Key Insights

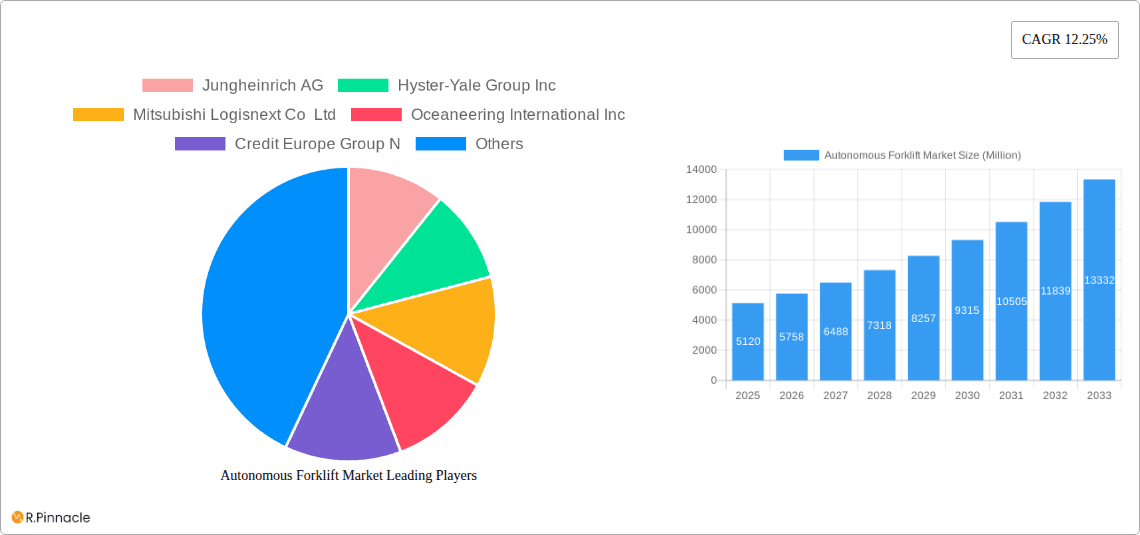

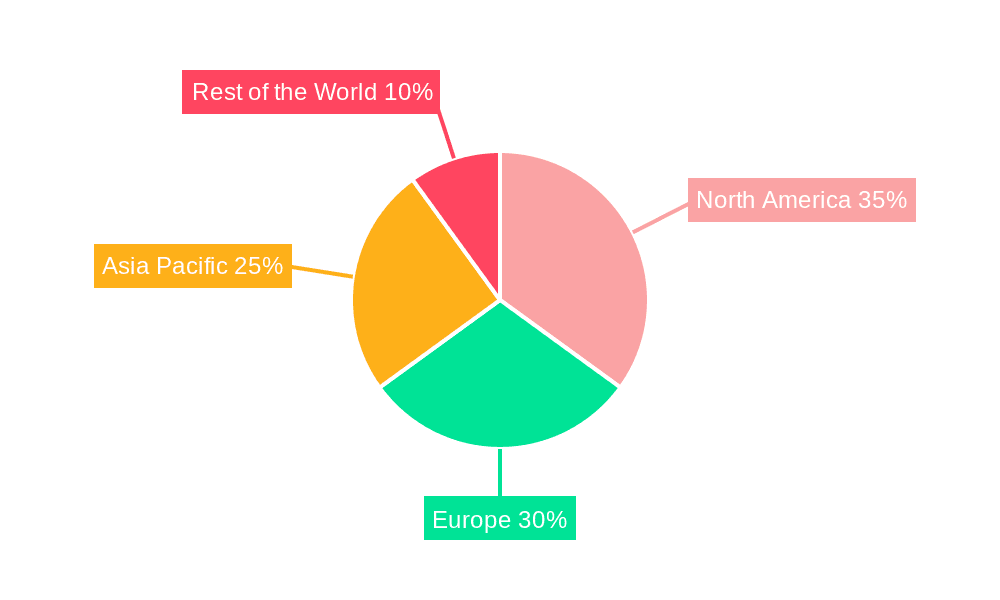

The global autonomous forklift market, valued at $5.12 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 12.25% from 2025 to 2033. This surge is driven primarily by the increasing demand for enhanced efficiency and productivity in logistics and warehousing, coupled with the rising adoption of automation across manufacturing and material handling sectors. The shift towards Industry 4.0 and the need to optimize supply chains are significant catalysts. Growth is further fueled by advancements in navigation technologies like laser guidance and vision guidance, offering more precise and reliable autonomous operations. Electric propulsion systems are gaining traction due to their environmental benefits and reduced operational costs, while various forklift types, including pallet trucks and stackers, contribute to market segmentation. Regional variations exist, with North America and Europe currently holding substantial market shares due to early adoption and advanced automation infrastructure, while the Asia-Pacific region is poised for significant growth, driven by expanding manufacturing hubs and rising labor costs.

Autonomous Forklift Market Market Size (In Billion)

However, the market faces some restraints. High initial investment costs for autonomous forklift systems can be a barrier to entry for smaller businesses. Furthermore, concerns regarding safety and integration with existing warehouse management systems need to be addressed to ensure seamless implementation. Despite these challenges, the long-term prospects remain positive, with continuous technological innovation leading to improved safety features, reduced operational complexities, and enhanced return on investment, ultimately driving widespread adoption across diverse industries globally. The market's segmentation by tonnage capacity, navigation technology, application, propulsion type, and forklift type reflects the diverse needs and preferences across various industries and applications. Continuous advancements in artificial intelligence and machine learning will likely further enhance the capabilities of autonomous forklifts in the coming years.

Autonomous Forklift Market Company Market Share

Autonomous Forklift Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Autonomous Forklift Market, offering invaluable insights for industry professionals, investors, and strategists. We examine market dynamics, key players, technological advancements, and future growth projections, covering the period from 2019 to 2033. The report leverages extensive data analysis and expert insights to provide actionable intelligence for informed decision-making. The market is segmented by tonnage capacity, navigation technology, application, propulsion type, and forklift type, enabling a granular understanding of market trends and opportunities. The report’s findings are supported by real-world examples and recent industry developments, including significant product launches and strategic partnerships. The global market value is projected to reach xx Million by 2033.

Autonomous Forklift Market Market Structure & Innovation Trends

The Autonomous Forklift Market is characterized by a moderately concentrated structure, with a few key players holding substantial market share. As of 2024, industry stalwarts like Jungheinrich AG, Hyster-Yale Group Inc., and Toyota Industries Corporation collectively command an estimated **xx%** of the market. However, this landscape is becoming increasingly dynamic with the emergence of agile players who are carving out niches by specializing in cutting-edge technologies or specific application areas. The relentless pace of innovation is fueled by significant advancements in artificial intelligence (AI), sophisticated sensor technologies such as LiDAR and advanced vision systems, and highly refined navigation algorithms. These technological leaps are crucial for enhancing operational efficiency and safety. Furthermore, the evolution of regulatory frameworks, encompassing stringent safety standards and comprehensive operational guidelines for autonomous vehicles, plays a pivotal role in shaping the trajectory of market growth. While traditional manually operated forklifts continue to offer a competitive alternative, especially in price-sensitive segments, the inherent advantages of autonomous solutions are increasingly driving their adoption. The end-user base is exceptionally diverse, spanning critical sectors like logistics, manufacturing, warehousing, and broader material handling operations. Mergers and acquisitions (M&A) have been a notable, albeit moderate, feature of the market, with recent years witnessing deal values averaging around **xx Million**. These strategic acquisitions are often aimed at integrating smaller, specialized technology firms to bolster core competencies and expand product offerings.

- Market Concentration: Moderately concentrated, with the top 3 players holding approximately xx% of the market share in 2024.

- Key Innovation Drivers: Significant advancements in artificial intelligence (AI), a diverse range of sensor technologies, and sophisticated navigation algorithms are spearheading market innovation.

- Crucial Regulatory Framework: The market's growth is significantly influenced by the development and implementation of robust safety standards and comprehensive operational guidelines for autonomous vehicles.

- M&A Activity: The market has experienced moderate M&A activity, with an average deal value of approximately xx Million in recent years, often targeting specialized technology acquisitions.

Autonomous Forklift Market Market Dynamics & Trends

The Autonomous Forklift Market is experiencing robust growth, driven by the increasing need for efficiency, safety, and reduced labor costs in various industries. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of advanced AI and IoT capabilities, are enhancing the capabilities of autonomous forklifts, leading to increased adoption. Consumer preferences are shifting toward more efficient, safer, and reliable solutions. Competitive dynamics are intensifying, with existing players investing heavily in R&D and new entrants disrupting the market with innovative offerings. Market penetration remains relatively low in certain regions and applications, presenting significant opportunities for future growth. The electric propulsion type segment shows a higher market penetration compared to diesel, owing to environmental concerns and government regulations. The below 5 tons tonnage capacity segment leads the market due to its wide applicability in various sectors.

Dominant Regions & Segments in Autonomous Forklift Market

North America currently stands as the leading region in the Autonomous Forklift Market. This dominance is attributed to a potent combination of robust demand from its thriving logistics and warehousing sectors and substantial investments channeled into automation technologies. Europe and the Asia-Pacific region follow closely, exhibiting impressive growth trajectories and significant potential for future expansion. These regions are actively embracing autonomous forklift solutions to enhance operational efficiency and address labor challenges.

- Leading Region: North America

- Key Drivers in North America: A high adoption rate within the logistics and warehousing sectors, coupled with significant capital investments in automation technologies.

- Key Drivers in Europe: Growing acceptance and implementation in manufacturing and material handling industries, supported by favorable government policies and incentives.

- Key Drivers in Asia-Pacific: Rapid industrialization, rising labor costs, and proactive government initiatives aimed at promoting widespread automation adoption.

By Tonnage Capacity: The "Below 5 Tons" segment commands the largest market share, primarily due to its exceptional versatility and suitability for a wide array of operational applications.

By Navigation Technology: Laser guidance technology is the dominant navigation method, owing to its unparalleled accuracy and proven reliability in diverse operational environments.

By Application: The Logistics and Warehousing segment is the leading application area, with Manufacturing and Material Handling following as significant contributors to market demand.

By Propulsion Type: Electric forklifts are experiencing a surge in popularity, driven by increasing environmental consciousness and the promise of significant cost savings over their operational lifespan.

By Type: The Pallet Truck/Mover/Jack category currently represents the most widely utilized type of autonomous forklift, underscoring its fundamental role in material handling operations.

Autonomous Forklift Market Product Innovations

Recent product innovations focus on enhancing safety, efficiency, and ease of use. New models incorporate advanced AI-powered navigation systems, improved obstacle detection, and user-friendly interfaces. The emphasis is on providing autonomous forklifts that can seamlessly integrate into existing warehouse and manufacturing environments. The market is seeing a shift towards modular designs allowing for greater flexibility and customization. The integration of cloud-based data analytics platforms enables better fleet management and predictive maintenance.

Report Scope & Segmentation Analysis

This report covers the global Autonomous Forklift Market across various segments:

By Tonnage Capacity: Below 5 Tons, 5-10 Tons, Above 10 Tons. The Below 5 Tons segment is projected to maintain its dominance.

By Navigation Technology: Laser Guidance, Vision Guidance, Optical Tape Guidance, Magnetic Guidance, Inductive Guidance, Others (Simultaneous Localization and Mapping, etc.). Laser Guidance is expected to remain the most popular option.

By Application: Logistics and Warehousing, Manufacturing, Material Handling, Others (Retail, etc.). Logistics and Warehousing will continue to be the largest application segment.

By Propulsion Type: Electric, Diesel, Others (CNG, LPG, etc.). Electric propulsion is projected to experience substantial growth.

By Type: Pallet Truck/Mover/Jack, Pallet Stackers, Others (Forked AGV, etc.). Pallet Truck/Mover/Jack remains the dominant type.

Each segment's growth is analyzed considering market size, growth projections, and competitive dynamics.

Key Drivers of Autonomous Forklift Market Growth

The Autonomous Forklift Market is experiencing significant growth due to several key factors:

- Increased Demand for Efficiency: Businesses seek to optimize warehouse operations and reduce labor costs.

- Enhanced Safety: Autonomous forklifts reduce the risk of human error and workplace accidents.

- Technological Advancements: Ongoing improvements in AI, sensor technologies, and navigation systems.

- Government Regulations: Environmental regulations are promoting the adoption of electric-powered forklifts.

Challenges in the Autonomous Forklift Market Sector

Despite the market's potential, challenges remain:

- High Initial Investment Costs: The cost of implementing autonomous forklift systems can be prohibitive for some businesses.

- Integration Complexity: Seamless integration with existing infrastructure can be technically challenging.

- Safety Concerns: Ensuring the safety and reliability of autonomous forklifts in complex environments is paramount.

- Limited Availability of Skilled Labor: Expertise in maintaining and operating these systems is still in relatively short supply.

Emerging Opportunities in Autonomous Forklift Market

Significant opportunities exist in:

- Expansion into New Markets: Growing demand in emerging economies presents considerable growth potential.

- Development of Advanced Technologies: Further advancements in AI and robotics will improve efficiency and capabilities.

- Focus on Customized Solutions: Tailoring autonomous forklift systems to meet specific industry needs.

- Integration of IoT and Cloud Technologies: Enabling remote monitoring, predictive maintenance, and data analytics.

Leading Players in the Autonomous Forklift Market Market

- Jungheinrich AG

- Hyster-Yale Group Inc

- Mitsubishi Logisnext Co Ltd

- Oceaneering International Inc

- Credit Europe Group N

- HD Hyundai Construction Equipment

- Toyota Industries Corporation

- Balyo

- Vecna AFL

- Agilox Services GmbH

- Hangcha Group Co Ltd

- Kion Group AG

- Otto Motors

- Gridbots Technologies Private Limited

- Swisslog Holding AG

Key Developments in Autonomous Forklift Market Industry

- February 2024: Seegrid Corporation unveiled its latest innovation, the Palion Lift CR1 autonomous lift truck, boasting an impressive 15-foot lift height and a substantial 4,000lb payload capacity, signaling advancements in lifting capabilities.

- September 2023: Worldwide Flight Services (WFS) initiated a significant trial utilizing Linde AGV forklift trucks at Barcelona Airport, exploring the potential of autonomous solutions in the aviation logistics sector.

- August 2023: Cyngn Inc. announced a strategic pre-order agreement with Arauco for 100 autonomous electric forklifts, highlighting a substantial commitment to large-scale adoption and integration.

These pivotal developments collectively underscore the continuous momentum of innovation and the accelerating adoption rate of autonomous forklift technology across various industries and applications.

Future Outlook for Autonomous Forklift Market Market

The Autonomous Forklift Market is on a trajectory for sustained and robust growth. This expansion will be propelled by continuous technological advancements, a burgeoning demand for enhanced automation solutions across industries, and the establishment of increasingly supportive regulatory frameworks. A primary focus on augmenting safety protocols, optimizing operational efficiencies, and reducing overall operating expenditures will continue to be key drivers for widespread adoption across a multitude of sectors. Strategic alliances, collaborative partnerships, and significant investments in research and development (R&D) will be paramount for companies aiming to maintain and strengthen their competitive positions within this rapidly evolving market. The market is anticipated to witness a marked increase in the deployment of electric and AI-powered autonomous forklifts, heralding a new era of heightened innovation and transformative growth in the years to come.

Autonomous Forklift Market Segmentation

-

1. Tonnage Capacity

- 1.1. Below 5 Tons

- 1.2. 5-10 Tons

- 1.3. Above 10 Tons

-

2. Navigation Technology

- 2.1. Laser Guidance

- 2.2. Vision Guidance

- 2.3. Optical Tape Guidance

- 2.4. Magnetic Guidance

- 2.5. Inductive Guidance

- 2.6. Others (

-

3. Application

- 3.1. Logistics and Warehousing

- 3.2. Manufacturing

- 3.3. Material Handling

- 3.4. Others (Retail, etc.)

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Diesel

- 4.3. Others (CNG, LPG, etc.)

-

5. Type

- 5.1. Pallet Truck/Mover/Jack

- 5.2. Pallet Stackers

- 5.3. Others (Forked AGV, etc.)

Autonomous Forklift Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Autonomous Forklift Market Regional Market Share

Geographic Coverage of Autonomous Forklift Market

Autonomous Forklift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.1.1. Below 5 Tons

- 5.1.2. 5-10 Tons

- 5.1.3. Above 10 Tons

- 5.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 5.2.1. Laser Guidance

- 5.2.2. Vision Guidance

- 5.2.3. Optical Tape Guidance

- 5.2.4. Magnetic Guidance

- 5.2.5. Inductive Guidance

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logistics and Warehousing

- 5.3.2. Manufacturing

- 5.3.3. Material Handling

- 5.3.4. Others (Retail, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Diesel

- 5.4.3. Others (CNG, LPG, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Pallet Truck/Mover/Jack

- 5.5.2. Pallet Stackers

- 5.5.3. Others (Forked AGV, etc.)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6. North America Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6.1.1. Below 5 Tons

- 6.1.2. 5-10 Tons

- 6.1.3. Above 10 Tons

- 6.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 6.2.1. Laser Guidance

- 6.2.2. Vision Guidance

- 6.2.3. Optical Tape Guidance

- 6.2.4. Magnetic Guidance

- 6.2.5. Inductive Guidance

- 6.2.6. Others (

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Logistics and Warehousing

- 6.3.2. Manufacturing

- 6.3.3. Material Handling

- 6.3.4. Others (Retail, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. Electric

- 6.4.2. Diesel

- 6.4.3. Others (CNG, LPG, etc.)

- 6.5. Market Analysis, Insights and Forecast - by Type

- 6.5.1. Pallet Truck/Mover/Jack

- 6.5.2. Pallet Stackers

- 6.5.3. Others (Forked AGV, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7. Europe Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7.1.1. Below 5 Tons

- 7.1.2. 5-10 Tons

- 7.1.3. Above 10 Tons

- 7.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 7.2.1. Laser Guidance

- 7.2.2. Vision Guidance

- 7.2.3. Optical Tape Guidance

- 7.2.4. Magnetic Guidance

- 7.2.5. Inductive Guidance

- 7.2.6. Others (

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Logistics and Warehousing

- 7.3.2. Manufacturing

- 7.3.3. Material Handling

- 7.3.4. Others (Retail, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. Electric

- 7.4.2. Diesel

- 7.4.3. Others (CNG, LPG, etc.)

- 7.5. Market Analysis, Insights and Forecast - by Type

- 7.5.1. Pallet Truck/Mover/Jack

- 7.5.2. Pallet Stackers

- 7.5.3. Others (Forked AGV, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8. Asia Pacific Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8.1.1. Below 5 Tons

- 8.1.2. 5-10 Tons

- 8.1.3. Above 10 Tons

- 8.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 8.2.1. Laser Guidance

- 8.2.2. Vision Guidance

- 8.2.3. Optical Tape Guidance

- 8.2.4. Magnetic Guidance

- 8.2.5. Inductive Guidance

- 8.2.6. Others (

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Logistics and Warehousing

- 8.3.2. Manufacturing

- 8.3.3. Material Handling

- 8.3.4. Others (Retail, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. Electric

- 8.4.2. Diesel

- 8.4.3. Others (CNG, LPG, etc.)

- 8.5. Market Analysis, Insights and Forecast - by Type

- 8.5.1. Pallet Truck/Mover/Jack

- 8.5.2. Pallet Stackers

- 8.5.3. Others (Forked AGV, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9. Rest of the World Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9.1.1. Below 5 Tons

- 9.1.2. 5-10 Tons

- 9.1.3. Above 10 Tons

- 9.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 9.2.1. Laser Guidance

- 9.2.2. Vision Guidance

- 9.2.3. Optical Tape Guidance

- 9.2.4. Magnetic Guidance

- 9.2.5. Inductive Guidance

- 9.2.6. Others (

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Logistics and Warehousing

- 9.3.2. Manufacturing

- 9.3.3. Material Handling

- 9.3.4. Others (Retail, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. Electric

- 9.4.2. Diesel

- 9.4.3. Others (CNG, LPG, etc.)

- 9.5. Market Analysis, Insights and Forecast - by Type

- 9.5.1. Pallet Truck/Mover/Jack

- 9.5.2. Pallet Stackers

- 9.5.3. Others (Forked AGV, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyster-Yale Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Logisnext Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oceaneering International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Credit Europe Group N

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HD Hyundai Construction Equipment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Industries Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Balyo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vecna AFL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilox Services GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hangcha Group Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kion Group AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Otto Motors

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gridbots Technologies Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Swisslog Holding AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Autonomous Forklift Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 3: North America Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 4: North America Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 5: North America Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 6: North America Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 9: North America Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: North America Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 15: Europe Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 16: Europe Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 17: Europe Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 18: Europe Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 21: Europe Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Europe Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 27: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 28: Asia Pacific Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 29: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 30: Asia Pacific Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 33: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: Asia Pacific Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 39: Rest of the World Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 40: Rest of the World Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 41: Rest of the World Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 42: Rest of the World Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 45: Rest of the World Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Rest of the World Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Rest of the World Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Rest of the World Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 2: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 3: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Autonomous Forklift Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 8: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 9: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 17: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 18: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 28: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 29: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Japan Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Korea Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 39: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 40: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 42: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Middle East and Africa Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Forklift Market?

The projected CAGR is approximately 12.25%.

2. Which companies are prominent players in the Autonomous Forklift Market?

Key companies in the market include Jungheinrich AG, Hyster-Yale Group Inc, Mitsubishi Logisnext Co Ltd, Oceaneering International Inc, Credit Europe Group N, HD Hyundai Construction Equipment, Toyota Industries Corporation, Balyo, Vecna AFL, Agilox Services GmbH, Hangcha Group Co Ltd, Kion Group AG, Otto Motors, Gridbots Technologies Private Limited, Swisslog Holding AG.

3. What are the main segments of the Autonomous Forklift Market?

The market segments include Tonnage Capacity, Navigation Technology, Application, Propulsion Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Forklift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Forklift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Forklift Market?

To stay informed about further developments, trends, and reports in the Autonomous Forklift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence