Key Insights

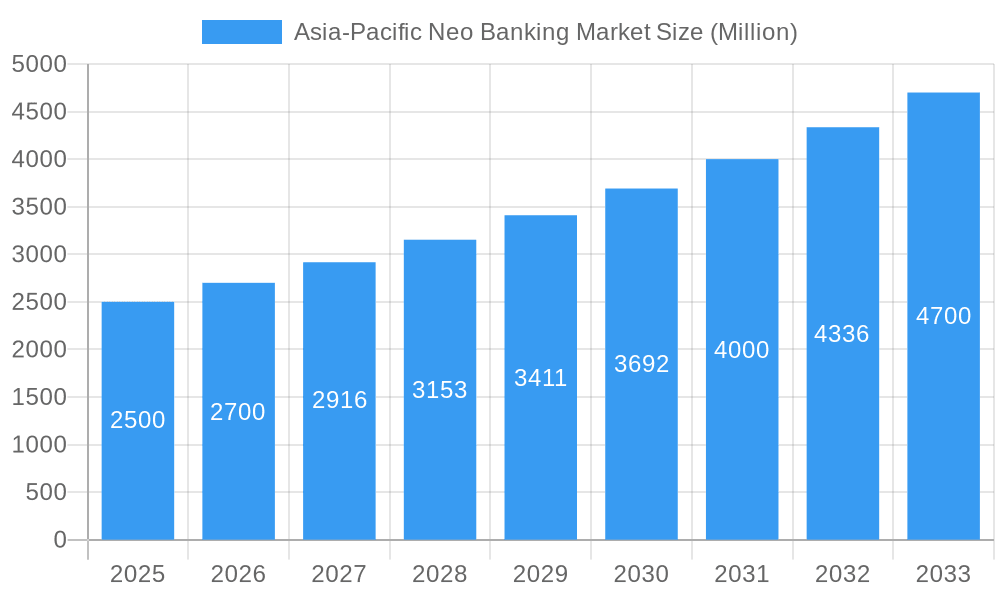

The Asia-Pacific neo-banking market is poised for significant expansion, fueled by a rapidly advancing digital economy and a young, digitally native demographic embracing mobile-first financial solutions. With an estimated CAGR of 47%, the market is projected for robust growth through 2033. Key growth catalysts include increasing smartphone adoption, enhanced internet connectivity, and widespread financial inclusion efforts targeting unbanked and underbanked populations. Neo-banks attract customers with their intuitive interfaces, tailored services, and competitive fee structures compared to conventional banks. The integration of advanced technologies such as AI and blockchain is further bolstering security and operational efficiency within the neo-banking ecosystem. Intense competition from established players and emerging fintech innovators drives market dynamism.

Asia-Pacific Neo Banking Market Market Size (In Billion)

Despite regulatory complexities, data security concerns, and the ongoing effort to build trust with traditionally-minded consumers, the long-term outlook for the Asia-Pacific neo-banking sector remains exceptionally strong. The region's pervasive digital transformation, combined with a growing demand for convenient and accessible financial services, ensures sustained market momentum. A burgeoning middle class and widespread adoption of mobile payments are substantial drivers of this positive trajectory. Strategic alliances between neo-banks and traditional financial institutions can also accelerate market penetration. Based on the projected CAGR and the competitive landscape, the market size is estimated to reach 261.4 billion by 2025, with continued substantial growth anticipated. In-depth analysis of individual company performance within this period is vital for understanding market evolution and forecasting future trends.

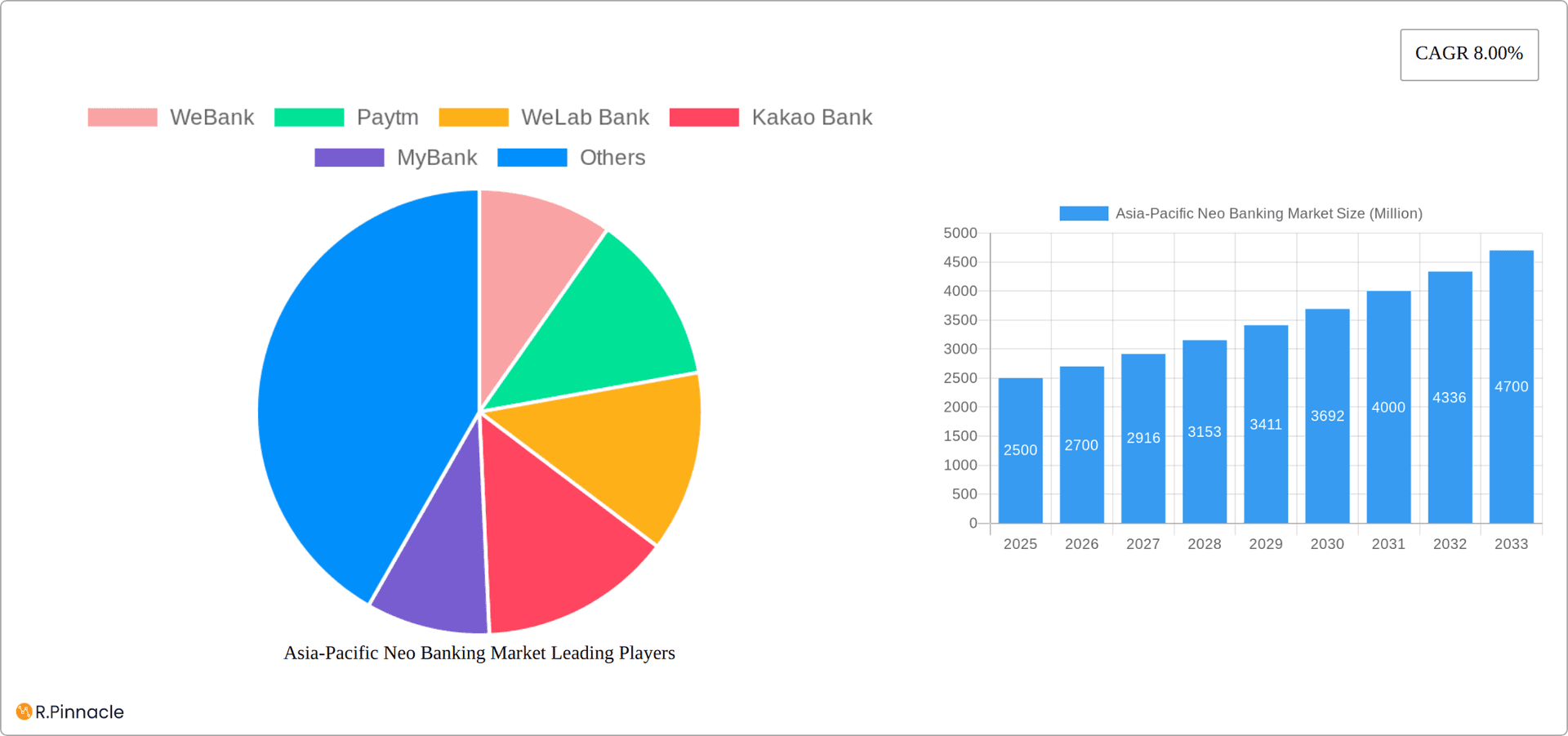

Asia-Pacific Neo Banking Market Company Market Share

Asia-Pacific Neo Banking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific neo banking market, offering valuable insights for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to deliver actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. Key players like WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto.com, Toss Bank, InstantPay, and Kyash (list not exhaustive) are profiled, showcasing their strategies and market positions. The report is structured to provide clear, concise information, allowing for efficient understanding and strategic decision-making.

Asia-Pacific Neo Banking Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory frameworks shaping the Asia-Pacific neo banking market. The market is characterized by a dynamic interplay of established players and emerging fintech startups. Market concentration is moderate, with a few dominant players holding significant market share (xx%), while numerous smaller players compete for niche segments. Innovation is driven by advancements in mobile technology, AI, and big data analytics, leading to the development of personalized financial products and services. Regulatory frameworks vary across countries, impacting market entry and operations. Mergers and acquisitions (M&A) activity has been significant (xx Million in deal value in 2024), with larger players consolidating their positions and acquiring smaller fintech companies to expand their product offerings and market reach. End-user demographics are diverse, encompassing a broad spectrum of age groups, income levels, and technological proficiency. The report delves into these aspects, providing a detailed analysis of market dynamics and trends.

- Market Concentration: Moderate, with xx% market share held by top players.

- Innovation Drivers: Mobile technology, AI, big data analytics.

- Regulatory Frameworks: Vary across countries, influencing market entry and operations.

- M&A Activity: Significant, with xx Million in deal value in 2024. Deals focus on expanding product offerings and market reach.

- End-User Demographics: Diverse, encompassing a wide range of age groups, income levels, and tech proficiency.

Asia-Pacific Neo Banking Market Market Dynamics & Trends

The Asia-Pacific neo banking market is experiencing a period of accelerated expansion, fueled by a confluence of transformative forces. Digitalization is at the forefront, with advancements in mobile banking platforms, sophisticated AI-driven financial advisory tools, and seamless user interfaces profoundly reshaping customer engagement and accessibility. A discernible shift in consumer behavior is evident, with a growing preference for digital-first banking experiences that prioritize convenience, hyper-personalization, and instant gratification. The competitive landscape is exceptionally dynamic, characterized by a fierce rivalry between agile neo banks and incumbent financial institutions, all striving to capture market share through pioneering product development and strategic ecosystem partnerships. The compound annual growth rate (CAGR) for this vibrant market is projected to be a robust XX% during the forecast period of 2025-2033, with market penetration anticipated to reach an impressive XX% by the year 2033. Further impetus for this growth is derived from escalating smartphone penetration across the region, a burgeoning digitally literate populace, and an increasingly supportive regulatory environment actively championing financial inclusion initiatives.

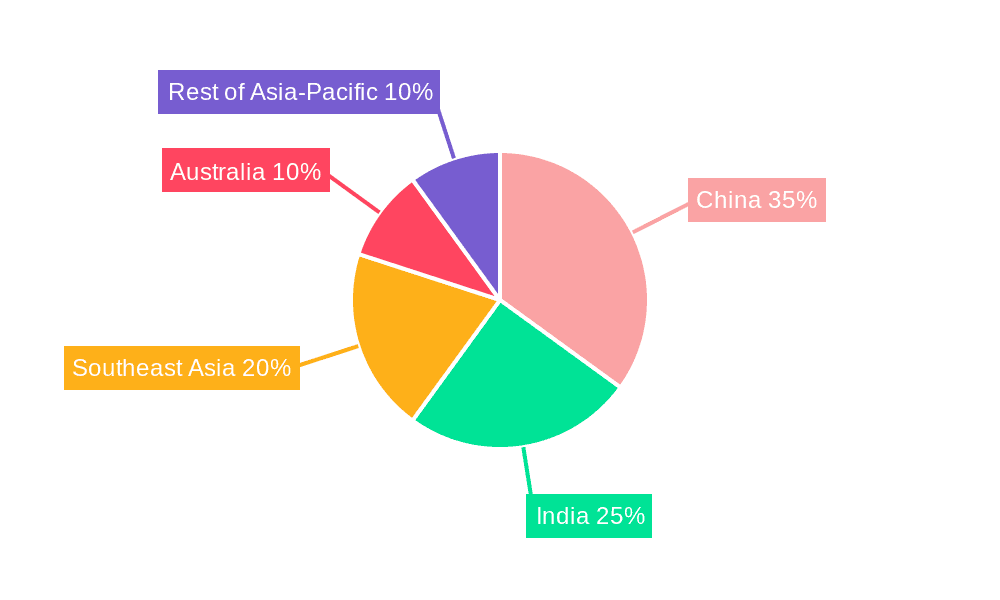

Dominant Regions & Segments in Asia-Pacific Neo Banking Market

Currently, the Asia-Pacific neo banking market is significantly influenced by the powerhouse economies of China and India. This regional dominance is underpinned by a synergistic combination of factors:

- China: A vast and expanding middle-class demographic, coupled with exceptionally high smartphone adoption rates and a conducive regulatory framework, has propelled China to the forefront.

- India: The sheer scale of its population, coupled with rapidly increasing digital adoption and proactive government initiatives aimed at democratizing financial services, makes India a critical growth engine.

While China and India lead the charge, other key markets such as South Korea, Singapore, and Australia are also witnessing substantial, albeit more moderate, growth trajectories. A deep dive into market segmentation reveals robust expansion within critical product categories, including advanced personal finance management tools, innovative lending solutions, and sophisticated investment platforms. This report offers a comprehensive geographical assessment, providing granular insights into the market's spatial distribution and the diverse preferences of its evolving customer base.

Asia-Pacific Neo Banking Market Product Innovations

The Asia-Pacific neo banking market is witnessing rapid product innovation, driven by technological advancements and changing customer needs. New products and services are leveraging AI-powered personalization, advanced analytics, and seamless integration with other financial and lifestyle apps. This focus on user experience, coupled with the availability of open APIs, results in a highly competitive market, where innovation is crucial for success. Neo banks are increasingly offering specialized services catering to specific demographic or financial needs, differentiating themselves from traditional banks and fostering higher market penetration.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Asia-Pacific neo banking market across a multi-faceted spectrum, encompassing geographical regions, diverse product types, distinct customer segments, and varied business models. Each segment undergoes rigorous analysis, yielding precise market size estimations, forward-looking growth projections, and a detailed examination of prevailing competitive dynamics. The analysis acknowledges and integrates the unique attributes of each segment and the pivotal factors steering their respective growth trajectories. For instance, the personal finance management segment is poised for exceptional growth, driven by the widespread adoption of intuitive budgeting applications and sophisticated investment management tools.

Key Drivers of Asia-Pacific Neo Banking Market Growth

Several factors contribute to the growth of the Asia-Pacific neo banking market:

- Technological Advancements: Mobile banking, AI, big data analytics improve customer experience and efficiency.

- Changing Consumer Preferences: Demand for digital-first solutions that offer convenience and personalization.

- Government Initiatives: Policies supporting financial inclusion and digital transformation.

Challenges in the Asia-Pacific Neo Banking Market Sector

Notwithstanding the abundant growth prospects, the Asia-Pacific neo banking market navigates a landscape replete with inherent challenges. Stringent and evolving regulatory frameworks in select nations can present significant hurdles to market entry and operational fluidity. The ever-present threat of sophisticated cyberattacks and the paramount importance of data privacy necessitate the implementation of robust, state-of-the-art security infrastructure and unwavering adherence to compliance mandates. The intensely competitive environment, marked by the presence of both established incumbents and agile disruptors, compels a continuous cycle of innovation and strategic differentiation to maintain a competitive edge. These multifaceted challenges simultaneously present significant risks and compelling opportunities for market participants operating within this dynamic ecosystem.

Emerging Opportunities in Asia-Pacific Neo Banking Market

The Asia-Pacific neo banking market is a fertile ground for a multitude of emerging opportunities:

- Inclusion of Underserved Populations: A significant opportunity lies in extending financial services to the unbanked and underbanked communities, particularly in remote and rural areas, thereby fostering greater financial inclusion.

- Leveraging Cutting-Edge Technologies: The integration of transformative technologies such as blockchain for enhanced security and transparency, open banking APIs for seamless data sharing, and embedded finance for contextual financial services holds immense potential for market expansion and innovation.

- Strategic Partnerships and Collaborations: Forging synergistic alliances with innovative fintech startups and established traditional banks can unlock new growth avenues, accelerate product development, and expand market reach through shared expertise and customer bases.

Leading Players in the Asia-Pacific Neo Banking Market Market

- WeBank

- Paytm

- WeLab Bank

- Kakao Bank

- MyBank

- Douugh

- Crypto.com

- Toss Bank

- InstantPay

- Kyash

Key Developments in Asia-Pacific Neo Banking Market Industry

- April 2022: WeLab Bank becomes the first virtual bank in Hong Kong to offer digital wealth advisory services, launching GoWealth.

- December 2021: Kakao Bank signs an MOU with Kyobo Life Insurance, Kyobo Bookstore, and Kyobo Securities for data cooperation and partnerships.

Future Outlook for Asia-Pacific Neo Banking Market Market

The Asia-Pacific neo banking market is poised for continued strong growth, driven by technological innovation, increasing digital adoption, and favorable regulatory environments. Strategic partnerships, expansion into underserved markets, and the adoption of emerging technologies will play crucial roles in shaping the future of the market. The market's potential for disruption and innovation remains significant, offering considerable opportunities for both established players and new entrants.

Asia-Pacific Neo Banking Market Segmentation

-

1. Account Type

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments and Tranfer

- 2.3. Loans

- 2.4. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Australia

- 4.4. Singapore

- 4.5. Hongkong

- 4.6. Rest of Asia-Pacific

Asia-Pacific Neo Banking Market Segmentation By Geography

- 1. China

- 2. India

- 3. Australia

- 4. Singapore

- 5. Hongkong

- 6. Rest of Asia Pacific

Asia-Pacific Neo Banking Market Regional Market Share

Geographic Coverage of Asia-Pacific Neo Banking Market

Asia-Pacific Neo Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Number of Customers for Neo Banking is Raising Significantly in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments and Tranfer

- 5.2.3. Loans

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Australia

- 5.4.4. Singapore

- 5.4.5. Hongkong

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Australia

- 5.5.4. Singapore

- 5.5.5. Hongkong

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Account Type

- 6. China Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 6.1.1. Business Account

- 6.1.2. Saving Account

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Mobile Banking

- 6.2.2. Payments and Tranfer

- 6.2.3. Loans

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Enterprise

- 6.3.2. Personal

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Australia

- 6.4.4. Singapore

- 6.4.5. Hongkong

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Account Type

- 7. India Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 7.1.1. Business Account

- 7.1.2. Saving Account

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Mobile Banking

- 7.2.2. Payments and Tranfer

- 7.2.3. Loans

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Enterprise

- 7.3.2. Personal

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Australia

- 7.4.4. Singapore

- 7.4.5. Hongkong

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Account Type

- 8. Australia Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 8.1.1. Business Account

- 8.1.2. Saving Account

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Mobile Banking

- 8.2.2. Payments and Tranfer

- 8.2.3. Loans

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Enterprise

- 8.3.2. Personal

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Australia

- 8.4.4. Singapore

- 8.4.5. Hongkong

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Account Type

- 9. Singapore Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 9.1.1. Business Account

- 9.1.2. Saving Account

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Mobile Banking

- 9.2.2. Payments and Tranfer

- 9.2.3. Loans

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Enterprise

- 9.3.2. Personal

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Australia

- 9.4.4. Singapore

- 9.4.5. Hongkong

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Account Type

- 10. Hongkong Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 10.1.1. Business Account

- 10.1.2. Saving Account

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Mobile Banking

- 10.2.2. Payments and Tranfer

- 10.2.3. Loans

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Enterprise

- 10.3.2. Personal

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Australia

- 10.4.4. Singapore

- 10.4.5. Hongkong

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Account Type

- 11. Rest of Asia Pacific Asia-Pacific Neo Banking Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 11.1.1. Business Account

- 11.1.2. Saving Account

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Mobile Banking

- 11.2.2. Payments and Tranfer

- 11.2.3. Loans

- 11.2.4. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Enterprise

- 11.3.2. Personal

- 11.3.3. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Australia

- 11.4.4. Singapore

- 11.4.5. Hongkong

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Account Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 WeBank

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Paytm

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 WeLab Bank

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kakao Bank

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MyBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Douugh

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Crypto com

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toss Bank

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 InstantPay

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kyash**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 WeBank

List of Figures

- Figure 1: Global Asia-Pacific Neo Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 3: China Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 4: China Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 5: China Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: China Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 7: China Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: China Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: China Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 11: China Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: India Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 13: India Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 14: India Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 15: India Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: India Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 17: India Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: India Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: India Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: India Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: India Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 23: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 24: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 25: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 26: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Australia Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Australia Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 33: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 34: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 35: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 36: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Singapore Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Singapore Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 43: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 44: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 45: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 46: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 47: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 49: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Hongkong Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Hongkong Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Account Type 2025 & 2033

- Figure 53: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Account Type 2025 & 2033

- Figure 54: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Service 2025 & 2033

- Figure 55: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Service 2025 & 2033

- Figure 56: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Application 2025 & 2033

- Figure 57: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Geography 2025 & 2033

- Figure 59: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Geography 2025 & 2033

- Figure 60: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific Asia-Pacific Neo Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 2: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 3: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 7: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 12: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 13: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 17: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 22: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 23: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 27: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 28: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Account Type 2020 & 2033

- Table 32: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Service 2020 & 2033

- Table 33: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Neo Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Neo Banking Market?

The projected CAGR is approximately 47%.

2. Which companies are prominent players in the Asia-Pacific Neo Banking Market?

Key companies in the market include WeBank, Paytm, WeLab Bank, Kakao Bank, MyBank, Douugh, Crypto com, Toss Bank, InstantPay, Kyash**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Neo Banking Market?

The market segments include Account Type, Service, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 261.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Number of Customers for Neo Banking is Raising Significantly in the Region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, WeLab Bank has become the first virtual bank in Hong Kong to be granted permission to provide digital wealth advising services. The Bank soft-launched its intelligent wealth solution GoWealth Digital Wealth Advisory (GoWealth) for selected customers after receiving Type 1 (Dealing in securities) and Type 4 (Advising on securities) licenses from the Hong Kong Securities and Futures Commission (HKSFC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Neo Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Neo Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Neo Banking Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Neo Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence