Key Insights

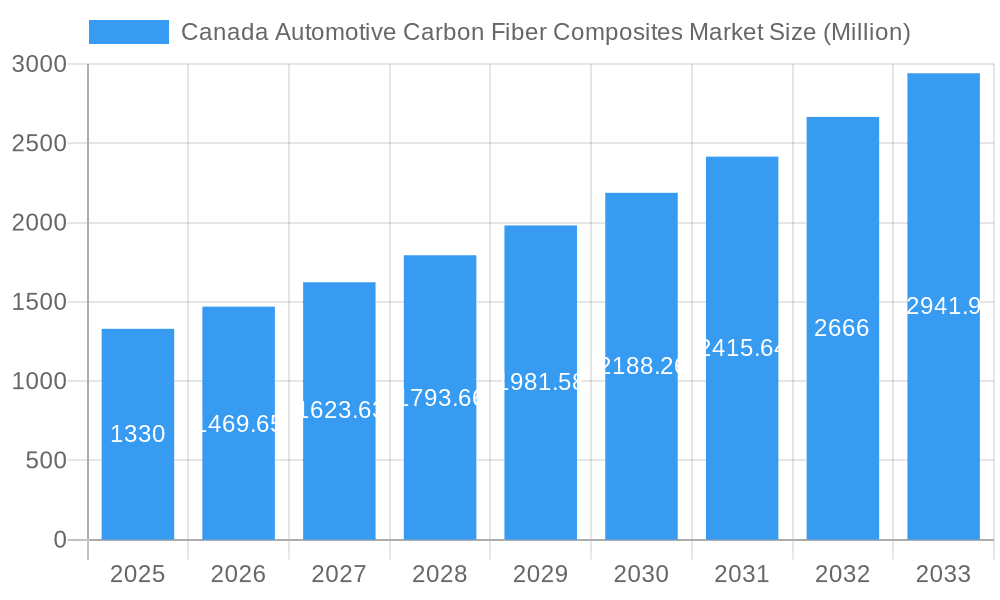

The Canada automotive carbon fiber composites market is poised for significant growth, projected to reach a value of $1.33 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is primarily driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions, a key focus within the automotive industry's pursuit of sustainability. Furthermore, the rising adoption of electric vehicles (EVs) further fuels this market growth, as carbon fiber composites offer superior performance characteristics compared to traditional materials in EV battery packs and structural components. Government initiatives promoting sustainable transportation and advancements in manufacturing processes that enhance the cost-effectiveness of carbon fiber composites are also contributing factors. The market is segmented by application type, encompassing structural assembly, powertrain components, interior and exterior applications, and other uses. Each segment contributes uniquely to the overall market value, with structural assembly likely holding a significant share due to its critical role in vehicle chassis design and safety. Regional variations within Canada (Eastern, Western, and Central) may also influence market dynamics, with potentially higher growth in regions with a strong automotive manufacturing presence.

Canada Automotive Carbon Fiber Composites Market Market Size (In Billion)

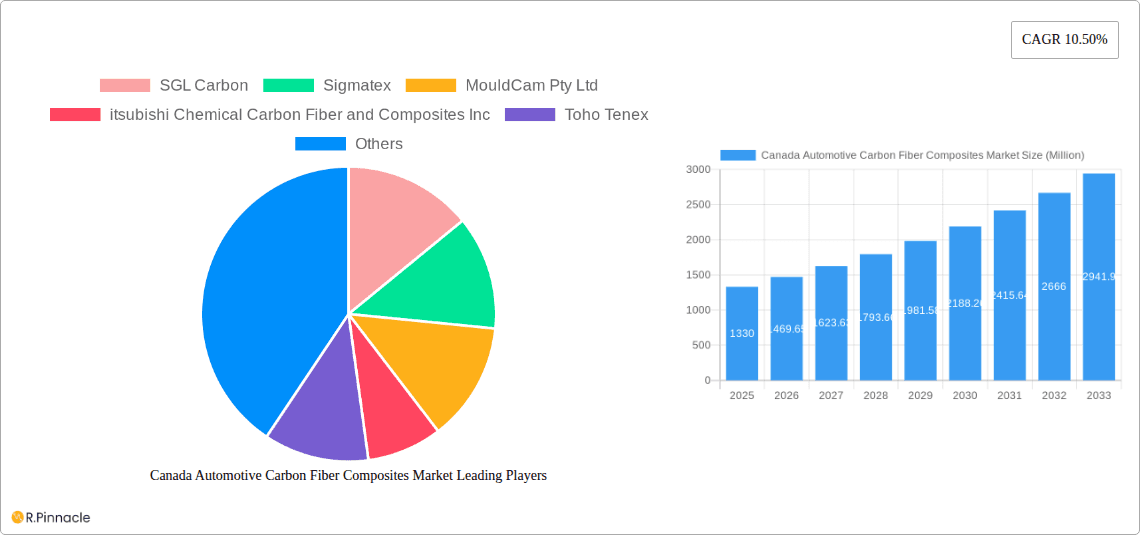

The competitive landscape is characterized by a mix of global and regional players, including SGL Carbon, Sigmatex, Mitsubishi Chemical Carbon Fiber and Composites Inc., Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, and Solva, among others. These companies are strategically focusing on innovation, partnerships, and mergers and acquisitions to gain a competitive edge. Despite these positive trends, the market faces certain restraints, including the relatively high cost of carbon fiber composites compared to traditional materials and the complexities involved in manufacturing and processing these advanced materials. However, ongoing research and development efforts aimed at reducing manufacturing costs and improving the performance characteristics of carbon fiber composites are likely to mitigate these challenges and further unlock the market's growth potential in the coming years. The forecast period of 2025-2033 suggests a trajectory of continued expansion, influenced by the converging factors of environmental regulations, technological advancements, and the evolving needs of the automotive industry.

Canada Automotive Carbon Fiber Composites Market Company Market Share

Canada Automotive Carbon Fiber Composites Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Automotive Carbon Fiber Composites Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024.

Canada Automotive Carbon Fiber Composites Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the Canadian automotive carbon fiber composites market. We delve into market concentration, examining market share held by key players like SGL Carbon, Sigmatex, MouldCam Pty Ltd, Mitsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, and Solva. The report explores the impact of mergers and acquisitions (M&A) activities, including deal values (where available) and their influence on market dynamics. Innovation drivers, such as advancements in carbon fiber manufacturing processes and the rising demand for lightweight vehicles, are thoroughly examined. We also analyze the regulatory framework impacting the industry, including environmental regulations and safety standards. Furthermore, we assess the presence of substitute materials and their potential impact on market growth. Finally, end-user demographics and their preferences are analyzed to provide a complete picture of the market structure. The analysis includes a detailed assessment of the xx Million market size in 2024 and its anticipated growth trajectory.

Canada Automotive Carbon Fiber Composites Market Market Dynamics & Trends

This section provides a comprehensive analysis of the market dynamics and trends shaping the Canadian automotive carbon fiber composites market. We examine key growth drivers, including the increasing adoption of electric vehicles (EVs), the growing demand for fuel efficiency, and stringent government regulations promoting lightweight vehicle construction. Technological disruptions, such as the development of advanced carbon fiber materials and innovative manufacturing processes, are also explored. Consumer preferences for high-performance, lightweight, and environmentally friendly vehicles are considered, along with their impact on market growth. Competitive dynamics are analyzed, including pricing strategies, product differentiation, and the competitive intensity among key players. This section also includes specific metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments, providing a clear understanding of the market's growth trajectory and potential. The analysis projects a xx Million market value by 2033.

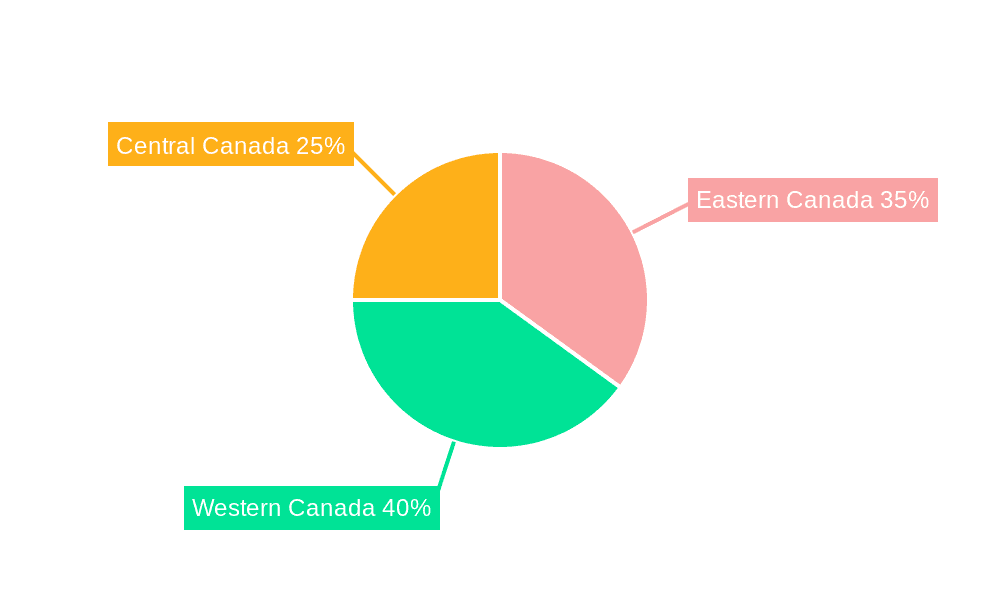

Dominant Regions & Segments in Canada Automotive Carbon Fiber Composites Market

This section identifies the leading regions and segments within the Canadian automotive carbon fiber composites market. Dominance analysis is provided for each application type: Structural Assembly, Powertrain Component, Interior, Exterior, and Other Applications. The key drivers of dominance in each segment are explored using bullet points, which may include economic policies, infrastructure development, and regional automotive production capabilities. For example, Ontario's strong automotive manufacturing sector might drive higher demand for carbon fiber composites in the structural assembly segment. Detailed analysis will highlight the leading segment (e.g., xx Million market size for Structural Assembly in 2025) and its projected growth compared to other segments. Factors like government incentives for EV adoption could influence growth in specific segments and regions, shaping market dominance.

- Structural Assembly: [Detailed analysis of market size, growth drivers, and competitive dynamics.]

- Powertrain Component: [Detailed analysis of market size, growth drivers, and competitive dynamics.]

- Interior: [Detailed analysis of market size, growth drivers, and competitive dynamics.]

- Exterior: [Detailed analysis of market size, growth drivers, and competitive dynamics.]

- Other Applications: [Detailed analysis of market size, growth drivers, and competitive dynamics.]

Canada Automotive Carbon Fiber Composites Market Product Innovations

This section summarizes recent product developments and their impact on the market. It highlights technological trends driving innovation in carbon fiber composites, such as the development of new materials with improved strength-to-weight ratios, enhanced durability, and cost-effectiveness. The discussion will analyze the competitive advantages offered by these new products, emphasizing their market fit within the context of the automotive industry's demand for lighter, more fuel-efficient vehicles. The impact of these innovations on market share and revenue generation among leading players is examined.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Canada Automotive Carbon Fiber Composites Market by Application Type, including:

- Structural Assembly: This segment encompasses the use of carbon fiber composites in various structural components of vehicles, offering growth projections and competitive insights. Market size estimates for 2025 are provided along with projected growth trends.

- Powertrain Component: The report analyzes the market size and growth trajectory of carbon fiber composites in powertrain components, including their competitive dynamics. The 2025 market size and growth projections are provided.

- Interior: This section details the market size and competitive landscape for interior applications of carbon fiber composites, including growth predictions. The 2025 market size and growth projections are provided.

- Exterior: The report analyzes the market size, growth rate, and competitive environment for exterior applications of carbon fiber composites. The 2025 market size and growth projections are provided.

- Other Applications: This section encompasses other applications of carbon fiber composites within the automotive industry, including their market dynamics and size. The 2025 market size and growth projections are provided.

Key Drivers of Canada Automotive Carbon Fiber Composites Market Growth

Several factors propel the growth of the Canada Automotive Carbon Fiber Composites Market. Government regulations mandating improved fuel efficiency and reduced emissions are key drivers, pushing automakers to adopt lightweight materials. The increasing popularity of electric vehicles (EVs), which benefit significantly from the lightweight properties of carbon fiber composites, further fuels market growth. Technological advancements in carbon fiber manufacturing, leading to reduced costs and improved material properties, also play a significant role. Furthermore, the growing focus on vehicle safety and performance, coupled with the ability of carbon fiber to enhance both, continues to support market expansion.

Challenges in the Canada Automotive Carbon Fiber Composites Market Sector

Despite significant growth potential, the Canadian automotive carbon fiber composites market faces challenges. The high cost of carbon fiber compared to traditional materials remains a barrier to widespread adoption. Supply chain disruptions and the dependence on imported raw materials can also impact market stability. Intense competition among established players and the emergence of new entrants may also pressure profit margins. Additionally, technical challenges related to processing and manufacturing carbon fiber composites need to be addressed to enhance scalability and reduce production costs. These factors could collectively impede market growth, potentially resulting in a xx% reduction in projected growth by 2030.

Emerging Opportunities in Canada Automotive Carbon Fiber Composites Market

Several emerging opportunities exist within the Canada Automotive Carbon Fiber Composites Market. The increasing adoption of hybrid and electric vehicles creates significant demand for lightweight materials, benefiting carbon fiber composites. Advancements in recycling and sustainable production methods for carbon fiber are reducing environmental concerns, creating further opportunities. The development of new applications for carbon fiber, beyond traditional automotive components, holds potential for market expansion. Furthermore, government initiatives promoting the adoption of advanced materials within the automotive industry will continue to drive market growth in the coming years.

Leading Players in the Canada Automotive Carbon Fiber Composites Market Market

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Key Developments in Canada Automotive Carbon Fiber Composites Market Industry

- February 2023: Tesla's launch of its new carbon-wrapped motor signifies a major technological leap, potentially accelerating the adoption of carbon fiber composites in high-performance electric vehicles. This innovation is expected to significantly improve vehicle efficiency, performance, and battery life.

- June 2023: The development of a new process at UBC to transform bitumen from Alberta's oil sands into carbon fiber represents a significant breakthrough, potentially creating a more sustainable and domestically sourced supply of this crucial material. This could reduce reliance on imports and stimulate domestic market growth.

Future Outlook for Canada Automotive Carbon Fiber Composites Market Market

The future outlook for the Canada Automotive Carbon Fiber Composites Market is positive, driven by the continued growth of the electric vehicle market, advancements in carbon fiber technology, and government support for sustainable transportation. Strategic partnerships between automakers and materials suppliers are expected to drive innovation and enhance the competitiveness of the Canadian automotive industry. The market is poised for significant expansion, with increasing demand for lightweight and high-performance materials, fostering continued investment and growth in the sector. The market is expected to reach xx Million by 2033, representing a substantial growth opportunity for stakeholders.

Canada Automotive Carbon Fiber Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Applications

Canada Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Canada

Canada Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Canada Automotive Carbon Fiber Composites Market

Canada Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Interior is Projected to Grow at an Exponential Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Canada Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Canada Automotive Carbon Fiber Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Canada Automotive Carbon Fiber Composites Market?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Interior is Projected to Grow at an Exponential Rate.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

February 2023: Tesla's new carbon-wrapped motor made waves in the automotive industry, with many touting it as the world's most advanced motor. This innovative technology is expected to offer increased efficiency, improved performance, longer battery life, and environmental benefits for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence