Key Insights

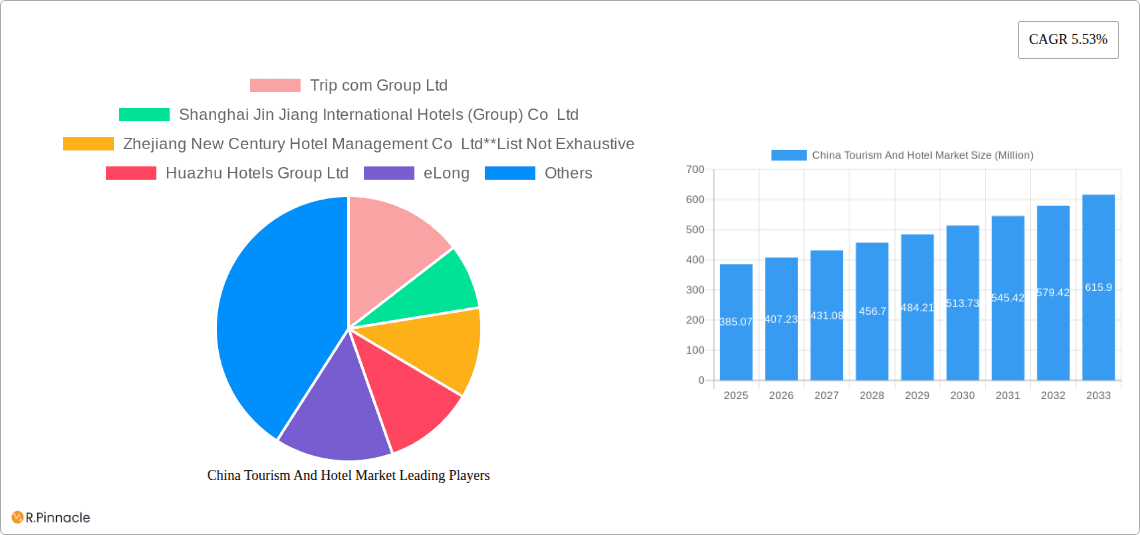

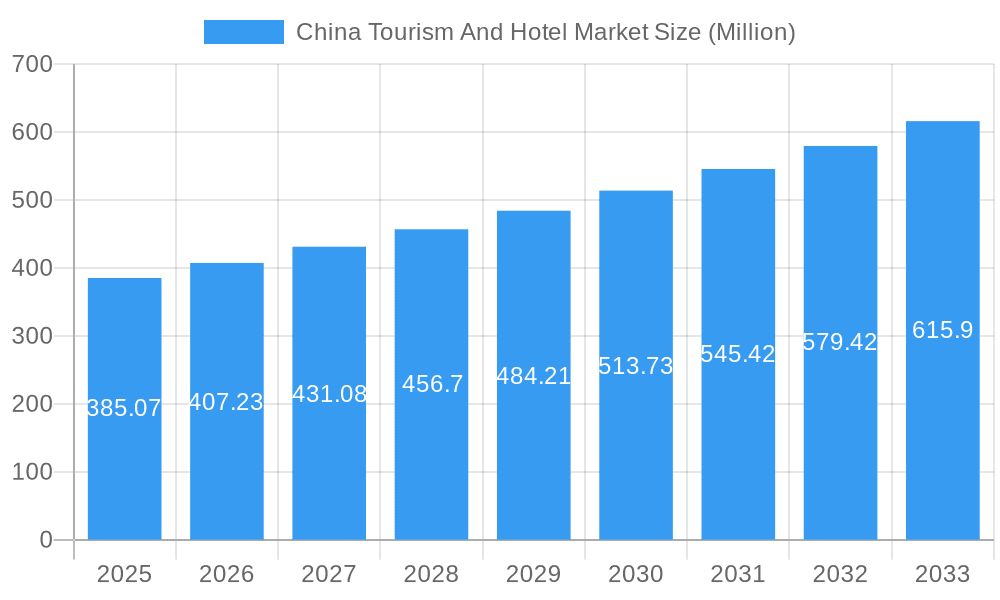

The China tourism and hotel market, valued at $385.07 million in 2025, exhibits robust growth potential, projected to expand at a CAGR of 5.53% from 2025 to 2033. This growth is fueled by several key factors. Firstly, a burgeoning Chinese middle class with increasing disposable income is driving a surge in both domestic and international travel. Secondly, significant government investment in infrastructure, including improved transportation networks and the development of new tourist destinations, further enhances accessibility and appeal. The market is segmented by type (inbound and outbound tourism) and product (chain and independent hotels). The dominance of chain hotels, driven by brands like Marriott, Shangri-La, and Huazhu, reflects a preference for standardized services and consistent quality. However, independent hotels cater to a niche market seeking unique experiences and local authenticity. Growth in outbound tourism is expected to be particularly strong, mirroring the increasing global reach of Chinese travelers. Challenges remain, including managing the environmental impact of increased tourism and maintaining service standards to meet evolving consumer expectations. Furthermore, economic fluctuations and geopolitical events could impact growth trajectories.

China Tourism And Hotel Market Market Size (In Million)

The competitive landscape is characterized by both large international hotel chains and significant domestic players. Companies like Trip.com, Ctrip, and eLong dominate the online travel booking sector, while hotel groups such as Jin Jiang International and Huazhu Hotels Group control a considerable share of the accommodation market. The increasing adoption of technology in the sector, including online booking platforms and digital marketing strategies, is transforming customer interactions and operational efficiency. Successfully navigating these technological advancements and adapting to changing consumer preferences will be crucial for sustained success in this dynamic and competitive market. The future of the China tourism and hotel market hinges on the delicate balance between sustainable growth, effective infrastructure development, and the preservation of cultural heritage.

China Tourism And Hotel Market Company Market Share

China Tourism and Hotel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China tourism and hotel market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, dynamics, and future potential. The market size is projected to reach xx Million by 2033.

China Tourism And Hotel Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, highlighting market concentration, key innovation drivers, regulatory influences, and the impact of mergers and acquisitions (M&A) activities. We examine the market share of major players such as Trip.com Group Ltd, Shanghai Jin Jiang International Hotels (Group) Co Ltd, Zhejiang New Century Hotel Management Co Ltd, Huazhu Hotels Group Ltd, eLong, Emei Shan Tourism Co Ltd, Huangshan Tourism Development, Marriott International, Shangri-la Hotels and Resorts, Tuniu Corp, and IHG Hotels. The analysis includes an assessment of product substitutes and end-user demographics, providing a 360-degree view of the market structure. Specific M&A deal values for the period 2019-2024 are estimated at approximately xx Million. Market share data for key players will be presented in the full report. The regulatory framework, particularly its impact on innovation and market entry, is critically examined.

China Tourism And Hotel Market Market Dynamics & Trends

This section delves into the key factors driving market growth, including technological advancements, evolving consumer preferences, and competitive dynamics. We project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors such as increasing disposable incomes, rising tourism numbers, and government initiatives to boost the hospitality sector. Market penetration of chain hotels versus independent hotels is analyzed, providing a granular view of the market's evolution. We also examine the impact of technological disruptions, such as the rise of online travel agencies (OTAs) and the adoption of innovative hospitality technologies.

Dominant Regions & Segments in China Tourism And Hotel Market

This section identifies the leading regions and segments within the China tourism and hotel market. A detailed analysis explores the dominance of specific regions and segments in terms of revenue generation, growth potential, and market share.

- By Type:

- Inbound Tourism: Key drivers include government tourism policies, visa facilitation, and infrastructure development.

- Outbound Tourism: Growth is influenced by economic conditions, visa policies of destination countries, and changing travel preferences.

- By Product:

- Chain Hotels: Dominance is influenced by brand recognition, operational efficiency, and loyalty programs.

- Independent Hotels: Growth is driven by unique offerings, localized experiences, and price competitiveness.

Detailed analysis of each segment's dominance and influencing factors is included in the full report.

China Tourism And Hotel Market Product Innovations

The market is witnessing significant product innovations, particularly in the area of technology integration. The adoption of digital platforms for booking, guest services, and operational efficiency is transforming the sector. Companies are focusing on personalized experiences and leveraging data analytics to enhance customer satisfaction. This trend creates competitive advantages for businesses that can effectively integrate new technologies.

Report Scope & Segmentation Analysis

This report segments the China tourism and hotel market by type (inbound and outbound tourism) and product (chain and independent hotels). Each segment's projected growth, market size, and competitive landscape are detailed in the report. Specific growth projections and market size estimations (in Millions) will be included in the full report.

Key Drivers of China Tourism And Hotel Market Growth

Several factors contribute to the market's growth, including:

- Technological advancements: The adoption of online booking platforms, mobile applications, and data analytics drives efficiency and customer satisfaction.

- Economic growth: Rising disposable incomes fuel both domestic and international tourism.

- Government initiatives: Favorable policies and investments in infrastructure boost the tourism sector.

Challenges in the China Tourism And Hotel Market Sector

The market faces challenges such as:

- Regulatory hurdles: Complex regulations can impact market entry and operations.

- Supply chain issues: Disruptions can affect hotel operations and guest experiences.

- Intense competition: The market's competitive nature demands continuous innovation and adaptation.

Emerging Opportunities in China Tourism And Hotel Market

The market offers exciting opportunities:

- Expansion into niche markets: Untapped segments present growth potential.

- Adoption of sustainable practices: Eco-friendly initiatives attract environmentally conscious travelers.

- Leveraging technology for personalization: Tailored experiences enhance customer loyalty.

Leading Players in the China Tourism And Hotel Market Market

- Trip.com Group Ltd

- Shanghai Jin Jiang International Hotels (Group) Co Ltd

- Zhejiang New Century Hotel Management Co Ltd

- Huazhu Hotels Group Ltd

- eLong

- Emei Shan Tourism Co Ltd

- Huangshan Tourism Development

- Marriott International

- Shangri-la Hotels and Resorts

- Tuniu Corp

- IHG Hotels

Key Developments in China Tourism And Hotel Market Industry

- May 2023: IRIS partners with MYM to expand its digital hospitality solutions in China.

- October 2022: Wyndham Hotels and Resorts opens its first hotels in the China-Taiwan region.

Future Outlook for China Tourism And Hotel Market Market

The China tourism and hotel market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and government support. Strategic partnerships, sustainable practices, and personalized services will define success in this dynamic market. The focus on experience-driven tourism and the increasing adoption of technology will shape the future landscape.

China Tourism And Hotel Market Segmentation

-

1. Type

- 1.1. Inbound Tourism

- 1.2. Outbound Tourism

-

2. Product

- 2.1. Chain Hotels

- 2.2. Independent Hotels

China Tourism And Hotel Market Segmentation By Geography

- 1. China

China Tourism And Hotel Market Regional Market Share

Geographic Coverage of China Tourism And Hotel Market

China Tourism And Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cultural Heritage and Tourism Attractions Are Driving the Market; Increasing Domestic and International Tourism

- 3.3. Market Restrains

- 3.3.1. Language Barrier Is Restraining the Market; Seasonality and Regional Disparities

- 3.4. Market Trends

- 3.4.1. Rising Demand for Hotels Is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Tourism And Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inbound Tourism

- 5.1.2. Outbound Tourism

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chain Hotels

- 5.2.2. Independent Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trip com Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Jin Jiang International Hotels (Group) Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhejiang New Century Hotel Management Co Ltd**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huazhu Hotels Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 eLong

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Emei Shan Tourism Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huangshan Tourism Development

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Marriott International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shangri-la Hotels and Resorts

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tuniu Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IHG Hotels

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trip com Group Ltd

List of Figures

- Figure 1: China Tourism And Hotel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Tourism And Hotel Market Share (%) by Company 2025

List of Tables

- Table 1: China Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China Tourism And Hotel Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: China Tourism And Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Tourism And Hotel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: China Tourism And Hotel Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: China Tourism And Hotel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Tourism And Hotel Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the China Tourism And Hotel Market?

Key companies in the market include Trip com Group Ltd, Shanghai Jin Jiang International Hotels (Group) Co Ltd, Zhejiang New Century Hotel Management Co Ltd**List Not Exhaustive, Huazhu Hotels Group Ltd, eLong, Emei Shan Tourism Co Ltd, Huangshan Tourism Development, Marriott International, Shangri-la Hotels and Resorts, Tuniu Corp, IHG Hotels.

3. What are the main segments of the China Tourism And Hotel Market?

The market segments include Type, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 385.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Cultural Heritage and Tourism Attractions Are Driving the Market; Increasing Domestic and International Tourism.

6. What are the notable trends driving market growth?

Rising Demand for Hotels Is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Language Barrier Is Restraining the Market; Seasonality and Regional Disparities.

8. Can you provide examples of recent developments in the market?

May 2023: IRIS, the provider of digital F&B and guest experience platforms, aimed to increase its market share across China’s growing hospitality market. The company made a new partnership with Asia-based hospitality technology reseller MYM, utilizing IRIS’s Chinese Azure cloud solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Tourism And Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Tourism And Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Tourism And Hotel Market?

To stay informed about further developments, trends, and reports in the China Tourism And Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence