Key Insights

The UK cybersecurity insurance market is experiencing robust growth, driven by increasing cyber threats and stringent data protection regulations like GDPR. The market, currently estimated at £X million in 2025 (assuming a logical extrapolation based on the provided global CAGR of 8% and considering the UK's significant digital economy), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, the rising sophistication and frequency of cyberattacks targeting businesses of all sizes are compelling organizations to secure robust insurance coverage. Secondly, regulatory compliance mandates, such as those imposed by the Information Commissioner's Office (ICO), necessitate comprehensive cybersecurity measures, which often include insurance as a key component. Finally, the increasing adoption of cloud computing and interconnected systems expands the attack surface, further driving demand for cyber insurance. The market is segmented by product type (packaged and standalone policies) and application type (banking & financial services, IT & telecom, healthcare, retail, and others). Major players like CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich, NIG, and Allianz are actively competing in this dynamic landscape, offering a range of specialized cyber insurance products to cater to diverse industry needs. The competitive landscape is characterized by both established insurers and specialized cyber underwriters, leading to innovation in product offerings and competitive pricing. While the market faces potential restraints such as difficulties in accurately assessing risk and the potential for increased premiums due to escalating claims, the overall outlook remains positive, anticipating continued strong growth throughout the forecast period. The UK market is expected to mirror global trends, showcasing a significant contribution to the European cyber insurance market.

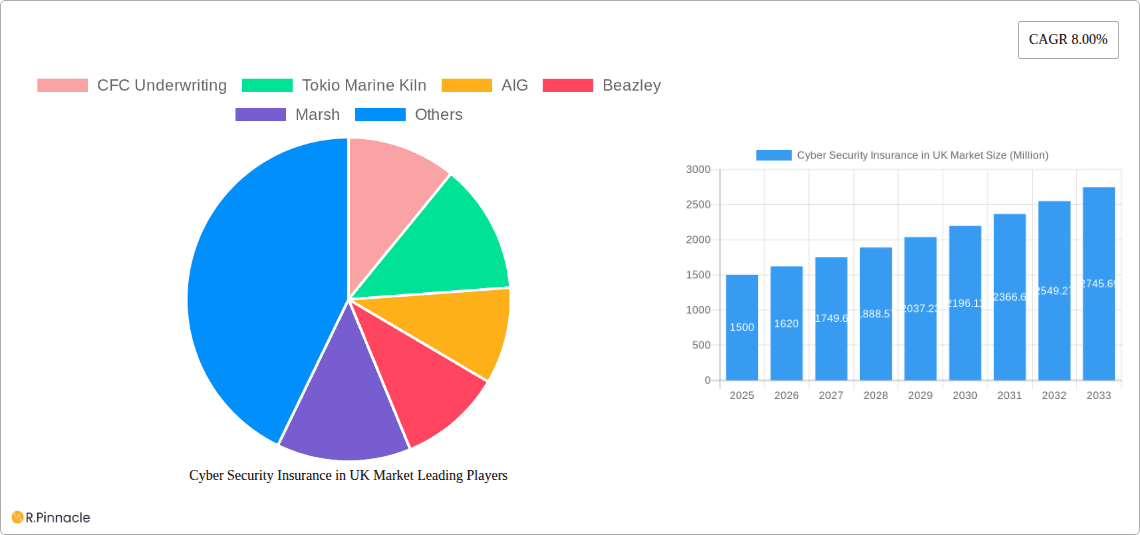

Cyber Security Insurance in UK Market Market Size (In Billion)

The segments within the UK cybersecurity insurance market offer diverse growth opportunities. The banking and financial services sector is anticipated to remain a dominant segment, given the sensitivity of financial data and the high potential impact of breaches. The IT and telecom sector, with its inherent reliance on digital infrastructure, is also expected to showcase strong demand. The healthcare sector, facing increasingly stringent data privacy regulations, is a rapidly growing segment. Retail, with its increasing reliance on e-commerce and sensitive customer data, shows a similar upward trend. The "other applications" segment represents the expanding coverage of cyber insurance across a wide range of industries, reflecting a growing awareness of the importance of proactive risk management. Future growth will depend on several factors including technological advancements in cyber threat detection and response, evolving regulatory landscapes, and the effectiveness of awareness campaigns promoting the adoption of cyber insurance.

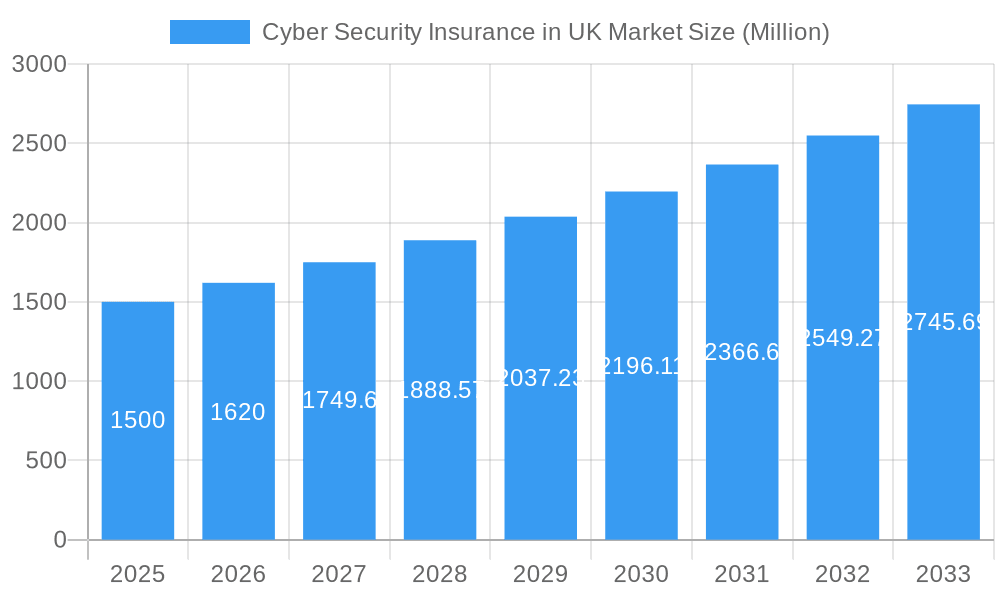

Cyber Security Insurance in UK Market Company Market Share

Cyber Security Insurance in UK Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK cyber security insurance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report leverages extensive data analysis to project market growth and identify key trends impacting this rapidly evolving sector. Market sizing is presented in millions (£/USD).

Cyber Security Insurance in UK Market Market Structure & Innovation Trends

The UK cyber security insurance market exhibits a moderately concentrated structure, with key players like CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich, NIG, and Allianz holding significant market share. However, the market is also characterized by increasing competition from smaller, specialized providers and InsurTech firms. Innovation is driven by rising cyber threats, evolving regulatory landscapes (e.g., NIS2 Directive), and increasing demand for specialized products tailored to specific industries. Mergers and acquisitions (M&A) activity within the sector is expected to continue, with deal values potentially reaching xx Million in the next five years, driven by consolidation and expansion strategies. The market is characterized by a range of product types (packaged and standalone policies), applied across diverse sectors including banking, IT, healthcare, and retail. End-user demographics reveal a growing demand for cyber insurance among SMEs and mid-market businesses, alongside continued uptake from larger enterprises.

- Market Concentration: Moderately concentrated with significant players holding substantial market share.

- Innovation Drivers: Increasing cyber threats, evolving regulations (NIS2), demand for specialized products.

- M&A Activity: Expected to continue, with deal values potentially reaching xx Million by 2030.

- Regulatory Frameworks: Driving standardization and compliance requirements, impacting product offerings.

- Product Substitutes: Limited, as specialized coverage is essential for addressing specific cyber risks.

- End-User Demographics: Growing demand among SMEs and mid-market companies.

Cyber Security Insurance in UK Market Market Dynamics & Trends

The UK cyber security insurance market is experiencing robust growth, fueled by the increasing frequency and severity of cyberattacks, stringent data privacy regulations, and growing awareness among businesses of their cyber risk exposure. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), driven by technological advancements in cyber security, including AI and machine learning applications within insurance underwriting and claims processes. Consumer preferences are shifting towards comprehensive, customized cyber insurance solutions that can address evolving threats. Competitive dynamics are intensifying with both established players and new entrants vying for market share. Market penetration is projected to increase to xx% by 2033, driven by rising awareness and increasing mandatory cyber insurance requirements for specific sectors. Technological disruptions are transforming product offerings through improved risk assessment models, automation, and real-time threat intelligence integration.

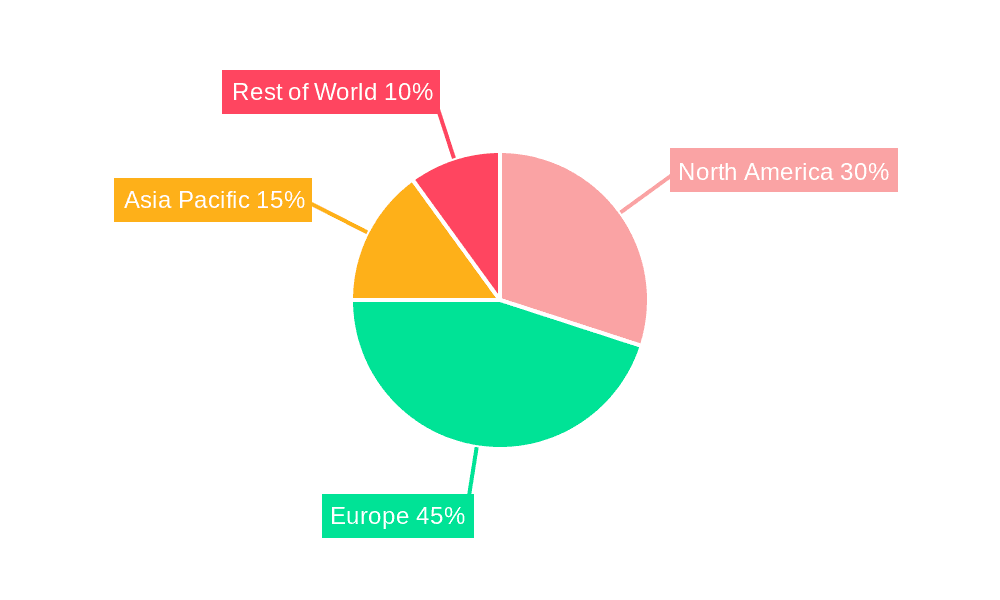

Dominant Regions & Segments in Cyber Security Insurance in UK Market

While the UK market is relatively homogenous in terms of geographic distribution, London and other major cities with high concentrations of financial and technological institutions exhibit the highest demand and market value. The Banking & Financial Services sector represents a dominant segment, followed closely by IT & Telecom. This is due to the high concentration of sensitive data and the significant financial consequences of cyber breaches.

- Leading Segment (By Product Type): Packaged policies are expected to dominate due to their comprehensive nature.

- Leading Segment (By Application Type): Banking & Financial Services, due to high data sensitivity and regulatory compliance requirements.

Key Drivers for Dominant Segments:

- Banking & Financial Services: Stringent regulatory compliance, high value of data, frequent cyberattacks.

- IT & Telecom: High concentration of data, reliance on interconnected systems, critical infrastructure status.

Cyber Security Insurance in UK Market Product Innovations

Recent product innovations focus on offering tailored coverage for specific cyber threats, including ransomware, phishing attacks, and social engineering. Companies are also leveraging technology to improve risk assessment, claims processing, and incident response services. The use of AI and machine learning in underwriting and pricing is enhancing accuracy and efficiency. The market demonstrates a strong preference for comprehensive policies that integrate prevention, detection, and response services. This approach aligns with the growing sophistication of cyberattacks and the need for holistic risk management solutions.

Report Scope & Segmentation Analysis

This report segments the UK cyber security insurance market by product type (packaged and standalone) and application type (Banking & Financial Services, IT & Telecom, Healthcare, Retail, Other). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For example, the packaged policy segment is projected to grow at a CAGR of xx%, exceeding the standalone segment. Similarly, the Banking and Financial Services segment is expected to maintain a dominant position due to regulatory pressures and financial risk exposure. The other segments exhibit varying growth rates, reflecting industry-specific risks and adoption rates of cyber security insurance.

Key Drivers of Cyber Security Insurance in UK Market Growth

Several factors fuel the market's growth. The increasing prevalence and sophistication of cyberattacks are a primary driver, pushing businesses to seek protection. Stricter data privacy regulations (GDPR, NIS2), coupled with potential penalties for data breaches, mandate cyber insurance coverage for many organizations. Technological advancements, such as AI-powered risk assessment tools, enable more accurate pricing and risk mitigation strategies, fostering greater market uptake. Finally, heightened awareness and education around cyber risks are driving proactive insurance adoption among businesses of all sizes.

Challenges in the Cyber Security Insurance in UK Market Sector

The UK cyber security insurance market faces several challenges. Accurately assessing and pricing cyber risk remains a significant hurdle, contributing to unpredictable premiums. The complexities of policy wording and coverage nuances can create ambiguity for businesses, limiting accessibility and understanding. Supply chain disruptions and capacity constraints within the insurance industry can restrict coverage availability, particularly during periods of heightened cyber activity. Furthermore, intense competition from both established and new market entrants is influencing pricing strategies and profitability margins. The potential for increased regulatory scrutiny and potential changes in legal frameworks also pose a challenge to market stability.

Emerging Opportunities in Cyber Security Insurance in UK Market

Several emerging trends present lucrative opportunities. The expanding adoption of cloud computing, IoT, and AI technologies creates new avenues for innovative cyber insurance products tailored to these digital environments. A growing demand for proactive cyber security solutions, including incident response and remediation services, offers opportunities to integrate these services within comprehensive insurance offerings. The market's evolution toward parametric cyber insurance, offering automated payouts based on predefined triggers, promises increased efficiency and transparency. Finally, opportunities lie in expanding market penetration into underinsured sectors and collaborating with technology providers to develop advanced risk assessment methodologies.

Leading Players in the Cyber Security Insurance in UK Market Market

- CFC Underwriting

- Tokio Marine Kiln

- AIG

- Beazley

- Marsh

- Hiscox

- AXA XL

- Zurich

- NIG

- Allianz

Key Developments in Cyber Security Insurance in UK Market Industry

- September 2023: Cowbell expands into the UK market with Cowbell Prime One, a customizable cyber policy for SMEs and mid-market businesses, addressing email scams, ransomware, and social engineering risks. This expansion significantly increases competition and expands coverage options for a previously underserved market segment.

- March 2023: Coalition enters the UK excess cyber insurance market, offering full-follow form coverage up to GBP 10 million (USD 12,126,000) above primary layers for cyber and technology professional indemnity (PI). This development addresses the growing demand for high-value excess capacity in the UK market, providing enhanced protection for businesses with large cyber risk exposures.

Future Outlook for Cyber Security Insurance in UK Market Market

The UK cyber security insurance market is poised for continued growth, driven by persistent cyber threats, increasing regulatory pressure, and greater business awareness of their vulnerability. Strategic opportunities exist for insurers to develop innovative products tailored to specific industry needs and leverage technological advancements to improve risk assessment and claims management. The market will likely see increased consolidation through mergers and acquisitions, while InsurTech firms continue to disrupt traditional models, further boosting innovation and competition. The evolving threat landscape will require insurers to remain agile and adapt to new risks, further fueling market growth and complexity.

Cyber Security Insurance in UK Market Segmentation

-

1. Product Type

- 1.1. Packaged

- 1.2. Standalone

-

2. Application Type

- 2.1. Banking & Financial Services

- 2.2. IT & Telecom

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Other Application Types

Cyber Security Insurance in UK Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Insurance in UK Market Regional Market Share

Geographic Coverage of Cyber Security Insurance in UK Market

Cyber Security Insurance in UK Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Data Privacy Regulations; Business Interruption

- 3.3. Market Restrains

- 3.3.1. Complexity and Lack of Understanding; Cost of Coverage

- 3.4. Market Trends

- 3.4.1. Impact of Cyber Insurance Policy Coverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Packaged

- 5.1.2. Standalone

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Banking & Financial Services

- 5.2.2. IT & Telecom

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Packaged

- 6.1.2. Standalone

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Banking & Financial Services

- 6.2.2. IT & Telecom

- 6.2.3. Healthcare

- 6.2.4. Retail

- 6.2.5. Other Application Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Packaged

- 7.1.2. Standalone

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Banking & Financial Services

- 7.2.2. IT & Telecom

- 7.2.3. Healthcare

- 7.2.4. Retail

- 7.2.5. Other Application Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Packaged

- 8.1.2. Standalone

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Banking & Financial Services

- 8.2.2. IT & Telecom

- 8.2.3. Healthcare

- 8.2.4. Retail

- 8.2.5. Other Application Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Packaged

- 9.1.2. Standalone

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Banking & Financial Services

- 9.2.2. IT & Telecom

- 9.2.3. Healthcare

- 9.2.4. Retail

- 9.2.5. Other Application Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Cyber Security Insurance in UK Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Packaged

- 10.1.2. Standalone

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Banking & Financial Services

- 10.2.2. IT & Telecom

- 10.2.3. Healthcare

- 10.2.4. Retail

- 10.2.5. Other Application Types

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CFC Underwriting

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tokio Marine Kiln

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AIG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beazley

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Marsh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hiscox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA XL

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zurich**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NIG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CFC Underwriting

List of Figures

- Figure 1: Global Cyber Security Insurance in UK Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: South America Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 11: South America Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: South America Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Europe Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific Cyber Security Insurance in UK Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cyber Security Insurance in UK Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 29: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 39: Global Cyber Security Insurance in UK Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cyber Security Insurance in UK Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Insurance in UK Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Cyber Security Insurance in UK Market?

Key companies in the market include CFC Underwriting, Tokio Marine Kiln, AIG, Beazley, Marsh, Hiscox, AXA XL, Zurich**List Not Exhaustive, NIG, Allianz.

3. What are the main segments of the Cyber Security Insurance in UK Market?

The market segments include Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Data Privacy Regulations; Business Interruption.

6. What are the notable trends driving market growth?

Impact of Cyber Insurance Policy Coverage.

7. Are there any restraints impacting market growth?

Complexity and Lack of Understanding; Cost of Coverage.

8. Can you provide examples of recent developments in the market?

September 2023: Cowbell is committed to addressing cyber risk challenges on a global scale, and our expansion into the UK is a testament to this. Cowbell Prime One is tailored towards SME and mid-market customers and allows brokers to customize cyber policies for different risk exposures, such as email scams, ransomware, and social engineering.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Insurance in UK Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Insurance in UK Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Insurance in UK Market?

To stay informed about further developments, trends, and reports in the Cyber Security Insurance in UK Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence