Key Insights

The Asia-Pacific small satellite industry is poised for significant expansion, driven by escalating demand for advanced Earth observation, communication, and navigation solutions. Key growth drivers include rapid technological innovation, favorable government policies, and a burgeoning private sector. The market is projected to expand at a CAGR of 31%, reaching an estimated market size of 3.79 billion by 2025 (base year). Major contributors to this growth include China, Japan, India, and South Korea, owing to substantial investments in space infrastructure and exploration. Primary applications such as Earth observation for agriculture, disaster management, and urban planning are witnessing accelerated adoption, alongside the increasing need for robust communication networks in underserved regions. The deployment of extensive small satellite constellations for enhanced global connectivity further fuels market momentum. The competitive landscape features established entities and agile new entrants, all vying for market dominance. Diverse orbit classes, with a notable surge in LEO constellations due to their cost-effectiveness and swift deployment, cater to a spectrum of user requirements. The industry trend towards electric propulsion underscores a commitment to efficiency and sustainability.

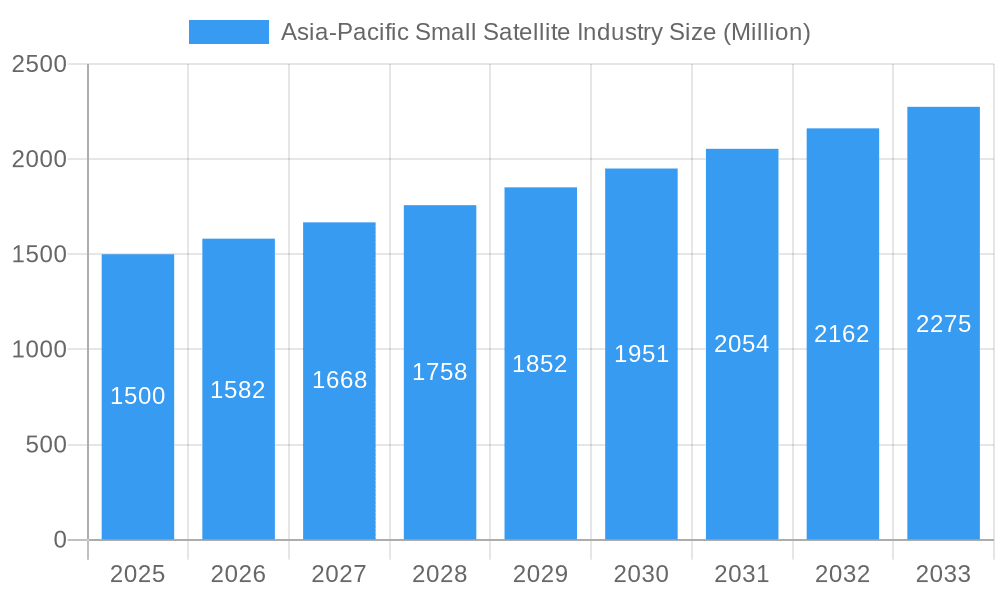

Asia-Pacific Small Satellite Industry Market Size (In Billion)

Despite facing challenges such as regulatory complexities and technical hurdles in miniaturization and enhanced functionality, the market outlook remains exceptionally strong. Substantial R&D investments across the Asia-Pacific region, coupled with the growing affordability and accessibility of small satellite technology, are expected to effectively address these obstacles. Commercial applications continue to lead market growth, supported by steady contributions from military and government sectors, ensuring sustained expansion of the Asia-Pacific small satellite industry throughout the forecast period. The interplay of technological advancements, policy frameworks, and a dynamic competitive environment will be instrumental in shaping the future trajectory of this critical industry.

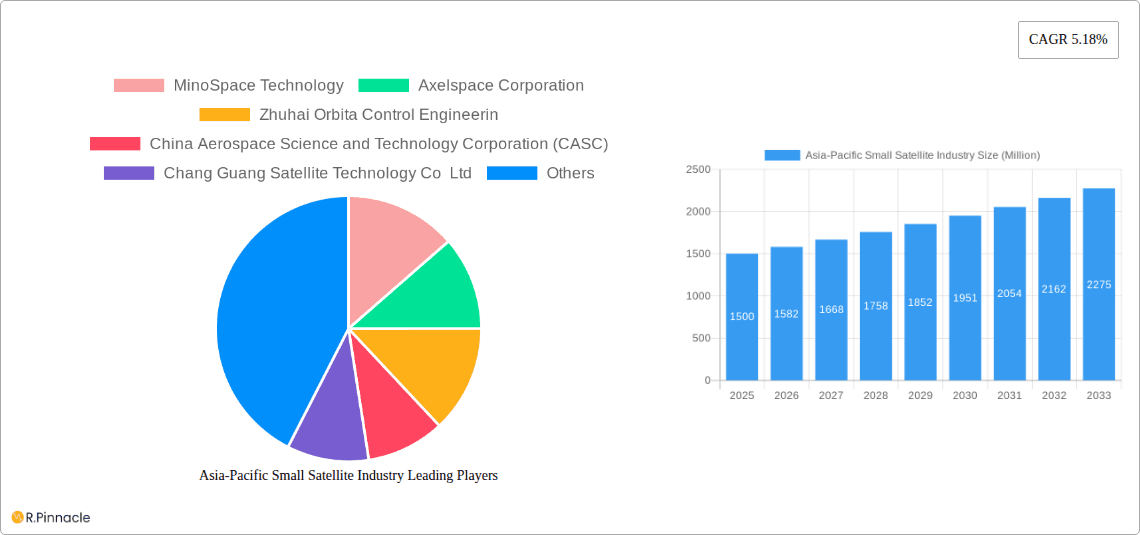

Asia-Pacific Small Satellite Industry Company Market Share

Asia-Pacific Small Satellite Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific small satellite industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on 2025, and incorporates detailed market segmentation, competitive landscape analysis, and future growth projections. The report leverages extensive primary and secondary research, delivering actionable intelligence to navigate the dynamic small satellite market.

Asia-Pacific Small Satellite Industry Market Structure & Innovation Trends

This section provides a deep dive into the foundational elements of the Asia-Pacific small satellite industry. We analyze key market characteristics including concentration levels, the driving forces behind innovation, the complex web of regulatory frameworks governing space activities, the presence and impact of alternative technologies, the evolving demographics of end-users, and the strategic significance of mergers and acquisitions. The historical performance from 2019-2024, with 2025 serving as the base year, offers a robust perspective for understanding past trajectory and forecasting future developments.

-

Market Concentration: The Asia-Pacific small satellite landscape is characterized by moderate concentration. A select group of dominant players commands a substantial portion of the market share (estimated at [Insert Specific Percentage Here]%). Concurrently, the ecosystem is witnessing a dynamic influx of emerging companies and innovative startups, actively fostering a competitive environment and spurring technological advancements. Detailed market share analyses for prominent entities such as China Aerospace Science and Technology Corporation (CASC), Guodian Gaoke, and other significant contributors are provided.

-

Innovation Drivers: The rapid evolution of miniaturization technologies, coupled with breakthroughs in advanced propulsion systems and sophisticated sensor technologies, are the primary catalysts for innovation within the sector. Furthermore, robust government initiatives aimed at promoting space exploration and fostering commercial space ventures are playing a pivotal role in driving progress.

-

Regulatory Frameworks: The diverse and often distinct national regulatory environments across the Asia-Pacific region significantly shape market operations. These regulations exert influence over crucial aspects such as licensing procedures, the approval processes for satellite launches, and the permissible use of satellite-derived data. A thorough examination of these regulatory nuances and their strategic implications is presented.

-

Product Substitutes: While small satellites offer distinct advantages, certain applications may find comparable solutions through the deployment of larger, more traditional satellite systems or advanced terrestrial technologies. This segment critically assesses potential substitute technologies and evaluates their competitive standing against small satellite solutions.

-

End-User Demographics: The report meticulously details the segmentation of end-users across key categories: Commercial entities, Military & Government organizations, and Other users. It scrutinizes their unique requirements and the industry's tailored responses to meet these demands.

-

M&A Activities: An in-depth analysis of historical and projected merger and acquisition activities is conducted. This includes quantifying estimated deal values (reaching up to [Insert Specific Million Value Here] Million) and dissecting the strategic motivations and consequences for market consolidation and the advancement of technological capabilities.

Asia-Pacific Small Satellite Industry Market Dynamics & Trends

This section provides an in-depth analysis of the dynamic forces and prevailing trends that are actively shaping the Asia-Pacific small satellite industry. The forecast period spanning from 2025 to 2033 is meticulously examined, offering projections for market expansion, the impact of disruptive technologies, and the evolving preferences of consumers.

The Asia-Pacific small satellite market is currently experiencing a period of accelerated growth, propelled by a confluence of factors including an escalating demand for high-resolution Earth observation data, significant advancements in satellite communication technologies, and a notable increase in government investment dedicated to space exploration initiatives. The Compound Annual Growth Rate (CAGR) for this period is projected to be approximately [Insert Specific CAGR Percentage Here]%. Market penetration is anticipated to reach an impressive [Insert Specific Market Penetration Percentage Here]% by the year 2033. Technological disruptions, most notably the pervasive rise of CubeSats and the increasing sophistication of nanosatellites, are fundamentally reshaping the industry's architecture. Competitive dynamics are characterized by intensity, with companies fiercely vying for market share based on competitive pricing, cutting-edge technological offerings, and superior service delivery. Consumer preferences are demonstrably shifting towards more cost-effective, readily accessible, and highly customizable satellite solutions. The report offers a comprehensive and detailed examination of these critical factors that are influencing and driving market growth.

Dominant Regions & Segments in Asia-Pacific Small Satellite Industry

This section identifies the leading regions, countries, and market segments within the Asia-Pacific small satellite industry. The analysis considers applications (Communication, Earth Observation, Navigation, Space Observation, Others), orbit classes (GEO, LEO, MEO), end-users (Commercial, Military & Government, Other), and propulsion technologies (Electric, Gas-based, Liquid Fuel).

Leading Region: China is currently the dominant region, fueled by strong government support and investments.

Leading Country: China's dominance is further amplified by its substantial investments in space infrastructure and the participation of major players like CASC and Guodian Gaoke.

Leading Application Segment: Earth Observation currently holds the largest market share due to high demand from various sectors.

Leading Orbit Class: LEO dominates due to its cost-effectiveness and suitability for various applications.

Leading End-User: The Commercial sector is expected to drive significant growth, driven by increasing private investment in space technologies.

Leading Propulsion Technology: Electric propulsion is gaining traction due to its efficiency and cost-effectiveness.

Key Drivers:

- Economic Policies: Government support and funding for space research and development.

- Infrastructure Development: Expansion of launch facilities and ground station networks.

- Technological Advancements: Miniaturization, improved sensor technologies, and advanced propulsion systems.

Asia-Pacific Small Satellite Industry Product Innovations

Recent years have witnessed significant product innovations in the Asia-Pacific small satellite industry. Miniaturization is a key trend, leading to the development of smaller, more cost-effective satellites capable of performing complex tasks. New sensor technologies are improving data resolution and quality, expanding the range of applications. Advanced propulsion systems are enabling longer mission durations and greater maneuverability. These innovations are enhancing the market fit and competitive advantages of small satellites.

Report Scope & Segmentation Analysis

This report offers a comprehensive and granular segmentation of the Asia-Pacific small satellite market, meticulously dissecting it across key dimensions: application, orbit class, end-user, and propulsion technology. For each segment, detailed projections for growth, current market size estimates, and prevailing competitive dynamics are provided. The estimated market size for each segment in 2025 is valued at [Insert Specific Million Value Here] Million, with a projected expansion to [Insert Specific Million Value Here] Million by 2033. The competitive landscape exhibits significant variation across these segments; some are largely dominated by established, long-standing players, while others are characterized by a high degree of dynamic competition fueled by agile new entrants.

- Application Segmentation: Presents detailed market size and growth projections for segments including Communication, Earth Observation, Navigation, Space Observation, and Other applications.

- Orbit Class Segmentation: Offers in-depth analysis of market size and growth forecasts for Geostationary Orbit (GEO), Low Earth Orbit (LEO), and Medium Earth Orbit (MEO) segments.

- End-User Segmentation: Provides a thorough analysis of the Commercial, Military & Government, and Other end-user segments, including their respective market sizes and growth trajectories.

- Propulsion Technology Segmentation: Delivers market size and growth predictions for Electric propulsion, Gas-based propulsion, and Liquid Fuel propulsion systems.

Key Drivers of Asia-Pacific Small Satellite Industry Growth

Several factors are driving the growth of the Asia-Pacific small satellite industry. Technological advancements, such as miniaturization and improved sensor technology, are making small satellites more affordable and capable. Government support and funding for space research and development are boosting innovation and deployment. The increasing demand for Earth observation data from various sectors, including agriculture, environmental monitoring, and disaster management, is fueling market expansion.

Challenges in the Asia-Pacific Small Satellite Industry Sector

Despite its substantial growth potential, the Asia-Pacific small satellite industry faces a number of significant challenges that can impede its progress. Navigating complex and often evolving regulatory hurdles, including the intricacies of licensing and obtaining launch approvals, can lead to substantial delays in deployment. Furthermore, persistent supply chain vulnerabilities, particularly concerning critical components, can negatively impact manufacturing schedules and overall project timelines. The intense competition emanating from both established industry veterans and a rising tide of new market entrants exerts considerable pricing pressure, consequently constraining profit margins. These multifaceted challenges have a direct bearing on the overall trajectory of market growth and necessitate careful strategic consideration and proactive mitigation by all industry stakeholders.

Emerging Opportunities in Asia-Pacific Small Satellite Industry

The Asia-Pacific small satellite industry is ripe with a multitude of promising emerging opportunities. New and expanding markets are rapidly developing within emerging economies, driven by an escalating demand for essential data and vital communication services. Concurrently, significant technological advancements, particularly in the realms of Artificial Intelligence (AI) and machine learning, are paving the way for the development and deployment of increasingly sophisticated and powerful satellite applications. Moreover, the growing trend of collaborative partnerships between governmental space agencies and private sector companies is a powerful catalyst for fostering innovation, accelerating development, and facilitating widespread deployment. These converging trends present substantial avenues for companies seeking to broaden their market reach, diversify their service offerings, and capitalize on the dynamic evolution of the space sector.

Leading Players in the Asia-Pacific Small Satellite Industry Market

- MinoSpace Technology

- Axelspace Corporation

- Zhuhai Orbita Control Engineering

- China Aerospace Science and Technology Corporation (CASC)

- Chang Guang Satellite Technology Co Ltd

- Spacety Aerospace Co

- Guodian Gaoke

Key Developments in Asia-Pacific Small Satellite Industry

March 2022: The China Aerospace Science and Technology Corporation (CASC) successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A rocket. This launch demonstrated advancements in launch capabilities and boosted confidence in the small satellite sector.

March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket. This launch highlighted the increasing involvement of private companies in the small satellite market.

February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC, each weighing 30-45 kg, were launched into orbit. This large-scale launch demonstrated CASC's capabilities in mass-producing and deploying small satellites.

Future Outlook for Asia-Pacific Small Satellite Industry Market

The future outlook for the Asia-Pacific small satellite industry is highly positive. Continued technological advancements, increasing government support, and rising private sector investments will drive significant growth. New applications, such as IoT and Earth observation for environmental monitoring, will create substantial market opportunities. Strategic partnerships and collaborations will play a critical role in shaping the industry's future landscape. The market is poised for continued expansion, driven by innovation and increasing demand across various sectors.

Asia-Pacific Small Satellite Industry Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Asia-Pacific Small Satellite Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

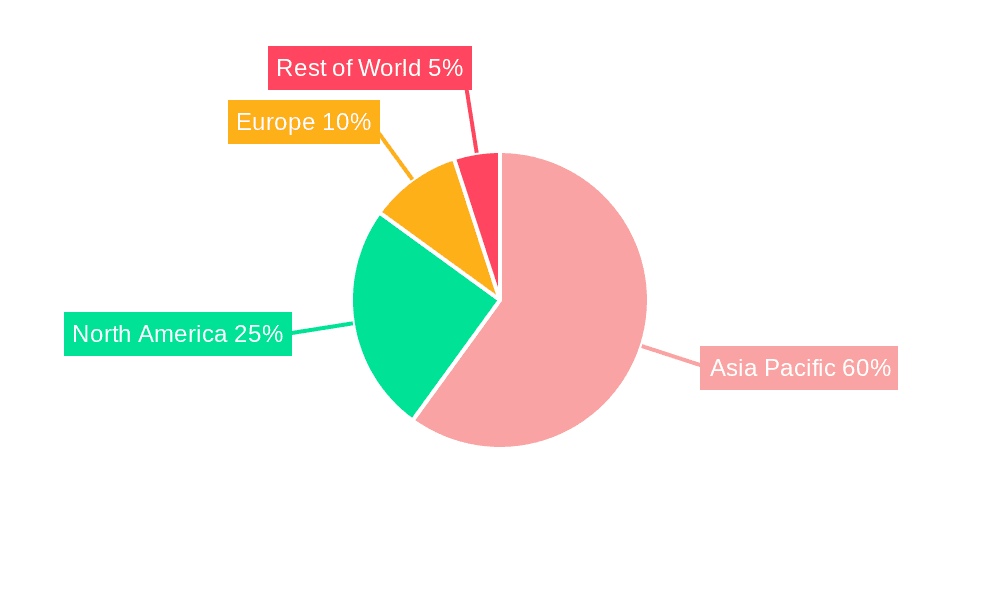

Asia-Pacific Small Satellite Industry Regional Market Share

Geographic Coverage of Asia-Pacific Small Satellite Industry

Asia-Pacific Small Satellite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Satellites that are being launched into LEO is driving the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MinoSpace Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axelspace Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhuhai Orbita Control Engineerin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Aerospace Science and Technology Corporation (CASC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chang Guang Satellite Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spacety Aerospace Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Guodian Gaoke

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 MinoSpace Technology

List of Figures

- Figure 1: Asia-Pacific Small Satellite Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Small Satellite Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Small Satellite Industry?

The projected CAGR is approximately 31%.

2. Which companies are prominent players in the Asia-Pacific Small Satellite Industry?

Key companies in the market include MinoSpace Technology, Axelspace Corporation, Zhuhai Orbita Control Engineerin, China Aerospace Science and Technology Corporation (CASC), Chang Guang Satellite Technology Co Ltd, Spacety Aerospace Co, Guodian Gaoke.

3. What are the main segments of the Asia-Pacific Small Satellite Industry?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Satellites that are being launched into LEO is driving the market demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: The China Aerospace Science and Technology Corporation successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A.March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket.February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC each weighing 30-45 kg were launched into orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Small Satellite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Small Satellite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Small Satellite Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Small Satellite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence