Key Insights

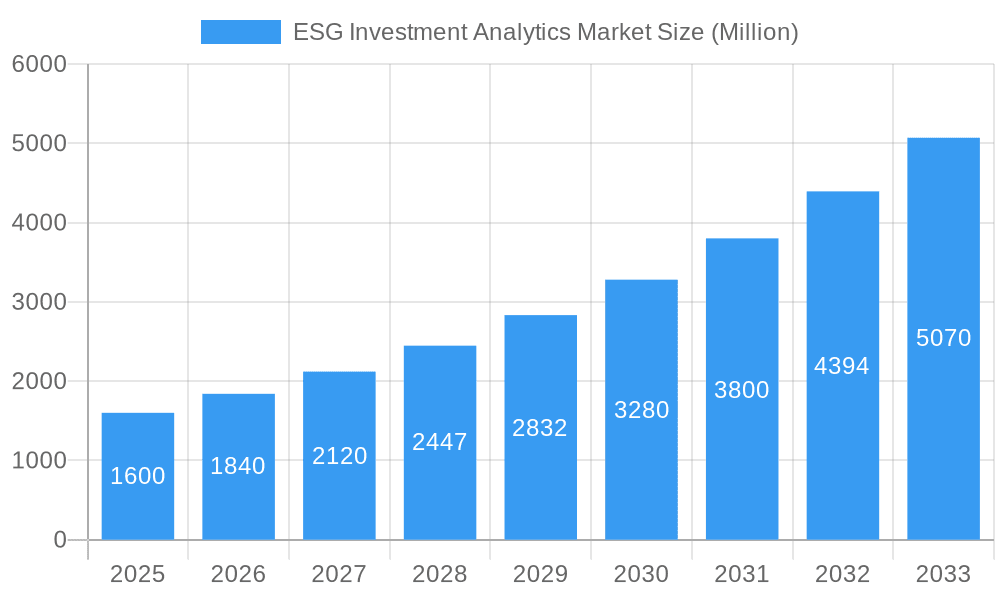

The ESG (Environmental, Social, and Governance) Investment Analytics market is experiencing robust growth, projected to reach $1.60 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 15.12% from 2025 to 2033. This expansion is fueled by increasing investor demand for sustainable and responsible investments, coupled with heightened regulatory scrutiny and growing awareness of environmental and social risks. Major drivers include the rising adoption of ESG integration strategies by institutional investors, the proliferation of ESG data providers and analytical tools, and a growing focus on impact measurement and reporting. Furthermore, the increasing sophistication of ESG analytics, incorporating advanced technologies like AI and machine learning for enhanced data processing and risk assessment, is significantly accelerating market growth. The market is segmented by various factors, likely including data type (environmental, social, governance), analytics type (quantitative, qualitative), service type (data provision, analytics platform, consulting services), and end-user (asset managers, pension funds, etc.). Competition is fierce, with major players like PwC, EY, Deloitte, KPMG, and specialized ESG firms vying for market share. The market's trajectory reflects a broader shift in global finance towards prioritizing sustainability, suggesting sustained growth throughout the forecast period.

ESG Investment Analytics Market Market Size (In Billion)

The significant players in this market – including the "Big Four" accounting firms and dedicated ESG specialists – are constantly innovating to improve the quality, breadth, and accessibility of ESG data and analytics. This includes developments in data aggregation, AI-powered risk modelling, and the integration of ESG factors into traditional financial analysis. Restraints on market growth could include data standardization challenges, inconsistencies in ESG reporting frameworks across jurisdictions, and the potential for "greenwashing" – misleading claims of environmental responsibility. However, the overall positive momentum driven by regulatory changes and increasing investor pressure is expected to outweigh these limitations. The regional distribution is likely skewed towards North America and Europe initially, but developing economies are predicted to witness significant growth as ESG adoption becomes more widespread globally. The historical period (2019-2024) likely shows a gradual increase in market size, setting the stage for the accelerated expansion projected in the forecast period (2025-2033).

ESG Investment Analytics Market Company Market Share

ESG Investment Analytics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ESG Investment Analytics Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The report features detailed analysis of market structure, dynamics, regional dominance, product innovation, and key players, including PwC, EY, Deloitte, KPMG, RSM Global, RPS Group, MSCI Inc, Crowe, RepRisk, ISS ESG, and Kroll (list not exhaustive). The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

ESG Investment Analytics Market Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, highlighting key players' market share and M&A activities. The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2024. Innovation is driven by the increasing demand for sophisticated ESG data analytics, stricter regulatory frameworks, and advancements in AI and machine learning.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- M&A Activity: A total of xx M&A deals valued at approximately xx Million were recorded between 2019 and 2024. Significant deals include [Insert Specific Deal Examples if available, otherwise use "Strategic acquisitions focused on enhancing data capabilities and expanding geographical reach"].

- Regulatory Frameworks: Increasingly stringent regulations regarding ESG disclosures are driving market growth and shaping product development.

- Product Substitutes: Limited direct substitutes exist, but the market faces indirect competition from general-purpose data analytics platforms.

- End-User Demographics: The primary end-users include institutional investors, asset managers, and corporations.

ESG Investment Analytics Market Market Dynamics & Trends

The ESG Investment Analytics Market is experiencing robust growth, driven by a confluence of factors. The escalating awareness of environmental, social, and governance (ESG) issues among investors, corporations, and consumers is a primary catalyst. This heightened awareness translates into a significant increase in demand for robust ESG analytics solutions. Further fueling this expansion are advancements in technology, particularly in artificial intelligence (AI) and machine learning (ML), which are enabling the development of increasingly sophisticated and insightful analytics tools. The market is also shaped by evolving consumer preferences, with a clear shift towards sustainable and responsible investments. Competitive dynamics are intensely active, characterized by continuous innovation, strategic partnerships, mergers and acquisitions, and a fierce battle for market share. Market penetration was estimated at xx% in 2024 and is projected to reach xx% by 2033, reflecting a significant growth trajectory.

Dominant Regions & Segments in ESG Investment Analytics Market

North America currently holds the dominant position in the ESG Investment Analytics Market, propelled by its robust regulatory frameworks, a high concentration of institutional investors, and a technologically advanced infrastructure. Europe follows as a substantial market, exhibiting considerable growth potential. The Asia-Pacific region also presents a significant opportunity, fueled by rapid economic growth and a burgeoning awareness of ESG considerations. This untapped potential promises considerable future expansion.

- North America: Strong regulatory environment, high investor interest, advanced technology, established market infrastructure.

- Europe: Growing regulatory pressure, increasing adoption by institutional investors, maturing market with diverse players.

- Asia-Pacific: Rapid economic growth, rising awareness of ESG issues, significant untapped potential, increasing governmental support for sustainable initiatives.

Market segmentation is multifaceted, encompassing solution type (e.g., software, data analytics platforms, specialized ESG databases, consulting services), deployment mode (cloud-based, on-premise, hybrid), and end-user industry (e.g., finance, energy, real estate, manufacturing, consumer goods). The software segment currently commands the largest market share, owing to its inherent scalability and cost-effectiveness, particularly for larger enterprises.

ESG Investment Analytics Market Product Innovations

Recent product innovations focus on integrating advanced analytics capabilities, such as AI and machine learning, to enhance the accuracy and efficiency of ESG data analysis. New platforms are incorporating real-time data feeds, allowing for dynamic risk assessments and improved investment decision-making. This trend reflects the market's evolving need for more comprehensive and nuanced ESG insights.

Report Scope & Segmentation Analysis

The report provides a detailed segmentation of the ESG Investment Analytics Market based on solution type, deployment mode, organization size, and end-user industry. Each segment’s growth projections, market sizes, and competitive dynamics are comprehensively analyzed. The software segment is projected to maintain its dominance throughout the forecast period.

Key Drivers of ESG Investment Analytics Market Growth

Several key factors are driving the growth of the ESG Investment Analytics Market. These include:

- Increasing Regulatory Scrutiny: Governments worldwide are implementing stricter regulations regarding ESG disclosures, mandating companies to report on their environmental and social impact.

- Growing Investor Demand: Investors are increasingly incorporating ESG factors into their investment decisions, driving demand for sophisticated analytics tools.

- Technological Advancements: AI and machine learning are enabling more efficient and accurate ESG data analysis, further fueling market growth.

Challenges in the ESG Investment Analytics Market Sector

Despite its significant growth, the ESG Investment Analytics Market faces several key challenges that impact its development and adoption:

- Data Standardization and Interoperability: The lack of universally accepted ESG data standards hinders effective comparison and benchmarking across different investments and industries. Improved data standardization and interoperability are crucial for market growth.

- Data Quality and Reliability: Ensuring the accuracy, completeness, and reliability of ESG data is paramount, yet remains a persistent challenge. Issues like data inconsistency, biases, and lack of transparency impact the integrity of analytics.

- High Implementation Costs and Complexity: Implementing comprehensive ESG analytics solutions can involve substantial upfront investment and ongoing operational costs, posing a barrier to entry for smaller companies and organizations.

- Greenwashing Concerns: The risk of companies engaging in "greenwashing"—making misleading or exaggerated claims about their ESG performance—undermines investor confidence and necessitates robust verification and validation mechanisms.

Emerging Opportunities in ESG Investment Analytics Market

Emerging opportunities include:

- Expansion into Developing Markets: Significant untapped potential exists in developing economies.

- Integration with other Data Sources: Combining ESG data with other relevant datasets can create more comprehensive insights.

- Development of specialized solutions: Tailored solutions for specific industries or investment strategies.

Key Developments in ESG Investment Analytics Market Industry

- June 2023: ESG Book and Arcesium partnered to deliver market-leading sustainability data for institutional investors, enhancing data accessibility and analysis capabilities.

- May 2023: Collective Artists Network and DialESG partnered to provide India's first comprehensive ESG solution, signifying growing demand in emerging markets.

Future Outlook for ESG Investment Analytics Market Market

The ESG Investment Analytics Market is poised for sustained and robust growth, driven by a powerful combination of factors. Increasing regulatory scrutiny and pressure, coupled with growing investor demand for high-quality, reliable ESG data, will significantly contribute to market expansion. Technological advancements continue to unlock new possibilities for data analysis and insight generation, further enhancing the market's potential. Strategic partnerships, mergers and acquisitions, and a focus on product innovation will shape the competitive landscape. The market is expected to see significant expansion in the coming years, presenting attractive opportunities for both established industry leaders and emerging players. The ongoing development of more sophisticated and integrated ESG analytics platforms, addressing the challenges of data quality and standardization, will be critical in shaping the future trajectory of this dynamic market.

ESG Investment Analytics Market Segmentation

-

1. Type

- 1.1. Addressing ESG Expectations

- 1.2. Preparing ESG Reports

-

2. Application

- 2.1. Financial Industry

- 2.2. Consumer and Retail

ESG Investment Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Russia

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

ESG Investment Analytics Market Regional Market Share

Geographic Coverage of ESG Investment Analytics Market

ESG Investment Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus on Corporate Social Responsibility

- 3.3. Market Restrains

- 3.3.1. Increased Focus on Corporate Social Responsibility

- 3.4. Market Trends

- 3.4.1. Increasing Consumer and Retail Fueling the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Addressing ESG Expectations

- 5.1.2. Preparing ESG Reports

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Financial Industry

- 5.2.2. Consumer and Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Addressing ESG Expectations

- 6.1.2. Preparing ESG Reports

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Financial Industry

- 6.2.2. Consumer and Retail

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Addressing ESG Expectations

- 7.1.2. Preparing ESG Reports

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Financial Industry

- 7.2.2. Consumer and Retail

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Addressing ESG Expectations

- 8.1.2. Preparing ESG Reports

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Financial Industry

- 8.2.2. Consumer and Retail

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Addressing ESG Expectations

- 9.1.2. Preparing ESG Reports

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Financial Industry

- 9.2.2. Consumer and Retail

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Addressing ESG Expectations

- 10.1.2. Preparing ESG Reports

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Financial Industry

- 10.2.2. Consumer and Retail

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates ESG Investment Analytics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Addressing ESG Expectations

- 11.1.2. Preparing ESG Reports

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Financial Industry

- 11.2.2. Consumer and Retail

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 PWC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EY

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Deloitte

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 KPMG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 RSM Global

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 RPS Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MSCI Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Crowe

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 RepRisk

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ISS ESG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Kroll**List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 PWC

List of Figures

- Figure 1: Global ESG Investment Analytics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ESG Investment Analytics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 41: South America ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 45: South America ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

- Figure 63: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Type 2025 & 2033

- Figure 64: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Type 2025 & 2033

- Figure 65: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Type 2025 & 2033

- Figure 67: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Application 2025 & 2033

- Figure 68: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Application 2025 & 2033

- Figure 69: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Application 2025 & 2033

- Figure 71: United Arab Emirates ESG Investment Analytics Market Revenue (Million), by Country 2025 & 2033

- Figure 72: United Arab Emirates ESG Investment Analytics Market Volume (Billion), by Country 2025 & 2033

- Figure 73: United Arab Emirates ESG Investment Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: United Arab Emirates ESG Investment Analytics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global ESG Investment Analytics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global ESG Investment Analytics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Germany ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 35: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 37: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: India ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: China ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: China ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 49: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 53: Brazil ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Brazil ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Argentina ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Argentina ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of South America ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of South America ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 61: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 62: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 63: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Global ESG Investment Analytics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 66: Global ESG Investment Analytics Market Volume Billion Forecast, by Type 2020 & 2033

- Table 67: Global ESG Investment Analytics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global ESG Investment Analytics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 69: Global ESG Investment Analytics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global ESG Investment Analytics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Saudi Arabia ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Africa ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East ESG Investment Analytics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East ESG Investment Analytics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ESG Investment Analytics Market?

The projected CAGR is approximately 15.12%.

2. Which companies are prominent players in the ESG Investment Analytics Market?

Key companies in the market include PWC, EY, Deloitte, KPMG, RSM Global, RPS Group, MSCI Inc, Crowe, RepRisk, ISS ESG, Kroll**List Not Exhaustive.

3. What are the main segments of the ESG Investment Analytics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus on Corporate Social Responsibility.

6. What are the notable trends driving market growth?

Increasing Consumer and Retail Fueling the Market.

7. Are there any restraints impacting market growth?

Increased Focus on Corporate Social Responsibility.

8. Can you provide examples of recent developments in the market?

June 2023: ESG Book, a global leader, and Arcesium, a leading global financial technology firm, announced a new partnership to deliver market-leading sustainability data for institutional investors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ESG Investment Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ESG Investment Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ESG Investment Analytics Market?

To stay informed about further developments, trends, and reports in the ESG Investment Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence