Key Insights

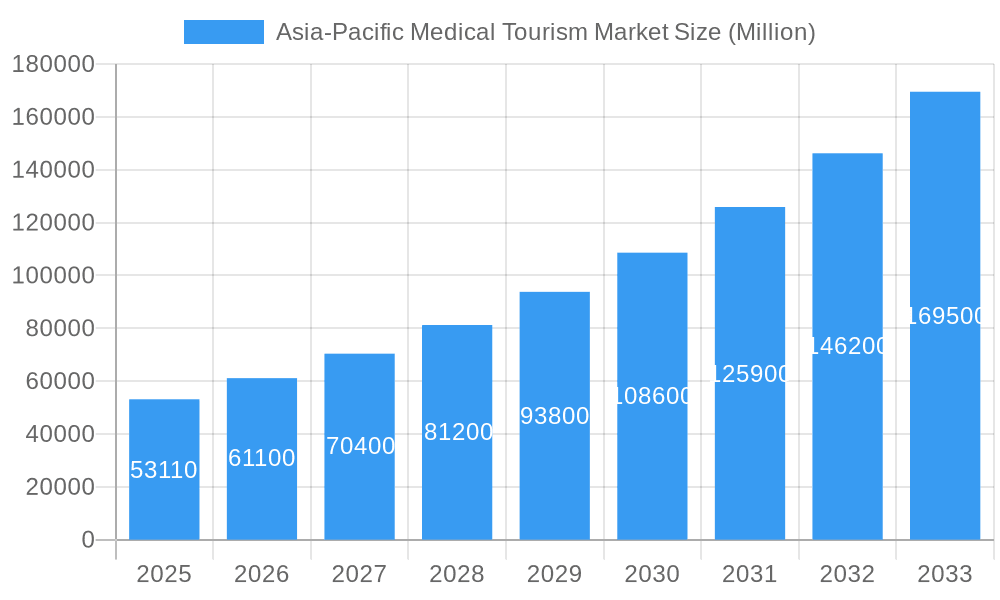

The Asia-Pacific medical tourism market is experiencing robust growth, projected to reach \$53.11 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.34% from 2025 to 2033. This surge is driven by several key factors. Firstly, the region boasts a significant number of advanced medical facilities offering high-quality care at competitive prices compared to Western nations. This price advantage is particularly attractive to patients from developed countries seeking cost-effective treatments. Secondly, increasing disposable incomes across many Asian countries are fueling demand for better healthcare, including elective procedures and specialized treatments previously inaccessible to a large segment of the population. Furthermore, improvements in regional infrastructure, including streamlined visa processes and improved connectivity, facilitate smoother travel for medical tourists. The rising prevalence of chronic diseases like cardiovascular conditions and cancer, coupled with an aging population, further boosts demand for specialized medical treatments. Finally, aggressive marketing strategies employed by hospitals and healthcare providers targeting international patients are effectively increasing awareness and attracting a wider clientele.

Asia-Pacific Medical Tourism Market Market Size (In Billion)

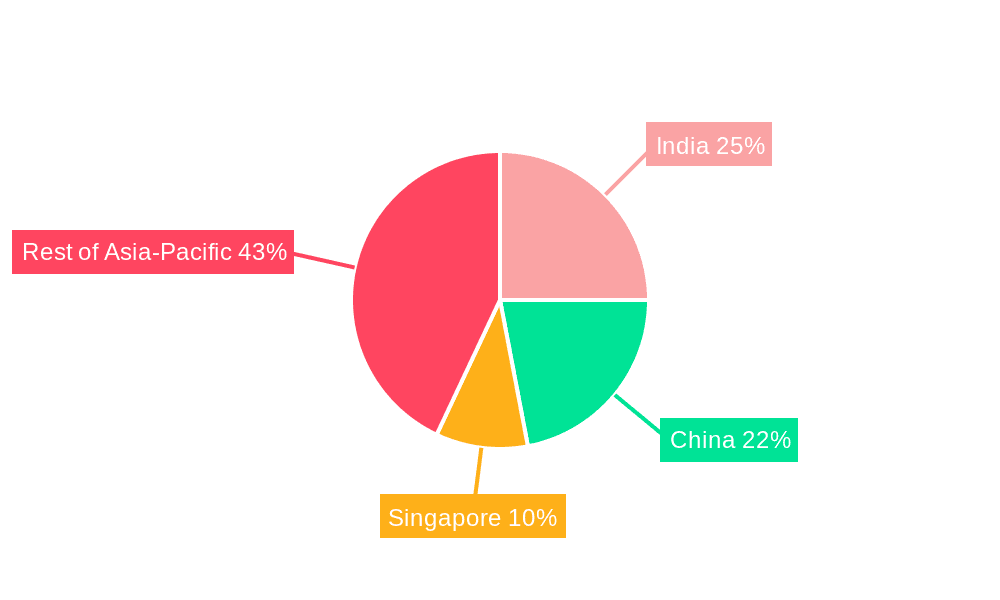

Market segmentation reveals a diverse landscape. Dental, cosmetic, and cardiovascular treatments dominate the treatment type segment, reflecting strong consumer preferences. Private service providers account for a larger share of the market compared to public facilities, indicating the significant role of the private healthcare sector in driving growth. Geographically, India, China, and Singapore are major players, contributing significantly to the overall market size. However, other countries within the region also present substantial growth opportunities, driven by factors such as investment in healthcare infrastructure and government initiatives promoting medical tourism. The competitive landscape includes a mix of established international chains and local hospitals, leading to fierce competition and driving innovation in service quality and pricing. The market’s future trajectory suggests continued expansion, driven by evolving healthcare needs, technological advancements, and government support.

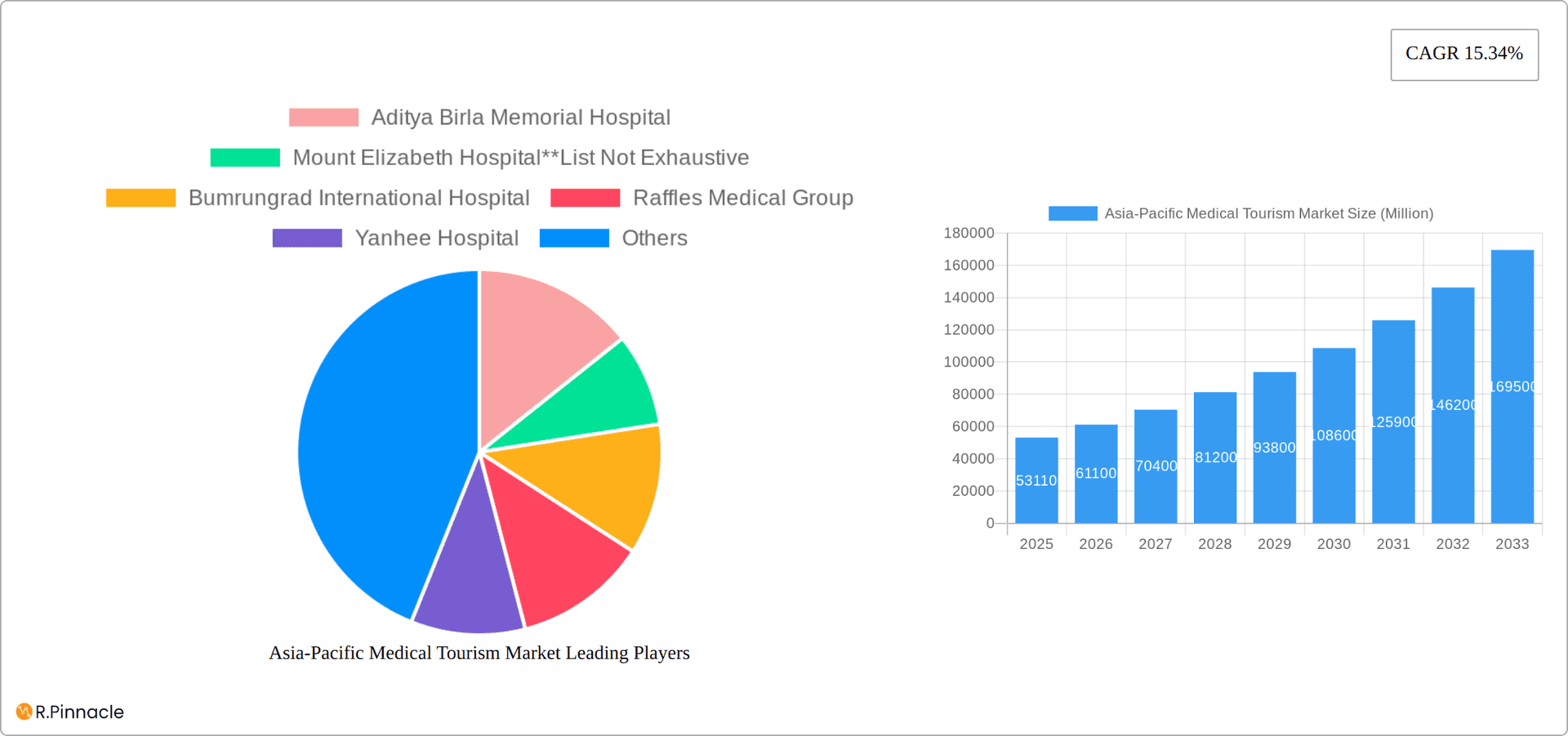

Asia-Pacific Medical Tourism Market Company Market Share

This comprehensive report provides a detailed analysis of the Asia-Pacific medical tourism market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous data analysis to illuminate current market dynamics and future growth trajectories. The market size is expected to reach xx Million by 2033, showcasing significant growth potential.

Asia-Pacific Medical Tourism Market Market Structure & Innovation Trends

The Asia-Pacific medical tourism market exhibits a moderately concentrated structure, with key players like Aditya Birla Memorial Hospital, Mount Elizabeth Hospital, Bumrungrad International Hospital, and Raffles Medical Group holding significant market share. However, the market also features numerous smaller, specialized providers, leading to a dynamic competitive landscape. Innovation is driven by advancements in medical technology, rising disposable incomes, and a growing preference for cost-effective, high-quality healthcare. Regulatory frameworks vary across countries, impacting market access and operational costs. Product substitutes, such as telemedicine and online health consultations, are emerging but haven't significantly disrupted the core medical tourism market yet. The end-user demographic is expanding, encompassing both domestic and international patients seeking specialized treatments. Mergers and acquisitions (M&A) activity is prevalent, with deal values fluctuating based on target size and strategic fit. Recent M&A activity includes Apollo Hospitals’ acquisition of a 60% stake in an Ayurveda hospital chain (October 2022), illustrating the ongoing consolidation in the sector. Market share data for key players and M&A deal values are detailed within the full report.

Asia-Pacific Medical Tourism Market Market Dynamics & Trends

The Asia-Pacific medical tourism market is charting a course of impressive expansion, propelled by a confluence of compelling factors. The escalating healthcare expenditures in developed economies continue to drive patients seeking more affordable yet high-quality alternatives abroad. Simultaneously, the burgeoning disposable incomes within emerging Asia-Pacific nations are fostering a growing demand for advanced medical treatments and procedures. This surge is further amplified by significant investments in cutting-edge medical technology and a tangible enhancement of healthcare infrastructure across numerous countries in the region. The compound annual growth rate (CAGR) is projected to be a robust **XX%** during the forecast period, reflecting this upward trajectory. Technological innovations, particularly the widespread adoption of telemedicine and the increasing prevalence of minimally invasive surgical techniques, are revolutionizing both the accessibility and the efficiency of medical tourism services. Consumer preferences are notably shifting, with a strong inclination towards personalized medicine, access to state-of-the-art treatments, and an overall elevated patient experience. The competitive landscape is dynamically shaped by strategic pricing, distinct service offerings, and the innovative development of specialized medical tourism packages tailored to diverse patient needs. Market penetration exhibits considerable variation across different treatment categories and geographical locales. This report delves into a comprehensive analysis of these evolving trends, providing quantifiable data points and insightful projections.

Dominant Regions & Segments in Asia-Pacific Medical Tourism Market

Leading Regions/Countries: India and Singapore currently hold dominant positions in the Asia-Pacific medical tourism market. India benefits from a large pool of skilled medical professionals and relatively lower costs, while Singapore leverages its advanced medical infrastructure and strong reputation for quality care. China and Indonesia are also experiencing significant growth, driven by rising affluence and improving healthcare infrastructure.

Dominant Treatment Types: The market is segmented by treatment type including Dental Treatment, Cosmetic Treatment, Cardiovascular Treatment, Orthopedic Treatment, Neurological Treatment, Cancer Treatment, Fertility Treatment, and Other Treatments. Currently, cosmetic and dental treatments account for a large portion of the market, driven by high demand and relatively shorter treatment durations. However, cardiovascular and orthopedic treatments are showing significant growth potential owing to technological advancements and an aging population.

Dominant Service Provider: The private sector dominates the Asia-Pacific medical tourism market, offering a wider range of specialized services and advanced technologies compared to the public sector.

Key Drivers:

- India: Government initiatives promoting medical tourism, a large pool of skilled medical professionals, and cost-effectiveness.

- Singapore: Advanced medical infrastructure, high-quality medical services, and a strong reputation for healthcare excellence.

- China: Rising disposable incomes, a growing middle class, and government investments in healthcare infrastructure.

- Indonesia: A large population, increasing healthcare expenditure, and government efforts to boost medical tourism.

Asia-Pacific Medical Tourism Market Product Innovations

Recent product innovations focus on minimally invasive surgical techniques, robotic surgery, advanced diagnostic tools, and personalized medicine approaches. These advancements enhance the quality of care, reduce recovery times, and improve patient outcomes, thereby strengthening the competitive advantage of providers offering such technologies. The market fit for these innovations is strong, aligning with the growing demand for superior healthcare services and shorter recovery periods.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Asia-Pacific medical tourism market to offer an in-depth understanding of its intricate structure. The segmentation is based on key parameters includingTreatment Type(encompassing Dental, Cosmetic, Cardiovascular, Orthopedic, Neurological, Cancer, Fertility, and Other specialized treatments), Service Provider(distinguishing between Public and Private healthcare facilities), and Country(with a granular focus on India, China, Indonesia, Singapore, and the Rest of the Asia-Pacific region). For each segment, the report provides detailed growth projections, current market size estimations, and an analysis of the prevailing competitive dynamics, thereby furnishing a holistic perspective on the diverse market opportunities available.

Key Drivers of Asia-Pacific Medical Tourism Market Growth

Key drivers include the increasing affordability of medical treatments in certain Asian countries, advancements in medical technology, rising disposable incomes within the region, and favorable government policies supporting medical tourism. These factors are attracting both domestic and international patients seeking cost-effective, high-quality healthcare services.

Challenges in the Asia-Pacific Medical Tourism Market Sector

Challenges include regulatory inconsistencies across countries, variations in healthcare standards, language barriers, and potential supply chain issues regarding medical equipment and supplies. These factors can impact the overall efficiency and cost-effectiveness of medical tourism operations. Furthermore, intense competition among providers necessitates continuous innovation and service differentiation to maintain a competitive edge.

Emerging Opportunities in Asia-Pacific Medical Tourism Market

The Asia-Pacific medical tourism market is ripe with emerging opportunities. Key among these is the strategic development of highly specialized medical tourism packages designed to cater to specific patient demographics and treatment needs. There is significant potential for expansion into niche treatment areas where regional expertise is particularly strong. Leveraging advanced technology, especially telemedicine, for seamless pre- and post-operative care offers a substantial advantage in patient engagement and recovery. Furthermore, forging robust relationships with international insurance providers can unlock new patient streams. The vast and largely untapped markets within the Asia-Pacific region also present significant untapped potential for strategic expansion and market penetration.

Leading Players in the Asia-Pacific Medical Tourism Market Market

- Aditya Birla Memorial Hospital

- Mount Elizabeth Hospital

- Bumrungrad International Hospital

- Raffles Medical Group

- Yanhee Hospital

- Sunway Medical Centre

- KPJ Healthcare Berhad

- Apollo Hospital Enterprise Limited

- Fortis Healthcare Limited

- Asian Heart Institute

Key Developments in Asia-Pacific Medical Tourism Market Industry

- October 2022: Apollo Hospitals made a significant strategic move by acquiring a 60% stake in an Ayurveda hospital chain. This acquisition underscores a dual focus on expanding its portfolio into complementary healthcare modalities and a strong emphasis on bolstering its digital health initiatives.

- May 2022: Fortis Healthcare announced ambitious plans to significantly expand its operational capacity by adding approximately 1,500 new beds. This strategic expansion is designed to enhance its market position and cater to the growing demand for healthcare services.

Future Outlook for Asia-Pacific Medical Tourism Market Market

The Asia-Pacific medical tourism market is confidently poised for sustained and significant expansion in the coming years. This optimistic outlook is underpinned by the relentless pace of technological advancements, the persistent rise in healthcare costs in established developed nations, and the expanding purchasing power of the growing middle-class population across the region. Strategic avenues for future growth include penetrating underserved markets, making judicious investments in cutting-edge innovative technologies, and crafting highly targeted marketing campaigns to attract a diverse international patient base. The market is anticipated to witness substantial growth, thereby creating significant and lucrative opportunities for all stakeholders involved in the industry.

Asia-Pacific Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Other Treatments

-

2. Service Provider

- 2.1. Public

- 2.2. Private

Asia-Pacific Medical Tourism Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Medical Tourism Market Regional Market Share

Geographic Coverage of Asia-Pacific Medical Tourism Market

Asia-Pacific Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Tourist Arrivals; Quality and Service Standards

- 3.3. Market Restrains

- 3.3.1. Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens

- 3.4. Market Trends

- 3.4.1 Increasing Demand for Affordable Healthcare (Oncology

- 3.4.2 Cardiovascular Diseases

- 3.4.3 and Cosmetic Surgery) is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Other Treatments

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aditya Birla Memorial Hospital

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mount Elizabeth Hospital**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bumrungrad International Hospital

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Raffles Medical Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yanhee Hospital

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunway Medical Centre

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KPJ Healthcare Berhad

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apollo Hospital Enterprise Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fortis Healthcare Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Heart Institute

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aditya Birla Memorial Hospital

List of Figures

- Figure 1: Asia-Pacific Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: Asia-Pacific Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Medical Tourism Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Medical Tourism Market?

The projected CAGR is approximately 15.34%.

2. Which companies are prominent players in the Asia-Pacific Medical Tourism Market?

Key companies in the market include Aditya Birla Memorial Hospital, Mount Elizabeth Hospital**List Not Exhaustive, Bumrungrad International Hospital, Raffles Medical Group, Yanhee Hospital, Sunway Medical Centre, KPJ Healthcare Berhad, Apollo Hospital Enterprise Limited, Fortis Healthcare Limited, Asian Heart Institute.

3. What are the main segments of the Asia-Pacific Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Tourist Arrivals; Quality and Service Standards.

6. What are the notable trends driving market growth?

Increasing Demand for Affordable Healthcare (Oncology. Cardiovascular Diseases. and Cosmetic Surgery) is Driving the Market.

7. Are there any restraints impacting market growth?

Skill Shortages and Labor Costs; Regulatory Challenges and Administrative Burdens.

8. Can you provide examples of recent developments in the market?

October 2022: Apollo Hospitals acquired a 60% stake in the Ayurveda hospital chain. Apollo Hospitals will use the primary investment to upgrade existing centers, set up new centers, strengthen enterprise platforms, and for digital health initiatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Medical Tourism Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence