Key Insights

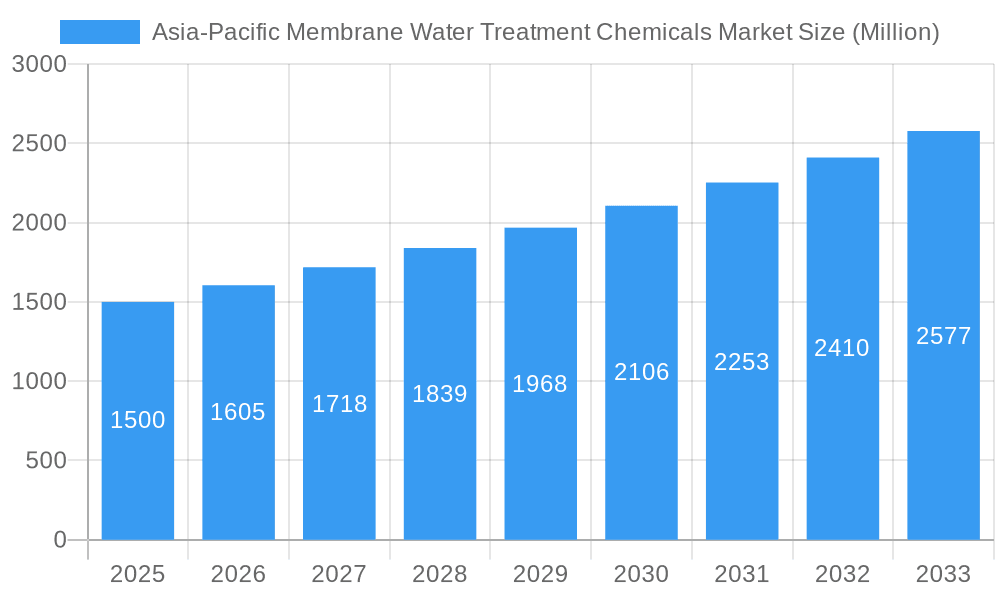

The Asia-Pacific membrane water treatment chemicals market is experiencing robust growth, driven by increasing water scarcity, stringent environmental regulations, and the rising adoption of membrane filtration technologies across various industrial and municipal applications. The market's Compound Annual Growth Rate (CAGR) exceeding 7% from 2019 to 2024 indicates a significant upward trajectory. This growth is further fueled by the expanding industrial sector in the region, particularly in countries like China, India, and Japan, where demand for efficient water treatment solutions is escalating. Furthermore, government initiatives promoting water conservation and investments in advanced water infrastructure are bolstering market expansion. The market is segmented by chemical type (e.g., cleaning agents, antiscalants, biocides), application (e.g., desalination, wastewater treatment, industrial processes), and geography. Major players like Dow, Genesys, Italmatch Chemicals, Kemira, Kurita, Solenis, Suez, and Veolia are actively participating, driving innovation and competition within the market. However, factors such as fluctuating raw material prices and potential environmental concerns related to certain chemical formulations pose challenges to sustained growth.

Asia-Pacific Membrane Water Treatment Chemicals Market Market Size (In Billion)

The forecast period (2025-2033) projects continued expansion, with the market size likely exceeding $XX million by 2033 (assuming a consistent CAGR of 7%). This projection accounts for the continued growth of industrialization, urbanization, and increasing awareness regarding water quality in the Asia-Pacific region. Furthermore, technological advancements focusing on sustainable and environmentally friendly water treatment chemicals will play a crucial role in shaping market dynamics. The competitive landscape is expected to remain dynamic, with existing players investing in research and development and new entrants seeking to capitalize on the market's potential. Strategic partnerships, mergers, and acquisitions will further influence the market structure and competitiveness throughout the forecast period.

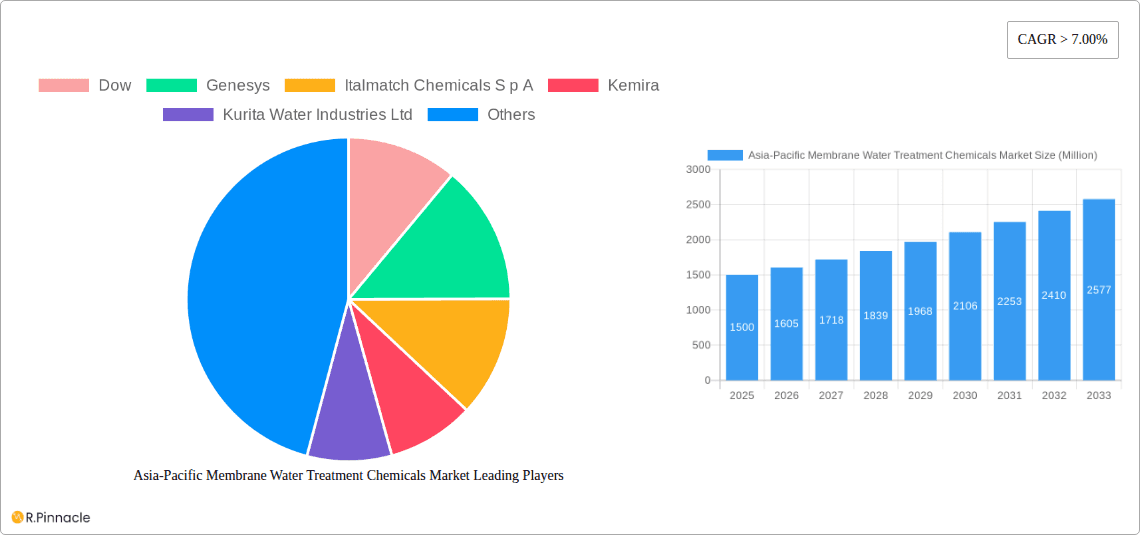

Asia-Pacific Membrane Water Treatment Chemicals Market Company Market Share

Asia-Pacific Membrane Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific membrane water treatment chemicals market, offering crucial insights for industry professionals, investors, and strategic decision-makers. The report covers market structure, dynamics, dominant regions, product innovations, and future outlook, with a detailed examination of the period from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024). Key players like Dow, Genesys, Italmatch Chemicals S.p.A, Kemira, Kurita Water Industries Ltd, Solenis, Suez, and Veolia Water Solutions and Technologies are profiled, although the list is not exhaustive. The report leverages high-ranking keywords such as "membrane water treatment," "Asia-Pacific market," "water treatment chemicals," and "market analysis" to ensure optimal search engine visibility.

Asia-Pacific Membrane Water Treatment Chemicals Market Structure & Innovation Trends

The Asia-Pacific membrane water treatment chemicals market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Dow, for example, commands an estimated xx% market share in 2025, while Kurita Water Industries Ltd holds approximately xx%. Innovation is driven by the increasing demand for sustainable and efficient water treatment solutions, coupled with stringent environmental regulations across the region. The market witnesses frequent mergers and acquisitions (M&A) activities, with deal values exceeding Million in the past five years. Key innovation drivers include the development of advanced polymer chemistries for enhanced membrane fouling control, biocide optimization for microbial management, and the introduction of eco-friendly chemicals. Product substitutes, such as physical filtration methods, are present but face limitations in terms of efficiency and cost-effectiveness. The end-user demographics comprise a wide range of industries, including municipal water treatment plants, industrial facilities, and power generation companies.

- Market Concentration: Moderately Concentrated

- Top 3 Players Market Share (2025): Dow (xx%), Kurita Water Industries Ltd (xx%), Solenis (xx%)

- M&A Activity (2020-2025): Deal Value exceeding XX Million

- Innovation Drivers: Sustainable solutions, stringent regulations, advanced polymer chemistries, eco-friendly chemicals.

Asia-Pacific Membrane Water Treatment Chemicals Market Dynamics & Trends

The Asia-Pacific membrane water treatment chemicals market is experiencing robust growth, driven by factors such as increasing industrialization, rapid urbanization, rising water scarcity, and stricter environmental regulations. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the development of advanced membrane materials and improved chemical formulations, are further accelerating market expansion. Consumer preference is shifting towards sustainable and high-performance chemicals with minimized environmental impact. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to product differentiation and pricing strategies. Market penetration is high in developed economies like Japan and Australia, while significant growth potential exists in developing nations.

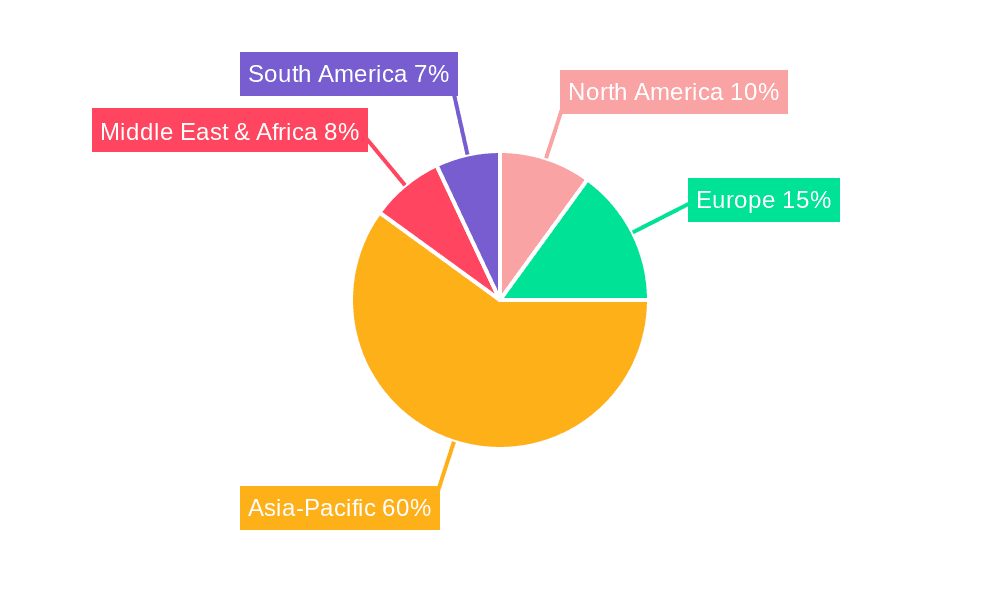

Dominant Regions & Segments in Asia-Pacific Membrane Water Treatment Chemicals Market

The Asia-Pacific membrane water treatment chemicals market is significantly shaped by the economic and industrial landscape of its key players. China continues to assert its dominance, propelled by its vast and expanding industrial sector, relentless urbanization, and substantial government-led investments in upgrading and developing water infrastructure. This robust demand for effective water management solutions fuels the consumption of various treatment chemicals.

India stands out as another crucial market with immense growth potential. The nation faces increasing water stress due to a growing population and developing industries, making water conservation and efficient treatment paramount. Supportive government initiatives aimed at improving water quality and accessibility further bolster this market's trajectory.

- Key Drivers for China: Sustained industrial expansion, rapid urbanization, substantial infrastructure development, and supportive government policies focused on environmental protection and water security are primary growth engines.

- Key Drivers for India: Addressing critical water scarcity challenges, coupled with proactive government programs for water management and recycling, and a continuous rise in industrialization, are key catalysts for market growth.

- Other Key Markets: Mature markets such as Japan, Australia, South Korea, and Singapore are characterized by advanced technological adoption and a strong emphasis on sustainable and high-performance water treatment solutions. These economies often lead in the implementation of cutting-edge membrane technologies and the associated chemical treatments.

The industrial water treatment sector emerges as the most dominant segment within the market. This dominance is largely attributed to the increasing stringency of effluent discharge regulations across the region, compelling industries to adopt advanced treatment methods for both compliance and efficient water reuse. The demand for specialized chemicals that can optimize membrane performance and longevity is therefore substantial.

Asia-Pacific Membrane Water Treatment Chemicals Market Product Innovations

Recent product innovations focus on developing highly efficient and environmentally friendly chemicals for membrane cleaning, fouling control, and disinfection. This includes the use of advanced polymer chemistries to enhance the longevity of membranes and reduce chemical consumption. These innovations offer significant competitive advantages by providing cost savings and reduced environmental impact, aligning with the industry's growing emphasis on sustainability. Market fit is strong given the increasing demand for sustainable and high-performance water treatment solutions.

Report Scope & Segmentation Analysis

This comprehensive report dissects the Asia-Pacific membrane water treatment chemicals market by meticulously analyzing key segments to provide granular insights. The market is segmented based on chemical type, encompassing critical categories such as coagulants, flocculants, disinfectants, antiscalants, and membrane cleaners. Furthermore, the analysis extends to application, differentiating between industrial water treatment, municipal water and wastewater treatment, and desalination processes. Geographical segmentation covers individual countries within the Asia-Pacific region, allowing for a detailed understanding of regional nuances.

Each of these segments exhibits distinct growth dynamics and market penetration. The industrial segment, in particular, is projected to experience the most robust growth, primarily driven by the escalating stringency of environmental regulations and the imperative for water conservation and recycling in manufacturing processes. The report provides in-depth analysis of market sizes, historical trends, and future growth projections for every segment, alongside a thorough examination of the competitive landscape.

Key Drivers of Asia-Pacific Membrane Water Treatment Chemicals Market Growth

The market’s growth is fueled by several key factors: Stringent environmental regulations mandating cleaner water discharge are driving demand for effective treatment chemicals. The burgeoning industrial sector and rapid urbanization are increasing water consumption and necessitating efficient water treatment solutions. Government initiatives promoting water conservation and infrastructure development are creating significant opportunities. Finally, the ongoing technological advancements in membrane technology and chemical formulations are enhancing treatment efficiency and sustainability.

Challenges in the Asia-Pacific Membrane Water Treatment Chemicals Market Sector

The Asia-Pacific membrane water treatment chemicals market navigates a complex terrain marked by several inherent challenges. Fluctuations in raw material prices, often influenced by global commodity markets and geopolitical factors, directly impact the production costs of these specialized chemicals, affecting profit margins for manufacturers. Supply chain disruptions, whether due to natural disasters, trade disputes, or logistical bottlenecks, can lead to shortages and delays in the availability of essential chemicals, thereby impeding project timelines and operational continuity.

The market is also characterized by intense competition. A mix of well-established global players and emerging regional manufacturers vie for market share, often leading to significant pricing pressures. Additionally, the varying regulatory landscapes across different countries within the Asia-Pacific region present a significant hurdle. Navigating diverse environmental standards, registration processes, and chemical usage guidelines can complicate market entry strategies and ongoing operations for businesses.

Emerging Opportunities in Asia-Pacific Membrane Water Treatment Chemicals Market

Emerging opportunities lie in the development of innovative, sustainable chemicals with reduced environmental impact. The increasing adoption of advanced membrane technologies presents opportunities for specialized chemicals catering to these technologies. The growing focus on water reuse and recycling creates demand for chemicals enabling efficient water recovery. Expansion into untapped markets within the Asia-Pacific region, particularly in developing economies, offers significant growth potential.

Leading Players in the Asia-Pacific Membrane Water Treatment Chemicals Market Market

The Asia-Pacific membrane water treatment chemicals market is populated by a dynamic set of global and regional leaders, each contributing to innovation and market development. The following companies are prominent players shaping the industry's future:

- Dow: A global leader in materials science, Dow offers a broad portfolio of specialty chemicals and solutions for water treatment.

- Genesys: Specializing in membrane treatment chemicals, Genesys is known for its innovative antiscalants and cleaning solutions.

- Italmatch Chemicals S.p.A: This company provides a wide range of specialty chemicals, including those for water treatment applications.

- Kemira: A global chemicals company, Kemira is a key supplier of solutions for water-intensive industries.

- Kurita Water Industries Ltd: A prominent Japanese company, Kurita offers comprehensive water treatment solutions, including chemicals and services.

- Solenis: Solenis is a leading global producer of specialty chemicals for water-intensive industries, with a strong focus on paper and water treatment.

- Suez: Though broadly a water management company, Suez's chemical divisions play a significant role in membrane treatment solutions.

- Veolia Water Solutions and Technologies: A major player in water and wastewater treatment, Veolia offers integrated solutions, including chemical treatments for membranes.

- List Not Exhaustive: This list represents key industry participants; the market features numerous other innovative companies and regional specialists.

Key Developments in Asia-Pacific Membrane Water Treatment Chemicals Market Industry

The Asia-Pacific membrane water treatment chemicals market is a dynamic sector characterized by continuous innovation and strategic growth initiatives. Key developments underscore the industry's commitment to sustainability, technological advancement, and market expansion:

- January 2023: Demonstrating a commitment to environmental responsibility, Dow unveiled a new generation of sustainable membrane cleaning agents designed to reduce environmental impact while maintaining high efficacy.

- June 2022: In a move to bolster its service offerings and technological capabilities, Kurita Water Industries Ltd successfully acquired a smaller, specialized chemical company with expertise in advanced membrane cleaning solutions, further strengthening its market position.

- September 2021: To drive innovation in membrane performance, Solenis initiated a strategic partnership with a leading research institution. This collaboration aims to develop novel polymer chemistries specifically engineered for enhanced membrane fouling control, promising extended membrane life and improved operational efficiency.

- Further developments to be detailed in the full report.: The full report will delve into additional recent advancements, including new product launches, strategic alliances, capacity expansions, and significant research breakthroughs that are shaping the future trajectory of the Asia-Pacific membrane water treatment chemicals market.

Future Outlook for Asia-Pacific Membrane Water Treatment Chemicals Market Market

The Asia-Pacific membrane water treatment chemicals market is poised for continued robust growth, driven by persistent water scarcity, stringent environmental regulations, and technological advancements. Strategic opportunities exist for companies focusing on sustainable solutions, innovative product development, and expansion into emerging markets. The market is expected to witness increased consolidation through mergers and acquisitions, leading to a more concentrated landscape. The focus on sustainability and circular economy principles will shape future market trends.

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Types

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Asia-Pacific Membrane Water Treatment Chemicals Market

Asia-Pacific Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.4. Market Trends

- 3.4.1. Food & Beverage Processing Industry to Account for the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. China Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. India Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Japan Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Pre-treatment

- 9.1.2. Biological Controllers

- 9.1.3. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage Processing

- 9.2.2. Healthcare

- 9.2.3. Municipal

- 9.2.4. Chemicals

- 9.2.5. Power

- 9.2.6. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Pre-treatment

- 10.1.2. Biological Controllers

- 10.1.3. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage Processing

- 10.2.2. Healthcare

- 10.2.3. Municipal

- 10.2.4. Chemicals

- 10.2.5. Power

- 10.2.6. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Pre-treatment

- 11.1.2. Biological Controllers

- 11.1.3. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Food & Beverage Processing

- 11.2.2. Healthcare

- 11.2.3. Municipal

- 11.2.4. Chemicals

- 11.2.5. Power

- 11.2.6. Other End-user Industries

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Genesys

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Italmatch Chemicals S p A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kemira

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kurita Water Industries Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Solenis

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Suez

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Veolia Water Solutions and Technologies*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 35: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 26: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Asia-Pacific Membrane Water Treatment Chemicals Market?

Key companies in the market include Dow, Genesys, Italmatch Chemicals S p A, Kemira, Kurita Water Industries Ltd, Solenis, Suez, Veolia Water Solutions and Technologies*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

6. What are the notable trends driving market growth?

Food & Beverage Processing Industry to Account for the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence