Key Insights

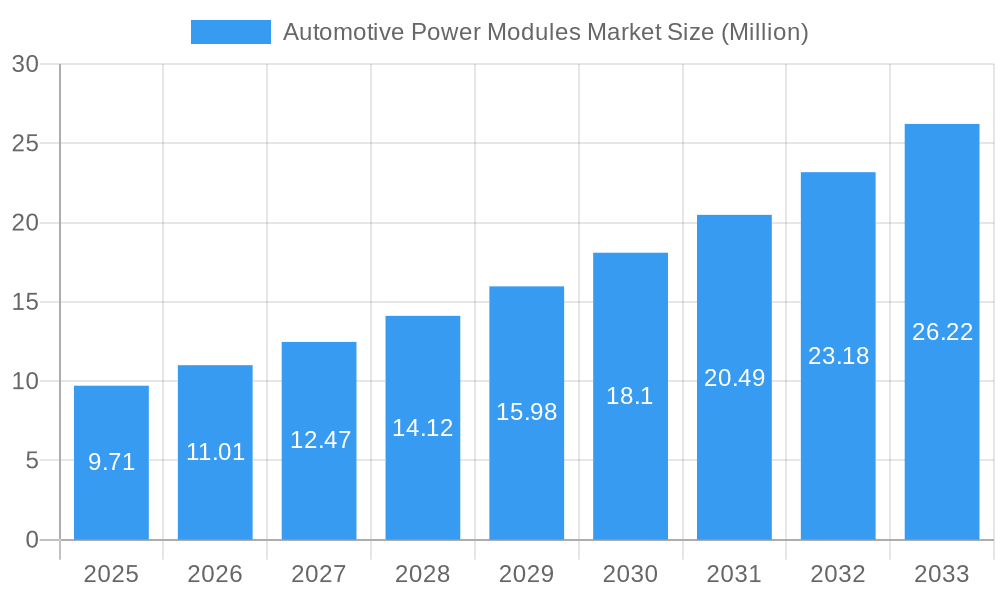

The global Automotive Power Modules market is poised for substantial expansion, projected to reach an estimated USD 9.71 billion in 2025. This robust growth is driven by a compelling CAGR of 13.50% over the forecast period of 2025-2033. A primary catalyst for this surge is the accelerating adoption of electric and hybrid vehicles, directly fueling demand for advanced power modules essential for efficient energy management and powertrain control. The increasing consumer preference for fuel-efficient and environmentally friendly transportation solutions, coupled with stringent government regulations on emissions, further solidifies the upward trajectory of this market. Key growth drivers include the relentless innovation in battery technology, enhanced charging infrastructure, and the continuous development of sophisticated electric powertrain systems. The market is experiencing a significant shift towards Battery Electric Vehicles (BEVs), Plug-in Hybrid Vehicles (PHEVs), and Full Hybrid Vehicles, each heavily reliant on high-performance power modules.

Automotive Power Modules Market Market Size (In Million)

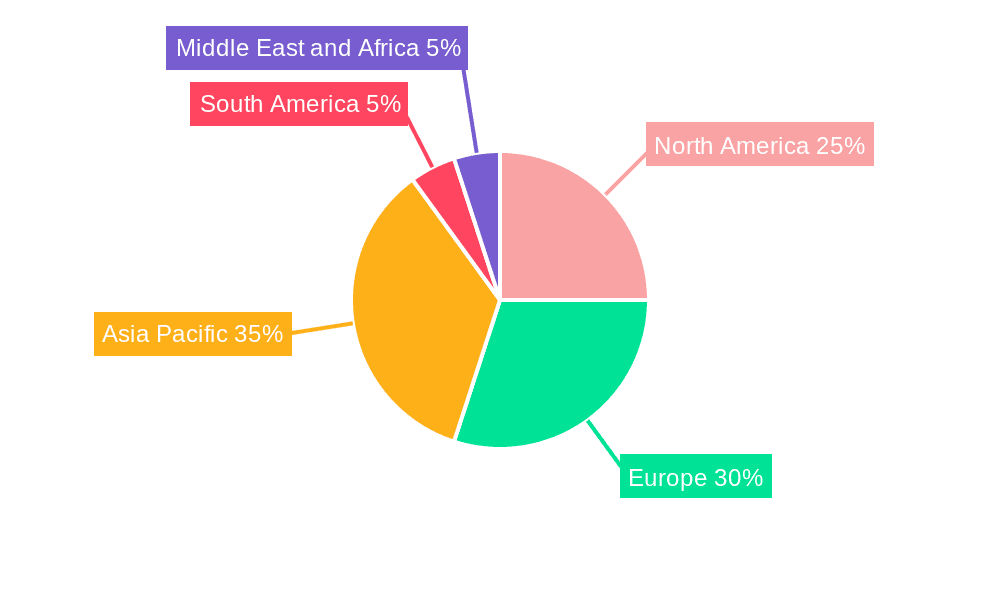

The market's segmentation reflects this electrifying automotive landscape. Within Electric Propulsion, the Battery Electric Vehicle segment is expected to lead the charge, followed closely by Plug-in Hybrid Vehicles and Full Hybrid Vehicles, each contributing to the overall market expansion. In terms of Vehicle Type, Passenger Cars will continue to dominate, owing to their high sales volumes globally. However, Commercial Vehicles are anticipated to witness considerable growth as electrification efforts extend to fleets and logistics operations. Geographically, the Asia Pacific region, led by China and Japan, is expected to be a dominant force, driven by strong manufacturing capabilities and a burgeoning electric vehicle market. Europe and North America are also projected to exhibit significant growth, supported by supportive government policies and substantial investments in EV infrastructure. Emerging restraints, such as the high initial cost of EVs and potential supply chain disruptions for critical components, are being actively addressed through technological advancements and strategic partnerships.

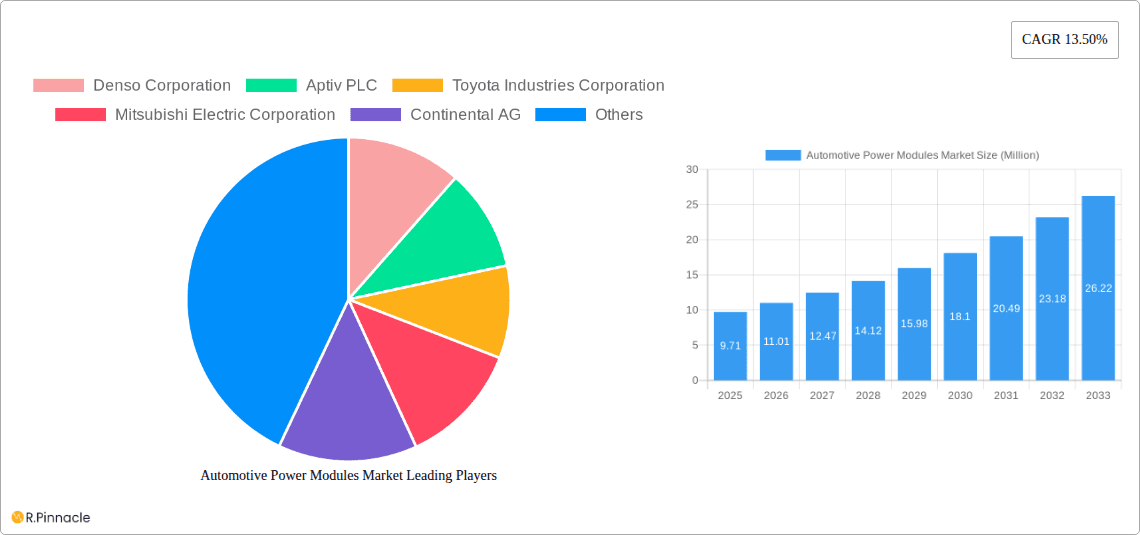

Automotive Power Modules Market Company Market Share

Automotive Power Modules Market: Unveiling Growth Drivers and Innovation in Electric Mobility

This comprehensive report delves into the dynamic Automotive Power Modules Market, forecasting significant expansion driven by the accelerating adoption of electric vehicles (EVs) and advancements in powertrain technology. Explore critical market segments, understand the influence of key industry players, and gain actionable insights into the future trajectory of this vital sector. With a Study Period of 2019–2033, a Base Year of 2025, and a Forecast Period of 2025–2033, this analysis provides a robust understanding of market evolution.

Automotive Power Modules Market Market Structure & Innovation Trends

The Automotive Power Modules Market exhibits a moderately concentrated structure, with several leading global players dominating market share. Innovation is primarily driven by the relentless pursuit of higher efficiency, increased power density, and enhanced thermal management solutions for electric vehicle powertrains. Regulatory frameworks, particularly those mandating stricter emissions standards and promoting EV adoption, act as significant innovation catalysts. Product substitutes, while evolving, are largely centered around optimizing existing semiconductor technologies and integrating advanced materials for improved performance. End-user demographics are shifting towards environmentally conscious consumers and fleet operators seeking cost-effective and sustainable transportation. Mergers and acquisitions (M&A) are strategically employed by key players to consolidate market presence, acquire advanced technological capabilities, and expand their product portfolios. For instance, recent M&A activities have focused on companies specializing in silicon carbide (SiC) and gallium nitride (GaN) power electronics, crucial for next-generation EV systems. Market share estimations reveal a continuous increase in the demand for sophisticated power modules, with the Battery Electric Vehicle (BEV) segment holding the largest share.

Automotive Power Modules Market Market Dynamics & Trends

The Automotive Power Modules Market is poised for robust growth, fueled by several compelling market dynamics and trends. The primary growth driver remains the escalating global demand for electric vehicles across all propulsion types: Full Hybrid Vehicles, Plug-in Hybrid Vehicles, and Battery Electric Vehicles. Government incentives, favorable policies, and increasing consumer awareness regarding environmental sustainability are accelerating EV adoption rates worldwide. Technological disruptions, particularly the widespread integration of Wide Bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN), are revolutionizing power module performance. These advanced materials enable higher operating temperatures, reduced energy losses, and smaller form factors, leading to more efficient and compact EV powertrains. Consumer preferences are increasingly leaning towards longer driving ranges, faster charging times, and lower running costs, all of which are directly addressed by advancements in power module technology. Competitive dynamics are intensifying, with established automotive suppliers and emerging semiconductor manufacturers vying for market leadership. Strategic partnerships and joint development agreements are becoming commonplace as companies collaborate to accelerate innovation and secure supply chains. The overall market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period, indicating a substantial market penetration of advanced power solutions in the automotive sector. The increasing complexity of EV powertrains, including inverters, DC-DC converters, and on-board chargers, further underscores the critical role of high-performance automotive power modules.

Dominant Regions & Segments in Automotive Power Modules Market

The Automotive Power Modules Market is witnessing significant dominance from key regions and segments, driven by distinct economic, regulatory, and consumer-driven factors. Asia Pacific, particularly China, stands as the leading region in terms of both production and consumption of automotive power modules. This leadership is underpinned by the region's extensive manufacturing capabilities, strong government support for electric mobility, and the presence of major EV manufacturers. Government policies aimed at carbon emission reduction and the promotion of new energy vehicles have created a fertile ground for the growth of the automotive power modules sector.

Within propulsion types, the Battery Electric Vehicle (BEV) segment exhibits the most substantial market share and is projected to grow at the fastest pace. This is directly attributable to the global surge in BEV sales, driven by advancements in battery technology, expanding charging infrastructure, and increasing consumer acceptance.

In terms of vehicle types, Passenger Cars represent the largest segment for automotive power modules. This is due to their sheer volume in global vehicle sales and the rapid electrification trend within this category. However, the Commercial Vehicles segment is also experiencing a notable growth trajectory as electric trucks, buses, and vans become increasingly viable alternatives for businesses aiming to reduce operational costs and environmental impact.

- Key Drivers for Regional Dominance (Asia Pacific):

- Favorable government policies and subsidies for EV adoption.

- Robust domestic automotive manufacturing ecosystem.

- Significant investments in charging infrastructure.

- Growing consumer demand for electric mobility solutions.

- Key Drivers for Segment Dominance (BEV):

- Increasing driving range and decreasing battery costs.

- Expanding charging network availability.

- Superior performance and lower running costs compared to internal combustion engine vehicles.

- Growing environmental consciousness among consumers.

- Key Drivers for Segment Dominance (Passenger Cars):

- Wide availability of electric models across various price points.

- Increasing adoption of advanced driver-assistance systems (ADAS) requiring significant electrical power.

- Personal mobility preferences aligning with sustainable transportation.

- Key Drivers for Emerging Dominance (Commercial Vehicles):

- Reduced total cost of ownership for fleets due to lower fuel and maintenance costs.

- Corporate sustainability goals and ESG mandates.

- Advancements in battery capacity and charging solutions for heavy-duty applications.

Automotive Power Modules Market Product Innovations

Product innovations in the automotive power modules market are primarily focused on enhancing performance, reliability, and integration. The adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors is a major trend, offering significant improvements in efficiency, power density, and thermal management compared to traditional silicon-based modules. These materials enable smaller, lighter, and more robust power electronic systems for EV inverters, DC-DC converters, and onboard chargers. Innovations also extend to advanced packaging technologies and thermal interface materials (TIMs) that ensure optimal heat dissipation, crucial for the longevity and performance of power modules in demanding automotive environments. The competitive advantage lies in developing modules that reduce energy losses, enable faster charging, and support higher voltage architectures for future EV platforms.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Automotive Power Modules Market across its critical segmentations to provide a comprehensive overview. The market is segmented based on Electric Propulsion: Full Hybrid Vehicle, Plug-in Hybrid Vehicle, and Battery Electric Vehicle. Further segmentation is conducted by Vehicle Type: Passenger Cars and Commercial Vehicles.

- Full Hybrid Vehicle Segment: This segment encompasses power modules designed for hybrid vehicles that utilize both an internal combustion engine and an electric motor for propulsion. Growth in this segment is steady, driven by consumers seeking improved fuel efficiency without the range anxiety associated with pure EVs.

- Plug-in Hybrid Vehicle Segment: This segment focuses on power modules for PHEVs, which offer a dedicated electric-only driving range before the internal combustion engine engages. This segment is expected to experience strong growth as consumers transition towards electrification, appreciating the flexibility of electric and hybrid modes.

- Battery Electric Vehicle Segment: This segment represents the fastest-growing and largest segment, dedicated to power modules for BEVs. The rapid advancements in battery technology, expanding charging infrastructure, and increasing consumer demand for zero-emission transportation are driving significant market expansion here.

- Passenger Cars Segment: Power modules for passenger cars constitute a major portion of the market. The widespread adoption of EVs across various passenger car segments, from compact to luxury, fuels the demand for these modules.

- Commercial Vehicles Segment: This segment includes power modules for electric trucks, buses, and vans. While currently smaller than the passenger car segment, it is projected to witness substantial growth as fleets increasingly adopt electric powertrains for their economic and environmental benefits.

Key Drivers of Automotive Power Modules Market Growth

The Automotive Power Modules Market is experiencing significant growth driven by a confluence of technological, economic, and regulatory factors. The primary catalyst is the rapid global transition towards electric mobility, propelled by stringent government regulations aimed at reducing greenhouse gas emissions and promoting sustainable transportation. Economic drivers include declining battery costs, increasing fuel prices, and the growing demand for energy-efficient vehicles. Technological advancements, particularly the integration of Wide Bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN), are enabling higher performance, greater efficiency, and smaller form factors for power modules. This technological leap is crucial for meeting the evolving demands of electric vehicle powertrains, including inverters, DC-DC converters, and onboard chargers. The expanding charging infrastructure further bolsters consumer confidence and accelerates EV adoption, thereby increasing the demand for automotive power modules.

Challenges in the Automotive Power Modules Market Sector

Despite its robust growth, the Automotive Power Modules Market faces several challenges that could impede its full potential. Supply chain disruptions, particularly for critical raw materials and specialized semiconductor components, pose a significant risk to production volumes and lead times. The high cost associated with advanced materials like SiC and GaN, coupled with complex manufacturing processes, contributes to the overall expense of power modules, impacting vehicle affordability. Stringent quality and reliability standards in the automotive industry necessitate extensive testing and validation, adding to development timelines and costs. Furthermore, the rapid pace of technological evolution creates a risk of obsolescence, requiring continuous investment in research and development to stay competitive. Intense competition among established players and emerging entrants can also lead to price pressures and reduced profit margins.

Emerging Opportunities in Automotive Power Modules Market

The Automotive Power Modules Market is ripe with emerging opportunities, fueled by innovation and evolving consumer demands. The widespread adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) technology presents a significant opportunity for manufacturers to develop more efficient, compact, and higher-performing power modules, leading to longer EV ranges and faster charging times. The increasing electrification of commercial vehicles, including trucks and buses, opens up a substantial new market segment with unique power requirements. Advancements in thermal management solutions and packaging technologies offer opportunities to improve the longevity and reliability of power modules in extreme automotive conditions. Furthermore, the growing demand for advanced driver-assistance systems (ADAS) and in-car electronics necessitates integrated power solutions, creating opportunities for customized and highly efficient power module designs. The potential for vehicle-to-grid (V2G) technology also presents new avenues for power module innovation, enabling bidirectional energy flow.

Leading Players in the Automotive Power Modules Market Market

- Denso Corporation

- Aptiv PLC

- Toyota Industries Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Hitachi Automotive Systems Ltd

- Meidensha Corporation

- Robert Bosch GmbH

- Marelli Corporation

- Valeo Group

Key Developments in Automotive Power Modules Market Industry

- March 2023: Infineon and Delta Electronics signed a memorandum of understanding with the purpose of enhancing their collaborative efforts in the development of advanced solutions for the electric vehicle sector. This partnership encompasses various components, including discrete high and low-voltage semiconductors, power modules, and microcontrollers. These are essential in EV drive systems, including the inverter, DC-DC converter, and on-board chargers. The primary goal is to provide more efficient and higher-performing products to meet the evolving demands of the EV market.

- November 2022: ROHM Semiconductor entered into a joint development agreement with Mazda Motor Corporation and Imasen Electric Industrial Co., Ltd. It is with the objective of collaboratively working on the development of inverters and silicon carbide power modules. These components are intended for use in the electric drive systems of electric vehicles, including the e-Axle.

- May 2022: Arieca signed a research agreement with ROHM Co., Ltd. to make efforts in the advancement of next-generation Thermal Interface Materials (TIM). This partnership exploits the Arieca Liquid Metal Embedded Elastomer Technology platform to deliver heat transfer capabilities while overcoming the reliability challenges typically associated with traditional TIM technologies.

- May 2022: Li Auto, a Chinese electric vehicle manufacturer, announced the construction of its power semiconductor research and development and production center in Suzhou City, Jiangsu province. This new facility in Suzhou will hold a primary emphasis on research and development as well as the production of third-generation automotive-grade silicon carbide (SiC) power modules. The goal is to enhance Li Auto's capacity to design and manufacture power modules specifically tailored for automobiles.

Future Outlook for Automotive Power Modules Market Market

The future outlook for the Automotive Power Modules Market is exceptionally bright, driven by the unstoppable momentum of vehicle electrification and the continuous pursuit of technological innovation. The market is expected to experience sustained high growth rates as governments worldwide reinforce their commitment to decarbonization targets. Key growth accelerators will include the increasing adoption of Wide Bandgap (WBG) semiconductors, leading to more efficient and powerful electric powertrains. Strategic opportunities lie in catering to the burgeoning demand for power modules in commercial electric vehicles and developing integrated power solutions for advanced driver-assistance systems and autonomous driving technologies. Furthermore, the potential for vehicle-to-grid (V2G) applications and the integration of renewable energy sources into vehicle charging ecosystems will create new frontiers for power module development. Companies that focus on R&D, strategic partnerships, and supply chain resilience will be well-positioned to capitalize on the immense potential of this evolving market.

Automotive Power Modules Market Segmentation

-

1. Electric Propulsion

- 1.1. Full Hybrid Vehicle

- 1.2. Plug-in Hybrid Vehicle

- 1.3. Battery Electric Vehicle

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Automotive Power Modules Market Segmentation By Geography

-

1. t

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Argentina

- 4.2. Chile

- 4.3. Brazil

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Oman

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Nigeria

Automotive Power Modules Market Regional Market Share

Geographic Coverage of Automotive Power Modules Market

Automotive Power Modules Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Battery Electric Vehicles May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 5.1.1. Full Hybrid Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.1.3. Battery Electric Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. t

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 6. t Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 6.1.1. Full Hybrid Vehicle

- 6.1.2. Plug-in Hybrid Vehicle

- 6.1.3. Battery Electric Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 7. Europe Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 7.1.1. Full Hybrid Vehicle

- 7.1.2. Plug-in Hybrid Vehicle

- 7.1.3. Battery Electric Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 8. Asia Pacific Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 8.1.1. Full Hybrid Vehicle

- 8.1.2. Plug-in Hybrid Vehicle

- 8.1.3. Battery Electric Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 9. South America Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 9.1.1. Full Hybrid Vehicle

- 9.1.2. Plug-in Hybrid Vehicle

- 9.1.3. Battery Electric Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 10. Middle East and Africa Automotive Power Modules Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 10.1.1. Full Hybrid Vehicle

- 10.1.2. Plug-in Hybrid Vehicle

- 10.1.3. Battery Electric Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Electric Propulsion

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Denso Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aptiv PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toyota Industries Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Continental AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi Automotive Systems Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Meidensha Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robert Bosch GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Marelli Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Valeo Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Power Modules Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: t Automotive Power Modules Market Revenue (Million), by Electric Propulsion 2025 & 2033

- Figure 3: t Automotive Power Modules Market Revenue Share (%), by Electric Propulsion 2025 & 2033

- Figure 4: t Automotive Power Modules Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: t Automotive Power Modules Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: t Automotive Power Modules Market Revenue (Million), by Country 2025 & 2033

- Figure 7: t Automotive Power Modules Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Power Modules Market Revenue (Million), by Electric Propulsion 2025 & 2033

- Figure 9: Europe Automotive Power Modules Market Revenue Share (%), by Electric Propulsion 2025 & 2033

- Figure 10: Europe Automotive Power Modules Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive Power Modules Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive Power Modules Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Power Modules Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Power Modules Market Revenue (Million), by Electric Propulsion 2025 & 2033

- Figure 15: Asia Pacific Automotive Power Modules Market Revenue Share (%), by Electric Propulsion 2025 & 2033

- Figure 16: Asia Pacific Automotive Power Modules Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Power Modules Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Power Modules Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Power Modules Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive Power Modules Market Revenue (Million), by Electric Propulsion 2025 & 2033

- Figure 21: South America Automotive Power Modules Market Revenue Share (%), by Electric Propulsion 2025 & 2033

- Figure 22: South America Automotive Power Modules Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: South America Automotive Power Modules Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Automotive Power Modules Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Automotive Power Modules Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive Power Modules Market Revenue (Million), by Electric Propulsion 2025 & 2033

- Figure 27: Middle East and Africa Automotive Power Modules Market Revenue Share (%), by Electric Propulsion 2025 & 2033

- Figure 28: Middle East and Africa Automotive Power Modules Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive Power Modules Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive Power Modules Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive Power Modules Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 2: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Power Modules Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 5: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Power Modules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 11: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive Power Modules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 18: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Automotive Power Modules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 25: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Automotive Power Modules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Argentina Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Chile Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Brazil Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Power Modules Market Revenue Million Forecast, by Electric Propulsion 2020 & 2033

- Table 31: Global Automotive Power Modules Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Power Modules Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Oman Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Nigeria Automotive Power Modules Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Power Modules Market?

The projected CAGR is approximately 13.50%.

2. Which companies are prominent players in the Automotive Power Modules Market?

Key companies in the market include Denso Corporation, Aptiv PLC, Toyota Industries Corporation, Mitsubishi Electric Corporation, Continental AG, Hitachi Automotive Systems Ltd, Meidensha Corporation, Robert Bosch GmbH, Marelli Corporation, Valeo Group*List Not Exhaustive.

3. What are the main segments of the Automotive Power Modules Market?

The market segments include Electric Propulsion, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Increasing Adoption of Battery Electric Vehicles May Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Infineon and Delta Electronics signed a memorandum of understanding with the purpose of enhancing their collaborative efforts in the development of advanced solutions for the electric vehicle sector. This partnership encompasses various components, including discrete high and low-voltage semiconductors, power modules, and microcontrollers. These are essential in EV drive systems, including the inverter, DC-DC converter, and on-board chargers. The primary goal is to provide more efficient and higher-performing products to meet the evolving demands of the EV market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Power Modules Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Power Modules Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Power Modules Market?

To stay informed about further developments, trends, and reports in the Automotive Power Modules Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence