Key Insights

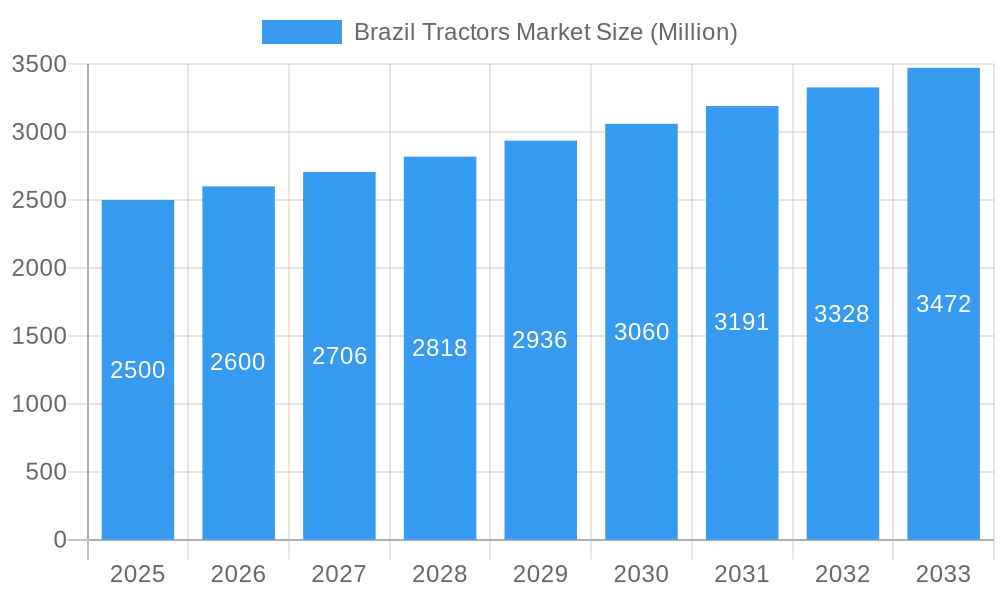

The Brazil tractors market, projected at $3.6 billion in the base year of 2025, is expected to achieve a Compound Annual Growth Rate (CAGR) of 5.02% from 2025 to 2033. This significant growth is underpinned by Brazil's robust agricultural sector, demanding continuous equipment modernization. Increased farmer focus on productivity and efficiency drives adoption of advanced tractors with precision farming capabilities. Government incentives for agricultural modernization further bolster market expansion. The growing demand for mechanization across diverse agricultural applications and the expansion of cultivated land are also key drivers. Analysis indicates accelerated growth in higher horsepower (above 100 HP) and four-wheel/all-wheel drive tractor segments, essential for large-scale farming.

Brazil Tractors Market Market Size (In Billion)

Market challenges include agricultural commodity price volatility, economic instability, and the impact of climate change on crop yields. Financing availability for equipment purchases also influences market dynamics. The competitive landscape features prominent domestic and international players, including Escorts Limited, Kuhn, CNH Industrial N.V., Deere & Company, Claas KGaA mbH, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, and Tractors and Farm Equipment Limited (TAFE). Key strategies for competitive advantage involve innovation in fuel-efficient and technologically advanced tractors, alongside robust distribution networks. Sustained market growth depends on effectively addressing these challenges while capitalizing on technological advancements and agricultural expansion opportunities.

Brazil Tractors Market Company Market Share

Brazil Tractors Market Analysis: Size, Trends, and Forecast (2019-2033)

This comprehensive market report offers in-depth analysis of the Brazil tractors market, providing critical insights for industry stakeholders, investors, and strategic planners. Covering the period 2019-2033, with a specific focus on the 2025 base year, the report meticulously examines market dynamics, segmentation, key players, and future projections. Leveraging extensive data analysis, it delivers actionable intelligence and forecasts to facilitate informed strategic decision-making.

Brazil Tractors Market Structure & Innovation Trends

The Brazilian tractors market exhibits a moderately concentrated structure, with key players like Deere & Company, CNH Industrial N.V., AGCO Corporation, and Mahindra & Mahindra Ltd holding significant market share. The combined market share of these top 4 players is estimated at xx%. Innovation in the Brazilian tractor market is driven by increasing demand for fuel efficiency, advanced technology integration (precision farming, automation), and regulatory pressures for sustainable agriculture. Recent M&A activity has been relatively subdued, with the total value of deals in the last five years estimated at $xx Million. However, strategic partnerships and joint ventures are increasingly common, especially in the areas of technology transfer and distribution network expansion. The regulatory framework, while evolving, primarily focuses on emission standards and safety regulations. The primary substitute for tractors remains manual labor, but its diminishing cost-effectiveness is driving tractor adoption, particularly in larger farms. End-user demographics show a growing segment of younger, tech-savvy farmers, influencing the demand for technologically advanced tractors.

- Market Concentration: xx% held by top 4 players

- M&A Deal Value (Last 5 years): $xx Million

- Key Innovation Drivers: Fuel efficiency, Precision farming, Automation, Sustainability

Brazil Tractors Market Dynamics & Trends

The Brazilian tractors market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include increasing agricultural output, government support for modernization of farming practices, and rising disposable incomes in rural areas leading to increased mechanization. Technological disruptions, particularly in precision farming and autonomous technologies, are reshaping the market landscape. Consumer preferences are shifting toward fuel-efficient, technologically advanced, and versatile tractors. Competitive dynamics are characterized by intense rivalry among established players and the emergence of local manufacturers offering cost-effective options. Market penetration of technologically advanced tractors remains relatively low compared to developed markets, representing a significant growth opportunity.

Dominant Regions & Segments in Brazil Tractors Market

The dominant regions within the Brazilian tractors market are primarily concentrated in the major agricultural producing states such as Mato Grosso, Minas Gerais, and Goiás. These regions benefit from favorable climate, fertile land, and established agricultural infrastructure.

- By Horsepower: The 40 HP - 100 HP segment currently holds the largest market share, driven by its suitability for a wide range of farming operations and a balance between affordability and productivity.

- By Drive Type: Four-Wheel Drive/All-Wheel Drive tractors are gaining popularity due to their superior traction and suitability for challenging terrains.

- By Application: Row Crop Tractors dominate the market, reflecting the prevalence of large-scale row crop farming in Brazil.

Key drivers for regional dominance include:

- Favorable government policies promoting agricultural development

- Well-developed agricultural infrastructure, including irrigation systems and transportation networks

- High agricultural productivity and land availability.

Brazil Tractors Market Product Innovations

Recent innovations in the Brazilian tractors market focus on enhancing fuel efficiency through advanced engine technologies, incorporating precision farming technologies like GPS-guided systems and sensors, and improving operator comfort and safety features. The introduction of the TL5 'Acessível' tractor by New Holland Agriculture exemplifies the trend of inclusivity and accessibility in agricultural machinery. These innovations cater to the evolving needs of modern farmers, prioritizing efficiency, productivity, and sustainability.

Report Scope & Segmentation Analysis

This comprehensive report delves into the dynamics of the Brazil tractors market, providing an in-depth analysis across key segmentation parameters. We dissect the market by horsepower (HP), categorizing it into

Key Drivers of Brazil Tractors Market Growth

Several factors contribute to the growth of the Brazilian tractors market. These include increasing government investments in agricultural infrastructure, favorable credit schemes for farmers to purchase new machinery, and a burgeoning demand for food products both domestically and internationally. Technological advancements like precision farming and automation are also boosting market growth by improving efficiency and yields.

Challenges in the Brazil Tractors Market Sector

The Brazil tractors market, while robust, is not without its complexities. Key challenges include the impact of high import tariffs on essential components, which can influence manufacturing costs and final product pricing. Fluctuating currency exchange rates introduce an element of unpredictability, affecting both import costs and export competitiveness. The inherent seasonality of Brazil's vast agricultural output also leads to significant seasonal variations in demand, requiring agile inventory management and production planning. Moreover, the relatively high cost of financing for farmers can be a barrier to new equipment acquisition. Finally, a persistent challenge is the lack of skilled labor in certain agricultural regions, impacting the adoption and maintenance of advanced machinery. Navigating these multifaceted hurdles is critical for sustained growth and profitability within the sector.

Emerging Opportunities in Brazil Tractors Market

Amidst the challenges, the Brazil tractors market presents a fertile ground for innovation and expansion. A significant emerging opportunity lies in the increasing adoption of precision farming technologies, driven by a growing awareness among medium and large-scale farm operators of the benefits in yield optimization and resource management. The global and domestic push towards sustainable agricultural practices creates a strong demand for tractors designed with reduced environmental impact, including fuel efficiency and lower emissions. Furthermore, the ongoing expansion of the Brazilian agricultural sector into previously underutilized regions and the diversification into new crop types offer considerable opportunities for manufacturers to develop and introduce specialized product lines, thereby achieving deeper market penetration and catering to evolving agricultural needs.

Leading Players in the Brazil Tractors Market Market

- Escorts Limited

- Kuhn

- CNH Industrial N.V.

- Deere and Company

- Claas KGaA mbH

- AGCO Corporation

- Kubota Agricultural Machinery Pvt Ltd

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

Key Developments in Brazil Tractors Market Industry

- August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms, focusing on four-wheel drive technology. This strengthens their position in the high-performance segment.

- August 2023: New Holland Agriculture launched the TL5 'Acessível' tractor, promoting inclusivity and accessibility within the farming community. This is a significant step towards social responsibility and potentially opens new market segments.

Future Outlook for Brazil Tractors Market Market

The future outlook for the Brazilian tractors market is positive, driven by continued growth in agricultural production, technological advancements, and government support for modernization of the agricultural sector. The increasing adoption of precision farming technologies and the focus on sustainable agricultural practices will drive demand for sophisticated and environmentally friendly tractors. The market presents significant opportunities for both established players and new entrants to capitalize on the expanding agricultural sector and the evolving needs of Brazilian farmers.

Brazil Tractors Market Segmentation

-

1. Horsepower

- 1.1. Below 40 HP

- 1.2. 40 HP - 100 HP

- 1.3. Above 100 H

-

2. Drive Type

- 2.1. Two-Wheel Drive

- 2.2. Four-Wheel Drive/All-Wheel Drive

-

3. Application

- 3.1. Row Crop Tractors

- 3.2. Orchard Tractors

- 3.3. Other Applications

Brazil Tractors Market Segmentation By Geography

- 1. Brazil

Brazil Tractors Market Regional Market Share

Geographic Coverage of Brazil Tractors Market

Brazil Tractors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption Rate Of Mechanization

- 3.3. Market Restrains

- 3.3.1. High Cost Of Tractors May Affect the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Need for Agricultural mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Tractors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 5.1.1. Below 40 HP

- 5.1.2. 40 HP - 100 HP

- 5.1.3. Above 100 H

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Two-Wheel Drive

- 5.2.2. Four-Wheel Drive/All-Wheel Drive

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Row Crop Tractors

- 5.3.2. Orchard Tractors

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Escorts Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CNH Industrial N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Claas KGaA mb

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kubota Agricultural Machinery Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tractors and Farm Equipment Limited (TAFE)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Escorts Limited

List of Figures

- Figure 1: Brazil Tractors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Tractors Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 2: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Brazil Tractors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 6: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 7: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Brazil Tractors Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Tractors Market?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Brazil Tractors Market?

Key companies in the market include Escorts Limited, Kuhn, CNH Industrial N V, Deere and Company, Claas KGaA mb, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE).

3. What are the main segments of the Brazil Tractors Market?

The market segments include Horsepower, Drive Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption Rate Of Mechanization.

6. What are the notable trends driving market growth?

Increasing Need for Agricultural mechanization.

7. Are there any restraints impacting market growth?

High Cost Of Tractors May Affect the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms. These platforms represent the company's commitment to developing four-wheel drive tractors not only in Brazil but also in various other nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Tractors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Tractors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Tractors Market?

To stay informed about further developments, trends, and reports in the Brazil Tractors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence