Key Insights

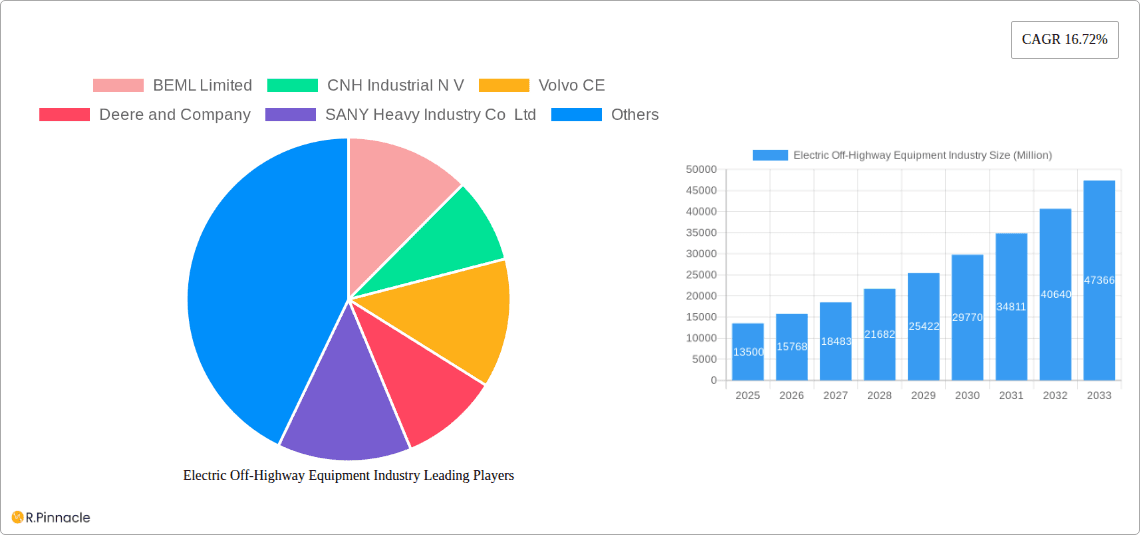

The electric off-highway equipment market is experiencing robust growth, projected to reach a substantial size, driven by stringent emission regulations, increasing demand for sustainable construction and agricultural practices, and advancements in battery technology. The market's Compound Annual Growth Rate (CAGR) of 16.72% from 2019-2033 indicates a significant upward trajectory. The pure electric powertrain segment is expected to be a major growth driver, fueled by continuous improvements in battery capacity, charging infrastructure, and overall vehicle performance, overcoming previous limitations on range and operational efficiency. Key applications like construction and mining are adopting electric equipment at an accelerated pace, particularly in urban areas where noise and emission restrictions are more pronounced. The adoption is also seen in the agricultural sector, where electric tractors and other equipment offer benefits in terms of reduced noise pollution and operating costs. Competition in the market is intensifying, with established players like Caterpillar, Deere & Company, and Volvo CE alongside emerging Chinese manufacturers vying for market share. This competitive landscape is accelerating innovation and driving down costs, further stimulating market growth.

Electric Off-Highway Equipment Industry Market Size (In Billion)

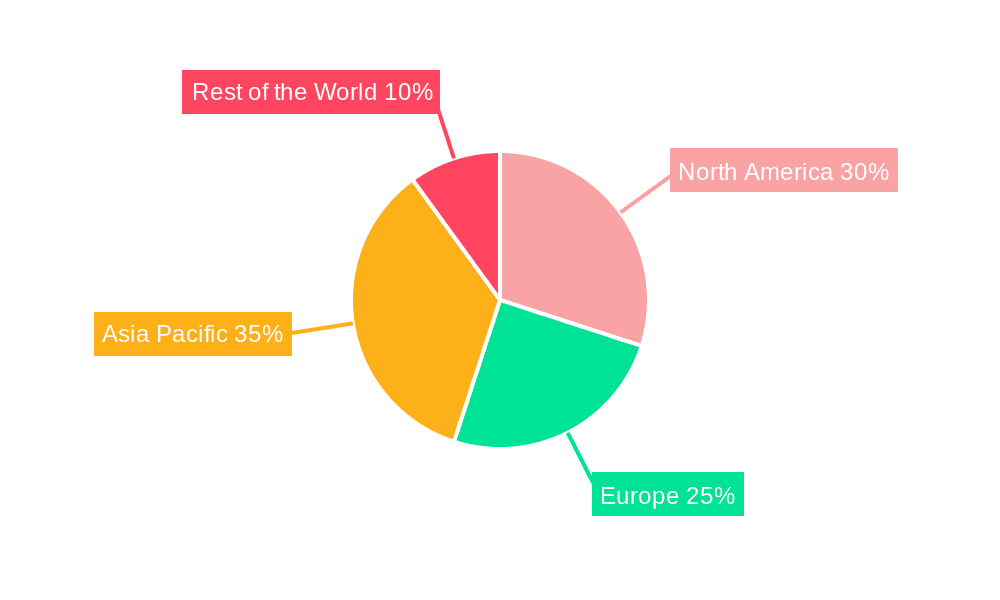

Regional variations in market penetration exist, with North America and Europe exhibiting relatively higher adoption rates due to supportive government policies and environmental awareness. However, the Asia-Pacific region, particularly China and India, is poised for substantial growth given its large infrastructure development projects and increasing focus on sustainable practices. The segment breakdown reveals that Loaders, Excavators, and Dump Trucks represent the largest portion of the market, reflecting their widespread use in construction and mining operations. The "Other Equipment Types" segment, encompassing bulldozers and similar machinery, will also show significant growth driven by increasing demand in infrastructure and mining projects globally. Continued innovation in battery technology, particularly in extending operational range and reducing charging times, will remain a crucial factor influencing market expansion throughout the forecast period (2025-2033).

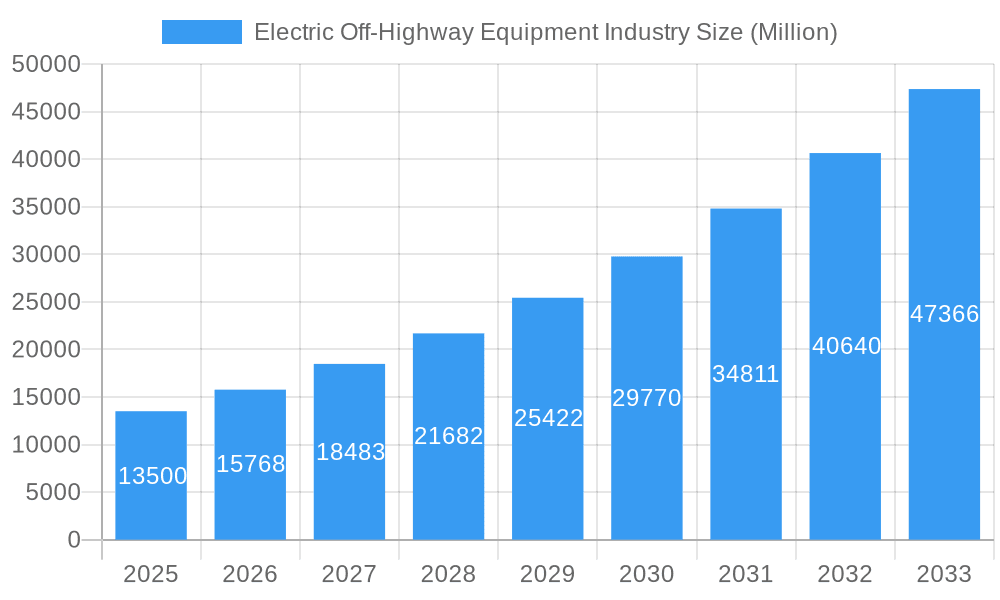

Electric Off-Highway Equipment Industry Company Market Share

Electric Off-Highway Equipment Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning electric off-highway equipment industry, offering valuable insights for industry professionals, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, technological advancements, and competitive landscapes to provide a clear picture of future growth potential. The global market is projected to reach xx Million by 2033.

Electric Off-Highway Equipment Industry Market Structure & Innovation Trends

The electric off-highway equipment market is characterized by a moderately concentrated structure, with key players like Caterpillar Inc, Komatsu Ltd, and Volvo CE holding significant market share. However, the emergence of several Chinese manufacturers like SANY Heavy Industry Co Ltd and XCMG Group Co Ltd is increasing competition. Innovation is driven by stringent environmental regulations, increasing demand for sustainable solutions, and advancements in battery technology and electric powertrain systems. The market witnesses frequent M&A activities, with deal values exceeding xx Million annually in recent years. Key factors influencing the market include:

- Market Concentration: Top 10 players account for approximately 60% of the global market share (estimated).

- Innovation Drivers: Government regulations promoting electrification, rising fuel costs, and the push for carbon neutrality are major drivers.

- Regulatory Frameworks: Stringent emission standards in various regions are accelerating the adoption of electric equipment.

- Product Substitutes: While few direct substitutes exist, the market faces competition from alternative technologies in specific applications.

- End-User Demographics: Construction, mining, and agricultural sectors are the primary end-users, with their demand patterns significantly impacting market growth.

- M&A Activities: Consolidation within the industry through mergers and acquisitions is expected to continue, shaping the competitive landscape. Recent deals have averaged xx Million per transaction.

Electric Off-Highway Equipment Industry Market Dynamics & Trends

The electric off-highway equipment market is experiencing robust growth, driven primarily by increasing environmental concerns and government incentives for green technologies. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. Market penetration of electric equipment is increasing steadily, particularly in developed regions with stringent emission norms. Technological disruptions, including advancements in battery technology and charging infrastructure, are further accelerating market expansion. Consumer preferences are shifting towards quieter, cleaner, and more efficient machinery, creating significant demand for electric alternatives. Competitive dynamics are characterized by both established players and new entrants vying for market share, leading to intensified innovation and price competition.

Dominant Regions & Segments in Electric Off-Highway Equipment Industry

Leading Region: North America and Europe currently dominate the market due to stringent environmental regulations and early adoption of electric technologies. However, Asia-Pacific is expected to witness the fastest growth in the coming years driven by increasing infrastructure development and government support for electric vehicle adoption.

Dominant Segments:

- By Powertrain: The Pure Electric segment is projected to hold the largest market share by 2033, driven by technological advancements and cost reductions in battery technology. Hybrid technology will maintain a significant presence, particularly in applications requiring high power and long operating durations.

- By Equipment Type: Loaders and excavators constitute the largest segments, followed by dump trucks. Farm tractors are experiencing increasing electrification due to the growing focus on sustainable agriculture.

- By Application: The construction and mining segment is the most significant application area, followed by agriculture and other industrial applications.

Key Drivers:

- Economic policies: Government subsidies and tax incentives are promoting electric equipment adoption.

- Infrastructure development: Expansion of charging infrastructure and grid modernization are crucial for wider adoption.

- Technological advancements: Improvements in battery technology, charging speeds, and motor efficiency are key to market growth.

Electric Off-Highway Equipment Industry Product Innovations

Recent product developments highlight a focus on enhancing battery life, increasing efficiency, and optimizing performance in various operating conditions. Manufacturers are increasingly integrating advanced technologies such as telematics, automation, and AI to improve operational efficiency and reduce downtime. These innovations are tailored to meet the specific requirements of different applications, offering competitive advantages through improved productivity, reduced operational costs, and enhanced environmental sustainability.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the electric off-highway equipment market. The market is segmented by powertrain (pure electric, hybrid), equipment type (loaders, excavators, dump trucks, farm tractors, other equipment), and application (construction and mining, agriculture). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. The projected market size for each segment varies significantly, with the construction and mining segment anticipated to dominate due to high demand and favorable regulatory environments. However, agricultural applications are expected to witness considerable growth owing to rising environmental consciousness and the increasing popularity of sustainable agricultural practices.

Key Drivers of Electric Off-Highway Equipment Industry Growth

The growth of the electric off-highway equipment industry is primarily propelled by stringent government regulations aimed at reducing carbon emissions, a growing focus on sustainable practices across various sectors, and technological advancements that enhance battery life and efficiency. Furthermore, the increasing cost of fossil fuels makes electric alternatives more economically attractive. Specific examples include the implementation of emission standards like Euro VI and Tier 4 Final, and government incentives such as tax credits and subsidies for electric vehicle purchases.

Challenges in the Electric Off-Highway Equipment Industry Sector

The industry faces challenges including the high initial cost of electric equipment compared to their diesel counterparts, limited charging infrastructure availability in certain regions, and the relatively shorter operating times of some electric machines compared to their diesel equivalents. Supply chain disruptions and the availability of critical raw materials for battery production also present significant challenges, impacting manufacturing and pricing. These factors restrict widespread adoption, particularly in remote areas or those with limited grid capacity. The total impact of these challenges is estimated to reduce the market size by xx Million by 2030.

Emerging Opportunities in Electric Off-Highway Equipment Industry

Significant opportunities exist in developing markets with rapidly growing infrastructure projects and in specialized applications where the benefits of reduced noise and emissions are particularly valuable. Advancements in fast-charging technologies, energy storage solutions, and the development of more powerful and longer-lasting batteries are key areas of opportunity. Moreover, integration with smart technologies, autonomous operation, and the development of efficient data analytics to optimize operation and maintenance can unlock significant potential within this sector.

Leading Players in the Electric Off-Highway Equipment Industry Market

- BEML Limited

- CNH Industrial N V (CNH Industrial)

- Volvo CE (Volvo Construction Equipment)

- Deere and Company (John Deere)

- SANY Heavy Industry Co Ltd (SANY Group)

- Hitachi Construction Machinery Co Ltd (Hitachi Construction Machinery)

- XCMG Group Co Ltd (XCMG)

- Doosan Grou

- Caterpillar Inc (Caterpillar)

- Liebherr International AG (Liebherr)

- Komatsu Ltd (Komatsu)

- Sennebogen Maschinenfabrik GmbH (Sennebogen)

- OJSC BelAZ

Key Developments in Electric Off-Highway Equipment Industry

- July 2023: JCB launched its first full electric wheeled loader, featuring a 20kWh battery and a full working day operational capacity.

- October 2023: Komatsu Ltd. announced plans to introduce its 20-tonne electric excavators as rental machines in Japan and Europe, with further expansion planned for Asia, North America, and Australia.

- November 2023: Volvo CE launched its ECR25 Electric compact excavator and L25 Compact wheeled loader in Indonesia, with further launches planned for China, South Korea, Japan, and Singapore.

Future Outlook for Electric Off-Highway Equipment Industry Market

The future of the electric off-highway equipment market is exceptionally promising. Continued technological advancements, coupled with supportive government policies and growing environmental awareness, will drive significant market expansion. The industry is poised for substantial growth, driven by increased adoption across various sectors and a shift towards sustainable practices. New product introductions, enhanced battery technologies, and the development of more efficient charging infrastructure will contribute to this positive outlook, further accelerating the transition towards a greener and more sustainable construction and industrial landscape.

Electric Off-Highway Equipment Industry Segmentation

-

1. Powertain

- 1.1. Pure Electric

- 1.2. Hybrid

-

2. Equipment Type

- 2.1. Loaders

- 2.2. Excavators

- 2.3. Dump Trucks

- 2.4. Farm Tractors

- 2.5. Other Equipment Types (Bulldozers, etc.)

-

3. Application

- 3.1. Construction and Mining

- 3.2. Agriculture

Electric Off-Highway Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Off-Highway Equipment Industry Regional Market Share

Geographic Coverage of Electric Off-Highway Equipment Industry

Electric Off-Highway Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Preference towards Availing Eco-Friendly Equipment/Machinery to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Powered Off-Highway Equipment Hampers the Market Growth

- 3.4. Market Trends

- 3.4.1. Hybrid Segment of the Market to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Powertain

- 5.1.1. Pure Electric

- 5.1.2. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Loaders

- 5.2.2. Excavators

- 5.2.3. Dump Trucks

- 5.2.4. Farm Tractors

- 5.2.5. Other Equipment Types (Bulldozers, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Construction and Mining

- 5.3.2. Agriculture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Powertain

- 6. North America Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Powertain

- 6.1.1. Pure Electric

- 6.1.2. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Loaders

- 6.2.2. Excavators

- 6.2.3. Dump Trucks

- 6.2.4. Farm Tractors

- 6.2.5. Other Equipment Types (Bulldozers, etc.)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Construction and Mining

- 6.3.2. Agriculture

- 6.1. Market Analysis, Insights and Forecast - by Powertain

- 7. Europe Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Powertain

- 7.1.1. Pure Electric

- 7.1.2. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Loaders

- 7.2.2. Excavators

- 7.2.3. Dump Trucks

- 7.2.4. Farm Tractors

- 7.2.5. Other Equipment Types (Bulldozers, etc.)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Construction and Mining

- 7.3.2. Agriculture

- 7.1. Market Analysis, Insights and Forecast - by Powertain

- 8. Asia Pacific Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Powertain

- 8.1.1. Pure Electric

- 8.1.2. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Loaders

- 8.2.2. Excavators

- 8.2.3. Dump Trucks

- 8.2.4. Farm Tractors

- 8.2.5. Other Equipment Types (Bulldozers, etc.)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Construction and Mining

- 8.3.2. Agriculture

- 8.1. Market Analysis, Insights and Forecast - by Powertain

- 9. Rest of the World Electric Off-Highway Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Powertain

- 9.1.1. Pure Electric

- 9.1.2. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Loaders

- 9.2.2. Excavators

- 9.2.3. Dump Trucks

- 9.2.4. Farm Tractors

- 9.2.5. Other Equipment Types (Bulldozers, etc.)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Construction and Mining

- 9.3.2. Agriculture

- 9.1. Market Analysis, Insights and Forecast - by Powertain

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 BEML Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CNH Industrial N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Volvo CE

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Deere and Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SANY Heavy Industry Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Construction Machinery Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 XCMG Group Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Doosan Grou

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Caterpillar Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Liebherr International AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Komatsu Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sennebogen Maschinenfabrik GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 OJSC BelAZ

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 BEML Limited

List of Figures

- Figure 1: Global Electric Off-Highway Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 3: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 4: North America Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 5: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 6: North America Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 11: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 12: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 13: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 14: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 19: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 20: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Powertain 2025 & 2033

- Figure 27: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Powertain 2025 & 2033

- Figure 28: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 29: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 30: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Electric Off-Highway Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Off-Highway Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 2: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 3: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 6: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 7: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 13: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 14: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 22: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 23: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Powertain 2020 & 2033

- Table 31: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 32: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Electric Off-Highway Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Electric Off-Highway Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Off-Highway Equipment Industry?

The projected CAGR is approximately 16.72%.

2. Which companies are prominent players in the Electric Off-Highway Equipment Industry?

Key companies in the market include BEML Limited, CNH Industrial N V, Volvo CE, Deere and Company, SANY Heavy Industry Co Ltd, Hitachi Construction Machinery Co Ltd, XCMG Group Co Ltd, Doosan Grou, Caterpillar Inc, Liebherr International AG, Komatsu Ltd, Sennebogen Maschinenfabrik GmbH, OJSC BelAZ.

3. What are the main segments of the Electric Off-Highway Equipment Industry?

The market segments include Powertain, Equipment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference towards Availing Eco-Friendly Equipment/Machinery to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Hybrid Segment of the Market to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Electric Powered Off-Highway Equipment Hampers the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2023: Volvo CE announced that its two flagship electric construction machines, the ECR25 Electric compact excavator and the L25 Compact wheeled loader, are available for sale in Indonesia after being presented to customers at Indotruck Utama’s Inspire 2023 event in September. Apart from Indonesia, the company is also strategizing to launch new electric products in China, South Korea, Japan, and Singapore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Off-Highway Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Off-Highway Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Off-Highway Equipment Industry?

To stay informed about further developments, trends, and reports in the Electric Off-Highway Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence