Key Insights

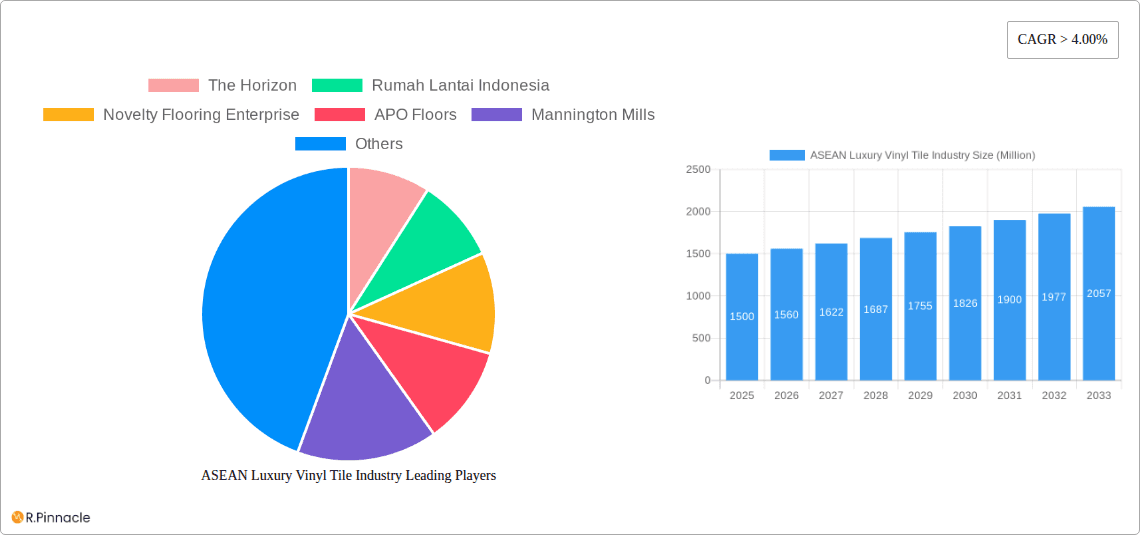

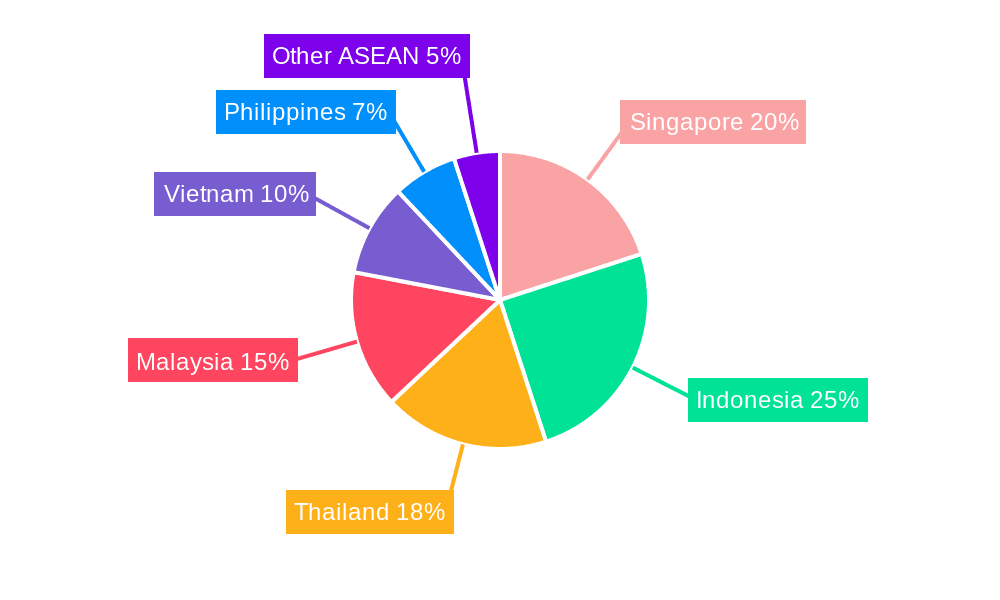

The ASEAN Luxury Vinyl Tile (LVT) market is poised for significant expansion, propelled by rising disposable incomes, a growing demand for durable and aesthetically pleasing flooring, and a robust construction sector. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.7%. Key growth drivers include the residential sector, influenced by urbanization and LVT's superior water resistance and ease of maintenance. Commercial applications are also expanding across hospitality, retail, and office spaces, leveraging LVT's cost-effectiveness and versatility. The increasing adoption of online sales channels enhances accessibility and product choice, further fueling market growth. While competition from established players such as The Horizon and Rumah Lantai Indonesia, alongside international brands like Mannington Mills and Polyflor, is considerable, the market's substantial size and promising growth present significant opportunities for both existing and new entrants. Notable market hubs include Singapore, Indonesia, and Thailand, driven by their economic strength and infrastructure development. Challenges such as fluctuating raw material prices and the need for optimized supply chain management are being addressed to meet escalating demand.

ASEAN Luxury Vinyl Tile Industry Market Size (In Billion)

The ASEAN LVT market's future outlook is highly positive, with sustained growth anticipated throughout the forecast period. Innovations in sustainable and advanced LVT products are expected to stimulate demand. Companies focusing on eco-friendly manufacturing and customized design solutions will gain a competitive edge. Government initiatives supporting sustainable construction and infrastructure development also contribute positively. Strategic market segmentation by product type (rigid vs. flexible) and distribution channels (online vs. offline) allows for targeted marketing and product development, optimizing reach and profitability. Continuous adaptation to evolving consumer preferences and design trends will be paramount for sustained success in this dynamic market.

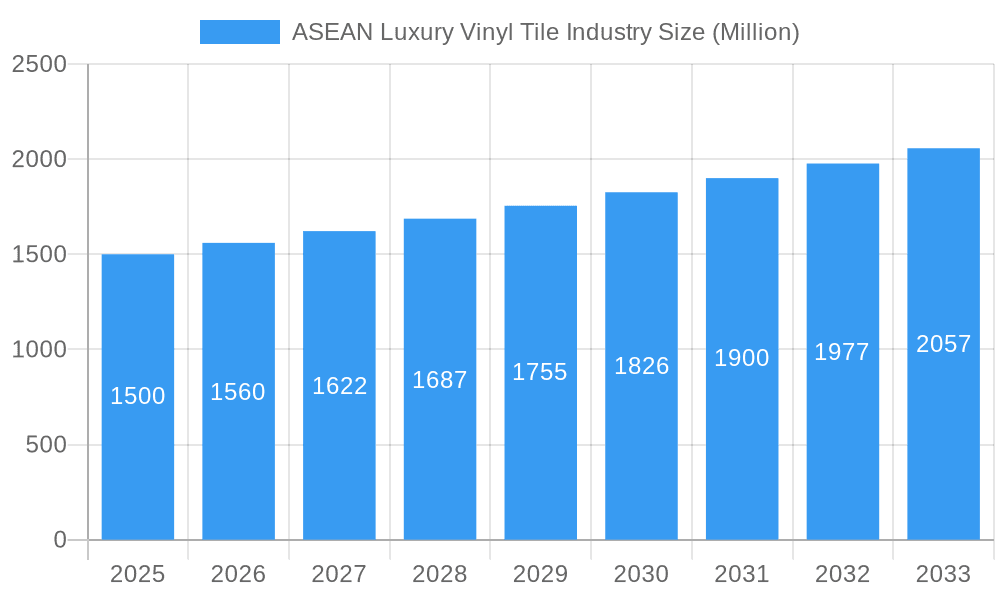

ASEAN Luxury Vinyl Tile Industry Company Market Share

This comprehensive report offers an in-depth analysis of the ASEAN Luxury Vinyl Tile (LVT) industry, providing essential insights for industry professionals, investors, and stakeholders. The analysis spans from 2019 to 2033, with 2025 serving as the base year. The market was valued at 3298 million in the base year, with projections indicating substantial growth by 2033.

ASEAN Luxury Vinyl Tile Industry Market Structure & Innovation Trends

This section analyzes the ASEAN LVT market's competitive landscape, innovation drivers, and regulatory environment. We examine market concentration, identifying key players like The Horizon, Rumah Lantai Indonesia, Novelty Flooring Enterprise, APO Floors, Mannington Mills, Power Décor, Hanyo, Polyflor, and Inovar (list not exhaustive). Market share data for these companies will be provided, along with an assessment of M&A activities within the industry, including deal values (xx Million). The report also explores innovation drivers such as technological advancements in LVT manufacturing, shifting consumer preferences towards sustainable and durable flooring, and evolving design trends influencing product development. Regulatory frameworks and their impact, along with the analysis of product substitutes and their market penetration, will be examined, alongside a detailed demographic analysis of the end-users in the residential, commercial, and other sectors.

ASEAN Luxury Vinyl Tile Industry Market Dynamics & Trends

This section delves into the key dynamics shaping the ASEAN LVT market, examining growth drivers (e.g., rising disposable incomes, increasing urbanization, construction boom), technological disruptions (e.g., advancements in material science, automation in manufacturing), evolving consumer preferences (e.g., preference for water-resistant and easy-to-maintain flooring), and competitive dynamics. The report will provide a detailed analysis of the Compound Annual Growth Rate (CAGR) for the forecast period and project market penetration rates for different LVT segments across the ASEAN region. The influence of economic factors like fluctuating raw material prices, changes in consumer spending patterns, and government policies will be discussed.

Dominant Regions & Segments in ASEAN Luxury Vinyl Tile Industry

This section pinpoints the leading regions and segments within the ASEAN LVT market. We analyze dominance across distribution channels (Manufacturer Owned Stores, Specialty Stores, Online Stores, Other Distribution Channels), product types (Rigid, Flexible), and end-users (Residential, Commercial).

Key Drivers of Segment Dominance:

- Economic Policies: Impact of government incentives and investment in infrastructure on market growth.

- Infrastructure Development: Correlation between construction activity and LVT demand.

- Consumer Preferences: Trends driving demand for specific product types and distribution channels in each region.

The dominance analysis will provide a detailed explanation for the leading segment, considering factors like market size, growth rate, and competitive intensity within each segment.

ASEAN Luxury Vinyl Tile Industry Product Innovations

This section highlights recent product innovations in the ASEAN LVT market, emphasizing technological advancements and their impact on market competitiveness. This includes advancements in material composition, surface textures, and design aesthetics, focusing on improvements in durability, water resistance, and ease of installation, which cater to specific consumer needs and preferences, contributing to the overall market growth.

Report Scope & Segmentation Analysis

This report segments the ASEAN LVT market by distribution channel (Manufacturer Owned Stores, Specialty Stores, Online Stores, Other Distribution Channels), product type (Rigid, Flexible), and end-user (Residential, Commercial). Each segment's growth projections, market size estimations (in Millions), and competitive dynamics are detailed, providing a clear picture of the market landscape.

Key Drivers of ASEAN Luxury Vinyl Tile Industry Growth

Key growth drivers include technological advancements leading to improved product features, increasing construction activity fueled by economic growth, supportive government policies promoting sustainable building materials, and rising consumer disposable incomes driving demand for premium flooring solutions.

Challenges in the ASEAN Luxury Vinyl Tile Industry Sector

Challenges include fluctuations in raw material prices impacting production costs, potential supply chain disruptions affecting product availability, intense competition from other flooring materials, and varying regulatory landscapes across different ASEAN countries creating operational complexities. These challenges represent quantifiable risks and are expected to impact the market growth trajectory.

Emerging Opportunities in ASEAN Luxury Vinyl Tile Industry

Emerging opportunities encompass the growing adoption of sustainable and eco-friendly LVT products, expansion into new markets within the ASEAN region, development of innovative product designs catering to specific niche preferences, and leveraging e-commerce platforms to enhance distribution reach and brand awareness.

Leading Players in the ASEAN Luxury Vinyl Tile Industry Market

- The Horizon

- Rumah Lantai Indonesia

- Novelty Flooring Enterprise

- APO Floors

- Mannington Mills

- Power Décor

- Hanyo

- Polyflor

- Inovar

Key Developments in ASEAN Luxury Vinyl Tile Industry Industry

- November 2020: Polyflor contributed to a unique surf center for those with disabilities, showcasing the versatility and adaptability of LVT in specialized applications.

- 2018: Puyat Flooring Products Inc. (APO Floors) introduced innovative ancillary product lines ('APO Power Primer' and 'APO Power Self Leveling Compound (SLC)'), expanding its product portfolio and strengthening its market position.

Future Outlook for ASEAN Luxury Vinyl Tile Industry Market

The ASEAN LVT market is poised for continued growth, driven by robust construction activity, increasing urbanization, rising consumer spending, and ongoing product innovation. Strategic opportunities lie in focusing on sustainable product development, enhancing distribution networks, and tailoring products to meet specific regional preferences. This favorable outlook points towards sustained growth and market expansion in the coming years.

ASEAN Luxury Vinyl Tile Industry Segmentation

-

1. Product Type

- 1.1. Rigid

- 1.2. Flexible

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Manufacturer Owned Stores

- 3.2. Speciality Stores

- 3.3. Online Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Indonesia

- 4.2. Malaysia

- 4.3. Philippines

- 4.4. Singapore

- 4.5. Thailand

- 4.6. Vietnam

- 4.7. Other Countries

ASEAN Luxury Vinyl Tile Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Philippines

- 4. Singapore

- 5. Thailand

- 6. Vietnam

- 7. Other Countries

ASEAN Luxury Vinyl Tile Industry Regional Market Share

Geographic Coverage of ASEAN Luxury Vinyl Tile Industry

ASEAN Luxury Vinyl Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Domestic and Commercial Construction in the Market; Increase in Sales of Laminated Flooring Through Online Channels

- 3.3. Market Restrains

- 3.3.1. Major Share of Market is Concentrated in Urban Centres; Nascent Production Capacity of Domestic Manufaturers

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of LVT in the ASEAN Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.2. Flexible

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Manufacturer Owned Stores

- 5.3.2. Speciality Stores

- 5.3.3. Online Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Indonesia

- 5.4.2. Malaysia

- 5.4.3. Philippines

- 5.4.4. Singapore

- 5.4.5. Thailand

- 5.4.6. Vietnam

- 5.4.7. Other Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.5.2. Malaysia

- 5.5.3. Philippines

- 5.5.4. Singapore

- 5.5.5. Thailand

- 5.5.6. Vietnam

- 5.5.7. Other Countries

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Indonesia ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rigid

- 6.1.2. Flexible

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Manufacturer Owned Stores

- 6.3.2. Speciality Stores

- 6.3.3. Online Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Indonesia

- 6.4.2. Malaysia

- 6.4.3. Philippines

- 6.4.4. Singapore

- 6.4.5. Thailand

- 6.4.6. Vietnam

- 6.4.7. Other Countries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Malaysia ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rigid

- 7.1.2. Flexible

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Manufacturer Owned Stores

- 7.3.2. Speciality Stores

- 7.3.3. Online Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Indonesia

- 7.4.2. Malaysia

- 7.4.3. Philippines

- 7.4.4. Singapore

- 7.4.5. Thailand

- 7.4.6. Vietnam

- 7.4.7. Other Countries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Philippines ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rigid

- 8.1.2. Flexible

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Manufacturer Owned Stores

- 8.3.2. Speciality Stores

- 8.3.3. Online Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Indonesia

- 8.4.2. Malaysia

- 8.4.3. Philippines

- 8.4.4. Singapore

- 8.4.5. Thailand

- 8.4.6. Vietnam

- 8.4.7. Other Countries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Singapore ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rigid

- 9.1.2. Flexible

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Manufacturer Owned Stores

- 9.3.2. Speciality Stores

- 9.3.3. Online Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Indonesia

- 9.4.2. Malaysia

- 9.4.3. Philippines

- 9.4.4. Singapore

- 9.4.5. Thailand

- 9.4.6. Vietnam

- 9.4.7. Other Countries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Thailand ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rigid

- 10.1.2. Flexible

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Manufacturer Owned Stores

- 10.3.2. Speciality Stores

- 10.3.3. Online Stores

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Indonesia

- 10.4.2. Malaysia

- 10.4.3. Philippines

- 10.4.4. Singapore

- 10.4.5. Thailand

- 10.4.6. Vietnam

- 10.4.7. Other Countries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Vietnam ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Rigid

- 11.1.2. Flexible

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Manufacturer Owned Stores

- 11.3.2. Speciality Stores

- 11.3.3. Online Stores

- 11.3.4. Other Distribution Channels

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Indonesia

- 11.4.2. Malaysia

- 11.4.3. Philippines

- 11.4.4. Singapore

- 11.4.5. Thailand

- 11.4.6. Vietnam

- 11.4.7. Other Countries

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Other Countries ASEAN Luxury Vinyl Tile Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Rigid

- 12.1.2. Flexible

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Manufacturer Owned Stores

- 12.3.2. Speciality Stores

- 12.3.3. Online Stores

- 12.3.4. Other Distribution Channels

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. Indonesia

- 12.4.2. Malaysia

- 12.4.3. Philippines

- 12.4.4. Singapore

- 12.4.5. Thailand

- 12.4.6. Vietnam

- 12.4.7. Other Countries

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Horizon

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Rumah Lantai Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Novelty Flooring Enterprise

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 APO Floors

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mannington Mills

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Power Décor*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hanyo

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Polyflor

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Inovar

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Horizon

List of Figures

- Figure 1: Global ASEAN Luxury Vinyl Tile Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 3: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 5: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 9: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 11: Indonesia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 13: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 15: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 17: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 19: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Malaysia ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 23: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 25: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 27: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 29: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Philippines ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Philippines ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 33: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 35: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 39: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Singapore ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 43: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 45: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 47: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 49: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Thailand ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 51: Thailand ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 53: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 55: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 56: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 57: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 59: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 61: Vietnam ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Product Type 2025 & 2033

- Figure 63: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 64: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by End User 2025 & 2033

- Figure 65: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by End User 2025 & 2033

- Figure 66: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Distribution Channel 2025 & 2033

- Figure 67: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 68: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Geography 2025 & 2033

- Figure 69: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue (million), by Country 2025 & 2033

- Figure 71: Other Countries ASEAN Luxury Vinyl Tile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 5: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 8: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 13: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 15: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 17: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 23: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 25: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 27: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 28: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 33: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 35: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 37: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by End User 2020 & 2033

- Table 38: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 40: Global ASEAN Luxury Vinyl Tile Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Luxury Vinyl Tile Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the ASEAN Luxury Vinyl Tile Industry?

Key companies in the market include The Horizon, Rumah Lantai Indonesia, Novelty Flooring Enterprise, APO Floors, Mannington Mills, Power Décor*List Not Exhaustive, Hanyo, Polyflor, Inovar.

3. What are the main segments of the ASEAN Luxury Vinyl Tile Industry?

The market segments include Product Type, End User , Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3298 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Domestic and Commercial Construction in the Market; Increase in Sales of Laminated Flooring Through Online Channels.

6. What are the notable trends driving market growth?

Increasing Consumption of LVT in the ASEAN Region.

7. Are there any restraints impacting market growth?

Major Share of Market is Concentrated in Urban Centres; Nascent Production Capacity of Domestic Manufaturers.

8. Can you provide examples of recent developments in the market?

In November 2020, Polyflor contributed to a unique surf center for those with disabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Luxury Vinyl Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Luxury Vinyl Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Luxury Vinyl Tile Industry?

To stay informed about further developments, trends, and reports in the ASEAN Luxury Vinyl Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence