Key Insights

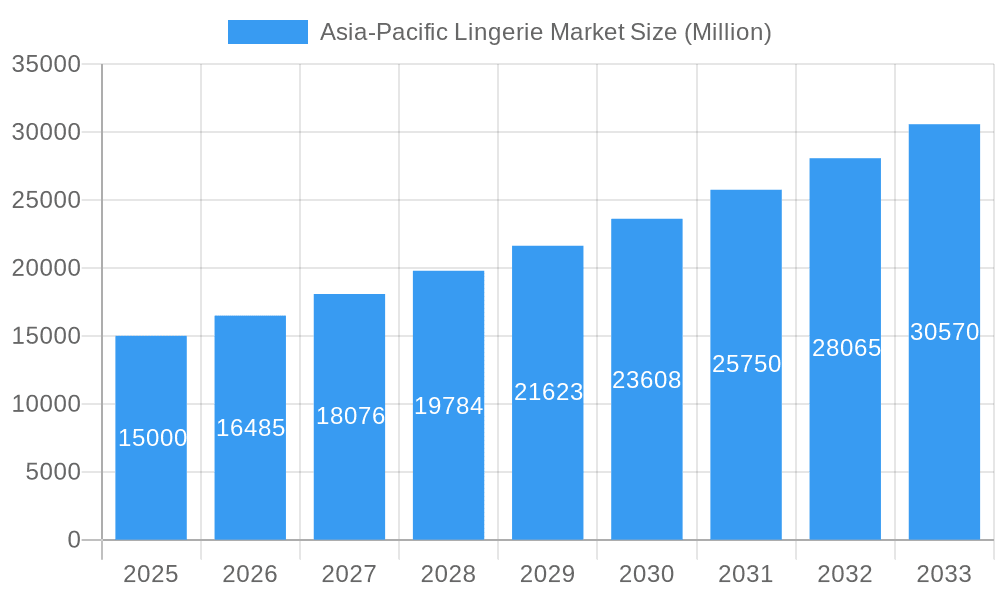

The Asia-Pacific lingerie market is poised for substantial expansion, projected to reach 48.59 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.67% from 2025 to 2033. Key growth drivers include escalating disposable incomes, particularly among younger demographics in emerging economies like India and China, fueling demand for premium intimate apparel. A growing emphasis on body positivity and self-care further stimulates consumer interest in comfortable and fashionable lingerie. The rapid growth of e-commerce provides enhanced accessibility and convenience for consumers across the region. Evolving fashion trends, innovative product designs featuring sustainable and technologically advanced materials, and strategic marketing initiatives tailored to diverse consumer needs also contribute significantly to market growth. However, the market navigates challenges such as intense competition, price sensitivity in specific segments, and raw material cost volatility.

Asia-Pacific Lingerie Market Market Size (In Billion)

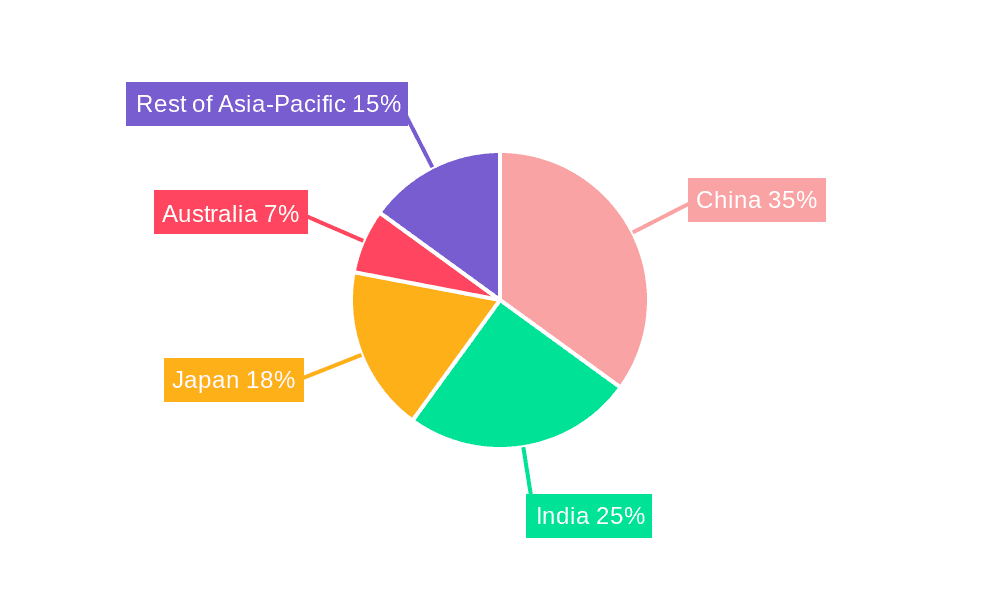

Significant regional variations characterize the Asia-Pacific lingerie market. China and India offer substantial growth prospects due to their large populations and expanding middle-class consumer base. Japan, a mature market, sustains steady growth through premium brand offerings and innovative products. Australia, while smaller, exhibits high per capita spending, reflecting a strong consumer preference for high-quality lingerie. Market segmentation by product type (brassieres, briefs, other categories) and distribution channel (supermarkets, specialty stores, online retail) highlights diverse consumer preferences and the evolving retail landscape. Major players including Hanesbrands, Triumph International, and Victoria’s Secret, alongside numerous regional competitors, actively pursue market share through product innovation, strategic branding, and channel expansion. This dynamic interplay of growth factors, challenges, and regional nuances will shape the future trajectory of the Asia-Pacific lingerie market.

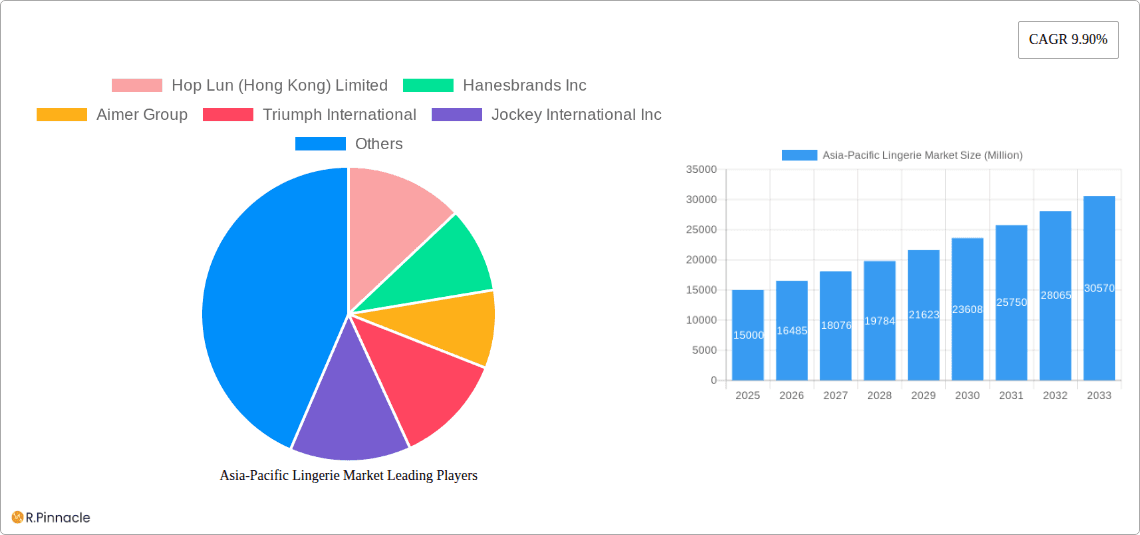

Asia-Pacific Lingerie Market Company Market Share

Asia-Pacific Lingerie Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific lingerie market, offering actionable insights for industry professionals. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The market is segmented by product type (brassiere, briefs, other), distribution channel (supermarkets/hypermarkets, specialty stores, online retail stores, other), and country (China, Japan, India, Australia, Rest of Asia-Pacific). Key players include Hop Lun (Hong Kong) Limited, Hanesbrands Inc, Aimer Group, Triumph International, Jockey International Inc, Victoria's Secret & Co, MAS Holdings, Wacoal Holdings corp, Berkshire Hathaway, and Zivame. The report reveals a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Asia-Pacific Lingerie Market Structure & Innovation Trends

The Asia-Pacific lingerie market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. For example, Triumph International and Wacoal Holdings Corp likely hold a combined xx% market share in 2025. However, the market also displays significant fragmentation, particularly amongst smaller regional and online brands.

Innovation is driven by several factors including:

- Technological advancements: Increased use of smart fabrics, sustainable materials, and 3D printing technologies.

- Changing consumer preferences: Growing demand for comfort, functionality, and ethically sourced products.

- Regulatory changes: Increasing focus on sustainability and ethical manufacturing practices.

- Product substitutes: Rise of athleisure wear impacting the traditional lingerie market.

Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with deal values typically in the xx Million range. However, increased consolidation is anticipated as larger players seek to expand their market share and geographic reach. Specific M&A deals are not extensively detailed in this report's scope. The end-user demographic is diverse, ranging from young adults to older women, with varying needs and preferences across different segments, including those requiring adaptive lingerie.

Asia-Pacific Lingerie Market Market Dynamics & Trends

The Asia-Pacific lingerie market is experiencing robust growth, driven by several key factors:

- Rising disposable incomes: Increased purchasing power, particularly in emerging economies like India and China, fuels demand for higher-quality lingerie.

- Changing lifestyles: Greater emphasis on personal comfort and self-care among women in urban centers.

- E-commerce expansion: Online retail channels provide convenient access to a wider variety of products.

- Increased brand awareness: Marketing campaigns highlighting comfort and style, particularly focusing on body positivity, are gaining traction.

- Growing influence of social media: Online platforms are influencing purchasing decisions and creating trends.

Technological disruptions, such as the adoption of personalized fitting technologies and the expansion of direct-to-consumer models, are reshaping the competitive landscape. The market penetration of online retail channels is increasing rapidly, with a projected xx% penetration rate by 2033. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new niche brands targeting specific customer segments. Several countries within the region are showing significant growth, creating a highly dynamic and competitive environment.

Dominant Regions & Segments in Asia-Pacific Lingerie Market

China: Remains the largest market due to its massive population, rising disposable incomes, and a burgeoning middle class. Key drivers include robust economic growth and increasing urbanization.

India: Experiencing rapid growth driven by a young and expanding female population, increased fashion awareness, and improving access to e-commerce platforms. Key drivers include favorable demographics and government initiatives.

Japan: A mature market with established players. However, growth is driven by innovation in product design and technology. Key drivers include advanced consumer preferences and established brand loyalty.

Brassieres: Represent the largest product segment due to their widespread use and higher price points.

Online Retail Stores: Exhibit the fastest growth among distribution channels, driven by increasing internet penetration and convenience.

Australia: Relatively smaller market compared to China and India; still holds significant potential.

Asia-Pacific Lingerie Market Product Innovations

Recent product innovations focus on enhancing comfort, functionality, and sustainability. New materials like breathable fabrics and eco-friendly options are gaining popularity. Technological advancements in fit and sizing are also shaping the market. Smart lingerie incorporating technology for health monitoring or personalized comfort settings is emerging as a promising area. These innovations cater to the growing demand for customized, health-conscious, and sustainable products.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation analysis of the Asia-Pacific lingerie market.

By Product Type: Brassieres, briefs, and other product types (e.g., shapewear, sleepwear) are analyzed in terms of market size, growth projections, and competitive dynamics.

By Distribution Channel: Supermarkets/hypermarkets, specialty stores, online retail stores, and other distribution channels are assessed for their market share, growth rates, and competitive landscape.

By Country: China, Japan, India, Australia, and the Rest of Asia-Pacific are analyzed for their market size, growth potential, and key regional drivers. Detailed market sizes and growth projections are provided for each segment.

Key Drivers of Asia-Pacific Lingerie Market Growth

The Asia-Pacific lingerie market is experiencing robust expansion fueled by a confluence of powerful drivers. The burgeoning e-commerce landscape has revolutionized accessibility, offering consumers an unparalleled variety of styles, brands, and sizes right at their fingertips. Coupled with this, a significant upswing in disposable incomes across the region, especially in emerging economies, is empowering consumers to invest more in premium and luxury lingerie, reflecting evolving lifestyle aspirations. A growing emphasis on personal well-being and comfort, alongside a heightened awareness of ethical sourcing and sustainable materials, is also shaping purchasing decisions, attracting a conscientious consumer base that seeks brands aligned with their values. Furthermore, continuous advancements in textile technology and design are leading to innovative product offerings, from enhanced comfort features to more sophisticated aesthetic appeal, further broadening the market's appeal.

Challenges in the Asia-Pacific Lingerie Market Sector

Despite its promising growth trajectory, the Asia-Pacific lingerie market navigates a complex terrain of challenges. The industry is characterized by intense competition, with both established global players and agile local brands vying for market share, demanding relentless innovation and strategic differentiation. Fluctuations in the cost and availability of raw materials, alongside potential supply chain disruptions, can significantly impact production costs and profit margins. Moreover, the sector is subject to a diverse and evolving set of regulatory requirements pertaining to product safety, labeling accuracy, and increasingly, sustainability standards, which add layers of operational complexity and compliance costs for businesses operating within the region.

Emerging Opportunities in Asia-Pacific Lingerie Market

The Asia-Pacific lingerie market is ripe with emerging opportunities for forward-thinking brands. Significant untapped potential exists within rural and semi-urban markets as e-commerce infrastructure continues to expand, creating new avenues for market penetration and customer acquisition. The growing demand for personalized experiences presents a key opportunity, with brands that offer customized sizing, fit solutions, and bespoke designs poised to capture consumer loyalty. The integration of cutting-edge technology into lingerie, such as the development of smart fabrics with functional benefits or virtual fitting tools, offers unique selling propositions and enhances the consumer journey. Crucially, brands that champion sustainability, ethical production practices, and transparent supply chains will resonate deeply with an increasingly environmentally and socially conscious consumer base.

Leading Players in the Asia-Pacific Lingerie Market Market

- Hop Lun (Hong Kong) Limited

- Hanesbrands Inc (Hanesbrands Inc)

- Aimer Group

- Triumph International (Triumph International)

- Jockey International Inc (Jockey International Inc)

- Victoria's Secret & Co (Victoria's Secret & Co)

- MAS Holdings

- Wacoal Holdings corp (Wacoal Holdings corp)

- Berkshire Hathaway

- Zivame

Key Developments in Asia-Pacific Lingerie Market Industry

- May 2022: American Eagle Outfitters announced a strategic expansion of its retail footprint in India, with plans to open approximately 50 new stores within a three-year timeframe, signaling confidence in the market's potential.

- April 2022: Wacoal, a prominent player in the lingerie industry, unveiled its highly anticipated Spring/Summer collection in Japan, showcasing innovative designs and styles for the season.

- February 2022: Caely Holdings Bhd revealed a significant joint venture in Indonesia, aimed at bolstering its production capacity and strengthening its manufacturing capabilities within the region.

Future Outlook for Asia-Pacific Lingerie Market Market

The future outlook for the Asia-Pacific lingerie market remains exceptionally bright, characterized by sustained and robust growth. This optimistic projection is underpinned by favorable demographic shifts, including a growing young population and an expanding middle class, coupled with a steady increase in disposable incomes. The continued proliferation and deepening penetration of e-commerce platforms will further democratize access to a wide array of lingerie products. Success in this dynamic market will hinge on strategic investments in cutting-edge product innovation, the genuine adoption of sustainable and ethical business practices, and the cultivation of strong, resonant brand identities. As competition intensifies, brands that demonstrate agility in adapting to evolving consumer preferences, embrace technological advancements, and effectively cater to the diverse needs across various sub-segments of the Asia-Pacific region are positioned for significant triumph.

Asia-Pacific Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Asia-Pacific Lingerie Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Lingerie Market Regional Market Share

Geographic Coverage of Asia-Pacific Lingerie Market

Asia-Pacific Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Smartwatches; Popularity of Luxury Watches

- 3.3. Market Restrains

- 3.3.1. Presence of Fake Brands in the Market

- 3.4. Market Trends

- 3.4.1. Inclination Towards Healthy Lifestyle Trends and Athleisure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hop Lun (Hong Kong) Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hanesbrands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aimer Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Triumph International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jockey International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Victoria's Secret & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAS Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wacoal Holdings corp *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berkshire Hathaway

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zivame

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hop Lun (Hong Kong) Limited

List of Figures

- Figure 1: Asia-Pacific Lingerie Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Lingerie Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Asia-Pacific Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia-Pacific Lingerie Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Asia-Pacific Lingerie Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Lingerie Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Lingerie Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Asia-Pacific Lingerie Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Asia-Pacific Lingerie Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Asia-Pacific Lingerie Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia-Pacific Lingerie Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Lingerie Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia-Pacific Lingerie Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia-Pacific Lingerie Market Volume (K Units ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Lingerie Market?

The projected CAGR is approximately 8.67%.

2. Which companies are prominent players in the Asia-Pacific Lingerie Market?

Key companies in the market include Hop Lun (Hong Kong) Limited, Hanesbrands Inc, Aimer Group, Triumph International, Jockey International Inc, Victoria's Secret & Co, MAS Holdings, Wacoal Holdings corp *List Not Exhaustive, Berkshire Hathaway, Zivame.

3. What are the main segments of the Asia-Pacific Lingerie Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Smartwatches; Popularity of Luxury Watches.

6. What are the notable trends driving market growth?

Inclination Towards Healthy Lifestyle Trends and Athleisure.

7. Are there any restraints impacting market growth?

Presence of Fake Brands in the Market.

8. Can you provide examples of recent developments in the market?

In May 2022, American Eagle Outfitters, Inc. announced the expansion of its retail presence in India through franchisees. The company aims to add another 50 stores in India over the next three years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Lingerie Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence