Key Insights

The China stevedoring and marine cargo handling market is experiencing robust growth, driven by the nation's expanding international trade and significant investments in port infrastructure modernization. With a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2019 to 2024, the market is poised for continued expansion throughout the forecast period (2025-2033). Key market segments include stevedoring services, cargo and handling transportation, and other related activities, catering to various cargo types such as bulk cargo, containerized cargo, and other specialized goods. The market's expansion is fueled by increasing container volumes, growing e-commerce activity, and government initiatives aimed at improving port efficiency and logistics infrastructure. Major players like COSCO, China Merchants Port Holdings, and numerous regional operators contribute to a competitive landscape characterized by both established giants and emerging specialized service providers. The dominance of containerized cargo reflects China's pivotal role in global supply chains. While challenges remain, such as fluctuating global trade patterns and environmental regulations, the long-term outlook for the Chinese stevedoring and marine cargo handling market remains positive, driven by sustained economic growth and infrastructure development.

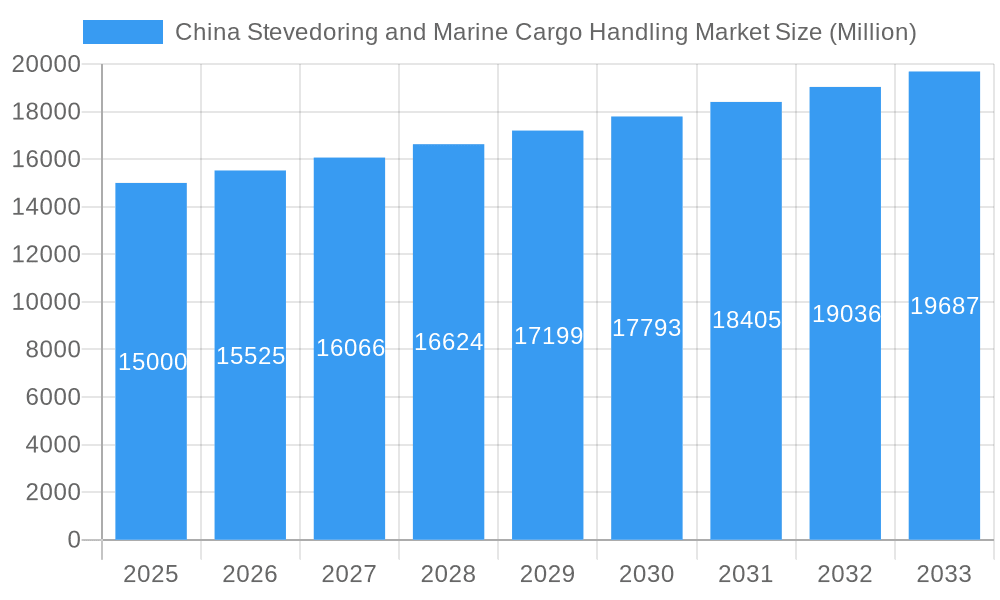

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

This dynamic market presents significant opportunities for both domestic and international companies. The increasing demand for efficient and reliable cargo handling solutions creates fertile ground for technological advancements, such as automation and digitalization, within the industry. Further growth will be stimulated by strategic partnerships, mergers and acquisitions, and the continuous upgrading of port facilities to accommodate larger vessels and increased cargo throughput. While competition is intense, companies that can offer innovative solutions, optimize operational efficiency, and effectively navigate evolving regulatory landscapes will be well-positioned to capitalize on the considerable growth potential within the China stevedoring and marine cargo handling market. The increasing focus on sustainability and environmentally friendly practices also presents opportunities for businesses adopting green technologies and practices.

China Stevedoring and Marine Cargo Handling Market Company Market Share

This comprehensive report provides an in-depth analysis of the China Stevedoring and Marine Cargo Handling Market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key players, and future growth prospects.

China Stevedoring and Marine Cargo Handling Market Market Structure & Innovation Trends

The China stevedoring and marine cargo handling market exhibits a moderately concentrated structure, with a few large players holding significant market share. Market share data for 2024 indicates that the top five players account for approximately xx% of the total market, with the remaining share distributed among numerous smaller companies and regional operators. This structure is influenced by significant capital investments required for port infrastructure and specialized equipment. Innovation is driven by increasing automation, digitalization of port operations, and the adoption of sustainable technologies to reduce environmental impact. The regulatory framework, primarily overseen by the Ministry of Transport, plays a critical role, influencing safety standards, environmental regulations, and tariff policies. Product substitutes are limited, primarily focusing on alternative transportation modes such as rail and road, but these are often less efficient for large-volume cargo. End-user demographics encompass a broad range, including importers, exporters, manufacturers, logistics providers, and government agencies. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with total deal values estimated at xx Million in 2024. Key M&A activities have focused on expanding geographical reach and integrating logistics capabilities.

China Stevedoring and Marine Cargo Handling Market Market Dynamics & Trends

The China stevedoring and marine cargo handling market is experiencing robust growth, driven by several key factors. The expanding Chinese economy and increasing global trade volumes contribute significantly to the demand for efficient cargo handling services. Technological advancements, particularly in automation and digitalization, are enhancing operational efficiency and reducing costs. Consumer preferences are shifting towards faster and more reliable delivery times, pushing the industry to optimize its processes. Competitive dynamics are characterized by a mix of established players and emerging entrants, leading to price competition and innovation in service offerings. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to increase significantly in less-developed regions. The rising adoption of containerized cargo transportation also fuels the market's growth. Technological disruptions such as the implementation of AI-powered port management systems and blockchain for supply chain transparency are revolutionizing the sector. Furthermore, government initiatives focused on infrastructure development and port modernization continue to create a positive impact.

Dominant Regions & Segments in China Stevedoring and Marine Cargo Handling Market

The coastal regions of China, particularly the Yangtze River Delta and the Pearl River Delta, dominate the stevedoring and marine cargo handling market due to their established port infrastructure, high concentration of manufacturing and export-oriented industries, and proximity to key trade routes.

- Key Drivers for Dominant Regions:

- Extensive port infrastructure and modernization initiatives.

- High volume of import and export activities.

- Favorable government policies supporting economic development.

- Strategic geographical location.

The containerized cargo segment represents the largest share of the market due to its efficiency and suitability for various goods. Bulk cargo remains a significant segment, driven by the demand for raw materials and energy resources. The stevedoring segment accounts for a substantial portion, while cargo and handling transportation and "others" (specialized services) represent smaller but growing segments.

China Stevedoring and Marine Cargo Handling Market Product Innovations

Recent product innovations are focused on enhancing efficiency, safety, and environmental sustainability. The adoption of automated guided vehicles (AGVs), automated stacking cranes, and advanced cargo handling equipment is significantly improving throughput. Intelligent port management systems leverage AI and machine learning to optimize operations and predict potential disruptions. Efforts to reduce carbon emissions are driving the adoption of electric and hybrid vehicles, as well as the implementation of green technologies in port infrastructure. These innovations align with the increasing demand for faster, more efficient, and environmentally conscious cargo handling solutions.

Report Scope & Segmentation Analysis

This report segments the China Stevedoring and Marine Cargo Handling Market based on Type (Stevedoring, Cargo and handling transportation, Others) and Cargo Type (Bulk Cargo, Containerized Cargo, Other Cargo).

Type: The Stevedoring segment is projected to witness significant growth due to the rising demand for efficient cargo loading and unloading services. Cargo and handling transportation shows steady growth driven by the increasing need for seamless logistics. The "Others" segment encompasses niche services and is expected to demonstrate moderate growth.

Cargo Type: The Containerized Cargo segment is expected to dominate the market due to its scalability and efficiency, while the Bulk Cargo segment will maintain a substantial share based on raw material imports and exports. The "Other Cargo" segment comprises specialized goods and exhibits moderate growth. Each segment's market size, growth projections, and competitive dynamics are detailed within the full report.

Key Drivers of China Stevedoring and Marine Cargo Handling Market Growth

Several factors are driving the growth of this market: the expansion of China's economy and its increasing global trade integration, government investments in port infrastructure development and modernization, technological advancements leading to greater efficiency and automation, and the rising demand for sustainable and environmentally friendly cargo handling solutions. The increasing adoption of containerization and the related infrastructure support further boost market growth.

Challenges in the China Stevedoring and Marine Cargo Handling Market Sector

The industry faces challenges such as intense competition among players leading to price pressure, the need for substantial investments in infrastructure and technology, potential disruptions from geopolitical events impacting global trade flows, stringent environmental regulations impacting operational costs, and the need for skilled labor to operate sophisticated equipment. These factors can collectively impact profitability and sustainable growth.

Emerging Opportunities in China Stevedoring and Marine Cargo Handling Market

Emerging opportunities include the growth of e-commerce and related logistics demand, the increasing adoption of smart ports and digitalization, the development of inland waterway transport, and expanding into new regions with growing trade activity. Focus on providing value-added services, such as customs brokerage and warehousing, represents another significant opportunity.

Leading Players in the China Stevedoring and Marine Cargo Handling Market Market

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Key Developments in China Stevedoring and Marine Cargo Handling Market Industry

- July 2022: Launch of China's first indigenously developed offshore oil and gas extraction facility significantly boosts domestic energy production and associated maritime transport needs.

- May 2022: Successful maiden voyage of the world's first LNG dual-fuel ultra-large crude oil tanker signifies a major step toward greener and more sustainable maritime transportation, potentially influencing future vessel designs and fuel choices within the industry.

Future Outlook for China Stevedoring and Marine Cargo Handling Market Market

The China stevedoring and marine cargo handling market is poised for continued growth, fueled by ongoing economic expansion, increased global trade, and technological advancements. Strategic investments in infrastructure, technological innovation, and sustainable practices will be crucial for players to maintain competitiveness and capitalize on emerging opportunities. The market's future growth will be shaped by the balance between capacity expansion, efficiency improvements, and environmental considerations.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence