Key Insights

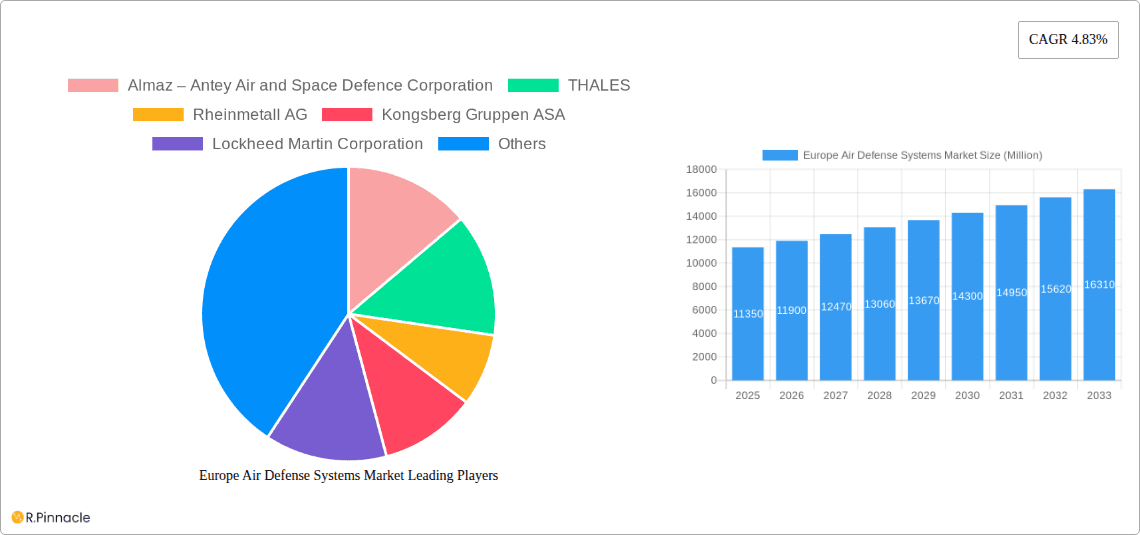

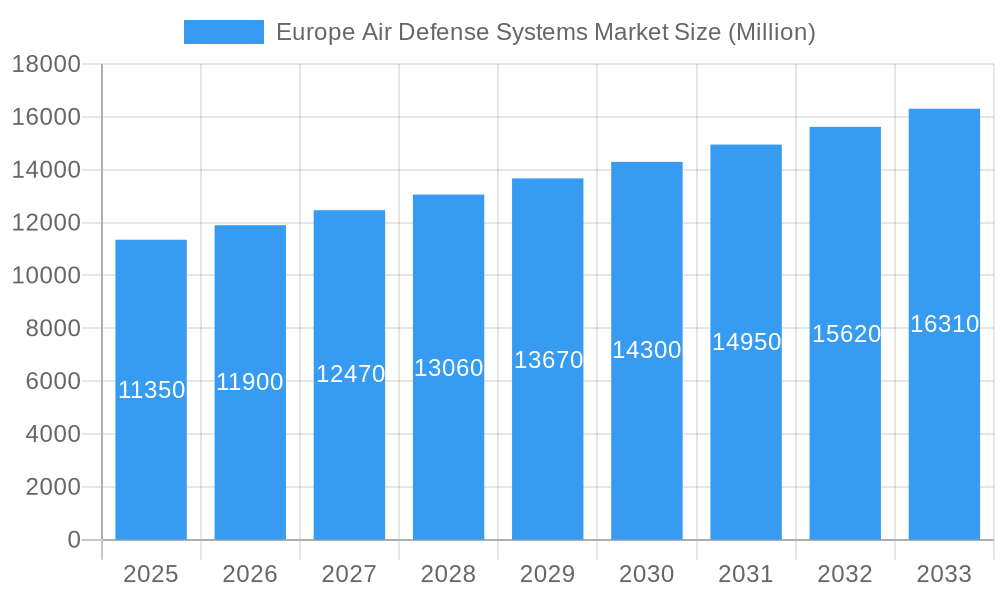

The European air defense systems market, valued at €11.35 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, increasing cross-border threats, and the modernization of existing defense infrastructure across the region. A Compound Annual Growth Rate (CAGR) of 4.83% is anticipated from 2025 to 2033, indicating a significant expansion of the market during the forecast period. Key drivers include the rising demand for advanced air defense solutions capable of countering evolving aerial threats, such as drones and hypersonic missiles. Furthermore, increasing investments in research and development, particularly in areas like AI-powered systems and laser-based technologies, are fueling market expansion. The market segmentation reveals strong demand across all platforms: air-based, sea-based, and land-based systems, with a likely higher concentration in land-based systems given the geographic layout of Europe and its diverse threat landscape. The presence of major defense contractors, such as Thales, Rheinmetall AG, and MBDA, within Europe ensures a robust supply chain and technological advancement. However, the market growth might face some restraints from budgetary constraints experienced by certain European nations and the complexity of integrating new systems into existing defense networks.

Europe Air Defense Systems Market Market Size (In Billion)

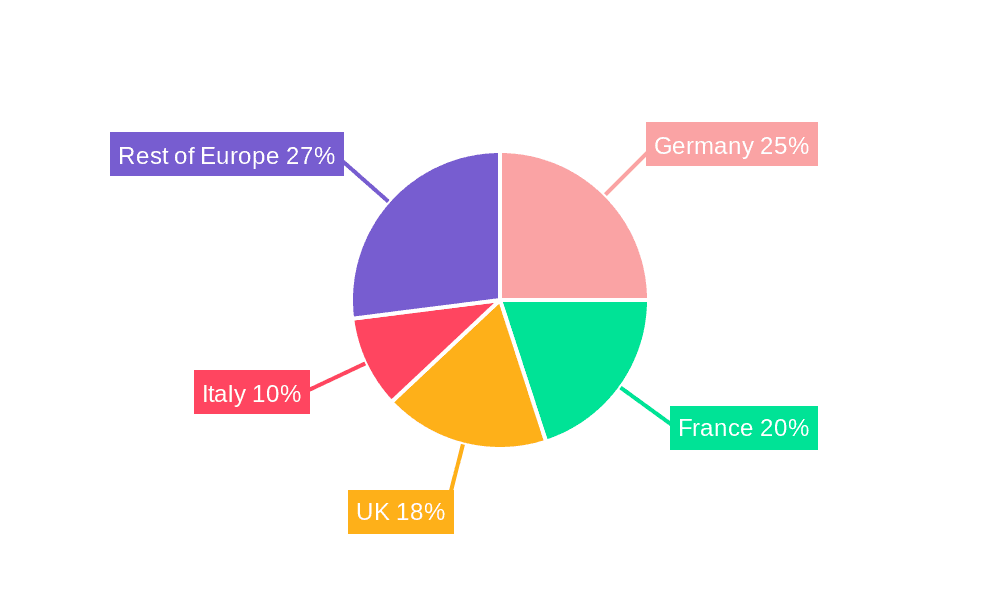

The growth will be significantly influenced by specific regional dynamics. Countries like Germany, France, and the United Kingdom, given their substantial defense budgets and strategic geopolitical positions, are expected to be key contributors to the market's expansion. The ongoing development and deployment of integrated air and missile defense (IAMD) systems across Europe will also play a significant role in driving market growth. While the “Rest of Europe” segment shows a lower projected market share than the major players, it still holds growth potential, reflecting the increasing awareness of the need for sophisticated air defense across the continent. The competitive landscape is shaped by established global players alongside smaller, specialized companies, leading to innovation and diverse product offerings within the market. The forecast period will witness significant technological advancements, potentially leading to the development of more effective and adaptable air defense systems.

Europe Air Defense Systems Market Company Market Share

Europe Air Defense Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Air Defense Systems Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a meticulous study period spanning from 2019 to 2033 (base year 2025, estimated year 2025, forecast period 2025-2033, historical period 2019-2024), this report unveils the market's structure, dynamics, and future trajectory. It examines key segments, leading players like Almaz – Antey Air and Space Defence Corporation, Thales, Rheinmetall AG, and more, and explores recent industry developments impacting growth. Discover actionable intelligence to navigate this crucial sector.

Europe Air Defense Systems Market Market Structure & Innovation Trends

The European Air Defense Systems market exhibits a moderately consolidated structure, with several major players holding significant market share. Almaz – Antey Air and Space Defence Corporation, Thales, and Lockheed Martin Corporation are among the leading companies, influencing market trends through innovation and substantial investments. Market concentration is estimated at xx%, indicating a competitive landscape with room for both established players and emerging innovators.

Key Market Structure Aspects:

- Market Share: Major players hold approximately xx% of the overall market share in 2025, with a projected xx% increase by 2033. Smaller companies and niche players account for the remaining share.

- Innovation Drivers: Technological advancements in missile technology, sensor systems, and AI-driven command and control systems are major drivers, continually enhancing the effectiveness and capabilities of air defense systems. Increased defense budgets across Europe further fuel innovation.

- Regulatory Frameworks: Stringent regulations regarding the export and usage of defense technologies significantly impact market dynamics, shaping production, deployment, and R&D strategies. Compliance costs affect smaller companies disproportionately.

- Product Substitutes: The market has limited direct substitutes, although advancements in cyber warfare and electronic countermeasures could potentially offer alternative approaches to air defense.

- End-User Demographics: The primary end-users are national defense forces, with a growing reliance on private military and security companies in specific sectors also observed.

- M&A Activities: The market has witnessed significant M&A activity in recent years, with deal values exceeding EUR xx Billion in the period 2019-2024. These transactions aim to enhance technological capabilities, expand market reach, and consolidate market power.

Europe Air Defense Systems Market Market Dynamics & Trends

The European Air Defense Systems market is characterized by a robust growth trajectory, driven by escalating geopolitical tensions, rising defense budgets across the region, and the increasing sophistication of air-based threats. The market experienced a CAGR of xx% during the historical period (2019-2024), and this is projected to reach a CAGR of xx% between 2025 and 2033. Market penetration of advanced technologies like AI and machine learning in air defense is gradually increasing, further fueling market growth. This growth is particularly pronounced in regions experiencing heightened geopolitical risks and facing evolving aerial threats. Technological disruptions, such as the integration of advanced sensor technologies and AI-powered decision support systems, are transforming the industry.

Dominant Regions & Segments in Europe Air Defense Systems Market

The Land-based segment dominates the European Air Defense Systems market, accounting for approximately xx% of the total market revenue in 2025. This dominance is primarily attributed to the widespread deployment of land-based air defense systems across various European nations for border protection, critical infrastructure defense, and military base security.

Key Drivers of Land-based Segment Dominance:

- Strategic Importance: Land-based systems offer a fixed and robust defense perimeter, critical for protecting strategic assets and population centers.

- Cost-Effectiveness: Compared to sea-based and air-based systems, land-based solutions often represent a more cost-effective approach to air defense, especially for nations with budget constraints.

- Infrastructure: Existing infrastructure in many European countries facilitates the integration and operation of land-based systems, minimizing additional investment in deployment.

Other Platform Segments:

- Air-based: This segment is expected to register notable growth, fueled by the increasing adoption of Airborne Early Warning and Control (AEW&C) systems, which offer wider surveillance ranges and enhanced situational awareness.

- Sea-based: The sea-based segment is witnessing growth, driven by the need to protect naval assets and coastal regions from aerial threats. The focus is on integrating advanced shipborne air defense systems.

Europe Air Defense Systems Market Product Innovations

Recent innovations focus on enhancing the speed, precision, and adaptability of air defense systems. This includes advancements in missile technology, such as the development of more agile and longer-range missiles, as well as the integration of advanced sensor systems and Artificial Intelligence (AI) for enhanced threat detection and response. The market is seeing a shift toward modular and networked systems, improving interoperability and reducing maintenance costs. The key trend is toward autonomous or semi-autonomous systems that can react to rapidly evolving aerial threats with minimal human intervention.

Report Scope & Segmentation Analysis

This report comprehensively segments the Europe Air Defense Systems market based on platform type:

- Air-based: This segment encompasses air-to-air missiles, airborne warning and control systems (AWACS), and other air-based defense technologies. Market size is projected at EUR xx Million in 2025, experiencing a CAGR of xx% during the forecast period.

- Sea-based: This segment includes shipborne air defense systems and coastal defense systems. Market size is estimated at EUR xx Million in 2025 and is forecast to grow at a CAGR of xx% during the forecast period. Competitive intensity is high due to the specialized nature of these technologies.

- Land-based: This segment is the largest, encompassing ground-based air defense systems, including short-range, medium-range, and long-range systems. This segment is projected to be valued at EUR xx Million in 2025, with a CAGR of xx% anticipated over the forecast period. The market is highly competitive, with established and emerging players vying for market share.

Key Drivers of Europe Air Defense Systems Market Growth

Several factors are driving growth in the European Air Defense Systems market:

- Geopolitical Instability: Increased regional tensions and potential conflicts significantly increase demand for enhanced air defense capabilities.

- Technological Advancements: Ongoing innovation in missile systems, sensors, and AI is creating more effective and adaptable defense solutions.

- Defense Budget Allocations: European nations continue to allocate substantial budgets to modernize and strengthen their defense capabilities. This funding directly translates into increased demand for advanced air defense systems.

Challenges in the Europe Air Defense Systems Market Sector

The market faces several challenges:

- High Development Costs: Developing and deploying advanced air defense systems requires significant investment, potentially hindering smaller players' participation.

- Regulatory Hurdles: Export controls and other regulations related to defense technology pose barriers to market entry and expansion.

- Supply Chain Disruptions: Global supply chain vulnerabilities can disrupt the production and delivery of critical components, impacting market stability.

Emerging Opportunities in Europe Air Defense Systems Market

Several emerging opportunities are shaping the market:

- Integration of AI and Machine Learning: Integrating AI algorithms enables more efficient threat detection and response, presenting significant growth potential.

- Cybersecurity Enhancements: Protecting air defense systems from cyberattacks is crucial, creating opportunities for cybersecurity solutions within the industry.

- Development of Hypersonic Missile Defense: The development of countermeasures to hypersonic threats is a crucial area of investment creating opportunities for specialized technologies.

Leading Players in the Europe Air Defense Systems Market Market

Key Developments in Europe Air Defense Systems Market Industry

- November 2023: The UK and Poland signed a EUR 4 billion (USD 4.33 billion) deal for Poland's air defense program. MBDA (UK) will supply over 1,000 CAMM-ER missiles and over 100 launchers to PGZ (Poland). This significantly boosts the ground-based air defense segment.

- February 2023: Spain approved the deployment of the NASAMS air defense system in Estonia for four months (April 2024). This deployment enhances Estonian defense capabilities and promotes the NASAMS system.

Future Outlook for Europe Air Defense Systems Market Market

The European Air Defense Systems market is poised for sustained growth, fueled by continuous technological advancements, geopolitical uncertainties, and increased defense spending. Strategic opportunities exist for companies focusing on developing advanced AI-driven systems, enhancing cybersecurity measures, and creating effective countermeasures for emerging threats like hypersonic missiles. The market's trajectory reflects a high degree of complexity and dynamism, calling for continuous adaptation and innovation within the industry.

Europe Air Defense Systems Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Air Defense Systems Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Air Defense Systems Market Regional Market Share

Geographic Coverage of Europe Air Defense Systems Market

Europe Air Defense Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Land-based Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Air Defense Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Almaz – Antey Air and Space Defence Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 THALES

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kongsberg Gruppen ASA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Boeing Compan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MBDA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RTX Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Leonardo S p A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Northrop Grumman Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saab AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Almaz – Antey Air and Space Defence Corporation

List of Figures

- Figure 1: Europe Air Defense Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Air Defense Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Air Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Air Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Air Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Air Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Air Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Air Defense Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Air Defense Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Air Defense Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Air Defense Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Air Defense Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Air Defense Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Air Defense Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Air Defense Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Air Defense Systems Market?

The projected CAGR is approximately 4.83%.

2. Which companies are prominent players in the Europe Air Defense Systems Market?

Key companies in the market include Almaz – Antey Air and Space Defence Corporation, THALES, Rheinmetall AG, Kongsberg Gruppen ASA, Lockheed Martin Corporation, The Boeing Compan, MBDA, RTX Corporation, Leonardo S p A, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the Europe Air Defense Systems Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.35 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Land-based Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

November 2023: The UK and Poland defense industries signed a milestone deal worth over EUR 4 billion (USD 4.33 billion) to continue the next phase of Poland’s future air defense program. MBDA (UK) signed the sub-contract with PGZ (Poland) in a program to provide Polish forces with an enhanced ground-based air defense system capable of launching missiles to engage air threats. As per the plan, MDMA and PGZ will develop more than 1,000 Common Anti-Air Modular Missiles – Extended Range (CAMM-ER) and over 100 launchers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Air Defense Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Air Defense Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Air Defense Systems Market?

To stay informed about further developments, trends, and reports in the Europe Air Defense Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence