Key Insights

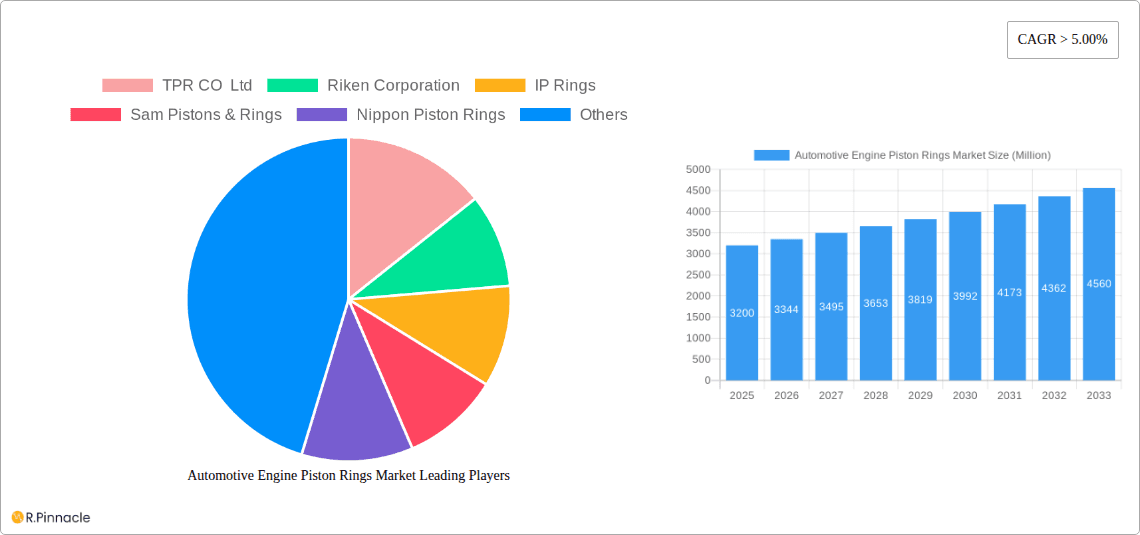

The global Automotive Engine Piston Rings Market is poised for significant expansion, projected to reach approximately USD 3.2 billion in 2025. Driven by robust demand for improved fuel efficiency, reduced emissions, and enhanced engine performance, the market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.5% throughout the forecast period of 2025-2033. Key growth enablers include the continuous evolution of internal combustion engines (ICE) and the increasing adoption of advanced materials like steel and aluminum alloys for piston rings, contributing to lighter and more durable engine components. The passenger vehicle segment is anticipated to be the largest contributor, fueled by rising global vehicle production and a growing middle class in emerging economies. Furthermore, the commercial vehicle segment is also expected to show steady growth, driven by the expansion of logistics and transportation industries worldwide.

Automotive Engine Piston Rings Market Market Size (In Billion)

Despite the burgeoning growth, the market faces certain challenges. Stringent environmental regulations and the accelerating transition towards electric vehicles (EVs) present a restraint, potentially dampening the long-term demand for traditional ICE engine components. However, the continued prevalence of ICE vehicles, particularly in developing regions and in specialized applications like heavy-duty commercial transport, ensures sustained market activity. Innovations in piston ring technology, such as advanced coatings and optimized designs for enhanced sealing and reduced friction, are crucial for manufacturers to stay competitive and address the evolving needs of the automotive industry. Key players like TPR Co. Ltd, Riken Corporation, and Nippon Piston Rings are actively investing in research and development to capitalize on these opportunities.

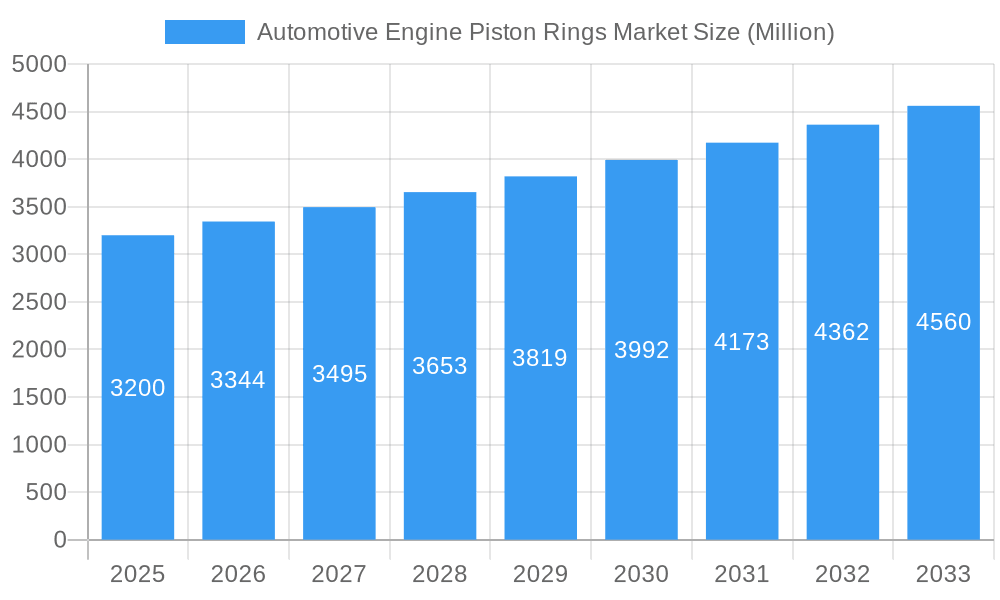

Automotive Engine Piston Rings Market Company Market Share

Automotive Engine Piston Rings Market: Comprehensive Industry Analysis and Future Projections (2019-2033)

This in-depth report provides a strategic overview of the global automotive engine piston rings market, a critical component in internal combustion engines. Our analysis covers the historical performance from 2019 to 2024, a detailed examination of the market structure and dynamics in the base year of 2025, and robust forecasts for the period of 2025 to 2033. With an estimated market size projected to reach $XX billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of XX%, this report is an indispensable resource for stakeholders seeking to navigate this evolving sector. We dissect key segments, identify dominant regions, and analyze innovative trends shaping the future of automotive piston rings.

Automotive Engine Piston Rings Market Market Structure & Innovation Trends

The automotive engine piston rings market exhibits a moderately consolidated structure, with a handful of key players holding significant market share. Innovation is a primary driver, fueled by the relentless pursuit of enhanced engine efficiency, reduced emissions, and improved durability. Companies are investing heavily in R&D to develop advanced materials and coatings that withstand higher operating temperatures and pressures, crucial for meeting stringent environmental regulations and evolving powertrain technologies. The regulatory landscape, particularly emission standards globally, plays a pivotal role in shaping product development and market entry strategies. Substitute products, while limited in the core function, include alternative engine technologies (e.g., electric powertrains), which indirectly impact the long-term demand for piston rings. End-user demographics are increasingly focused on fuel economy and performance, influencing the design and material choices for piston rings. Mergers and acquisitions (M&A) activity, valued at an estimated $XX billion in the historical period, continues to consolidate the market and foster technological synergies.

- Market Concentration: Moderately consolidated with key players holding substantial market share.

- Innovation Drivers: Emission reduction, fuel efficiency, engine performance, durability.

- Regulatory Frameworks: Stringent emission standards (e.g., Euro 7, EPA standards) are paramount.

- Product Substitutes: Alternative powertrains (e.g., EVs) indirectly influence demand.

- End-User Demographics: Growing demand for fuel-efficient and high-performance vehicles.

- M&A Activities: Strategic consolidation to gain market share and technological advancements.

Automotive Engine Piston Rings Market Market Dynamics & Trends

The automotive engine piston rings market is experiencing robust growth, propelled by several dynamic factors. The increasing global vehicle parc, particularly in emerging economies, directly translates to higher demand for replacement and aftermarket piston rings. Furthermore, advancements in internal combustion engine (ICE) technology, including higher compression ratios and turbocharging, necessitate the use of more sophisticated and durable piston rings, driving innovation and market penetration for premium products. The transition towards hybridization also impacts the market; while electric vehicles (EVs) do not utilize piston rings, hybrid vehicles still rely on ICEs, thus maintaining demand. Technological disruptions are primarily centered around material science and surface treatments. The development of advanced coatings like PVD (Physical Vapor Deposition) and DLC (Diamond-Like Carbon) offers superior wear resistance and reduced friction, leading to improved fuel economy and extended engine life. Consumer preferences are increasingly leaning towards vehicles that offer a balance of performance and environmental consciousness, which in turn pushes Original Equipment Manufacturers (OEMs) to source piston rings that meet these demands. The competitive landscape is intense, characterized by both global players and regional manufacturers. Price sensitivity remains a factor, especially in the aftermarket segment, but the growing emphasis on total cost of ownership and vehicle longevity is creating opportunities for manufacturers offering higher-value, performance-oriented piston rings. The overall market penetration for advanced piston ring technologies is steadily increasing as OEMs strive for greater efficiency and compliance with evolving regulations.

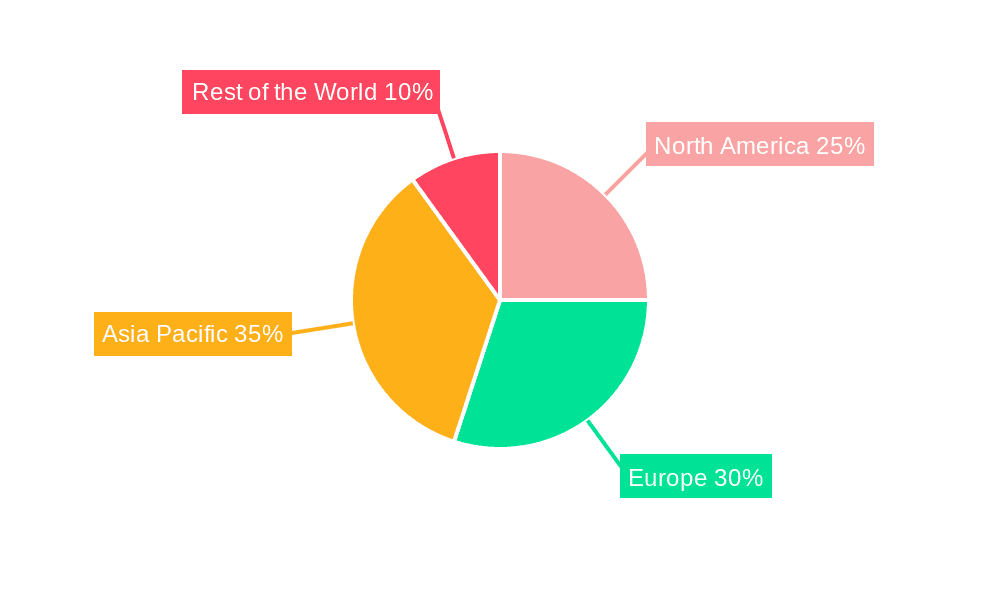

Dominant Regions & Segments in Automotive Engine Piston Rings Market

The Asia Pacific region stands as the dominant force in the global automotive engine piston rings market. This leadership is primarily attributed to the burgeoning automotive manufacturing hubs in countries like China, India, and Japan. Robust economic policies, significant investments in infrastructure, and a rapidly growing middle class with increasing disposable incomes fuel the demand for both passenger vehicles and commercial vehicles. The sheer volume of vehicle production and sales in this region makes it a primary market for piston rings.

Within Vehicle Type, Passenger Vehicles represent the largest segment. The proliferation of compact and mid-size passenger cars, driven by urbanization and changing lifestyle preferences, directly contributes to the high demand for piston rings in this category. However, the Commercial Vehicles segment is also witnessing substantial growth, propelled by e-commerce logistics and infrastructure development projects, necessitating robust and durable piston rings for heavy-duty applications.

In terms of Material Type, Steel piston rings continue to hold a significant market share due to their inherent strength, durability, and cost-effectiveness. However, Aluminum piston rings, often combined with advanced coatings, are gaining traction, especially in performance-oriented and lightweight applications where reduced reciprocating mass and improved thermal conductivity are desired. The development of advanced alloys and composite materials also presents future growth avenues.

- Leading Region: Asia Pacific (driven by China, India, Japan)

- Key Drivers: High vehicle production, growing middle class, favorable economic policies, infrastructure development.

- Dominant Vehicle Type Segment: Passenger Vehicles

- Key Drivers: Urbanization, rising disposable incomes, demand for personal mobility.

- Emerging Vehicle Type Segment: Commercial Vehicles

- Key Drivers: E-commerce growth, infrastructure projects, logistics industry expansion.

- Dominant Material Type: Steel

- Key Drivers: Cost-effectiveness, high tensile strength, proven durability.

- Growing Material Type: Aluminum

- Key Drivers: Lightweight applications, improved thermal management, performance enhancements.

Automotive Engine Piston Rings Market Product Innovations

Product innovation in the automotive engine piston rings market is largely focused on enhancing engine efficiency and reducing emissions. Advancements include the development of low-friction coatings such as Diamond-Like Carbon (DLC) and various ceramic-based treatments, which significantly reduce wear and improve fuel economy. Researchers are also exploring novel alloy compositions and ring designs to optimize sealing performance under extreme operating conditions, contributing to higher engine power output and lower oil consumption. These innovations provide a competitive edge by enabling manufacturers to meet increasingly stringent environmental regulations and consumer demands for performance and longevity.

Report Scope & Segmentation Analysis

This report meticulously analyzes the automotive engine piston rings market, encompassing a comprehensive segmentation analysis. The study covers the Vehicle Type segmentation, detailing the market dynamics for Passenger Vehicles and Commercial Vehicles. Furthermore, it delves into the Material Type segmentation, examining the market for Steel and Aluminum piston rings. Growth projections and competitive dynamics are assessed for each segment, providing a granular view of market potential and strategic positioning opportunities.

- Vehicle Type:

- Passenger Vehicles: This segment is projected for steady growth, driven by the continuous demand for personal transportation globally. Market penetration of advanced piston rings is high, with OEMs prioritizing fuel efficiency and emissions.

- Commercial Vehicles: Expected to witness robust growth due to the expansion of logistics and transportation sectors, particularly in developing economies. Demand for durable and high-performance piston rings for heavy-duty applications is a key driver.

- Material Type:

- Steel: Continues to be a dominant material due to its cost-effectiveness and reliability. Market growth will be steady, catering to a broad spectrum of vehicles.

- Aluminum: Exhibits higher growth potential, driven by its lightweight properties and suitability for advanced engine designs. Increased adoption in performance vehicles and fuel-efficient applications.

Key Drivers of Automotive Engine Piston Rings Market Growth

The automotive engine piston rings market is driven by several interconnected factors. The persistent global demand for vehicles, especially in emerging economies, directly fuels the need for piston rings. Furthermore, the ongoing evolution of internal combustion engine technology, including turbocharging and direct injection, necessitates the use of more advanced, high-performance piston rings capable of withstanding higher pressures and temperatures. Stringent government regulations aimed at reducing vehicular emissions are a significant catalyst, compelling manufacturers to innovate and adopt fuel-efficient and low-emission piston ring technologies. Finally, the aftermarket segment, driven by vehicle maintenance and replacement needs, provides a stable and growing revenue stream.

Challenges in the Automotive Engine Piston Rings Market Sector

Despite the positive growth trajectory, the automotive engine piston rings market faces several challenges. The most significant is the accelerating shift towards electric vehicles (EVs), which do not utilize internal combustion engines and therefore have no demand for piston rings. This long-term disruption poses a substantial threat to market volume. Additionally, intense price competition, particularly in the aftermarket, can squeeze profit margins. Supply chain volatilities, including raw material price fluctuations and geopolitical disruptions, can impact production costs and lead times. Navigating the complex and evolving regulatory landscape across different regions also presents a challenge for global manufacturers.

Emerging Opportunities in Automotive Engine Piston Rings Market

The automotive engine piston rings market is ripe with emerging opportunities. The increasing adoption of hybrid vehicle technology, which still relies on ICEs, presents a significant growth avenue. Innovations in advanced materials and coatings, such as graphene-infused piston rings, offer the potential for further improvements in friction reduction and wear resistance, catering to the demand for enhanced engine performance and longevity. The growing aftermarket for performance tuning and classic car restoration also creates niche market opportunities. Furthermore, the development of piston rings for specialized applications, such as industrial engines or off-highway vehicles, can diversify revenue streams.

Leading Players in the Automotive Engine Piston Rings Market Market

- TPR CO Ltd

- Riken Corporation

- IP Rings

- Sam Pistons & Rings

- Nippon Piston Rings

- Abilities India Piston & Ring

- Grover Corporation

- Asimco Technologies

- Feder Mogul LLC

- Shriram Pistons & Rings Ltd

Key Developments in Automotive Engine Piston Rings Market Industry

- 2024: Launch of new low-friction DLC-coated piston rings by leading manufacturers to meet stringent Euro 7 emission standards.

- 2023: Strategic partnerships formed between piston ring manufacturers and EV component suppliers to explore residual market opportunities in hybrid powertrains.

- 2022: Significant investment in R&D for advanced ceramic composite piston rings aimed at improving thermal efficiency in high-performance engines.

- 2021: Acquisition of a specialized piston ring coating technology firm by a major global player to enhance its product portfolio.

- 2020: Introduction of redesigned piston ring sets optimized for smaller displacement, turbocharged engines in passenger vehicles.

Future Outlook for Automotive Engine Piston Rings Market Market

The future outlook for the automotive engine piston rings market is one of adaptation and specialization. While the long-term trend favors electrification, the immediate and medium-term future will be defined by the continued demand from internal combustion engine vehicles, particularly in developing economies and hybrid powertrains. Opportunities lie in further enhancing the efficiency and durability of piston rings through advanced materials and coatings to meet evolving performance and environmental expectations. Strategic diversification into specialized applications and a focus on high-performance and aftermarket segments will be crucial for sustained growth and profitability in this dynamic market.

Automotive Engine Piston Rings Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Material Type

- 2.1. Steel

- 2.2. Aluminum

Automotive Engine Piston Rings Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Engine Piston Rings Market Regional Market Share

Geographic Coverage of Automotive Engine Piston Rings Market

Automotive Engine Piston Rings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Steel

- 5.2.2. Aluminum

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Steel

- 6.2.2. Aluminum

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Steel

- 7.2.2. Aluminum

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Steel

- 8.2.2. Aluminum

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Engine Piston Rings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Steel

- 9.2.2. Aluminum

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TPR CO Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Riken Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IP Rings

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sam Pistons & Rings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Piston Rings

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abilities India Piston & Ring

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Grover Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Asimco Technologies

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Feder Mogul LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shriram Pistons & Rings Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 TPR CO Ltd

List of Figures

- Figure 1: Global Automotive Engine Piston Rings Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 9: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 23: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Automotive Engine Piston Rings Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Engine Piston Rings Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 19: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 27: Global Automotive Engine Piston Rings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Mexico Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Other Countries Automotive Engine Piston Rings Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Engine Piston Rings Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Automotive Engine Piston Rings Market?

Key companies in the market include TPR CO Ltd, Riken Corporation, IP Rings, Sam Pistons & Rings, Nippon Piston Rings, Abilities India Piston & Ring, Grover Corporation, Asimco Technologies, Feder Mogul LLC, Shriram Pistons & Rings Ltd.

3. What are the main segments of the Automotive Engine Piston Rings Market?

The market segments include Vehicle Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Electric Vehicles Sales During the Forecast Period will be a Restraint for the Market.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Engine Piston Rings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Engine Piston Rings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Engine Piston Rings Market?

To stay informed about further developments, trends, and reports in the Automotive Engine Piston Rings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence