Key Insights

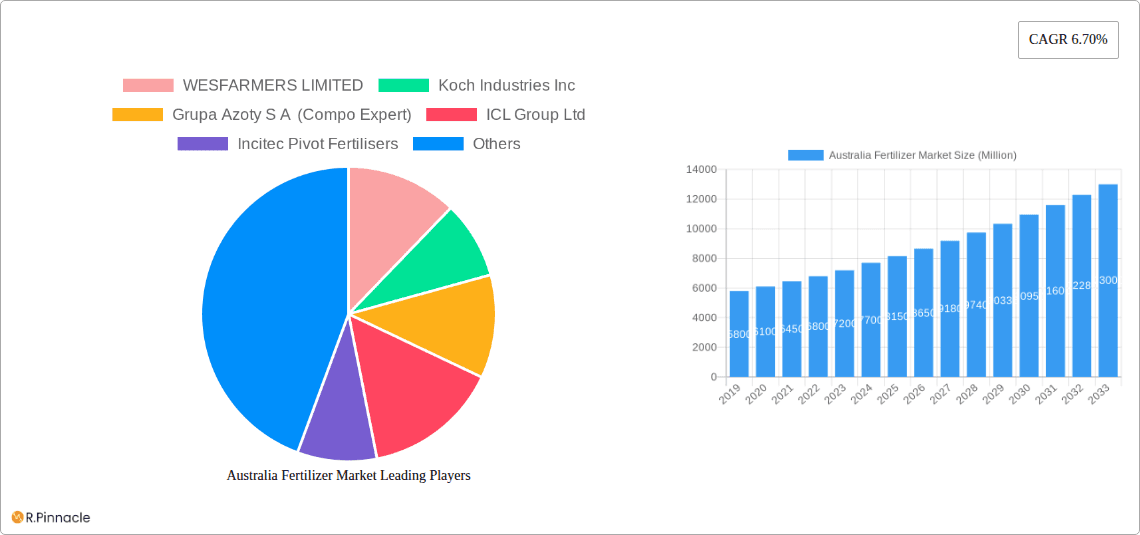

The Australian fertilizer market is projected to reach a substantial market size of $6.51 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.17%. This expansion is driven by the escalating global demand for food, necessitating enhanced crop yields through optimized nutrient application and advanced farming practices. Furthermore, the expansion of agricultural land, particularly for high-value crops, alongside government support for sustainable agriculture and soil health initiatives, bolsters market growth. Increasing farmer awareness of balanced fertilization's benefits for soil fertility and crop quality is a key consumption driver.

Australia Fertilizer Market Market Size (In Billion)

Challenges within the Australian fertilizer market include volatile raw material prices impacting profitability and market stability. The high cost of advanced fertilizer technologies and specialized infrastructure for distribution and application can also pose adoption barriers. Stringent environmental regulations regarding nutrient runoff may influence product development and market dynamics. Nevertheless, continuous research and development are focused on creating efficient and eco-friendly fertilizer solutions. The market is segmented by product type and application, with detailed analyses of production, consumption, import, and export. Key industry players include Yara International AS, Nutrien Ltd, and WESFARMERS LIMITED, actively influencing the competitive landscape through strategic investments and product innovations.

Australia Fertilizer Market Company Market Share

Australia Fertilizer Market Report: Unveiling Growth Drivers & Investment Opportunities (2019-2033)

Gain unparalleled insights into the Australian fertilizer market with this comprehensive report. Covering the historical period (2019-2024), base year (2025), estimated year (2025), and a robust forecast period (2025-2033), this analysis delivers actionable intelligence for industry professionals, investors, and stakeholders. Delve deep into production and consumption trends, import/export dynamics, and intricate price movements. We meticulously dissect market structure, explore key drivers and challenges, and highlight emerging opportunities. Featuring detailed analyses of leading players and pivotal industry developments, this report is your definitive guide to navigating the Australian fertilizer landscape. Optimized for search visibility with high-ranking keywords like "Australia fertilizer market analysis," "fertilizer industry Australia," "agricultural inputs Australia," and "fertilizer consumption Australia," this report ensures you find the critical information you need.

Australia Fertilizer Market Market Structure & Innovation Trends

The Australian fertilizer market exhibits a moderately concentrated structure, with a few key players dominating production and distribution. This concentration is influenced by significant capital investment requirements for manufacturing facilities and the logistical complexities of reaching diverse agricultural regions. Innovation within the market is primarily driven by the demand for enhanced crop yields, improved nutrient use efficiency, and a growing emphasis on sustainable agriculture practices. This includes the development and adoption of slow-release fertilizers, micronutrient-fortified products, and biological fertilizers. Regulatory frameworks, overseen by bodies like the Australian Pesticides and Veterinary Medicines Authority (APVMA) and state agricultural departments, play a crucial role in ensuring product safety and environmental compliance, acting as both an enabler and a potential barrier to innovation. Product substitutes, while limited in core nutrient provision, include organic amendments and improved soil management techniques that can reduce reliance on synthetic fertilizers. End-user demographics are diverse, ranging from large-scale broadacre farms to smaller horticultural operations, each with distinct fertilizer needs and purchasing behaviors. Mergers and acquisition (M&A) activities, while not rampant, are strategic, aimed at consolidating market share, expanding product portfolios, and enhancing distribution networks. For instance, an acquisition valued in the tens of millions of dollars could significantly alter regional market dynamics. The market share of major players often hovers around 10-20% each, with smaller, specialized companies catering to niche segments.

Australia Fertilizer Market Market Dynamics & Trends

The Australian fertilizer market is propelled by a confluence of dynamic factors that shape its trajectory throughout the study period. A primary growth driver is the ever-increasing demand for food security and agricultural productivity to meet both domestic consumption and international export markets. Australia's significant agricultural output necessitates consistent and efficient nutrient replenishment for its vast arable land. This is further amplified by a growing understanding among Australian farmers regarding the critical role of balanced fertilization in maximizing crop yields and quality, thereby enhancing their profitability. Technological disruptions are playing a transformative role, with the advent of precision agriculture technologies enabling more targeted and efficient fertilizer application. This includes the use of GPS-guided equipment, soil sensors, and drone technology that allow farmers to apply fertilizers precisely where and when they are needed, minimizing waste and environmental impact. Consumer preferences, both domestically and globally, are increasingly leaning towards sustainably produced food. This has a ripple effect on fertilizer manufacturers, pushing them to develop and promote environmentally friendly fertilizer options, including those with reduced greenhouse gas emissions or improved nutrient uptake. The competitive landscape is characterized by a blend of large multinational corporations with extensive product portfolios and a presence in R&D, alongside agile local players specializing in specific fertilizer types or regional needs. This competitive dynamic fosters innovation and drives efficiency. Market penetration of advanced fertilizer technologies is steadily increasing, though adoption rates can vary significantly based on farm size, technological literacy, and access to capital. The Compound Annual Growth Rate (CAGR) for the Australian fertilizer market is projected to be between 3% and 5% over the forecast period, driven by these underlying trends. Economic policies, such as government subsidies for agricultural inputs or initiatives promoting sustainable farming, also significantly influence market dynamics. Furthermore, volatile global commodity prices for raw materials used in fertilizer production can introduce price fluctuations, impacting overall market value and producer margins.

Dominant Regions & Segments in Australia Fertilizer Market

Production Analysis:

The eastern seaboard of Australia, encompassing New South Wales, Queensland, and Victoria, dominates fertilizer production. This is due to a combination of factors including access to major port infrastructure for importing raw materials and exporting finished products, proximity to large agricultural belts, and a well-established industrial base.

- Key Drivers:

- Proximity to Agricultural Hubs: Major food production regions are concentrated in these states, creating a direct demand for locally produced fertilizers.

- Port Infrastructure: Access to major ports facilitates the import of essential raw materials like phosphate rock, potash, and natural gas, crucial for fertilizer manufacturing.

- Skilled Workforce and Capital Investment: Established industrial zones offer a skilled labor pool and attract the substantial capital investment required for fertilizer plants.

Consumption Analysis:

Western Australia and the southern regions of South Australia and Victoria are the largest consumers of fertilizers in Australia. These areas are characterized by extensive broadacre cropping operations, including wheat, barley, and canola, which have high nutrient requirements.

- Key Drivers:

- Vast Arable Land: Large-scale farming operations require substantial amounts of fertilizers to maintain soil fertility and optimize crop yields.

- Dominance of Cereal and Oilseed Crops: These crops are nutrient-intensive and constitute a significant portion of Australia's agricultural output, driving demand for nitrogen, phosphorus, and potassium fertilizers.

- Soil Deficiencies: Many Australian soils are naturally deficient in certain nutrients, necessitating regular fertilizer application.

Import Market Analysis (Value & Volume):

The import market is largely driven by the demand for specific fertilizer types that are not economically produced domestically, particularly urea, potash, and specialized nutrient blends. The port cities of Melbourne and Fremantle are critical entry points for imported fertilizers due to their strategic locations serving major agricultural regions.

- Key Drivers:

- Cost-Effectiveness: Importing certain fertilizers can be more economically viable than domestic production due to global supply chain efficiencies and raw material availability.

- Specialty Nutrient Requirements: Australia imports specialized fertilizers that cater to specific crop needs or advanced farming practices.

- Logistical Networks: Efficient port operations and inland transportation networks are crucial for managing the large volumes of imported fertilizers. The import market value is estimated to be in the billions of Australian dollars annually, with volumes in the millions of tonnes.

Export Market Analysis (Value & Volume):

While Australia is a significant importer, it also exports certain fertilizer products, primarily processed fertilizers and those derived from unique domestic mineral resources. Exports are typically channeled through major ports like Newcastle and Port Hedland.

- Key Drivers:

- Niche Product Demand: Australia may export niche fertilizers or by-products that have specific international market demand.

- Resource Advantage: Leveraging unique domestic mineral resources for fertilizer production could create export opportunities.

- Trade Agreements: Favorable trade agreements can facilitate export market access.

Price Trend Analysis:

Price trends are significantly influenced by global commodity prices for raw materials (natural gas, phosphate rock, potash), energy costs, and fluctuations in the Australian dollar. Major price shifts can occur seasonally, tied to planting and harvesting cycles.

- Key Drivers:

- Global Raw Material Prices: Fluctuations in the prices of natural gas (for nitrogen fertilizers), phosphate rock, and potash directly impact production costs.

- Energy Costs: Fertilizer production is energy-intensive, making energy prices a critical determinant of final product cost.

- Currency Exchange Rates: The value of the Australian dollar against major currencies affects the cost of imported raw materials and finished fertilizers.

Australia Fertilizer Market Product Innovations

Product innovations in the Australian fertilizer market are increasingly focused on enhancing nutrient use efficiency and minimizing environmental impact. This includes the development and widespread adoption of slow-release and controlled-release fertilizers, which deliver nutrients to plants over an extended period, reducing the need for frequent applications and minimizing nutrient leaching. Enhanced efficiency fertilizers (EEFs) that incorporate nitrification inhibitors or urease inhibitors are also gaining traction. Furthermore, there's a growing emphasis on micronutrient fortification, with products tailored to address specific soil deficiencies in elements like zinc, copper, and manganese, crucial for optimal crop health and yield. The development of bio-fertilizers, harnessing beneficial microorganisms to improve nutrient availability and uptake, represents a significant technological trend, aligning with the growing demand for sustainable agricultural inputs. These innovations provide competitive advantages by offering farmers solutions that improve crop performance while aligning with environmental stewardship goals.

Australia Fertilizer Market Report & Segmentation Analysis

This report segments the Australian fertilizer market based on key analytical pillars: Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Each segment provides granular insights into specific market dynamics.

Production Analysis: Forecasts for domestic fertilizer production will detail expected output volumes and capacity utilization, highlighting regional manufacturing strengths and potential bottlenecks.

Consumption Analysis: Projections for fertilizer demand will be segmented by crop type and agricultural region, offering insights into the evolving needs of Australian farmers.

Import Market Analysis (Value & Volume): Detailed forecasts will cover the value and volume of imported fertilizers, identifying key product categories and dominant import origins, crucial for supply chain planning.

Export Market Analysis (Value & Volume): An assessment of Australia's export potential for fertilizers, including anticipated volumes and target markets, will be provided.

Price Trend Analysis: This segment offers a granular outlook on fertilizer price movements, considering raw material costs, currency fluctuations, and seasonal demand patterns.

Key Drivers of Australia Fertilizer Market Growth

The Australian fertilizer market's growth is underpinned by several critical factors. Firstly, the increasing global and domestic demand for food necessitates higher agricultural productivity, directly driving fertilizer consumption. Secondly, advancements in agricultural technology, particularly precision farming, enable more efficient and effective fertilizer application, encouraging adoption. Thirdly, government policies and initiatives promoting sustainable agriculture and soil health encourage the use of advanced and environmentally friendly fertilizer solutions. Furthermore, growing awareness among farmers about the economic benefits of optimal fertilization in terms of yield enhancement and resource efficiency plays a significant role. The continuous need to replenish soil nutrients in Australia's vast and often nutrient-depleted agricultural landscapes also acts as a persistent growth accelerator.

Challenges in the Australia Fertilizer Market Sector

The Australian fertilizer market faces several significant challenges. Volatility in global raw material prices, such as natural gas, phosphate rock, and potash, can lead to unpredictable input costs and affect profit margins. Increasing energy costs associated with fertilizer production and transportation further exacerbate this challenge. Environmental regulations and concerns surrounding nutrient runoff and greenhouse gas emissions are pushing for more sustainable practices, requiring significant investment in new technologies and product development. Logistical complexities and infrastructure limitations in Australia's vast geography can lead to high transportation costs and supply chain disruptions. Competition from international suppliers offering lower-priced products can also pressure domestic producers. Finally, climatic uncertainties and drought conditions can impact farmer demand for fertilizers in certain years.

Emerging Opportunities in Australia Fertilizer Market

Emerging opportunities in the Australian fertilizer market are predominantly linked to sustainable agriculture and innovative product development. The growing demand for specialty fertilizers, including micronutrient-enhanced and bio-fertilizers, presents significant growth avenues. The adoption of digital agriculture and precision farming technologies is creating opportunities for smart fertilizer solutions that optimize application and enhance efficiency. There is also an opportunity in developing fertilizers that improve soil health and carbon sequestration, aligning with climate change mitigation efforts. Expansion into niche agricultural sectors, such as horticulture and viticulture, which often require specialized nutrient management, offers further potential. Furthermore, partnerships and collaborations between fertilizer manufacturers, agricultural technology providers, and research institutions can drive innovation and market penetration.

Leading Players in the Australia Fertilizer Market Market

- WESFARMERS LIMITED

- Koch Industries Inc

- Grupa Azoty S A (Compo Expert)

- ICL Group Ltd

- Incitec Pivot Fertilisers

- Haifa Group

- K+S Aktiengesellschaft

- Yara International AS

- Nutrien Ltd

Key Developments in Australia Fertilizer Market Industry

- April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.

- January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.

- June 2022: K+S, through an associate, acquired a 50% interest in Jorf Fertilizers Company III, JFC III, from OCP and established a 50-50 joint venture between the two companies. This Joint venture will leverage both OCP and K+S' customer base and their logistical capacity to further increase the supply of phosphate-based fertilizers throughout the globe.

Future Outlook for Australia Fertilizer Market Market

The future outlook for the Australian fertilizer market remains positive, driven by sustained demand for agricultural products and a strong push towards sustainable farming practices. The market is expected to witness continued growth, with an increasing emphasis on value-added and specialty fertilizers that offer enhanced nutrient use efficiency and environmental benefits. Technological advancements in precision agriculture will further shape consumption patterns, leading to more targeted applications and reduced waste. Investment in R&D for bio-fertilizers and organic nutrient solutions is likely to accelerate. Strategic partnerships and collaborations will play a crucial role in expanding market reach and fostering innovation. While challenges related to raw material price volatility and logistics will persist, the overarching trend towards increasing agricultural productivity and environmental stewardship will create significant growth accelerators and strategic opportunities for market players. The market is projected to expand by an estimated value of several billion Australian dollars over the forecast period, indicating robust long-term potential.

Australia Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia Fertilizer Market Segmentation By Geography

- 1. Australia

Australia Fertilizer Market Regional Market Share

Geographic Coverage of Australia Fertilizer Market

Australia Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WESFARMERS LIMITED

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Koch Industries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupa Azoty S A (Compo Expert)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ICL Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Incitec Pivot Fertilisers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haifa Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 K+S Aktiengesellschaft

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yara International AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nutrien Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 WESFARMERS LIMITED

List of Figures

- Figure 1: Australia Fertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Australia Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Australia Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Australia Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Australia Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Australia Fertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Australia Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Australia Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Australia Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Australia Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Australia Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Australia Fertilizer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Fertilizer Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Australia Fertilizer Market?

Key companies in the market include WESFARMERS LIMITED, Koch Industries Inc, Grupa Azoty S A (Compo Expert), ICL Group Ltd, Incitec Pivot Fertilisers, Haifa Group, K+S Aktiengesellschaft, Yara International AS, Nutrien Ltd.

3. What are the main segments of the Australia Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.June 2022: KAES, through an associate, acquired a 50% interest in Jorf Fertilizers Company III, JFC III, from OCP and established a 50-50 joint venture between the two companies. This Joint venture will leverage both OCP and KAES' customer base and their logistical capacity to further increase the supply of phosphate-based fertilizers throughout the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Fertilizer Market?

To stay informed about further developments, trends, and reports in the Australia Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence