Key Insights

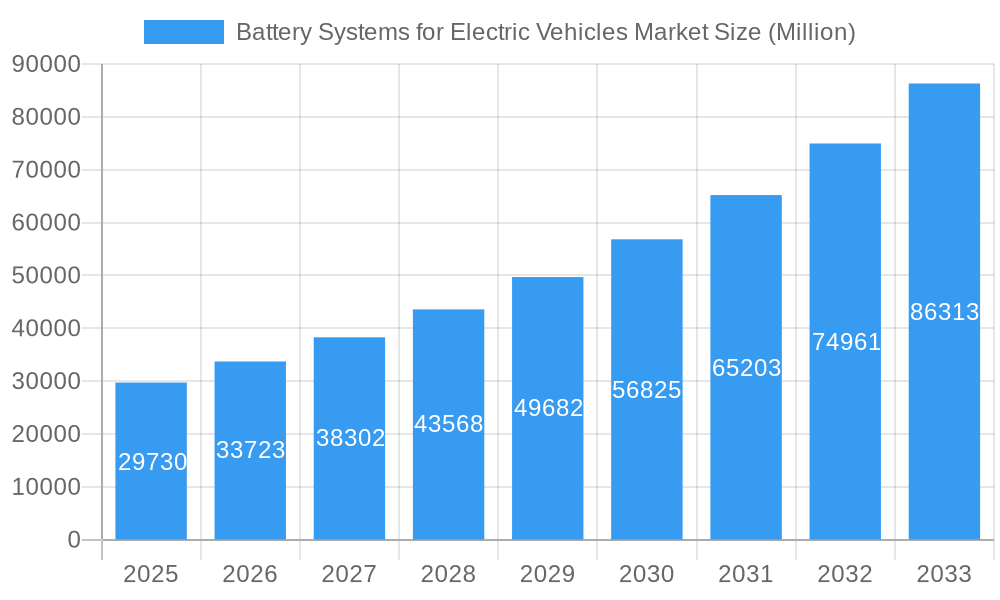

The Battery Systems for Electric Vehicles (EV) market is experiencing robust growth, projected to reach \$29.73 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 13.50% from 2025 to 2033. This expansion is fueled by several key factors. The increasing global demand for electric vehicles, driven by stringent emission regulations and growing environmental concerns, is a primary driver. Furthermore, advancements in battery technology, leading to higher energy density, longer lifespan, and improved safety features, are significantly enhancing market appeal. Government incentives and subsidies aimed at promoting EV adoption are also contributing to market growth. Lithium-ion batteries currently dominate the market due to their superior performance characteristics, although nickel-metal hydride and lead-acid batteries maintain a presence in specific niches. The passenger car segment leads in terms of battery system demand, followed by commercial vehicles. Geographic growth is expected across all regions, with Asia Pacific (particularly China) and North America showcasing the most significant market share due to high EV production and sales volumes. Challenges remain, including the high initial cost of EV batteries, concerns over raw material sourcing and supply chain stability, and the need for improved battery recycling infrastructure. However, ongoing research and development efforts, coupled with increasing economies of scale, are progressively addressing these limitations.

Battery Systems for Electric Vehicles Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. While Lithium-ion batteries command the largest share, the market is seeing increased interest in ultracapacitors due to their potential for rapid charging and high power output, particularly in niche applications within the commercial vehicle sector. Leading market players, including Johnson Controls International PLC, Samsung SDI Co Ltd, and Panasonic Corporation, are actively engaged in innovation and expansion efforts to solidify their market positions. The competitive landscape is marked by strategic partnerships, mergers and acquisitions, and a continuous drive toward technological advancement. The forecast period (2025-2033) suggests a period of sustained growth with significant potential for market expansion and diversification of battery technologies to meet the evolving needs of the electric vehicle industry.

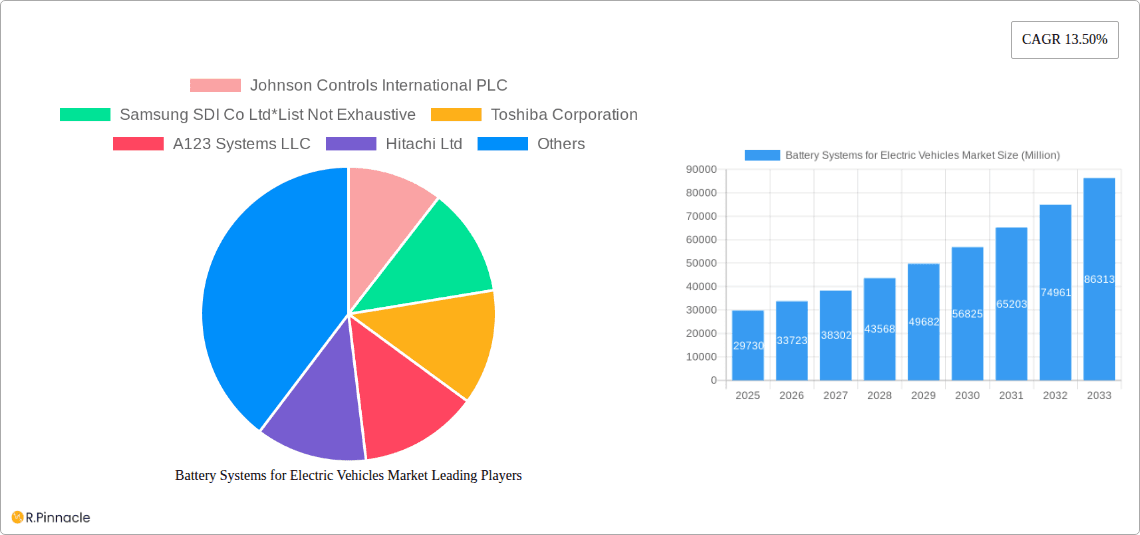

Battery Systems for Electric Vehicles Market Company Market Share

Battery Systems for Electric Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Battery Systems for Electric Vehicles market, offering actionable insights for industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, technological advancements, and future growth potential. The report leverages extensive market research to deliver a clear understanding of the current landscape and future projections. Expect detailed segmentation analysis, highlighting growth opportunities and challenges within the industry.

Battery Systems for Electric Vehicles Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Battery Systems for Electric Vehicles market. The market shows moderate concentration with key players holding significant shares, though numerous smaller companies contribute to innovation. The xx% market share held by the top 5 players (Johnson Controls International PLC, Samsung SDI Co Ltd, Toshiba Corporation, A123 Systems LLC, and Hitachi Ltd) highlights the competitive intensity. Mergers and acquisitions (M&A) activity has been substantial, with deal values exceeding xx Million in the past five years. Recent M&A activity demonstrates a focus on securing supply chains and expanding production capacity.

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Innovation Drivers: Demand for higher energy density, improved safety, faster charging, and reduced costs.

- Regulatory Frameworks: Government incentives, emission regulations, and safety standards are major drivers.

- Product Substitutes: Fuel cells and other energy storage technologies pose potential competition.

- End-User Demographics: Growing adoption of EVs in passenger cars and commercial vehicles is a key driver.

- M&A Activity: Significant activity observed with a focus on vertical integration and geographical expansion. Deal values exceeding xx Million in the last 5 years.

Battery Systems for Electric Vehicles Market Market Dynamics & Trends

The Battery Systems for Electric Vehicles market is experiencing robust growth, driven by the increasing adoption of electric vehicles globally. The market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including stringent government regulations aimed at reducing carbon emissions, technological advancements leading to improved battery performance and reduced costs, and increasing consumer preference for environmentally friendly vehicles. Market penetration is expected to increase significantly, particularly in developed nations where EV infrastructure is well established. Competitive dynamics remain intense, with established players and new entrants vying for market share. Technological disruptions, such as the development of solid-state batteries, are also expected to reshape the market landscape.

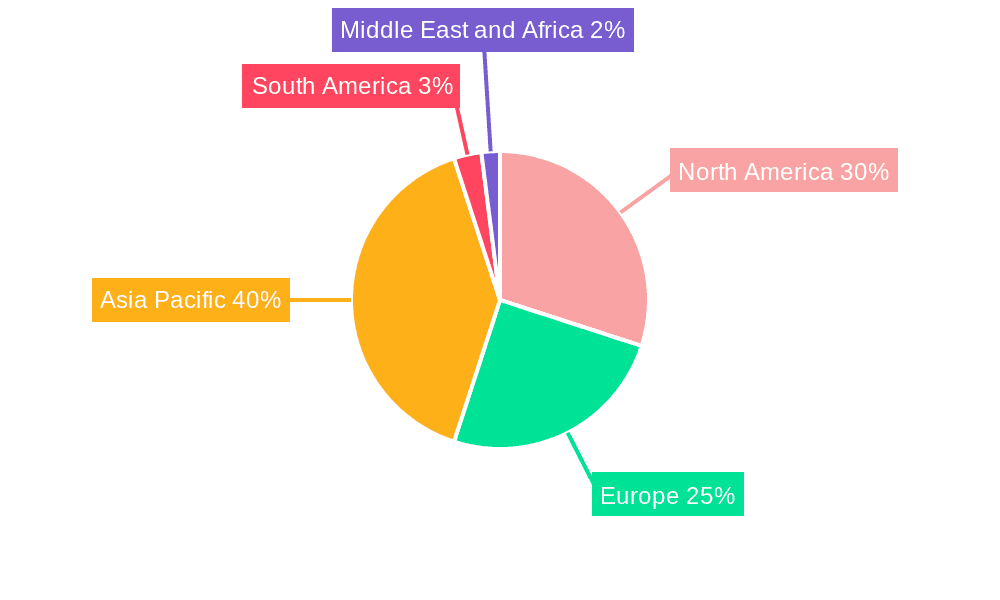

Dominant Regions & Segments in Battery Systems for Electric Vehicles Market

The global Battery Systems for Electric Vehicles market is a geographically diverse and segment-rich landscape, with distinct regional leadership and segment dominance. The Asia Pacific region currently stands as the undisputed leader, propelled by a strong manufacturing base, robust government support, and high EV adoption rates, particularly in countries like China. North America and Europe follow closely, demonstrating significant growth and commitment to electrification. Within these regions, pivotal markets such as the United States and Germany are at the forefront of EV deployment. On the technology front, Lithium-ion batteries continue to dominate due to their superior energy density and performance characteristics. However, the market is also witnessing promising growth in emerging segments such as Ultra-capacitors, which offer distinct advantages in specific applications requiring rapid energy discharge and charge cycles.

Key Drivers:

- Passenger Cars: The burgeoning demand for sustainable personal transportation, coupled with favorable government policies and increasing model availability, fuels significant growth in this segment.

- Commercial Vehicles: A growing imperative to decarbonize the logistics and public transportation sectors, driven by regulatory pressures and the pursuit of operational efficiency, is accelerating EV adoption in commercial fleets.

- Lithium-ion Batteries: Their established advantages in terms of energy density, power output, and cycle life make them the current benchmark, with ongoing research focused on further enhancing their performance and safety.

- Asia Pacific: The region's dominance is cemented by its vast market size, comprehensive government backing for EV infrastructure and manufacturing, and an established ecosystem of automotive and battery producers.

Battery Systems for Electric Vehicles Market Product Innovations

Recent years have witnessed significant advancements in battery technology, leading to higher energy density, faster charging times, and enhanced safety features. The development of solid-state batteries and improved battery management systems has further enhanced efficiency and longevity. The market is seeing increased adoption of innovative battery chemistries, including those employing niobium-titanium oxide (NTO) for increased performance and durability. This aligns with the increasing demand for extended vehicle range and reduced charging times. These improvements are directly contributing to increased market acceptance and expansion.

Report Scope & Segmentation Analysis

This report segments the Battery Systems for Electric Vehicles market by battery type (Lithium-ion Batteries, Nickel-Metal Hydride Batteries, Lead-Acid Batteries, Ultra capacitors, Others) and vehicle type (Passenger Cars, Commercial Vehicles). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The Lithium-ion battery segment is expected to maintain its dominance due to its superior energy density. The passenger car segment is currently larger, but the commercial vehicle segment is anticipated to exhibit faster growth due to increasing demand for electric buses and trucks.

Key Drivers of Battery Systems for Electric Vehicles Market Growth

The growth of the Battery Systems for Electric Vehicles market is fueled by several factors:

- Technological advancements: Continuous improvements in battery technology leading to increased energy density, range, and safety.

- Stringent emission regulations: Governments worldwide are implementing stricter emission norms, driving the adoption of EVs.

- Government incentives: Subsidies, tax breaks, and other financial incentives are boosting EV adoption.

- Rising consumer awareness: Increasing environmental consciousness among consumers is fueling demand for EVs.

Challenges in the Battery Systems for Electric Vehicles Market Sector

Despite its robust growth trajectory, the Battery Systems for Electric Vehicles market navigates a landscape marked by several significant challenges that require continuous innovation and strategic adaptation:

- Raw Material Availability and Price Volatility: The procurement of critical raw materials like lithium, cobalt, and nickel is subject to geopolitical influences and market speculation, leading to fluctuating production costs and impacting the affordability of battery systems.

- Supply Chain Disruptions: Global events, trade tensions, and logistical complexities can create bottlenecks in the intricate battery supply chain, affecting manufacturing timelines and the timely delivery of essential components.

- Battery Safety Concerns: While significant strides have been made, ensuring the absolute safety of battery systems remains paramount. Incidents related to thermal runaway and potential fire hazards necessitate ongoing research into advanced battery management systems and robust safety features to maintain consumer trust.

- Infrastructure Limitations: The pace of EV adoption is often constrained by the availability and accessibility of charging infrastructure. Inadequate charging networks in certain regions can act as a deterrent for potential EV buyers, necessitating substantial investment in public and private charging solutions.

- Recycling and Sustainability: The end-of-life management of batteries presents an environmental challenge. Developing efficient and cost-effective battery recycling processes is crucial to minimize waste and recover valuable materials, fostering a circular economy.

Emerging Opportunities in Battery Systems for Electric Vehicles Market

Several emerging opportunities are shaping the future of the Battery Systems for Electric Vehicles market:

- Solid-state batteries: This technology promises higher energy density, improved safety, and faster charging.

- Second-life applications: Reusing EV batteries for stationary energy storage can create new revenue streams.

- Expansion into developing markets: Growing economies in Asia, Africa, and Latin America offer significant growth potential.

- Integration with smart grids: Batteries can play a crucial role in stabilizing power grids and enabling renewable energy integration.

Leading Players in the Battery Systems for Electric Vehicles Market Market

- Johnson Controls International PLC

- Samsung SDI Co Ltd

- Toshiba Corporation

- A123 Systems LLC

- Hitachi Ltd

- LG Chem

- NEC Corporation

- Boston-Power Inc

- Altairnano

- Panasonic Corporation

Key Developments in Battery Systems for Electric Vehicles Market Industry

- March 2023: Argonne National Laboratory's lithium-air battery breakthrough promises significantly increased EV range.

- July 2022: Ford secures contracts for 60 GWh annual battery capacity, aiming for 600,000 EV production by late 2023.

- November 2021: Hitachi and First Bus partner to advance electric bus adoption in the UK.

- October 2021: LG Group invests KRW 15.1 trillion (approx. JPY 1.4345 trillion) in its South Korean battery business.

- October 2021: Stellantis and Samsung SDI establish a joint venture for battery production in North America.

- October 2021: Panasonic showcases a prototype battery with five times the storage capacity of current batteries.

- September 2021: Toshiba, Sojitz, and CBMM collaborate to commercialize next-generation lithium-ion batteries using NTO.

Future Outlook for Battery Systems for Electric Vehicles Market Market

The Battery Systems for Electric Vehicles market is poised for continued strong growth, driven by the ongoing shift towards electric mobility and advancements in battery technology. The market's future potential is substantial, with opportunities in diverse applications, including electric vehicles, stationary energy storage, and portable electronics. Strategic partnerships and collaborations among automotive manufacturers, battery producers, and technology companies will further accelerate market growth, while innovations like solid-state batteries and improved battery recycling technologies will redefine the competitive landscape. The market's future success will also depend on addressing challenges related to raw material supply chains, battery safety, and charging infrastructure development.

Battery Systems for Electric Vehicles Market Segmentation

-

1. Type

- 1.1. Lithium-Ion Batteries

- 1.2. Nickel-Metal Hydride Batteries

- 1.3. Lead-Acid Batteries

- 1.4. Ultra capacitors

- 1.5. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Battery Systems for Electric Vehicles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Battery Systems for Electric Vehicles Market Regional Market Share

Geographic Coverage of Battery Systems for Electric Vehicles Market

Battery Systems for Electric Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments worldwide are implementing strict regulations and providing incentives to promote the adoption of electric vehicles; Others

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Others

- 3.4. Market Trends

- 3.4.1. High Cost of Battery and Limited Driving Range Hindering the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lithium-Ion Batteries

- 5.1.2. Nickel-Metal Hydride Batteries

- 5.1.3. Lead-Acid Batteries

- 5.1.4. Ultra capacitors

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lithium-Ion Batteries

- 6.1.2. Nickel-Metal Hydride Batteries

- 6.1.3. Lead-Acid Batteries

- 6.1.4. Ultra capacitors

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lithium-Ion Batteries

- 7.1.2. Nickel-Metal Hydride Batteries

- 7.1.3. Lead-Acid Batteries

- 7.1.4. Ultra capacitors

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lithium-Ion Batteries

- 8.1.2. Nickel-Metal Hydride Batteries

- 8.1.3. Lead-Acid Batteries

- 8.1.4. Ultra capacitors

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lithium-Ion Batteries

- 9.1.2. Nickel-Metal Hydride Batteries

- 9.1.3. Lead-Acid Batteries

- 9.1.4. Ultra capacitors

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Battery Systems for Electric Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lithium-Ion Batteries

- 10.1.2. Nickel-Metal Hydride Batteries

- 10.1.3. Lead-Acid Batteries

- 10.1.4. Ultra capacitors

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Johnson Controls International PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung SDI Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 A123 Systems LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NEC Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston-Power Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Altairnano

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: Global Battery Systems for Electric Vehicles Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Battery Systems for Electric Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Battery Systems for Electric Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Battery Systems for Electric Vehicles Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Battery Systems for Electric Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Battery Systems for Electric Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Battery Systems for Electric Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Battery Systems for Electric Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Battery Systems for Electric Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Battery Systems for Electric Vehicles Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Battery Systems for Electric Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Battery Systems for Electric Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Battery Systems for Electric Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Battery Systems for Electric Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Battery Systems for Electric Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Battery Systems for Electric Vehicles Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Battery Systems for Electric Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Battery Systems for Electric Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Battery Systems for Electric Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Battery Systems for Electric Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Battery Systems for Electric Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Battery Systems for Electric Vehicles Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: South America Battery Systems for Electric Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Battery Systems for Electric Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Battery Systems for Electric Vehicles Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Battery Systems for Electric Vehicles Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 35: Global Battery Systems for Electric Vehicles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Battery Systems for Electric Vehicles Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Systems for Electric Vehicles Market?

The projected CAGR is approximately 13.50%.

2. Which companies are prominent players in the Battery Systems for Electric Vehicles Market?

Key companies in the market include Johnson Controls International PLC, Samsung SDI Co Ltd*List Not Exhaustive, Toshiba Corporation, A123 Systems LLC, Hitachi Ltd, LG Chem, NEC Corporation, Boston-Power Inc, Altairnano, Panasonic Corporation.

3. What are the main segments of the Battery Systems for Electric Vehicles Market?

The market segments include Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments worldwide are implementing strict regulations and providing incentives to promote the adoption of electric vehicles; Others.

6. What are the notable trends driving market growth?

High Cost of Battery and Limited Driving Range Hindering the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Costs; Others.

8. Can you provide examples of recent developments in the market?

March 2023: The US Department of Energy's Argonne National Laboratory announced the development of a revolutionary lithium-air battery system. This breakthrough technology has the potential to significantly increase the range of electric vehicles, paving the way for the replacement of traditional lithium-ion (Li-ion) batteries. The new design opens up possibilities for powering not just electric cars but also domestic airplanes and long-haul trucks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Battery Systems for Electric Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Battery Systems for Electric Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Battery Systems for Electric Vehicles Market?

To stay informed about further developments, trends, and reports in the Battery Systems for Electric Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence