Key Insights

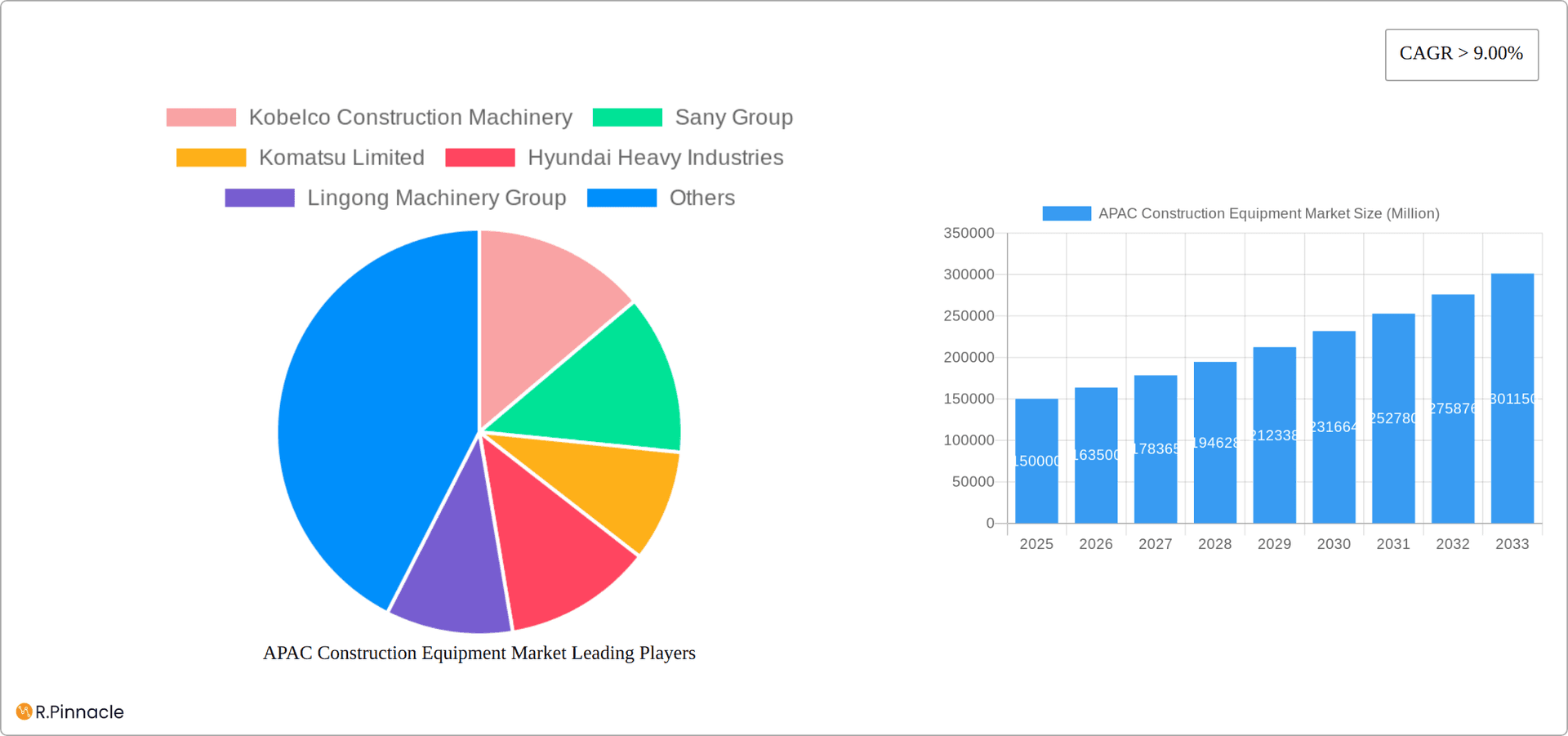

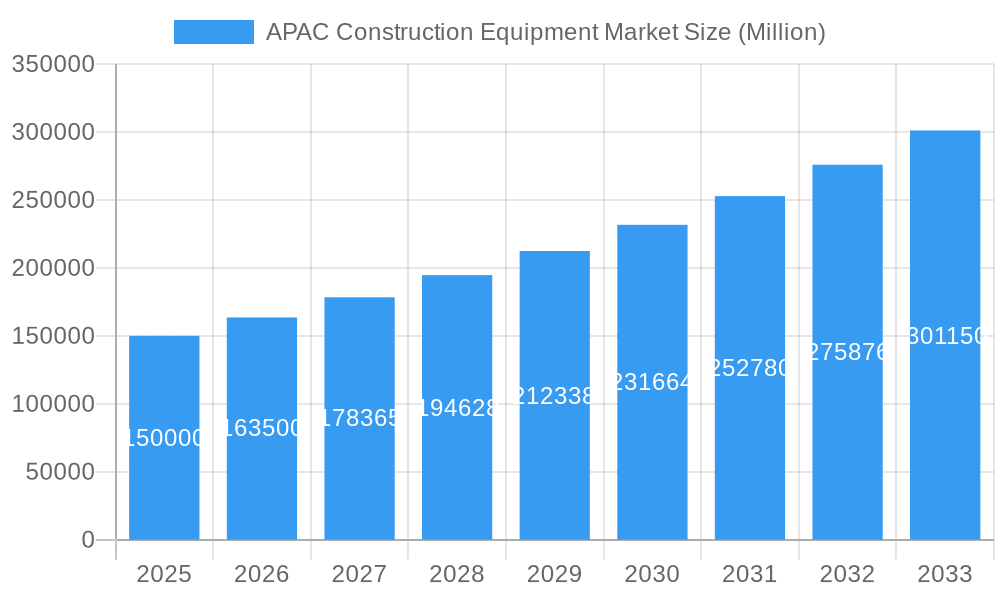

The Asia-Pacific (APAC) construction equipment market is poised for substantial expansion, driven by significant infrastructure development initiatives across the region. Key contributors such as China, India, and Japan are experiencing robust demand across machinery segments including cranes, excavators, and loaders. With a projected Compound Annual Growth Rate (CAGR) of 8.7%, the market size is estimated to reach 242.17 billion by the base year of 2025. Growth drivers include increasing urbanization, elevated government investment in infrastructure projects (roads, railways, and buildings), and rising industrialization in emerging economies like India and Southeast Asia. A notable trend is the adoption of technologically advanced equipment, such as electric and hybrid models, influenced by environmental regulations and a drive for sustainable construction practices. Challenges may arise from fluctuating commodity prices, potential supply chain disruptions, and economic volatility in specific areas. While internal combustion engine (ICE) machinery currently dominates, the electric and hybrid segment is rapidly gaining traction and is anticipated to capture a significant market share. The competitive landscape features prominent global and regional players focusing on product innovation, technological advancements, and strategic alliances.

APAC Construction Equipment Market Market Size (In Billion)

The diverse nature of the APAC market necessitates a tailored approach to understanding growth dynamics. While China remains the largest market, substantial opportunities exist in rapidly developing nations. India's aggressive infrastructure development is a key demand driver for construction equipment. Japan, despite its mature market status, continues to invest in infrastructure upgrades, requiring specialized and advanced machinery. Understanding the specific regulatory frameworks, infrastructure priorities, and local preferences in each market is crucial for successful market entry and participation. The forecast period (2025-2033) anticipates continuous expansion, with potential acceleration driven by advancements in automation and digitalization within the construction sector. Proactive adaptation to evolving market demands and careful navigation of economic headwinds will be critical for success in this dynamic industry.

APAC Construction Equipment Market Company Market Share

This report delivers a comprehensive analysis of the APAC construction equipment market, offering essential insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a specific focus on 2025, this analysis meticulously examines market dynamics, key players, and future growth potential. Expect actionable data and projections to inform strategic decision-making within this evolving sector.

APAC Construction Equipment Market Structure & Innovation Trends

The APAC construction equipment market is characterized by a moderately concentrated landscape, with key players like Komatsu Limited, Sany Group, and XCMG Group holding significant market share. However, the presence of numerous regional players fosters competition and innovation. Market share fluctuates based on factors such as technological advancements, government infrastructure spending, and economic growth. While precise figures for market share are proprietary to the full report, analysis reveals that the top five players likely control xx% of the overall market in 2025, indicating a trend towards consolidation. Innovation is driven by the demand for efficient, sustainable, and technologically advanced equipment, leading to the development of electric and hybrid models and autonomous systems. Stringent environmental regulations across the region further propel the adoption of environmentally friendly technologies. The market also witnesses frequent M&A activities, with deal values exceeding xx Million in recent years. These transactions often aim to enhance technological capabilities, expand market reach, and consolidate market share. End-user demographics are influenced by the varying construction activities in different countries. For example, China's extensive infrastructure projects drive demand for heavy machinery, while India's growing urbanization fuels demand for smaller and more versatile equipment.

APAC Construction Equipment Market Market Dynamics & Trends

The APAC construction equipment market is poised for substantial growth from 2025 to 2033, driven by robust infrastructure development and a burgeoning need for modernized construction techniques across the region. While precise CAGR figures require further analysis, projections indicate a healthy growth trajectory fueled by government investments in transportation networks, urban expansion projects, and industrial capacity enhancements. This growth is not solely quantitative; it's also qualitative, reflecting a significant shift in the industry landscape.

Technological advancements are reshaping the competitive dynamics. The integration of automation, artificial intelligence (AI), and digitalization is improving efficiency, reducing operational costs, and bolstering safety standards. This technological push is coupled with a growing consumer preference for equipment boasting enhanced fuel efficiency and a reduced environmental footprint. While internal combustion engine (ICE) models continue to dominate market share, the increasing penetration of electric and hybrid construction equipment signifies a decisive move towards environmentally sustainable practices, aligning with global ESG goals. Competition remains fierce, with leading manufacturers engaged in a continuous cycle of innovation and product portfolio expansion to meet evolving market demands and emerging regional specifications. This includes localization efforts to cater to unique terrain and construction needs.

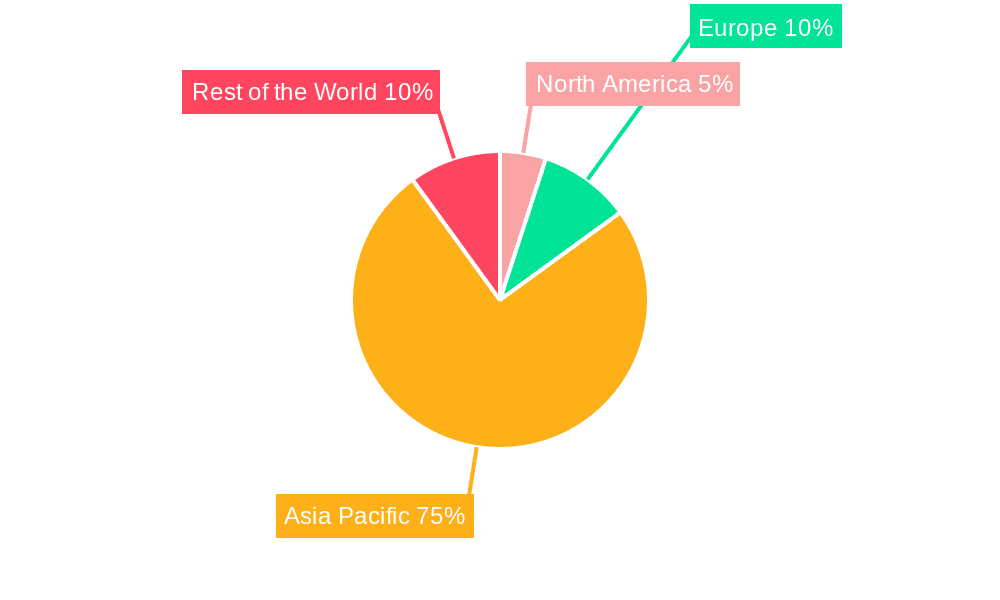

Dominant Regions & Segments in APAC Construction Equipment Market

- Dominant Region: China remains the dominant market in the APAC region, accounting for xx% of the total market size in 2025 due to the substantial investments in infrastructure projects and its vast construction sector. India, however, is poised for significant growth in the coming years.

- Dominant Country: China's dominance is primarily due to its massive scale of infrastructure projects, government initiatives promoting construction, and a strong manufacturing base within the country. Key drivers include government spending on infrastructure projects such as high-speed rail, roads, and urban development initiatives.

- Dominant Machinery Type: Excavators represent the largest segment, followed closely by loaders and backhoes, owing to their versatility and widespread use in various construction applications. The demand for cranes is also substantial, driven by the construction of high-rise buildings and other large-scale projects.

- Dominant Drive Type: Currently, IC Engine drive types dominate the market due to their established technology and cost-effectiveness. However, the market share of electric and hybrid drive types is growing rapidly, indicating a significant shift in the future driven by stringent emission norms.

APAC Construction Equipment Market Product Innovations

Recent product innovations underscore a clear focus on improving efficiency, sustainability, and safety. The emergence of electric and hybrid models is a direct response to tightening environmental regulations and the escalating costs associated with traditional fuel sources. Furthermore, the incorporation of autonomous features and advanced telematics systems is enhancing productivity by reducing reliance on manual labor and optimizing equipment utilization. These advancements cater to the rising demand for technologically sophisticated, environmentally conscious, and cost-effective solutions. Manufacturers are increasingly tailoring equipment designs to meet the specific needs of diverse regional markets, encompassing factors such as challenging terrains and unique construction applications.

Examples of this trend include the launch of the Potain MCT 805 in China, specifically designed for the Chinese market, and Sany's introduction of 22 new products tailored for the Indian market. This localized approach highlights the importance of understanding and catering to the nuanced needs of each regional market within APAC. Further innovation is expected in areas such as remote diagnostics, predictive maintenance, and connected equipment management systems.

Report Scope & Segmentation Analysis

This report segments the APAC construction equipment market by country (China, India, Japan, South Korea, Rest of Asia Pacific), machinery type (Cranes, Telescopic Handling, Excavator, Loaders And Backhoe, Motor Grader, Others), and drive type (IC Engine, Electric And Hybrid). Each segment's market size, growth projections, and competitive dynamics are analyzed thoroughly. For instance, the Excavator segment shows substantial growth with a projected xx Million market size by 2033, driven by the infrastructure boom across the APAC region. The Electric and Hybrid segment's growth is anticipated to be faster due to increased environmental concerns.

Key Drivers of APAC Construction Equipment Market Growth

Several factors drive the growth of the APAC construction equipment market. Government initiatives focused on infrastructure development, particularly in China and India, play a major role. Rapid urbanization and industrialization across the region increase the demand for construction equipment. Technological advancements, such as the adoption of automation and digital technologies, improve efficiency and productivity. Finally, favorable economic conditions in certain parts of the region further stimulate construction activities, consequently boosting equipment sales.

Challenges in the APAC Construction Equipment Market Sector

Challenges include supply chain disruptions, particularly regarding raw material sourcing and component availability. Fluctuations in commodity prices impact production costs and profitability. Stringent emission regulations pose significant challenges for manufacturers of traditional IC engine equipment, necessitating significant investments in research and development of eco-friendly alternatives. Intense competition among established players and new entrants puts pressure on pricing and profit margins.

Emerging Opportunities in APAP Construction Equipment Market

The market presents numerous opportunities. The growth of sustainable construction practices creates demand for eco-friendly equipment. The increasing adoption of automation and digital technologies presents opportunities for innovative solutions. Expansion into less-developed regions of APAC with high construction potential creates exciting market possibilities. The rising need for specialized equipment for unique construction applications opens further doors for niche players.

Leading Players in the APAC Construction Equipment Market Market

- Kobelco Construction Machinery

- Sany Group

- Komatsu Limited (Komatsu Limited)

- Hyundai Heavy Industries

- Lingong Machinery Group

- XCMG Group (XCMG Group)

- Doosan Group

- Hitachi Construction Equipments Co Ltd (Hitachi Construction Equipments Co Ltd)

- Zoomlion Heavy Industry Science And Technology Co Lt (Zoomlion Heavy Industry Science And Technology Co Lt)

Key Developments in APAC Construction Equipment Market Industry

- May 2022: Sany Bharat launched 22 new products exclusively designed for the Indian market, demonstrating a commitment to localized solutions and understanding regional needs.

- April 2022: Manitowoc launched the Potain MCT 805, manufactured in China, highlighting the growing importance of local manufacturing capabilities within the region.

- June 2022: Cummins Inc. and Komatsu Corp. announced a collaboration to develop zero-emissions mining haul trucks, reflecting the industry's commitment to sustainability and reducing carbon footprints.

- August 2022: Volvo CE announced the development of its Bengaluru facility into an export hub for medium-sized excavators, signifying the strategic importance of the Indian market and its potential as a manufacturing and export center.

- [Add more recent key developments here with dates and brief descriptions.]

Future Outlook for APAC Construction Equipment Market Market

The APAC construction equipment market is projected to experience sustained and robust growth, driven by ongoing infrastructure investments and continuous technological advancements. The increasing adoption of electrification, automation, and digital technologies will fundamentally reshape the industry's operational landscape. Strategic alliances, mergers and acquisitions, and a steadfast focus on developing sustainable solutions will be critical success factors for market players. The market's trajectory remains strongly positive, presenting significant opportunities for established industry leaders and emerging market entrants alike. Further growth will be shaped by factors such as government policies, economic conditions, and evolving technological capabilities.

APAC Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handling

- 1.3. Excavator

- 1.4. Loaders And Backhoe

- 1.5. Motor Grader

- 1.6. Others

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric And Hybrid

APAC Construction Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Construction Equipment Market Regional Market Share

Geographic Coverage of APAC Construction Equipment Market

APAC Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Government Regulations to Adopt Fire Safety Standards

- 3.3. Market Restrains

- 3.3.1. High Purchase and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Growing Demand for Excavators to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handling

- 5.1.3. Excavator

- 5.1.4. Loaders And Backhoe

- 5.1.5. Motor Grader

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric And Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Telescopic Handling

- 6.1.3. Excavator

- 6.1.4. Loaders And Backhoe

- 6.1.5. Motor Grader

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. IC Engine

- 6.2.2. Electric And Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. South America APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Telescopic Handling

- 7.1.3. Excavator

- 7.1.4. Loaders And Backhoe

- 7.1.5. Motor Grader

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. IC Engine

- 7.2.2. Electric And Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Europe APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Telescopic Handling

- 8.1.3. Excavator

- 8.1.4. Loaders And Backhoe

- 8.1.5. Motor Grader

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. IC Engine

- 8.2.2. Electric And Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Middle East & Africa APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Telescopic Handling

- 9.1.3. Excavator

- 9.1.4. Loaders And Backhoe

- 9.1.5. Motor Grader

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. IC Engine

- 9.2.2. Electric And Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Asia Pacific APAC Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Telescopic Handling

- 10.1.3. Excavator

- 10.1.4. Loaders And Backhoe

- 10.1.5. Motor Grader

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. IC Engine

- 10.2.2. Electric And Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kobelco Construction Machinery

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sany Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Komatsu Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hyundai Heavy Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lingong Machinery Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XCMG Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hitachi Construction Equipments Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoomlion Heavy Industry Science And Technology Co Lt

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Global APAC Construction Equipment Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 3: North America APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 5: North America APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 9: South America APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 10: South America APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 11: South America APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: South America APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 15: Europe APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Europe APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 17: Europe APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Europe APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 23: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Middle East & Africa APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Machinery Type 2025 & 2033

- Figure 27: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Drive Type 2025 & 2033

- Figure 29: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Asia Pacific APAC Construction Equipment Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Construction Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Global APAC Construction Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 5: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 11: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 12: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 17: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 18: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 29: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 30: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Construction Equipment Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 38: Global APAC Construction Equipment Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 39: Global APAC Construction Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Construction Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Construction Equipment Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the APAC Construction Equipment Market?

Key companies in the market include Kobelco Construction Machinery, Sany Group, Komatsu Limited, Hyundai Heavy Industries, Lingong Machinery Group, XCMG Group, Doosan Group, Hitachi Construction Equipments Co Ltd, Zoomlion Heavy Industry Science And Technology Co Lt.

3. What are the main segments of the APAC Construction Equipment Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 242.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Strict Government Regulations to Adopt Fire Safety Standards.

6. What are the notable trends driving market growth?

Growing Demand for Excavators to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

High Purchase and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

In August 2022, Volvo CE announced to development of its manufacturing facility located in Bengaluru in India into an export hub. The company stated that this investment will allow Volvo Construction Equipment to produce medium-sized excavators at the plant. The company further stated that these machines will primarily be used in the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Construction Equipment Market?

To stay informed about further developments, trends, and reports in the APAC Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence