Key Insights

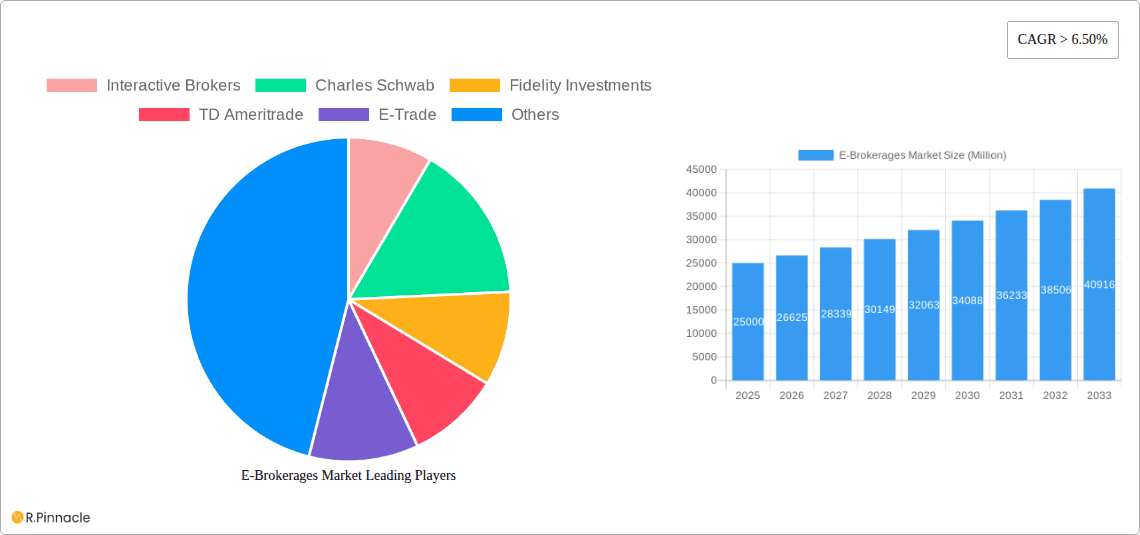

The global e-brokerage market is experiencing robust growth, driven by increasing digitalization, the rise of mobile trading platforms, and a growing preference for online investment services among both retail and institutional investors. The market's Compound Annual Growth Rate (CAGR) exceeding 6.50% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors: the accessibility and convenience of online trading, the lower commission fees compared to traditional brokerage firms, and the availability of sophisticated trading tools and educational resources directly accessible to users. The expanding millennial and Gen Z investor populations, increasingly comfortable with digital financial services, further bolster market expansion. Technological advancements, including AI-powered trading tools and algorithmic trading platforms, are enhancing efficiency and profitability for both brokers and investors, contributing to the overall market growth. However, market volatility, regulatory changes, and the ongoing threat of cybersecurity risks present challenges to sustained growth. Competition among established players like Interactive Brokers, Charles Schwab, Fidelity Investments, and newer entrants is fierce, demanding constant innovation and adaptation.

E-Brokerages Market Market Size (In Billion)

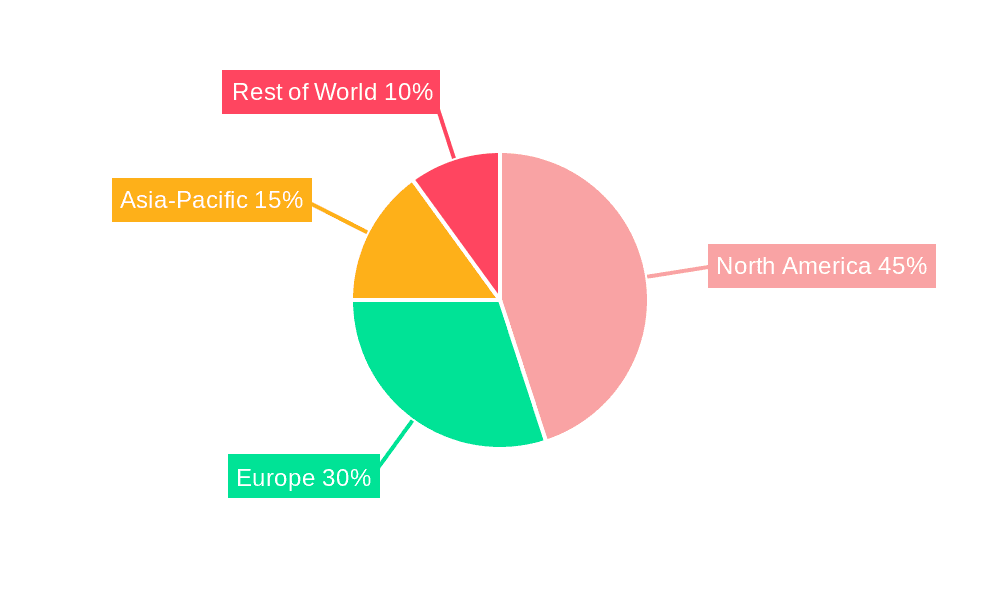

The segment analysis (though not explicitly provided) likely reveals substantial growth in mobile trading platforms and specific investment products like ETFs and options. Geographical distribution likely shows stronger growth in regions with high internet penetration and a burgeoning middle class. North America and Europe are presently dominant regions, but Asia-Pacific holds significant future potential due to its rapidly expanding online investment base. While the exact market size for 2025 isn't specified, estimating the 2025 market value, based on a reasonable assumption of a 2024 market size of $X billion (adjust X based on your best estimate of available data) and the provided CAGR, yields a projected value for 2025 that reflects the sustained expansion. Looking ahead to 2033, continued growth under the projected CAGR leads to a significantly larger market size. The key to continued success for e-brokerage firms will lie in adapting to changing investor demographics, enhancing technological capabilities, and navigating the evolving regulatory landscape.

E-Brokerages Market Company Market Share

E-Brokerages Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global E-Brokerages Market, offering valuable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on the estimated year 2025, this report unveils market dynamics, competitive landscapes, and future growth potential. The report analyzes key players such as Interactive Brokers, Charles Schwab, Fidelity Investments, TD Ameritrade, E-Trade, TastyWorks, eToro, X-Trade Brokers, IC Markets, Eoption, and First Prudential Markets (list not exhaustive). It also explores market segmentation and regional variations, providing actionable intelligence for informed decision-making.

E-Brokerages Market Market Structure & Innovation Trends

This section analyzes the market structure, highlighting market concentration, key innovation drivers, and regulatory landscapes influencing the E-brokerage sector. We examine the impact of mergers and acquisitions (M&A) activities, assessing deal values and their effect on market share. End-user demographics and the presence of product substitutes are also considered. The analysis covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

- Market Concentration: Analysis of market share held by top players, including Interactive Brokers, Charles Schwab, and Fidelity Investments. (Specific market share percentages will be detailed in the full report).

- Innovation Drivers: Examination of factors driving innovation, such as advancements in trading technology, increasing demand for mobile trading platforms, and regulatory changes.

- Regulatory Frameworks: Assessment of the impact of regulations on market dynamics, including those related to data privacy, security, and anti-money laundering.

- Product Substitutes: Evaluation of alternative investment platforms and their competitive impact on the e-brokerage market.

- End-User Demographics: Analysis of the changing demographics of e-brokerage users, including age, income level, and investment experience.

- M&A Activities: Review of significant mergers and acquisitions, including deal values and their impact on market consolidation. (e.g., eToro's acquisition of Gatsby for USD 50 Million). The full report will include a detailed list and analysis of M&A activities.

E-Brokerages Market Market Dynamics & Trends

This section provides a comprehensive analysis of the forces shaping the e-brokerages market. We explore the pivotal growth drivers propelling the industry forward, alongside the disruptive impact of technological advancements. Understanding evolving consumer preferences is crucial, as is dissecting the intricate competitive dynamics at play. To project the future landscape, we meticulously analyze the Compound Annual Growth Rate (CAGR) and current market penetration rates, offering a clear vision of the market's size and anticipated growth trajectory.

The e-brokerage landscape is experiencing rapid evolution, driven by several key factors. The proliferation of user-friendly mobile trading applications has democratized access to financial markets, empowering a new generation of investors. Robo-advisors are gaining significant traction, offering automated, algorithm-driven investment management that appeals to cost-conscious and time-poor individuals. Furthermore, the advent of fractional share trading has lowered the barrier to entry for many, allowing smaller investors to participate in high-value stocks. Macroeconomic conditions, including interest rate fluctuations, inflation, and geopolitical events, significantly influence investor sentiment and behavior, creating both challenges and opportunities for e-brokerage platforms.

Dominant Regions & Segments in E-Brokerages Market

This section identifies the leading regions and segments within the e-brokerage market. We analyze the key factors driving their dominance, such as economic policies, technological infrastructure, and regulatory environments.

(This section will contain a 600-word analysis focusing on the dominant region(s) and segment(s). It will use bullet points to highlight key drivers and paragraphs for detailed dominance analysis. For example, the high adoption rate of online trading in North America will be discussed. The full report will include a detailed regional breakdown and segment analysis.)

E-Brokerages Market Product Innovations

This section meticulously examines the cutting-edge product developments and innovative applications emerging within the dynamic e-brokerage sector. We assess the distinct competitive advantages offered by these new solutions and delve into the technological trends that are fundamentally shaping product innovation. Each new offering is evaluated for its market fit, ensuring that it addresses the evolving needs and expectations of investors.

Recent product innovations in e-brokerages are heavily influenced by technological advancements aimed at enhancing the trading experience. The integration of sophisticated AI-powered trading tools, such as predictive analytics and sentiment analysis, is becoming increasingly common, enabling more informed decision-making. Furthermore, there is a growing focus on developing personalized investment solutions, leveraging user data and preferences to create tailored portfolios and recommendations. These innovations are designed to attract and retain a diverse range of investors by offering greater efficiency, accessibility, and customization.

Report Scope & Segmentation Analysis

This section details the market segmentation used in the report. It provides growth projections, market sizes, and competitive dynamics for each segment.

(This section will provide a 100-150 word description of the market segmentation, including details on growth projections and market size for each segment.)

Key Drivers of E-Brokerages Market Growth

The e-brokerages market is experiencing robust expansion, propelled by a confluence of influential factors. At the forefront are rapid technological advancements, which continue to enhance accessibility and user experience. Favorable economic conditions, including periods of market growth and increased disposable income, also play a significant role by encouraging investment activity. Moreover, supportive regulatory frameworks are being implemented in many regions, fostering a more secure and transparent environment for online trading. These elements collectively contribute to the sustained and upward trajectory of the e-brokerage industry.

Challenges in the E-Brokerages Market Sector

This section discusses the challenges and restraints facing the e-brokerage market, including regulatory hurdles, supply chain issues, and competitive pressures.

(This section will provide a 150-word analysis of challenges and restraints using paragraphs or lists, including quantifiable impacts where possible.)

Emerging Opportunities in E-Brokerages Market

The e-brokerage sector is ripe with emerging opportunities, driven by the exploration of new markets, the adoption of pioneering technologies, and the continuous evolution of consumer preferences. As digital adoption continues its global ascent, e-brokerage firms are identifying underserved regions and demographics, paving the way for significant expansion. The integration of emerging technologies, such as blockchain for enhanced security and transparency, and advanced data analytics for hyper-personalization, presents further avenues for innovation and competitive differentiation. Simultaneously, a growing awareness of sustainable investing and alternative asset classes is creating demand for new product offerings and investment strategies, opening doors for e-brokerages to cater to these burgeoning investor interests.

Leading Players in the E-Brokerages Market Market

This section lists the leading players in the e-brokerages market. Where possible, links to company websites are provided.

- Interactive Brokers

- Charles Schwab

- Fidelity Investments

- TD Ameritrade

- E-Trade

- TastyWorks

- eToro

- X-Trade Brokers

- IC Markets

- Eoption

- First Prudential Markets (List not exhaustive)

Key Developments in E-Brokerages Market Industry

This section details significant industry developments, highlighting their impact on market dynamics and strategic positioning.

- May 2022: Interactive Brokers enhanced its platform by partnering with TradingView, allowing clients to seamlessly execute trades directly from TradingView's advanced charting and workspace environments. This integration significantly boosts analytical capabilities and trading efficiency for users.

- May 2022: Fidelity International forged a strategic partnership with Conquest, aiming to distribute its sophisticated financial planning software within the UK's independent financial advice market. This collaboration seeks to empower advisors with advanced tools for comprehensive client wealth management.

- August 2022: eToro, a prominent social trading platform, bolstered its market presence and technological capabilities by acquiring Gatsby, a commission-free investing app, for a substantial USD 50 Million in cash and common shares. This acquisition is expected to expand eToro's user base and service offerings, particularly among younger investors.

Future Outlook for E-Brokerages Market Market

This section summarizes growth accelerators and strategic opportunities within the e-brokerage market, focusing on future market potential.

(This section will provide a 150-word summary of future growth accelerators and strategic opportunities.)

E-Brokerages Market Segmentation

-

1. Client

- 1.1. Retailers

- 1.2. Institutional

-

2. Services Provided

- 2.1. Full Time Brokers

- 2.2. Discounted Brokers

-

3. Ownership

- 3.1. Privately Held

- 3.2. Publicly Held

E-Brokerages Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

E-Brokerages Market Regional Market Share

Geographic Coverage of E-Brokerages Market

E-Brokerages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Zero commission in United States equity markets change market dynamics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client

- 5.1.1. Retailers

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Services Provided

- 5.2.1. Full Time Brokers

- 5.2.2. Discounted Brokers

- 5.3. Market Analysis, Insights and Forecast - by Ownership

- 5.3.1. Privately Held

- 5.3.2. Publicly Held

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Client

- 6. North America E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client

- 6.1.1. Retailers

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Services Provided

- 6.2.1. Full Time Brokers

- 6.2.2. Discounted Brokers

- 6.3. Market Analysis, Insights and Forecast - by Ownership

- 6.3.1. Privately Held

- 6.3.2. Publicly Held

- 6.1. Market Analysis, Insights and Forecast - by Client

- 7. Europe E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client

- 7.1.1. Retailers

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Services Provided

- 7.2.1. Full Time Brokers

- 7.2.2. Discounted Brokers

- 7.3. Market Analysis, Insights and Forecast - by Ownership

- 7.3.1. Privately Held

- 7.3.2. Publicly Held

- 7.1. Market Analysis, Insights and Forecast - by Client

- 8. Asia Pacific E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client

- 8.1.1. Retailers

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Services Provided

- 8.2.1. Full Time Brokers

- 8.2.2. Discounted Brokers

- 8.3. Market Analysis, Insights and Forecast - by Ownership

- 8.3.1. Privately Held

- 8.3.2. Publicly Held

- 8.1. Market Analysis, Insights and Forecast - by Client

- 9. South America E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client

- 9.1.1. Retailers

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Services Provided

- 9.2.1. Full Time Brokers

- 9.2.2. Discounted Brokers

- 9.3. Market Analysis, Insights and Forecast - by Ownership

- 9.3.1. Privately Held

- 9.3.2. Publicly Held

- 9.1. Market Analysis, Insights and Forecast - by Client

- 10. Middle East and Africa E-Brokerages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client

- 10.1.1. Retailers

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Services Provided

- 10.2.1. Full Time Brokers

- 10.2.2. Discounted Brokers

- 10.3. Market Analysis, Insights and Forecast - by Ownership

- 10.3.1. Privately Held

- 10.3.2. Publicly Held

- 10.1. Market Analysis, Insights and Forecast - by Client

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Brokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Charles Schwab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fidelity Investments

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TD Ameritrade

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 E-Trade

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TastyWorks

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Etoro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 X-Trade Brokers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IC Markets

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eoption

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 First Prudential Markets**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Interactive Brokers

List of Figures

- Figure 1: Global E-Brokerages Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America E-Brokerages Market Revenue (Million), by Client 2025 & 2033

- Figure 3: North America E-Brokerages Market Revenue Share (%), by Client 2025 & 2033

- Figure 4: North America E-Brokerages Market Revenue (Million), by Services Provided 2025 & 2033

- Figure 5: North America E-Brokerages Market Revenue Share (%), by Services Provided 2025 & 2033

- Figure 6: North America E-Brokerages Market Revenue (Million), by Ownership 2025 & 2033

- Figure 7: North America E-Brokerages Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 8: North America E-Brokerages Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America E-Brokerages Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe E-Brokerages Market Revenue (Million), by Client 2025 & 2033

- Figure 11: Europe E-Brokerages Market Revenue Share (%), by Client 2025 & 2033

- Figure 12: Europe E-Brokerages Market Revenue (Million), by Services Provided 2025 & 2033

- Figure 13: Europe E-Brokerages Market Revenue Share (%), by Services Provided 2025 & 2033

- Figure 14: Europe E-Brokerages Market Revenue (Million), by Ownership 2025 & 2033

- Figure 15: Europe E-Brokerages Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 16: Europe E-Brokerages Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe E-Brokerages Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific E-Brokerages Market Revenue (Million), by Client 2025 & 2033

- Figure 19: Asia Pacific E-Brokerages Market Revenue Share (%), by Client 2025 & 2033

- Figure 20: Asia Pacific E-Brokerages Market Revenue (Million), by Services Provided 2025 & 2033

- Figure 21: Asia Pacific E-Brokerages Market Revenue Share (%), by Services Provided 2025 & 2033

- Figure 22: Asia Pacific E-Brokerages Market Revenue (Million), by Ownership 2025 & 2033

- Figure 23: Asia Pacific E-Brokerages Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 24: Asia Pacific E-Brokerages Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific E-Brokerages Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America E-Brokerages Market Revenue (Million), by Client 2025 & 2033

- Figure 27: South America E-Brokerages Market Revenue Share (%), by Client 2025 & 2033

- Figure 28: South America E-Brokerages Market Revenue (Million), by Services Provided 2025 & 2033

- Figure 29: South America E-Brokerages Market Revenue Share (%), by Services Provided 2025 & 2033

- Figure 30: South America E-Brokerages Market Revenue (Million), by Ownership 2025 & 2033

- Figure 31: South America E-Brokerages Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 32: South America E-Brokerages Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America E-Brokerages Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa E-Brokerages Market Revenue (Million), by Client 2025 & 2033

- Figure 35: Middle East and Africa E-Brokerages Market Revenue Share (%), by Client 2025 & 2033

- Figure 36: Middle East and Africa E-Brokerages Market Revenue (Million), by Services Provided 2025 & 2033

- Figure 37: Middle East and Africa E-Brokerages Market Revenue Share (%), by Services Provided 2025 & 2033

- Figure 38: Middle East and Africa E-Brokerages Market Revenue (Million), by Ownership 2025 & 2033

- Figure 39: Middle East and Africa E-Brokerages Market Revenue Share (%), by Ownership 2025 & 2033

- Figure 40: Middle East and Africa E-Brokerages Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa E-Brokerages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 2: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 3: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 4: Global E-Brokerages Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 6: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 7: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 8: Global E-Brokerages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 10: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 11: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 12: Global E-Brokerages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 14: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 15: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 16: Global E-Brokerages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 18: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 19: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 20: Global E-Brokerages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global E-Brokerages Market Revenue Million Forecast, by Client 2020 & 2033

- Table 22: Global E-Brokerages Market Revenue Million Forecast, by Services Provided 2020 & 2033

- Table 23: Global E-Brokerages Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 24: Global E-Brokerages Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerages Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the E-Brokerages Market?

Key companies in the market include Interactive Brokers, Charles Schwab, Fidelity Investments, TD Ameritrade, E-Trade, TastyWorks, Etoro, X-Trade Brokers, IC Markets, Eoption, First Prudential Markets**List Not Exhaustive.

3. What are the main segments of the E-Brokerages Market?

The market segments include Client, Services Provided, Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Zero commission in United States equity markets change market dynamics.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2022: Interactive Brokers partnered with TradingView. The new partnership was like a win-win for all parties, particularly for Interactive broker clients as they were now trading directly from their TradingView workspaces and charts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerages Market?

To stay informed about further developments, trends, and reports in the E-Brokerages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence