Key Insights

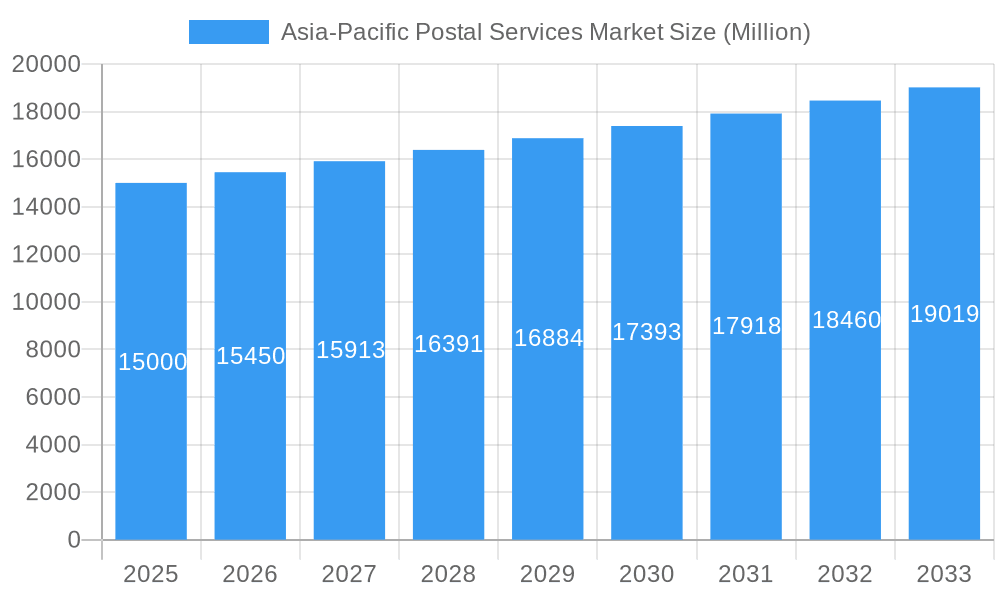

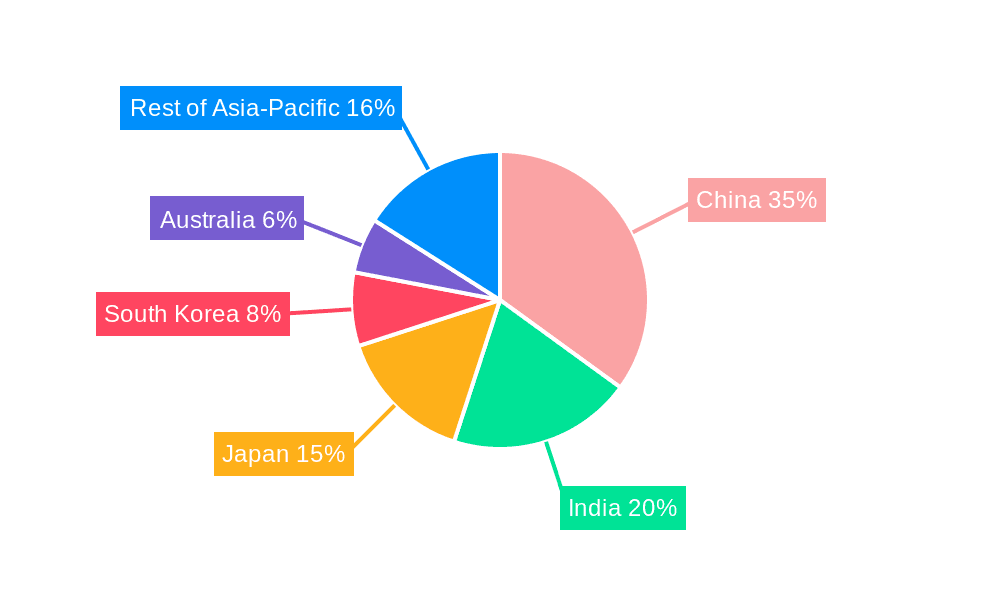

The Asia-Pacific Postal Services Market is poised for significant expansion, driven by the booming e-commerce sector and escalating cross-border trade. Valued at approximately $172.37 billion in the base year 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2025 to 2033. Key growth catalysts include a rising middle class fueling consumer spending and parcel volumes. The proliferation of mobile commerce and digital platforms is further intensifying the demand for efficient and reliable postal, particularly express, services. Government-led digitalization and infrastructure development initiatives across the region also contribute to this upward trajectory. Despite robust competition from private courier firms, the inherent strengths of postal services lie in their established networks and extensive reach, especially in rural areas. The market is segmented by service type (express vs. standard), item type (parcels vs. letters), and destination (domestic vs. international). Express postal services and parcel deliveries are exhibiting faster growth than their standard counterparts and letter volumes, respectively. International deliveries hold substantial potential due to increasing globalization and e-commerce expansion. China, India, and Japan are the leading national markets, significantly impacting overall market growth.

Asia-Pacific Postal Services Market Market Size (In Billion)

Market segmentation analysis reveals distinct regional variations and growth opportunities. While China and India are dominant players, countries such as South Korea, Singapore, Australia, and New Zealand present considerable growth potential, supported by advanced e-commerce infrastructure and high per capita incomes. The market features a competitive landscape with both national postal operators and international logistics providers. Key challenges involve balancing service quality and affordability, particularly in areas with underdeveloped infrastructure. Strategic collaborations and technological integration are vital for postal service providers to secure market share and meet the dynamic demands of the e-commerce era. The forecast period (2025-2033) indicates sustained market expansion, with ample opportunities in both mature and emerging economies.

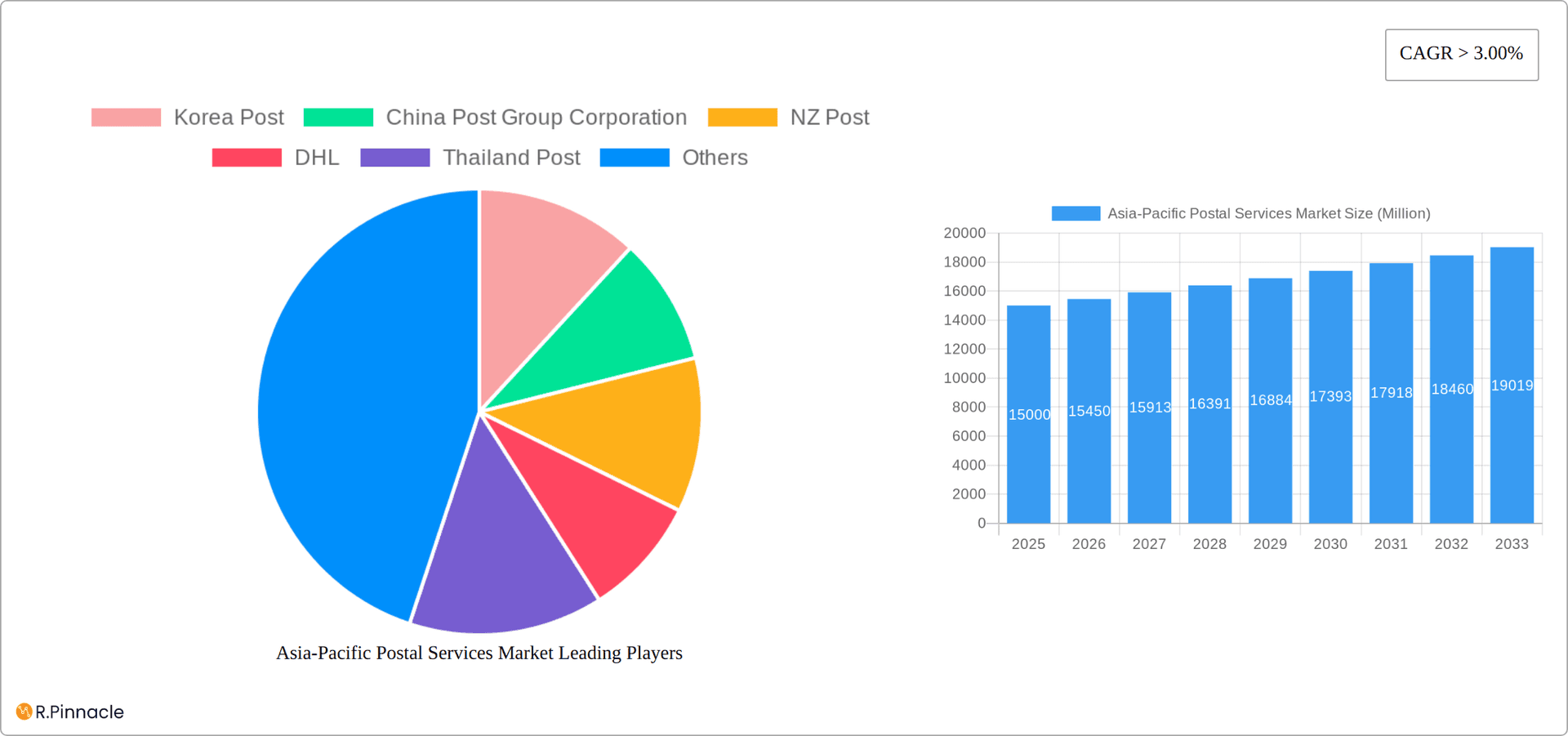

Asia-Pacific Postal Services Market Company Market Share

Asia-Pacific Postal Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific postal services market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future trends, empowering informed decision-making. The market is segmented by type (Express Postal Services, Standard Postal Services), item (Letter, Parcel), destination (Domestic, International), and country (India, China, Japan, Singapore, South Korea, Australia, New Zealand, Rest of Asia-Pacific). Key players analyzed include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, and Pos Indonesia.

Asia-Pacific Postal Services Market Structure & Innovation Trends

The Asia-Pacific postal services market exhibits a complex structure characterized by a mix of state-owned enterprises and private players. Market concentration varies significantly across countries, with some dominated by national postal services and others featuring a more competitive landscape with significant private sector participation. Innovation is driven by the need to enhance efficiency, improve last-mile delivery, and meet the growing demand for e-commerce logistics. Regulatory frameworks differ across the region, influencing pricing, competition, and service quality. Substitute services, such as private couriers and digital communication platforms, exert competitive pressure. End-user demographics are crucial, with a growing middle class and rising e-commerce penetration driving demand for faster and more reliable postal services. M&A activity has been relatively limited, with a few notable exceptions, focusing on expanding market reach or enhancing technological capabilities. Estimated M&A deal values in the last 5 years totaled approximately xx Million. Market share is highly fragmented, with the top 5 players collectively holding approximately xx% of the market.

- Market Concentration: Highly fragmented, varying by country.

- Innovation Drivers: E-commerce growth, technological advancements, efficiency improvements.

- Regulatory Frameworks: Diverse across countries, impacting competition and pricing.

- Product Substitutes: Private couriers, digital communication channels.

- End-User Demographics: Rising middle class, increasing e-commerce penetration.

- M&A Activity: Limited, focused on expansion and technological enhancement.

Asia-Pacific Postal Services Market Dynamics & Trends

The Asia-Pacific postal services market is experiencing robust growth, driven by factors such as the expansion of e-commerce, increasing urbanization, and rising disposable incomes. The CAGR during the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, including the adoption of automation, big data analytics, and drone delivery, are transforming operational efficiency and customer experience. Consumer preferences are shifting towards faster, more reliable, and trackable delivery services. Intense competition among established players and new entrants necessitates continuous innovation and strategic partnerships. Market penetration of express postal services is increasing steadily, while standard postal services face challenges due to competition from alternative communication methods. The overall market size is projected to reach xx Million by 2033.

Dominant Regions & Segments in Asia-Pacific Postal Services Market

China and India are the dominant regions in the Asia-Pacific postal services market due to their large populations and rapid economic growth. The express postal services segment is experiencing faster growth than standard postal services, driven by the e-commerce boom. Parcels represent the most significant item category, reflecting the shift towards online shopping. International postal services are growing at a faster pace compared to domestic services, fuelled by increased cross-border trade and consumer demand for global products.

- Key Drivers for China: Strong e-commerce growth, extensive logistics infrastructure, government support.

- Key Drivers for India: Rapid economic expansion, large and growing population, rising disposable incomes.

- Express Postal Services: Fueled by e-commerce growth and demand for faster delivery.

- Parcel Segment: Dominated by e-commerce and online shopping.

- International Segment: Driven by increased cross-border trade and globalization.

Asia-Pacific Postal Services Market Product Innovations

Recent innovations focus on enhancing delivery speed, improving tracking capabilities, and incorporating sustainable practices. This includes the implementation of automated sorting systems, the use of data analytics for route optimization, and the adoption of eco-friendly packaging materials. The integration of mobile apps and digital platforms is enhancing customer experience and providing greater transparency. These innovations contribute to a more efficient and customer-centric postal services landscape.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific postal services market, segmented by several key parameters to offer a granular understanding of market dynamics. The segmentation includes service type (Express and Standard), item type (Letters and Parcels), delivery destination (Domestic and International), and key countries within the region (India, China, Japan, Singapore, South Korea, Australia, New Zealand, and the Rest of Asia-Pacific). Each segment is thoroughly examined, providing detailed insights into growth projections, market size estimations, and competitive landscapes. For example, the Express Postal Services segment is poised for robust growth, outpacing Standard Postal Services due to the exponential rise of e-commerce. The Parcel segment currently holds the largest market share and is expected to maintain its dominant position, fueled by continuous expansion in online retail. The report further analyzes the interplay between these segments and their contribution to the overall market value.

Key Drivers of Asia-Pacific Postal Services Market Growth

The robust growth of the Asia-Pacific postal services market is propelled by several interconnected factors. The rapid expansion of e-commerce is a primary catalyst, creating a surge in demand for reliable and efficient delivery solutions. This is further amplified by strong economic growth across the region, leading to increased consumer spending and higher utilization of postal services. Government initiatives focused on infrastructure development, including investments in modernizing postal networks, significantly enhance operational efficiency and expand service reach. Simultaneously, technological advancements, such as automation, data analytics, and sophisticated tracking systems, streamline operations and improve overall service quality.

Challenges in the Asia-Pacific Postal Services Market Sector

The Asia-Pacific postal services market faces several challenges, including increasing competition from private courier companies, infrastructure limitations in certain regions, and the need to adapt to evolving consumer expectations. Regulatory hurdles and varying levels of digitalization across countries also pose obstacles. Furthermore, fluctuations in global trade and economic downturns can negatively impact demand for postal services. These factors necessitate strategic adaptations by postal operators to maintain their competitiveness.

Emerging Opportunities in Asia-Pacific Postal Services Market

Significant opportunities exist for growth and innovation within the Asia-Pacific postal services market. Expanding services into underserved rural areas presents a considerable potential market. The adoption of innovative last-mile delivery solutions, including the utilization of drones and autonomous vehicles, offers improved efficiency and cost-effectiveness. The integration of fintech solutions enables seamless digital payments, enhancing customer convenience. The increasing focus on environmental sustainability is driving the development of green logistics solutions, reducing the carbon footprint of postal operations. Furthermore, the demand for personalized and customized services is on the rise, presenting opportunities for value-added offerings. The application of big data and AI provides significant potential for optimizing operations, enhancing customer experience, and improving predictive analytics for better resource allocation.

Leading Players in the Asia-Pacific Postal Services Market Market

- Korea Post

- China Post Group Corporation

- NZ Post

- DHL

- Thailand Post

- Australian Postal Corporation

- Hongkong Post

- FedEx

- India Post

- Singapore Post Limited

- Japan Post Co Ltd

- DTDC EXPRESS LTD

- Pos Malaysia Berhad

- Pos Indonesia

Key Developments in Asia-Pacific Postal Services Market Industry

- September 2022: The Australian Government and Australia Post launched a Pacific Postal Development Partnership, receiving a USD 450,000 contribution to enhance postal services across the Pacific region. This initiative is expected to significantly improve regional connectivity and service quality, fostering economic development in the participating nations.

- July 2022: China's postal sector announced a significant commitment to a green transformation initiative. The plan includes ambitious targets to recycle 700 million corrugated boxes and utilize 10 million recyclable boxes annually, contributing to a substantial reduction in the environmental impact of postal operations.

- [Add more recent key developments here with dates and brief descriptions. This section should be kept up-to-date.]

Future Outlook for Asia-Pacific Postal Services Market Market

The Asia-Pacific postal services market is poised for continued growth, driven by the sustained expansion of e-commerce, increasing urbanization, and rising disposable incomes. Strategic investments in technology and infrastructure, along with innovative service offerings, will be crucial for maintaining competitiveness and capturing market share. The focus on sustainability and efficient last-mile delivery will shape future market dynamics, creating significant opportunities for players who can adapt to these evolving demands.

Asia-Pacific Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Asia-Pacific Postal Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Postal Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Postal Services Market

Asia-Pacific Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Liberalization Affecting the Market Share of Designated Operators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NZ Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thailand Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Australian Postal Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 India Post

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Post Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Japan Post Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC EXPRESS LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pos Malaysia Berhad

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pos Indonesia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Korea Post

List of Figures

- Figure 1: Asia-Pacific Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia-Pacific Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Asia-Pacific Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Postal Services Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Postal Services Market?

Key companies in the market include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post**List Not Exhaustive, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, Pos Indonesia.

3. What are the main segments of the Asia-Pacific Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Liberalization Affecting the Market Share of Designated Operators.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Australian Government and Australia Post announced a new Pacific Postal Development Partnership to strengthen postal services in the Pacific by signing a joint declaration with the Universal Postal Union (UPU) and Asian-Pacific Postal Union (APPU) to improve the efficiency and security of postal services between Australia and Pacific island countries, benefiting consumers and businesses. To support the three-year partnership, the government has provided Australia Post with a USD 450,000 contribution to target improvements to postal systems, processes, technology, and training in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Postal Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence