Key Insights

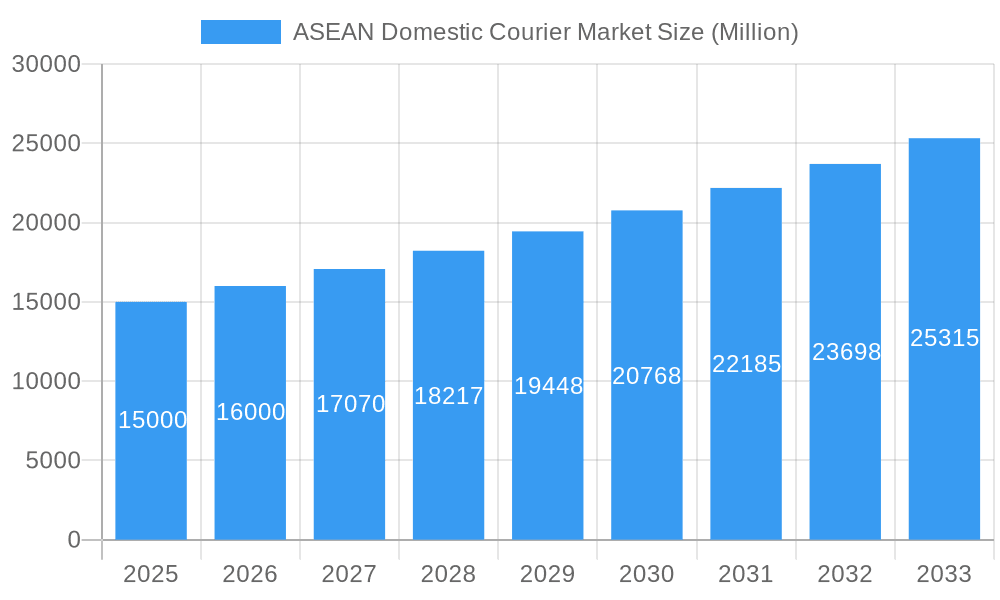

The ASEAN domestic courier market, valued at $172.37 billion in 2025, is poised for significant expansion, projecting a compound annual growth rate (CAGR) of 7.7% between 2025 and 2033. This growth is primarily propelled by the burgeoning e-commerce sector across key nations including Indonesia, Malaysia, the Philippines, Thailand, and Vietnam. Increased online shopping, a growing middle class, and enhanced digital infrastructure are driving the demand for expedited and dependable delivery solutions. Advancements in logistics technology, such as sophisticated tracking systems and optimized route planning, further contribute to this upward trend. While the market navigates challenges like volatile fuel prices and intense competition from global leaders (e.g., DHL, FedEx) and robust regional players (e.g., J&T Express, Ninja Logistics), the overall outlook remains optimistic. The market is segmented by delivery speed (express, non-express), shipment weight (light, medium, heavy), and end-user industry (e-commerce, BFSI, healthcare, manufacturing, etc.). The Business-to-Consumer (B2C) segment currently leads, reflecting the e-commerce surge, with significant growth anticipated in the Business-to-Business (B2B) segment as companies increasingly leverage efficient courier services for supply chain optimization. Indonesia and Vietnam are identified as pivotal growth markets, owing to their substantial populations and rapidly developing e-commerce ecosystems.

ASEAN Domestic Courier Market Market Size (In Billion)

Key strategies for courier companies will revolve around technological enhancement, optimizing last-mile delivery, and expanding network reach to meet diverse ASEAN market demands. This includes investing in advanced sorting facilities and extending service coverage to underserved rural regions. Companies that prioritize customer experience through transparent tracking, flexible delivery options, and consistent service reliability will gain a competitive edge. The ongoing development of digital payment systems further supports seamless transactions, bolstering the growth trajectory of the ASEAN domestic courier market. The competitive landscape is dynamic, with mergers and acquisitions expected to reshape the industry as companies seek to consolidate market share and improve operational efficiencies.

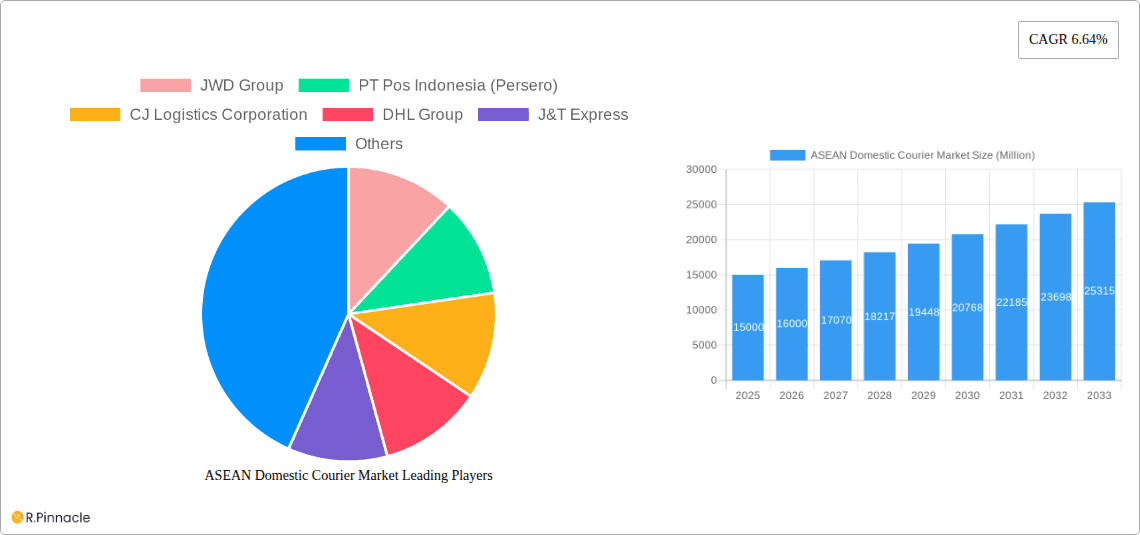

ASEAN Domestic Courier Market Company Market Share

ASEAN Domestic Courier Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN domestic courier market, offering valuable insights for industry professionals, investors, and strategists. With a focus on market dynamics, key players, and future growth potential, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is projected to reach xx Million by 2033.

ASEAN Domestic Courier Market Structure & Innovation Trends

This section analyzes the competitive landscape of the ASEAN domestic courier market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established international players and rapidly growing local companies. Market share is highly dynamic, with significant competition among players like J&T Express, Ninja Van, and others. While precise market share figures require deeper market research, it's observed that e-commerce growth significantly impacts the industry.

- Market Concentration: The market exhibits moderate concentration, with several key players holding significant shares, but smaller players also playing a vital role. Consolidation is evident through mergers and acquisitions (M&A).

- Innovation Drivers: Technological advancements like automated sorting systems, real-time tracking, and drone delivery are major drivers of innovation. E-commerce growth is fundamentally shaping the market.

- Regulatory Frameworks: Varying regulations across ASEAN countries influence operational costs and compliance requirements, impacting market dynamics.

- Product Substitutes: Alternative delivery options such as postal services and peer-to-peer delivery platforms provide indirect competition.

- End-User Demographics: The growing middle class and rising e-commerce adoption fuel demand for courier services, especially in the B2C segment.

- M&A Activities: Recent M&A activity involves the consolidation of smaller players and expansion of existing players into new markets. The value of these deals varies considerably, ranging from xx Million to xx Million. Many of these deals are driven by the need to scale operations and expand geographic reach, especially considering cross-border logistics within ASEAN.

ASEAN Domestic Courier Market Dynamics & Trends

The ASEAN domestic courier market demonstrates robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, and is projected to be xx% for the forecast period (2025-2033). Market penetration is increasing steadily across different segments and countries. E-commerce boom is a major driver, with a significant surge in online shopping activity across the region.

The market's rapid expansion is fueled by the burgeoning e-commerce sector, expanding logistics infrastructure, and increasing consumer preference for faster delivery options. Technological advancements, such as improved tracking systems and last-mile delivery solutions, further enhance efficiency and customer satisfaction. However, competitive pressures and regulatory complexities present challenges for sustained growth. The market is highly dynamic, with continuous innovations and strategic shifts impacting competition. The increasing adoption of digital technologies, particularly in the payment and tracking systems, is transforming the customer experience. This leads to increasing adoption of express delivery and services catered towards B2C customers, particularly in fast-growing economies.

Dominant Regions & Segments in ASEAN Domestic Courier Market

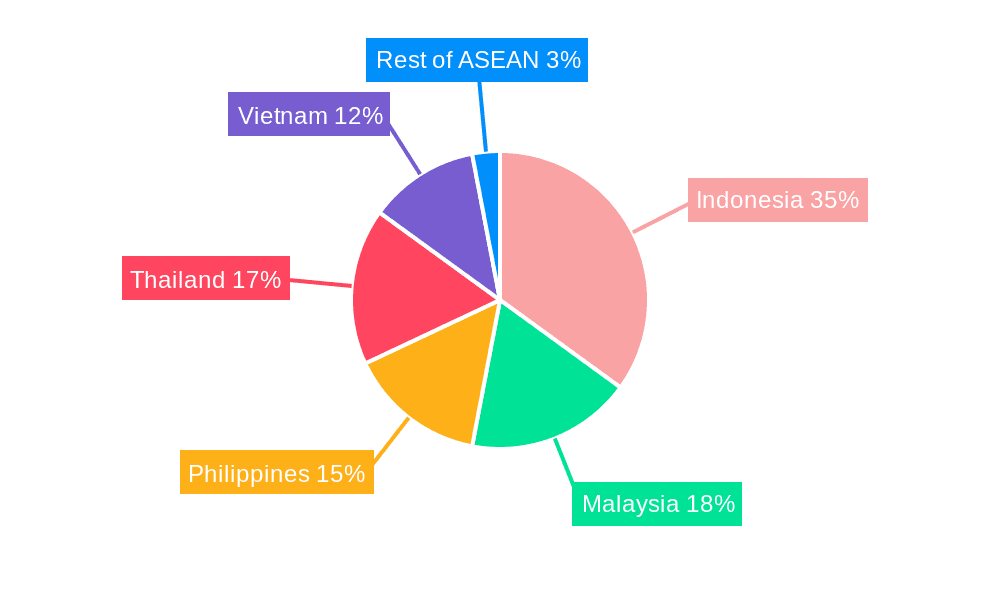

Indonesia, Vietnam, and Thailand are the dominant regions in the ASEAN domestic courier market, owing to their large populations, expanding economies, and high e-commerce penetration. The B2C segment is currently the largest, driven by the massive growth of e-commerce.

Key Drivers:

- Economic Growth: Strong GDP growth in key ASEAN countries fuels consumer spending and e-commerce adoption.

- E-commerce Expansion: The rapid growth of e-commerce is a primary driver across all segments.

- Improving Infrastructure: Investment in transportation and logistics infrastructure improves delivery efficiency.

- Government Policies: Supportive government policies promoting e-commerce and logistics development further contribute to the growth.

Dominance Analysis: Indonesia's substantial population and burgeoning e-commerce market make it a leading market. Vietnam demonstrates rapid growth due to a young and tech-savvy population. Thailand benefits from a strong existing logistics infrastructure and advanced e-commerce ecosystem.

ASEAN Domestic Courier Market Product Innovations

The ASEAN domestic courier market is a hotbed of product innovation, with a relentless focus on enhancing delivery speed, real-time tracking precision, and a wider array of delivery options. Cutting-edge technological advancements are at the forefront, including the strategic deployment of AI-powered route optimization for smarter logistics, the implementation of highly efficient automated sorting facilities, and the pioneering use of drones for last-mile delivery. These innovations are not just improving operational efficiency and significantly reducing costs, but are also empowering companies to gain a distinct competitive edge through demonstrably faster delivery timelines, superior tracking accuracy, and the expansion of service coverage. The market is also experiencing a significant shift towards the development of specialized, niche services meticulously tailored to the unique demands of burgeoning sectors like healthcare and the booming e-commerce industry, thereby accelerating the adoption of highly customized and integrated logistics solutions.

Report Scope & Segmentation Analysis

This report segments the ASEAN domestic courier market across various dimensions:

- Model: Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Consumer (C2C). B2C holds the largest share currently but B2B is expected to show stronger growth in the future.

- Country: Indonesia, Malaysia, Philippines, Thailand, Vietnam, and Rest of ASEAN. Indonesia, Vietnam, and Thailand dominate the market.

- Speed of Delivery: Express and Non-Express. Express delivery is becoming increasingly popular due to consumer preference.

- Shipment Weight: Light Weight Shipments, Medium Weight Shipments, Heavy Weight Shipments. Medium weight shipments contribute significantly.

- End User Industry: E-commerce, Financial Services (BFSI), Healthcare, Manufacturing, Primary Industry, Wholesale and Retail Trade (Offline), and Others. E-commerce currently leads, but BFSI is expected to grow steadily. Each segment presents unique opportunities and growth projections. Competitive dynamics vary considerably across each segment, driven by the specific needs and requirements of individual industries.

Key Drivers of ASEAN Domestic Courier Market Growth

The robust growth trajectory of the ASEAN domestic courier market is propelled by a confluence of powerful key drivers. At the forefront is the explosive expansion of the e-commerce sector, which acts as a primary catalyst, generating an insatiable demand for efficient, dependable, and customer-centric delivery services. Complementing this surge are transformative technological advancements, such as sophisticated real-time tracking systems that offer unparalleled visibility and highly efficient automated sorting systems that streamline operations and elevate customer satisfaction to new heights. Furthermore, the presence of supportive government policies aimed at fostering trade and logistics, coupled with the continuous improvement and expansion of logistics infrastructure across many ASEAN nations, are collectively creating a fertile ground for sustained market expansion and investment.

Challenges in the ASEAN Domestic Courier Market Sector

Despite its impressive growth, the ASEAN domestic courier market grapples with a set of formidable challenges that require strategic navigation. A significant hurdle lies in the heterogeneity of regulatory frameworks that differ substantially across individual countries, introducing considerable complexities in operational execution and legal compliance. In certain regions, persistent infrastructure limitations, such as underdeveloped road networks or insufficient warehousing facilities, can lead to operational delays and impede overall delivery efficiency. The market is also characterized by intense competition from a multitude of players, exerting considerable pressure on pricing strategies and impacting profit margins. Moreover, the inherent volatility in global fuel prices adds a substantial layer of uncertainty and contributes significantly to increased operational costs for courier companies.

Emerging Opportunities in ASEAN Domestic Courier Market

Several emerging opportunities exist in the ASEAN domestic courier market. The growth of e-commerce in less-penetrated regions presents expansion prospects. The increasing adoption of technology, such as drone delivery and AI-powered logistics solutions, creates opportunities for innovative service offerings. The rising demand for specialized services catering to specific industries, such as healthcare and cold chain logistics, opens new avenues for growth.

Leading Players in the ASEAN Domestic Courier Market Market

- JWD Group

- PT Pos Indonesia (Persero)

- CJ Logistics Corporation

- DHL Group

- J&T Express

- Thailand Post

- FedEx

- Vietnam Post Corporation (VNPost)

- United Parcel Service of America Inc (UPS)

- City-Link Express (M) Sdn Bhd

- ViettelPos

- Pos Malaysia

- SkyNet Worldwide Express

- Ninja Logistics

- SF Express (KEX-SF)

- Best Inc

Key Developments in ASEAN Domestic Courier Market Industry

- September 2023: PT Pos Indonesia (Persero) initiated construction of the East Jakarta Postal Processing Center (SPP), consolidating two existing SPPs. The project covers 5000 sq. m of land. This signifies investment in improved infrastructure and efficiency.

- August 2023: Thailand Post partnered with The Transport Company Limited (Bor Kor Sor), expanding delivery services and leveraging route expertise. This collaboration strengthens delivery networks and capacity.

- July 2023: City-Link Express was officially appointed as Shoppymore's delivery agent, expanding its reach and partnerships. This highlights the growing partnerships between e-commerce platforms and courier companies.

Future Outlook for ASEAN Domestic Courier Market Market

The ASEAN domestic courier market is poised for sustained growth, driven by ongoing e-commerce expansion, technological advancements, and supportive government policies. The market will likely see increased consolidation among players, and further adoption of technology, such as AI and automation, to enhance efficiency and customer experiences. Opportunities lie in specializing in niche markets and catering to specific industry requirements, with the potential for higher profitability and market share.

ASEAN Domestic Courier Market Segmentation

-

1. Speed Of Delivery

- 1.1. Express

- 1.2. Non-Express

-

2. Shipment Weight

- 2.1. Heavy Weight Shipments

- 2.2. Light Weight Shipments

- 2.3. Medium Weight Shipments

-

3. End User Industry

- 3.1. E-Commerce

- 3.2. Financial Services (BFSI)

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Primary Industry

- 3.6. Wholesale and Retail Trade (Offline)

- 3.7. Others

-

4. Model

- 4.1. Business-to-Business (B2B)

- 4.2. Business-to-Consumer (B2C)

- 4.3. Consumer-to-Consumer (C2C)

ASEAN Domestic Courier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Domestic Courier Market Regional Market Share

Geographic Coverage of ASEAN Domestic Courier Market

ASEAN Domestic Courier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.1.1. Express

- 5.1.2. Non-Express

- 5.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.2.1. Heavy Weight Shipments

- 5.2.2. Light Weight Shipments

- 5.2.3. Medium Weight Shipments

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. E-Commerce

- 5.3.2. Financial Services (BFSI)

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Primary Industry

- 5.3.6. Wholesale and Retail Trade (Offline)

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Model

- 5.4.1. Business-to-Business (B2B)

- 5.4.2. Business-to-Consumer (B2C)

- 5.4.3. Consumer-to-Consumer (C2C)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6. North America ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.1.1. Express

- 6.1.2. Non-Express

- 6.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.2.1. Heavy Weight Shipments

- 6.2.2. Light Weight Shipments

- 6.2.3. Medium Weight Shipments

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. E-Commerce

- 6.3.2. Financial Services (BFSI)

- 6.3.3. Healthcare

- 6.3.4. Manufacturing

- 6.3.5. Primary Industry

- 6.3.6. Wholesale and Retail Trade (Offline)

- 6.3.7. Others

- 6.4. Market Analysis, Insights and Forecast - by Model

- 6.4.1. Business-to-Business (B2B)

- 6.4.2. Business-to-Consumer (B2C)

- 6.4.3. Consumer-to-Consumer (C2C)

- 6.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7. South America ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.1.1. Express

- 7.1.2. Non-Express

- 7.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.2.1. Heavy Weight Shipments

- 7.2.2. Light Weight Shipments

- 7.2.3. Medium Weight Shipments

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. E-Commerce

- 7.3.2. Financial Services (BFSI)

- 7.3.3. Healthcare

- 7.3.4. Manufacturing

- 7.3.5. Primary Industry

- 7.3.6. Wholesale and Retail Trade (Offline)

- 7.3.7. Others

- 7.4. Market Analysis, Insights and Forecast - by Model

- 7.4.1. Business-to-Business (B2B)

- 7.4.2. Business-to-Consumer (B2C)

- 7.4.3. Consumer-to-Consumer (C2C)

- 7.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8. Europe ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.1.1. Express

- 8.1.2. Non-Express

- 8.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.2.1. Heavy Weight Shipments

- 8.2.2. Light Weight Shipments

- 8.2.3. Medium Weight Shipments

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. E-Commerce

- 8.3.2. Financial Services (BFSI)

- 8.3.3. Healthcare

- 8.3.4. Manufacturing

- 8.3.5. Primary Industry

- 8.3.6. Wholesale and Retail Trade (Offline)

- 8.3.7. Others

- 8.4. Market Analysis, Insights and Forecast - by Model

- 8.4.1. Business-to-Business (B2B)

- 8.4.2. Business-to-Consumer (B2C)

- 8.4.3. Consumer-to-Consumer (C2C)

- 8.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9. Middle East & Africa ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.1.1. Express

- 9.1.2. Non-Express

- 9.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.2.1. Heavy Weight Shipments

- 9.2.2. Light Weight Shipments

- 9.2.3. Medium Weight Shipments

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. E-Commerce

- 9.3.2. Financial Services (BFSI)

- 9.3.3. Healthcare

- 9.3.4. Manufacturing

- 9.3.5. Primary Industry

- 9.3.6. Wholesale and Retail Trade (Offline)

- 9.3.7. Others

- 9.4. Market Analysis, Insights and Forecast - by Model

- 9.4.1. Business-to-Business (B2B)

- 9.4.2. Business-to-Consumer (B2C)

- 9.4.3. Consumer-to-Consumer (C2C)

- 9.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10. Asia Pacific ASEAN Domestic Courier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.1.1. Express

- 10.1.2. Non-Express

- 10.2. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.2.1. Heavy Weight Shipments

- 10.2.2. Light Weight Shipments

- 10.2.3. Medium Weight Shipments

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. E-Commerce

- 10.3.2. Financial Services (BFSI)

- 10.3.3. Healthcare

- 10.3.4. Manufacturing

- 10.3.5. Primary Industry

- 10.3.6. Wholesale and Retail Trade (Offline)

- 10.3.7. Others

- 10.4. Market Analysis, Insights and Forecast - by Model

- 10.4.1. Business-to-Business (B2B)

- 10.4.2. Business-to-Consumer (B2C)

- 10.4.3. Consumer-to-Consumer (C2C)

- 10.1. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JWD Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Pos Indonesia (Persero)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CJ Logistics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 J&T Express

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thailand Post

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vietnam Post Corporation (VNPost)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United Parcel Service of America Inc (UPS)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 City-Link Express (M) Sdn Bhd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ViettelPos

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pos Malaysia

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SkyNet Worldwide Express

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ninja Logistics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SF Express (KEX-SF)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Best Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 JWD Group

List of Figures

- Figure 1: Global ASEAN Domestic Courier Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Domestic Courier Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 3: North America ASEAN Domestic Courier Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 4: North America ASEAN Domestic Courier Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 5: North America ASEAN Domestic Courier Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 6: North America ASEAN Domestic Courier Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 7: North America ASEAN Domestic Courier Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: North America ASEAN Domestic Courier Market Revenue (billion), by Model 2025 & 2033

- Figure 9: North America ASEAN Domestic Courier Market Revenue Share (%), by Model 2025 & 2033

- Figure 10: North America ASEAN Domestic Courier Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America ASEAN Domestic Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America ASEAN Domestic Courier Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 13: South America ASEAN Domestic Courier Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 14: South America ASEAN Domestic Courier Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 15: South America ASEAN Domestic Courier Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 16: South America ASEAN Domestic Courier Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 17: South America ASEAN Domestic Courier Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: South America ASEAN Domestic Courier Market Revenue (billion), by Model 2025 & 2033

- Figure 19: South America ASEAN Domestic Courier Market Revenue Share (%), by Model 2025 & 2033

- Figure 20: South America ASEAN Domestic Courier Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America ASEAN Domestic Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe ASEAN Domestic Courier Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 23: Europe ASEAN Domestic Courier Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 24: Europe ASEAN Domestic Courier Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 25: Europe ASEAN Domestic Courier Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 26: Europe ASEAN Domestic Courier Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: Europe ASEAN Domestic Courier Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Europe ASEAN Domestic Courier Market Revenue (billion), by Model 2025 & 2033

- Figure 29: Europe ASEAN Domestic Courier Market Revenue Share (%), by Model 2025 & 2033

- Figure 30: Europe ASEAN Domestic Courier Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe ASEAN Domestic Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa ASEAN Domestic Courier Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 33: Middle East & Africa ASEAN Domestic Courier Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 34: Middle East & Africa ASEAN Domestic Courier Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 35: Middle East & Africa ASEAN Domestic Courier Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 36: Middle East & Africa ASEAN Domestic Courier Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 37: Middle East & Africa ASEAN Domestic Courier Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 38: Middle East & Africa ASEAN Domestic Courier Market Revenue (billion), by Model 2025 & 2033

- Figure 39: Middle East & Africa ASEAN Domestic Courier Market Revenue Share (%), by Model 2025 & 2033

- Figure 40: Middle East & Africa ASEAN Domestic Courier Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa ASEAN Domestic Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific ASEAN Domestic Courier Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 43: Asia Pacific ASEAN Domestic Courier Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 44: Asia Pacific ASEAN Domestic Courier Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 45: Asia Pacific ASEAN Domestic Courier Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 46: Asia Pacific ASEAN Domestic Courier Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 47: Asia Pacific ASEAN Domestic Courier Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 48: Asia Pacific ASEAN Domestic Courier Market Revenue (billion), by Model 2025 & 2033

- Figure 49: Asia Pacific ASEAN Domestic Courier Market Revenue Share (%), by Model 2025 & 2033

- Figure 50: Asia Pacific ASEAN Domestic Courier Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific ASEAN Domestic Courier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 2: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 3: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 5: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 7: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 8: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 9: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 10: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 15: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 16: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 17: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 18: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 23: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 24: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 25: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 26: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 37: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 38: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 39: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 40: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 48: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 49: Global ASEAN Domestic Courier Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 50: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Model 2020 & 2033

- Table 51: Global ASEAN Domestic Courier Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific ASEAN Domestic Courier Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Domestic Courier Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the ASEAN Domestic Courier Market?

Key companies in the market include JWD Group, PT Pos Indonesia (Persero), CJ Logistics Corporation, DHL Group, J&T Express, Thailand Post, FedEx, Vietnam Post Corporation (VNPost), United Parcel Service of America Inc (UPS), City-Link Express (M) Sdn Bhd, ViettelPos, Pos Malaysia, SkyNet Worldwide Express, Ninja Logistics, SF Express (KEX-SF), Best Inc.

3. What are the main segments of the ASEAN Domestic Courier Market?

The market segments include Speed Of Delivery, Shipment Weight, End User Industry, Model.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

September 2023: PT Pos Indonesia (Persero) started the construction of the East Jakarta Postal Processing Center (SPP) project. The main objective of this development is to consolidate the existing two SPPs throughout Jakarta. The East Jakarta SPP office has a land area of 5000 sq. m on a site of 7553 sq. m.August 2023: Thailand Post Company Limited partnered with The Transport Company Limited (Bor Kor Sor) to provide delivery and parcel delivery services. The amount of consignment and delivery continued to increase steadily due to expertise in routes, vehicles, technology, and information, including service points.July 2023: On January 7, 2023, Shoppymore held a formal event to officiate City-Link Express as the platform’s delivery agent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Domestic Courier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Domestic Courier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Domestic Courier Market?

To stay informed about further developments, trends, and reports in the ASEAN Domestic Courier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence