Key Insights

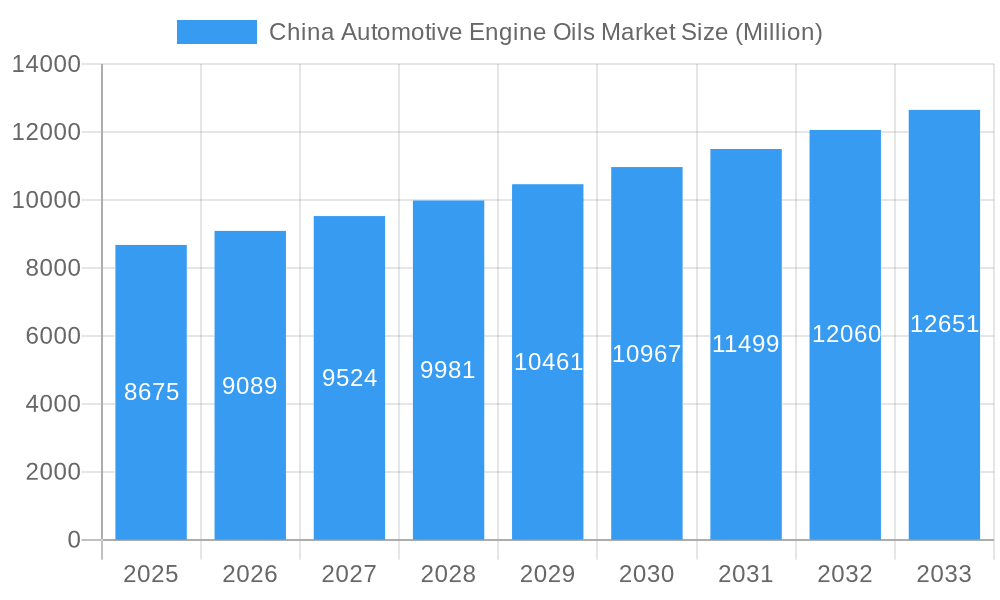

The China Automotive Engine Oils Market is projected for significant expansion, anticipated to reach an estimated market size of USD 45.56 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This robust growth is driven by an expanding vehicle parc across commercial, passenger, and two-wheeler segments, alongside increasing consumer awareness of high-performance lubricants for enhanced vehicle longevity and fuel efficiency. China's substantial automotive production and sales volumes underpin this demand. The market is trending towards synthetic and semi-synthetic engine oils, fueled by stringent emission standards and the demand for superior engine protection, reduced friction, and improved fuel economy. Key global and domestic players, including BP PLC (Castrol), Chevron Corporation, China National Petroleum Corporation, ExxonMobil Corporation, and Royal Dutch Shell Plc, are competitively offering diverse product portfolios to meet varied vehicle types and performance requirements.

China Automotive Engine Oils Market Market Size (In Billion)

The passenger vehicle segment is a significant growth driver, propelled by ongoing urbanization and a growing middle class. Advanced engine technologies in commercial vehicles also necessitate specialized, high-performance engine oils. While market competition from aftermarket brands and potential base oil price volatility present challenges, these are largely offset by strong demand and continuous innovation in lubricant formulations. The market's trajectory emphasizes eco-friendly and high-efficiency engine oils, aligning with China's environmental objectives and automotive industry evolution. The presence of both dominant domestic players and international leaders signifies a dynamic and competitive landscape where innovation and strategic partnerships are crucial for market success.

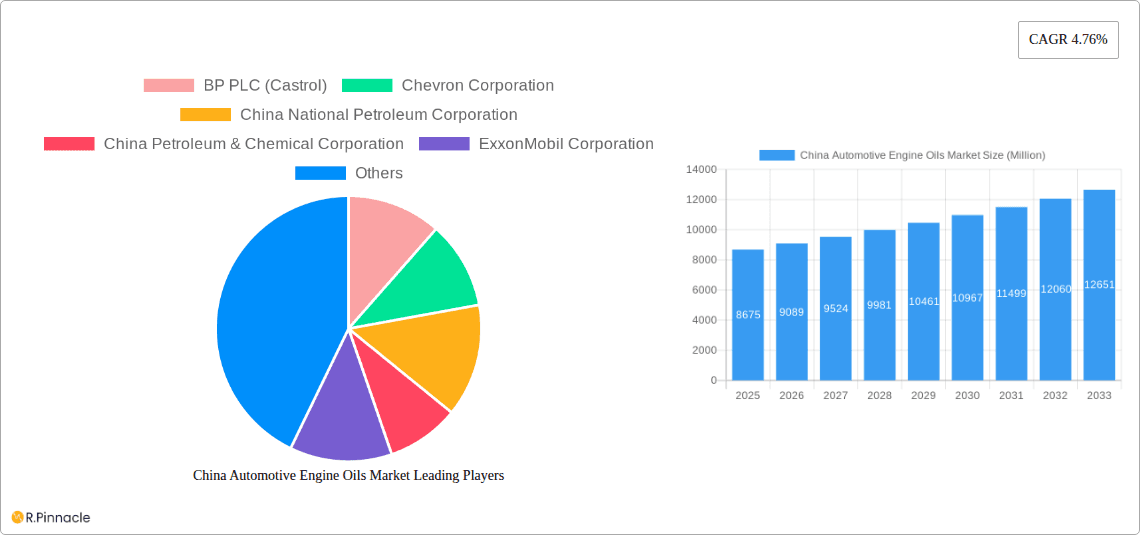

China Automotive Engine Oils Market Company Market Share

This comprehensive report offers unparalleled insights into the dynamic China automotive engine oils market, analyzing market structure, dynamics, regional dominance, product innovations, and future outlook from 2019 to 2033, with a base year of 2025. Leveraging high-ranking keywords such as "China automotive engine oil market," "lubricant market China," and "vehicle engine oil China," this study is essential for industry professionals navigating this rapidly evolving sector. It provides actionable insights, details key players, industry developments, and critical growth drivers and challenges, offering a strategic roadmap for success.

China Automotive Engine Oils Market Market Structure & Innovation Trends

The China automotive engine oils market exhibits a moderately concentrated structure, characterized by the presence of both global giants and significant domestic players. Innovation drivers are primarily fueled by increasingly stringent emission standards (National VI), the growing adoption of advanced engine technologies (e.g., turbocharging, direct injection), and the rising demand for fuel efficiency and extended drain intervals. Regulatory frameworks, such as emission norms and product quality standards, play a crucial role in shaping market entry and product development. Substitutes, while limited for core engine oil functions, include aftermarket additives and re-refined oils, though their penetration remains relatively low for primary lubrication. End-user demographics are shifting, with a growing middle class demanding higher quality and performance lubricants for their passenger vehicles, while commercial fleets focus on TCO (Total Cost of Ownership) and extended service life. Mergers and acquisitions (M&A) activities are observed, albeit not as frequently as in more mature markets, with deal values typically ranging in the tens of millions, aimed at expanding market reach or acquiring new technologies. The overall market share for the top five players is estimated to be around 70-75%, with domestic players gradually increasing their footprint.

China Automotive Engine Oils Market Market Dynamics & Trends

The China automotive engine oils market is experiencing robust growth, driven by several interconnected dynamics. A key growth driver is the sheer size of China's automotive parc, which continues to expand, albeit at a moderating pace, coupled with an increasing average age of vehicles necessitating regular maintenance and oil changes. The ongoing transition towards electric vehicles (EVs) presents a dual-edged sword: while it may reduce demand for traditional engine oils in the long term, the massive existing internal combustion engine (ICE) fleet ensures sustained demand for the foreseeable future. Technological disruptions are a constant, with the development of synthetic and semi-synthetic oils offering superior performance, fuel economy, and extended drain capabilities, thereby capturing a larger market share. Consumer preferences are evolving; there's a clear shift towards premium, high-performance lubricants that promise enhanced engine protection and longevity, especially in the passenger vehicle segment. The competitive landscape is intense, characterized by aggressive pricing strategies, extensive distribution networks, and a growing emphasis on brand building and after-sales services. Market penetration for high-quality synthetic engine oils is projected to reach approximately 55-60% by 2033, up from around 35-40% in 2025. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is anticipated to be in the range of 4.5% to 5.2%, indicating a healthy and sustained expansion of the market. The growing demand for specialized lubricants for hybrid vehicles, reflecting the country's push towards cleaner mobility, is another significant trend shaping market dynamics.

Dominant Regions & Segments in China Automotive Engine Oils Market

The Passenger Vehicles segment is the dominant force within the China automotive engine oils market, contributing significantly to overall volume and value. This dominance is underpinned by several key drivers:

- Economic Policies & Consumer Spending: China's robust economic growth and expanding middle class have led to a surge in passenger vehicle ownership. Government policies promoting domestic consumption and rising disposable incomes directly translate into increased demand for personal transportation and, consequently, engine oils.

- Urbanization & Infrastructure: Rapid urbanization across major economic hubs like the Yangtze River Delta, Pearl River Delta, and the Beijing-Tianjin-Hebei region has created dense urban environments with high vehicle density, driving consistent demand for passenger car maintenance.

- Brand Consciousness & Premiumization: Consumers in these urban centers are increasingly brand-conscious and willing to invest in premium, high-performance engine oils that offer enhanced engine protection, fuel efficiency, and longer service intervals. This trend supports the growth of synthetic and semi-synthetic product grades.

- Regulatory Compliance: The adoption of stringent emission standards, such as National VI, mandates the use of compliant lubricants that support cleaner engine operation, further boosting demand for advanced formulations.

While Commercial Vehicles represent a substantial segment, particularly for heavy-duty diesel engines, their growth is more closely tied to industrial output and logistics, which can be more cyclical. Motorcycles, though a significant category in terms of unit numbers, generally utilize lower-volume, less complex engine oils compared to passenger vehicles, thus having a comparatively smaller impact on the overall market value.

In terms of geographical dominance, the eastern and southern coastal regions of China, including provinces like Guangdong, Jiangsu, Zhejiang, and Shandong, historically lead in automotive sales and vehicle parc. These regions benefit from strong economic activity, high population density, and well-developed automotive aftermarket infrastructure. The increasing focus on developing inland regions and the government's "Western Development" strategy are expected to contribute to a more balanced regional distribution of demand over the long term, but the established economic powerhouses are projected to maintain their leadership in the forecast period.

China Automotive Engine Oils Market Product Innovations

Product innovation in the China automotive engine oils market is primarily focused on meeting evolving environmental regulations and enhancing engine performance. Key trends include the development of ultra-low viscosity oils for improved fuel economy, synthetic lubricants with extended drain intervals, and specialized formulations for hybrid and advanced internal combustion engines. These innovations aim to provide superior wear protection, thermal stability, and deposit control under demanding operating conditions. Competitive advantages are derived from superior technological formulations, adherence to stringent OEM (Original Equipment Manufacturer) approvals, and the ability to offer tailored solutions for specific vehicle types and driving conditions.

China Automotive Engine Oils Market Report Scope & Segmentation Analysis

This report meticulously segments the China automotive engine oils market across key categories to provide granular insights.

Vehicle Type:

- Passenger Vehicles: This segment is the largest and fastest-growing, driven by rising disposable incomes, urbanization, and consumer demand for high-quality lubricants. Growth projections are robust, with market share expected to increase.

- Commercial Vehicles: This segment, encompassing trucks, buses, and vans, represents a significant volume, driven by logistics and industrial activity. Growth is steady, with a focus on durability and TCO.

- Motorcycles: While a large unit market, this segment generally utilizes lower-value lubricants. Growth is moderate, influenced by urban mobility trends.

Product Grade: Analysis will cover mineral, semi-synthetic, and synthetic engine oils, detailing their respective market sizes, growth trajectories, and competitive dynamics. Synthetic oils are projected to witness the highest growth rate due to their superior performance characteristics.

Key Drivers of China Automotive Engine Oils Market Growth

The China automotive engine oils market is propelled by a confluence of critical factors. The ever-expanding automotive parc, even with the rise of EVs, ensures a continuous need for engine maintenance. Stringent environmental regulations, such as the National VI emission standards, are compelling manufacturers to develop and utilize advanced lubricants that minimize emissions and improve fuel efficiency. The increasing adoption of advanced engine technologies, including turbocharging and direct injection, necessitates higher-performance lubricants for optimal protection and longevity. Furthermore, a growing middle class with rising disposable incomes leads to greater demand for premium and technologically advanced engine oils that offer enhanced performance and extended service life for their passenger vehicles. The economic growth and industrialization continue to drive the commercial vehicle segment, requiring robust and reliable engine oils.

Challenges in the China Automotive Engine Oils Market Sector

Despite robust growth, the China automotive engine oils market faces several challenges. Intense price competition among numerous domestic and international players exerts downward pressure on profit margins. Fluctuations in raw material prices, particularly crude oil derivatives, can significantly impact production costs and profitability. Counterfeit products remain a persistent issue, eroding brand trust and market integrity. The transition towards electric vehicles, while not an immediate threat to the ICE fleet, represents a long-term challenge as it will gradually reduce the overall demand for traditional engine oils. Ensuring consistent product quality and supply chain reliability across such a vast and geographically diverse market is also a significant logistical hurdle.

Emerging Opportunities in China Automotive Engine Oils Market

Emerging opportunities in the China automotive engine oils market are ripe for exploration. The growing demand for specialty lubricants for hybrid vehicles presents a significant growth avenue as China leads in hybrid technology adoption. The increasing popularity of vintage and classic cars is creating a niche market for specialized, high-quality restoration and maintenance oils. As automotive aftermarket services become more sophisticated, there's an opportunity for lubricant manufacturers to offer bundled services and value-added solutions. Furthermore, the increasing awareness of sustainability is driving demand for environmentally friendly lubricants, including those made from renewable resources or those that offer enhanced fuel efficiency, thereby reducing carbon footprints. The development of smart lubricants with diagnostic capabilities also holds future promise.

Leading Players in the China Automotive Engine Oils Market Market

- BP PLC (Castrol)

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ExxonMobil Corporation

- Jiangsu Lopal Tech Co Ltd

- Qingdao COPTON Technology Co Ltd

- Royal Dutch Shell Plc

- Tongyi Petrochemical Co Ltd

- TotalEnergie

Key Developments in China Automotive Engine Oils Market Industry

- January 2022: ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.

- July 2021: TotalEnergies unveiled a new product (hybrid transmission fluid), which is specially made for Great Wall Motors to use in hybrid technology vehicles for high efficiency and high performance.

- May 2021: Jiangsu Lopal Tech Co. Ltd launched two new National VI lubricants, especially for Volkswagen's high-end gasoline engines and long-range diesel engines.

Future Outlook for China Automotive Engine Oils Market Market

The future outlook for the China automotive engine oils market remains positive, albeit with a shifting landscape. While the long-term growth trajectory for traditional engine oils will be influenced by the pace of EV adoption, the sheer size of the existing internal combustion engine fleet ensures sustained demand for the medium term. The market will increasingly favor high-performance, synthetic lubricants that meet stringent emission standards and offer fuel efficiency benefits. Opportunities will emerge for companies that can innovate in specialty lubricants for hybrid powertrains and advanced engine designs. Strategic partnerships and a focus on brand building and customer loyalty will be crucial for market success. The market is expected to witness continued consolidation and a focus on sustainable product offerings to align with China's environmental goals.

China Automotive Engine Oils Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

- 2. Product Grade

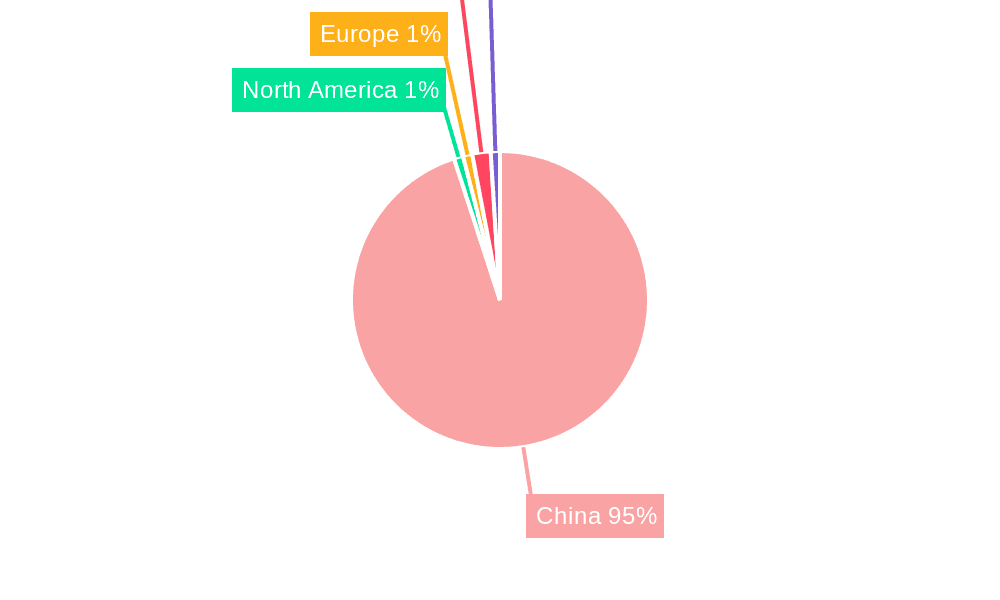

China Automotive Engine Oils Market Segmentation By Geography

- 1. China

China Automotive Engine Oils Market Regional Market Share

Geographic Coverage of China Automotive Engine Oils Market

China Automotive Engine Oils Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Engine Oils Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP PLC (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China National Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Petroleum & Chemical Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ExxonMobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jiangsu Lopal Tech Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao COPTON Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal Dutch Shell Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tongyi Petrochemical Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TotalEnergie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP PLC (Castrol)

List of Figures

- Figure 1: China Automotive Engine Oils Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Automotive Engine Oils Market Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Engine Oils Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: China Automotive Engine Oils Market Revenue billion Forecast, by Product Grade 2020 & 2033

- Table 3: China Automotive Engine Oils Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Automotive Engine Oils Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: China Automotive Engine Oils Market Revenue billion Forecast, by Product Grade 2020 & 2033

- Table 6: China Automotive Engine Oils Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Engine Oils Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the China Automotive Engine Oils Market?

Key companies in the market include BP PLC (Castrol), Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, ExxonMobil Corporation, Jiangsu Lopal Tech Co Ltd, Qingdao COPTON Technology Co Ltd, Royal Dutch Shell Plc, Tongyi Petrochemical Co Ltd, TotalEnergie.

3. What are the main segments of the China Automotive Engine Oils Market?

The market segments include Vehicle Type, Product Grade.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.56 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Passenger Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.July 2021: TotalEnergies unveiled a new product (hybrid transmission fluid), which is specially made for Great Wall Motors to use in hybrid technology vehicles for high efficiency and high performance.May 2021: Jiangsu Lopal Tech Co. Ltd launched two new National VI lubricants, especially for Volkswagen's high-end gasoline engines and long-range diesel engines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Engine Oils Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Engine Oils Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Engine Oils Market?

To stay informed about further developments, trends, and reports in the China Automotive Engine Oils Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence