Key Insights

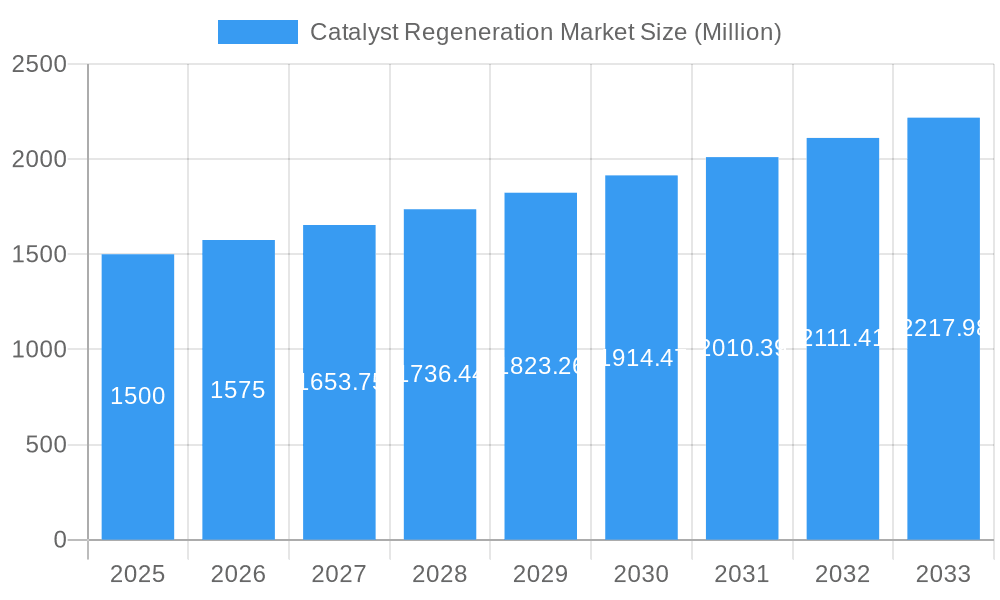

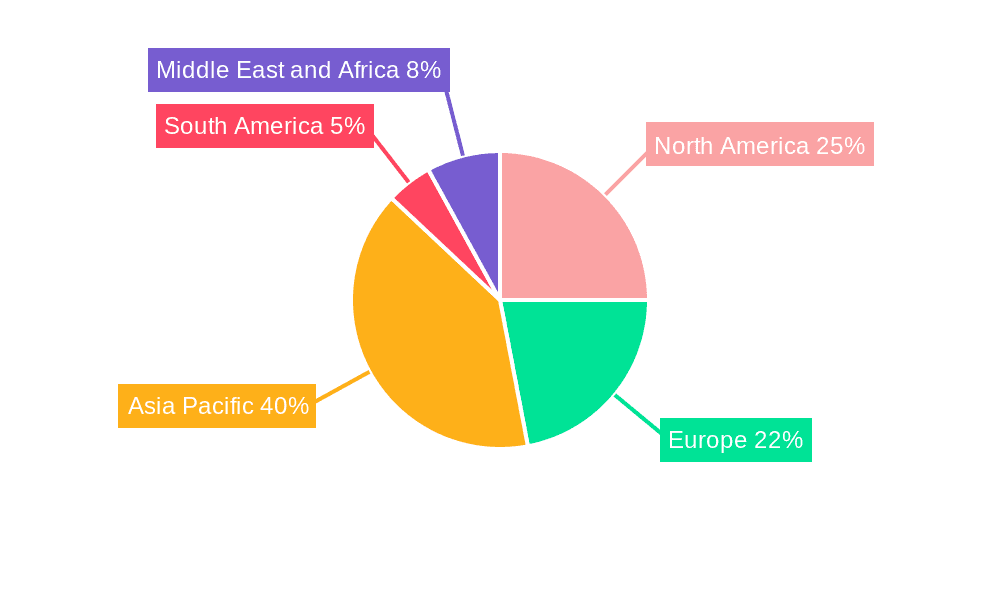

The global catalyst regeneration market is experiencing substantial growth, propelled by escalating demand from the refining and petrochemical sectors and stringent environmental regulations advocating for cleaner industrial processes. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.3%, indicating sustained expansion through 2033. Key growth drivers include the imperative for efficient catalyst reuse to reduce operational expenditures and minimize waste, the increasing complexity of catalytic operations requiring frequent regeneration, and a growing industry-wide commitment to sustainability. The market is segmented by regeneration method (ex situ and in situ) and application (refineries, petrochemicals, environmental, energy & power, and others). While ex situ regeneration, conducted off-site, currently dominates, in situ methods are gaining traction due to their cost-effectiveness and reduced operational downtime. The Asia-Pacific region, led by China and India, is anticipated to be the leading market, fueled by rapid industrialization and significant investments in refining and petrochemical infrastructure. North America and Europe also represent substantial market shares, supported by the presence of established industry players and robust environmental policies. Intense competition exists among established firms such as Axens, BASF SE, and Evonik Industries; however, opportunities are emerging for smaller enterprises specializing in niche applications or innovative regeneration technologies. Challenges include the substantial capital investment needed for advanced regeneration facilities and potential safety concerns related to handling spent catalysts. Nevertheless, the long-term outlook for the catalyst regeneration market remains optimistic, driven by heightened environmental awareness and the continued expansion of energy-intensive industries.

Catalyst Regeneration Market Market Size (In Billion)

Technological advancements in regeneration techniques, the development of more durable and easily regenerable catalysts, and the growth of the renewable energy sector, which may introduce novel catalyst types and demands, will further shape the market's trajectory. While short-term growth may be influenced by fluctuating crude oil prices and economic downturns, underlying trends in environmental regulation and cost optimization are expected to sustain long-term market expansion. Additionally, government initiatives promoting circular economy principles are likely to accelerate the adoption of catalyst regeneration technologies, thereby mitigating the environmental impact of industrial operations and optimizing resource utilization. This market is poised for continued growth across all key segments and geographical regions, presenting significant opportunities for both established and emerging participants.

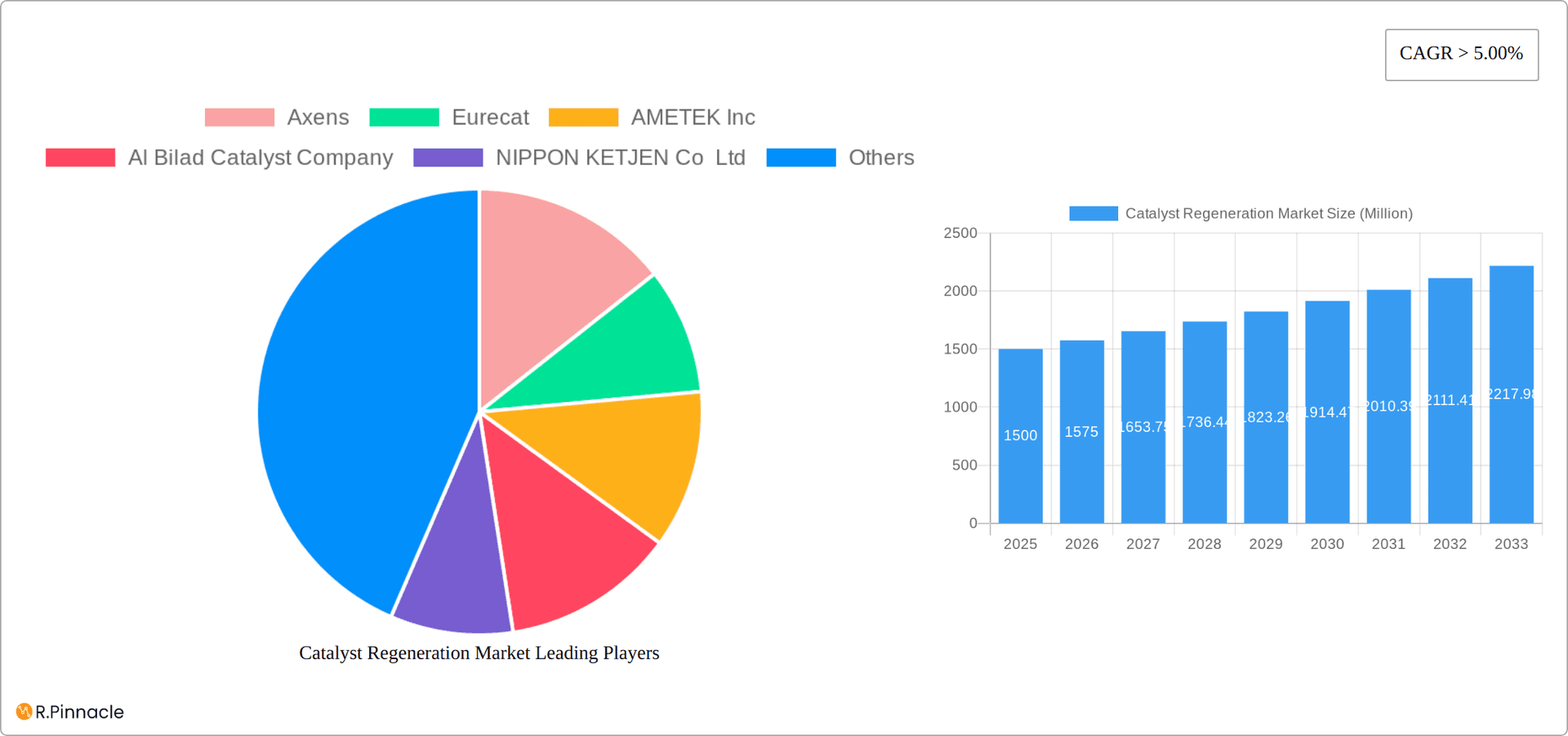

Catalyst Regeneration Market Company Market Share

Catalyst Regeneration Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Catalyst Regeneration Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by method (Ex Situ, In Situ), application (Refineries and Petrochemical Complexes, Environmental, Energy & Power, Other Applications), and key geographic regions. The report projects a market value exceeding xx Million by 2033, driven by significant technological advancements and growing environmental concerns.

Catalyst Regeneration Market Market Structure & Innovation Trends

The Catalyst Regeneration Market exhibits a moderately concentrated structure with several major players and numerous smaller niche operators. Market share is currently dominated by companies such as BASF SE, Axens, and Evonik Industries AG (Porocel), each holding a significant portion (estimated at xx% for BASF, xx% for Axens, and xx% for Evonik, respectively). However, smaller players actively participate, driving innovation and specialization within specific segments.

Key innovation drivers include the growing demand for sustainable and cost-effective catalyst recycling solutions, stricter environmental regulations, and advancements in catalyst technologies leading to higher efficiency and longer lifespans. The regulatory landscape is evolving, with increasing emphasis on reducing waste and promoting circular economy principles, impacting the market significantly. The market also witnesses substantial M&A activity, as exemplified by BASF's acquisition of Zodiac Enterprises LLC in July 2021, which expanded its recycling capacity. The total value of M&A deals in the past five years is estimated at xx Million.

- Market Concentration: Moderately concentrated

- Key Players: BASF SE, Axens, Evonik Industries AG (Porocel), and others.

- Innovation Drivers: Sustainability, environmental regulations, technological advancements.

- M&A Activity: Significant, with deals totaling xx Million in the past five years.

- Product Substitutes: Limited, with focus on improving existing regeneration methods.

Catalyst Regeneration Market Market Dynamics & Trends

The Catalyst Regeneration Market is experiencing a significant upswing, propelled by the escalating demand for catalysts across a diverse range of industrial applications, including oil refining, petrochemical production, and critical environmental remediation efforts. Industry projections indicate a robust Compound Annual Growth Rate (CAGR) of [Insert specific CAGR here, e.g., 5.5%] during the forecast period (2025-2033). This expansion is a direct consequence of increasingly stringent global environmental regulations, compelling industries to adopt more sustainable operational methodologies, with catalyst regeneration standing out as a key strategy. Furthermore, ongoing technological innovations, particularly in the development of advanced and more efficient regeneration techniques, are acting as powerful catalysts for market growth. The growing consumer and industrial preference for eco-friendly products and processes is also a significant contributing factor. The competitive landscape is characterized by intense rivalry, with leading market participants making substantial investments in research and development (R&D) and strategic expansion initiatives, which is leading to heightened competition, particularly in areas of pricing and the advancement of cutting-edge technologies. Market penetration is anticipated to reach approximately [Insert specific penetration percentage here, e.g., 70%] by 2033.

Dominant Regions & Segments in Catalyst Regeneration Market

The Asia-Pacific region currently holds the largest market share, driven by rapid industrialization and growing demand for catalysts across various sectors in countries such as China and India. Within the method segment, Ex Situ regeneration currently dominates, owing to its established infrastructure and suitability for diverse catalyst types. However, In Situ regeneration is gaining traction due to its cost-effectiveness and reduced transportation requirements.

In terms of application, Refineries and Petrochemical Complexes represent the largest segment due to the high volume of catalyst usage in these sectors. However, the Environmental and Energy & Power segments are exhibiting rapid growth, fueled by increasing environmental concerns and the need for cleaner energy solutions.

- Leading Region: Asia-Pacific

- Key Drivers: Rapid industrialization, high catalyst demand.

- Dominant Method: Ex Situ Regeneration

- Key Drivers: Established infrastructure, broad applicability.

- Largest Application Segment: Refineries and Petrochemical Complexes

- Key Drivers: High catalyst consumption.

- Fastest-Growing Segment: Environmental Applications

- Key Drivers: Stricter environmental regulations.

Catalyst Regeneration Market Product Innovations

Recent product developments focus on enhancing the efficiency and sustainability of catalyst regeneration processes. Innovations include the development of advanced technologies that reduce energy consumption, minimize waste generation, and improve catalyst recovery rates. These advancements cater to the growing demand for environmentally friendly and cost-effective solutions, offering competitive advantages to market players. The market is witnessing a shift toward integrated solutions combining regeneration with catalyst manufacturing and distribution.

Report Scope & Segmentation Analysis

This report segments the Catalyst Regeneration Market by method (Ex Situ, In Situ) and application (Refineries and Petrochemical Complexes, Environmental, Energy & Power, Other Applications). Each segment is analyzed comprehensively, detailing growth projections, market size, and competitive dynamics. The Ex Situ segment is projected to grow at xx% CAGR while the In Situ segment is expected to experience xx% CAGR. The Refineries and Petrochemical Complexes segment is the largest, followed by Environmental applications. Each application segment's growth is further analyzed according to regional specifics.

Key Drivers of Catalyst Regeneration Market Growth

The sustained growth trajectory of the Catalyst Regeneration Market is underpinned by a confluence of potent driving forces:

- Stringent Environmental Regulations: Governments and international bodies are progressively implementing and enforcing more rigorous emission standards and environmental protection mandates. This regulatory pressure directly fuels the demand for cleaner, more efficient, and sustainable catalyst regeneration services as industries strive to meet compliance requirements and minimize their ecological footprint.

- Escalating Demand for Catalysts: The rapid expansion of key industrial sectors such as petrochemicals, refining, and environmental management is leading to an exponential increase in catalyst consumption. This heightened demand naturally translates into a greater need for effective and cost-efficient catalyst regeneration solutions to ensure continuous and optimal operational performance.

- Pioneering Technological Advancements: Continuous innovation in catalyst regeneration technologies is a critical growth enabler. Developments in areas like advanced chemical treatments, physical regeneration methods, and novel process designs are leading to improved regeneration efficiency, reduced operational costs, extended catalyst lifespan, and enhanced overall sustainability.

- Economic Benefits and Cost Savings: Catalyst regeneration offers a compelling economic advantage by significantly reducing the capital expenditure associated with purchasing new catalysts. By extending the useful life of existing catalysts, industries can achieve substantial cost savings, thereby boosting profitability and operational efficiency.

Challenges in the Catalyst Regeneration Market Sector

The market faces several challenges:

- High capital investment: Establishing regeneration facilities requires significant upfront investment, hindering entry for smaller players.

- Fluctuating raw material prices: The cost of raw materials impacts regeneration costs and profitability.

- Technological complexities: Certain catalyst types pose significant challenges for efficient regeneration.

Emerging Opportunities in Catalyst Regeneration Market

The Catalyst Regeneration Market is rife with promising opportunities for growth and innovation:

- Expansion in Emerging Economies: Developing nations are witnessing unprecedented industrialization and infrastructure development. This surge in industrial activity, particularly in sectors reliant on catalysts, presents a substantial untapped market for catalyst regeneration services and technologies.

- Integration of Advanced Technologies (AI & Automation): The strategic adoption of Artificial Intelligence (AI) and automation technologies in catalyst regeneration processes holds immense potential. These advancements can lead to enhanced process optimization, predictive maintenance, improved quality control, and significant reductions in operational costs and human error.

- Embracing Circular Economy Principles: The global shift towards a circular economy, emphasizing resource efficiency, waste reduction, and product lifecycle management, creates a fertile ground for innovative catalyst regeneration solutions. Companies that can effectively implement closed-loop systems and offer sustainable regeneration models aligned with these principles are poised for significant success.

- Development of Specialized Regeneration Services: As catalyst technologies become more sophisticated, there is a growing need for specialized regeneration services tailored to specific catalyst types and applications. Niche players focusing on offering bespoke regeneration solutions can carve out significant market share.

Leading Players in the Catalyst Regeneration Market Market

- Axens

- Eurecat

- AMETEK Inc

- Al Bilad Catalyst Company

- NIPPON KETJEN Co Ltd

- Advanced Catalyst Systems LLC

- Yokogawa Corporation of America

- CORMETECH

- BASF SE

- Zibo Hengji chemical Co Ltd

- EBINGER Katalysatorservice GmbH & Co KG

- Evonik Industries AG (Porocel)

Key Developments in Catalyst Regeneration Market Industry

- July 2021: BASF, a global leader in the chemical industry, strategically expanded its chemical catalyst recycling capacity and capabilities through the acquisition of Zodiac Enterprises LLC, located in Caldwell, Texas. This pivotal acquisition significantly bolstered BASF's market presence and enhanced its technological prowess in the catalyst regeneration and recycling domain, positioning them for further growth and innovation.

- [Insert another recent development here, e.g., Company X launched a new, highly efficient regeneration process for FCC catalysts in Q1 2023, improving catalyst lifespan by 15% and reducing operational costs for refineries.]

Future Outlook for Catalyst Regeneration Market Market

The Catalyst Regeneration Market is on a trajectory of sustained and robust expansion, driven by a powerful synergy of escalating environmental consciousness, rapid technological advancements, and the ever-increasing global demand for catalysts across a multitude of industrial sectors. Strategic and substantial investments in cutting-edge research and development (R&D), coupled with the widespread adoption of innovative and highly efficient regeneration technologies, are set to sculpt the future landscape of this dynamic market. The intensifying global focus on sustainability and the principles of a circular economy presents unparalleled opportunities for market participants to conceptualize, develop, and implement pioneering, environmentally responsible solutions. The market is anticipated to witness further strategic consolidation through mergers and acquisitions, as established corporations aim to solidify their market share, expand their technological capabilities, and achieve greater economies of scale, ultimately driving industry evolution and innovation.

Catalyst Regeneration Market Segmentation

-

1. Method

- 1.1. Ex Situ

- 1.2. In Situ

-

2. Application

- 2.1. Refineries and Petrochemical Complexes

- 2.2. Environmental

- 2.3. Energy & Power

- 2.4. Other Applications

Catalyst Regeneration Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Catalyst Regeneration Market Regional Market Share

Geographic Coverage of Catalyst Regeneration Market

Catalyst Regeneration Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of New Catalyst and Regulations Related to the Disposal of Spent Catalyst; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Refineries and Petrochemical Complexes Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Method

- 5.1.1. Ex Situ

- 5.1.2. In Situ

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Refineries and Petrochemical Complexes

- 5.2.2. Environmental

- 5.2.3. Energy & Power

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Method

- 6. Asia Pacific Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Method

- 6.1.1. Ex Situ

- 6.1.2. In Situ

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Refineries and Petrochemical Complexes

- 6.2.2. Environmental

- 6.2.3. Energy & Power

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Method

- 7. North America Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Method

- 7.1.1. Ex Situ

- 7.1.2. In Situ

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Refineries and Petrochemical Complexes

- 7.2.2. Environmental

- 7.2.3. Energy & Power

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Method

- 8. Europe Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Method

- 8.1.1. Ex Situ

- 8.1.2. In Situ

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Refineries and Petrochemical Complexes

- 8.2.2. Environmental

- 8.2.3. Energy & Power

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Method

- 9. South America Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Method

- 9.1.1. Ex Situ

- 9.1.2. In Situ

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Refineries and Petrochemical Complexes

- 9.2.2. Environmental

- 9.2.3. Energy & Power

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Method

- 10. Middle East and Africa Catalyst Regeneration Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Method

- 10.1.1. Ex Situ

- 10.1.2. In Situ

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Refineries and Petrochemical Complexes

- 10.2.2. Environmental

- 10.2.3. Energy & Power

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Axens

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurecat

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMETEK Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Bilad Catalyst Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NIPPON KETJEN Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Advanced Catalyst Systems LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yokogawa Corporation of America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CORMETECH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BASF SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zibo Hengji chemical Co Ltd *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EBINGER Katalysatorservice GmbH & Co KG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Evonik Industries AG (Porocel)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Axens

List of Figures

- Figure 1: Global Catalyst Regeneration Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 3: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 4: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 9: North America Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 10: North America Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 11: North America Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 15: Europe Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 16: Europe Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 21: South America Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 22: South America Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Method 2025 & 2033

- Figure 27: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Method 2025 & 2033

- Figure 28: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Catalyst Regeneration Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Catalyst Regeneration Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 2: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Catalyst Regeneration Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 5: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 14: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United States Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Canada Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 20: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: France Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Russia Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 29: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Catalyst Regeneration Market Revenue billion Forecast, by Method 2020 & 2033

- Table 35: Global Catalyst Regeneration Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Catalyst Regeneration Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: South Africa Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Catalyst Regeneration Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Catalyst Regeneration Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Catalyst Regeneration Market?

Key companies in the market include Axens, Eurecat, AMETEK Inc, Al Bilad Catalyst Company, NIPPON KETJEN Co Ltd, Advanced Catalyst Systems LLC, Yokogawa Corporation of America, CORMETECH, BASF SE, Zibo Hengji chemical Co Ltd *List Not Exhaustive, EBINGER Katalysatorservice GmbH & Co KG, Evonik Industries AG (Porocel).

3. What are the main segments of the Catalyst Regeneration Market?

The market segments include Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.6 billion as of 2022.

5. What are some drivers contributing to market growth?

High Cost of New Catalyst and Regulations Related to the Disposal of Spent Catalyst; Other Drivers.

6. What are the notable trends driving market growth?

Refineries and Petrochemical Complexes Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

In July 2021, BASF has expanded its chemical catalyst recycling capacity and capability with the acquisition of Zodiac Enterprises LLC in Caldwell, Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Catalyst Regeneration Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Catalyst Regeneration Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Catalyst Regeneration Market?

To stay informed about further developments, trends, and reports in the Catalyst Regeneration Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence