Key Insights

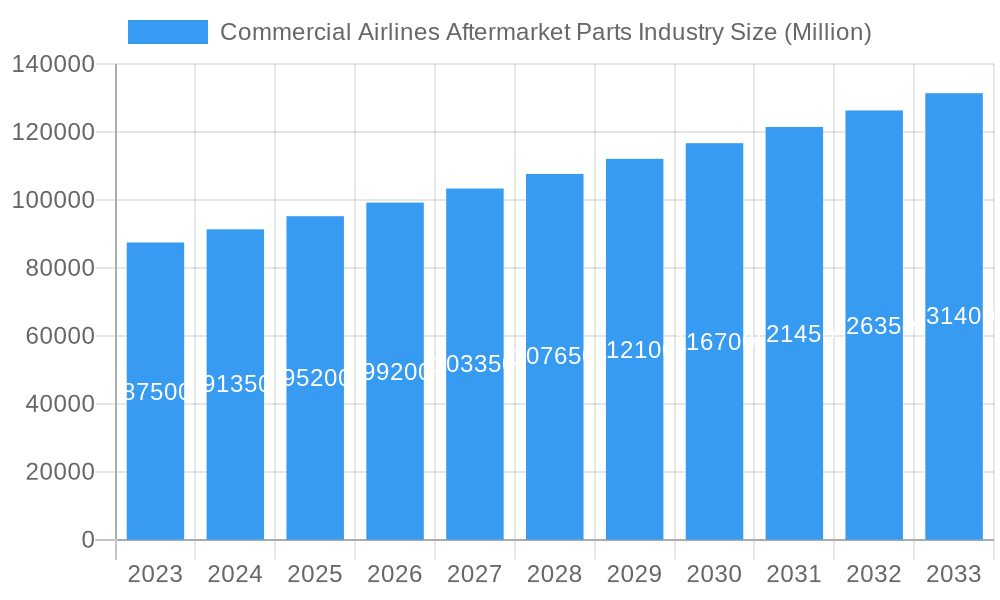

The Commercial Airlines Aftermarket Parts industry is poised for significant expansion, with a projected market size of approximately $95,200 million by 2025, growing at a robust Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This dynamic market is propelled by several key drivers, including the increasing global air passenger traffic, necessitating higher fleet utilization and a greater demand for replacement and maintenance parts. Furthermore, the aging global commercial aircraft fleet plays a crucial role, as older aircraft require more frequent and extensive maintenance, thereby boosting the aftermarket parts sector. The ongoing technological advancements in aircraft design and manufacturing are also contributing to market growth, as new, more efficient, and durable components are introduced, requiring specialized MRO (Maintenance, Repair, and Overhaul) services and parts. The industry is also benefiting from a strong focus on safety regulations and compliance, which mandates the use of certified and high-quality aftermarket parts to ensure operational integrity and passenger safety.

Commercial Airlines Aftermarket Parts Industry Market Size (In Billion)

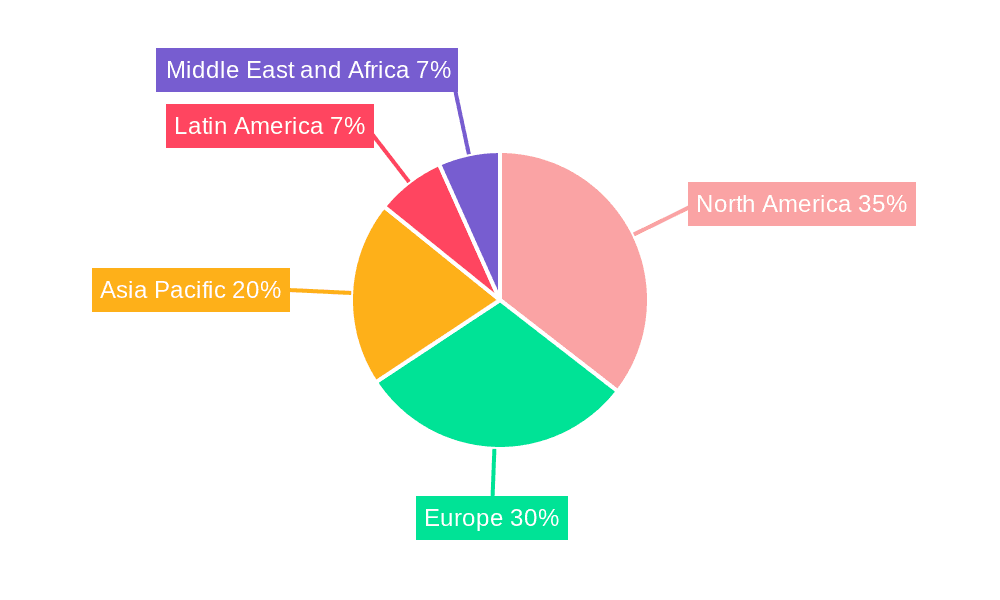

Key trends shaping the Commercial Airlines Aftermarket Parts industry include the growing emphasis on predictive maintenance technologies, which leverage data analytics to anticipate part failures and optimize maintenance schedules, leading to increased demand for advanced diagnostic tools and replacement parts. The rise of digital solutions and e-commerce platforms for parts procurement is streamlining supply chains and improving accessibility for airlines and MRO providers. Significant growth is anticipated across various segments, with MRO parts and Rotable Replacement Parts expected to witness substantial demand. Geographically, North America and Europe currently dominate the market due to their large established airline fleets and advanced MRO infrastructure. However, the Asia Pacific region is emerging as a significant growth engine, driven by the rapid expansion of its aviation sector and increasing investments in MRO capabilities. Despite the promising outlook, the market faces restraints such as the high cost of specialized parts and the complex regulatory landscape that governs aviation maintenance and parts certification. The consolidation within the aerospace manufacturing sector also presents a dynamic competitive environment.

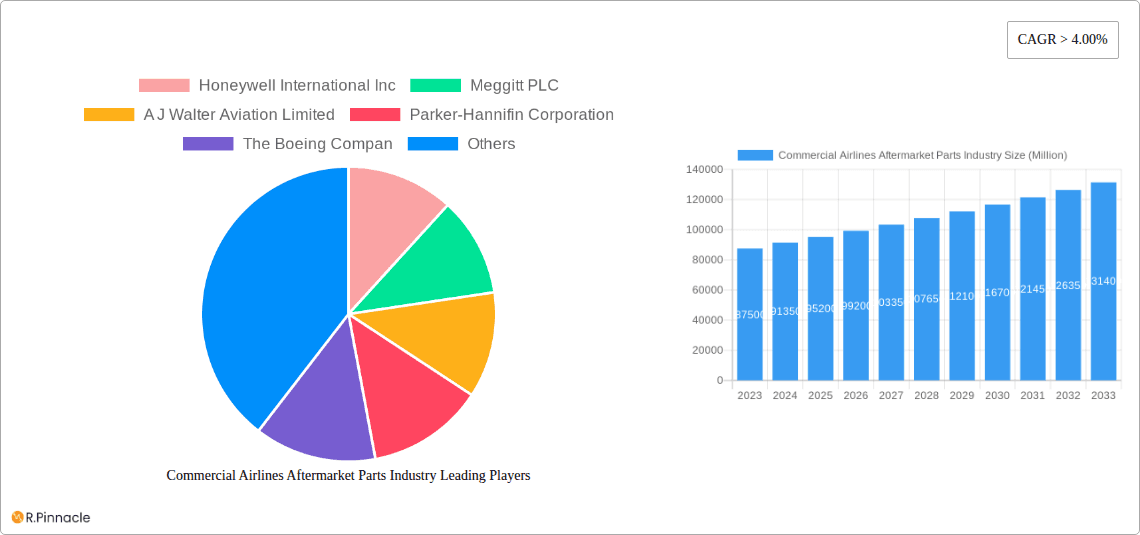

Commercial Airlines Aftermarket Parts Industry Company Market Share

Gain unparalleled insights into the commercial airlines aftermarket parts industry with this comprehensive report. Covering the historical period of 2019–2024 and a robust forecast from 2025–2033, with 2025 as the base and estimated year, this analysis delves deep into market structure, dynamics, segmentation, and future trends. Essential for aviation MRO providers, component manufacturers, airlines, and investors, this report provides actionable intelligence to navigate this multi-million dollar market.

Commercial Airlines Aftermarket Parts Industry Market Structure & Innovation Trends

The commercial airlines aftermarket parts industry is characterized by a moderate to high market concentration, with a few major players like Honeywell International Inc., Collins Aerospace (Raytheon Technologies Corporation), and General Electric Company holding significant market share. Innovation is a key driver, fueled by the need for enhanced aircraft performance, fuel efficiency, and reduced maintenance costs. Regulatory frameworks, dictated by bodies like the FAA and EASA, play a crucial role in ensuring safety and compliance, influencing product development and market entry. The threat of product substitutes is relatively low due to stringent aviation safety standards, but evolving materials and digital solutions are creating new avenues for improvement. End-user demographics are dominated by commercial airlines of all sizes, with a growing segment of leasing companies and independent MRO providers. Mergers and acquisitions (M&A) activities are prevalent, with notable deals in the multi-million dollar range, consolidating market power and expanding service portfolios. For instance, the acquisition of GKN Aerospace (Melrose Industries) by a consortium in recent years signaled strategic consolidation, with deal values estimated in the billions of US Dollars.

Commercial Airlines Aftermarket Parts Industry Market Dynamics & Trends

The commercial airlines aftermarket parts industry is poised for significant growth, driven by a multitude of factors including the expanding global airline fleet, increasing air travel demand, and the growing emphasis on aircraft maintenance, repair, and overhaul (MRO). The historical period (2019–2024) witnessed the resilience of the market despite global disruptions, with a projected Compound Annual Growth Rate (CAGR) of approximately 5-7% during the forecast period (2025–2033). Technological advancements are revolutionizing the aftermarket, with a surge in demand for rotatable replacement parts and advanced MRO parts incorporating lightweight materials and intelligent diagnostics. The trend towards fleet modernization and the retirement of older aircraft necessitate a consistent supply of high-quality spare parts. Furthermore, the increasing complexity of modern aircraft systems drives the need for specialized components and expert MRO services. Consumer preferences are shifting towards integrated service solutions and predictive maintenance, compelling providers to offer value-added services beyond simple parts supply. Competitive dynamics are intense, with established Original Equipment Manufacturers (OEMs) like The Boeing Company and Airbus, alongside independent parts suppliers and MRO organizations, vying for market share. The market penetration of advanced digital MRO solutions is expected to accelerate, enhancing efficiency and reducing turnaround times. The growing demand for sustainable aviation fuels and electric propulsion systems will also influence future parts development and MRO strategies, presenting both challenges and opportunities.

Dominant Regions & Segments in Commercial Airlines Aftermarket Parts Industry

The commercial airlines aftermarket parts industry is demonstrably dominated by North America, with the United States leading the charge due to its large airline fleet, extensive MRO infrastructure, and robust aviation ecosystem. Key drivers for this dominance include significant government investment in aviation infrastructure, favorable economic policies supporting the aerospace sector, and a high concentration of major airlines and MRO providers. The Engine segment is a substantial contributor to the market's value, driven by the high cost and frequent maintenance requirements of aircraft engines, with an estimated market share exceeding 35%. Within the Parts segmentation, Rotable Replacement Parts command a significant portion of the market due to their extensive use in aircraft maintenance and the need for immediate availability. The Airframe segment also holds substantial importance, driven by structural integrity and component replacements.

North America:

- Key Drivers: High aircraft utilization rates, advanced MRO capabilities, strong regulatory oversight ensuring component reliability.

- Dominance Analysis: The presence of major aircraft manufacturers and a mature airline industry creates a consistent demand for aftermarket parts and services. Significant investments in advanced MRO technologies and a skilled workforce further solidify its leading position.

Europe:

- Key Drivers: A substantial number of commercial aircraft operations, strict adherence to safety regulations, and a growing focus on sustainable aviation practices.

- Dominance Analysis: Europe is a major hub for aircraft manufacturing and MRO, contributing significantly to the aftermarket parts market. Collaborative initiatives and a strong network of specialized MRO companies support its robust market presence.

Asia Pacific:

- Key Drivers: Rapidly expanding airline fleets, increasing air passenger traffic, and a growing middle class fueling air travel demand.

- Dominance Analysis: This region is the fastest-growing market for aftermarket parts, driven by the emergence of new airlines and the continuous expansion of existing ones. Investments in MRO facilities are also on the rise, indicating a strong future growth trajectory.

Component Type: Engine:

- Key Drivers: High complexity and cost of engine components, necessitating specialized MRO and frequent replacement.

- Dominance Analysis: Engine maintenance and component replacements represent a significant portion of aftermarket expenditure due to the critical role of engines in flight operations.

Parts: Rotable Replacement Parts:

- Key Drivers: The need for immediate and reliable replacement of high-value components, ensuring minimal aircraft downtime.

- Dominance Analysis: The demand for certified and traceable rotable parts remains consistently high, underpinning the operational efficiency of airlines.

Commercial Airlines Aftermarket Parts Industry Product Innovations

Product innovations in the commercial airlines aftermarket parts industry are primarily focused on enhancing durability, reducing weight, and improving diagnostic capabilities. Advanced materials like composites and alloys are increasingly being utilized to create lighter and more robust components, contributing to fuel efficiency and extended service life. The integration of IoT sensors and predictive analytics into parts is enabling proactive maintenance, significantly reducing unscheduled downtime and associated costs. This technological advancement offers a competitive advantage by allowing for more efficient inventory management and optimized maintenance schedules, directly benefiting airline operators.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the commercial airlines aftermarket parts industry, segmented across key areas. The Component Type segmentation includes Airframe, Engine, Interior, and Other Component Types, each analyzed for market size, growth projections, and competitive dynamics. The Parts segmentation breaks down the market into MRO Parts and Rotable Replacement Parts, detailing their respective market shares and growth trajectories. These segments are crucial for understanding the specific demands and opportunities within the aftermarket.

- Airframe Parts: Expected to witness steady growth driven by the need for structural repairs and component replacements on aging fleets.

- Engine Parts: A high-value segment projected to experience robust growth due to the complexity and maintenance intensity of aircraft engines.

- Interior Parts: Demand is anticipated to increase with fleet modernization and passenger experience enhancements.

- MRO Parts: This broad category encompasses various components used in maintenance, repair, and overhaul activities, with consistent demand linked to aircraft utilization.

- Rotable Replacement Parts: Critical for minimizing downtime, this segment is expected to maintain strong demand due to the high cost and long lead times for new parts.

Key Drivers of Commercial Airlines Aftermarket Parts Industry Growth

The commercial airlines aftermarket parts industry is propelled by several key growth drivers. The increasing number of commercial aircraft in operation globally, coupled with the ongoing expansion of air travel demand, directly fuels the need for replacement parts and MRO services. Technological advancements, such as the development of lighter and more durable materials, contribute to improved aircraft performance and reduced maintenance costs, incentivizing upgrades and replacements. Furthermore, the rising average age of the global commercial aircraft fleet necessitates more frequent and extensive maintenance, thereby driving demand for aftermarket parts. Regulatory mandates for safety and airworthiness standards also ensure a continuous requirement for certified and high-quality components.

Challenges in the Commercial Airlines Aftermarket Parts Industry Sector

Despite robust growth prospects, the commercial airlines aftermarket parts industry faces several challenges. Supply chain disruptions, exacerbated by geopolitical events and production bottlenecks, can lead to increased lead times and higher costs for critical components. The stringent and evolving regulatory landscape, while crucial for safety, can also present hurdles for new market entrants and necessitate significant investment in compliance. Intense competitive pressures from both established OEMs and independent MRO providers can impact profit margins. Moreover, the increasing complexity of modern aircraft systems requires specialized expertise and advanced diagnostic tools, creating a knowledge gap challenge for some smaller MRO players. The need for sustainable aviation practices also introduces challenges in sourcing and manufacturing eco-friendlier parts.

Emerging Opportunities in Commercial Airlines Aftermarket Parts Industry

Emerging opportunities within the commercial airlines aftermarket parts industry are diverse and promising. The growing demand for sustainable aviation solutions presents a significant opportunity for the development and supply of parts made from recycled materials or designed for greater energy efficiency. The digital transformation of MRO, including the adoption of AI-powered predictive maintenance and blockchain for parts traceability, offers avenues for service innovation and enhanced efficiency. The expansion of air travel in emerging economies, particularly in the Asia Pacific region, creates new markets for aftermarket parts and MRO services. Furthermore, the development of advanced composite materials and additive manufacturing (3D printing) for aerospace components opens up possibilities for customized parts and on-demand production, reducing inventory costs and lead times.

Leading Players in the Commercial Airlines Aftermarket Parts Industry Market

The leading players in the commercial airlines aftermarket parts industry market include:

- Honeywell International Inc.

- Meggitt PLC

- A J Walter Aviation Limited

- Parker-Hannifin Corporation

- The Boeing Company

- GKN Aerospace (Melrose Industries)

- Moog Inc.

- Aventure International Aviation Services

- Bombardier Inc.

- Collins Aerospace (Raytheon Technologies Corporation)

- General Electric Company

Key Developments in Commercial Airlines Aftermarket Parts Industry Industry

- May 2022: Boeing and Airline MRO Parts (AMP) signed a Tailored Parts Package (TPP) agreement that makes Boeing a supplier for AMP's parts business and identifies the former as a Platinum Supplier.

- February 2022: Chilean low-cost operator SKY signed an agreement with Airbus to obtain FHS-Components Flight Hour Services for its A320 fleet. The agreement, part of the Airbus Flight Hour Services offering, will allow SKY to obtain the daily management and servicing of the airline's components from the manufacturer.

Future Outlook for Commercial Airlines Aftermarket Parts Industry Market

The future outlook for the commercial airlines aftermarket parts industry remains exceptionally positive, driven by sustained growth in global air travel and the continuous need to maintain and upgrade aging aircraft fleets. Strategic collaborations between OEMs, MRO providers, and airlines will become increasingly crucial for optimizing supply chains and delivering integrated service solutions. The adoption of advanced digital technologies, including AI, IoT, and blockchain, will further revolutionize MRO processes, enabling predictive maintenance, enhanced traceability, and operational efficiency. Investments in sustainable aviation technologies and parts will also gain momentum, aligning with global environmental initiatives. The market is expected to witness continued consolidation through strategic mergers and acquisitions, leading to a more integrated and efficient aftermarket ecosystem. The expanding middle class in developing economies will continue to fuel air travel demand, creating long-term growth opportunities for aftermarket parts and services.

Commercial Airlines Aftermarket Parts Industry Segmentation

-

1. Component Type

- 1.1. Airframe

- 1.2. Engine

- 1.3. Interior

- 1.4. Other Component Types

-

2. Parts

- 2.1. MRO Parts

- 2.2. Rotable Replacement Parts

Commercial Airlines Aftermarket Parts Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Commercial Airlines Aftermarket Parts Industry Regional Market Share

Geographic Coverage of Commercial Airlines Aftermarket Parts Industry

Commercial Airlines Aftermarket Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Narrow-body Segment Expected to Witness the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Airframe

- 5.1.2. Engine

- 5.1.3. Interior

- 5.1.4. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by Parts

- 5.2.1. MRO Parts

- 5.2.2. Rotable Replacement Parts

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Airframe

- 6.1.2. Engine

- 6.1.3. Interior

- 6.1.4. Other Component Types

- 6.2. Market Analysis, Insights and Forecast - by Parts

- 6.2.1. MRO Parts

- 6.2.2. Rotable Replacement Parts

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Airframe

- 7.1.2. Engine

- 7.1.3. Interior

- 7.1.4. Other Component Types

- 7.2. Market Analysis, Insights and Forecast - by Parts

- 7.2.1. MRO Parts

- 7.2.2. Rotable Replacement Parts

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Airframe

- 8.1.2. Engine

- 8.1.3. Interior

- 8.1.4. Other Component Types

- 8.2. Market Analysis, Insights and Forecast - by Parts

- 8.2.1. MRO Parts

- 8.2.2. Rotable Replacement Parts

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Latin America Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Airframe

- 9.1.2. Engine

- 9.1.3. Interior

- 9.1.4. Other Component Types

- 9.2. Market Analysis, Insights and Forecast - by Parts

- 9.2.1. MRO Parts

- 9.2.2. Rotable Replacement Parts

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Middle East and Africa Commercial Airlines Aftermarket Parts Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 10.1.1. Airframe

- 10.1.2. Engine

- 10.1.3. Interior

- 10.1.4. Other Component Types

- 10.2. Market Analysis, Insights and Forecast - by Parts

- 10.2.1. MRO Parts

- 10.2.2. Rotable Replacement Parts

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meggitt PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A J Walter Aviation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Parker-Hannifin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Boeing Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GKN Aerospace (Melrose Industries)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moog Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aventure International Aviation Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collins Aerospace (Raytheon Technologies Corporation)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 General Electric Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Commercial Airlines Aftermarket Parts Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 3: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 5: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 6: North America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 9: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 11: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 12: Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 17: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 18: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 21: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 23: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 24: Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 27: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Parts 2025 & 2033

- Figure 29: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Parts 2025 & 2033

- Figure 30: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 3: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 5: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 6: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 10: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 11: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 18: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 19: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 26: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 27: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 32: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Parts 2020 & 2033

- Table 33: Global Commercial Airlines Aftermarket Parts Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Egypt Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Commercial Airlines Aftermarket Parts Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Airlines Aftermarket Parts Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Commercial Airlines Aftermarket Parts Industry?

Key companies in the market include Honeywell International Inc, Meggitt PLC, A J Walter Aviation Limited, Parker-Hannifin Corporation, The Boeing Compan, GKN Aerospace (Melrose Industries), Moog Inc, Aventure International Aviation Services, Bombardier Inc, Collins Aerospace (Raytheon Technologies Corporation), General Electric Company.

3. What are the main segments of the Commercial Airlines Aftermarket Parts Industry?

The market segments include Component Type, Parts.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Narrow-body Segment Expected to Witness the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: Boeing and Airline MRO Parts (AMP) signed a Tailored Parts Package (TPP) agreement that makes Boeing a supplier for AMP's parts business and identifies the former as a Platinum Supplier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Airlines Aftermarket Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Airlines Aftermarket Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Airlines Aftermarket Parts Industry?

To stay informed about further developments, trends, and reports in the Commercial Airlines Aftermarket Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence