Key Insights

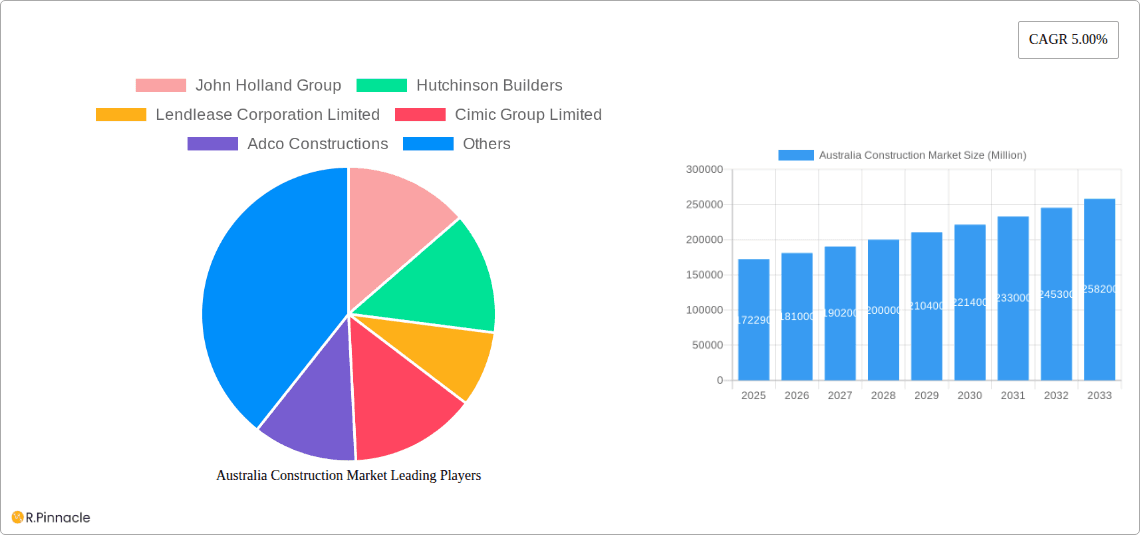

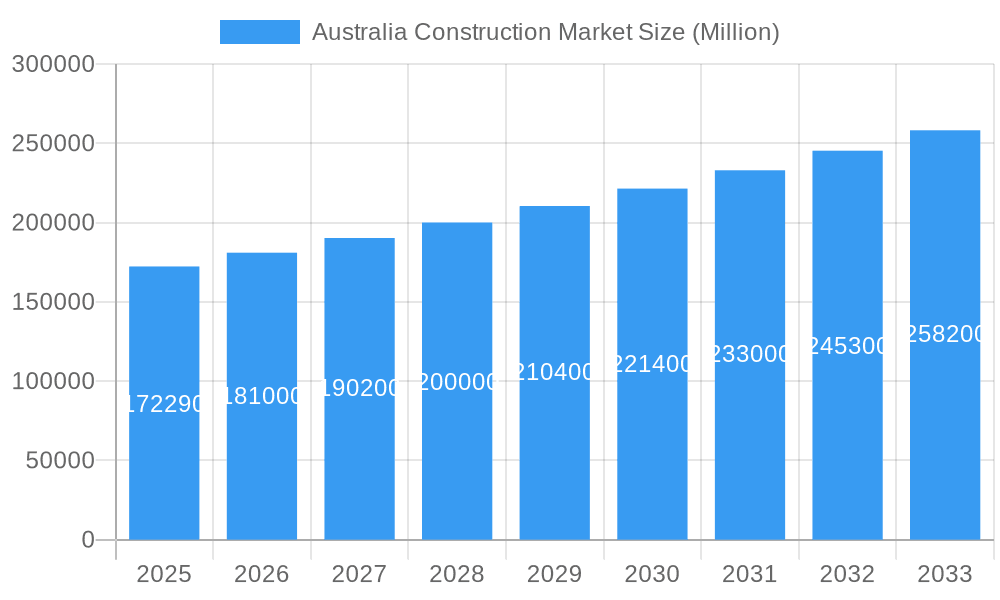

The Australian construction market, valued at $172.29 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.00% from 2025 to 2033. This expansion is driven by several key factors. Significant infrastructure projects, fueled by government investment in transportation networks and utilities upgrades, are a primary catalyst. Furthermore, a burgeoning residential sector, driven by population growth and increasing urbanization, contributes substantially to market expansion. The commercial sector also shows promise, with ongoing developments in office spaces and retail properties. However, potential headwinds exist. Supply chain disruptions, fluctuating material costs, and skilled labor shortages could temper growth in certain segments. The market is segmented across residential, commercial, industrial, infrastructure, and energy and utilities sectors, each exhibiting unique growth trajectories influenced by specific economic and policy factors. Major players like John Holland Group, Lendlease, and Cimic Group Limited compete within this dynamic landscape, leveraging their expertise and scale to secure significant projects.

Australia Construction Market Market Size (In Billion)

The forecast period (2025-2033) anticipates consistent expansion, with the market value likely exceeding $260 billion by 2033. This projection assumes a continued stable macroeconomic environment, consistent government investment in infrastructure, and gradual resolution of supply chain challenges. Growth within the infrastructure sector will be particularly significant, as large-scale projects currently underway reach completion and new initiatives are commissioned. The residential sector will maintain a strong contribution, reflecting ongoing population increase and demand for housing, while the commercial sector's growth will be largely dependent on economic conditions and investor confidence. Careful monitoring of these factors, alongside regulatory changes, is crucial for accurate long-term projections.

Australia Construction Market Company Market Share

Australia Construction Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Australian construction market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report projects robust growth and explores the key trends shaping this dynamic sector. The report features detailed segmentation by sector (Residential, Commercial, Industrial, Infrastructure, Energy and Utilities), identifies leading players, and analyzes significant market developments. Download now to gain a competitive edge.

Australia Construction Market Market Structure & Innovation Trends

This section analyzes the Australian construction market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activity. The report examines the market share of key players such as John Holland Group, Hutchinson Builders, Lendlease Corporation Limited, Cimic Group Limited, Adco Constructions, Laing O'Rourke, CPB Contractors, UGL Limited, Fulton Hogan, and Thiess Pty Ltd (list not exhaustive). We delve into the impact of mergers and acquisitions, estimating their total value at approximately $XX Million during the historical period (2019-2024).

- Market Concentration: The Australian construction market exhibits a moderately concentrated structure, with a few large players dominating specific segments. The top 5 firms hold an estimated XX% market share.

- Innovation Drivers: Government initiatives promoting sustainable construction practices, advancements in building information modeling (BIM), and the adoption of prefabrication techniques are key drivers of innovation.

- Regulatory Frameworks: Building codes, environmental regulations, and labor laws significantly influence construction practices and project costs. The impact of these regulations on market growth is quantitatively assessed.

- Product Substitutes: The emergence of alternative building materials and construction methods is impacting traditional practices and stimulating innovation.

- End-User Demographics: The report analyzes changing demographics and their implications for demand across various construction sectors.

- M&A Activities: The report tracks M&A activity, analyzing deal sizes and their strategic implications for market consolidation and technological advancement.

Australia Construction Market Market Dynamics & Trends

This section examines the market dynamics driving the Australian construction market's growth. We analyze factors such as infrastructure investments, urbanization, population growth, and evolving consumer preferences. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at XX%, with market penetration in key segments reaching XX% by 2033.

The report discusses technological disruptions, including the integration of robotics and automation, the impact of digital technologies on project management and design, and the increasing use of sustainable and innovative building materials. We explore the competitive dynamics amongst major players, focusing on strategies such as diversification, technological adoption, and strategic partnerships. Furthermore, we analyze consumer preferences regarding sustainable building practices, smart homes and buildings, and cost-effectiveness influencing demand across various sectors.

Dominant Regions & Segments in Australia Construction Market

This section identifies the leading regions and segments within the Australian construction market. The analysis considers economic policies, infrastructure development, and population distribution to assess market dominance.

Key Drivers:

- Infrastructure Investment: Government spending on infrastructure projects (roads, railways, utilities) is a major driver of growth.

- Urbanization: Population shifts towards urban areas fuels demand for residential and commercial construction.

- Economic Growth: Overall economic performance impacts construction activity levels.

Dominant Segment Analysis: While precise market share data is proprietary, based on our analysis the Infrastructure sector is projected as the dominant segment. The residential sector witnesses significant but somewhat fluctuating growth depending on interest rates and economic cycles. Commercial construction displays moderate and consistent growth. Industrial construction grows in line with broader economic activity. Energy and Utilities present significant opportunities driven by renewable energy investment.

Australia Construction Market Product Innovations

This section highlights significant product developments and applications within the Australian construction market, emphasizing technological trends and market fit. Recent innovations include advanced building materials, modular construction methods, and the integration of IoT sensors in buildings. These innovations offer improved efficiency, sustainability, and reduced costs, leading to increased market adoption and competitive advantages for early adopters. Specific examples of innovative products and their market penetration rates are detailed in the full report.

Report Scope & Segmentation Analysis

This report segments the Australian construction market by sector: Residential, Commercial, Industrial, Infrastructure, and Energy and Utilities. Each segment’s analysis includes growth projections, market size estimations, and competitive dynamics.

- Residential: This segment shows strong growth driven by population growth and housing demand. Market size is estimated at $XX Million in 2025.

- Commercial: Growth is moderate and depends on economic conditions and office space demand. Market size is estimated at $XX Million in 2025.

- Industrial: Growth is tied to manufacturing and logistics activities. Market size is estimated at $XX Million in 2025.

- Infrastructure: Significant government investment drives substantial growth. Market size is estimated at $XX Million in 2025.

- Energy and Utilities: Growing investment in renewable energy projects fuels expansion. Market size is estimated at $XX Million in 2025.

Key Drivers of Australia Construction Market Growth

Several factors drive the Australian construction market's growth. Strong government infrastructure spending, particularly in transport and utilities, is a significant contributor. Population growth and urbanization create demand for new housing and commercial spaces. Technological advancements, like BIM and prefabrication, improve efficiency and productivity. Furthermore, the increasing focus on sustainable construction practices is driving innovation and investment. The ongoing transition to renewable energy sources also fuels growth in the energy and utilities sector.

Challenges in the Australia Construction Market Sector

The Australian construction market faces several challenges. Skills shortages continue to impact project timelines and costs. Supply chain disruptions, particularly regarding materials, cause delays and increased expenses. Stringent environmental regulations can increase project complexity and costs. Finally, intense competition among construction companies puts pressure on profit margins. The impact of these challenges on project profitability is discussed.

Emerging Opportunities in Australia Construction Market

Several emerging opportunities exist in the Australian construction market. The growing adoption of digital technologies, particularly BIM and IoT, offers opportunities for efficiency gains. Demand for sustainable construction practices creates opportunities for companies offering green building solutions. Furthermore, investment in renewable energy infrastructure presents significant opportunities for specialized construction firms. Expansion into new markets, such as modular construction, also holds potential.

Leading Players in the Australia Construction Market Market

- John Holland Group

- Hutchinson Builders

- Lendlease Corporation Limited

- Cimic Group Limited

- Adco Constructions

- Laing O'Rourke

- CPB Contractors

- Ugl Limited

- Fulton Hogan

- Thiess Pty Ltd

(List Not Exhaustive)

Key Developments in Australia Construction Market Industry

- July 2022: Laing O'Rourke partnered with Robotics Australia Group to explore robotics applications in construction, addressing productivity, labor shortages, and safety challenges.

- April 2022: Thiess (CIMIC Group) signed a cooperation agreement with Tata Steel to provide mine design and engineering services, expanding its global reach.

- May 2023: The Indonesia-Australia partnership for Infrastructure (KIAT) opened a new office, signifying increased collaboration on infrastructure projects in the region.

Future Outlook for Australia Construction Market Market

The Australian construction market is poised for continued growth, driven by sustained infrastructure investment, population growth, and technological advancements. Strategic opportunities exist for companies focusing on sustainable construction practices, digital technologies, and specialized services. The market's future potential is significant, presenting attractive prospects for investors and industry players alike.

Australia Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Australia Construction Market Segmentation By Geography

- 1. Australia

Australia Construction Market Regional Market Share

Geographic Coverage of Australia Construction Market

Australia Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives is driving the market; Increase In Residential Sector

- 3.3. Market Restrains

- 3.3.1. Supply chain issues and rising material costs; Rising labor costs and labor shortages

- 3.4. Market Trends

- 3.4.1. Increase in Non-Residential and Infrastructure Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 John Holland Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hutchinson Builders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lendlease Corporation Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cimic Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adco Constructions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Laing O'rourke

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CPB Contractors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ugl Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fulton Hogan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Thiess Pty Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 John Holland Group

List of Figures

- Figure 1: Australia Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Australia Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Australia Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Australia Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Construction Market?

Key companies in the market include John Holland Group, Hutchinson Builders, Lendlease Corporation Limited, Cimic Group Limited, Adco Constructions, Laing O'rourke, CPB Contractors, Ugl Limited, Fulton Hogan, Thiess Pty Ltd**List Not Exhaustive.

3. What are the main segments of the Australia Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives is driving the market; Increase In Residential Sector.

6. What are the notable trends driving market growth?

Increase in Non-Residential and Infrastructure Construction.

7. Are there any restraints impacting market growth?

Supply chain issues and rising material costs; Rising labor costs and labor shortages.

8. Can you provide examples of recent developments in the market?

May 2023: New office of the Indonesia-Australia partnership for Infrastructure (KIAT) was opened by the Australian ambassador to Indonesia, Penny Williams (PSM), and minister of public works and housing of the Republic of Indonesia, Basuki Hidayat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Market?

To stay informed about further developments, trends, and reports in the Australia Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence