Key Insights

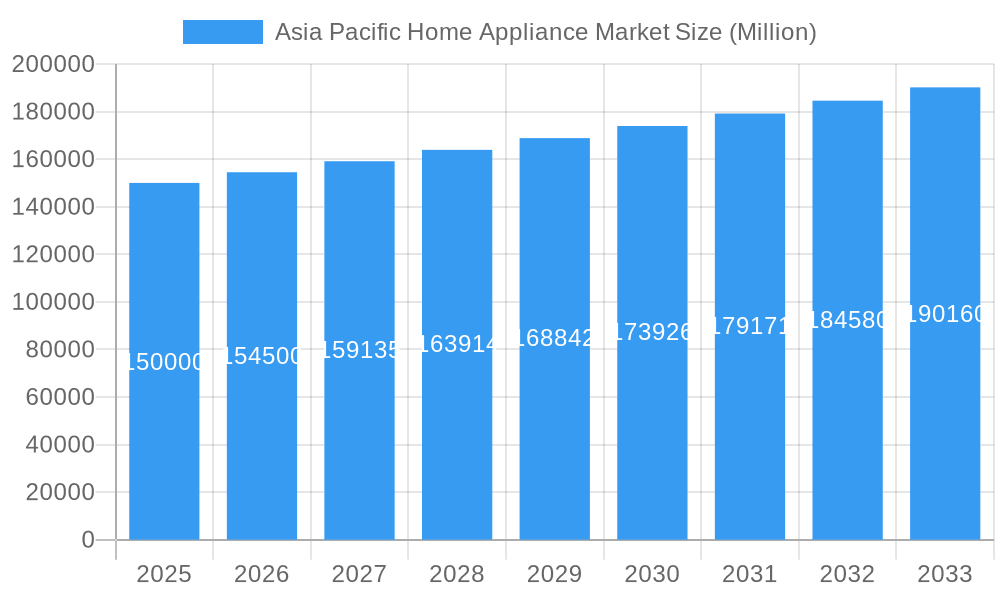

The Asia Pacific home appliance market, projected at $348.45 billion in 2025, is forecasted to experience substantial growth, achieving a Compound Annual Growth Rate (CAGR) of 4.51% between 2025 and 2033. Key growth drivers include escalating disposable incomes, particularly in emerging economies like India and Southeast Asia, which boosts consumer spending on essential home appliances such as refrigerators, washing machines, and air conditioners. Urbanization trends further amplify demand for modern home appliances as populations migrate to urban centers. Technological innovations, including smart home integration and the proliferation of energy-efficient models, are propelling market premiumization and expansion. The market is segmented by product category (refrigerators, freezers, dishwashers, washing machines, cookers & ovens, air conditioners, and others), distribution channel (hypermarkets/supermarkets, specialty stores, online, and others), and geographical region (China, India, Japan, South Korea, Australia, Malaysia, Thailand, Indonesia, Singapore, and others). The competitive landscape is characterized by intense rivalry among leading global players such as Whirlpool, Panasonic, Electrolux, Samsung, LG, and Haier, who are actively pursuing market share through product innovation, strategic alliances, and extensive marketing initiatives.

Asia Pacific Home Appliance Market Market Size (In Billion)

Despite positive growth prospects, certain factors may present challenges. Volatility in raw material prices, especially for metals and plastics, can influence manufacturing costs and profitability. Economic downturns in specific regions could lead to reduced consumer expenditure on discretionary appliances. Additionally, increasing environmental consciousness mandates manufacturers to adopt sustainable practices, necessitating considerable investment in research and development. Nevertheless, the long-term trajectory for the Asia Pacific home appliance market remains favorable, underpinned by ongoing economic development and a growing consumer appetite for convenience and enhanced living standards. While established global players are expected to maintain their dominance, the rise of strong regional brands is anticipated to inject greater dynamism into the market. Future market evolution will be shaped by competitive brand strategies, consumer preference for smart appliances, and the region's adaptation to evolving environmental regulations.

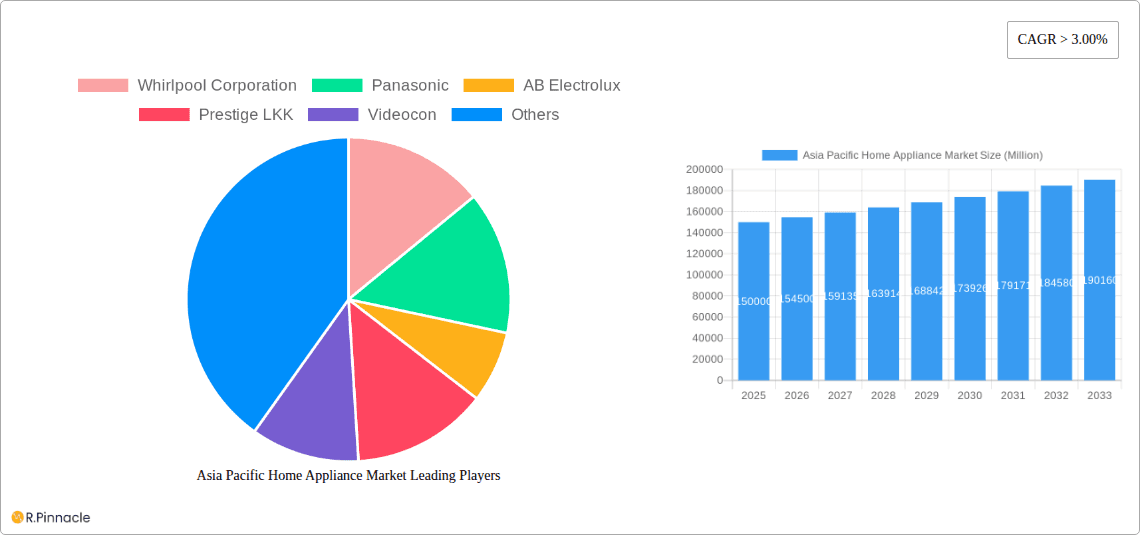

Asia Pacific Home Appliance Market Company Market Share

Asia Pacific Home Appliance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific home appliance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth potential. The study period is 2019–2033, with 2025 as the base and estimated year, and 2025–2033 as the forecast period. The historical period covered is 2019–2024.

Asia Pacific Home Appliance Market Structure & Innovation Trends

This section analyzes the market concentration, identifying key players like Whirlpool Corporation, Panasonic, AB Electrolux, Samsung Electronics, LG Electronics, and many more. We delve into innovation drivers, such as technological advancements in energy efficiency and smart home integration, and examine the regulatory frameworks impacting the industry. The report also assesses the influence of product substitutes, evolving end-user demographics (e.g., rising urban populations, changing lifestyles), and the impact of M&A activities. Market share data for key players will be presented, along with an analysis of M&A deal values (estimated at xx Million for the period 2019-2024). The analysis will highlight the competitive intensity and the strategic implications of these activities. The report will also include a detailed analysis of the competitive landscape, including market share data and an assessment of competitive strategies.

- Market Concentration: Analysis of market share held by top players.

- Innovation Drivers: Exploration of technological advancements and consumer demands driving innovation.

- Regulatory Landscape: Examination of relevant regulations and their impact on market growth.

- M&A Activity: Analysis of mergers and acquisitions, including deal values and strategic implications.

Asia Pacific Home Appliance Market Dynamics & Trends

This section explores the key factors shaping the Asia Pacific home appliance market's growth trajectory. We examine growth drivers such as rising disposable incomes, increasing urbanization, and the growing preference for convenience and technology-enabled appliances. Technological disruptions, such as the increasing adoption of smart home technology and the Internet of Things (IoT), are analyzed for their impact on market dynamics. Consumer preferences, including shifts towards energy-efficient and eco-friendly appliances, are also considered. The competitive dynamics, including pricing strategies, product differentiation, and brand loyalty, are meticulously examined. The Compound Annual Growth Rate (CAGR) and market penetration rates for key product segments are projected for the forecast period (2025-2033).

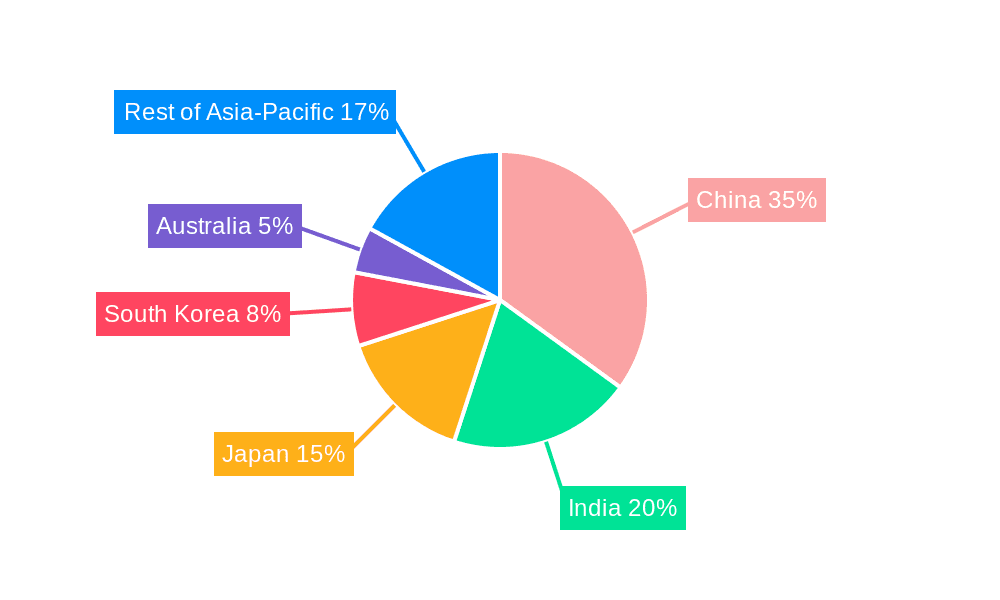

Dominant Regions & Segments in Asia Pacific Home Appliance Market

This section identifies the leading regions and segments within the Asia Pacific home appliance market. Detailed analysis will highlight the dominance of specific regions (e.g., China, India, Japan) and product categories (e.g., Refrigerators, Air Conditioners, Washing Machines). Key drivers for each dominant region and segment will be outlined, including economic policies, infrastructure development, consumer spending patterns and technological advancements. A comprehensive analysis of the market share held by various regions and segments will also be presented, based on historical data and future projections.

- China: Economic growth, urbanization, and consumer preferences.

- India: Rising middle class, increasing urbanization, and government initiatives.

- Japan: Technological advancements, high consumer spending, and preference for premium products.

- Refrigerators: Market size, growth drivers, and competitive landscape.

- Air Conditioners: Market size, growth drivers, and competitive landscape.

- Online Distribution: Growth drivers, market share, and future trends.

Asia Pacific Home Appliance Market Product Innovations

This section summarizes recent product developments, highlighting key technological trends like smart appliances, energy-efficient designs, and improved functionalities. It analyzes the competitive advantages offered by these innovations and their market fit within the context of consumer needs and preferences. Examples of specific product launches and their market impact will be included.

Report Scope & Segmentation Analysis

This section details the market segmentation across product types (Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Cookers and Ovens, Air Conditioners, Others), distribution channels (Specialty Stores, Hypermarkets/Supermarkets, Online, Others), and regions (China, India, Japan, South Korea, Australia, Malaysia, Thailand, Indonesia, Singapore, Others). Each segment's growth projections, market size estimations, and competitive dynamics are analyzed, providing a comprehensive overview of the market's structure and opportunities. Specific growth projections and market sizes for each segment in Million USD will be provided for the forecast period.

Key Drivers of Asia Pacific Home Appliance Market Growth

This section highlights the key factors driving the growth of the Asia Pacific home appliance market. It emphasizes technological advancements, economic expansion, and supportive government regulations, providing specific examples to illustrate their impact.

Challenges in the Asia Pacific Home Appliance Market Sector

This section discusses the major challenges faced by the Asia Pacific home appliance market, such as regulatory hurdles, supply chain disruptions, and intense competition. The analysis includes a quantification of the impact of these challenges on market growth.

Emerging Opportunities in Asia Pacific Home Appliance Market

This section identifies emerging trends and opportunities, including new markets, technologies, and evolving consumer preferences. It highlights the potential for growth in specific segments and regions.

Leading Players in the Asia Pacific Home Appliance Market Market

- Whirlpool Corporation

- Panasonic

- AB Electrolux

- Prestige LKK

- Videocon

- Samsung Electronics

- Philips

- Hisense

- Siemens

- Midea Group

- Robert Bosch GmbH

- Gree Electric Appliance

- Hitachi

- Haier(GE)

- LG Electronics

- Tiger Corporation

- LG Corporation

Key Developments in Asia Pacific Home Appliance Market Industry

- [Date]: Launch of a new energy-efficient refrigerator model by [Company Name].

- [Date]: Acquisition of [Company A] by [Company B].

- [Date]: Introduction of a new smart home appliance platform by [Company Name].

- (Further key developments will be listed with dates and details of their impact)

Future Outlook for Asia Pacific Home Appliance Market Market

This section provides a concise summary of the future outlook for the Asia Pacific home appliance market. It highlights the growth accelerators and strategic opportunities that are likely to shape the market in the coming years. This includes projections for market size and potential growth areas based on the trends identified throughout the report.

Asia Pacific Home Appliance Market Segmentation

-

1. Product

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Cookers and Ovens

- 1.6. Air- Conditioners

- 1.7. Others

-

2. Distribution Channel

- 2.1. Others

- 2.2. Speciality Stores

- 2.3. Hypermarkets/ Supermarkets

- 2.4. Online

Asia Pacific Home Appliance Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Home Appliance Market Regional Market Share

Geographic Coverage of Asia Pacific Home Appliance Market

Asia Pacific Home Appliance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising Exports of Refrigerator and Freezer Home Appliances from Asia-Pacific Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Home Appliance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Cookers and Ovens

- 5.1.6. Air- Conditioners

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Others

- 5.2.2. Speciality Stores

- 5.2.3. Hypermarkets/ Supermarkets

- 5.2.4. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Panasonic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AB Electrolux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prestige LKK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Videocon

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philips

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hisense

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Siemens

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Robert Bosch GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gree Electric Appliance

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hitachi*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Haier(GE)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 LG Electronics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Tiger Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 LG Corporation

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Asia Pacific Home Appliance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Home Appliance Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Home Appliance Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Asia Pacific Home Appliance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Home Appliance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Home Appliance Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Asia Pacific Home Appliance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Home Appliance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Home Appliance Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Home Appliance Market?

The projected CAGR is approximately 4.51%.

2. Which companies are prominent players in the Asia Pacific Home Appliance Market?

Key companies in the market include Whirlpool Corporation, Panasonic, AB Electrolux, Prestige LKK, Videocon, Samsung Electronics, Philips, Hisense, Siemens, Midea Group, Robert Bosch GmbH, Gree Electric Appliance, Hitachi*List Not Exhaustive, Haier(GE), LG Electronics, Tiger Corporation, LG Corporation.

3. What are the main segments of the Asia Pacific Home Appliance Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 348.45 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising Exports of Refrigerator and Freezer Home Appliances from Asia-Pacific Region.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Home Appliance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Home Appliance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Home Appliance Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Home Appliance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence