Key Insights

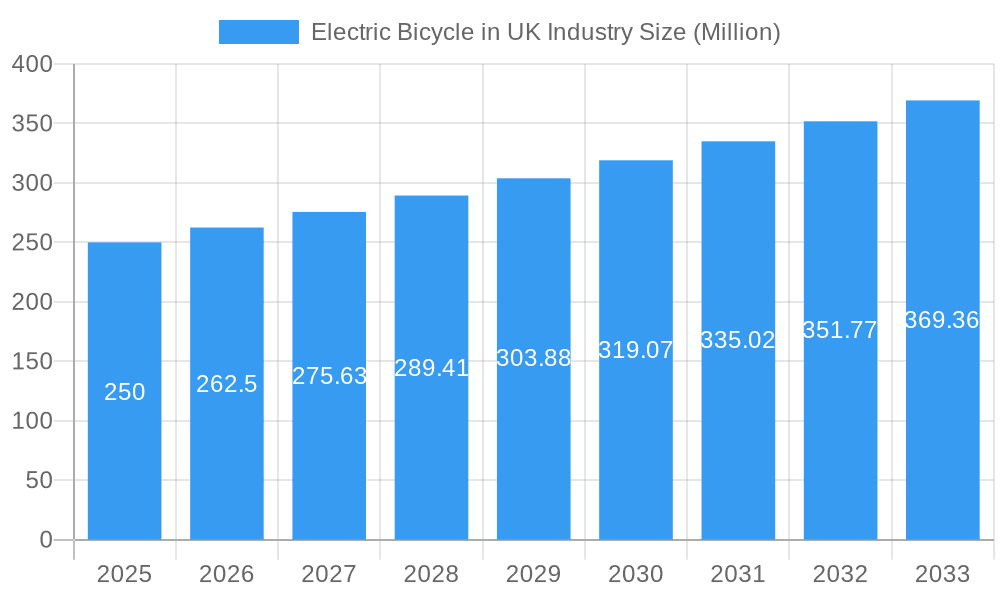

The UK electric bicycle market is experiencing substantial expansion, propelled by heightened environmental consciousness, government support for sustainable transport, and the escalating appeal of e-bikes for both commuting and leisure. The market, projected to reach 305.88 million by 2025, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 8% through 2033. Key growth drivers include the diversification of e-bike models for varied applications (cargo, urban, trekking), advancements in battery technology with lithium-ion batteries becoming dominant, and enhanced e-bike performance and design. Increased affordability and improved cycling infrastructure further contribute to this growth. While initial purchase costs and battery lifecycle concerns exist, technological innovations and government initiatives are mitigating these challenges. The market is segmented by propulsion type (pedal-assisted, speed pedelec, throttle-assisted), application (cargo/utility, city/urban, trekking), and battery type (lithium-ion, lead-acid, others). Prominent brands like Gocycle, Volt Electric Bike, Brompton, and Giant are spearheading innovation, reinforcing the UK's significant presence in the European e-bike sector.

Electric Bicycle in UK Industry Market Size (In Million)

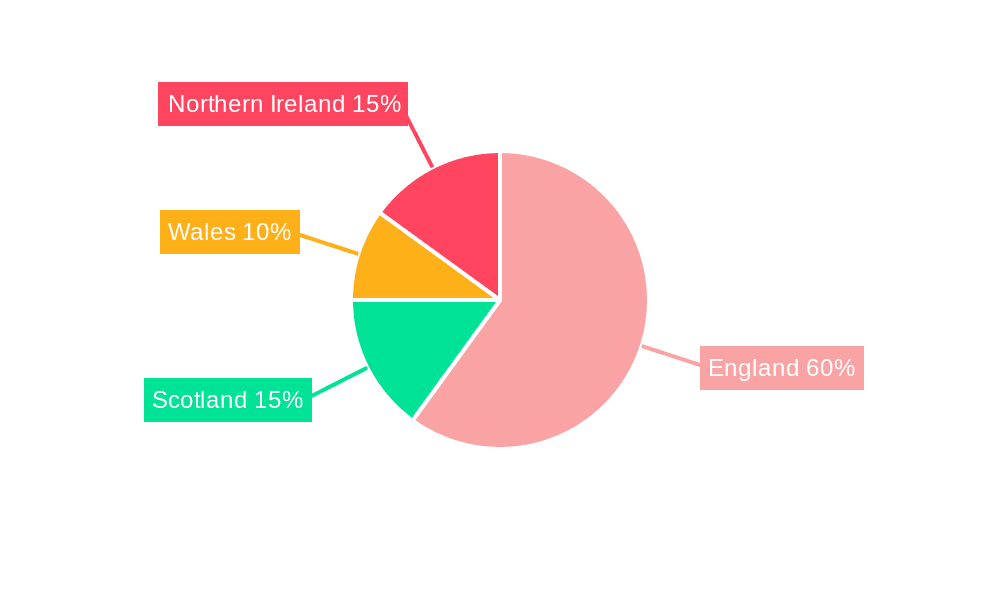

Regional adoption varies across the UK, with England leading due to its population density, while Scotland, Wales, and Northern Ireland present growth opportunities influenced by localized policies and infrastructure development. The prevalence of lithium-ion batteries signals a trend towards higher-performance, longer-lasting e-bikes. The cargo/utility segment is rapidly expanding, driven by its utility in delivery and light commercial applications. Continued advancements in battery technology and government investment in cycling infrastructure are poised to drive further market growth. Projections indicate a significant increase in market size and broader e-bike integration across various segments within the 2025-2033 forecast period, highlighting a robust and developing UK market.

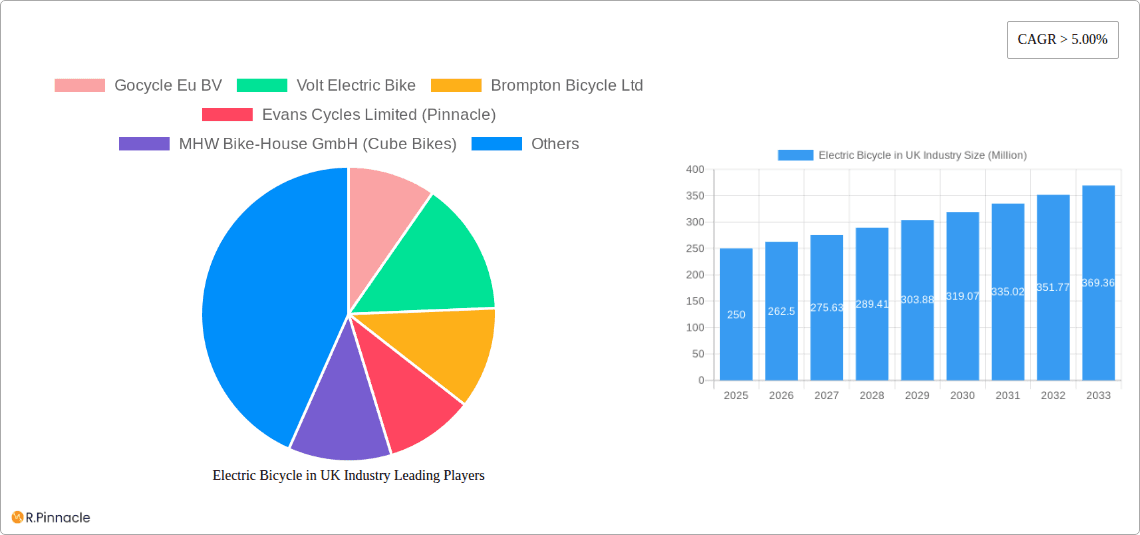

Electric Bicycle in UK Industry Company Market Share

UK Electric Bicycle Market Analysis: Size, Trends, and Forecast 2025-2033

This comprehensive report offers an in-depth analysis of the UK electric bicycle market, detailing market size, growth catalysts, competitive dynamics, and future projections. Utilizing historical data from 2019-2024, with 2025 as the base year, the report forecasts market growth up to 2033. It serves as a critical resource for industry stakeholders, investors, and those seeking insights into this dynamic sector. The market is projected to be valued at 305.88 million in 2025, with an anticipated growth to [future market size] million by 2033.

Electric Bicycle in UK Industry Market Structure & Innovation Trends

The UK electric bicycle market exhibits a moderately concentrated structure, with key players such as Gocycle Eu BV, Volt Electric Bike, Brompton Bicycle Ltd, Evans Cycles Limited (Pinnacle), MHW Bike-House GmbH (Cube Bikes), Raleigh Bicycle Company, Tandem Group Cycles (Falcon Cycles), Giant Manufacturing Co Ltd, POWABYKE UK LIMITED (Powabyke), Trek Bicycle Corporation, and Tandem Group Cycles (DAWES) holding significant market share. However, the market also accommodates numerous smaller niche players and startups driving innovation.

Market share distribution among these leading players is estimated at xx% for the top three players, with the remaining xx% spread amongst others. Recent years have witnessed significant M&A activity, although specific deal values remain undisclosed for many transactions (xx Million estimated for disclosed transactions in 2024). Innovation is driven by advancements in battery technology (particularly Lithium-ion), improved motor efficiency, lightweight frame materials, and integrated smart technologies (GPS, connectivity). Regulatory frameworks, such as e-bike classification and safety standards, play a crucial role in shaping market growth. Product substitutes include traditional bicycles and other forms of personal transportation, while end-user demographics are increasingly diverse, encompassing commuters, leisure cyclists, and delivery services.

Electric Bicycle in UK Industry Market Dynamics & Trends

The UK electric bicycle market demonstrates robust growth, propelled by several key factors. Increasing environmental awareness, coupled with government incentives promoting sustainable transportation, has significantly boosted demand. Technological advancements resulting in longer battery life, improved performance, and enhanced safety features also contribute to this growth. Furthermore, changing consumer preferences towards healthier lifestyles and convenient commuting options fuel the market's expansion. The rising popularity of e-bikes for various applications (commuting, leisure, cargo) is evident in the market’s growth. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, with market penetration rates increasing steadily. Competitive dynamics are characterized by ongoing innovation, brand building, and expanding distribution networks.

Dominant Regions & Segments in Electric Bicycle in UK Industry

The UK's major urban centers (London, Manchester, Birmingham) dominate the electric bicycle market. Within segments:

Propulsion Type: Lithium-ion battery powered Pedal Assisted e-bikes currently hold the largest market share, driven by their balance of assistance and range. Speed Pedelec and Throttle Assisted segments are experiencing growth, but at a slower pace.

Application Type: The City/Urban segment enjoys the highest demand, fueled by commuting needs. The Cargo/Utility segment is also expanding, driven by businesses and families.

Battery Type: Lithium-ion batteries dominate, due to superior energy density and lifespan compared to Lead Acid batteries.

Key drivers include supportive government policies, expanding charging infrastructure, and increasing consumer preference for eco-friendly transport. The dominance of urban areas is attributed to higher population density, better cycling infrastructure, and increased congestion.

Electric Bicycle in UK Industry Product Innovations

Recent product innovations focus on improved battery technology, lighter frame materials, more powerful motors, and enhanced safety features. Full-suspension e-bikes, such as Giant's Stormguard E+, represent a notable advancement catering to a wider range of users and terrains. Integration of smart technologies (connectivity, GPS) is also a key trend, enhancing user experience and functionality. These innovations address market demands for longer range, improved performance, and enhanced comfort and safety.

Report Scope & Segmentation Analysis

This report segments the UK electric bicycle market based on propulsion type (Pedal Assisted, Speed Pedelec, Throttle Assisted), application type (Cargo/Utility, City/Urban, Trekking), and battery type (Lead Acid Battery, Lithium-ion Battery, Others). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed, providing a detailed understanding of market structure and potential. For example, the Pedal Assisted segment is expected to show a xx% CAGR, while the Lithium-ion battery segment will dominate, driven by improved performance and range.

Key Drivers of Electric Bicycle in UK Industry Growth

Government incentives for e-bike purchases, increasing environmental awareness, growing urban congestion leading to demand for alternative commuting options, technological advancements resulting in improved battery life and performance, and expanding charging infrastructure are all key growth drivers.

Challenges in the Electric Bicycle in UK Industry Sector

Challenges include the high initial cost of e-bikes, range anxiety related to battery capacity, concerns about theft and security, and potential supply chain disruptions impacting component availability. Furthermore, regulatory uncertainty regarding e-bike standards in some local areas also poses a barrier to market growth. These challenges collectively impact market expansion and require innovative solutions.

Emerging Opportunities in Electric Bicycle in UK Industry

Emerging opportunities include the growth of the Cargo/Utility segment, particularly for last-mile delivery services and family transportation. The development of improved battery technologies, enabling longer ranges and faster charging times, offers significant potential. Furthermore, integration of smart technologies presents opportunities for enhanced user experiences and new service offerings.

Leading Players in the Electric Bicycle in UK Industry Market

- Gocycle Eu BV

- Volt Electric Bike

- Brompton Bicycle Ltd

- Evans Cycles Limited (Pinnacle)

- MHW Bike-House GmbH (Cube Bikes)

- Raleigh Bicycle Company

- Tandem Group Cycles (Falcon Cycles)

- Giant Manufacturing Co Ltd

- POWABYKE UK LIMITED (Powabyke)

- Trek Bicycle Corporation

- Tandem Group Cycles (DAWES)

Key Developments in Electric Bicycle in UK Industry Industry

- November 2022: The Tandem Group opened an eMobility sales and demo showroom under the Electric Life banner in Birmingham.

- November 2022: Giant unveiled the Stormguard E+, a full-suspension e-bike.

- December 2022: Volt Bikes and City AM collaborated on an ESG-focused project through Impact AM.

These developments highlight the industry's focus on sustainability, expanding retail presence, and innovation in product offerings.

Future Outlook for Electric Bicycle in UK Industry Market

The UK electric bicycle market is poised for continued strong growth, driven by ongoing technological advancements, supportive government policies, and shifting consumer preferences. New market segments, such as cargo bikes and e-bike sharing schemes, present significant opportunities. Strategic investments in R&D, expanding distribution networks, and addressing existing challenges will be crucial for sustained market success.

Electric Bicycle in UK Industry Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Electric Bicycle in UK Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Bicycle in UK Industry Regional Market Share

Geographic Coverage of Electric Bicycle in UK Industry

Electric Bicycle in UK Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Cargo/Utility

- 6.2.2. City/Urban

- 6.2.3. Trekking

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lead Acid Battery

- 6.3.2. Lithium-ion Battery

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Cargo/Utility

- 7.2.2. City/Urban

- 7.2.3. Trekking

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lead Acid Battery

- 7.3.2. Lithium-ion Battery

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Cargo/Utility

- 8.2.2. City/Urban

- 8.2.3. Trekking

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lead Acid Battery

- 8.3.2. Lithium-ion Battery

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Cargo/Utility

- 9.2.2. City/Urban

- 9.2.3. Trekking

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lead Acid Battery

- 9.3.2. Lithium-ion Battery

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific Electric Bicycle in UK Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Cargo/Utility

- 10.2.2. City/Urban

- 10.2.3. Trekking

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lead Acid Battery

- 10.3.2. Lithium-ion Battery

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gocycle Eu BV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Volt Electric Bike

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brompton Bicycle Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Evans Cycles Limited (Pinnacle)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MHW Bike-House GmbH (Cube Bikes)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Raleigh Bicycle Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tandem Group Cycles (Falcon Cycles)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Giant Manufacturing Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 POWABYKE UK LIMITED (Powabyke)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trek Bicycle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tandem Group Cycles (DAWES)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Gocycle Eu BV

List of Figures

- Figure 1: Global Electric Bicycle in UK Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Electric Bicycle in UK Industry Revenue (million), by Propulsion Type 2025 & 2033

- Figure 3: North America Electric Bicycle in UK Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 4: North America Electric Bicycle in UK Industry Revenue (million), by Application Type 2025 & 2033

- Figure 5: North America Electric Bicycle in UK Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Electric Bicycle in UK Industry Revenue (million), by Battery Type 2025 & 2033

- Figure 7: North America Electric Bicycle in UK Industry Revenue Share (%), by Battery Type 2025 & 2033

- Figure 8: North America Electric Bicycle in UK Industry Revenue (million), by Country 2025 & 2033

- Figure 9: North America Electric Bicycle in UK Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Electric Bicycle in UK Industry Revenue (million), by Propulsion Type 2025 & 2033

- Figure 11: South America Electric Bicycle in UK Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: South America Electric Bicycle in UK Industry Revenue (million), by Application Type 2025 & 2033

- Figure 13: South America Electric Bicycle in UK Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: South America Electric Bicycle in UK Industry Revenue (million), by Battery Type 2025 & 2033

- Figure 15: South America Electric Bicycle in UK Industry Revenue Share (%), by Battery Type 2025 & 2033

- Figure 16: South America Electric Bicycle in UK Industry Revenue (million), by Country 2025 & 2033

- Figure 17: South America Electric Bicycle in UK Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Electric Bicycle in UK Industry Revenue (million), by Propulsion Type 2025 & 2033

- Figure 19: Europe Electric Bicycle in UK Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 20: Europe Electric Bicycle in UK Industry Revenue (million), by Application Type 2025 & 2033

- Figure 21: Europe Electric Bicycle in UK Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Europe Electric Bicycle in UK Industry Revenue (million), by Battery Type 2025 & 2033

- Figure 23: Europe Electric Bicycle in UK Industry Revenue Share (%), by Battery Type 2025 & 2033

- Figure 24: Europe Electric Bicycle in UK Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Electric Bicycle in UK Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Electric Bicycle in UK Industry Revenue (million), by Propulsion Type 2025 & 2033

- Figure 27: Middle East & Africa Electric Bicycle in UK Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 28: Middle East & Africa Electric Bicycle in UK Industry Revenue (million), by Application Type 2025 & 2033

- Figure 29: Middle East & Africa Electric Bicycle in UK Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East & Africa Electric Bicycle in UK Industry Revenue (million), by Battery Type 2025 & 2033

- Figure 31: Middle East & Africa Electric Bicycle in UK Industry Revenue Share (%), by Battery Type 2025 & 2033

- Figure 32: Middle East & Africa Electric Bicycle in UK Industry Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Electric Bicycle in UK Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Electric Bicycle in UK Industry Revenue (million), by Propulsion Type 2025 & 2033

- Figure 35: Asia Pacific Electric Bicycle in UK Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 36: Asia Pacific Electric Bicycle in UK Industry Revenue (million), by Application Type 2025 & 2033

- Figure 37: Asia Pacific Electric Bicycle in UK Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 38: Asia Pacific Electric Bicycle in UK Industry Revenue (million), by Battery Type 2025 & 2033

- Figure 39: Asia Pacific Electric Bicycle in UK Industry Revenue Share (%), by Battery Type 2025 & 2033

- Figure 40: Asia Pacific Electric Bicycle in UK Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Electric Bicycle in UK Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 4: Global Electric Bicycle in UK Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 8: Global Electric Bicycle in UK Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 13: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 15: Global Electric Bicycle in UK Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 21: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 22: Global Electric Bicycle in UK Industry Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 34: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 35: Global Electric Bicycle in UK Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Electric Bicycle in UK Industry Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 43: Global Electric Bicycle in UK Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 44: Global Electric Bicycle in UK Industry Revenue million Forecast, by Battery Type 2020 & 2033

- Table 45: Global Electric Bicycle in UK Industry Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Electric Bicycle in UK Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bicycle in UK Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Electric Bicycle in UK Industry?

Key companies in the market include Gocycle Eu BV, Volt Electric Bike, Brompton Bicycle Ltd, Evans Cycles Limited (Pinnacle), MHW Bike-House GmbH (Cube Bikes), Raleigh Bicycle Company, Tandem Group Cycles (Falcon Cycles), Giant Manufacturing Co Ltd, POWABYKE UK LIMITED (Powabyke), Trek Bicycle Corporation, Tandem Group Cycles (DAWES).

3. What are the main segments of the Electric Bicycle in UK Industry?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 305.88 million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

December 2022: Volt Bikes and City AM collaborate for the Launch of an ESG-Focused Project. Impact AM is a brand-new division of City AM that specializes in environmental, social, and governance issues.November 2022: The Tandem Group opens eMobility sales and demo showroom, the Launched under the Electric Life banner the space will be found in Birmingham, located off the M6 in Castle Vale.November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bicycle in UK Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bicycle in UK Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bicycle in UK Industry?

To stay informed about further developments, trends, and reports in the Electric Bicycle in UK Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence