Key Insights

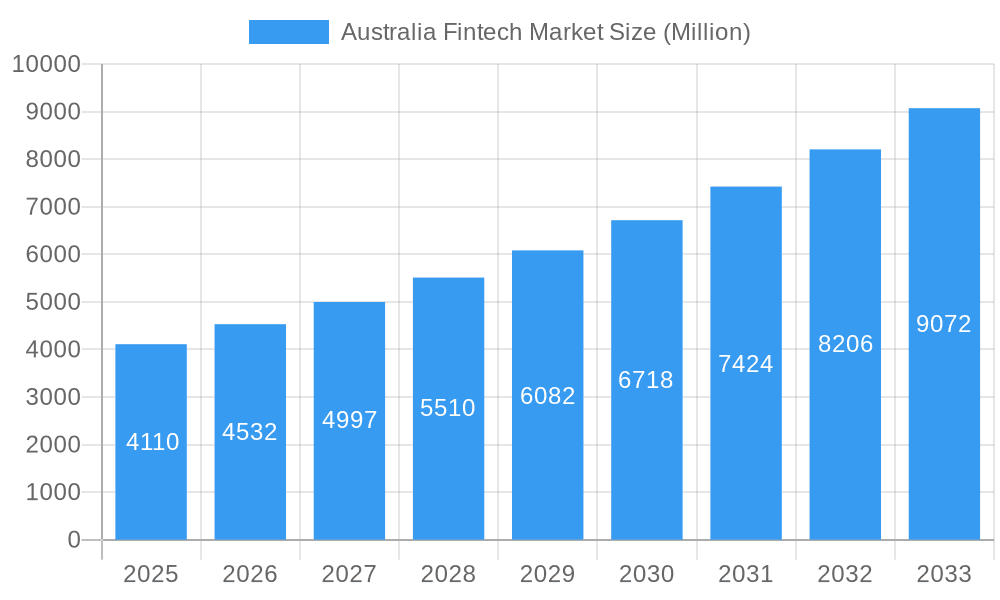

The Australian Fintech market, valued at $4.11 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.32% from 2025 to 2033. This dynamic expansion is fueled by several key factors. Increased smartphone penetration and digital literacy among Australians are driving higher adoption of digital financial services. Furthermore, government initiatives promoting financial inclusion and technological innovation are fostering a fertile environment for Fintech companies. The rising demand for convenient and personalized financial solutions, coupled with the increasing preference for mobile banking and contactless payments, are significant contributors to this market growth. Competition is fierce, with established players like Afterpay Touch and newer entrants like Airwallex vying for market share. The market is segmented by service type (payments, lending, investments, etc.), user demographics, and geographic location. Challenges remain, including regulatory hurdles and cybersecurity concerns, which Fintech companies must address to maintain sustainable growth. However, the overall outlook for the Australian Fintech market remains positive, with significant potential for further expansion in the coming years.

Australia Fintech Market Market Size (In Billion)

The market's growth trajectory reflects a global trend towards digitalization in finance. Australia's strong regulatory framework, while presenting certain challenges, also provides a stable foundation for Fintech development. The presence of major international players like Stripe and Wise alongside successful homegrown companies like Zeller Australia and Judo Bank underscores the market's maturity and attractiveness to both domestic and international investors. Future growth will likely be shaped by the adoption of open banking initiatives, the increasing use of artificial intelligence (AI) and machine learning (ML) in financial services, and the emergence of innovative solutions addressing specific niche markets. Continuous innovation and adaptation to evolving consumer preferences will be crucial for success in this competitive and rapidly evolving landscape.

Australia Fintech Market Company Market Share

Australia Fintech Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian Fintech market, offering valuable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, key players, and future outlook. The report leverages extensive data analysis to deliver actionable intelligence, enabling informed decision-making in this rapidly evolving landscape.

Australia Fintech Market Structure & Innovation Trends

The Australian Fintech market exhibits a dynamic interplay of established players and emerging startups. Market concentration is moderate, with a few dominant players alongside numerous niche players. Innovation is driven by advancements in AI, blockchain, and open banking, fostering the development of innovative payment solutions, lending platforms, and wealth management tools. The regulatory framework, while evolving, generally supports innovation, though navigating compliance remains a key challenge. Product substitutes include traditional banking services, but Fintech solutions increasingly offer superior convenience, speed, and cost-effectiveness. End-user demographics are broad, encompassing individuals, businesses, and institutional investors. M&A activity is significant, with deal values exceeding xx Million in recent years, reflecting the consolidation and expansion efforts within the sector. Key metrics indicate a market share distribution as follows: Afterpay Touch holds approximately xx% market share, followed by Airwallex at xx%, and Wise at xx%, with the remaining share dispersed among numerous other players.

Australia Fintech Market Market Dynamics & Trends

The Australian Fintech market is on a trajectory of significant expansion, fueled by a confluence of powerful drivers. The widespread adoption of smartphones and increasing digital literacy among the populace are laying the groundwork for seamless digital financial interactions. Furthermore, the Australian government's proactive stance on digital transformation is creating a fertile environment for innovation and the integration of advanced financial technologies. The transformative power of technological advancements, particularly the burgeoning influence of Artificial Intelligence (AI) and Machine Learning (ML), is actively reshaping how financial services are delivered, paving the way for entirely new business models and unparalleled opportunities. Consumers are increasingly gravitating towards financial solutions that are not only personalized and intuitive but also exude an unwavering commitment to security and convenience. The competitive landscape is exceptionally dynamic, with agile and disruptive Fintech startups continuously challenging the established financial institutions and global Fintech behemoths. Projections indicate a robust Compound Annual Growth Rate (CAGR) of approximately XX% within the forecast period of 2025-2033, underscoring the substantial growth anticipated in this sector. Market penetration continues to deepen, with an estimated XX% of the Australian population actively utilizing at least one Fintech service.

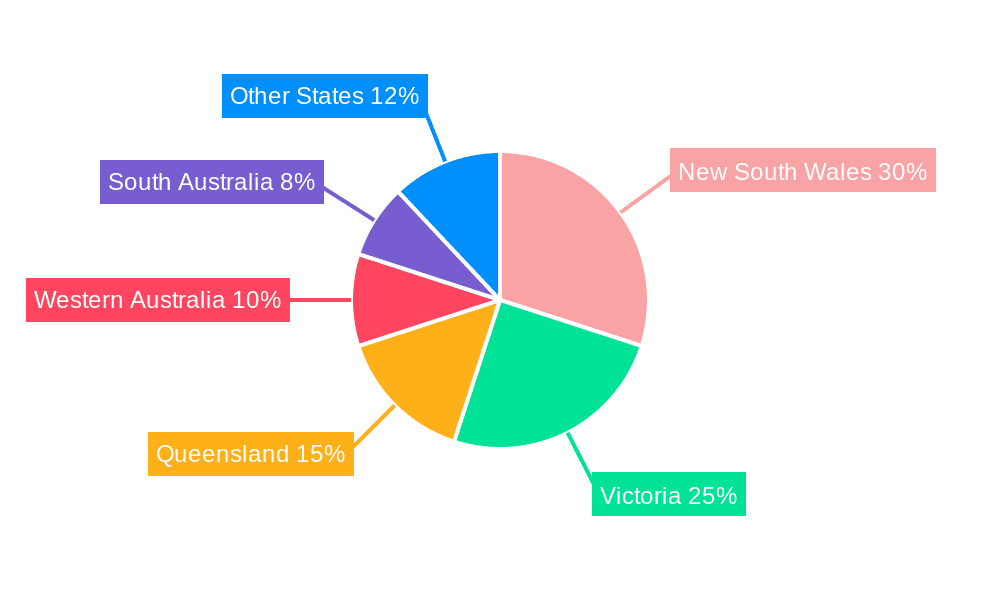

Dominant Regions & Segments in Australia Fintech Market

The Australian Fintech market exhibits a pronounced geographical concentration, with key hubs of activity flourishing in major metropolitan centers such as Sydney, Melbourne, and Brisbane. These urban epicenters are characterized by a strong ecosystem of skilled talent, sophisticated infrastructure, and policy frameworks designed to encourage technological advancement. The primary catalysts contributing to the dominance of these regions include:

- Pioneering Technological Infrastructure: The availability of high-speed internet connectivity and a robust digital infrastructure forms the bedrock upon which innovative Fintech solutions are built and scaled.

- Progressive Regulatory Frameworks: While subject to ongoing evolution, the regulatory environment in Australia is increasingly designed to foster innovation while upholding stringent consumer protection standards.

- High Digital Savvy and Adoption Rates: A substantial segment of the Australian population readily embraces digital technologies, creating a receptive market and driving sustained demand for a diverse array of Fintech services.

Sydney, in particular, stands out as a dominant force within the Fintech landscape. This preeminence is attributed to its rich concentration of emerging Fintech startups and established industry players, which collectively attract significant investment and nurture a vibrant and collaborative ecosystem.

Australia Fintech Market Product Innovations

Recent product innovations include sophisticated AI-powered personalized financial management tools, blockchain-based secure payment systems, and embedded finance solutions seamlessly integrated into various platforms. These innovations highlight a shift towards enhanced user experience, increased security, and streamlined financial processes. The market fit is strong, with a growing demand for efficient, accessible, and personalized financial services.

Report Scope & Segmentation Analysis

This report segments the Australian Fintech market based on several criteria, including:

- Payment Solutions: This segment is dominated by companies like Afterpay Touch and Stripe, and is expected to maintain a CAGR of xx% due to increased e-commerce adoption.

- Lending & Borrowing: This segment shows strong growth, with platforms like Sofi and Athena Mortgage targeting specific customer needs, resulting in a projected CAGR of xx%.

- Wealth Management: This segment experiences steady growth driven by demand for innovative investment tools and personalized advice, showing a projected CAGR of xx%.

- Insurtech: This segment, while smaller, shows potential for rapid growth, driven by the adoption of new technologies, projecting a CAGR of xx%.

Key Drivers of Australia Fintech Market Growth

Several factors fuel the Australian Fintech market's growth. Technological advancements, particularly in AI, blockchain, and cloud computing, are driving efficiency, security, and innovation. The increasing adoption of mobile devices and digital platforms fuels demand for mobile-first financial solutions. Supportive government policies, such as initiatives promoting digital transformation, also create a favorable environment for growth. Finally, evolving consumer preferences, demanding personalized and seamless financial experiences, further bolster market expansion.

Challenges in the Australia Fintech Market Sector

Navigating the Australian Fintech market presents a series of formidable challenges. Chief among these is the imperative to maintain stringent regulatory compliance within a perpetually evolving legal and compliance landscape. This dynamic can impose substantial operational costs and require continuous adaptation. The ever-present threat of sophisticated cybersecurity breaches necessitates significant and ongoing investment in robust security protocols and advanced protective measures. Furthermore, the intense competitive pressure emanating from both entrenched incumbent financial institutions and an influx of agile new market entrants demands relentless innovation and strategic agility to preserve and expand market share. Failure to adequately address these multifaceted challenges could potentially temper market growth by an estimated XX% annually.

Emerging Opportunities in Australia Fintech Market

Open banking presents a significant opportunity for innovation, facilitating the development of new financial products and services built upon data sharing. The rise of embedded finance allows Fintech solutions to seamlessly integrate into other platforms, expanding reach and market potential. Growing demand for personalized financial advice and wealth management solutions offers significant growth opportunities for specialized platforms.

Leading Players in the Australia Fintech Market Market

- Zeller Australia Pty Ltd

- Paytron Pty Ltd

- mx51 Pty Ltd

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- DiviPay

- Judo Bank

- Afterpay (Block Inc.)

- SoFi

- Wise

- Stripe

- This list is not exhaustive and represents a snapshot of key contributors to the market.

Key Developments in Australia Fintech Market Industry

- February 2023: Fintech innovator Zeller strategically enhanced its offerings by launching a comprehensive transaction account, a feature-rich debit card, and a user-friendly mobile application. This move directly positions Zeller as a significant competitor to traditional banking institutions, particularly within the small business segment.

- March 2023: Airwallex achieved a pivotal milestone by securing a payment business license in China, a significant expansion of its global operational footprint. This strategic acquisition was facilitated by its successful integration of Guangzhou Shang Wu Tong Network Technology Co., Ltd., significantly broadening Airwallex's market reach and capabilities within the Asian region.

Future Outlook for Australia Fintech Market Market

The Australian Fintech market is poised for continued strong growth, driven by ongoing technological advancements, increasing digital adoption, and evolving consumer preferences. Strategic partnerships, international expansion, and the development of innovative solutions will be key to success in this competitive landscape. The market is expected to reach xx Million by 2033, representing significant opportunities for growth and investment.

Australia Fintech Market Segmentation

-

1. Service proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Other Service Propositions

Australia Fintech Market Segmentation By Geography

- 1. Australia

Australia Fintech Market Regional Market Share

Geographic Coverage of Australia Fintech Market

Australia Fintech Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital ID Framework Witnessing Growth in Australia Fintech Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Fintech Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Other Service Propositions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zeller Australia Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paytron Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 mx51 Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airwallex Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Athena Mortgage Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DiviPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Afterpay Touch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sofi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wise

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stripe**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Zeller Australia Pty Ltd

List of Figures

- Figure 1: Australia Fintech Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Fintech Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 2: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 3: Australia Fintech Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Fintech Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Australia Fintech Market Revenue Million Forecast, by Service proposition 2020 & 2033

- Table 6: Australia Fintech Market Volume Billion Forecast, by Service proposition 2020 & 2033

- Table 7: Australia Fintech Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Australia Fintech Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Fintech Market?

The projected CAGR is approximately 10.32%.

2. Which companies are prominent players in the Australia Fintech Market?

Key companies in the market include Zeller Australia Pty Ltd, Paytron Pty Ltd, mx51 Pty Ltd, Airwallex Pty Ltd, Athena Mortgage Pty Ltd, DiviPay, Judo bank, Afterpay Touch, Sofi, Wise, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Fintech Market?

The market segments include Service proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital ID Framework Witnessing Growth in Australia Fintech Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Financial platform Airwallex secured a payment business license in China, following the successful acquisition of a 100% stake in Guangzhou Shang Wu Tong Network Technology Co., Ltd., an information and online payment services company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Fintech Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Fintech Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Fintech Market?

To stay informed about further developments, trends, and reports in the Australia Fintech Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence