Key Insights

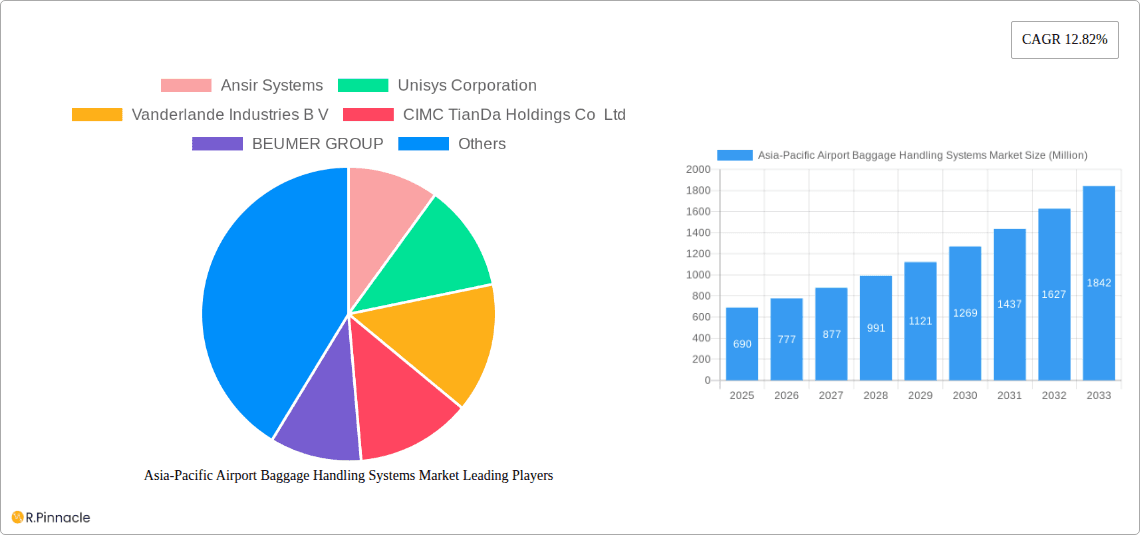

The Asia-Pacific Airport Baggage Handling Systems market, valued at $0.69 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.82% from 2025 to 2033. This expansion is driven by several factors. Increased air passenger traffic across the region, particularly in rapidly developing economies like China and India, fuels the demand for efficient and reliable baggage handling solutions. Furthermore, the growing adoption of advanced technologies such as automated baggage sorting systems, self-service kiosks, and real-time tracking systems enhances operational efficiency and passenger experience, contributing significantly to market growth. Expansion of airport infrastructure, including new terminals and runways in major hubs across the Asia-Pacific region, further fuels market expansion. The market is segmented by airport capacity, reflecting the varying needs of different sized airports, ranging from those handling up to 15 million passengers to those exceeding 40 million. Key players like Ansir Systems, Unisys Corporation, and Vanderlande Industries are leading the innovation and expansion within this dynamic market, leveraging technological advancements and strategic partnerships to capture market share.

Asia-Pacific Airport Baggage Handling Systems Market Market Size (In Million)

The market's growth trajectory is influenced by several trends. The increasing focus on improving passenger experience drives the adoption of more sophisticated systems, while regulatory pressures towards enhanced security and safety measures also fuel demand. However, the market faces certain restraints. High initial investment costs associated with implementing advanced baggage handling systems can be a barrier for smaller airports. Furthermore, integration challenges and the need for skilled personnel to operate and maintain these complex systems present ongoing obstacles. Nevertheless, the long-term prospects for the Asia-Pacific Airport Baggage Handling Systems market remain highly positive, fueled by sustained growth in air travel and continuous technological advancements. The region's diverse market landscape, with significant growth potential in emerging economies, presents substantial opportunities for market participants.

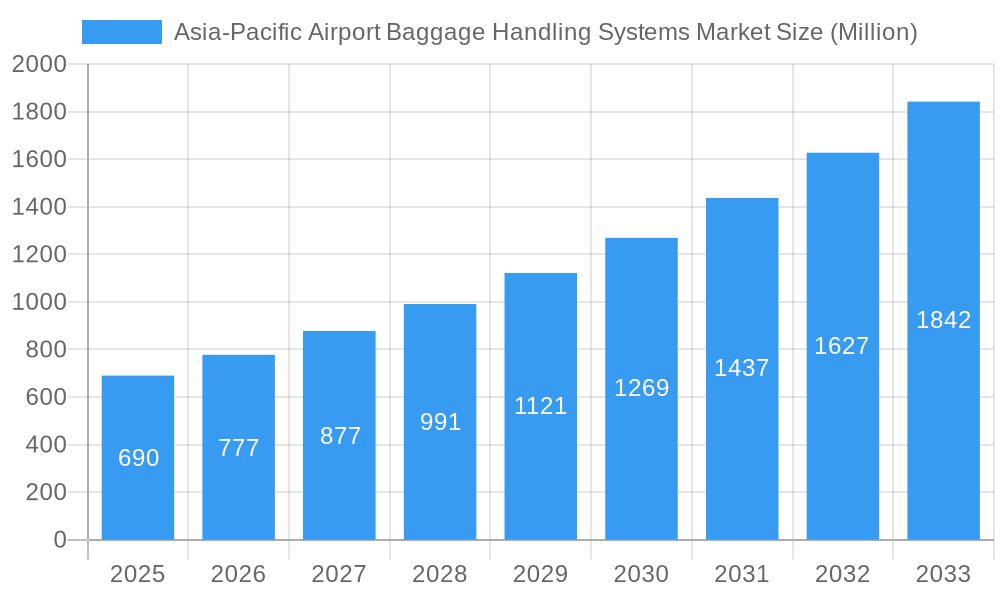

Asia-Pacific Airport Baggage Handling Systems Market Company Market Share

Asia-Pacific Airport Baggage Handling Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific Airport Baggage Handling Systems market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report covers market size, segmentation, growth drivers, challenges, and future outlook, providing a 360-degree view of this dynamic market. Key players like Ansir Systems, Unisys Corporation, Vanderlande Industries B.V., CIMC TianDa Holdings Co Ltd, BEUMER GROUP, Leonardo S.p.A, Daifuku Co Ltd, SITA, G&S Airport Conveyo, and Siemens Logistics GmbH are thoroughly analyzed.

Asia-Pacific Airport Baggage Handling Systems Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Asia-Pacific Airport Baggage Handling Systems market. We examine market concentration, revealing the market share held by key players. The report also explores the impact of mergers and acquisitions (M&A) activities, including deal values (xx Million) and their influence on market dynamics. Innovation drivers, such as advancements in automation, AI, and data analytics, are assessed alongside regulatory frameworks impacting system implementation and safety standards. The analysis further considers the existence and influence of substitute technologies and the evolving end-user demographics of airports across the region, categorized by airport capacity.

- Market Concentration: High (xx%), with top 5 players controlling xx% of the market.

- M&A Activity: xx major deals valued at approximately xx Million in the last 5 years.

- Innovation Drivers: Automation, AI-powered baggage tracking, improved security systems.

- Regulatory Landscape: Focus on safety, security, and efficiency standards.

- Product Substitutes: Limited, primarily involving legacy systems.

Asia-Pacific Airport Baggage Handling Systems Market Market Dynamics & Trends

This section dives into the factors driving market growth, technological disruptions, and evolving consumer preferences within the Asia-Pacific Airport Baggage Handling Systems market. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing passenger traffic, airport modernization projects, and rising demand for efficient baggage handling solutions. The analysis includes detailed examination of market penetration rates across different airport capacities and regions. Competitive dynamics, including strategic partnerships and product differentiation, are also explored.

The increasing passenger traffic within the Asia-Pacific region is a key driver, pushing the need for modernized and efficient baggage handling solutions. Technological advancements, particularly the integration of automation and AI, contribute significantly to optimizing operational efficiency and reducing costs. The preference for enhanced passenger experience also fuels innovation and demand. Competitive dynamics are shaped by technological innovation, strategic alliances, and the expansion of key players into new markets.

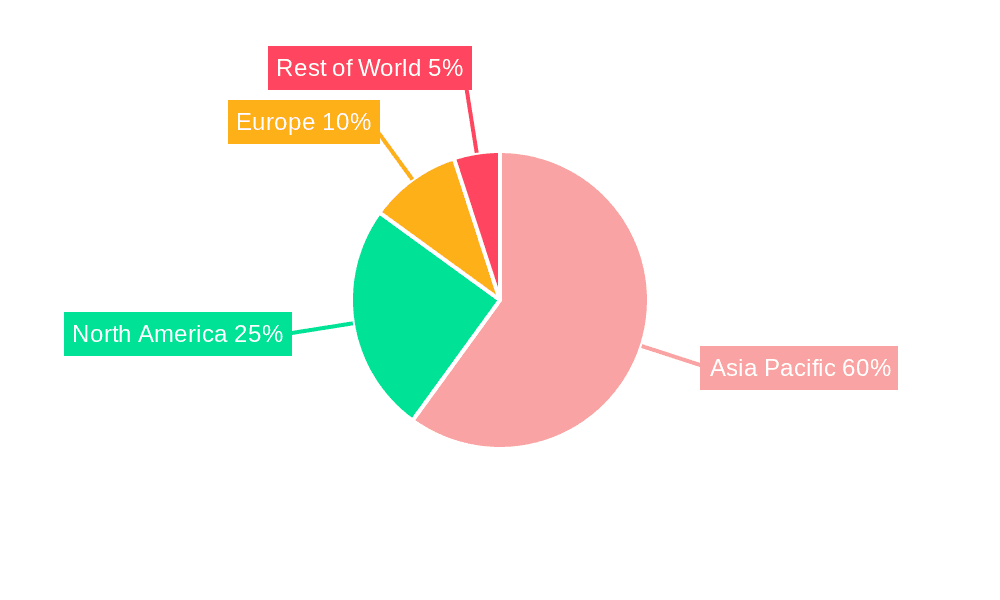

Dominant Regions & Segments in Asia-Pacific Airport Baggage Handling Systems Market

This section identifies the leading regions and segments within the Asia-Pacific Airport Baggage Handling Systems market, categorized by airport capacity: Up to 15 Million, 15 to 25 Million, 25 to 40 Million, and More than 40 Million passengers annually. The analysis details the market share of each segment and pinpoints the key growth drivers, such as economic policies, infrastructure developments, and regulatory changes, contributing to their dominance.

- Dominant Region: China, due to its rapid airport expansion and growing passenger traffic.

- Dominant Segment (Airport Capacity): More than 40 Million, driven by large international hubs requiring high-throughput systems.

Key Drivers (for each segment):

- Up to 15 Million: Growing domestic tourism and regional connectivity initiatives.

- 15 to 25 Million: Airport expansion and modernization projects.

- 25 to 40 Million: Rising passenger numbers and the need for efficient handling.

- More than 40 Million: High passenger volume and focus on improved passenger experience.

Asia-Pacific Airport Baggage Handling Systems Market Product Innovations

The Asia-Pacific Airport Baggage Handling Systems market is witnessing significant product innovation. New systems emphasize automation, AI-powered baggage tracking, improved security features, and enhanced data analytics capabilities for optimizing operations. These innovations are designed to meet the needs of airports with varying passenger volumes and enhance the overall passenger experience, aligning with the industry trend toward greater efficiency and passenger satisfaction. The competitive advantage lies in offering innovative, reliable, and scalable solutions that address specific airport needs.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific Airport Baggage Handling Systems market by airport capacity:

Up to 15 Million Passengers: This segment shows a steady growth projection of xx% during the forecast period, primarily driven by regional airport expansion. Market size in 2025 is estimated at xx Million. Competition is relatively moderate.

15 to 25 Million Passengers: Expected CAGR of xx%. Market size in 2025 is estimated at xx Million. High competition due to increasing modernization projects.

25 to 40 Million Passengers: This segment demonstrates robust growth, projected at xx% CAGR. Market size in 2025 is xx Million. Competition is intense, driven by technological advancements.

More than 40 Million Passengers: Highest growth potential with a projected xx% CAGR. Market size in 2025 is xx Million. Strong competition among major players focused on high-capacity solutions.

Key Drivers of Asia-Pacific Airport Baggage Handling Systems Market Growth

Several factors are fueling the growth of the Asia-Pacific Airport Baggage Handling Systems market. These include the increasing passenger traffic at airports across the region, driven by economic growth and rising tourism. Government initiatives promoting airport modernization and infrastructure development play a significant role. Technological advancements, such as AI-powered baggage tracking and automation, are enhancing efficiency and optimizing operations. Lastly, the rising emphasis on enhancing passenger experience further propels the demand for advanced baggage handling systems.

Challenges in the Asia-Pacific Airport Baggage Handling Systems Market Sector

The Asia-Pacific Airport Baggage Handling Systems market faces challenges, including high initial investment costs for advanced systems. Supply chain disruptions and the complexity of integrating new technologies into existing infrastructure pose further hurdles. Intense competition among established and emerging players creates pricing pressures. Regulatory compliance and the need to meet stringent safety standards also present significant challenges, influencing operational costs and complexity.

Emerging Opportunities in Asia-Pacific Airport Baggage Handling Systems Market

The Asia-Pacific Airport Baggage Handling Systems market presents significant opportunities. The growing number of low-cost carriers and the expansion of regional connectivity create demand for efficient and cost-effective solutions. The integration of innovative technologies, such as AI and IoT, offers scope for enhancing system efficiency, security, and passenger experience. The increasing focus on sustainability opens avenues for developing environmentally friendly baggage handling systems.

Leading Players in the Asia-Pacific Airport Baggage Handling Systems Market Market

- Ansir Systems

- Unisys Corporation

- Vanderlande Industries B.V.

- CIMC TianDa Holdings Co Ltd

- BEUMER GROUP

- Leonardo S.p.A

- Daifuku Co Ltd

- SITA

- G&S Airport Conveyo

- Siemens Logistics GmbH

Key Developments in Asia-Pacific Airport Baggage Handling Systems Market Industry

February 2023: Aena selected Siemens Logistics for a five-year contract to operate and maintain baggage handling systems at Madrid-Barajas Airport (MAD), covering 140 kilometers of conveyor systems. This highlights the growing market for service and maintenance contracts.

January 2023: Kyzylorda Airport in Kazakhstan contracted Alstef Group to design and deploy a new BHS for its terminal, encompassing inbound and outbound systems with features like ATR integration and X-ray screening. This showcases investment in new airport infrastructure and advanced system features.

Future Outlook for Asia-Pacific Airport Baggage Handling Systems Market Market

The Asia-Pacific Airport Baggage Handling Systems market exhibits strong growth potential. Continued expansion of airport infrastructure, increasing passenger traffic, and technological advancements will drive demand. Strategic partnerships, investments in R&D, and focus on providing innovative and sustainable solutions will shape the market's future. The integration of AI and IoT technologies will play a pivotal role in improving efficiency, security, and the overall passenger experience, thus creating lucrative opportunities for market players.

Asia-Pacific Airport Baggage Handling Systems Market Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 to 25 million

- 1.3. 25 to 40 million

- 1.4. More than 40 million

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia-Pacific Airport Baggage Handling Systems Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Airport Baggage Handling Systems Market Regional Market Share

Geographic Coverage of Asia-Pacific Airport Baggage Handling Systems Market

Asia-Pacific Airport Baggage Handling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. More than 40 Million Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 to 25 million

- 5.1.3. 25 to 40 million

- 5.1.4. More than 40 million

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. China Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6.1.1. Up to 15 million

- 6.1.2. 15 to 25 million

- 6.1.3. 25 to 40 million

- 6.1.4. More than 40 million

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7. India Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7.1.1. Up to 15 million

- 7.1.2. 15 to 25 million

- 7.1.3. 25 to 40 million

- 7.1.4. More than 40 million

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8. Japan Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8.1.1. Up to 15 million

- 8.1.2. 15 to 25 million

- 8.1.3. 25 to 40 million

- 8.1.4. More than 40 million

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9. South Korea Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9.1.1. Up to 15 million

- 9.1.2. 15 to 25 million

- 9.1.3. 25 to 40 million

- 9.1.4. More than 40 million

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10. Rest of Asia Pacific Asia-Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10.1.1. Up to 15 million

- 10.1.2. 15 to 25 million

- 10.1.3. 25 to 40 million

- 10.1.4. More than 40 million

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ansir Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unisys Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vanderlande Industries B V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CIMC TianDa Holdings Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BEUMER GROUP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leonardo S p A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daifuku Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SITA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 G&S Airport Conveyo

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens Logistics GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ansir Systems

List of Figures

- Figure 1: Asia-Pacific Airport Baggage Handling Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Airport Baggage Handling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 5: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 8: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 11: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 14: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 17: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Airport Baggage Handling Systems Market?

The projected CAGR is approximately 12.82%.

2. Which companies are prominent players in the Asia-Pacific Airport Baggage Handling Systems Market?

Key companies in the market include Ansir Systems, Unisys Corporation, Vanderlande Industries B V, CIMC TianDa Holdings Co Ltd, BEUMER GROUP, Leonardo S p A, Daifuku Co Ltd, SITA, G&S Airport Conveyo, Siemens Logistics GmbH.

3. What are the main segments of the Asia-Pacific Airport Baggage Handling Systems Market?

The market segments include Airport Capacity, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

More than 40 Million Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Aena selected Siemens Logistics to operate and maintain the baggage handling systems at Adolfo Suárez Madrid-Barajas Airport in Spain (MAD). The service contract was signed for five years and includes technical support for 140 kilometers of conveyor systems, tray, and belt technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Airport Baggage Handling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Airport Baggage Handling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Airport Baggage Handling Systems Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Airport Baggage Handling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence