Key Insights

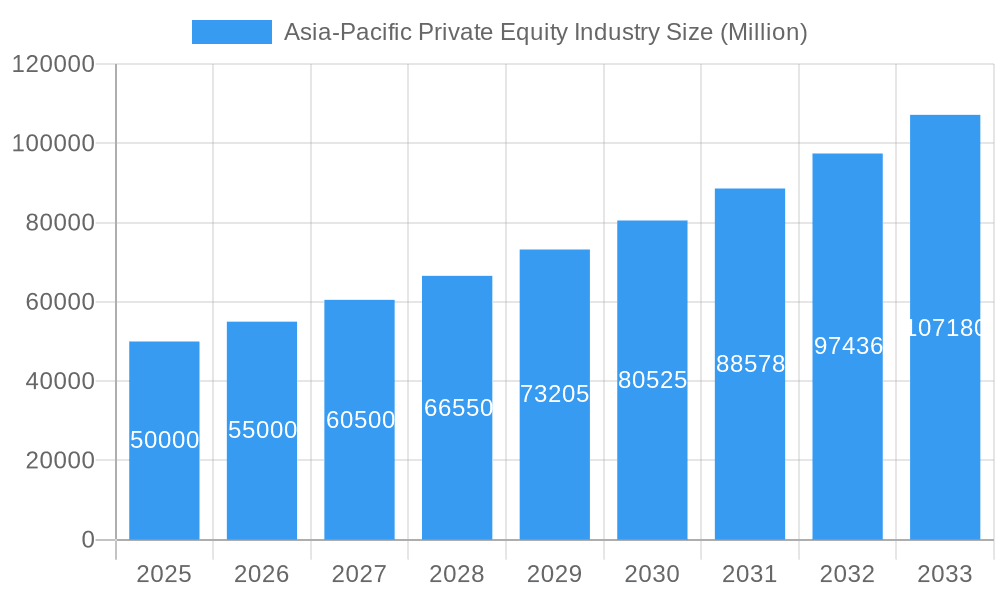

The Asia-Pacific private equity industry is experiencing robust growth, driven by a confluence of factors including increasing domestic capital, a burgeoning middle class fueling consumer spending, and supportive government policies promoting infrastructure development and technological innovation. The region's diverse economies, ranging from mature markets like Japan and Australia to rapidly developing nations like India and Indonesia, present a rich tapestry of investment opportunities across various sectors. While the historical period (2019-2024) likely saw fluctuations influenced by global economic events, the forecast period (2025-2033) anticipates sustained expansion, fueled by the region's long-term economic growth trajectory. This growth is further amplified by the increasing sophistication of local private equity firms and a growing appetite for alternative investments from institutional and high-net-worth investors within the region. We estimate a significant increase in deal flow, particularly in technology, healthcare, and renewable energy sectors, which are experiencing rapid expansion. The consistent influx of foreign capital, seeking exposure to high-growth Asian markets, also contributes significantly to the overall market size expansion.

Asia-Pacific Private Equity Industry Market Size (In Billion)

Despite potential headwinds like geopolitical uncertainties and economic cycles, the long-term outlook for the Asia-Pacific private equity industry remains positive. The increasing availability of data analytics and technological advancements are enhancing deal sourcing, due diligence, and portfolio management, creating greater efficiency and improving investment returns. This is leading to a more competitive landscape, with increased competition among private equity firms to secure attractive deals and deploy capital effectively. Strategic partnerships and mergers & acquisitions among firms are also expected to shape the industry's future, consolidating market share and leading to further specialization in niche sectors. Overall, the industry is poised for continued expansion, creating significant opportunities for investors and stakeholders alike.

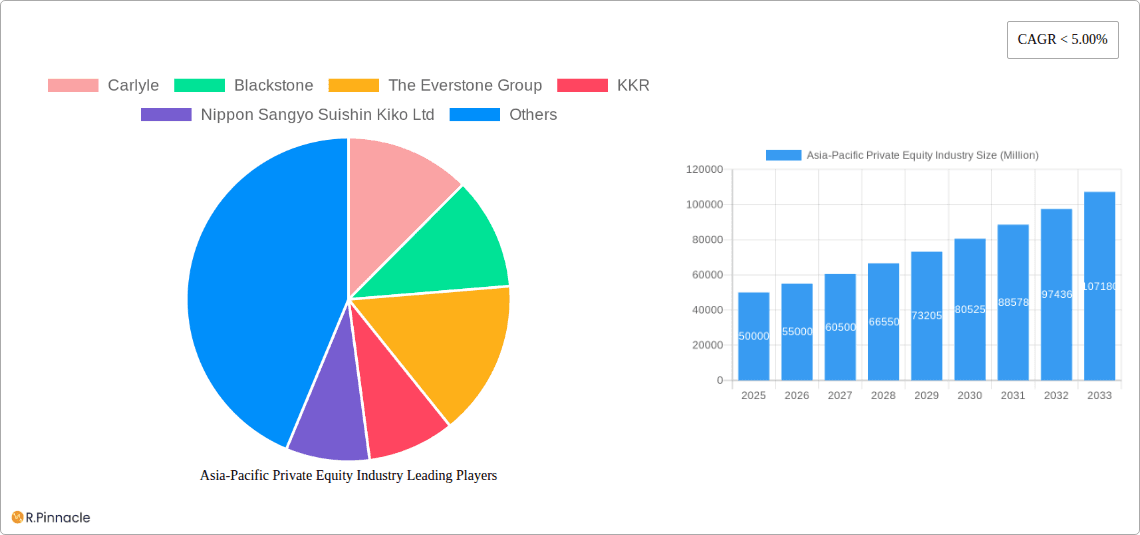

Asia-Pacific Private Equity Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Asia-Pacific private equity industry, offering actionable insights for investors, industry professionals, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the dynamic landscape of this lucrative market, including detailed market sizing and growth projections.

Asia-Pacific Private Equity Industry Market Structure & Innovation Trends

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the Asia-Pacific private equity industry. The competitive landscape is shaped by a mix of global giants and regional players. Key players include Carlyle, Blackstone, The Everstone Group, KKR, Nippon Sangyo Suishin Kiko Ltd, Bain Capital, Warburg Pincus, J-Star, Ascent Capital, and CVC Capital Partners. This list is not exhaustive.

Market concentration is moderate, with the top 10 firms controlling approximately XX% of the market share in 2024. Innovation is driven by technological advancements, evolving investor preferences, and regulatory changes. M&A activity has been robust, with total deal value exceeding USD xx Million in 2024. Average deal size is estimated at USD xx Million.

- Market Concentration: Moderate, top 10 players hold approximately XX% market share (2024).

- Innovation Drivers: Technological advancements, evolving investor preferences, regulatory changes.

- M&A Activity: Robust, total deal value exceeding USD xx Million in 2024. Average deal size: USD xx Million.

- Regulatory Frameworks: Vary across countries, impacting investment strategies.

Asia-Pacific Private Equity Industry Market Dynamics & Trends

This section delves into the market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the Asia-Pacific private equity industry. The market is experiencing significant growth, driven by factors such as increasing disposable incomes, rising private investment, and supportive government policies. Technological disruptions, particularly in fintech and e-commerce, are creating new investment opportunities. The CAGR for the forecast period (2025-2033) is projected to be XX%, with market penetration expected to reach XX% by 2033. Competitive dynamics are intense, with firms vying for market share through strategic acquisitions, fund launches, and geographic expansion.

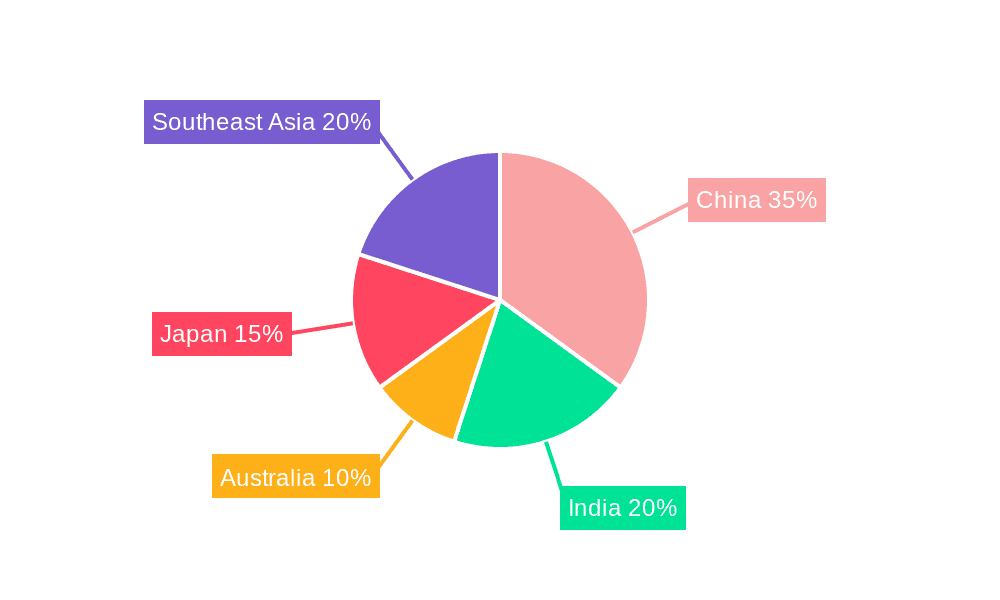

Dominant Regions & Segments in Asia-Pacific Private Equity Industry

This section identifies the leading regions and segments within the Asia-Pacific private equity industry. China and India are currently the dominant markets, fueled by robust economic growth and a large pool of investable companies. However, Southeast Asia is witnessing a surge in activity, driven by factors such as increasing infrastructure development and supportive government policies. Key segments include technology, healthcare, and consumer goods.

- China: Strong economic growth, supportive government policies, large investable market.

- India: Rapid economic expansion, burgeoning middle class, significant growth potential.

- Southeast Asia: Rising infrastructure development, increasing foreign investment, supportive government initiatives.

- Dominant Segments: Technology, healthcare, consumer goods.

Asia-Pacific Private Equity Industry Product Innovations

Recent innovations in the industry include the development of specialized funds targeting specific sectors, the use of data analytics to improve investment decisions, and the rise of impact investing focused on environmental, social, and governance (ESG) factors. These innovations are enhancing portfolio returns and aligning investor goals with long-term sustainability.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific private equity market by investment strategy (e.g., buyout, venture capital, growth equity), industry sector (e.g., technology, healthcare, consumer goods), and geographic location (e.g., China, India, Southeast Asia). Each segment is further analyzed to provide a detailed market size, growth projections, and competitive dynamics. Projected market size for 2033 is estimated at USD xx Million.

Key Drivers of Asia-Pacific Private Equity Industry Growth

Key growth drivers include rising disposable incomes, increasing private investment, supportive government policies (e.g., tax incentives), and strong economic growth in several key markets within the region. Technological advancements further fuel this growth, particularly in sectors like Fintech and e-commerce.

Challenges in the Asia-Pacific Private Equity Industry Sector

Challenges include regulatory uncertainties in some markets, geopolitical risks, and competition from other asset classes. Supply chain disruptions and talent shortages pose significant hurdles, potentially impacting deal flow and returns. The overall impact of these challenges is a projected reduction in market growth by approximately XX% by 2033.

Emerging Opportunities in Asia-Pacific Private Equity Industry

Emerging opportunities lie in the growing middle class, increasing digitalization across various industries, and the rise of sustainable and impact investing. The development of specialized funds focusing on technology, healthcare, and other high-growth sectors offers significant potential.

Leading Players in the Asia-Pacific Private Equity Industry Market

- Carlyle

- Blackstone

- The Everstone Group

- KKR

- Nippon Sangyo Suishin Kiko Ltd

- Bain Capital

- Warburg Pincus

- J-Star

- Ascent Capital

- CVC Capital Partners (List Not Exhaustive)

Key Developments in Asia-Pacific Private Equity Industry

- September 2022: The Asian Development Bank (ADB) signed a USD 15 Million equity investment in KV Asia Capital Fund II LP, boosting growth capital for Southeast Asian companies across various sectors (healthcare, finance, education, manufacturing, business services, consumer).

- July 2022: Navis Capital Partners launched the Navis Asia Credit platform, expanding credit opportunities within the region.

Future Outlook for Asia-Pacific Private Equity Industry Market

The Asia-Pacific private equity market is poised for continued growth, driven by strong economic fundamentals, technological advancements, and increasing private investment. Strategic partnerships, geographic expansion, and sector specialization will be key success factors for firms seeking to capitalize on the market's potential. The long-term outlook is positive, with considerable potential for expansion across various sectors and geographies.

Asia-Pacific Private Equity Industry Segmentation

-

1. Investment

- 1.1. Real Estate

- 1.2. Private Investment in Public Equity (PIPE)

- 1.3. Buyouts

- 1.4. Exits

Asia-Pacific Private Equity Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Private Equity Industry Regional Market Share

Geographic Coverage of Asia-Pacific Private Equity Industry

Asia-Pacific Private Equity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Deals Made a Remarkable Rebound in Asia-Pacific Private Equity Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Private Equity Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment

- 5.1.1. Real Estate

- 5.1.2. Private Investment in Public Equity (PIPE)

- 5.1.3. Buyouts

- 5.1.4. Exits

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Carlyle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Blackstone

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Everstone Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KKR

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Sangyo Suishin Kiko Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bain Capital

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Warburg Pincus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 J-Star

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascent Capital

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CVC Capital Partners**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Carlyle

List of Figures

- Figure 1: Asia-Pacific Private Equity Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Private Equity Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Private Equity Industry Revenue Million Forecast, by Investment 2020 & 2033

- Table 2: Asia-Pacific Private Equity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Private Equity Industry Revenue Million Forecast, by Investment 2020 & 2033

- Table 4: Asia-Pacific Private Equity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Private Equity Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Private Equity Industry?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Asia-Pacific Private Equity Industry?

Key companies in the market include Carlyle, Blackstone, The Everstone Group, KKR, Nippon Sangyo Suishin Kiko Ltd, Bain Capital, Warburg Pincus, J-Star, Ascent Capital, CVC Capital Partners**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Private Equity Industry?

The market segments include Investment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Deals Made a Remarkable Rebound in Asia-Pacific Private Equity Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: The Asian Development Bank (ADB) signed a USD 15 million equity investment in KV Asia Capital Fund II LP, a private equity fund managed by KV Asia to provide growth capital to companies in the health care, financial services, education, manufacturing, business services, and consumer sectors across Southeast Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Private Equity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Private Equity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Private Equity Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Private Equity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence