Key Insights

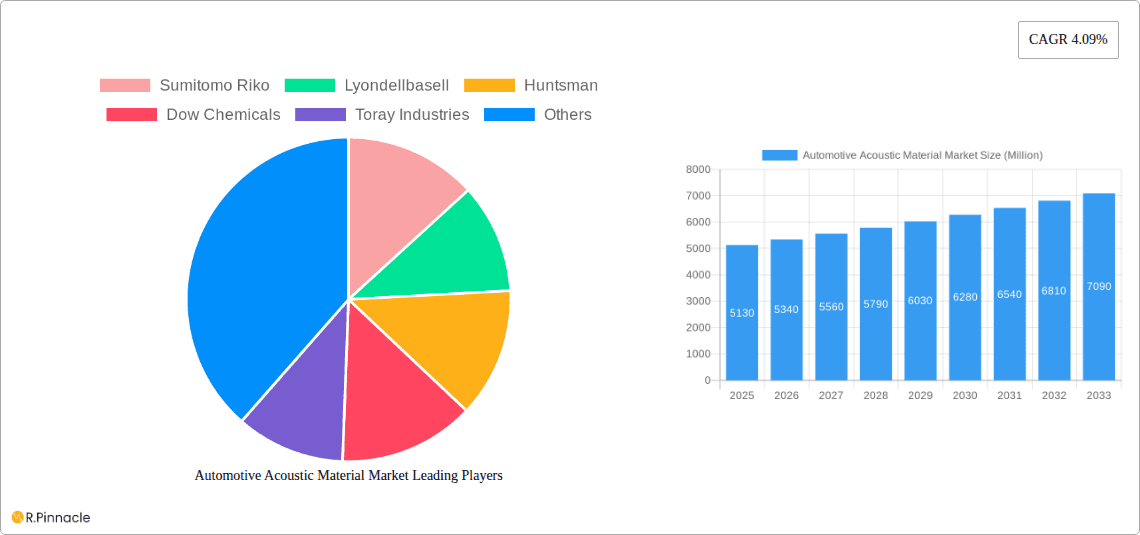

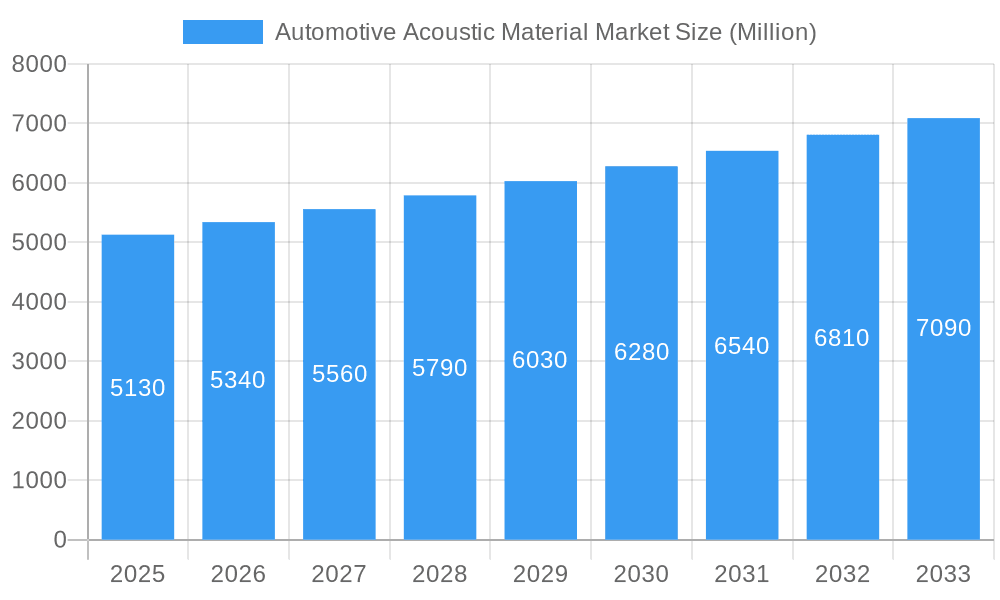

The global automotive acoustic material market, valued at $5.13 billion in 2025, is projected to experience robust growth, driven by the increasing demand for noise reduction in vehicles and stricter global emission regulations. The market's Compound Annual Growth Rate (CAGR) of 4.09% from 2019 to 2024 indicates a steady upward trajectory, expected to continue through 2033. Key drivers include the rising adoption of lightweight materials in vehicle manufacturing, the growing popularity of electric vehicles (EVs) – which require enhanced sound insulation due to the absence of engine noise – and the increasing consumer preference for improved cabin comfort and quietness. Market segmentation reveals significant contributions from passenger cars, followed by commercial vehicles. Polyurethane remains a dominant material due to its excellent sound absorption properties and cost-effectiveness. However, the market is witnessing a rising adoption of textile and fiberglass materials due to their lightweight nature and improved environmental friendliness. Geographically, North America and Europe currently hold significant market shares, but the Asia-Pacific region is expected to witness the fastest growth due to the rapid expansion of the automotive industry in countries like China and India. The competitive landscape is characterized by established players like Sumitomo Riko, LyondellBasell, and Huntsman, who are focused on innovation and expanding their product portfolios to cater to evolving market demands. Challenges include fluctuating raw material prices and the need for continuous technological advancements to create lighter, more effective, and sustainable acoustic materials.

Automotive Acoustic Material Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market growth, primarily propelled by the continued expansion of the global automotive sector and heightened consumer demand for quieter vehicles. Technological innovations, such as the development of advanced acoustic materials with enhanced performance and sustainability, will play a crucial role in shaping the market's future. Companies are investing in research and development to create next-generation materials that meet stricter emission standards and offer improved sound insulation while reducing weight and overall vehicle cost. This continuous innovation, coupled with the ongoing electrification of the automotive industry, will contribute to the long-term growth of the automotive acoustic material market. Strategic partnerships and mergers and acquisitions are also likely to influence the market dynamics and reshape the competitive landscape.

Automotive Acoustic Material Market Company Market Share

Automotive Acoustic Material Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Acoustic Material Market, offering actionable insights for industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market structure, dynamics, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Automotive Acoustic Material Market Market Structure & Innovation Trends

The Automotive Acoustic Material Market is moderately concentrated, with key players such as Sumitomo Riko, LyondellBasell, Huntsman, Dow Chemicals, Toray Industries, Henkel Adhesive Technologies, BASF SE, Covestro, Sika, Freudenberg Group, and 3M Acoustics holding significant market share. Precise market share data for each company varies and requires further specific analysis, but the combined market share of these top players exceeds xx%. Innovation is driven by stringent noise and vibration regulations, increasing demand for lightweight vehicles, and the rising popularity of electric vehicles (EVs). The market also witnesses significant M&A activity, exemplified by Freudenberg Group's acquisition of Low & Bonar PLC in May 2020. While the exact deal value is not publicly disclosed, such acquisitions signify a consolidation trend and an attempt to capture larger market share. Regulatory frameworks, such as those concerning material safety and environmental impact, are shaping material selection. Product substitutes, such as advanced damping technologies and noise-canceling systems, pose a competitive challenge. End-user demographics, particularly the growing preference for SUVs and luxury vehicles, significantly influence market demand.

Automotive Acoustic Material Market Market Dynamics & Trends

The Automotive Acoustic Material Market is witnessing robust growth fueled by several key factors. The increasing demand for enhanced NVH (Noise, Vibration, and Harshness) performance in vehicles, particularly with the rise of electric vehicles (EVs), is a significant driver. EVs, lacking the masking noise of combustion engines, necessitate advanced acoustic materials for a comfortable driving experience. Technological advancements, such as the development of lightweight and high-performance materials (like BASF's new flame-retardant Ultramid grade), are improving the acoustic properties and reducing the overall weight of vehicles. Consumer preferences for quieter and more comfortable vehicles further bolster market growth. Competitive dynamics are characterized by technological innovation, strategic partnerships, and mergers and acquisitions, all contributing to market expansion. The market penetration rate of advanced acoustic materials is steadily increasing, reaching xx% in 2025, and is expected to grow further in the coming years.

Dominant Regions & Segments in Automotive Acoustic Material Market

Leading Region: The market is currently dominated by [Region Name - e.g., North America/ Europe] due to [Reasons: e.g., high vehicle production, stringent emission regulations, well-established automotive industry]. Specific country level dominance needs further analysis for details.

Dominant Vehicle Type: Passenger cars currently represent the largest segment, driven by increasing vehicle sales and consumer demand for comfort.

Dominant Application: Bonnet liners and door trims are currently the leading applications for automotive acoustic materials, due to their significant contribution to noise reduction.

Dominant Material: Polyurethane remains the dominant material, owing to its cost-effectiveness and versatility. However, the use of lightweight, high-performance materials like textiles and fiberglass is steadily increasing.

Key drivers for each segment vary, with economic factors like GDP growth and automotive production rates strongly influencing overall market size. Infrastructure development and government policies promoting eco-friendly vehicles also play an important role.

Automotive Acoustic Material Market Product Innovations

Recent product developments focus on lightweight, high-performance materials that offer superior noise reduction and vibration damping capabilities while minimizing vehicle weight. These innovations leverage advanced material science and manufacturing techniques. Key competitive advantages are achieved through superior acoustic properties, cost-effectiveness, and compliance with stringent environmental regulations. The market showcases a clear trend towards sustainable and environmentally friendly materials.

Report Scope & Segmentation Analysis

This report segments the Automotive Acoustic Material Market by:

Vehicle Type: Passenger Cars and Commercial Vehicles. Growth projections for passenger cars are significantly higher due to increasing demand. Commercial vehicle segments show slower growth, depending on overall economic conditions.

Application: Bonnet Liner, Door Trim, and Other Applications (e.g., underbody, wheel arches). Bonnet liners and door trims continue to dominate this segment. Growth in 'Other Applications' will depend on technological advancements and vehicle design.

Material: Polyurethane, Textile, Fiberglass, and Other Materials (e.g., foams, composites). Polyurethane maintains its leading position due to its versatility. However, the market share of lightweight materials such as textiles and fiberglass is expected to increase.

Key Drivers of Automotive Acoustic Material Market Growth

The market is primarily driven by stringent regulations concerning vehicle noise emission, increasing demand for improved NVH performance, the rising popularity of electric vehicles (requiring advanced acoustic solutions), and technological advancements in materials science leading to lighter and more efficient acoustic materials. The growth of the automotive industry itself is a fundamental driver, with increasing production volumes directly influencing the demand for acoustic materials.

Challenges in the Automotive Acoustic Material Market Sector

Significant challenges include fluctuating raw material prices, supply chain disruptions, intense competition among established players and new entrants, and the need to balance performance with cost-effectiveness. Meeting increasingly stringent environmental regulations while maintaining material performance poses a considerable hurdle. The development of effective and cost-competitive substitutes presents a continuous competitive challenge.

Emerging Opportunities in Automotive Acoustic Material Market

Emerging opportunities lie in the development of advanced lightweight materials, bio-based and recycled materials, and integration with active noise cancellation systems. Expansion into new markets like autonomous vehicles and commercial EVs, along with greater emphasis on sustainability, presents significant growth prospects. Technological advancements offer opportunities for differentiation and value creation.

Leading Players in the Automotive Acoustic Material Market Market

- Sumitomo Riko

- LyondellBasell (LyondellBasell)

- Huntsman (Huntsman)

- Dow Chemicals (Dow)

- Toray Industries (Toray Industries)

- Henkel Adhesive Technologies (Henkel)

- BASF SE (BASF)

- Covestro (Covestro)

- Sika (Sika)

- Freudenberg Group (Freudenberg)

- 3M Acoustics (3M)

Key Developments in Automotive Acoustic Material Market Industry

- October 2021: Sumitomo Riko enhanced its vehicle testing capabilities, focusing on NVH evaluation. This strengthens their ability to develop improved acoustic materials.

- September 2021: BASF introduced a new flame-retardant Ultramid grade for electric vehicles, improving both safety and acoustic performance.

- May 2020: Freudenberg Group's acquisition of Low & Bonar PLC expanded its market presence and product portfolio.

Future Outlook for Automotive Acoustic Material Market Market

The Automotive Acoustic Material Market is poised for significant growth, driven by continuous advancements in material science, increasing demand for superior NVH performance, and the burgeoning electric vehicle market. Strategic partnerships, technological innovations, and the adoption of sustainable materials will shape future market dynamics. The expanding global automotive industry provides a robust foundation for sustained growth.

Automotive Acoustic Material Market Segmentation

-

1. Material

- 1.1. Polyurethane

- 1.2. Textile

- 1.3. Fiberglass

- 1.4. Other Materials

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Application

- 3.1. Bonnet Liner

- 3.2. Door Trim

- 3.3. Other Applications

Automotive Acoustic Material Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Automotive Acoustic Material Market Regional Market Share

Geographic Coverage of Automotive Acoustic Material Market

Automotive Acoustic Material Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Premium Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyurethane

- 5.1.2. Textile

- 5.1.3. Fiberglass

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bonnet Liner

- 5.3.2. Door Trim

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyurethane

- 6.1.2. Textile

- 6.1.3. Fiberglass

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bonnet Liner

- 6.3.2. Door Trim

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyurethane

- 7.1.2. Textile

- 7.1.3. Fiberglass

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bonnet Liner

- 7.3.2. Door Trim

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyurethane

- 8.1.2. Textile

- 8.1.3. Fiberglass

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bonnet Liner

- 8.3.2. Door Trim

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyurethane

- 9.1.2. Textile

- 9.1.3. Fiberglass

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bonnet Liner

- 9.3.2. Door Trim

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sumitomo Riko

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lyondellbasell

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Huntsman

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dow Chemicals

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toray Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Henkel Adhesive Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Covestro

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sika

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Freudenberg Grou

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 3M Acoustics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Sumitomo Riko

List of Figures

- Figure 1: Global Automotive Acoustic Material Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Automotive Acoustic Material Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 21: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Acoustic Material Market?

The projected CAGR is approximately 4.09%.

2. Which companies are prominent players in the Automotive Acoustic Material Market?

Key companies in the market include Sumitomo Riko, Lyondellbasell, Huntsman, Dow Chemicals, Toray Industries, Henkel Adhesive Technologies, BASF SE, Covestro, Sika, Freudenberg Grou, 3M Acoustics.

3. What are the main segments of the Automotive Acoustic Material Market?

The market segments include Material , Vehicle Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Premium Cars.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2021, Sumitomo Riko announced that as part of a joint research project with the National Institute of Advanced Industrial Science and Technology (AIST) in Japan, it had recovered a part of the proving ground for vehicle testing installed at the Tsukuba North Site of AIST and installed a new course with special road surfaces. Six types of special road surfaces were installed: road noise road, ride comfort road, Belgian-block road, undulating road, gravel and sand exposed road, and harshness road, to measure and evaluate the NVH of vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Acoustic Material Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Acoustic Material Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Acoustic Material Market?

To stay informed about further developments, trends, and reports in the Automotive Acoustic Material Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence