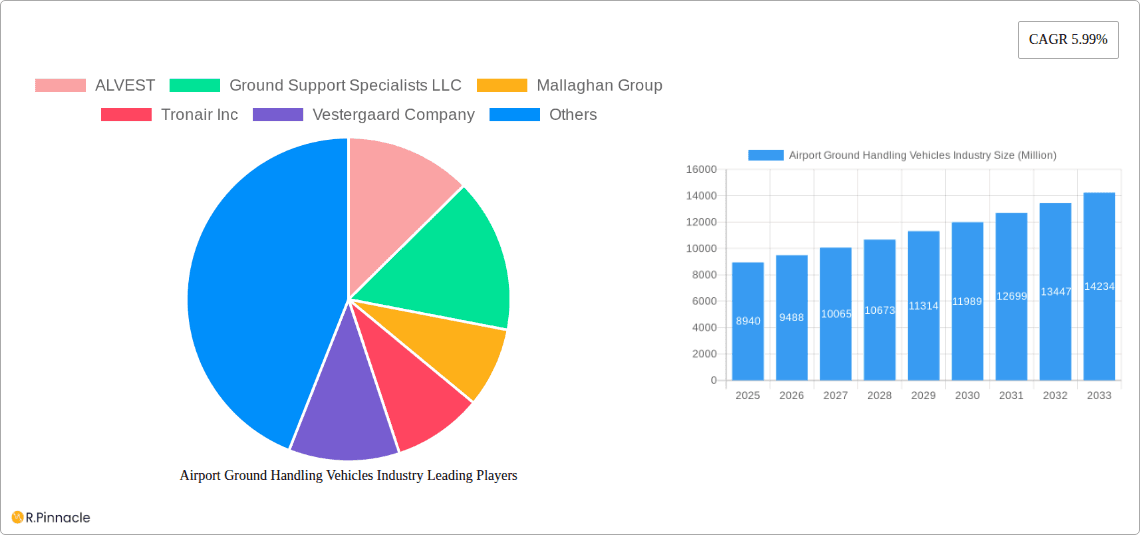

The competitive landscape comprises both established players and emerging companies. Major players like Textron, JBT, and ALVEST are focusing on innovation and strategic partnerships to consolidate their market share. Smaller companies are specializing in niche segments or geographic areas, leveraging their agility and expertise. The future success of AGHV manufacturers hinges on their ability to adapt to evolving technological advancements, stringent emission standards, and growing demand for autonomous and remotely operated vehicles, alongside robust after-sales support and maintenance services that ensure operational uptime for airport clients. The ongoing focus on enhancing the passenger experience will also influence future demand, driving the need for more efficient and comfortable passenger buses and improved ground transportation within airport complexes.

Airport Ground Handling Vehicles Industry Company Market Share

Airport Ground Handling Vehicles Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Airport Ground Handling Vehicles industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. We delve into market dynamics, technological advancements, competitive landscapes, and future growth potential, providing actionable intelligence to navigate this dynamic sector. The report encompasses a market size valuation of $XX Million in 2025, projecting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

Airport Ground Handling Vehicles Industry Market Structure & Innovation Trends

This section delves into the intricate market structure and the driving forces behind innovation within the Airport Ground Handling Vehicles (AGHV) industry. We meticulously analyze the competitive landscape, pinpointing market concentration, key innovation drivers, the pervasive influence of regulatory frameworks, and overarching industry trends. Our examination includes a thorough assessment of the strategic roles played by mergers and acquisitions (M&A) and the impact of substitute products on the market's trajectory. The report features detailed market share distribution analysis among prominent industry players, including ALVEST, Ground Support Specialists LLC, Mallaghan Group, Tronair Inc, Vestergaard Company, TIPS d o o, JBT Corporation, MULAG, Textron Ground Support Equipment Inc (Textron Inc), and COBUS Industries Gmb. We quantify M&A activities with an estimated total value of $XX Million in transactions between 2019 and 2024, providing a clear picture of industry consolidation.

- Market Concentration: The AGHV market demonstrates a [moderately concentrated/fragmented] structure, with the top 5 players collectively commanding an estimated XX% market share in 2025, signaling a significant presence of leading entities.

- Innovation Drivers: The primary catalysts for innovation include the escalating demand for eco-friendly electric and hybrid vehicles, coupled with increasingly stringent global emission regulations. Advancements in automation, artificial intelligence (AI), and vehicle-to-infrastructure (V2I) connectivity are also pivotal in shaping the future of ground handling operations.

- Regulatory Framework: A robust and evolving regulatory landscape, characterized by stringent safety standards and environmental mandates, is actively shaping industry practices. These regulations are not merely compliance burdens but are powerful drivers propelling the development and adoption of advanced, sustainable ground handling solutions.

- Product Substitutes: While new technologies are emerging, older, less efficient vehicle models and manual operational methods can act as substitutes. Overcoming this inertia through demonstrating clear ROI, enhanced efficiency, and environmental benefits is crucial for the widespread penetration of next-generation AGHV.

- End-User Demographics: The core end-users of AGHV are major international airports and dedicated ground handling service providers. The sustained growth in global air passenger traffic, coupled with ongoing airport expansion projects, directly fuels the demand for modern and efficient ground support equipment.

Airport Ground Handling Vehicles Industry Market Dynamics & Trends

This section offers an in-depth exploration of the dynamic forces influencing growth and technological disruption within the Airport Ground Handling Vehicles (AGHV) market. We meticulously dissect market drivers, evolving consumer preferences, and the nuances of competitive dynamics. The analysis highlights the transformative impact of technological advancements, including the seamless integration of advanced sensor arrays, sophisticated data analytics platforms, and the burgeoning capabilities of autonomous driving features in AGHV. This comprehensive view encompasses critical factors fueling market expansion: the robust growth in global air passenger traffic, significant investments in airport infrastructure development worldwide, and a pronounced industry-wide focus on optimizing operational efficiency and enhancing sustainability within aviation ecosystems. The report incorporates specific, quantifiable data on the market penetration of electric vehicles and the projected Compound Annual Growth Rate (CAGR) for the overall AGHV market.

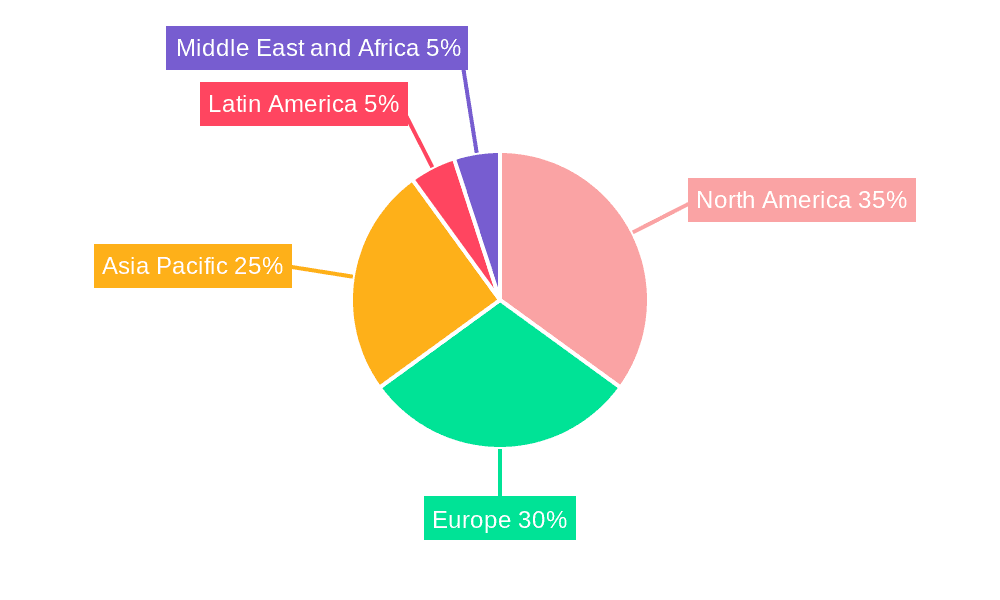

Dominant Regions & Segments in Airport Ground Handling Vehicles Industry

This section identifies the leading geographical regions and product segments within the Airport Ground Handling Vehicles industry. We analyze market dominance across regions, examining factors like economic policies, infrastructure development, and regional air traffic growth. Key segments including Refuelers, Tugs and Tractors, Passenger Buses, De-icing Vehicles, Ground Power Units, and Others are analyzed based on their power source (Electric, Non-Electric, Hybrid).

Leading Region: [Region Name] dominates the market due to factors such as [Specific Reasons - e.g., high air passenger traffic, significant airport infrastructure investments, supportive government policies].

Leading Segment (Type): [Segment Name] holds the largest market share driven by [Specific reasons - e.g., increasing demand, technological advancements].

Leading Segment (Power Source): [Power Source] is the dominant power source due to factors like [Specific reasons - e.g., environmental regulations, cost-effectiveness, technological maturity].

Key Drivers (Examples):

- Favorable economic policies promoting aviation infrastructure development

- Increasing investments in airport modernization and expansion projects

- Government regulations encouraging the adoption of sustainable technologies

Airport Ground Handling Vehicles Industry Product Innovations

This section spotlights cutting-edge product developments and the most impactful technological trends shaping the Airport Ground Handling Vehicles (AGHV) market. We critically assess the competitive advantages conferred by these innovations, with a strong emphasis on technological advancements and their precise market fit. The analysis demonstrates how these innovations effectively address persistent industry challenges while strategically capitalizing on emerging opportunities. A prime example is the accelerating adoption of electric and hybrid power systems, driven by a dual imperative: achieving ambitious sustainability goals and realizing significant reductions in operational costs, thereby enhancing the overall economic viability of ground handling operations.

Report Scope & Segmentation Analysis

This comprehensive report segments the Airport Ground Handling Vehicles (AGHV) market based on key differentiators, including vehicle type and power source. Vehicle types analyzed include Refuelers, Tugs and Tractors, Passenger Buses, De-icing Vehicles, Ground Power Units (GPUs), and a category for 'Others'. The power source segmentation covers Electric, Non-Electric, and Hybrid powertrains. For each segment, we provide detailed growth projections, precise market size estimations (in millions of dollars), and a thorough analysis of competitive dynamics. This granular approach offers deep insights into each segment's market size, projected growth rate, and future potential. For instance, the electric vehicle segment is anticipated to experience exceptionally rapid growth, propelled by heightened environmental consciousness and supportive government incentives aimed at promoting green transportation solutions.

Key Drivers of Airport Ground Handling Vehicles Industry Growth

The growth of the Airport Ground Handling Vehicles industry is propelled by several key factors: Increased air passenger traffic, necessitating efficient ground handling operations; stringent environmental regulations pushing the adoption of sustainable technologies; and advancements in automation and electric power systems improving operational efficiency and reducing emissions. Growing investments in airport infrastructure globally also contribute significantly to market growth.

Challenges in the Airport Ground Handling Vehicles Industry Sector

The Airport Ground Handling Vehicles industry faces challenges including the high initial cost of electric and hybrid vehicles, potential supply chain disruptions affecting component availability, and intense competition among established players and new entrants. Regulatory compliance and the need for continuous technological upgrades also present ongoing challenges. These factors can impact market growth and profitability.

Emerging Opportunities in Airport Ground Handling Vehicles Industry

Emerging opportunities lie in the expansion of electric and autonomous vehicles, the development of advanced safety features, and the integration of data analytics for optimized fleet management. Growing demand in emerging markets and the development of innovative service models represent significant future growth potential for industry participants.

Leading Players in the Airport Ground Handling Vehicles Industry Market

- ALVEST

- Ground Support Specialists LLC

- Mallaghan Group

- Tronair Inc

- Vestergaard Company

- TIPS d o o

- JBT Corporation

- MULAG

- Textron Ground Support Equipment Inc (Textron Inc)

- COBUS Industries Gmb

Key Developments in Airport Ground Handling Vehicles Industry Industry

- [Month, Year]: [Company Name] launched a new electric tug, expanding its sustainable product portfolio.

- [Month, Year]: [Company Name] acquired [Company Name], strengthening its market position and expanding its product range.

- [Month, Year]: New emission regulations were implemented in [Region], driving demand for electric vehicles.

Future Outlook for Airport Ground Handling Vehicles Industry Market

The future outlook for the Airport Ground Handling Vehicles (AGHV) industry is exceptionally robust and promising. This optimistic trajectory is underpinned by the sustained and projected growth in global air travel, substantial and ongoing investments in critical airport infrastructure development, and the accelerating adoption of sustainable and technologically advanced ground handling equipment. The market is poised for significant expansion, with particularly strong growth anticipated in the segments of electric and autonomous vehicles. These evolving segments present considerable strategic opportunities for industry players who demonstrate agility, embrace innovation, and effectively adapt to the dynamic shifts in market demands and technological landscapes.

Airport Ground Handling Vehicles Industry Segmentation

-

1. Type

- 1.1. Refuelers

- 1.2. Tugs and Tractors

- 1.3. Passenger Buses

- 1.4. De-icing Vehicles

- 1.5. Ground Power Units

- 1.6. Others

-

2. Power Source

- 2.1. Electric

- 2.2. Non-Electric

- 2.3. Hybrid

Airport Ground Handling Vehicles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Airport Ground Handling Vehicles Industry Regional Market Share

Geographic Coverage of Airport Ground Handling Vehicles Industry

Airport Ground Handling Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Tugs and Tractor Segment is expected to Occupy the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refuelers

- 5.1.2. Tugs and Tractors

- 5.1.3. Passenger Buses

- 5.1.4. De-icing Vehicles

- 5.1.5. Ground Power Units

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. Electric

- 5.2.2. Non-Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Refuelers

- 6.1.2. Tugs and Tractors

- 6.1.3. Passenger Buses

- 6.1.4. De-icing Vehicles

- 6.1.5. Ground Power Units

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. Electric

- 6.2.2. Non-Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Refuelers

- 7.1.2. Tugs and Tractors

- 7.1.3. Passenger Buses

- 7.1.4. De-icing Vehicles

- 7.1.5. Ground Power Units

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. Electric

- 7.2.2. Non-Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Refuelers

- 8.1.2. Tugs and Tractors

- 8.1.3. Passenger Buses

- 8.1.4. De-icing Vehicles

- 8.1.5. Ground Power Units

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. Electric

- 8.2.2. Non-Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Refuelers

- 9.1.2. Tugs and Tractors

- 9.1.3. Passenger Buses

- 9.1.4. De-icing Vehicles

- 9.1.5. Ground Power Units

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. Electric

- 9.2.2. Non-Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Refuelers

- 10.1.2. Tugs and Tractors

- 10.1.3. Passenger Buses

- 10.1.4. De-icing Vehicles

- 10.1.5. Ground Power Units

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Power Source

- 10.2.1. Electric

- 10.2.2. Non-Electric

- 10.2.3. Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALVEST

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ground Support Specialists LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mallaghan Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tronair Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vestergaard Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TIPS d o o

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JBT Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MULAG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Textron Ground Support Equipment Inc (Textron Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 COBUS Industries Gmb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ALVEST

List of Figures

- Figure 1: Global Airport Ground Handling Vehicles Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 5: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 6: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 11: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 12: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 17: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 18: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 23: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 24: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 29: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 30: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 3: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 6: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 11: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 19: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 27: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 33: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Qatar Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Ground Handling Vehicles Industry?

The projected CAGR is approximately 5.99%.

2. Which companies are prominent players in the Airport Ground Handling Vehicles Industry?

Key companies in the market include ALVEST, Ground Support Specialists LLC, Mallaghan Group, Tronair Inc, Vestergaard Company, TIPS d o o, JBT Corporation, MULAG, Textron Ground Support Equipment Inc (Textron Inc ), COBUS Industries Gmb.

3. What are the main segments of the Airport Ground Handling Vehicles Industry?

The market segments include Type, Power Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Tugs and Tractor Segment is expected to Occupy the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Ground Handling Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Ground Handling Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Ground Handling Vehicles Industry?

To stay informed about further developments, trends, and reports in the Airport Ground Handling Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence