Key Insights

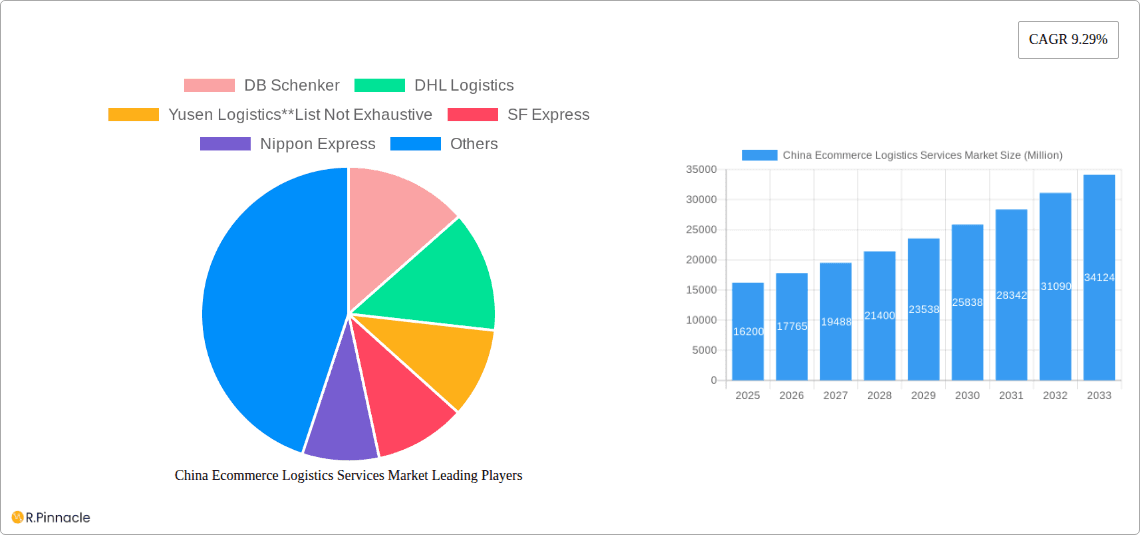

The China e-commerce logistics services market is experiencing robust growth, projected to reach \$16.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.29% from 2025 to 2033. This expansion is fueled by several key factors. The explosive growth of e-commerce in China, driven by rising disposable incomes and increasing internet and smartphone penetration, is a primary driver. Consumers are increasingly demanding faster and more reliable delivery options, fostering innovation in last-mile delivery solutions, including drone delivery and automated sorting facilities. Furthermore, the increasing complexity of cross-border e-commerce necessitates sophisticated logistics solutions to manage international shipping, customs clearance, and regulatory compliance. The market segmentation reveals a significant share held by B2C services, reflecting the dominance of direct-to-consumer online sales. Transportation services form a major component, alongside warehousing and inventory management, with value-added services like packaging and labeling playing an increasingly crucial role in enhancing customer experience. Key players such as DHL Logistics, SF Express, and JD Logistics are constantly investing in technological advancements and strategic partnerships to maintain their competitive edge within this dynamic market.

China Ecommerce Logistics Services Market Market Size (In Billion)

The significant growth in the market is also influenced by the diversification of products transported. While fashion and apparel, consumer electronics, and home appliances maintain a substantial share, the expansion into other product categories, such as beauty and personal care and even food products, further fuels market expansion. However, challenges remain. Intense competition among logistics providers requires continuous innovation and cost optimization. Infrastructure limitations in certain regions of China, particularly in rural areas, could hinder efficient last-mile delivery. Regulatory changes and environmental concerns related to transportation emissions also pose potential restraints on market growth. Despite these challenges, the long-term outlook remains positive, with continued growth driven by the ongoing expansion of China's e-commerce sector and the evolving needs of both businesses and consumers.

China Ecommerce Logistics Services Market Company Market Share

China Ecommerce Logistics Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Ecommerce Logistics Services Market, offering valuable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a data-driven perspective on market dynamics, growth drivers, and future opportunities. The market size is projected to reach xx Million by 2033, presenting significant growth potential.

China Ecommerce Logistics Services Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory environment of the China ecommerce logistics services market. Market concentration is moderate, with several key players holding significant market share, but a substantial number of smaller, specialized companies also contributing. Leading players include DB Schenker, DHL Logistics, Yusen Logistics, SF Express, Nippon Express, XPO Logistics, CEVA Logistics, VHK Logistics, CTS International Logistics, and FedEx Express. The market is characterized by continuous innovation driven by advancements in technology, such as automation, AI, and big data analytics. Stringent government regulations regarding data privacy and cross-border trade influence market operations. Product substitution is minimal, given the specialized nature of the services, but cost pressures lead to ongoing efforts to enhance efficiency and optimize operations. End-user demographics are diverse, encompassing B2B and B2C businesses across numerous industries. M&A activity has been moderate, with deal values averaging xx Million in recent years, reflecting consolidation efforts among larger players and the acquisition of smaller specialized firms.

- Market Concentration: Moderate, with top players holding xx% combined market share in 2024.

- Innovation Drivers: Automation, AI, big data analytics, and improved supply chain management.

- Regulatory Framework: Stringent regulations around data privacy and cross-border trade.

- M&A Activity: Moderate activity, with average deal values around xx Million.

China Ecommerce Logistics Services Market Dynamics & Trends

The China ecommerce logistics services market exhibits robust growth, driven by the expansion of e-commerce, increasing consumer demand, and significant infrastructure development. Technological disruptions, such as the adoption of autonomous vehicles and drones, are transforming logistics operations, enhancing efficiency and reducing costs. Consumer preferences for faster delivery times and improved transparency are further shaping market dynamics. Competitive dynamics are intense, with established players and new entrants vying for market share through service differentiation, price competitiveness, and strategic partnerships. The market is expected to achieve a CAGR of xx% during the forecast period, with market penetration increasing from xx% in 2024 to xx% by 2033.

Dominant Regions & Segments in China Ecommerce Logistics Services Market

The eastern coastal regions of China, including Guangdong, Jiangsu, and Zhejiang provinces, dominate the market due to their well-developed infrastructure, proximity to major ports, and high concentration of e-commerce businesses.

By Service: Transportation is the largest segment, followed by warehousing and inventory management, and value-added services.

- Key Drivers for Transportation: Robust e-commerce growth, expanding infrastructure, and technological advancements.

- Key Drivers for Warehousing & Inventory Management: Increased demand for efficient inventory management, cost optimization, and improved supply chain visibility.

- Key Drivers for Value-Added Services: Growing demand for customized packaging and labeling solutions to meet specific consumer and product requirements.

By Business: B2C accounts for a larger share than B2B.

- Key Drivers for B2C: Explosive growth of online retail, increasing consumer demand, and focus on fast delivery.

- Key Drivers for B2B: Growth in online wholesale and business-to-business e-commerce platforms.

By Destination: Domestic logistics constitutes a larger segment compared to international/cross-border logistics, but cross-border trade is rapidly growing.

- Key Drivers for Domestic: High volume of domestic e-commerce transactions, well-established infrastructure.

- Key Drivers for International/Cross-border: Growing global trade, increased consumer demand for international products, and government support for cross-border e-commerce.

By Product: Fashion and apparel, consumer electronics, and home appliances are the major product categories.

- Key Drivers for Fashion & Apparel: High online demand, diverse product offerings, and fast fashion trends.

- Key Drivers for Consumer Electronics: Increasing adoption of smartphones, smart devices, and other electronic products.

- Key Drivers for Home Appliances: Rising disposable incomes, improving living standards, and preference for online purchases.

China Ecommerce Logistics Services Market Product Innovations

Recent innovations focus on enhancing efficiency and improving service quality. This includes the integration of AI-powered route optimization systems, automated warehousing solutions, and advanced tracking technologies. These innovations improve delivery speed, reduce costs, and enhance supply chain visibility, catering to the growing demands of ecommerce businesses and consumers for seamless logistics experiences.

Report Scope & Segmentation Analysis

This report segments the China ecommerce logistics services market based on service type (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, electronics, home appliances, furniture, beauty products, other). Each segment is analyzed based on market size, growth projections, and competitive dynamics. For example, the transportation segment is projected to grow at a CAGR of xx% during the forecast period, driven by increasing e-commerce volume and infrastructure development. The B2C segment is anticipated to dominate due to the rapid growth of online retail, whereas the international segment will witness faster growth driven by globalization and rising international trade.

Key Drivers of China Ecommerce Logistics Services Market Growth

Several factors fuel market growth, including the explosive growth of e-commerce in China, substantial investments in logistics infrastructure (high-speed rail, improved road networks), technological advancements in automation and data analytics, and supportive government policies promoting digital economy growth. The increasing demand for faster and more efficient delivery services also plays a crucial role.

Challenges in the China Ecommerce Logistics Services Market Sector

Challenges include intense competition, increasing labor costs, stringent regulatory requirements (especially regarding data security and cross-border trade), and infrastructure limitations in certain regions. Supply chain disruptions caused by unforeseen events can significantly impact operations, causing delays and increasing costs. These factors can hinder the market’s growth trajectory unless efficiently addressed.

Emerging Opportunities in China Ecommerce Logistics Services Market

Emerging opportunities include the integration of new technologies like drones and autonomous vehicles, the growth of last-mile delivery solutions, and the expansion of cross-border e-commerce. The increasing demand for personalized logistics services, including customized packaging and delivery options, also presents significant opportunities for market players. Furthermore, the development of smart logistics hubs and the adoption of sustainable practices offer considerable growth potential.

Leading Players in the China Ecommerce Logistics Services Market Market

- DB Schenker

- DHL Logistics

- Yusen Logistics

- SF Express

- Nippon Express

- XPO Logistics

- CEVA Logistics

- VHK Logistics

- CTS International Logistics

- FedEx Express

Key Developments in China Ecommerce Logistics Services Market Industry

- October 2023: DHL inaugurated a new gateway in Wuxi, expanding its network and enhancing service capabilities. Simultaneously, DHL expanded its North Asia Hub in Shanghai, further boosting its operational resilience.

- May 2023: FedEx Express partnered with the Guangzhou Municipal Government to enhance customs clearance, international e-commerce, and the South China Operations Center, strengthening its presence in the region.

Future Outlook for China Ecommerce Logistics Services Market Market

The China ecommerce logistics services market is poised for continued robust growth, driven by technological innovation, infrastructure development, and the ongoing expansion of e-commerce. Strategic opportunities exist for companies that can adapt to evolving consumer preferences, embrace technological advancements, and navigate regulatory changes effectively. The market's future growth hinges on the ability of logistics providers to optimize operations, enhance supply chain resilience, and offer innovative solutions that meet the evolving needs of businesses and consumers.

China Ecommerce Logistics Services Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory management

- 1.3. Value-Added Services (Labeling, Packaging, etc)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

China Ecommerce Logistics Services Market Segmentation By Geography

- 1. China

China Ecommerce Logistics Services Market Regional Market Share

Geographic Coverage of China Ecommerce Logistics Services Market

China Ecommerce Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming mobile commerce; Massive online market

- 3.3. Market Restrains

- 3.3.1. Geographic size and population density; Fragmented supply chain

- 3.4. Market Trends

- 3.4.1. Cross border eCommerce driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Ecommerce Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory management

- 5.1.3. Value-Added Services (Labeling, Packaging, etc)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SF Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 XPO Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VHK Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS International Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FedEx Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Ecommerce Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Ecommerce Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: China Ecommerce Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: China Ecommerce Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Ecommerce Logistics Services Market?

The projected CAGR is approximately 9.29%.

2. Which companies are prominent players in the China Ecommerce Logistics Services Market?

Key companies in the market include DB Schenker, DHL Logistics, Yusen Logistics**List Not Exhaustive, SF Express, Nippon Express, XPO Logistics, CEVA Logistics, VHK Logistics, CTS International Logistics, FedEx Express.

3. What are the main segments of the China Ecommerce Logistics Services Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Booming mobile commerce; Massive online market.

6. What are the notable trends driving market growth?

Cross border eCommerce driving the growth of the market.

7. Are there any restraints impacting market growth?

Geographic size and population density; Fragmented supply chain.

8. Can you provide examples of recent developments in the market?

October 2023: DHL inaugurated a new gateway in Wuxi, Jiangsu Province, East China, as part of its ongoing expansion initiatives. Simultaneously, DHL is extending its North Asia Hub in Shanghai Pudong, reinforcing the company's network resilience and service capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Ecommerce Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Ecommerce Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Ecommerce Logistics Services Market?

To stay informed about further developments, trends, and reports in the China Ecommerce Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence