Key Insights

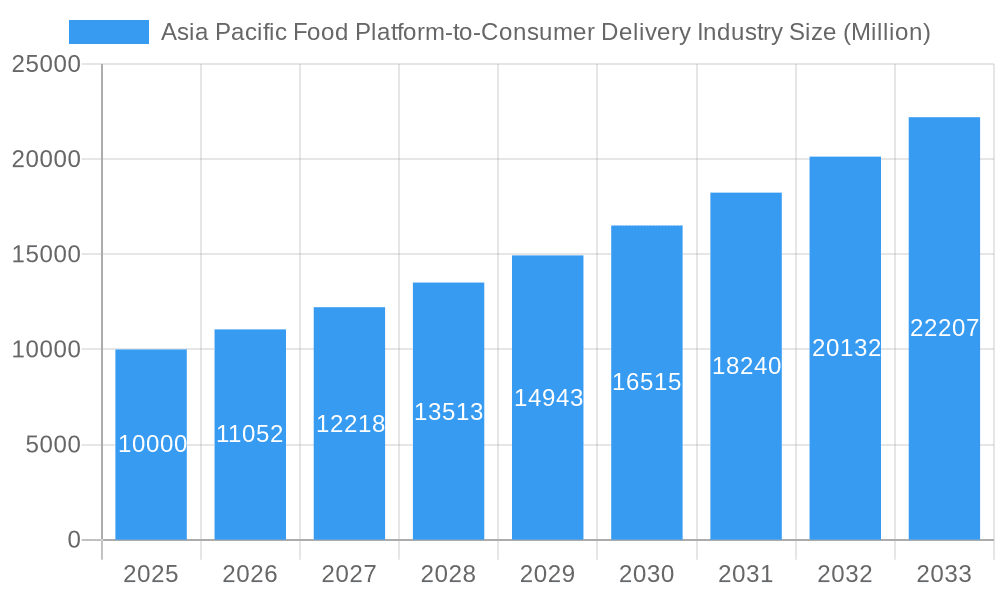

The Asia-Pacific food platform-to-consumer delivery industry is poised for substantial expansion, driven by escalating smartphone adoption, rising disposable incomes, and a growing consumer demand for convenience across key economies such as China, India, and Japan. The market, valued at approximately $250 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 10% through 2033. This growth is bolstered by the diversification of delivery services, extending beyond restaurant meals to include grocery and specialized food items. The increasing prevalence of online payment methods further fuels market expansion, gradually superseding traditional cash-on-delivery. Despite challenges including intense market competition, evolving regulatory landscapes, and food safety concerns, the industry's growth trajectory remains robust.

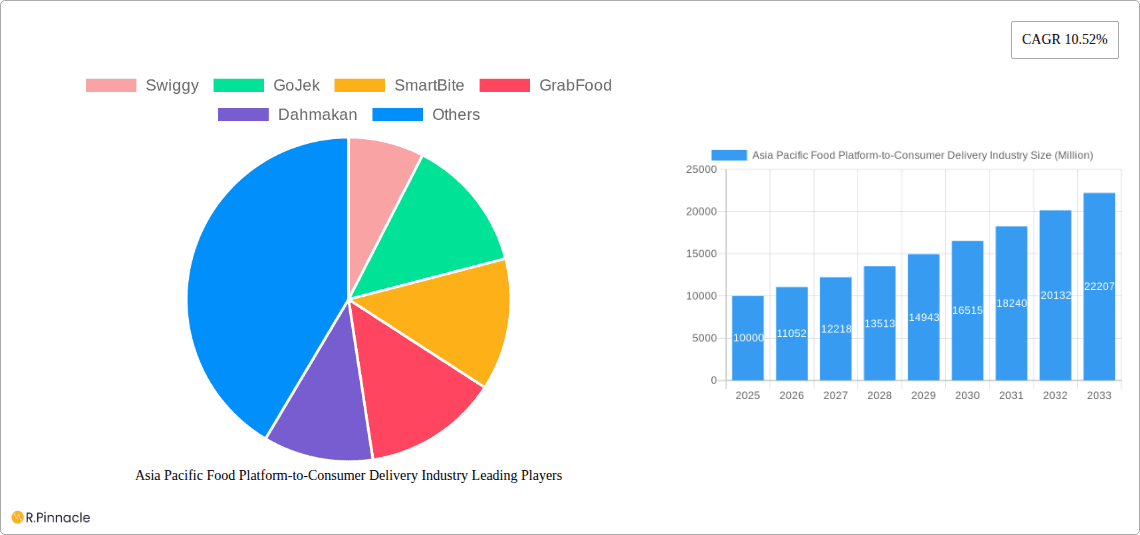

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Size (In Billion)

Within the industry, food delivery currently commands the largest market share, followed by grocery delivery. Home delivery remains the primary method, though office delivery is demonstrating significant growth potential in urban centers. The widespread adoption of online payments signifies increasing consumer confidence in digital transactions and platform security. Leading market players, including Swiggy, GoJek, GrabFood, and Deliveroo, are actively investing in technology and logistics to optimize operations, broaden service coverage, and enhance customer satisfaction. The Asia-Pacific region, particularly its major economies, offers a highly attractive market due to its large, digitally-native population. Growth is anticipated to be dynamic, with India and China expected to lead expansion fueled by their vast populations and burgeoning middle classes.

Asia Pacific Food Platform-to-Consumer Delivery Industry Company Market Share

This report delivers a comprehensive analysis of the Asia-Pacific food platform-to-consumer delivery industry, examining market structure, dynamics, key segments, and future growth opportunities. Providing actionable insights and crucial performance indicators, this study is indispensable for industry stakeholders, investors, and strategists navigating this dynamic sector. The analysis covers the period from 2019 to 2033, with 2025 serving as the base and estimated year.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Structure & Innovation Trends

This section analyzes the market concentration, highlighting key players like Swiggy, GoJek, GrabFood, and Deliveroo, and their respective market shares (exact figures unavailable, estimated at xx Million USD). We examine innovation drivers such as technological advancements in logistics and payment systems, the influence of regulatory frameworks on operations, and the impact of substitute products (e.g., restaurant dine-in). The analysis further explores end-user demographics, including age, income, and location preferences, and assesses the impact of mergers and acquisitions (M&A) activities. Specific M&A deal values are unavailable for this report, but the report will explore overall M&A activity trends and their impact on market consolidation.

- Market Concentration: High concentration in major metropolitan areas, with regional variations.

- Innovation Drivers: AI-powered routing, drone delivery trials, cashless payment systems, personalized recommendations.

- Regulatory Frameworks: Varying regulations across countries impacting licensing, food safety, and data privacy.

- Product Substitutes: Restaurant dine-in, traditional grocery stores, meal-kit delivery services.

- End-User Demographics: High adoption among young adults and working professionals in urban areas.

- M&A Activities: Consolidation expected to continue with larger players acquiring smaller companies.

Asia Pacific Food Platform-to-Consumer Delivery Industry Market Dynamics & Trends

This section explores the market's growth trajectory, examining key drivers such as rising disposable incomes, increasing urbanization, and changing consumer lifestyles. We analyze technological disruptions, such as the rise of mobile ordering and delivery apps, and the evolving consumer preferences for convenience, speed, and diverse food options. Competitive dynamics are assessed, focusing on pricing strategies, marketing campaigns, and service differentiation. The CAGR (Compound Annual Growth Rate) for the forecast period (2025-2033) is estimated at xx%, with market penetration projected to reach xx% by 2033.

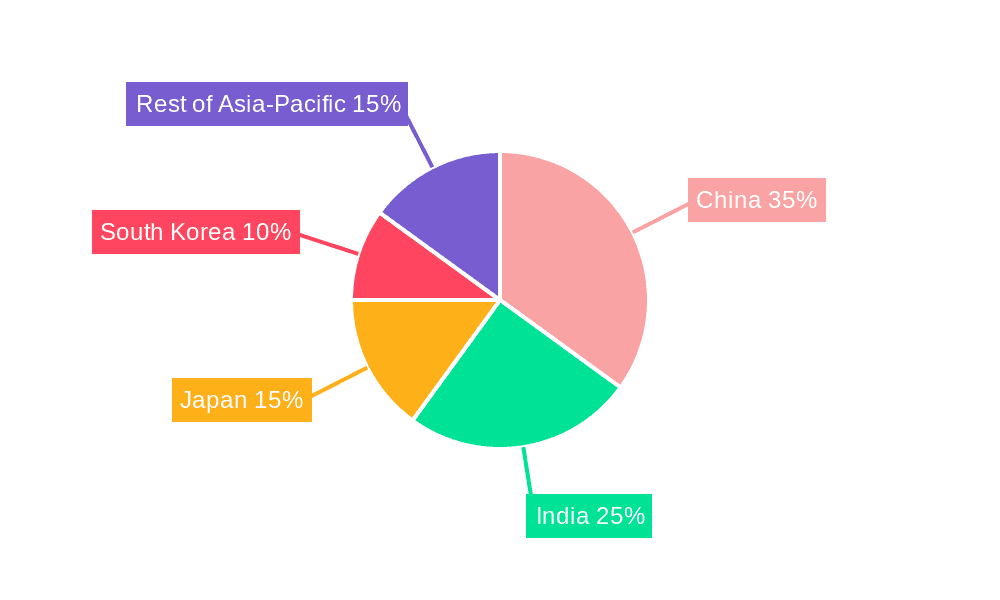

Dominant Regions & Segments in Asia Pacific Food Platform-to-Consumer Delivery Industry

This section identifies the leading regions and segments within the Asia Pacific food delivery market. It analyzes the dominance of specific countries (e.g., India, Indonesia, Singapore) and segments across product type (food delivery, grocery delivery, other), delivery method (home delivery, office delivery, other), and payment method (cash on delivery, online payment, other).

- Key Drivers of Dominance:

- Economic Policies: Government support for digital infrastructure and e-commerce.

- Infrastructure: Availability of reliable transportation networks and internet access.

- Consumer Behavior: High smartphone penetration and adoption of online services.

The dominance analysis will delve into the specific factors contributing to the success of each leading region and segment, considering market size, growth rate, and competitive landscape.

Asia Pacific Food Platform-to-Consumer Delivery Industry Product Innovations

Recent product innovations include personalized recommendations, subscription models, and integration with loyalty programs. Technological trends like AI-powered delivery optimization and the use of drones are gaining traction, improving efficiency and expanding service reach. These innovations directly address consumer demands for convenience and choice, enhancing the market fit of existing platforms.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific food platform-to-consumer delivery market across three key dimensions:

Product Type: Food delivery (market size xx Million USD, projected growth xx%), Grocery delivery (market size xx Million USD, projected growth xx%), Other (market size xx Million USD, projected growth xx%). Competitive dynamics vary significantly across these segments.

Delivery Method: Home delivery (market size xx Million USD, projected growth xx%), Office delivery (market size xx Million USD, projected growth xx%), Other (market size xx Million USD, projected growth xx%). Market size and growth rate will differ based on local business conditions.

Payment Method: Cash on delivery (market size xx Million USD, projected growth xx%), Online payment (market size xx Million USD, projected growth xx%), Other (market size xx Million USD, projected growth xx%). The preferred payment method significantly affects market penetration.

Key Drivers of Asia Pacific Food Platform-to-Consumer Delivery Industry Growth

The industry's growth is driven by several factors: the rapid expansion of smartphone penetration and internet access, increasing urbanization leading to busier lifestyles and higher demand for convenience, supportive government policies promoting digital economies, and continuous technological innovations improving delivery efficiency and user experience.

Challenges in the Asia Pacific Food Platform-to-Consumer Delivery Industry Sector

Challenges include maintaining profitability amidst intense competition and fluctuating fuel prices (estimated xx% impact on operational costs), navigating complex regulatory environments, ensuring food safety and quality standards, and addressing concerns related to rider welfare and fair labor practices. Supply chain disruptions, particularly during peak periods, pose significant operational challenges.

Emerging Opportunities in Asia Pacific Food Platform-to-Consumer Delivery Industry

Emerging opportunities include expanding into underserved markets, integrating with other services such as grocery delivery and retail, leveraging advanced technologies like AI and blockchain for enhanced efficiency and security, and exploring new business models such as subscription services and partnerships with restaurants.

Key Developments in Asia Pacific Food Platform-to-Consumer Delivery Industry Industry

August 2022: GrabFood launched in Phnom Penh, Cambodia, offering discounts of up to 50%. This expansion significantly increases GrabFood's market reach and reinforces its position as a leading player in Southeast Asia.

August 2022: Uber Eats partnered with MotionAds to provide delivery drivers with additional income opportunities through advertising on their delivery bikes, addressing the rising cost of living. This initiative improves driver welfare and enhances brand visibility.

August 2022: Deliveroo Singapore collaborated with TreeDots to reduce food waste and operational costs by connecting restaurants with surplus food products. This partnership promotes sustainability and improves profit margins for restaurants.

Future Outlook for Asia Pacific Food Platform-to-Consumer Delivery Industry Market

The Asia Pacific food delivery market is poised for continued strong growth, driven by factors such as increasing smartphone penetration, rising disposable incomes, and evolving consumer preferences for convenience. Strategic partnerships, technological innovations, and expansion into new markets will play a crucial role in shaping the future of this dynamic industry. Companies that adapt to changing consumer demands and invest in efficient logistics will be best positioned to capitalize on emerging opportunities.

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation

-

1. Product type

- 1.1. Food delivery

- 1.2. Grocery delivery

- 1.3. Other

-

2. Method

- 2.1. Mome delivery

- 2.2. Office delivery

- 2.3. Other

-

3. Payment method

- 3.1. Cash on delivery

- 3.2. Online payment

- 3.3. Other

Asia Pacific Food Platform-to-Consumer Delivery Industry Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Rest of Asia Pacific

Asia Pacific Food Platform-to-Consumer Delivery Industry Regional Market Share

Geographic Coverage of Asia Pacific Food Platform-to-Consumer Delivery Industry

Asia Pacific Food Platform-to-Consumer Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders

- 3.3. Market Restrains

- 3.3.1. High Cost of Forestry Equipment; Lack of Information About Forestry Equipment

- 3.4. Market Trends

- 3.4.1. Smart Phones and Internet Penetrations in the region are driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Food delivery

- 5.1.2. Grocery delivery

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Mome delivery

- 5.2.2. Office delivery

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Payment method

- 5.3.1. Cash on delivery

- 5.3.2. Online payment

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. China Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. Food delivery

- 6.1.2. Grocery delivery

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Mome delivery

- 6.2.2. Office delivery

- 6.2.3. Other

- 6.3. Market Analysis, Insights and Forecast - by Payment method

- 6.3.1. Cash on delivery

- 6.3.2. Online payment

- 6.3.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. India Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. Food delivery

- 7.1.2. Grocery delivery

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Mome delivery

- 7.2.2. Office delivery

- 7.2.3. Other

- 7.3. Market Analysis, Insights and Forecast - by Payment method

- 7.3.1. Cash on delivery

- 7.3.2. Online payment

- 7.3.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. South Korea Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. Food delivery

- 8.1.2. Grocery delivery

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Mome delivery

- 8.2.2. Office delivery

- 8.2.3. Other

- 8.3. Market Analysis, Insights and Forecast - by Payment method

- 8.3.1. Cash on delivery

- 8.3.2. Online payment

- 8.3.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Rest of Asia Pacific Asia Pacific Food Platform-to-Consumer Delivery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. Food delivery

- 9.1.2. Grocery delivery

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Mome delivery

- 9.2.2. Office delivery

- 9.2.3. Other

- 9.3. Market Analysis, Insights and Forecast - by Payment method

- 9.3.1. Cash on delivery

- 9.3.2. Online payment

- 9.3.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Swiggy

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GoJek

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SmartBite

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GrabFood

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dahmakan

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Delivery Guy

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kims Kitchen

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Deliveroo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Swiggy

List of Figures

- Figure 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 2: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 3: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 4: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 6: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 7: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 8: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 10: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 11: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 12: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 14: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 15: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 16: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Product type 2020 & 2033

- Table 18: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 19: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Payment method 2020 & 2033

- Table 20: Asia Pacific Food Platform-to-Consumer Delivery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

Key companies in the market include Swiggy, GoJek, SmartBite, GrabFood, Dahmakan, Delivery Guy, Kims Kitchen, Deliveroo.

3. What are the main segments of the Asia Pacific Food Platform-to-Consumer Delivery Industry?

The market segments include Product type, Method , Payment method .

4. Can you provide details about the market size?

The market size is estimated to be USD 250 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Penetration; Surge in Internet Penetration; Ease of Access and Discount on orders.

6. What are the notable trends driving market growth?

Smart Phones and Internet Penetrations in the region are driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Forestry Equipment; Lack of Information About Forestry Equipment.

8. Can you provide examples of recent developments in the market?

August 2022: The introduction of GrabFood in Phnom Penh was announced by Grab following a successful four-month "beta" test in the capital. GrabFood is the top meal delivery service in Southeast Asia, connecting customers to a wide range of food and drink options and providing on-demand delivery to customers' doors. With the new service, customers may save up to 50% when they order from GrabFood no matter how far away the restaurant or cafe is from the user's location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Food Platform-to-Consumer Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Food Platform-to-Consumer Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Food Platform-to-Consumer Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence