Key Insights

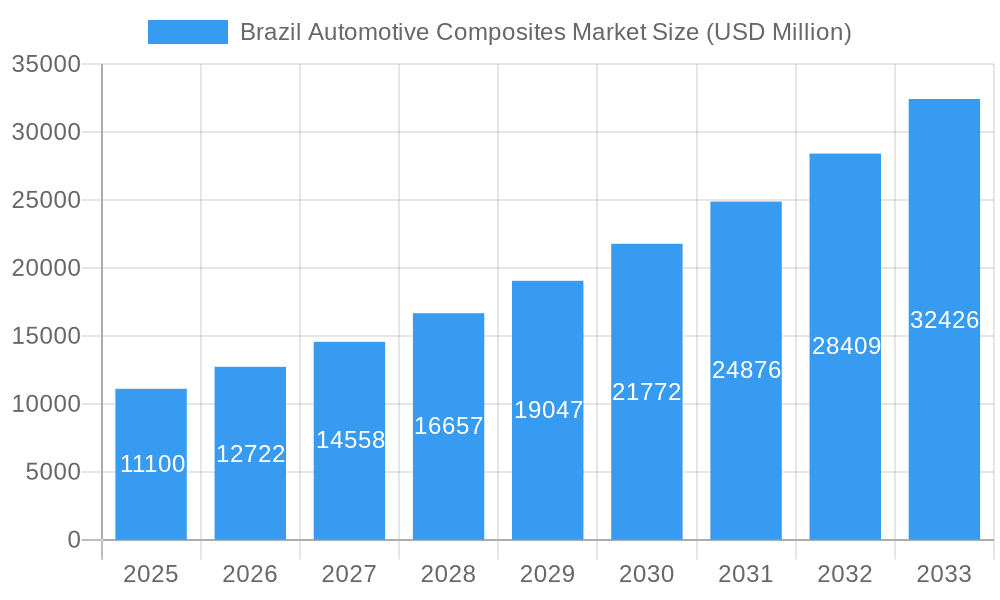

The Brazil automotive composites market is poised for substantial expansion, projected to reach an estimated $11.1 billion in 2025. This robust growth is driven by a compelling CAGR of 14.5% during the forecast period, indicating a dynamic and rapidly evolving landscape. Key factors propelling this surge include the increasing demand for lightweight materials in vehicles to enhance fuel efficiency and reduce emissions, a critical consideration in Brazil's evolving automotive sector. Furthermore, advancements in composite material technology, offering superior strength-to-weight ratios and design flexibility, are making them increasingly attractive alternatives to traditional metals. The expanding production of electric vehicles (EVs) in Brazil also presents a significant opportunity, as composites play a crucial role in battery enclosures and lightweight structural components for these next-generation vehicles.

Brazil Automotive Composites Market Market Size (In Billion)

The market's segmentation reveals a diverse range of applications and material preferences. Production processes like Hand Layup and Compression Molding are expected to see consistent adoption, while Injection Molding is likely to gain traction with advancements in high-volume manufacturing of composite parts. In terms of applications, Structural Assembly and Powertrain Components will remain dominant segments, benefiting from the inherent performance advantages of composites. The growing emphasis on aesthetics and customization in the automotive industry will also fuel demand for composite applications in Interior and Exterior trims. Thermoset Polymers and Thermoplastic Polymers will continue to be foundational materials, with a notable rise in the utilization of Carbon Fiber and Glass Fiber reinforcements to achieve specific performance targets. Major global and local players like Toray Industries, Hexcel Corporation, and Mitsubishi Chemical Carbon Fiber and Composites Inc. are actively investing in the region, further stimulating market growth and innovation.

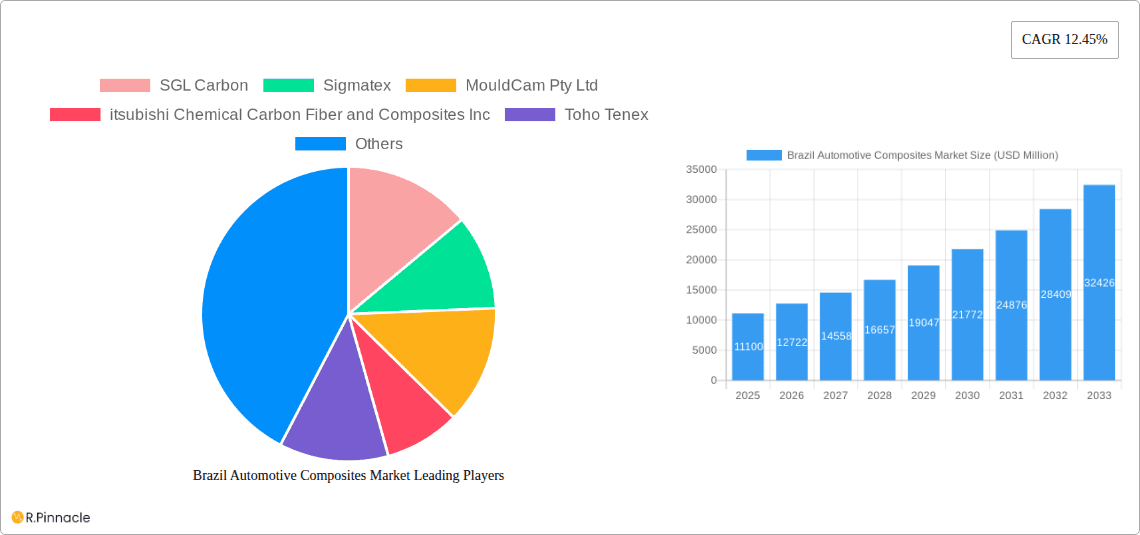

Brazil Automotive Composites Market Company Market Share

Brazil Automotive Composites Market: Comprehensive Insights & Forecast 2019-2033

This in-depth report provides an unparalleled analysis of the Brazil automotive composites market, offering strategic insights for stakeholders navigating this dynamic sector. We delve into the intricate details of market structure, dynamics, regional dominance, product innovations, and future outlook, leveraging high-ranking keywords like "automotive composites Brazil," "carbon fiber automotive," "lightweight materials Brazil," and "EV composites Brazil" to ensure maximum visibility for industry professionals. Our comprehensive study covers the study period of 2019–2033, with 2025 serving as both the base and estimated year, and a forecast period from 2025–2033, building upon a robust historical period of 2019–2024. This report is designed for immediate use, requiring no further modification.

Brazil Automotive Composites Market Market Structure & Innovation Trends

The Brazil automotive composites market is characterized by a moderate level of market concentration, with key players like Toray Industries, Hexcel Corporation, SGL Carbon, and Mitsubishi Chemical Carbon Fiber and Composites Inc. holding significant market shares. Innovation is primarily driven by the relentless pursuit of lightweighting solutions to enhance fuel efficiency and reduce emissions, particularly with the burgeoning electric vehicle (EV) sector. Regulatory frameworks, such as those promoting greener manufacturing and higher safety standards, also act as crucial innovation catalysts. Product substitutes, including advanced high-strength steels and aluminum alloys, present a competitive challenge, but the superior strength-to-weight ratio of composites continues to drive adoption. End-user demographics are shifting towards a demand for more sustainable and performance-oriented vehicles, influencing R&D efforts. Mergers and acquisitions (M&A) activities, while not yet at an explosive pace, are anticipated to increase as larger players seek to consolidate their market position and acquire specialized technological capabilities. Anticipated M&A deal values in the next five years are projected to reach between $500 million and $1.5 billion, signaling growing strategic consolidation within the sector.

Brazil Automotive Composites Market Market Dynamics & Trends

The Brazil automotive composites market is experiencing robust growth, driven by an escalating demand for lightweight materials that improve vehicle performance, fuel efficiency, and reduce CO2 emissions. This trend is amplified by evolving government regulations and increasing consumer awareness regarding environmental sustainability. The compound annual growth rate (CAGR) for the automotive composites market in Brazil is projected to be around 9.5% from 2025 to 2033. Technological disruptions, including advancements in resin systems, fiber impregnation techniques, and automated manufacturing processes, are significantly enhancing the cost-effectiveness and performance of composite components. The penetration of composites in the Brazilian automotive industry, currently at approximately 15% for structural and semi-structural components, is expected to rise to over 25% by 2033. Consumer preferences are increasingly leaning towards vehicles that offer superior performance and a reduced environmental footprint, directly benefiting the adoption of composite materials. Competitive dynamics are intensifying, with established global players investing heavily in research and development and local manufacturers focusing on niche applications and supply chain integration. The growing automotive production in Brazil, coupled with incentives for manufacturing advanced materials, further fuels this upward trajectory. The integration of composites in electric vehicles (EVs) is a particularly strong growth driver, as the lightweight nature of composites helps to offset the weight of batteries, thereby extending EV range. Furthermore, advancements in thermoplastic composites are enabling faster cycle times in manufacturing, making them more competitive for mass-produced vehicle components. The shift towards customizability and modular vehicle designs also presents opportunities for composites, which can be molded into complex shapes.

Dominant Regions & Segments in Brazil Automotive Composites Market

The Brazil automotive composites market is witnessing significant dominance in key regions and specific segments, driven by a confluence of economic policies, infrastructure development, and industry specialization. São Paulo state emerges as the leading region due to its established automotive manufacturing hub and strong presence of Tier 1 and Tier 2 automotive suppliers. Economic policies favoring local manufacturing and investment in advanced materials have bolstered its position.

Production Process Type Dominance:

- Compression Molding: This process holds a dominant position due to its efficiency in producing complex parts with good surface finish, ideal for high-volume automotive applications. Its dominance is underpinned by its cost-effectiveness for moderate to large production runs and its ability to handle a variety of composite materials.

- Continuous Process: Gaining traction, particularly for structural components, due to its ability to produce long, consistent profiles with high material utilization. Its increasing adoption is linked to the demand for lightweight chassis and body-in-white components.

Application Type Dominance:

- Structural Assembly: This segment is the most significant, encompassing components like chassis parts, body panels, and reinforcement structures. The primary driver is the critical need for weight reduction to improve fuel efficiency and vehicle dynamics. Economic policies promoting stricter emission standards further accentuate the importance of this segment.

- Exterior: With a projected market share of over 20%, exterior applications such as bumpers, hoods, and spoilers are increasingly utilizing composites for their design flexibility and impact resistance.

Material Type Dominance:

- Carbon Fiber: While historically more expensive, carbon fiber is experiencing significant growth in high-performance vehicles and EVs, driven by its exceptional strength-to-weight ratio. Its increasing affordability and advancements in manufacturing are expanding its application scope.

- Glass Fiber: This material remains a dominant force due to its cost-effectiveness and versatility. It is widely used in various automotive components, including interior parts, body panels, and under-the-hood applications, benefiting from its balance of performance and affordability for mass-market vehicles.

Brazil Automotive Composites Market Product Innovations

Product innovations in the Brazil automotive composites market are centered on developing advanced materials and manufacturing techniques that enhance performance, reduce weight, and improve cost-effectiveness. Companies are focusing on novel resin formulations for higher temperature resistance and faster curing times, alongside the development of pre-impregnated materials (prepregs) that simplify manufacturing processes. The integration of smart functionalities into composite parts, such as embedded sensors for structural health monitoring, represents a key technological trend. These innovations offer a competitive advantage by enabling the creation of lighter, stronger, and more intelligent automotive components, particularly for the growing electric vehicle segment.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Brazil automotive composites market, segmented across key parameters.

Production Process Type:

- Hand Layup: While labor-intensive, it remains relevant for low-volume production and prototyping, offering flexibility.

- Compression Molding: A dominant process for high-volume production of complex parts, offering good surface finish and efficiency. Growth projections indicate continued strong performance.

- Continuous Process: Expected to see robust growth, particularly for structural components, due to its efficiency in producing long, consistent profiles.

- Injection Molding: Gaining traction for smaller, intricate parts and thermoplastic composites, enabling faster cycle times and cost reduction.

Application Type:

- Structural Assembly: Forecasted to remain the largest segment, driven by demand for lightweighting in chassis and body structures. Projected market sizes are significant, with strong growth anticipated.

- Powertrain Component: Increasing adoption for components like engine covers and brackets, contributing to overall vehicle weight reduction.

- Interior: Steady growth expected for components like dashboards and door panels, enhancing aesthetics and reducing weight.

- Exterior: Significant growth anticipated for applications like bumpers and body panels, driven by design freedom and impact resistance.

- Others: Encompassing various smaller applications, with niche growth opportunities.

Material Type:

- Thermoset Polymer: Continues to be a cornerstone due to its excellent mechanical properties and chemical resistance, with steady market share expected.

- Thermoplastic Polymer: Witnessing rapid growth due to its recyclability, impact resistance, and faster processing times, particularly for high-volume applications.

- Carbon Fiber: Experiencing substantial growth, driven by its high strength-to-weight ratio and demand in high-performance vehicles and EVs.

- Glass Fiber: Remains a dominant material due to its cost-effectiveness and versatility, catering to a broad range of automotive applications.

Key Drivers of Brazil Automotive Composites Market Growth

The Brazil automotive composites market is propelled by several key drivers:

- Stringent Emission Regulations: Government mandates for reduced CO2 emissions are forcing automakers to adopt lightweight materials like composites to improve fuel efficiency.

- Growing Electric Vehicle (EV) Adoption: The lightweight nature of composites is crucial for offsetting battery weight in EVs, extending range and enhancing performance.

- Technological Advancements: Innovations in resin systems, manufacturing processes, and composite materials are making them more cost-effective and versatile.

- Demand for Enhanced Performance and Safety: The superior strength-to-weight ratio of composites allows for improved vehicle dynamics, crashworthiness, and overall performance.

- Government Support and Incentives: Policies promoting local manufacturing of advanced materials and investments in the automotive sector create a favorable environment.

Challenges in the Brazil Automotive Composites Market Sector

Despite its growth potential, the Brazil automotive composites market faces several challenges:

- High Material Costs: Carbon fiber, in particular, remains more expensive than traditional materials, impacting its widespread adoption in mass-market vehicles.

- Recycling Infrastructure Limitations: Establishing efficient and cost-effective recycling processes for composite materials is an ongoing challenge.

- Skilled Labor Shortage: The specialized nature of composite manufacturing requires a skilled workforce, which can be a constraint in some regions.

- Complex Manufacturing Processes: While improving, some composite manufacturing processes can be more complex and time-consuming than those for metals.

- Economic Volatility: Fluctuations in the Brazilian economy can impact automotive production volumes and investment in new technologies.

Emerging Opportunities in Brazil Automotive Composites Market

The Brazil automotive composites market presents significant emerging opportunities:

- Expansion of EV Market: The rapid growth of the EV sector creates a substantial demand for lightweight composite battery enclosures, chassis components, and body structures.

- Development of Sustainable Composites: Increasing focus on bio-based resins and recycled materials presents opportunities for eco-friendly composite solutions.

- Advanced Manufacturing Techniques: The adoption of additive manufacturing (3D printing) and automated fiber placement technologies can unlock new design possibilities and cost efficiencies.

- Hybrid Structures: Combining composites with metals to leverage the best properties of each material offers a pathway to optimized performance and cost.

- Aftermarket and Repair Solutions: Developing specialized composite repair services and aftermarket parts can tap into a growing market.

Leading Players in the Brazil Automotive Composites Market Market

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Key Developments in Brazil Automotive Composites Market Industry

- 2023/06: Toray Industries announces expansion of carbon fiber production capacity to meet rising automotive demand.

- 2023/11: Hexcel Corporation showcases advanced composite solutions for electric vehicle lightweighting at a major automotive exhibition in Brazil.

- 2024/01: Mitsubishi Chemical Carbon Fiber and Composites Inc. partners with a Brazilian automotive Tier 1 supplier to develop innovative composite solutions for local vehicle production.

- 2024/03: SGL Carbon highlights advancements in recycled carbon fiber materials for automotive applications, emphasizing sustainability.

- 2024/05: Sigmatex introduces new high-performance textiles for composite reinforcement, targeting structural applications in the Brazilian automotive sector.

Future Outlook for Brazil Automotive Composites Market Market

The future outlook for the Brazil automotive composites market is exceptionally positive, driven by an intensifying global push for sustainable mobility and enhanced vehicle performance. The continued electrification of vehicles will be a primary growth accelerator, as composites offer critical weight savings essential for extending EV range. Advancements in thermoplastic composites promise faster production cycles and improved recyclability, making them increasingly competitive for mass production. Furthermore, ongoing research into novel resin systems and manufacturing processes will unlock new applications and further reduce costs. Strategic partnerships between material suppliers, automotive OEMs, and technology providers will be crucial for scaling up production and fostering innovation. The market is poised for sustained double-digit growth as Brazil solidifies its position as a key player in the adoption of advanced lightweight materials for its automotive industry.

Brazil Automotive Composites Market Segmentation

-

1. Production Process Type

- 1.1. Hand Layup

- 1.2. Compression Molding

- 1.3. Continous Process

- 1.4. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

-

3. Material Type

- 3.1. Thermoset Polymer

- 3.2. Thermoplastic Polymer

- 3.3. Carbon Fiber

- 3.4. Glass Fiber

Brazil Automotive Composites Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Composites Market Regional Market Share

Geographic Coverage of Brazil Automotive Composites Market

Brazil Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Hand Layup

- 5.1.2. Compression Molding

- 5.1.3. Continous Process

- 5.1.4. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Thermoset Polymer

- 5.3.2. Thermoplastic Polymer

- 5.3.3. Carbon Fiber

- 5.3.4. Glass Fiber

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Brazil Automotive Composites Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 4: Brazil Automotive Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Brazil Automotive Composites Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 6: Brazil Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Brazil Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 8: Brazil Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Brazil Automotive Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Brazil Automotive Composites Market?

The market segments include Production Process Type, Application Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence