Key Insights

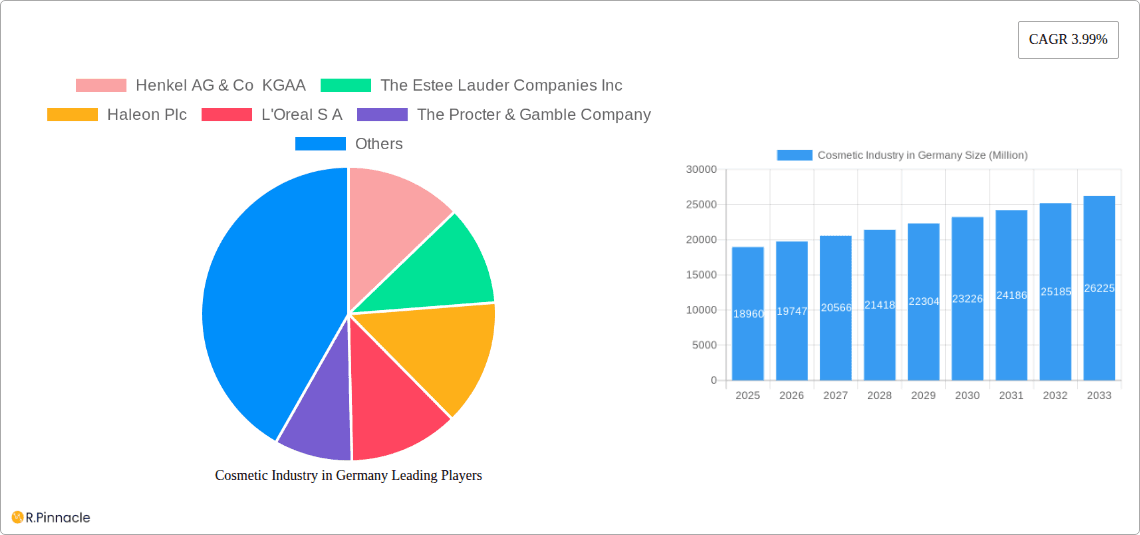

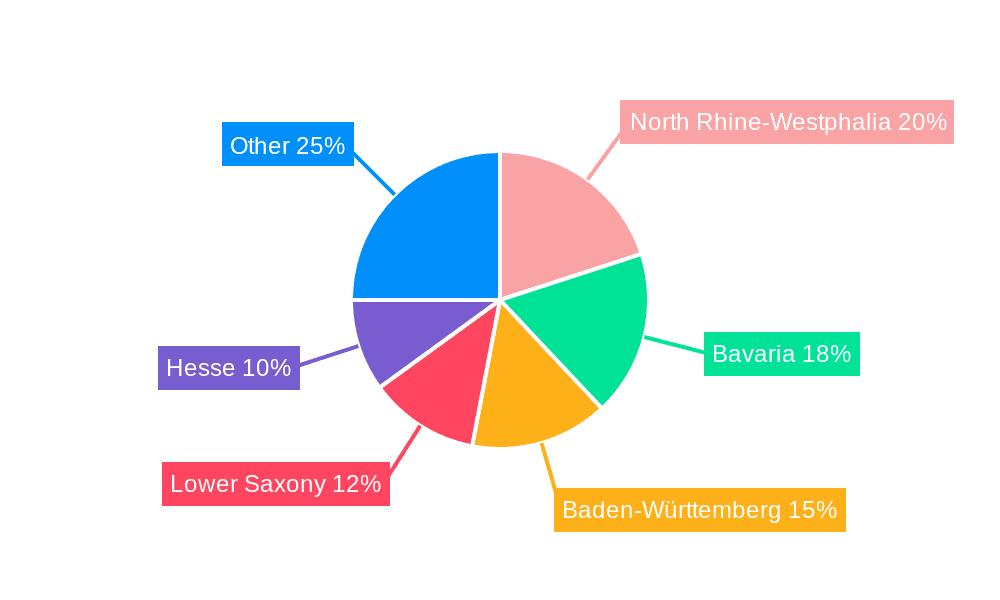

The German cosmetic market, valued at €18.96 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.99% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes among German consumers, coupled with a growing awareness of personal care and beauty trends, particularly among younger demographics, are driving increased demand for a wide range of cosmetic products. The market is segmented across product types (personal care, hair care, skincare), categories (mass, premium), and distribution channels (specialist retailers, supermarkets, pharmacies, online). The strong presence of established international players like L'Oréal, Henkel, and Procter & Gamble, alongside successful domestic brands, contributes to market dynamism. Furthermore, the increasing popularity of natural and organic cosmetics, driven by growing consumer concerns about sustainability and ingredient transparency, presents a significant opportunity for growth within specific segments. The diverse regional distribution, with strong markets in North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, reflects the country's overall economic strength and consumer spending patterns. Challenges include potential economic downturns that could impact consumer spending and increasing competition from both established players and new entrants.

Cosmetic Industry in Germany Market Size (In Billion)

Premium product segments are expected to outperform mass market segments due to higher profit margins and increasing consumer willingness to invest in high-quality, specialized products. Online retail channels are experiencing significant growth, driven by convenience and accessibility, presenting both opportunities and challenges for traditional retailers. Maintaining a competitive edge requires brands to leverage digital marketing strategies and adapt to evolving consumer preferences. Regulatory changes related to ingredient safety and environmental sustainability will continue to shape market dynamics, prompting companies to prioritize product innovation and transparency. The forecast period suggests sustained growth, although the rate might fluctuate slightly year-on-year depending on macroeconomic factors and consumer behavior. Analyzing specific regional trends within Germany, including consumer preferences and purchasing habits, offers opportunities for targeted marketing and product development strategies to capitalize on this expanding market.

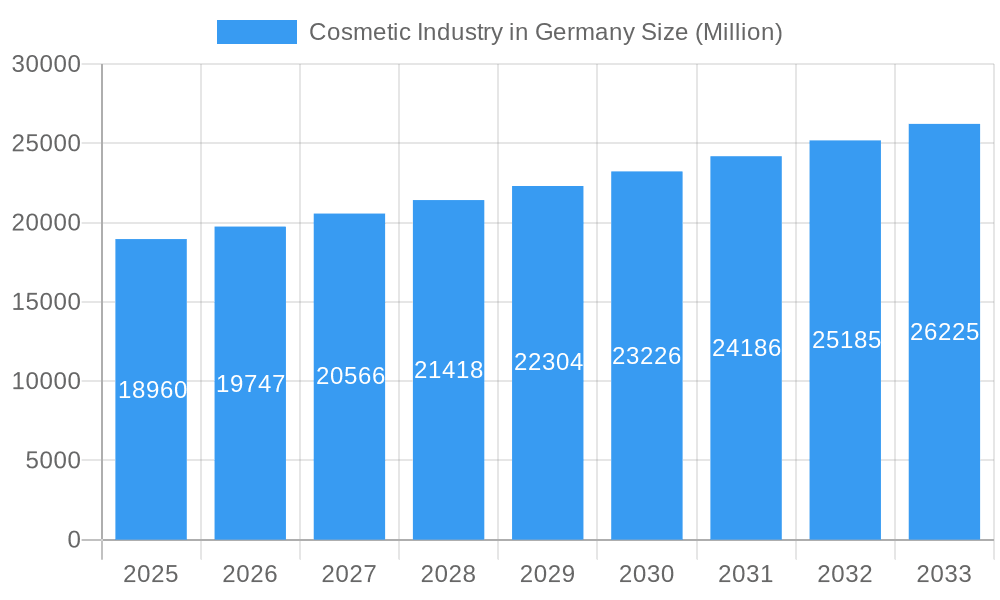

Cosmetic Industry in Germany Company Market Share

This comprehensive report provides a detailed analysis of the German cosmetic industry, covering market structure, dynamics, key players, and future growth prospects. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market.

Cosmetic Industry in Germany Market Structure & Innovation Trends

The German cosmetic market is characterized by a mix of established multinational corporations and smaller, niche players. Market concentration is moderate, with several key players holding significant shares. Henkel AG & Co KGaA, L'Oréal S.A., Beiersdorf AG, and The Procter & Gamble Company are major players, each commanding a significant share of the market (estimated at xx% collectively in 2025). However, the market also demonstrates a healthy level of competition from numerous smaller brands, particularly in niche segments like organic and natural cosmetics.

Innovation in the German cosmetic industry is driven by several factors, including:

- Technological advancements: Development of new formulations, packaging solutions, and digital marketing strategies.

- Consumer demand for natural and sustainable products: Growing interest in organic ingredients and ethical sourcing.

- Stringent regulatory frameworks: Compliance with EU regulations drives innovation in product safety and labeling.

The industry witnesses frequent M&A activity. While precise deal values are confidential, several high-value mergers and acquisitions have reshaped the competitive landscape in recent years, exceeding €xx Million in total value (2019-2024). These activities often involve established players acquiring smaller, innovative companies to expand their product portfolio and market reach. Product substitutes, such as homemade remedies and natural alternatives, represent a minor but growing competitive threat. The end-user demographics are diverse, encompassing all age groups and genders, with specific segments showing greater affinity towards certain product types or brands.

Cosmetic Industry in Germany Market Dynamics & Trends

The German cosmetic market exhibits a steady growth trajectory, driven by several key factors:

- Rising disposable incomes: Increased purchasing power fuels demand for premium and luxury cosmetics.

- Growing awareness of personal care: Increased focus on skincare and haircare boosts market growth.

- E-commerce expansion: Online channels offer greater convenience and reach to a wider consumer base.

- Influence of social media: Digital marketing and influencer collaborations impact consumer purchasing decisions.

Technological disruptions, such as the rise of personalized cosmetics and AI-driven beauty tech, are reshaping consumer preferences and influencing purchasing behaviour. This has resulted in a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to remain at xx% during the forecast period (2025-2033). Market penetration of specific product categories (e.g., organic cosmetics) continues to grow significantly, reflecting evolving consumer trends and preferences. The competitive dynamics are characterized by intense rivalry amongst established brands and the emergence of innovative players.

Dominant Regions & Segments in Cosmetic Industry in Germany

While data for precise regional dominance is unavailable, it's generally accepted that urban centers and affluent regions contribute most significantly to the overall market value. The distribution of revenue varies slightly according to product types and brands.

Key Drivers for Segment Dominance:

Product Type: Skin care products (e.g. anti-aging serums and moisturisers) continue to command substantial market share followed by hair care products and personal care. The premium segment displays significantly higher growth potential than the mass segment.

Category: The premium segment displays significantly higher growth potential than the mass segment.

Distribution Channel: While traditional channels like pharmacies and supermarkets remain strong, online retail channels are experiencing rapid growth and increasing market share. This is driven by convenience and the ability to target specific consumer segments effectively. Specialist retail stores maintain a niche position, catering to discerning customers seeking specialized advice and high-end products.

Cosmetic Industry in Germany Product Innovations

Recent product innovations focus on natural ingredients, sustainable packaging, personalized formulations, and technologically advanced delivery systems. The market is witnessing an increased demand for vegan and cruelty-free products, as evidenced by Unilever's Axe brand gaining PETA approval. These innovations offer significant competitive advantages by appealing to specific consumer preferences and demonstrating a commitment to ethical and sustainable practices. Technological trends such as AI-powered skin analysis tools are influencing product development and consumer engagement strategies, enhancing the customer experience.

Report Scope & Segmentation Analysis

This report segments the German cosmetic market based on:

Product Type: Personal Care Products, Hair Care Products, Skin Care Products. Each segment has witnessed significant growth throughout the historical period with varying CAGRs, demonstrating distinct consumer preferences. The market size for each segment differs substantially and is predicted to expand further during the forecast period.

Category: Mass Products and Premium Products. The premium category exhibits higher growth potential, driven by increasing disposable incomes and willingness to pay more for premium quality and prestige brands.

Distribution Channel: Specialist Retail Stores, Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Channels, Other Distribution Channels. Each distribution channel displays unique growth trajectories, with online channels experiencing rapid expansion, while traditional channels remain vital for market reach.

Key Drivers of Cosmetic Industry in Germany Growth

Several key factors drive growth in the German cosmetic market:

- Increased consumer spending on personal care: Rising disposable incomes and greater awareness of personal grooming lead to increased spending on cosmetic products.

- Growing demand for natural and organic cosmetics: Consumers are increasingly conscious of the ingredients used in their cosmetics, driving demand for natural and sustainable products.

- Technological advancements: Innovations in formulation, packaging, and delivery systems create new opportunities for growth.

Challenges in the Cosmetic Industry in Germany Sector

The German cosmetic industry faces several challenges, including:

- Intense competition: The market is characterized by intense competition from both established brands and new entrants.

- Regulatory compliance: Meeting stringent EU regulations on product safety and labeling can be costly and time-consuming.

- Supply chain disruptions: Global supply chain issues can impact the availability of raw materials and packaging, potentially affecting production and profitability.

Emerging Opportunities in Cosmetic Industry in Germany

Several opportunities exist for growth in the German cosmetic market:

- Growth of the online retail channel: Expanding online presence can provide access to a wider consumer base and enhance brand visibility.

- Increasing demand for personalized cosmetics: Developing personalized products caters to individual needs and preferences.

- Focus on sustainability and ethical sourcing: Meeting growing consumer demand for eco-friendly and ethical products.

Leading Players in the Cosmetic Industry in Germany Market

Key Developments in Cosmetic Industry in Germany Industry

- December 2023: L’Oréal SA brand Aesop opened a new retail store in Munich, expanding its retail presence and market reach in Germany.

- December 2023: Unilever acquired the premium biotech haircare brand K18, strengthening its portfolio in high-growth segments.

- January 2024: Unilever brand Axe gained PETA approval and joined the Beauty Without Bunnies list, enhancing its brand image and appeal to ethically conscious consumers.

Future Outlook for Cosmetic Industry in Germany Market

The German cosmetic market is poised for continued growth, driven by factors like rising disposable incomes, increasing consumer awareness, and technological advancements. Strategic opportunities lie in leveraging e-commerce channels, personalizing product offerings, and embracing sustainable practices. The market's dynamic nature necessitates continuous innovation and adaptation to changing consumer preferences to maintain competitiveness. The forecast suggests sustained growth throughout the projection period (2025-2033), with a projected market value exceeding €xx Million.

Cosmetic Industry in Germany Segmentation

-

1. Product Type

-

1.1. Personal Care Products

-

1.1.1. Hair Care Products

- 1.1.1.1. Shampoo

- 1.1.1.2. Conditioners

- 1.1.1.3. Other Hair Care Products

-

1.1.2. Skin Care Products

- 1.1.2.1. Facial Care Products

- 1.1.2.2. Body Care Products

- 1.1.2.3. Lip Care Products

- 1.1.2.4. Bath and Shower Productrs

-

1.1.3. Oral Care

- 1.1.3.1. Toothbrushes

- 1.1.3.2. Toothpaste

- 1.1.3.3. Mouthwashes and Rinses

- 1.1.3.4. Other Oral Care Products

- 1.1.4. Deodrants and Antiperspirants

-

1.1.1. Hair Care Products

-

1.2. Cosmetics/Make-up Products

- 1.2.1. Facial Cosmetics

- 1.2.2. Eye Cosmetic Products

- 1.2.3. Lip and Nail Make-up Products

- 1.2.4. Hair styling and colouring products

-

1.1. Personal Care Products

-

2. Category

- 2.1. Mass Products

- 2.2. Premium Products

-

3. Distribution Channel

- 3.1. Specialist Retail Stores

- 3.2. Supermarkets/Hypermarkets

- 3.3. Pharmacies/Drug Stores

- 3.4. Online Retail Channels

- 3.5. Other Distribution Channel

Cosmetic Industry in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cosmetic Industry in Germany Regional Market Share

Geographic Coverage of Cosmetic Industry in Germany

Cosmetic Industry in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Effective Skincare

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Personal Care Products

- 5.1.1.1. Hair Care Products

- 5.1.1.1.1. Shampoo

- 5.1.1.1.2. Conditioners

- 5.1.1.1.3. Other Hair Care Products

- 5.1.1.2. Skin Care Products

- 5.1.1.2.1. Facial Care Products

- 5.1.1.2.2. Body Care Products

- 5.1.1.2.3. Lip Care Products

- 5.1.1.2.4. Bath and Shower Productrs

- 5.1.1.3. Oral Care

- 5.1.1.3.1. Toothbrushes

- 5.1.1.3.2. Toothpaste

- 5.1.1.3.3. Mouthwashes and Rinses

- 5.1.1.3.4. Other Oral Care Products

- 5.1.1.4. Deodrants and Antiperspirants

- 5.1.1.1. Hair Care Products

- 5.1.2. Cosmetics/Make-up Products

- 5.1.2.1. Facial Cosmetics

- 5.1.2.2. Eye Cosmetic Products

- 5.1.2.3. Lip and Nail Make-up Products

- 5.1.2.4. Hair styling and colouring products

- 5.1.1. Personal Care Products

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass Products

- 5.2.2. Premium Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialist Retail Stores

- 5.3.2. Supermarkets/Hypermarkets

- 5.3.3. Pharmacies/Drug Stores

- 5.3.4. Online Retail Channels

- 5.3.5. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Personal Care Products

- 6.1.1.1. Hair Care Products

- 6.1.1.1.1. Shampoo

- 6.1.1.1.2. Conditioners

- 6.1.1.1.3. Other Hair Care Products

- 6.1.1.2. Skin Care Products

- 6.1.1.2.1. Facial Care Products

- 6.1.1.2.2. Body Care Products

- 6.1.1.2.3. Lip Care Products

- 6.1.1.2.4. Bath and Shower Productrs

- 6.1.1.3. Oral Care

- 6.1.1.3.1. Toothbrushes

- 6.1.1.3.2. Toothpaste

- 6.1.1.3.3. Mouthwashes and Rinses

- 6.1.1.3.4. Other Oral Care Products

- 6.1.1.4. Deodrants and Antiperspirants

- 6.1.1.1. Hair Care Products

- 6.1.2. Cosmetics/Make-up Products

- 6.1.2.1. Facial Cosmetics

- 6.1.2.2. Eye Cosmetic Products

- 6.1.2.3. Lip and Nail Make-up Products

- 6.1.2.4. Hair styling and colouring products

- 6.1.1. Personal Care Products

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Mass Products

- 6.2.2. Premium Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Specialist Retail Stores

- 6.3.2. Supermarkets/Hypermarkets

- 6.3.3. Pharmacies/Drug Stores

- 6.3.4. Online Retail Channels

- 6.3.5. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Personal Care Products

- 7.1.1.1. Hair Care Products

- 7.1.1.1.1. Shampoo

- 7.1.1.1.2. Conditioners

- 7.1.1.1.3. Other Hair Care Products

- 7.1.1.2. Skin Care Products

- 7.1.1.2.1. Facial Care Products

- 7.1.1.2.2. Body Care Products

- 7.1.1.2.3. Lip Care Products

- 7.1.1.2.4. Bath and Shower Productrs

- 7.1.1.3. Oral Care

- 7.1.1.3.1. Toothbrushes

- 7.1.1.3.2. Toothpaste

- 7.1.1.3.3. Mouthwashes and Rinses

- 7.1.1.3.4. Other Oral Care Products

- 7.1.1.4. Deodrants and Antiperspirants

- 7.1.1.1. Hair Care Products

- 7.1.2. Cosmetics/Make-up Products

- 7.1.2.1. Facial Cosmetics

- 7.1.2.2. Eye Cosmetic Products

- 7.1.2.3. Lip and Nail Make-up Products

- 7.1.2.4. Hair styling and colouring products

- 7.1.1. Personal Care Products

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Mass Products

- 7.2.2. Premium Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Specialist Retail Stores

- 7.3.2. Supermarkets/Hypermarkets

- 7.3.3. Pharmacies/Drug Stores

- 7.3.4. Online Retail Channels

- 7.3.5. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Personal Care Products

- 8.1.1.1. Hair Care Products

- 8.1.1.1.1. Shampoo

- 8.1.1.1.2. Conditioners

- 8.1.1.1.3. Other Hair Care Products

- 8.1.1.2. Skin Care Products

- 8.1.1.2.1. Facial Care Products

- 8.1.1.2.2. Body Care Products

- 8.1.1.2.3. Lip Care Products

- 8.1.1.2.4. Bath and Shower Productrs

- 8.1.1.3. Oral Care

- 8.1.1.3.1. Toothbrushes

- 8.1.1.3.2. Toothpaste

- 8.1.1.3.3. Mouthwashes and Rinses

- 8.1.1.3.4. Other Oral Care Products

- 8.1.1.4. Deodrants and Antiperspirants

- 8.1.1.1. Hair Care Products

- 8.1.2. Cosmetics/Make-up Products

- 8.1.2.1. Facial Cosmetics

- 8.1.2.2. Eye Cosmetic Products

- 8.1.2.3. Lip and Nail Make-up Products

- 8.1.2.4. Hair styling and colouring products

- 8.1.1. Personal Care Products

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Mass Products

- 8.2.2. Premium Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Specialist Retail Stores

- 8.3.2. Supermarkets/Hypermarkets

- 8.3.3. Pharmacies/Drug Stores

- 8.3.4. Online Retail Channels

- 8.3.5. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Personal Care Products

- 9.1.1.1. Hair Care Products

- 9.1.1.1.1. Shampoo

- 9.1.1.1.2. Conditioners

- 9.1.1.1.3. Other Hair Care Products

- 9.1.1.2. Skin Care Products

- 9.1.1.2.1. Facial Care Products

- 9.1.1.2.2. Body Care Products

- 9.1.1.2.3. Lip Care Products

- 9.1.1.2.4. Bath and Shower Productrs

- 9.1.1.3. Oral Care

- 9.1.1.3.1. Toothbrushes

- 9.1.1.3.2. Toothpaste

- 9.1.1.3.3. Mouthwashes and Rinses

- 9.1.1.3.4. Other Oral Care Products

- 9.1.1.4. Deodrants and Antiperspirants

- 9.1.1.1. Hair Care Products

- 9.1.2. Cosmetics/Make-up Products

- 9.1.2.1. Facial Cosmetics

- 9.1.2.2. Eye Cosmetic Products

- 9.1.2.3. Lip and Nail Make-up Products

- 9.1.2.4. Hair styling and colouring products

- 9.1.1. Personal Care Products

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Mass Products

- 9.2.2. Premium Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Specialist Retail Stores

- 9.3.2. Supermarkets/Hypermarkets

- 9.3.3. Pharmacies/Drug Stores

- 9.3.4. Online Retail Channels

- 9.3.5. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cosmetic Industry in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Personal Care Products

- 10.1.1.1. Hair Care Products

- 10.1.1.1.1. Shampoo

- 10.1.1.1.2. Conditioners

- 10.1.1.1.3. Other Hair Care Products

- 10.1.1.2. Skin Care Products

- 10.1.1.2.1. Facial Care Products

- 10.1.1.2.2. Body Care Products

- 10.1.1.2.3. Lip Care Products

- 10.1.1.2.4. Bath and Shower Productrs

- 10.1.1.3. Oral Care

- 10.1.1.3.1. Toothbrushes

- 10.1.1.3.2. Toothpaste

- 10.1.1.3.3. Mouthwashes and Rinses

- 10.1.1.3.4. Other Oral Care Products

- 10.1.1.4. Deodrants and Antiperspirants

- 10.1.1.1. Hair Care Products

- 10.1.2. Cosmetics/Make-up Products

- 10.1.2.1. Facial Cosmetics

- 10.1.2.2. Eye Cosmetic Products

- 10.1.2.3. Lip and Nail Make-up Products

- 10.1.2.4. Hair styling and colouring products

- 10.1.1. Personal Care Products

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Mass Products

- 10.2.2. Premium Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Specialist Retail Stores

- 10.3.2. Supermarkets/Hypermarkets

- 10.3.3. Pharmacies/Drug Stores

- 10.3.4. Online Retail Channels

- 10.3.5. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGAA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estee Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Haleon Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Oreal S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Procter & Gamble Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Natura & Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colgate - Palmolive Company*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beiersdorf AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGAA

List of Figures

- Figure 1: Global Cosmetic Industry in Germany Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 5: North America Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 11: South America Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 13: South America Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 14: South America Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 21: Europe Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 22: Europe Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 29: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 30: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Category 2025 & 2033

- Figure 37: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Category 2025 & 2033

- Figure 38: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Cosmetic Industry in Germany Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cosmetic Industry in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cosmetic Industry in Germany Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 14: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 21: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 34: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cosmetic Industry in Germany Revenue Million Forecast, by Product Type 2020 & 2033

- Table 43: Global Cosmetic Industry in Germany Revenue Million Forecast, by Category 2020 & 2033

- Table 44: Global Cosmetic Industry in Germany Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Cosmetic Industry in Germany Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cosmetic Industry in Germany Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Industry in Germany?

The projected CAGR is approximately 3.99%.

2. Which companies are prominent players in the Cosmetic Industry in Germany?

Key companies in the market include Henkel AG & Co KGAA, The Estee Lauder Companies Inc, Haleon Plc, L'Oreal S A, The Procter & Gamble Company, Natura & Co, Johnson & Johnson Services Inc, Colgate - Palmolive Company*List Not Exhaustive, Beiersdorf AG.

3. What are the main segments of the Cosmetic Industry in Germany?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness About Effective Skincare; Aggressive Marketing and Advertising Strategies By Brands.

6. What are the notable trends driving market growth?

Increasing Awareness About Effective Skincare.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2024: Unilever brand Axe gained PETA approval and joined the Beauty Without Bunnies list.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Industry in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Industry in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Industry in Germany?

To stay informed about further developments, trends, and reports in the Cosmetic Industry in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence