Key Insights

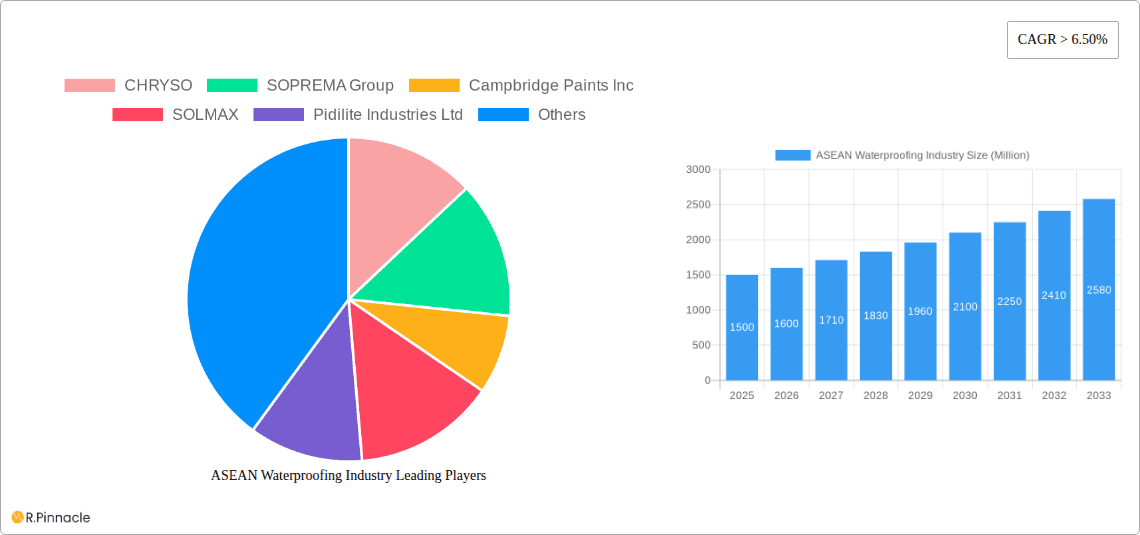

ASEAN Waterproofing Industry Market Size (In Million)

ASEAN Waterproofing Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the ASEAN waterproofing industry, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, and future trends. The ASEAN waterproofing market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a robust CAGR.

ASEAN Waterproofing Industry Market Structure & Innovation Trends

The ASEAN waterproofing market exhibits a moderately fragmented structure with several major players and numerous smaller regional companies. Key players include CHRYSO, SOPREMA Group, Campbridge Paints Inc, SOLMAX, Pidilite Industries Ltd, BASF SE, Xypex Chemical Corporation, Dow, SWC Construction, Fosroc Inc, MAPEI S.p.A, Sika AG, Minerals Technologies Inc, Bostik, and Saint-Gobain Weber. However, the market share held by each player varies significantly. Innovation is driven by the need for sustainable, high-performance, and cost-effective waterproofing solutions, particularly in response to increasingly stringent building codes and the growing demand for environmentally friendly materials. Regulatory frameworks, such as those focused on energy efficiency and building safety, significantly influence product development. The increasing prevalence of extreme weather events is also a major driver of innovation, prompting the development of more resilient waterproofing materials. Substitutes include traditional methods like tar and felt but are being increasingly displaced by advanced technologies. M&A activity is moderate, with deal values averaging xx Million in recent years.

- Market Concentration: Moderately fragmented.

- Innovation Drivers: Sustainable materials, high performance, cost-effectiveness, stringent building codes, extreme weather events.

- Regulatory Frameworks: Influence material selection and performance standards.

- Product Substitutes: Traditional methods (tar, felt), being replaced by newer technologies.

- M&A Activity: Moderate, with average deal values of xx Million.

ASEAN Waterproofing Industry Market Dynamics & Trends

The ASEAN waterproofing market is experiencing significant growth fueled by rapid urbanization, rising infrastructure development, and a surge in construction activities across both residential and commercial sectors. The increasing awareness of building durability and the escalating demand for energy-efficient buildings are key market growth drivers. Technological advancements, such as the introduction of self-healing membranes and smart waterproofing systems, are disrupting the traditional market landscape. Consumer preferences are shifting towards eco-friendly, durable, and easy-to-install solutions. Competitive dynamics are characterized by both price competition and product differentiation, with leading players focusing on innovation and brand building. The market penetration of advanced waterproofing technologies remains relatively low, presenting significant growth potential.

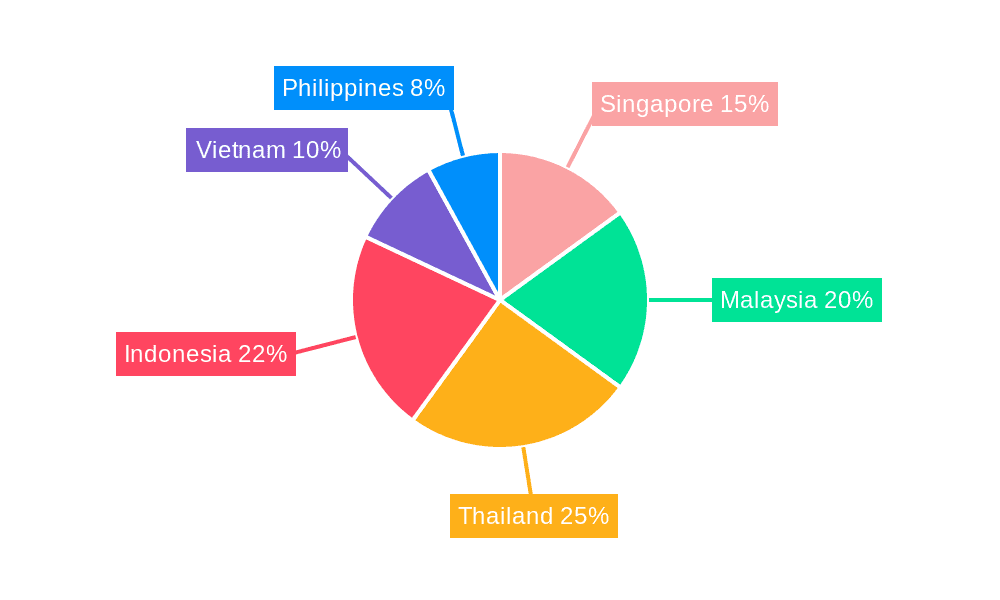

Dominant Regions & Segments in ASEAN Waterproofing Industry

The ASEAN waterproofing market is experiencing significant growth across several regions, with [Specific Country/Region, e.g., Singapore or Vietnam] emerging as a leading market. This is primarily driven by robust economic growth, substantial infrastructure development projects (e.g., high-speed rail networks, airport expansions, and urban redevelopment), and favorable government policies promoting sustainable construction practices.

- Leading Region/Country: [Specific Country/Region, e.g., Singapore or Vietnam].

- Key Drivers:

- Robust economic growth

- Extensive infrastructure development

- Supportive government policies

- Growing construction activity

Within the market segmentation, the following segments demonstrate strong growth:

- Type: Liquid-applied waterproofing membranes are leading due to their adaptability and ease of application, followed by cementitious waterproofing coatings due to their cost-effectiveness.

- Application: Commercial construction projects and infrastructure projects are showing strong growth due to large-scale developments.

- End-User: Contractors remain the largest end-user segment, driven by the expansion of the construction industry.

ASEAN Waterproofing Industry Product Innovations

Recent innovations in the ASEAN waterproofing industry include the development of self-healing membranes that automatically repair minor damage, enhancing product durability and lifespan. Smart waterproofing systems incorporating sensors and data analytics are emerging, providing real-time monitoring of waterproofing system performance and enabling predictive maintenance. These innovations address the challenges of material degradation and water ingress, improving building performance and reducing lifecycle costs. The market is witnessing a growing adoption of eco-friendly waterproofing materials made from recycled or renewable resources, aligning with the increasing emphasis on sustainability in the construction sector.

Report Scope & Segmentation Analysis

This report segments the ASEAN waterproofing market by type (Liquid-applied waterproofing membranes, cementitious waterproofing coatings, sheet membranes, bitumen-based waterproofing, and others), application (Residential construction, commercial construction, infrastructure, industrial, and others), and end-user (Contractors, architects, engineers, builders, and homeowners). Each segment displays unique growth trajectories and competitive dynamics, reflecting specific market needs and technological advancements. Growth projections indicate strong expansion in all segments, with particular momentum in liquid-applied membranes and infrastructure applications. Market sizes for each segment are detailed within the full report, showcasing the substantial overall market opportunity.

Key Drivers of ASEAN Waterproofing Industry Growth

Several factors fuel the growth of the ASEAN waterproofing industry. Firstly, rapid urbanization and population growth are driving increased construction activity, boosting demand for waterproofing solutions. Secondly, governments are investing heavily in infrastructure development, creating opportunities for waterproofing contractors. Thirdly, technological advancements, such as the development of sustainable and high-performance waterproofing materials, are creating new market opportunities. Finally, increasing awareness of building durability and the need for protection against extreme weather conditions are stimulating the demand for sophisticated waterproofing solutions.

Challenges in the ASEAN Waterproofing Industry Sector

The ASEAN waterproofing industry faces several challenges. Supply chain disruptions caused by global events can lead to material shortages and price volatility, impacting project timelines and profitability. The high cost of advanced waterproofing materials can limit adoption in certain markets, particularly in budget-conscious projects. Furthermore, the lack of standardized testing and certification procedures for waterproofing materials can create inconsistencies in product quality and performance. Finally, intense competition among manufacturers necessitates continuous innovation and cost optimization.

Emerging Opportunities in ASEAN Waterproofing Industry

The ASEAN waterproofing industry presents significant emerging opportunities. The growing adoption of green building practices creates a demand for environmentally friendly waterproofing solutions. Government initiatives promoting sustainable construction further stimulate this trend. Furthermore, the development of innovative waterproofing technologies, such as self-healing membranes and smart waterproofing systems, presents growth potential. Finally, expanding into the rural construction sector, which has historically relied on less advanced techniques, holds promise for significant market penetration.

Leading Players in the ASEAN Waterproofing Industry Market

- CHRYSO

- SOPREMA Group

- Campbridge Paints Inc

- SOLMAX

- Pidilite Industries Ltd

- BASF SE

- Xypex Chemical Corporation

- Dow

- SWC Construction

- Fosroc Inc

- MAPEI S.p.A

- Sika AG

- Minerals Technologies Inc

- Bostik

- Saint-Gobain Weber

Key Developments in ASEAN Waterproofing Industry

- July 2022: Sika AG partnered with All Weather Insulated Panels, launching a product combining Sika AG's PVC roof membrane and AWIP's Dekinsulated roof panel.

- May 2022: Sika AG launched SarnafilAT, a hybrid roofing membrane with Cradle to Grave Certification.

Future Outlook for ASEAN Waterproofing Industry Market

The future outlook for the ASEAN waterproofing industry is positive, driven by sustained economic growth, infrastructure development, and increasing demand for durable and sustainable building materials. The adoption of advanced waterproofing technologies and eco-friendly materials is expected to accelerate, creating new market opportunities. The industry will likely see increased consolidation through mergers and acquisitions, leading to greater market concentration. Strategic partnerships between waterproofing manufacturers and construction companies will also play a vital role in driving market growth.

ASEAN Waterproofing Industry Segmentation

-

1. Geography

- 1.1. Malaysia

- 1.2. Indonesia

- 1.3. Thailand

- 1.4. Singapore

- 1.5. Philippines

- 1.6. Vietnam

- 1.7. Myanmar

ASEAN Waterproofing Industry Segmentation By Geography

- 1. Malaysia

- 2. Indonesia

- 3. Thailand

- 4. Singapore

- 5. Philippines

- 6. Vietnam

- 7. Myanmar

ASEAN Waterproofing Industry Regional Market Share

Geographic Coverage of ASEAN Waterproofing Industry

ASEAN Waterproofing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Investments on Construction Projects

- 3.3. Market Restrains

- 3.3.1. Geopolitical Concerns and Volatility of Trade

- 3.4. Market Trends

- 3.4.1. Traffic Systems/Topcoats to Boost the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Malaysia

- 5.1.2. Indonesia

- 5.1.3. Thailand

- 5.1.4. Singapore

- 5.1.5. Philippines

- 5.1.6. Vietnam

- 5.1.7. Myanmar

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malaysia

- 5.2.2. Indonesia

- 5.2.3. Thailand

- 5.2.4. Singapore

- 5.2.5. Philippines

- 5.2.6. Vietnam

- 5.2.7. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Malaysia ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Malaysia

- 6.1.2. Indonesia

- 6.1.3. Thailand

- 6.1.4. Singapore

- 6.1.5. Philippines

- 6.1.6. Vietnam

- 6.1.7. Myanmar

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Indonesia ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Malaysia

- 7.1.2. Indonesia

- 7.1.3. Thailand

- 7.1.4. Singapore

- 7.1.5. Philippines

- 7.1.6. Vietnam

- 7.1.7. Myanmar

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Thailand ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Malaysia

- 8.1.2. Indonesia

- 8.1.3. Thailand

- 8.1.4. Singapore

- 8.1.5. Philippines

- 8.1.6. Vietnam

- 8.1.7. Myanmar

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Singapore ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Malaysia

- 9.1.2. Indonesia

- 9.1.3. Thailand

- 9.1.4. Singapore

- 9.1.5. Philippines

- 9.1.6. Vietnam

- 9.1.7. Myanmar

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Philippines ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Malaysia

- 10.1.2. Indonesia

- 10.1.3. Thailand

- 10.1.4. Singapore

- 10.1.5. Philippines

- 10.1.6. Vietnam

- 10.1.7. Myanmar

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Vietnam ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Malaysia

- 11.1.2. Indonesia

- 11.1.3. Thailand

- 11.1.4. Singapore

- 11.1.5. Philippines

- 11.1.6. Vietnam

- 11.1.7. Myanmar

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Myanmar ASEAN Waterproofing Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Malaysia

- 12.1.2. Indonesia

- 12.1.3. Thailand

- 12.1.4. Singapore

- 12.1.5. Philippines

- 12.1.6. Vietnam

- 12.1.7. Myanmar

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 CHRYSO

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SOPREMA Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Campbridge Paints Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SOLMAX

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Pidilite Industries Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BASF SE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Xypex Chemical Corporation*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dow

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SWC Construction

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Fosroc Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MAPEI S p A

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Sika AG

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Minerals Technologies Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Bostik

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Saint-Gobain Weber

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 CHRYSO

List of Figures

- Figure 1: ASEAN Waterproofing Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: ASEAN Waterproofing Industry Share (%) by Company 2025

List of Tables

- Table 1: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 2: ASEAN Waterproofing Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 4: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 8: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 10: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 14: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: ASEAN Waterproofing Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 16: ASEAN Waterproofing Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Waterproofing Industry?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the ASEAN Waterproofing Industry?

Key companies in the market include CHRYSO, SOPREMA Group, Campbridge Paints Inc, SOLMAX, Pidilite Industries Ltd, BASF SE, Xypex Chemical Corporation*List Not Exhaustive, Dow, SWC Construction, Fosroc Inc, MAPEI S p A, Sika AG, Minerals Technologies Inc, Bostik, Saint-Gobain Weber.

3. What are the main segments of the ASEAN Waterproofing Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 514.86 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Investments on Construction Projects.

6. What are the notable trends driving market growth?

Traffic Systems/Topcoats to Boost the Market Demand.

7. Are there any restraints impacting market growth?

Geopolitical Concerns and Volatility of Trade.

8. Can you provide examples of recent developments in the market?

July 2022: Sika AG expanded its product portfolio as it partnered with insulation expert manufacturer All Weather Insulated Panels and launched a product that will contain PVC roof membrane of Sika AG and AWIP Dekinsulated roof panel of AWIP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Waterproofing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Waterproofing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Waterproofing Industry?

To stay informed about further developments, trends, and reports in the ASEAN Waterproofing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence