Key Insights

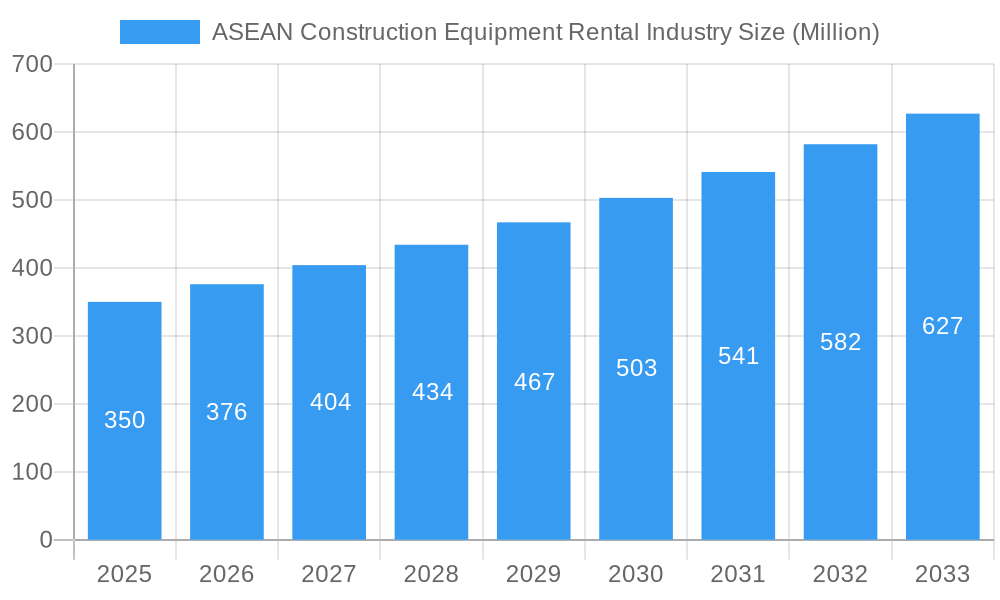

The ASEAN construction equipment rental market is experiencing significant expansion, propelled by substantial infrastructure development across the region. A projected Compound Annual Growth Rate (CAGR) of 7% indicates a robust and ascending market trajectory. This growth is primarily attributed to increasing urbanization and industrialization in key economies like Indonesia, Vietnam, and the Philippines, driving heightened construction activity. Government-led infrastructure initiatives, including road networks and transportation hubs, further stimulate demand for rental equipment. The preference for rental solutions over outright purchase, owing to cost-effectiveness and reduced operational burdens, also contributes significantly.

ASEAN Construction Equipment Rental Industry Market Size (In Billion)

The market is strategically segmented by vehicle type, encompassing earthmoving and material handling equipment, and by propulsion, including internal combustion engines and hybrid drives, to address the diverse requirements of the construction sector. With a projected market size of 5.14 billion in 2025, and considering ongoing infrastructural investments, this positive trend is anticipated to persist through 2033. However, potential economic slowdowns and commodity price fluctuations may influence growth rates.

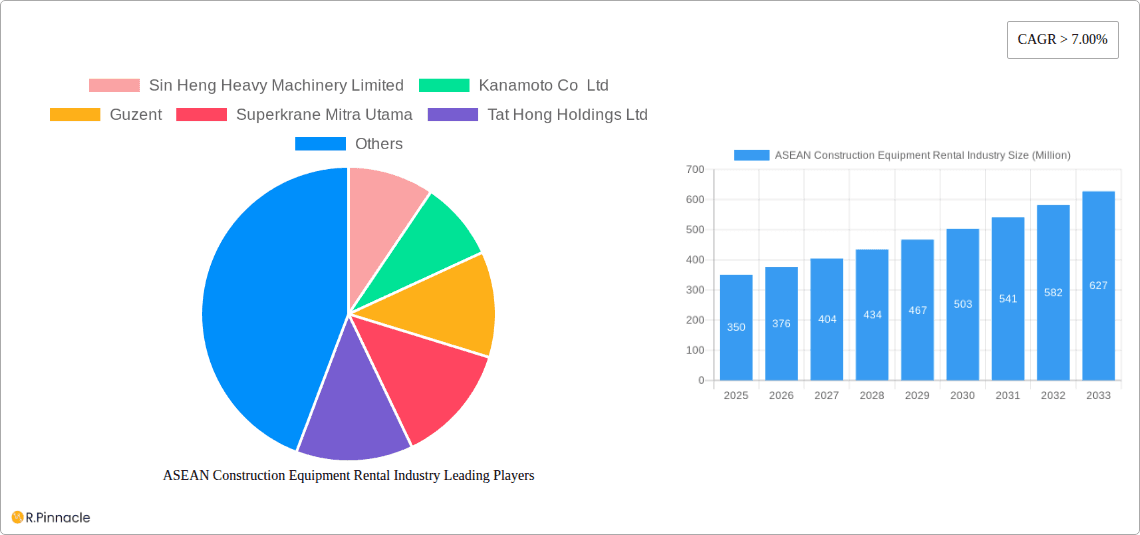

ASEAN Construction Equipment Rental Industry Company Market Share

The competitive arena features a dynamic mix of local and international enterprises, with notable players such as Sin Heng Heavy Machinery Limited and Tat Hong Holdings Ltd. The growing adoption of advanced equipment, including hybrid and electric models, underscores a commitment to sustainability and enhanced efficiency within the industry. Geographically, Indonesia, Thailand, Vietnam, and the Philippines represent crucial markets due to their extensive construction projects, while other ASEAN nations are also poised for growth.

Sustained economic momentum, continued infrastructure investment, and the integration of innovative technologies are pivotal for the market's future success, driving further optimization and minimizing environmental impact. A detailed analysis of specific market segments and regional variances is essential for a precise market outlook.

ASEAN Construction Equipment Rental Industry: Comprehensive Market Analysis (2019-2033)

This comprehensive report delivers an in-depth analysis of the ASEAN construction equipment rental industry, providing critical insights for industry professionals, investors, and strategic planners. The study spans the period from 2019 to 2033, with 2025 serving as the base year and the forecast period extending from 2025 to 2033. Extensive data analysis is employed to present a clear overview of market dynamics, segmentation, key stakeholders, and future growth prospects.

ASEAN Construction Equipment Rental Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the ASEAN construction equipment rental market, exploring market concentration, innovation drivers, regulatory frameworks, and key industry trends. The market is characterized by a mix of large multinational corporations and smaller regional players. Market share is concentrated among the top 10 players, estimated at 65% in 2025, with the remainder distributed among numerous smaller firms. The total market value in 2025 is estimated at $XX Million.

- Market Concentration: The top five players—Sin Heng Heavy Machinery Limited, Kanamoto Co Ltd, Guzent, Superkrane Mitra Utama, and Tat Hong Holdings Ltd—hold a significant portion of the market share. Smaller companies often specialize in niche segments or geographic areas.

- Innovation Drivers: Technological advancements, including the increasing adoption of telematics and hybrid/electric equipment, are driving innovation. Government regulations promoting sustainability are also influencing the market.

- Regulatory Frameworks: Varying regulatory environments across ASEAN nations impact market access and operational costs. Harmonization of regulations across the region could spur further growth.

- Product Substitutes: The availability of alternative construction methods and technologies presents some level of substitution, but demand for rental equipment remains substantial, particularly for specialized or short-term projects.

- End-User Demographics: The end-user base comprises a diverse range of construction companies, ranging from large multinational contractors to smaller local firms. Government infrastructure projects constitute a significant portion of the demand.

- M&A Activities: Consolidation activity has been moderate over the past five years, with several deals totaling an estimated $XX Million in value. Further M&A activity is expected as larger companies seek to expand their market share.

ASEAN Construction Equipment Rental Industry Market Dynamics & Trends

This section delves into the key drivers and trends shaping the ASEAN construction equipment rental market. The market exhibits robust growth fueled by increasing infrastructure development, urbanization, and rising construction activity across the region. However, economic fluctuations and global events can impact growth trajectories.

The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at 7.5%, driven by substantial government spending on infrastructure projects across various ASEAN nations. Market penetration of rental equipment is also anticipated to increase as construction companies increasingly adopt rental models for cost optimization and flexibility. Technological disruptions, such as the introduction of autonomous equipment and digital platforms for equipment management, are reshaping the competitive dynamics. Consumer preferences are shifting towards environmentally friendly and technologically advanced equipment. The competitive landscape is dynamic, with both local and international players vying for market share. Price competition, service quality, and technological innovation are key differentiators.

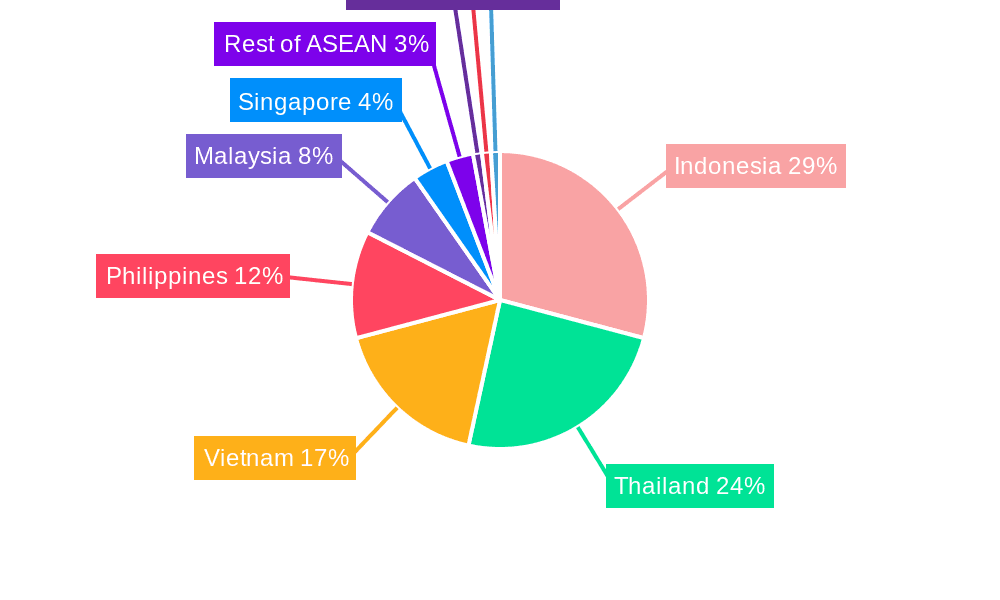

Dominant Regions & Segments in ASEAN Construction Equipment Rental Industry

This section identifies the leading regions and segments within the ASEAN construction equipment rental market.

By Country: Indonesia, Thailand, and Vietnam represent the largest markets, driven by robust economic growth and significant infrastructure development projects. Singapore and Malaysia are also significant, though smaller, markets characterized by high levels of construction activity. The Philippines and the Rest of ASEAN exhibit growing potential but at a slower rate than leading countries.

By Vehicle Type: Earthmoving equipment (excavators, bulldozers, etc.) dominates the market, accounting for approximately 60% of the total rental revenue. Material handling equipment (forklifts, cranes, etc.) represents a significant segment, driven by the logistical demands of construction projects.

By Propulsion: IC Engine powered equipment currently holds the majority of the market share, though the adoption of hybrid drive and electric equipment is expected to gradually increase due to environmental concerns and potential cost savings in the long run.

Key Drivers of Dominance:

- Economic Policies: Government investments in infrastructure development significantly impact market growth.

- Infrastructure Development: Large-scale projects, such as highway construction, port development, and urban renewal initiatives, propel demand for rental equipment.

- Urbanization: Rapid urbanization in many ASEAN nations drives construction activities, fueling demand for rental equipment.

ASEAN Construction Equipment Rental Industry Product Innovations

The ASEAN construction equipment rental market is witnessing a wave of technological advancements. Manufacturers are incorporating features such as telematics, improved fuel efficiency, and enhanced safety mechanisms into their equipment. This focus on technological advancements is enhancing equipment performance, optimizing operational efficiency, and improving environmental sustainability. The market is also seeing increased adoption of hybrid and electric-powered equipment to address growing environmental concerns. These innovations cater to the growing demand for more efficient, safer, and environmentally friendly construction equipment.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the ASEAN construction equipment rental market, segmented by vehicle type (earthmoving equipment and material handling), propulsion type (IC engine and hybrid drive), and country (Indonesia, Thailand, Vietnam, Singapore, Malaysia, Philippines, and Rest of ASEAN). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed. For example, the earthmoving segment is expected to experience significant growth driven by large infrastructure projects. The hybrid drive segment, while still relatively small, shows significant growth potential due to increasing environmental concerns.

Key Drivers of ASEAN Construction Equipment Rental Industry Growth

The growth of the ASEAN construction equipment rental industry is propelled by several key factors. Firstly, substantial government investments in infrastructure development across the region are creating substantial demand. Secondly, rapid urbanization and industrialization are leading to increased construction activities. Thirdly, the increasing adoption of rental models by construction companies for cost optimization and operational flexibility is further driving market expansion. Finally, technological advancements, offering improved equipment efficiency and safety, further contribute to the market's growth trajectory.

Challenges in the ASEAN Construction Equipment Rental Industry Sector

The ASEAN construction equipment rental industry faces several challenges. Fluctuations in commodity prices and fuel costs can directly impact operational expenses. Furthermore, the varying regulatory environments across different ASEAN nations present complexities for businesses operating across multiple countries. Competition among established players and emerging entrants can also intensify price pressures. Finally, supply chain disruptions and skilled labor shortages pose additional difficulties for the industry.

Emerging Opportunities in ASEAN Construction Equipment Rental Industry

Several opportunities exist for growth in the ASEAN construction equipment rental industry. The rising adoption of technology, including telematics and remote equipment monitoring, presents avenues for enhanced efficiency and cost optimization. The increasing focus on sustainable construction practices creates opportunities for companies offering eco-friendly equipment. Expanding into underserved markets within the ASEAN region and tapping into the growing demand for specialized equipment further present significant business prospects.

Leading Players in the ASEAN Construction Equipment Rental Industry Market

- Sin Heng Heavy Machinery Limited

- Kanamoto Co Ltd

- Guzent

- Superkrane Mitra Utama

- Tat Hong Holdings Ltd

- Asia Machinery Solutions Vietnam Co Ltd

- Aktio Co Ltd

- Rent (Thailand) Co Ltd

- Shanghai Pangyuan Machinery Rental Co Lt

- Nishio Rent All Co Ltd

Key Developments in ASEAN Construction Equipment Rental Industry Industry

- 2022 Q4: Significant investment in telematics technology by several major players.

- 2023 Q1: Launch of a new hybrid excavator model by a leading manufacturer.

- 2023 Q3: Merger between two regional rental companies in Thailand.

- 2024 Q2: Introduction of a new government initiative promoting sustainable construction practices in Vietnam.

Future Outlook for ASEAN Construction Equipment Rental Industry Market

The ASEAN construction equipment rental market is poised for continued growth. Government infrastructure investments, coupled with rapid urbanization and industrialization, will remain key drivers of demand. Technological innovations will continue to enhance efficiency and sustainability within the sector. Strategic partnerships and acquisitions will shape the competitive landscape, as companies strive for expansion and market leadership. Overall, the long-term outlook for the industry remains positive, offering numerous growth opportunities for businesses with effective strategies.

ASEAN Construction Equipment Rental Industry Segmentation

-

1. Vehicle Type

- 1.1. Earth Moving Equipment

- 1.2. Material Handling

-

2. Propulsion

- 2.1. IC Engine

- 2.2. Hybrid Drive

ASEAN Construction Equipment Rental Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Construction Equipment Rental Industry Regional Market Share

Geographic Coverage of ASEAN Construction Equipment Rental Industry

ASEAN Construction Equipment Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Economy And Infrastructural Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. Increasing Investments Towards Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Earth Moving Equipment

- 5.1.2. Material Handling

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. IC Engine

- 5.2.2. Hybrid Drive

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Earth Moving Equipment

- 6.1.2. Material Handling

- 6.2. Market Analysis, Insights and Forecast - by Propulsion

- 6.2.1. IC Engine

- 6.2.2. Hybrid Drive

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Earth Moving Equipment

- 7.1.2. Material Handling

- 7.2. Market Analysis, Insights and Forecast - by Propulsion

- 7.2.1. IC Engine

- 7.2.2. Hybrid Drive

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Earth Moving Equipment

- 8.1.2. Material Handling

- 8.2. Market Analysis, Insights and Forecast - by Propulsion

- 8.2.1. IC Engine

- 8.2.2. Hybrid Drive

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Earth Moving Equipment

- 9.1.2. Material Handling

- 9.2. Market Analysis, Insights and Forecast - by Propulsion

- 9.2.1. IC Engine

- 9.2.2. Hybrid Drive

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific ASEAN Construction Equipment Rental Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Earth Moving Equipment

- 10.1.2. Material Handling

- 10.2. Market Analysis, Insights and Forecast - by Propulsion

- 10.2.1. IC Engine

- 10.2.2. Hybrid Drive

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sin Heng Heavy Machinery Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kanamoto Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guzent

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Superkrane Mitra Utama

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tat Hong Holdings Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Asia Machinery Solutions Vietnam Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aktio Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rent (Thailand) Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai Pangyuan Machinery Rental Co Lt

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nishio Rent All Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sin Heng Heavy Machinery Limited

List of Figures

- Figure 1: Global ASEAN Construction Equipment Rental Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Construction Equipment Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America ASEAN Construction Equipment Rental Industry Revenue (billion), by Propulsion 2025 & 2033

- Figure 5: North America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 6: North America ASEAN Construction Equipment Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America ASEAN Construction Equipment Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: South America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: South America ASEAN Construction Equipment Rental Industry Revenue (billion), by Propulsion 2025 & 2033

- Figure 11: South America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 12: South America ASEAN Construction Equipment Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America ASEAN Construction Equipment Rental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe ASEAN Construction Equipment Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe ASEAN Construction Equipment Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe ASEAN Construction Equipment Rental Industry Revenue (billion), by Propulsion 2025 & 2033

- Figure 17: Europe ASEAN Construction Equipment Rental Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 18: Europe ASEAN Construction Equipment Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe ASEAN Construction Equipment Rental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue (billion), by Propulsion 2025 & 2033

- Figure 23: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 24: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue (billion), by Propulsion 2025 & 2033

- Figure 29: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue Share (%), by Propulsion 2025 & 2033

- Figure 30: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific ASEAN Construction Equipment Rental Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 3: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 6: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 12: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 18: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 30: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 39: Global ASEAN Construction Equipment Rental Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific ASEAN Construction Equipment Rental Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Construction Equipment Rental Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the ASEAN Construction Equipment Rental Industry?

Key companies in the market include Sin Heng Heavy Machinery Limited, Kanamoto Co Ltd, Guzent, Superkrane Mitra Utama, Tat Hong Holdings Ltd, Asia Machinery Solutions Vietnam Co Ltd, Aktio Co Ltd, Rent (Thailand) Co Ltd, Shanghai Pangyuan Machinery Rental Co Lt, Nishio Rent All Co Ltd.

3. What are the main segments of the ASEAN Construction Equipment Rental Industry?

The market segments include Vehicle Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.14 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Economy And Infrastructural Growth.

6. What are the notable trends driving market growth?

Increasing Investments Towards Construction Industry.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Construction Equipment Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Construction Equipment Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Construction Equipment Rental Industry?

To stay informed about further developments, trends, and reports in the ASEAN Construction Equipment Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence