Key Insights

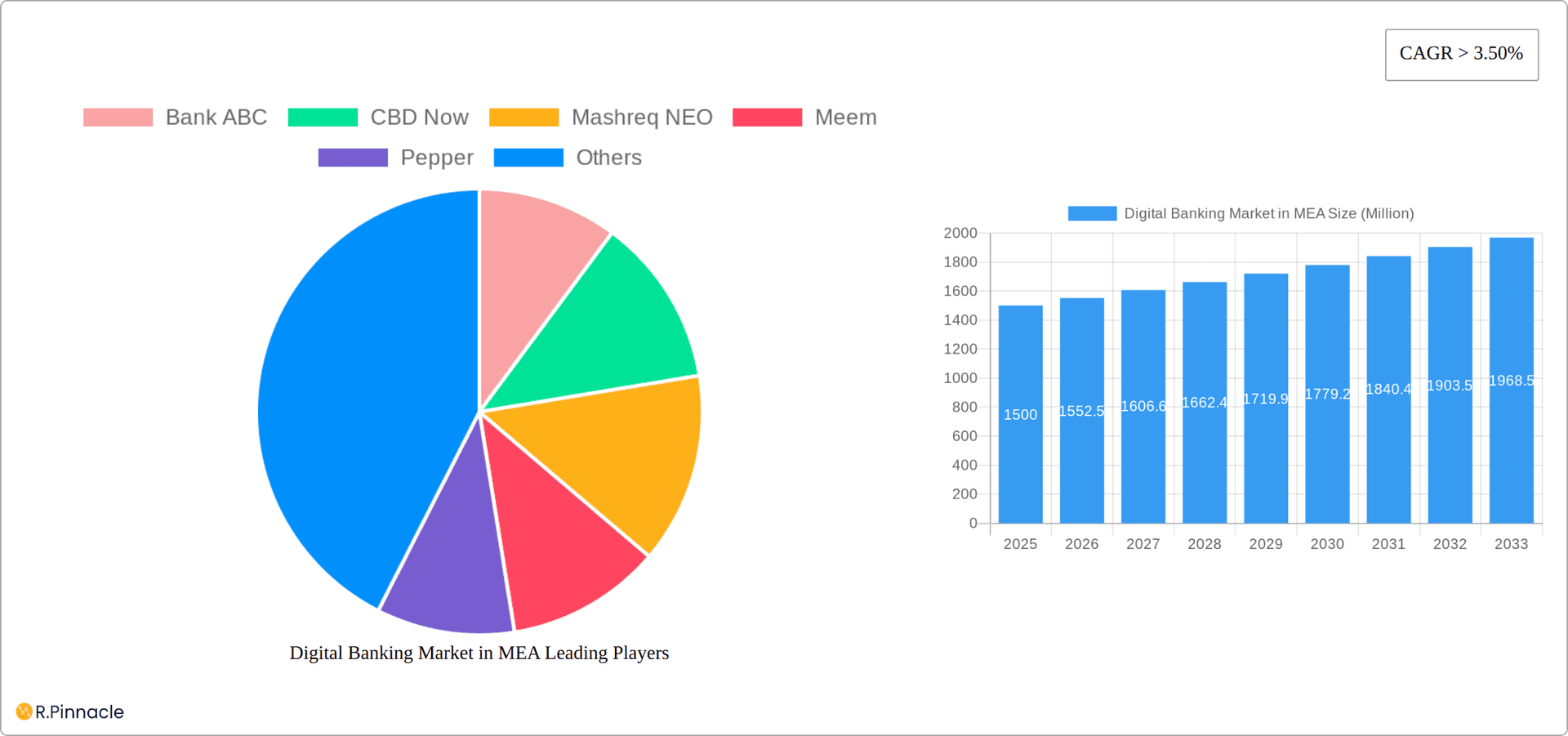

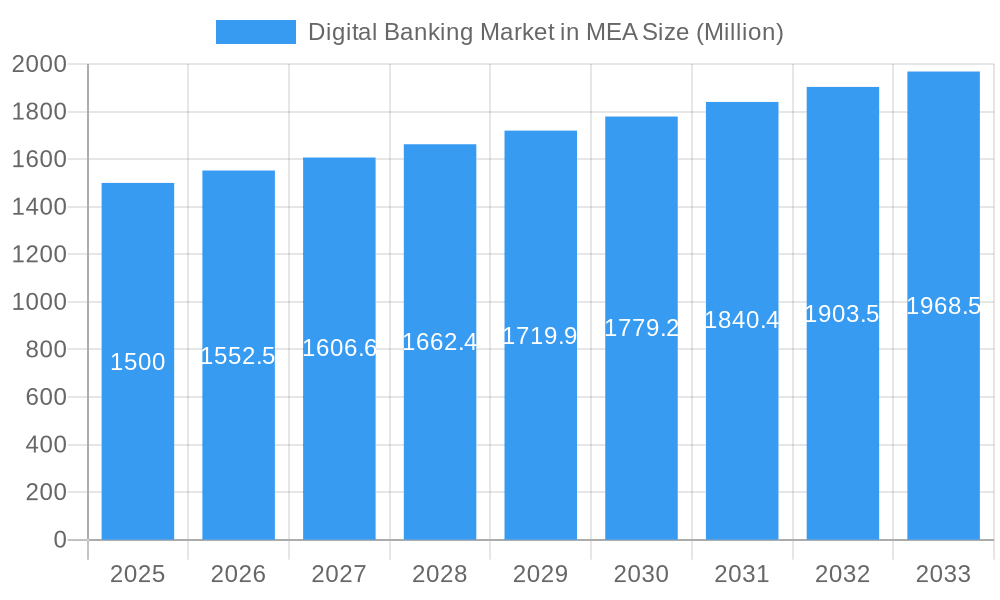

The Middle East and Africa (MEA) digital banking market is experiencing robust growth, fueled by increasing smartphone penetration, rising internet usage, and a young, tech-savvy population. The market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of >3.50% and a market size of XX million), is projected to maintain a healthy growth trajectory throughout the forecast period (2025-2033). Key drivers include the region's burgeoning fintech ecosystem, government initiatives promoting financial inclusion, and the increasing demand for convenient and accessible banking services. The shift towards mobile-first banking strategies, coupled with the adoption of innovative technologies like AI and blockchain, further propels market expansion. While challenges remain, such as cybersecurity concerns and the digital literacy gap in certain segments of the population, the overall trend suggests significant opportunities for growth for both established players like Bank ABC, Mashreq NEO, and ADCB Hayyak and emerging fintechs such as Meem, Pepper, and Liv. The segmentation within the market will likely continue to evolve, with specialized services catering to specific demographics and business needs gaining prominence.

Digital Banking Market in MEA Market Size (In Billion)

The competitive landscape is characterized by a mix of established banks adapting to the digital era and agile fintech companies disrupting traditional banking models. The success of players in this dynamic market hinges on their ability to offer seamless user experiences, robust security measures, and innovative financial products tailored to the unique needs of the MEA region. Continued investment in technological infrastructure and strategic partnerships will be crucial for maintaining a competitive edge. Regional variations in digital adoption rates and regulatory frameworks will necessitate a localized approach for effective market penetration. The long-term forecast indicates sustained growth, driven by continued technological advancements and an ever-increasing demand for digital financial services across the MEA region. We anticipate a substantial increase in market value by 2033, driven by factors like expanding financial inclusion initiatives, increasing adoption of open banking APIs, and the development of advanced digital payment systems.

Digital Banking Market in MEA Company Market Share

Digital Banking Market in MEA: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Digital Banking Market in the Middle East and Africa (MEA) region, covering the period from 2019 to 2033. It offers actionable insights for industry professionals, investors, and strategic planners seeking to understand the market's structure, dynamics, and future potential. The report leverages extensive data analysis, combining historical performance (2019-2024) with current estimations (2025) and future forecasts (2025-2033) to deliver a complete picture. Key players such as Bank ABC, CBD Now, Mashreq NEO, Meem, Pepper, Liv, Hala, ADCB Hayyak, and Opay (list not exhaustive) are analyzed for their market positioning and strategies. The report's projected market size for 2025 is xx Million.

Digital Banking Market in MEA Market Structure & Innovation Trends

The Middle East and Africa (MEA) digital banking market is experiencing a period of rapid transformation, driven by technological advancements, evolving consumer preferences, and supportive regulatory frameworks. This section delves into the intricate structure of this dynamic market, highlighting key innovation trends and their impact on market participants. We analyze market concentration, revealing the market share held by major players and the competitive landscape. A detailed assessment of regulatory frameworks and their influence on market dynamics is provided, including a comprehensive analysis of recent mergers and acquisitions (M&A) activities and their associated deal values (xx Million USD). Furthermore, the report explores the influence of product substitutes, end-user demographics, and innovation drivers on overall market growth, with a specific focus on the accelerating adoption of mobile banking, the disruptive influence of fintech companies, and the increasing demand for personalized financial solutions.

- Market Concentration and Competitive Landscape: A detailed analysis of market share distribution among key players, including established banks and emerging fintechs, examining their competitive strategies and market positioning.

- Innovation Drivers: A comprehensive examination of factors driving innovation, including technological advancements (AI, machine learning, blockchain), regulatory changes promoting digitalization, evolving consumer expectations (personalization, convenience), and the competitive pressure exerted by fintech entrants.

- Regulatory Frameworks and their Impact: An in-depth assessment of the impact of regional and national regulatory changes on market participants, focusing on their effects on competition, innovation, and financial inclusion.

- M&A Activities and Market Consolidation: Analysis of recent mergers and acquisitions, including their impact on market consolidation, the creation of new competitive dynamics, and the fostering of innovation through strategic partnerships.

Digital Banking Market in MEA Market Dynamics & Trends

This section delves into the key dynamics and trends shaping the MEA digital banking market. We analyze market growth drivers, including the rising adoption of smartphones and internet penetration, contributing to a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration rates are examined across different segments, with analysis of technological disruptions, evolving consumer preferences, and competitive dynamics. The impact of factors like financial inclusion initiatives and government policies is also considered.

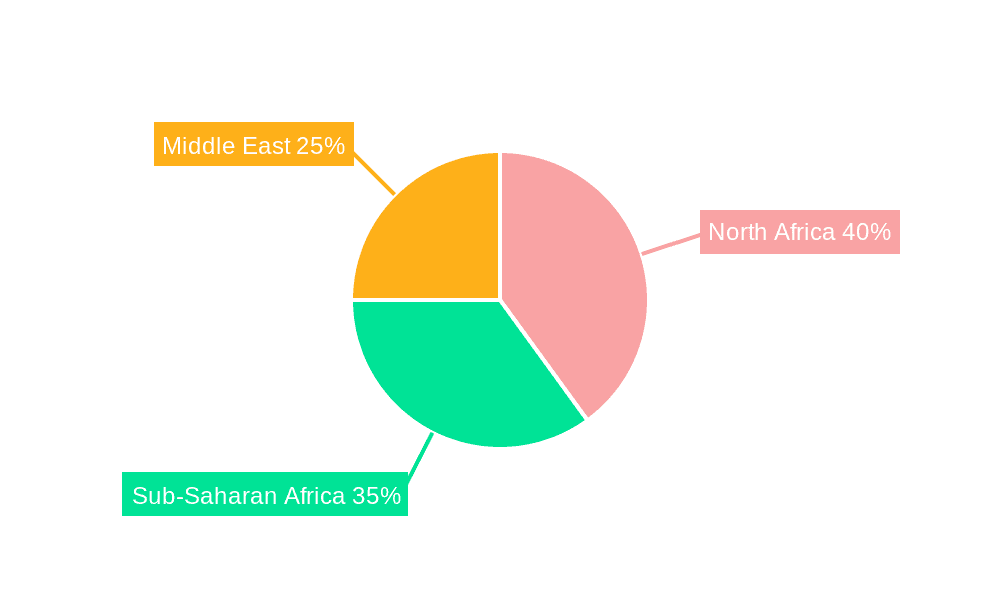

Dominant Regions & Segments in Digital Banking Market in MEA

This section pinpoints the leading regions and segments within the MEA digital banking market. A detailed analysis of the dominant region (e.g., UAE) and its key drivers is provided. The dominance of specific segments (e.g., mobile banking) is also explored.

- Key Drivers (UAE Example):

- Strong government support for fintech and digital transformation.

- High internet and smartphone penetration rates.

- Favorable regulatory environment.

- High concentration of technologically advanced banking institutions.

Digital Banking Market in MEA Product Innovations

This section highlights the latest product innovations shaping the MEA digital banking landscape. We explore the emergence of personalized financial solutions tailored to individual customer needs and preferences, leveraging data analytics and AI-powered services to enhance customer experience and financial management. The competitive advantages offered by these innovations are discussed, including improved customer engagement, enhanced risk management, and increased operational efficiency. The report also examines the market fit of these innovative products and their contribution to overall market growth and transformation.

Report Scope & Segmentation Analysis

This report segments the MEA digital banking market based on several factors, including banking services offered (e.g., mobile banking, online banking, etc.), user demographics (e.g., age, income level), and geographic location. Each segment's growth projections, market size, and competitive dynamics are detailed.

Key Drivers of Digital Banking Market in MEA Growth

The robust growth of the MEA digital banking market is fueled by a confluence of factors. Rapid technological advancements, particularly the integration of AI and machine learning in banking solutions, are significantly enhancing operational efficiency, security, and customer experience. Supportive economic policies and increasing government initiatives aimed at promoting financial inclusion are playing a pivotal role in expanding access to digital banking services. Furthermore, regulatory changes designed to stimulate digitalization and encourage innovation are acting as powerful catalysts for market growth. The increasing smartphone penetration and internet connectivity across the region further accelerate this growth.

Challenges in the Digital Banking Market in MEA Sector

The MEA digital banking market faces several challenges. Regulatory hurdles in some countries can slow down market expansion. Concerns around cybersecurity and data privacy also pose significant risks. Intense competition among existing banks and new fintech entrants creates pressure on margins and profitability.

Emerging Opportunities in Digital Banking Market in MEA

The MEA digital banking market presents numerous lucrative opportunities for growth and expansion. Untapped market potential in under-banked and underserved regions offers significant scope for reaching new customer segments and providing essential financial services. Emerging technologies such as blockchain technology and open banking frameworks offer unique opportunities to enhance service offerings, improve interoperability, and create innovative financial products. Changes in consumer preferences, particularly the increasing demand for personalized and convenient banking solutions, present opportunities for banks to differentiate themselves and improve customer loyalty.

Leading Players in the Digital Banking Market in MEA Market

- Bank ABC

- CBD Now

- Mashreq NEO

- Meem

- Pepper

- Liv

- Hala

- ADCB Hayyak

- Opay (List Not Exhaustive)

Key Developments in Digital Banking Market in MEA Industry

- March 2022: United Arab Emirates' Mashreq Bank launched Neopay, a unified merchant acquiring and consumer paytech business.

- May 2022: Mastercard, One Global, and i2c partnered to provide tailored financial solutions enabling the issuance of digital mobile wallets in the MEA region.

Future Outlook for Digital Banking Market in MEA Market

The MEA digital banking market is poised for sustained and significant growth. Continued technological advancements, supportive government policies, and the rising adoption of digital banking services across all demographics will drive substantial market expansion. Strategic partnerships and mergers & acquisitions will continue to shape the market landscape, fostering innovation and enhancing competitive dynamics. The accelerating adoption of mobile payments, coupled with the increasing penetration of mobile banking and fintech solutions, will further fuel market growth. The future of digital banking in MEA promises a vibrant and dynamic ecosystem, driven by technological innovation and a commitment to financial inclusion.

Digital Banking Market in MEA Segmentation

-

1. Account

- 1.1. Business account

- 1.2. Savings account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments & Money transfer

- 2.3. Savings account

- 2.4. Loans

- 2.5. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

-

4. Geography

- 4.1. UAE

- 4.2. Saudi Arabia

- 4.3. United Arab Emirates

- 4.4. Qatar

- 4.5. South Africa

- 4.6. Oman

- 4.7. Israel

- 4.8. Turkey

- 4.9. Rest of the Middle East

Digital Banking Market in MEA Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Qatar

- 5. South Africa

- 6. Oman

- 7. Israel

- 8. Turkey

- 9. Rest of the Middle East

Digital Banking Market in MEA Regional Market Share

Geographic Coverage of Digital Banking Market in MEA

Digital Banking Market in MEA REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Advanced Technology and Security are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account

- 5.1.1. Business account

- 5.1.2. Savings account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments & Money transfer

- 5.2.3. Savings account

- 5.2.4. Loans

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. UAE

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Qatar

- 5.4.5. South Africa

- 5.4.6. Oman

- 5.4.7. Israel

- 5.4.8. Turkey

- 5.4.9. Rest of the Middle East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. UAE

- 5.5.2. Saudi Arabia

- 5.5.3. United Arab Emirates

- 5.5.4. Qatar

- 5.5.5. South Africa

- 5.5.6. Oman

- 5.5.7. Israel

- 5.5.8. Turkey

- 5.5.9. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Account

- 6. UAE Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Account

- 6.1.1. Business account

- 6.1.2. Savings account

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Mobile Banking

- 6.2.2. Payments & Money transfer

- 6.2.3. Savings account

- 6.2.4. Loans

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Enterprise

- 6.3.2. Personal

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. UAE

- 6.4.2. Saudi Arabia

- 6.4.3. United Arab Emirates

- 6.4.4. Qatar

- 6.4.5. South Africa

- 6.4.6. Oman

- 6.4.7. Israel

- 6.4.8. Turkey

- 6.4.9. Rest of the Middle East

- 6.1. Market Analysis, Insights and Forecast - by Account

- 7. Saudi Arabia Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Account

- 7.1.1. Business account

- 7.1.2. Savings account

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Mobile Banking

- 7.2.2. Payments & Money transfer

- 7.2.3. Savings account

- 7.2.4. Loans

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Enterprise

- 7.3.2. Personal

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. UAE

- 7.4.2. Saudi Arabia

- 7.4.3. United Arab Emirates

- 7.4.4. Qatar

- 7.4.5. South Africa

- 7.4.6. Oman

- 7.4.7. Israel

- 7.4.8. Turkey

- 7.4.9. Rest of the Middle East

- 7.1. Market Analysis, Insights and Forecast - by Account

- 8. United Arab Emirates Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Account

- 8.1.1. Business account

- 8.1.2. Savings account

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Mobile Banking

- 8.2.2. Payments & Money transfer

- 8.2.3. Savings account

- 8.2.4. Loans

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Enterprise

- 8.3.2. Personal

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. UAE

- 8.4.2. Saudi Arabia

- 8.4.3. United Arab Emirates

- 8.4.4. Qatar

- 8.4.5. South Africa

- 8.4.6. Oman

- 8.4.7. Israel

- 8.4.8. Turkey

- 8.4.9. Rest of the Middle East

- 8.1. Market Analysis, Insights and Forecast - by Account

- 9. Qatar Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Account

- 9.1.1. Business account

- 9.1.2. Savings account

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Mobile Banking

- 9.2.2. Payments & Money transfer

- 9.2.3. Savings account

- 9.2.4. Loans

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Enterprise

- 9.3.2. Personal

- 9.3.3. Others

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. UAE

- 9.4.2. Saudi Arabia

- 9.4.3. United Arab Emirates

- 9.4.4. Qatar

- 9.4.5. South Africa

- 9.4.6. Oman

- 9.4.7. Israel

- 9.4.8. Turkey

- 9.4.9. Rest of the Middle East

- 9.1. Market Analysis, Insights and Forecast - by Account

- 10. South Africa Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Account

- 10.1.1. Business account

- 10.1.2. Savings account

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Mobile Banking

- 10.2.2. Payments & Money transfer

- 10.2.3. Savings account

- 10.2.4. Loans

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Enterprise

- 10.3.2. Personal

- 10.3.3. Others

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. UAE

- 10.4.2. Saudi Arabia

- 10.4.3. United Arab Emirates

- 10.4.4. Qatar

- 10.4.5. South Africa

- 10.4.6. Oman

- 10.4.7. Israel

- 10.4.8. Turkey

- 10.4.9. Rest of the Middle East

- 10.1. Market Analysis, Insights and Forecast - by Account

- 11. Oman Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Account

- 11.1.1. Business account

- 11.1.2. Savings account

- 11.2. Market Analysis, Insights and Forecast - by Service

- 11.2.1. Mobile Banking

- 11.2.2. Payments & Money transfer

- 11.2.3. Savings account

- 11.2.4. Loans

- 11.2.5. Others

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Enterprise

- 11.3.2. Personal

- 11.3.3. Others

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. UAE

- 11.4.2. Saudi Arabia

- 11.4.3. United Arab Emirates

- 11.4.4. Qatar

- 11.4.5. South Africa

- 11.4.6. Oman

- 11.4.7. Israel

- 11.4.8. Turkey

- 11.4.9. Rest of the Middle East

- 11.1. Market Analysis, Insights and Forecast - by Account

- 12. Israel Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Account

- 12.1.1. Business account

- 12.1.2. Savings account

- 12.2. Market Analysis, Insights and Forecast - by Service

- 12.2.1. Mobile Banking

- 12.2.2. Payments & Money transfer

- 12.2.3. Savings account

- 12.2.4. Loans

- 12.2.5. Others

- 12.3. Market Analysis, Insights and Forecast - by Application

- 12.3.1. Enterprise

- 12.3.2. Personal

- 12.3.3. Others

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. UAE

- 12.4.2. Saudi Arabia

- 12.4.3. United Arab Emirates

- 12.4.4. Qatar

- 12.4.5. South Africa

- 12.4.6. Oman

- 12.4.7. Israel

- 12.4.8. Turkey

- 12.4.9. Rest of the Middle East

- 12.1. Market Analysis, Insights and Forecast - by Account

- 13. Turkey Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Account

- 13.1.1. Business account

- 13.1.2. Savings account

- 13.2. Market Analysis, Insights and Forecast - by Service

- 13.2.1. Mobile Banking

- 13.2.2. Payments & Money transfer

- 13.2.3. Savings account

- 13.2.4. Loans

- 13.2.5. Others

- 13.3. Market Analysis, Insights and Forecast - by Application

- 13.3.1. Enterprise

- 13.3.2. Personal

- 13.3.3. Others

- 13.4. Market Analysis, Insights and Forecast - by Geography

- 13.4.1. UAE

- 13.4.2. Saudi Arabia

- 13.4.3. United Arab Emirates

- 13.4.4. Qatar

- 13.4.5. South Africa

- 13.4.6. Oman

- 13.4.7. Israel

- 13.4.8. Turkey

- 13.4.9. Rest of the Middle East

- 13.1. Market Analysis, Insights and Forecast - by Account

- 14. Rest of the Middle East Digital Banking Market in MEA Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Account

- 14.1.1. Business account

- 14.1.2. Savings account

- 14.2. Market Analysis, Insights and Forecast - by Service

- 14.2.1. Mobile Banking

- 14.2.2. Payments & Money transfer

- 14.2.3. Savings account

- 14.2.4. Loans

- 14.2.5. Others

- 14.3. Market Analysis, Insights and Forecast - by Application

- 14.3.1. Enterprise

- 14.3.2. Personal

- 14.3.3. Others

- 14.4. Market Analysis, Insights and Forecast - by Geography

- 14.4.1. UAE

- 14.4.2. Saudi Arabia

- 14.4.3. United Arab Emirates

- 14.4.4. Qatar

- 14.4.5. South Africa

- 14.4.6. Oman

- 14.4.7. Israel

- 14.4.8. Turkey

- 14.4.9. Rest of the Middle East

- 14.1. Market Analysis, Insights and Forecast - by Account

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Bank ABC

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 CBD Now

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Mashreq NEO

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Meem

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Pepper

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Liv

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Hala

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 ADCB Hayyak

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Opay**List Not Exhaustive

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.1 Bank ABC

List of Figures

- Figure 1: Digital Banking Market in MEA Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Digital Banking Market in MEA Share (%) by Company 2025

List of Tables

- Table 1: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 2: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 3: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: Digital Banking Market in MEA Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 7: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 8: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 12: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 13: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 17: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 18: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 22: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 23: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 27: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 28: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 32: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 33: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 35: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 37: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 38: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 40: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 42: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 43: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 45: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Digital Banking Market in MEA Revenue undefined Forecast, by Account 2020 & 2033

- Table 47: Digital Banking Market in MEA Revenue undefined Forecast, by Service 2020 & 2033

- Table 48: Digital Banking Market in MEA Revenue undefined Forecast, by Application 2020 & 2033

- Table 49: Digital Banking Market in MEA Revenue undefined Forecast, by Geography 2020 & 2033

- Table 50: Digital Banking Market in MEA Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Banking Market in MEA?

The projected CAGR is approximately 18.4%.

2. Which companies are prominent players in the Digital Banking Market in MEA?

Key companies in the market include Bank ABC, CBD Now, Mashreq NEO, Meem, Pepper, Liv, Hala, ADCB Hayyak, Opay**List Not Exhaustive.

3. What are the main segments of the Digital Banking Market in MEA?

The market segments include Account, Service, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Advanced Technology and Security are Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: Mastercard, One Global and i2c have announced a partnership to provide tailored financial solutions that will enable the issuance of digital mobile wallets in the region. Through this partnership, banks, fintech, merchants and wallet providers can now offer consumers in the region easy access to cutting edge, digital-first payment solutions and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Banking Market in MEA," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Banking Market in MEA report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Banking Market in MEA?

To stay informed about further developments, trends, and reports in the Digital Banking Market in MEA, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence