Key Insights

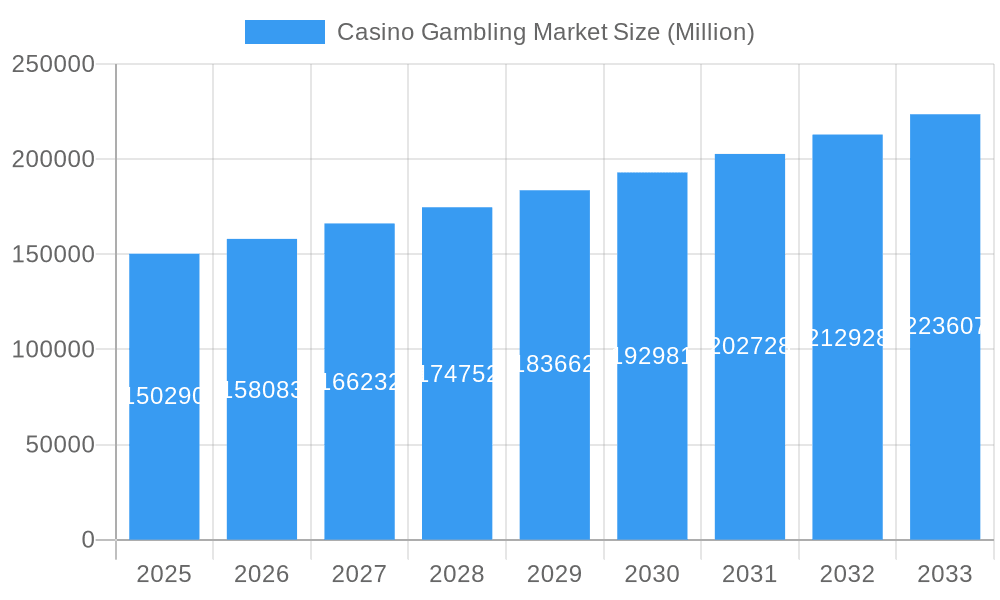

The global casino gambling market, valued at $150.29 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.95% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing disposable incomes in emerging economies, coupled with the rising popularity of online casino games and mobile gambling platforms, significantly contribute to market growth. Furthermore, strategic marketing campaigns by casino operators, the introduction of innovative gaming technologies (virtual reality, augmented reality), and the legalization of gambling in new jurisdictions are all propelling market expansion. The market's segmentation reveals a diverse landscape, with live casinos, baccarat, blackjack, poker, and slots as prominent game types, each catering to different player preferences and contributing to the overall market revenue. The competitive landscape is dominated by major players like Caesars Entertainment, Melco Resorts & Entertainment, Las Vegas Sands, and MGM Resorts International, constantly innovating and expanding their offerings to maintain a competitive edge. Geographic distribution shows North America and Asia-Pacific as key revenue generators, although the European and South American markets are also demonstrating promising growth trajectories.

Casino Gambling Market Market Size (In Billion)

The market's growth, however, faces certain challenges. Stringent regulatory frameworks and licensing requirements in various regions impose limitations on market expansion. Concerns regarding responsible gaming and the prevention of gambling addiction are also emerging as significant factors influencing market dynamics. Fluctuations in economic conditions can also impact consumer spending on entertainment and gambling activities. Despite these restraints, the overall outlook for the casino gambling market remains positive, driven by technological advancements, evolving consumer preferences, and strategic expansions by key market players. The market is expected to see significant diversification in game offerings, a greater emphasis on personalized customer experiences, and an increased focus on responsible gambling initiatives in the years to come. This will shape the industry's future and further propel its growth.

Casino Gambling Market Company Market Share

Casino Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Casino Gambling Market, covering the period from 2019 to 2033. It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand market dynamics, emerging trends, and future growth opportunities. The report leverages rigorous data analysis and expert insights to provide actionable intelligence for strategic decision-making. With a focus on key players like Caesars Entertainment, Melco Resorts & Entertainment, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, and Hard Rock International, this report is an essential resource for navigating this dynamic market.

Casino Gambling Market Market Structure & Innovation Trends

The global casino gambling market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market share distribution varies across segments (Live Casino, Slots, etc.) and geographic regions. Innovation is a crucial driver, fueled by technological advancements in online gaming, virtual reality (VR), and augmented reality (AR) experiences. Regulatory frameworks significantly influence market dynamics, with varying degrees of legalization and licensing impacting growth. Product substitutes, such as online gaming platforms and alternative entertainment options, pose a competitive challenge. The end-user demographic is evolving, with younger generations increasingly engaging with online casino platforms. Mergers and acquisitions (M&A) activity is significant, with deal values reaching xx Million in recent years. Key M&A activities include:

- Increased focus on online gaming: Many operators are investing heavily in online platforms to expand their reach and cater to changing consumer preferences.

- Strategic partnerships and collaborations: To enhance their technology and expand their market footprint, many significant businesses are working together.

- High level of competition: The market is incredibly competitive, particularly in the online gambling industry, pushing businesses to continuously innovate and provide exceptional client experiences.

Casino Gambling Market Market Dynamics & Trends

The casino gambling market is experiencing robust growth, driven by several factors. The rising disposable incomes in emerging economies, coupled with increasing tourism, are contributing to expansion. Technological advancements, particularly in online and mobile gaming, are driving market penetration. Consumer preferences are shifting towards convenient and immersive gaming experiences. Competitive dynamics are intense, with established players and new entrants vying for market share. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, driven by increasing popularity of online gaming platforms and technological advancements. Market penetration in emerging markets remains a significant growth opportunity. The market is expected to reach xx Million by 2033, indicating a substantial increase from the estimated value of xx Million in 2025.

Dominant Regions & Segments in Casino Gambling Market

The Asia-Pacific region currently holds the dominant position in the global casino gambling market. This dominance is fueled by a confluence of factors: robust economic growth, a burgeoning tourism sector, and a vast population base. Within this dynamic region, Macau and Singapore stand out as key contributors to the market's overall size. Analyzing the various game types reveals that Slots consistently capture the largest market share, owing to their broad appeal and user-friendly nature. The Asia-Pacific region's leading role is further solidified by:

- Favorable Regulatory Environments: Certain areas within the Asia-Pacific region boast regulatory frameworks that are conducive to the growth of the casino gambling industry. These favorable conditions incentivize investment and expansion.

- Strong Economic Development: The region's sustained economic growth translates to increased disposable income among consumers, leading to a rise in demand for entertainment options such as casino gaming.

- Significant Tourism Influx: The substantial tourism numbers in the Asia-Pacific region bring a steady stream of visitors who contribute significantly to the revenue generated by casino gambling establishments.

- High Concentration of Wealth: The region is home to a substantial concentration of high-net-worth individuals, a demographic known for its significant contribution to the premium segments of the casino gambling market.

Beyond Slots, other segments, including Live Casino, Baccarat, Blackjack, Poker, and other casino games, are also exhibiting growth, albeit at varying paces. The Live Casino segment, in particular, is poised for significant expansion, driven by the increasing popularity of online platforms and the immersive gaming experiences they offer. This trend is further amplified by technological advancements such as improved streaming quality and interactive features.

Casino Gambling Market Product Innovations

The casino gambling market is witnessing continuous innovation in gaming technology, aiming to create more engaging and immersive experiences for players. The integration of VR/AR technology, personalized gaming experiences, and advanced analytics are key trends. New game formats and features, tailored to diverse player preferences, are constantly being introduced. The development of mobile-first gaming platforms and improved user interfaces (UI) are driving market growth and expanding the accessibility of casino games.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the casino gambling market, categorized by game type:

- Live Casino: This segment is experiencing robust growth due to the rising demand for immersive and interactive gaming experiences. Market projections indicate a significant expansion, reaching an estimated value of xx Million by 2033.

- Baccarat: This classic casino game remains a consistently popular choice among players, contributing a substantial share to the overall market. Market forecasts predict it will reach xx Million by 2033.

- Blackjack: A timeless casino game, Blackjack maintains its sustained popularity and is projected to reach xx Million by 2033.

- Poker: The popularity of Poker continues to grow steadily, propelled by the expansion of online platforms and the excitement of online and live tournaments. It is anticipated to reach xx Million by 2033.

- Slots: As the largest segment, Slots continues to demonstrate consistent growth and is projected to reach xx Million by 2033.

- Other Casino Games: This diverse category encompasses a range of games and exhibits moderate growth, projected to reach xx Million by 2033.

The growth trajectory of each segment is shaped by a complex interplay of factors, including evolving player preferences, technological innovations, and regulatory changes within specific jurisdictions.

Key Drivers of Casino Gambling Market Growth

Several factors drive the growth of the casino gambling market. Technological advancements in online gaming platforms and mobile apps are increasing accessibility and convenience. The rise of esports and the integration of gaming with social media further enhances engagement. Economic growth in emerging markets leads to increased disposable incomes and spending on leisure activities, including casino gaming. Favorable regulatory environments in specific jurisdictions fuel market expansion. The growing popularity of online casinos offers a significant contribution to the market's growth.

Challenges in the Casino Gambling Market Sector

The casino gambling market faces a number of significant challenges. The increasingly stringent regulations and licensing requirements imposed by various jurisdictions can hinder market expansion. Furthermore, growing concerns surrounding responsible gambling and the potential for addiction present substantial regulatory hurdles. The rise of alternative entertainment options poses a competitive threat, potentially impacting market share. Economic downturns and supply chain disruptions can also negatively affect profitability. Finally, intense competition, both from established players and new entrants, exerts considerable pressure on profit margins.

Emerging Opportunities in Casino Gambling Market

The casino gambling market presents significant opportunities. Expansion into new geographic markets with less saturated industries presents lucrative prospects. The increasing adoption of blockchain technology for secure and transparent transactions presents further opportunities. The growth of virtual reality and augmented reality gaming promises immersive experiences, attracting a wider audience. The integration of artificial intelligence (AI) for personalized gaming experiences is also opening up new possibilities.

Leading Players in the Casino Gambling Market Market

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Key Developments in Casino Gambling Market Industry

- May 2023: MGM Resorts International announced the acquisition of Push Gaming Holding Limited, significantly bolstering LeoVegas' content creation capabilities and expanding its game portfolio.

- April 2023: Caesars Entertainment successfully reopened Tropicana Online Casino in New Jersey, implementing enhancements to the user experience and seamlessly integrating it with the Caesars Rewards loyalty program.

- Add more recent key developments here...

Future Outlook for Casino Gambling Market Market

The future of the casino gambling market appears promising. Continued technological innovation, expansion into new markets, and the increasing acceptance of online gaming are expected to drive significant growth. Strategic partnerships, mergers, and acquisitions will shape market consolidation. A focus on responsible gaming practices will be crucial for long-term sustainability and regulatory compliance. The market is poised for sustained expansion, driven by evolving consumer preferences and technological advancements.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence